Loan Repayment Form Templates

Documents:

92

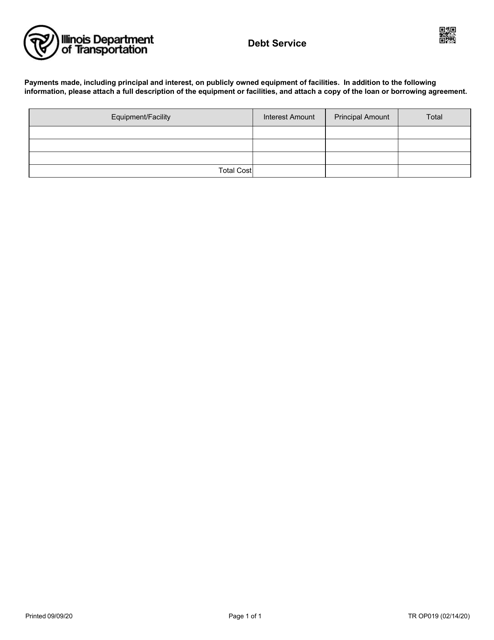

This form is used for reporting debt service in the state of Illinois. It helps individuals and businesses track their debt payments and stay organized financially.

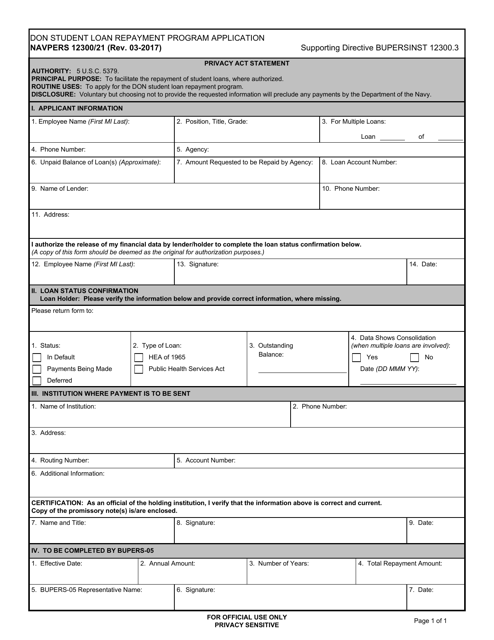

This document is used for applying for the Student Loan Repayment Program.

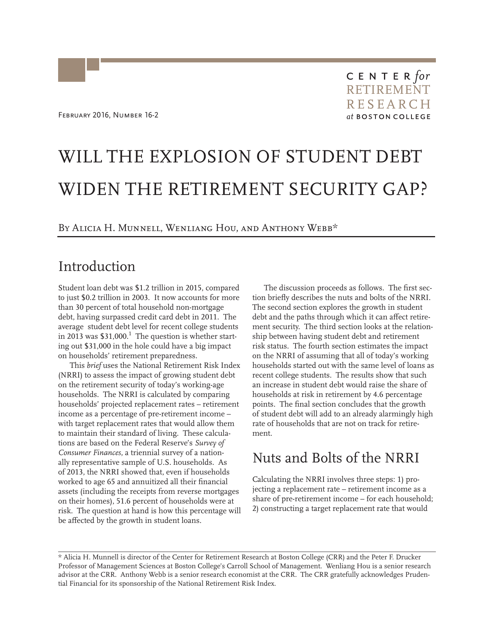

This document examines the potential impact of the growing student debt on retirement security in the United States. It discusses how the increasing amount of student debt could potentially worsen the retirement savings gap.

This document provides guidance on applying for the Nurse Corps Loan Repayment Program, which offers loan forgiveness for nurses working in underserved areas. It includes information on eligibility requirements, application process, and program benefits.

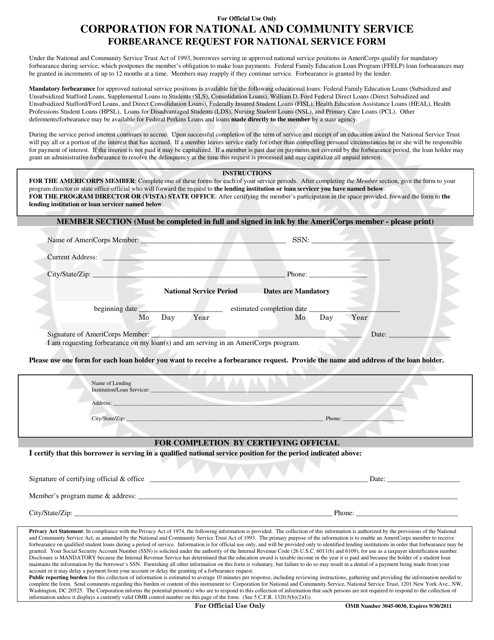

This document is used to request forbearance for national service obligations.

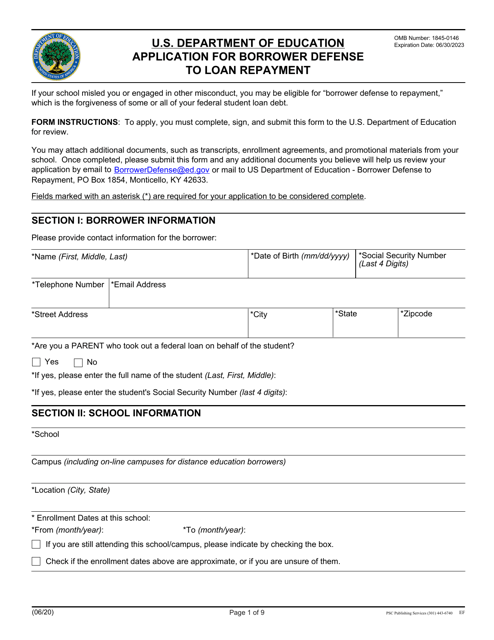

This form is used for applying for borrower defense to loan repayment. It is a request to have your student loan debt forgiven due to misconduct by your school.

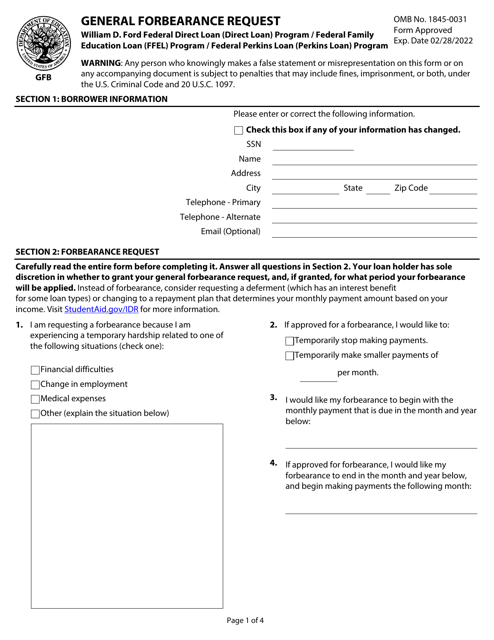

This document is used for requesting a forbearance, which allows the borrower to temporarily suspend or reduce their loan payments.

This document is a Loan Guaranty Agreement specific to the state of Virginia. It outlines the terms and conditions of a loan guarantee between the borrower and the guarantor.

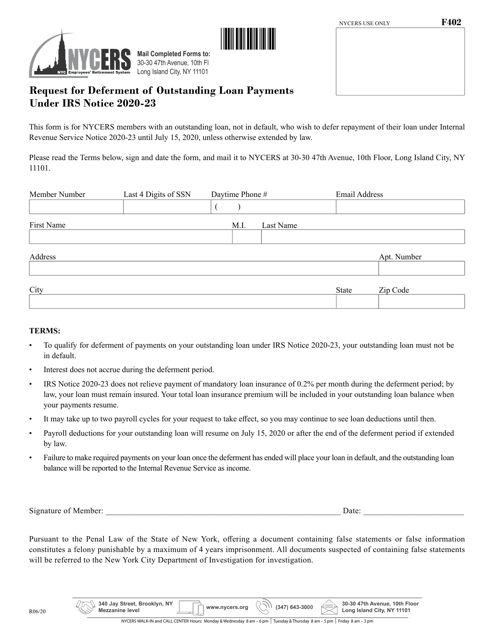

This Form is used for requesting a deferment of outstanding loan payments in New York City due to IRS Notice 2020-23.

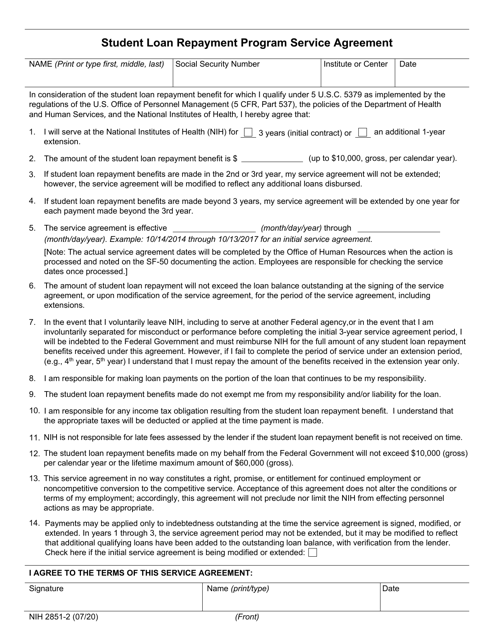

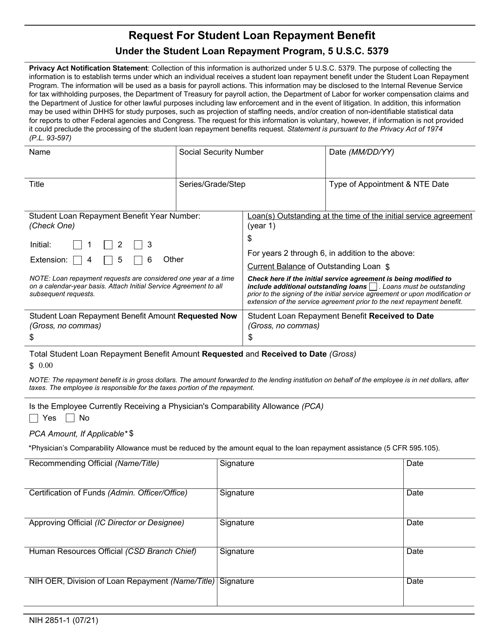

This Form is used for the Student Loan Repayment Program Service Agreement in the NIH2851-2 form. This document is used to establish the terms and conditions of the student loan repayment program for eligible participants.

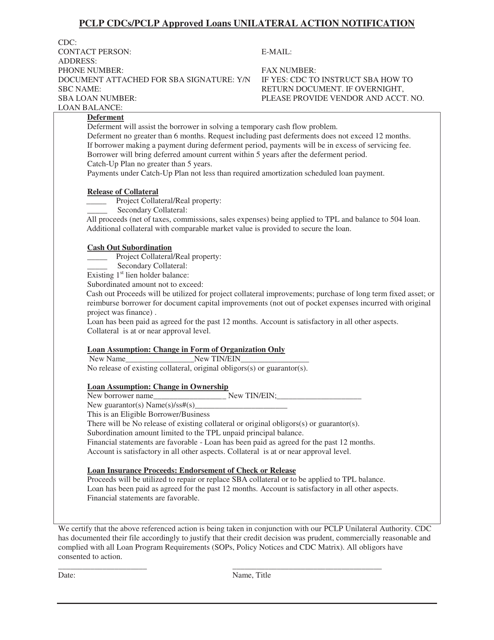

This document is for notifying individuals about unilateral actions taken in regards to PCLP CDCs/PCLP approved loans.

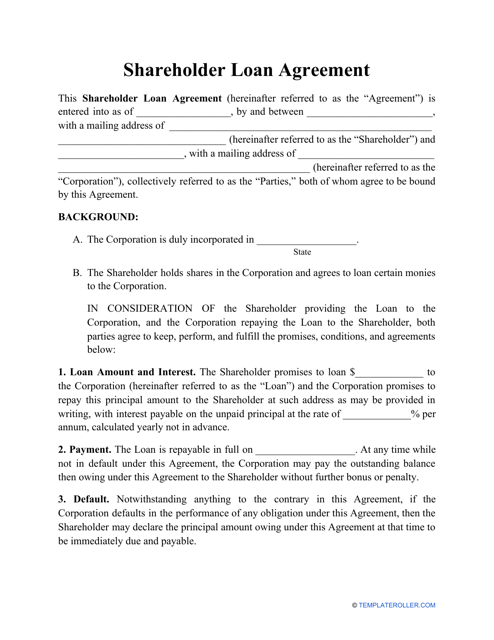

This type of agreement is used when a corporation borrows money from a shareholder in order to explain the details of the loan and to serve as evidence of the debt.

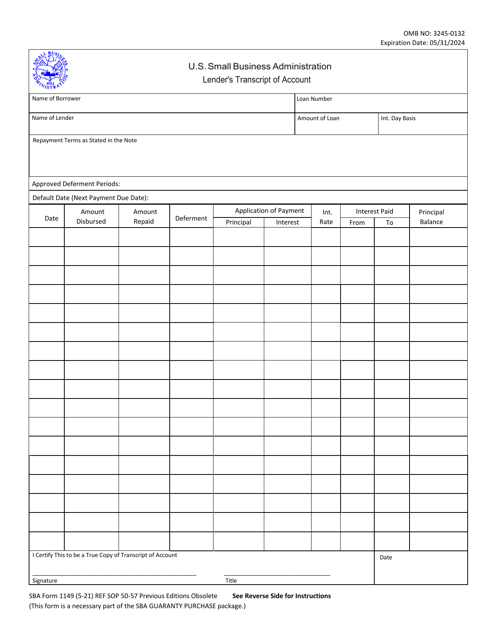

This document keeps track of the disbursement of 7(a) Loan proceeds and the applications of payments. It allows to determine the date the loan went into default and to assess how much interest the lender is receiving.

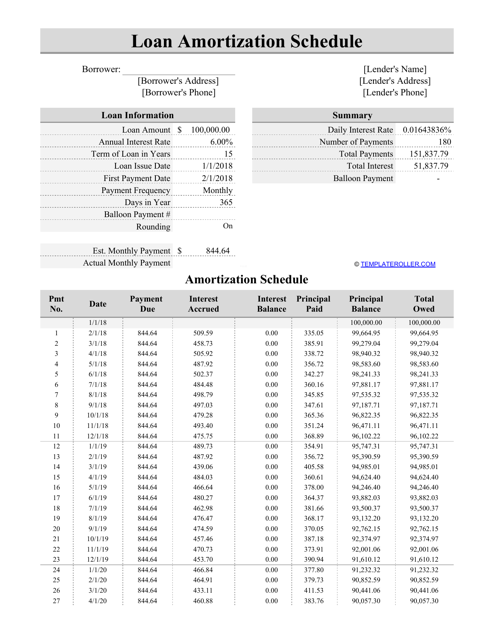

An individual can use this spreadsheet to outline payments for a loan, to calculate the money that goes towards the lender and to the interest until the borrower has paid off the entire amount of a loan.

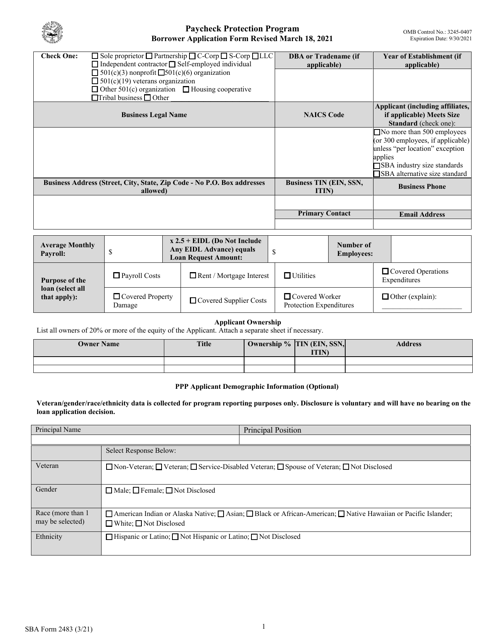

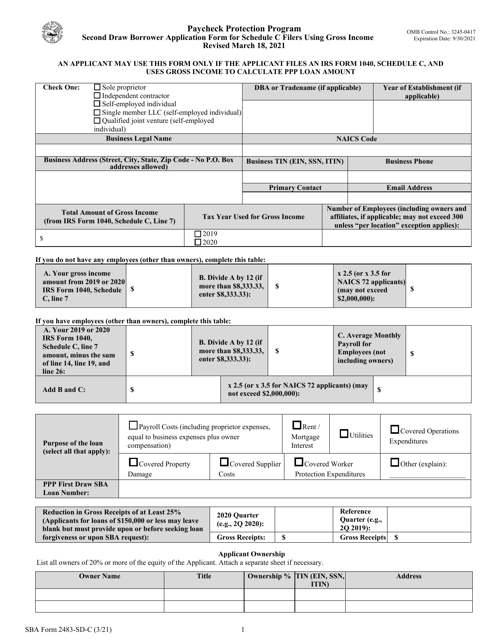

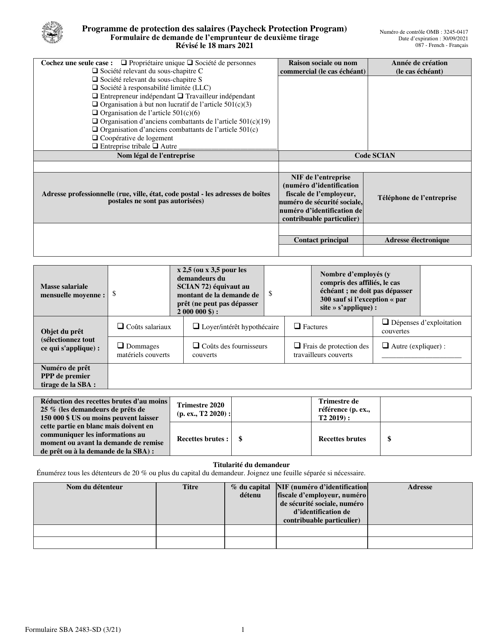

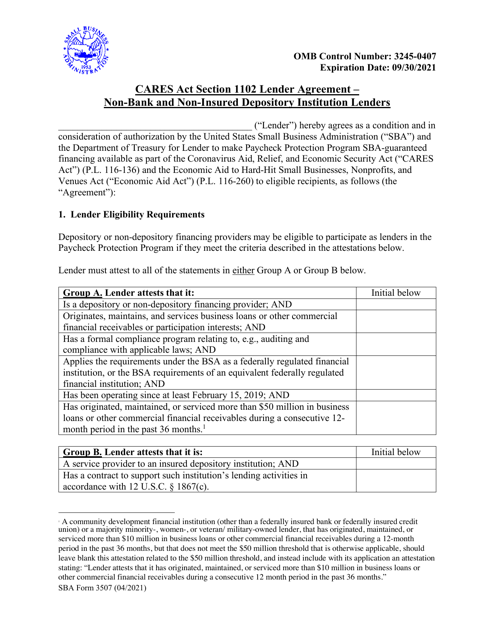

This form is used for small business owners who file their taxes with a Schedule C form and are applying for a second draw loan through the Small Business Administration. The form specifically caters to those who calculate eligibility based on gross income.

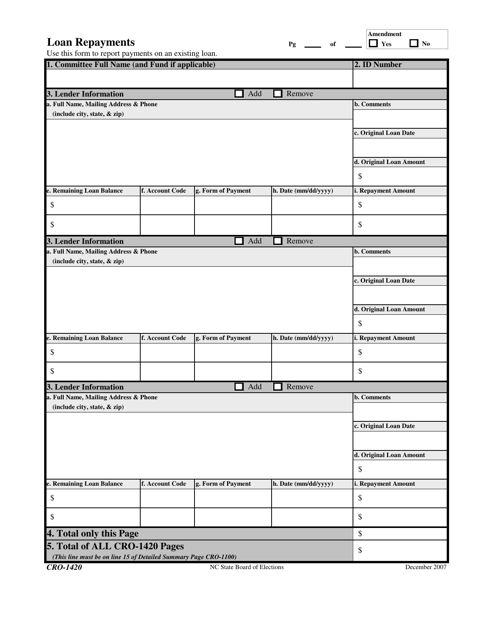

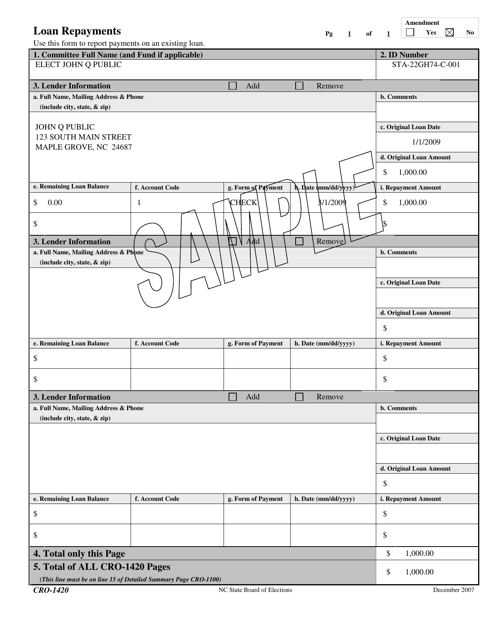

This form is used for documenting loan repayments in the state of North Carolina.

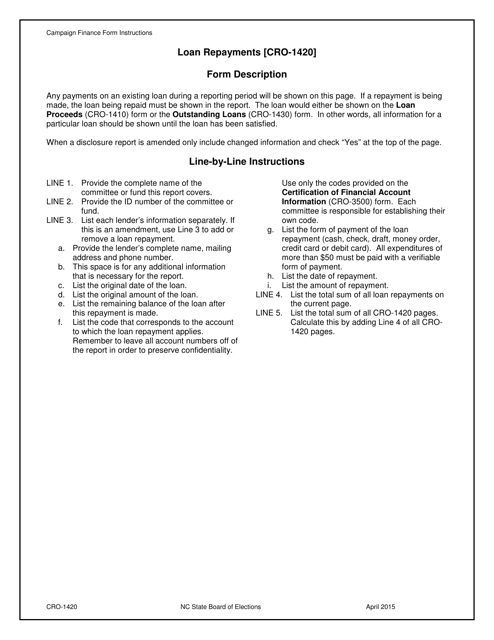

This Form is used for making loan repayments in North Carolina. It provides instructions on how to submit the payment and what information is required.

This Form is used for loan repayments in North Carolina.

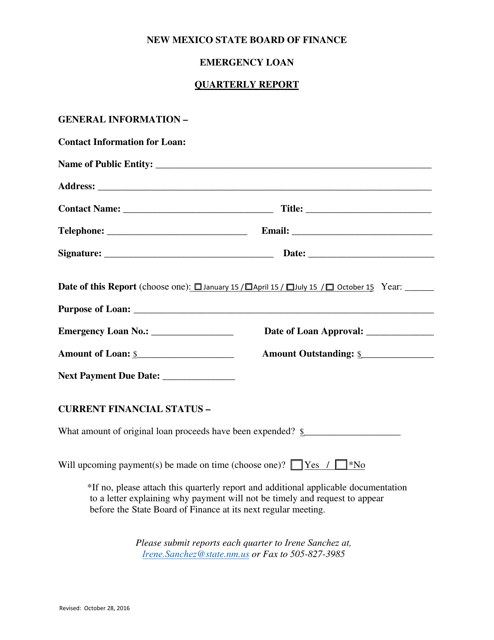

This document provides a quarterly report on emergency loans in the state of New Mexico.

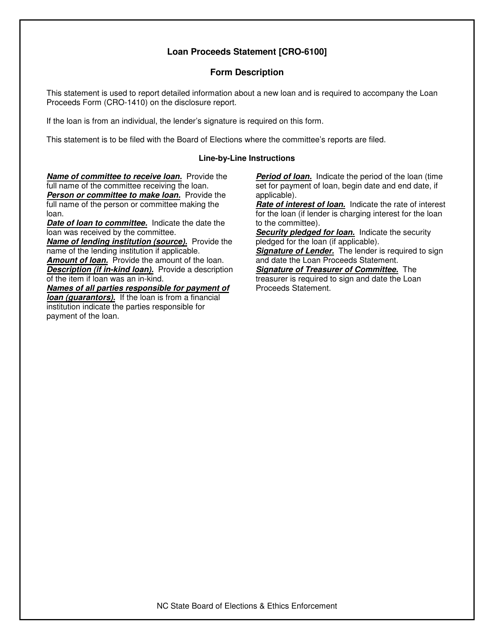

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

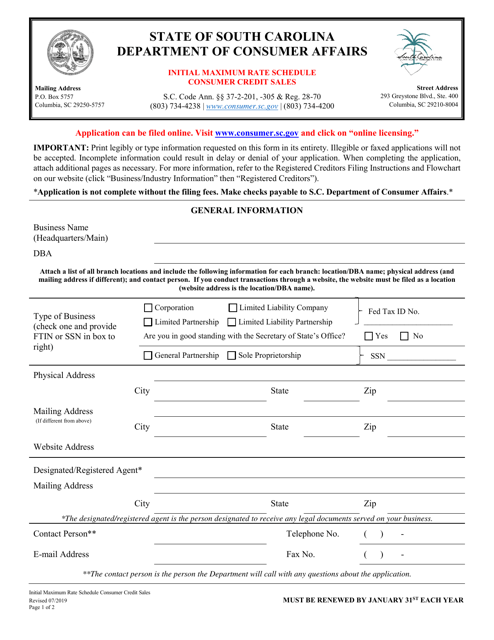

This document provides the maximum interest rates for consumer credit sales in South Carolina.

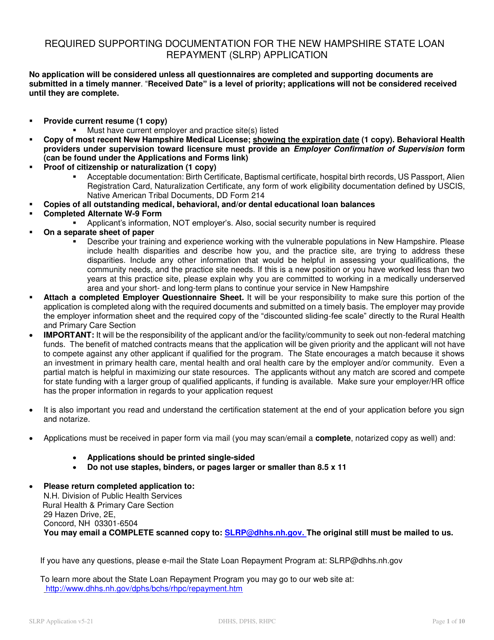

This document is an application form for the New Hampshire State Loan Repayment Program. Residents of New Hampshire can use this form to apply for financial assistance to repay their loans.

This form is used for requesting the student loan repayment benefit from NIH (National Institutes of Health).

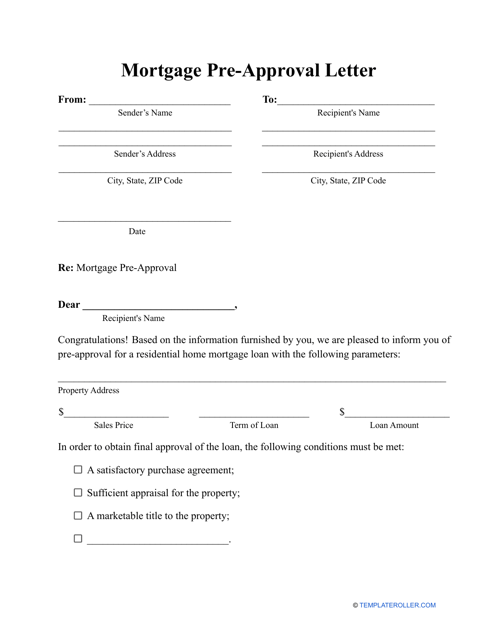

This is a written statement composed by a lender and sent to a borrower to notify the latter their mortgage application has been evaluated and approved subject to certain conditions the borrower must adhere to.

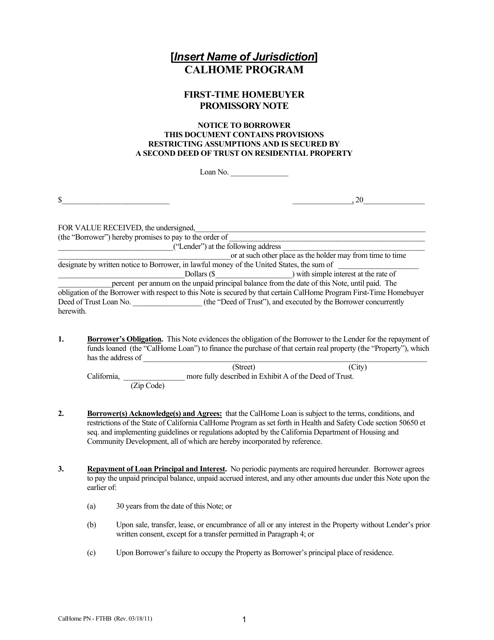

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

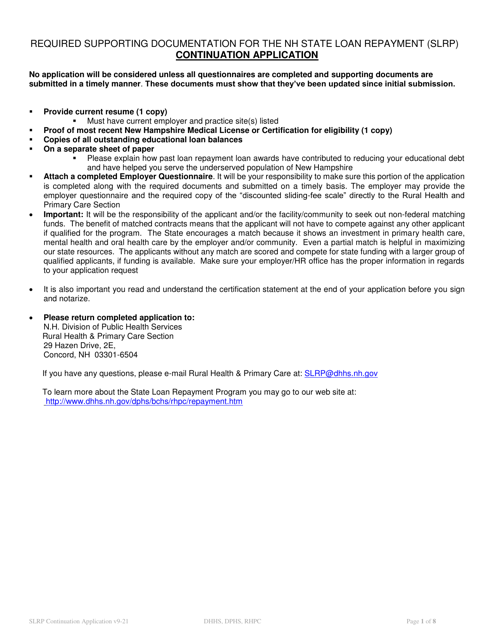

This document is used for applying to continue a contract in the New Hampshire State Loan Repayment Program.

Use this type of written Promissory Note to promise to repay a debt by an agreed date.

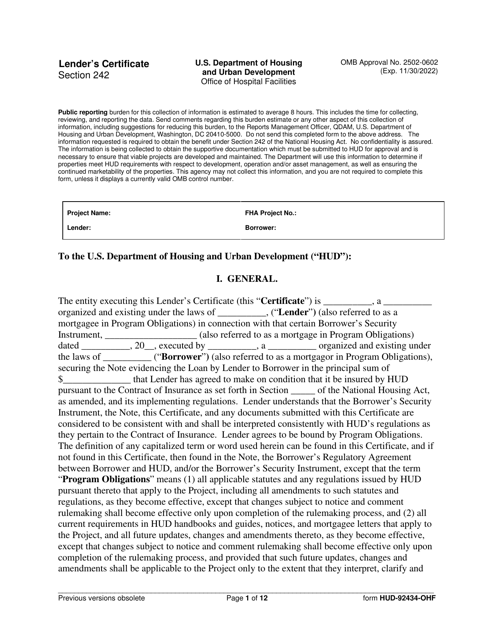

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

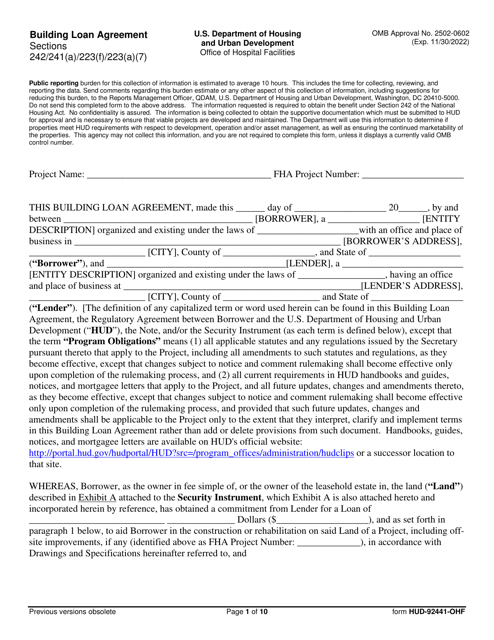

This document is a Building Loan Agreement form (Form HUD-92441-OHF) used by the U.S. Department of Housing and Urban Development (HUD) for financing the construction or rehabilitation of affordable housing projects.

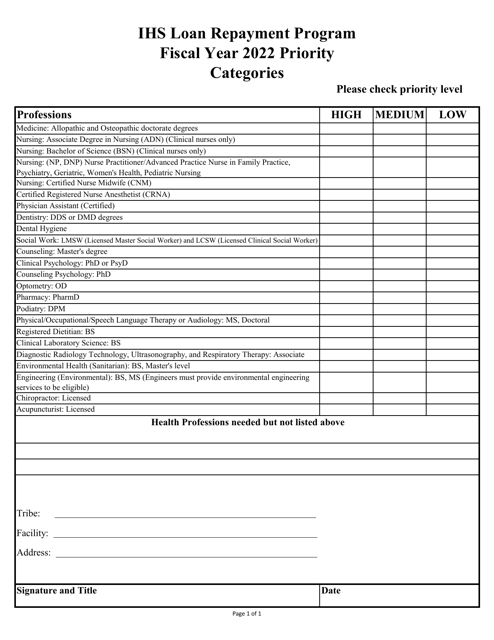

This document provides a priority chart for the IHS Loan Repayment Program. It outlines the order in which applications are reviewed and prioritized.

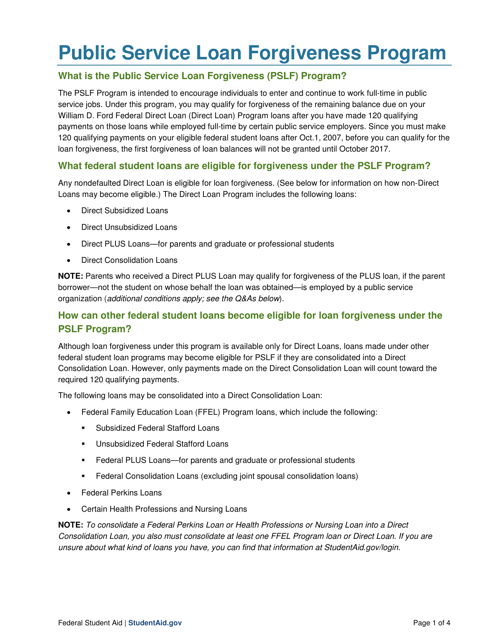

This fact sheet provides information about the Public Service Loan Forgiveness program, including eligibility requirements, application process, and benefits. It is designed to help borrowers understand how they may qualify for loan forgiveness through public service employment.

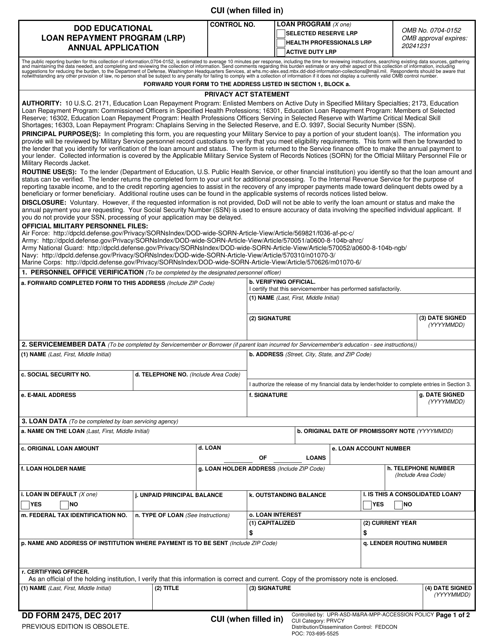

This is a form used by service members to request the U.S. Army to pay off a portion of their student loan. The provided information will be reviewed by the Military Service Personnel record custodian to verify that eligibility requirements are met.

This document provides guidance and important information for borrowers of federal student loans who are preparing to exit or finish their loan repayment. It helps borrowers understand their rights and responsibilities and provides tips for managing their student loan debt after graduation.

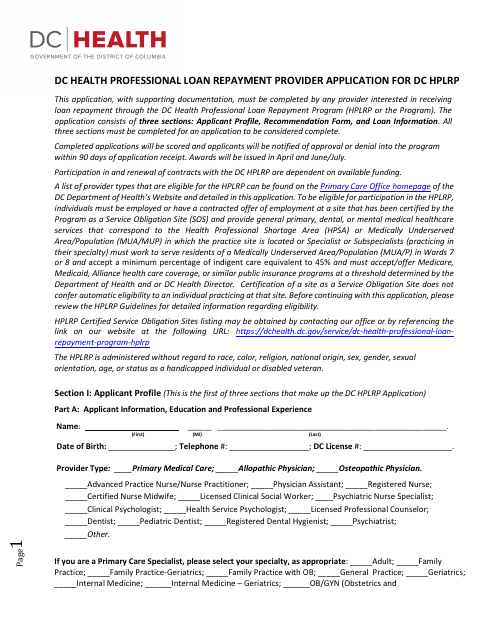

This document is an application form for healthcare professionals in Washington, D.C. seeking loan repayment through the D.C. Health Professional Loan Repayment Program. It includes an applicant profile section.

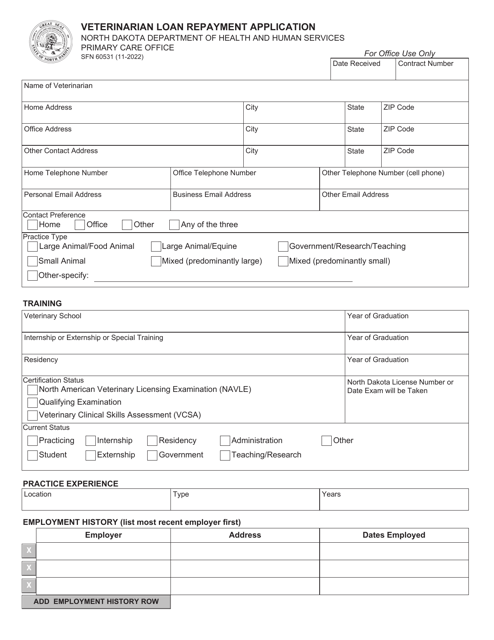

This form is used for applying for the Veterinarian Loan Repayment Program in North Dakota. It allows veterinarians to apply for loan repayment in exchange for practicing in a designated shortage area.