Loan Agreement Form Templates

Documents:

256

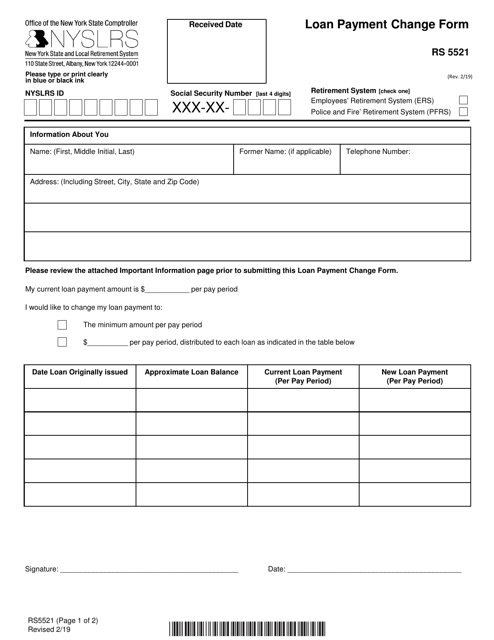

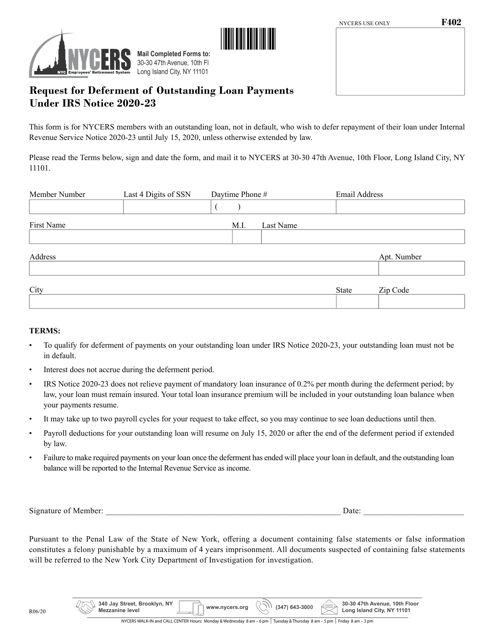

This form is used for requesting changes to loan payments in the state of New York.

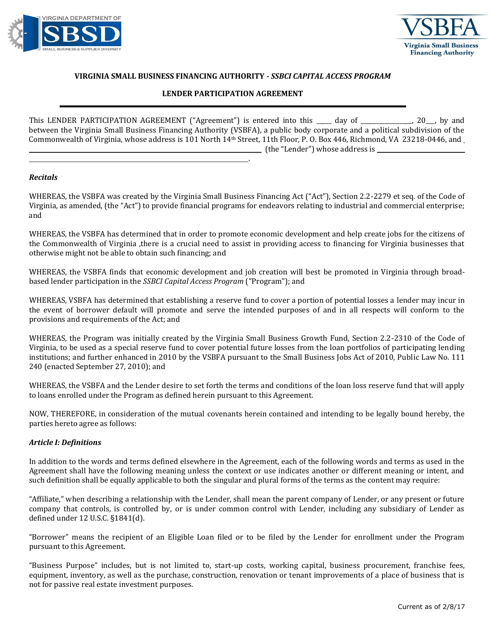

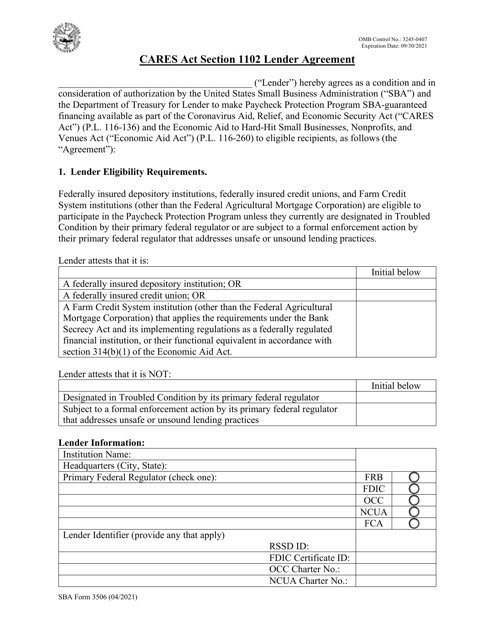

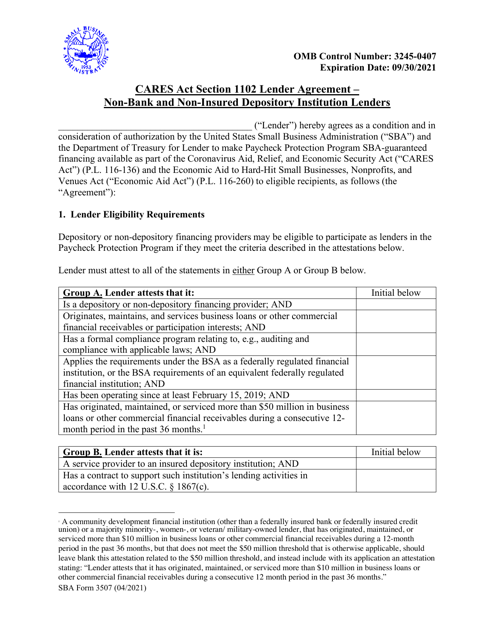

This document outlines the agreement between a lender and the state of Virginia for participation in the State Small Business Credit Initiative (SSBCI) Capital Access Program (CAP). It specifies the terms and conditions of the lender's participation.

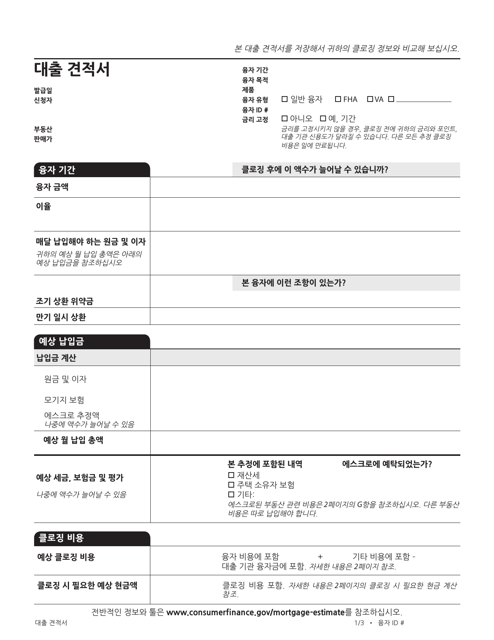

This document provides a loan estimate form from the Consumer Financial Protection Bureau specifically for residents of California who speak Korean. The form is used to understand the terms and costs associated with a loan.

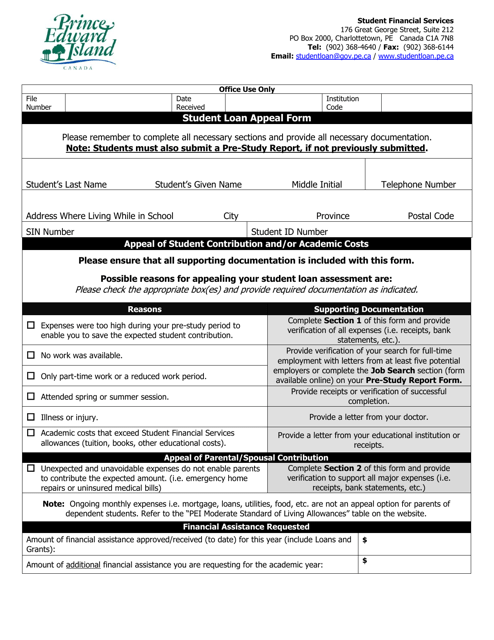

This document is used for appealing a student loan decision in Prince Edward Island, Canada.

This form is used for the Loan Guaranty Program Borrower's Agreement in Virginia. It outlines the agreement between the lender and the borrower for a loan guaranty program.

This document is used for securing a certificate of deposit in the state of Louisiana. It outlines the terms and conditions of the agreement between the depositor and the financial institution.

This Form is used for documenting the right of way parcels in the state of California. It serves as a diary to keep track of the parcels and their corresponding information.

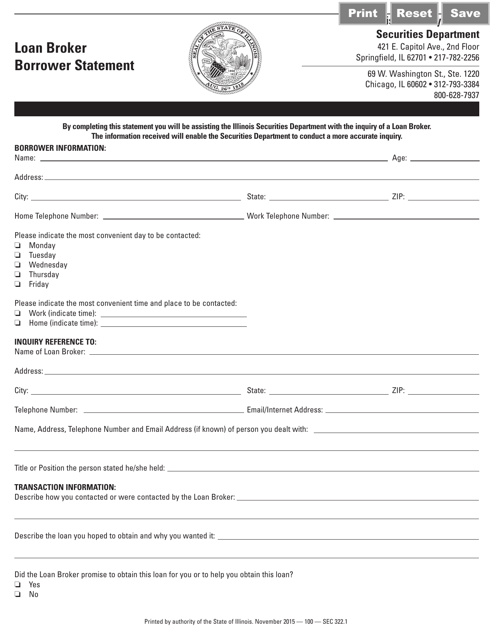

This form is used for borrowers in Illinois who are working with a loan broker. It is a statement that includes important information about the borrower's financial situation and their agreement with the loan broker.

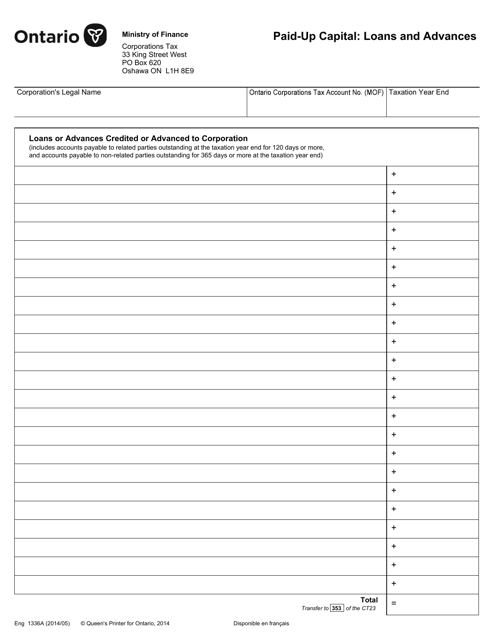

This form is used for declaring the paid-up capital, loans, and advances in Ontario, Canada.

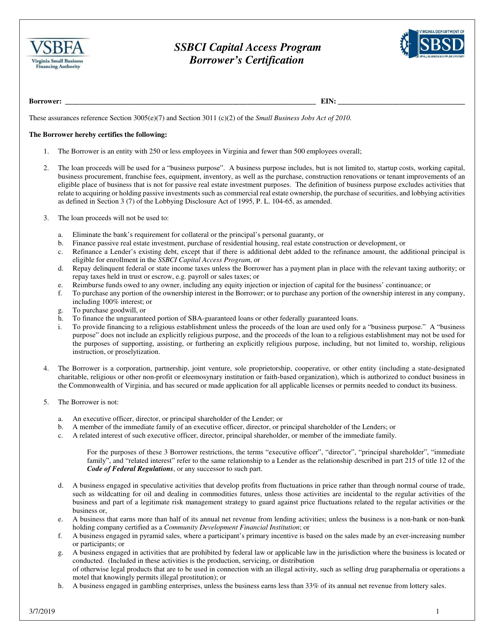

This document certifies borrowers participating in the SSBIC Capital Access Program in Virginia.

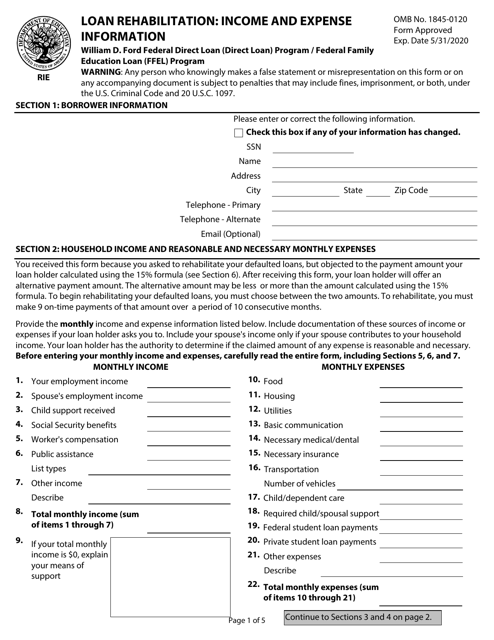

Fill in this legal document used by Collection Agencies to calculate the size of an affordable minimum monthly payment for the loan rehabilitation program.

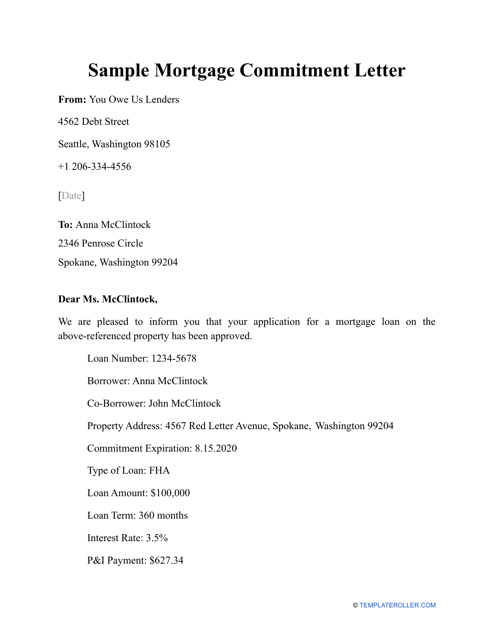

This letter is sent to the borrower after their mortgage application is accepted.

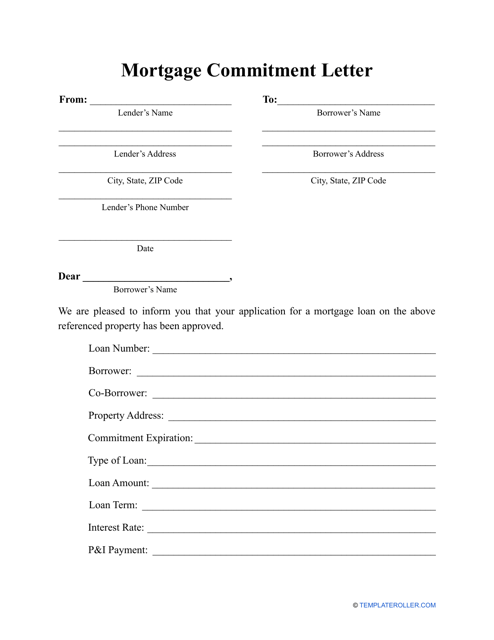

This formal letter can be used to confirm the willingness of a lender to sign a mortgage agreement with a borrower.

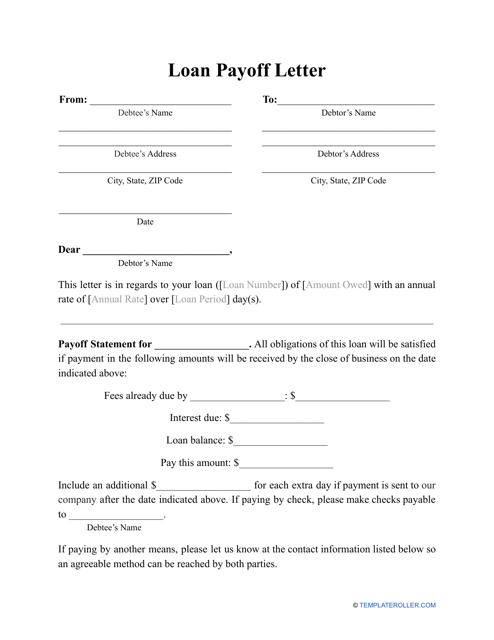

This letter provides detailed instructions on how to pay off a loan.

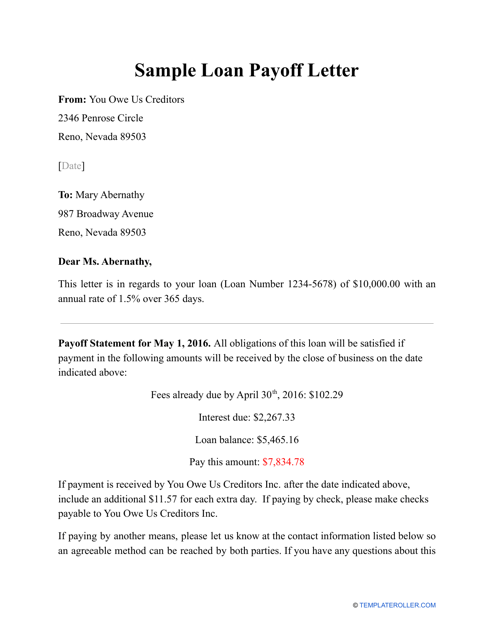

Check out this sample before drafting your own Loan Payoff Letter.

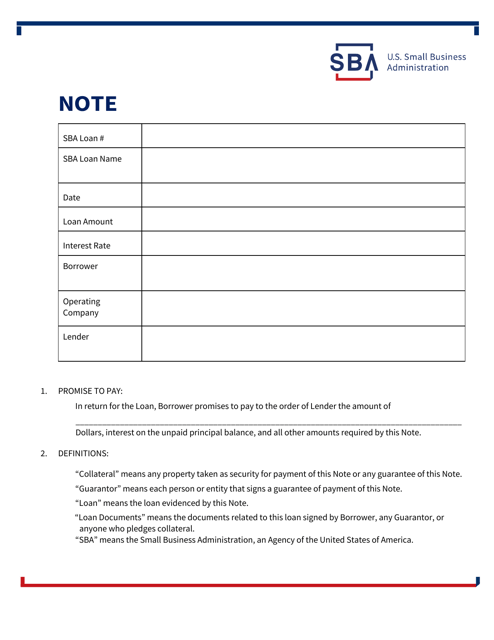

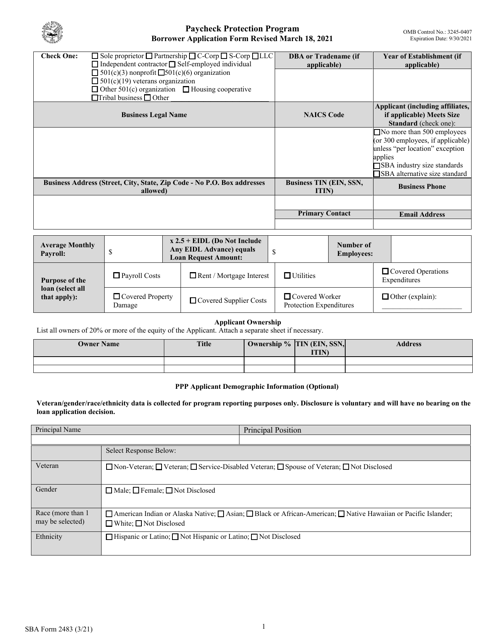

This document is used for issuing standard loan notes by the Small Business Administration (SBA). It outlines the terms and conditions of the loan, including repayment terms and interest rates.

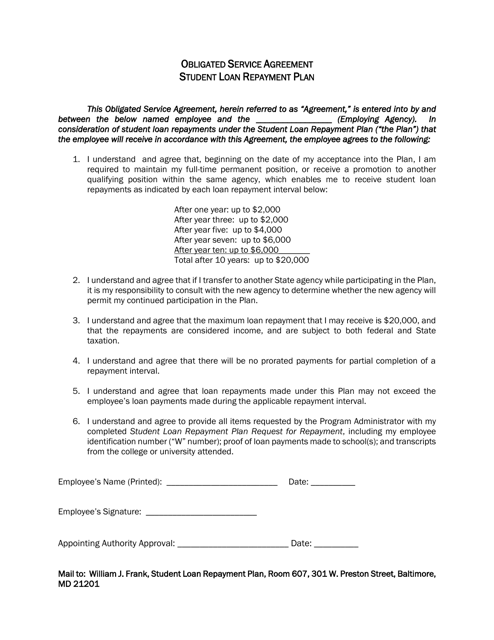

This document is for a student loan repayment plan in Maryland that requires an obligated service agreement.

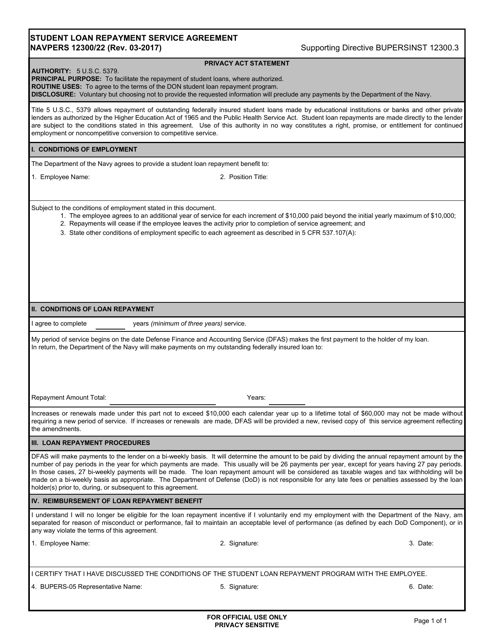

This document is used for enrolling in the Student Loan Repayment Service Agreement as part of the Navy Personnel Command.

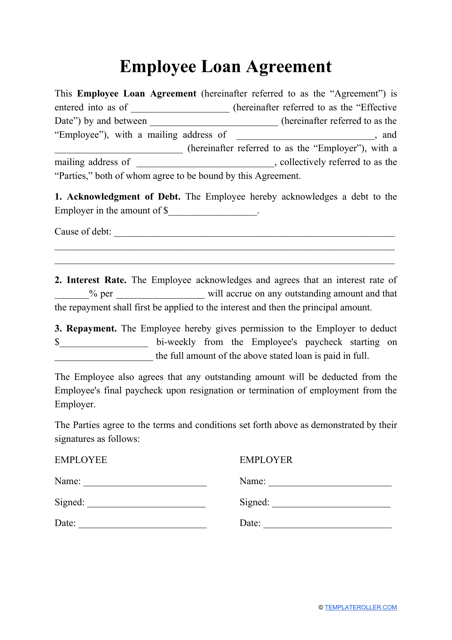

This contract contains the consent of an employer to provide a loan to an employee, which will be further deducted from the employee's payroll.

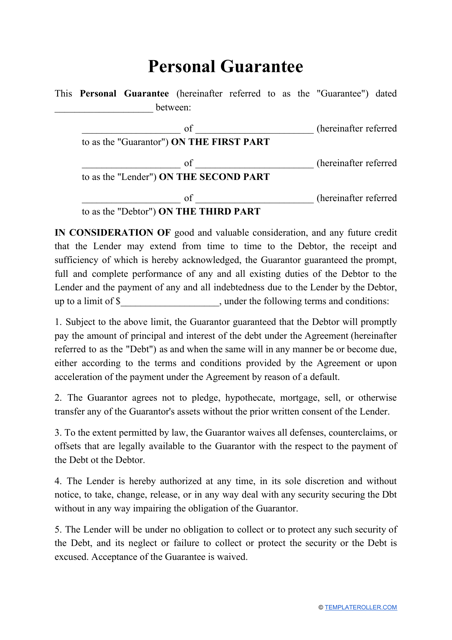

This form expresses a written promise by a guarantor to take responsibility for a debtor if they fail to pay their debt to a lender.

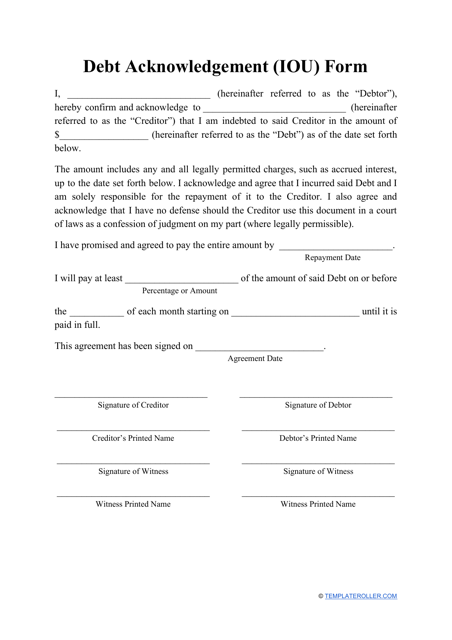

An IOU is a typed or handwritten document that outlines the details about the debt owed by one party (borrower, or debtor) to another (creditor, or lender).

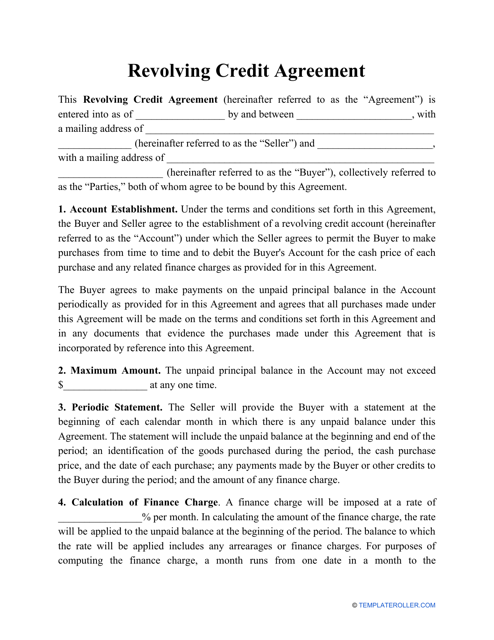

According to a Revolving Credit Agreement, a seller allows a buyer to make purchases under this account on the terms and conditions established in the agreement.

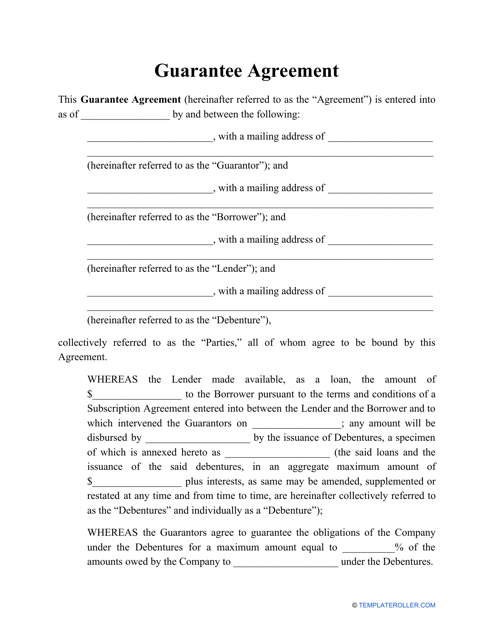

This document acts as an official pledge listing a third party (known as the guarantor) who will ensure payment of a debt will be fully repaid to the creditor.

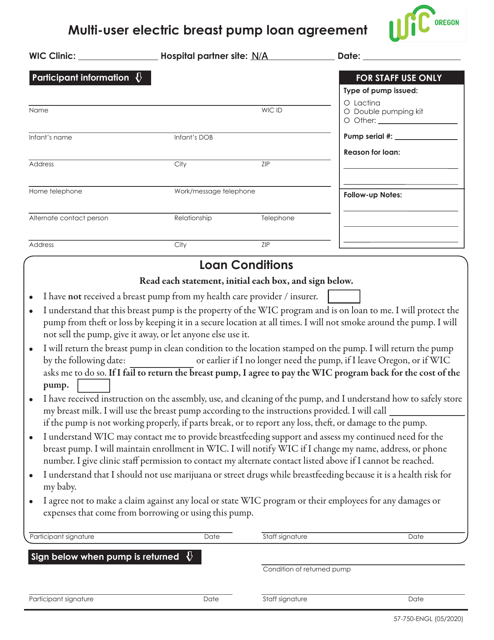

This document is a loan agreement form for a multi-user electric breast pump in the state of Oregon. It allows individuals to borrow and use the breast pump for a specific period of time.

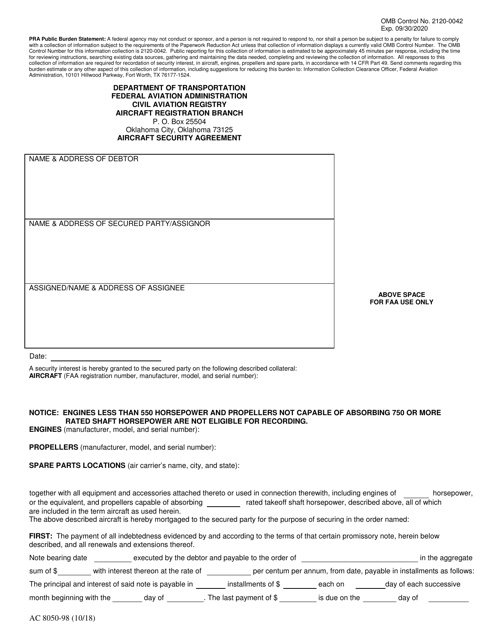

This Form is used for completing an aircraft security agreement, which is a legal document that outlines the terms and conditions for securing an aircraft. It ensures that the aircraft is collateral for a loan or other financial arrangement, providing protection for lenders or creditors in case of default.

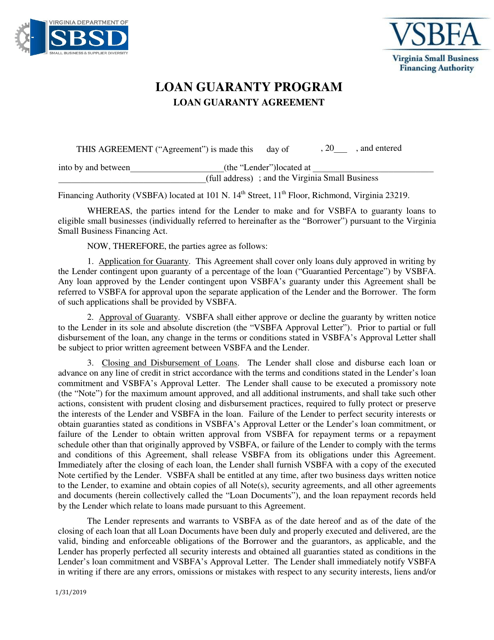

This document is a Loan Guaranty Agreement specific to the state of Virginia. It outlines the terms and conditions of a loan guarantee between the borrower and the guarantor.

This Form is used for requesting a deferment of outstanding loan payments in New York City due to IRS Notice 2020-23.

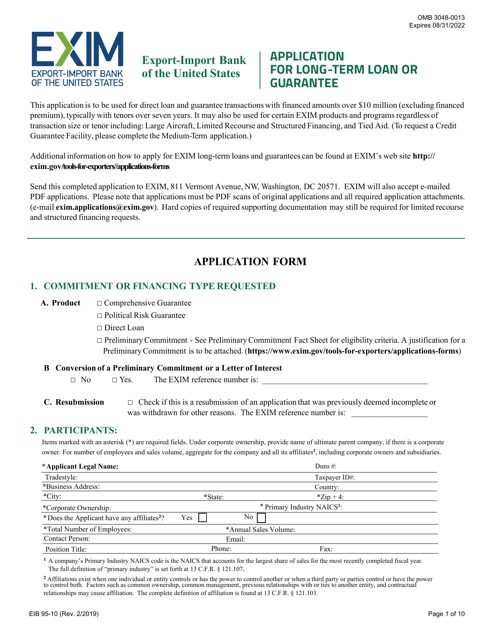

This Form is used for applying for a long-term loan or guarantee from the EIB (European Investment Bank).

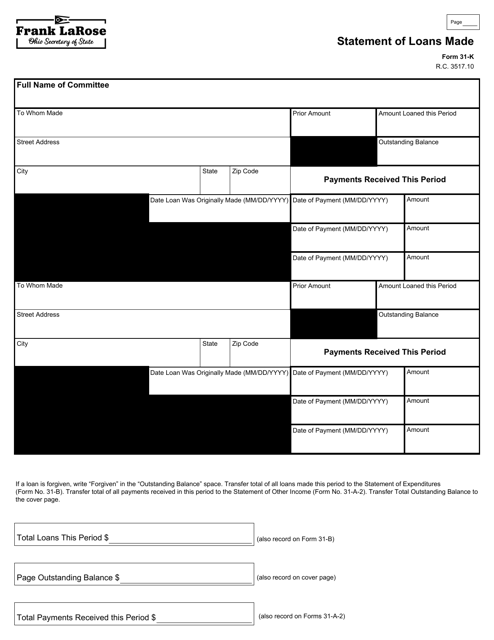

This document is used for reporting loans made in the state of Ohio. It provides a statement of all loans made by a lender within a specific period of time.

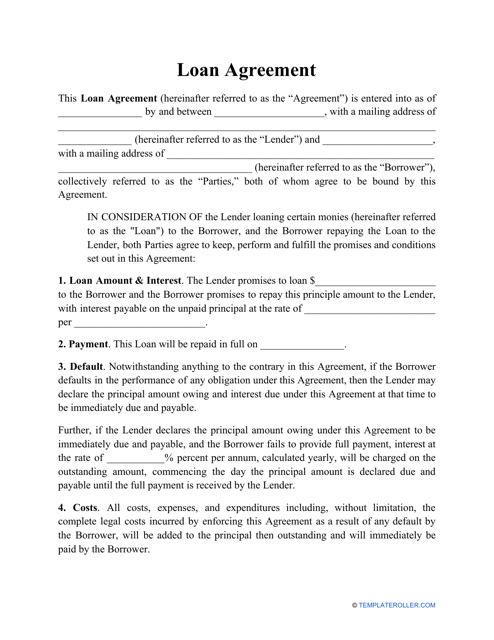

This is a contract used to document and formalize all obligations that regulate receiving the loan and paying it back.

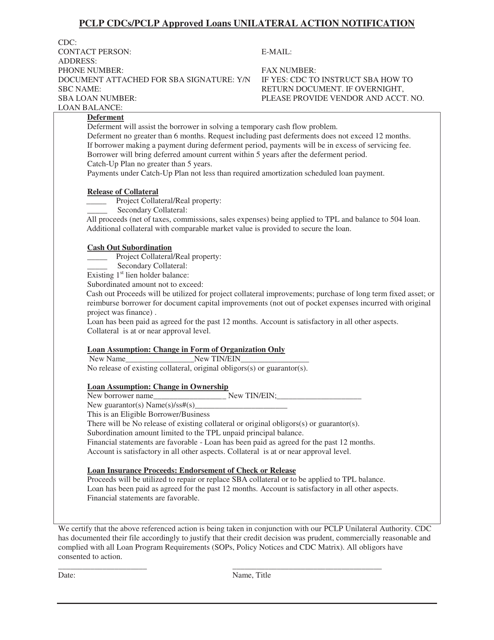

This document is for notifying individuals about unilateral actions taken in regards to PCLP CDCs/PCLP approved loans.

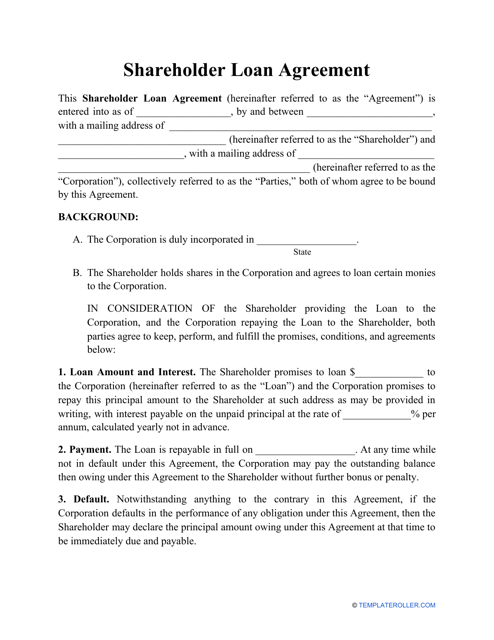

This type of agreement is used when a corporation borrows money from a shareholder in order to explain the details of the loan and to serve as evidence of the debt.

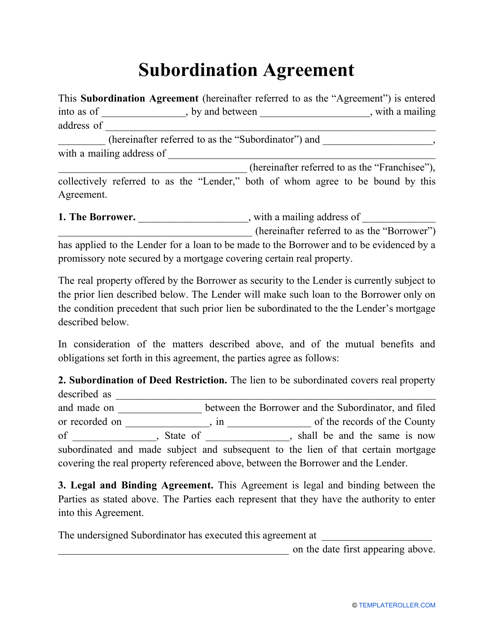

This is a formal document signed by a lender and a debtor by means of which the parties confirm the existing debt owed by the borrower has a preference before other debts of the borrower.

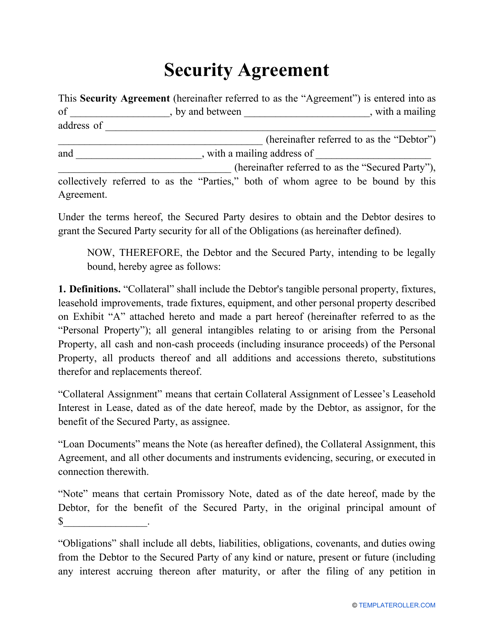

This is a formal document signed by a lender and a borrower in which the borrower provides their property or interest in an asset as collateral for a loan.