Loan Agreement Form Templates

Documents:

256

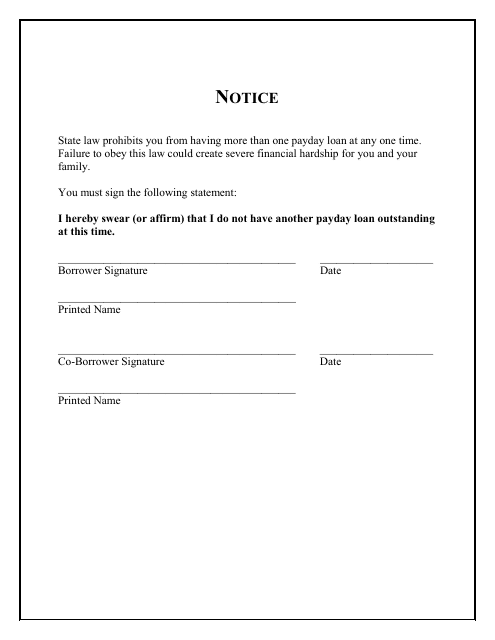

This document is an affidavit that is used by borrowers in the state of Montana. It is typically used to provide sworn statements or declarations related to a loan or mortgage agreement.

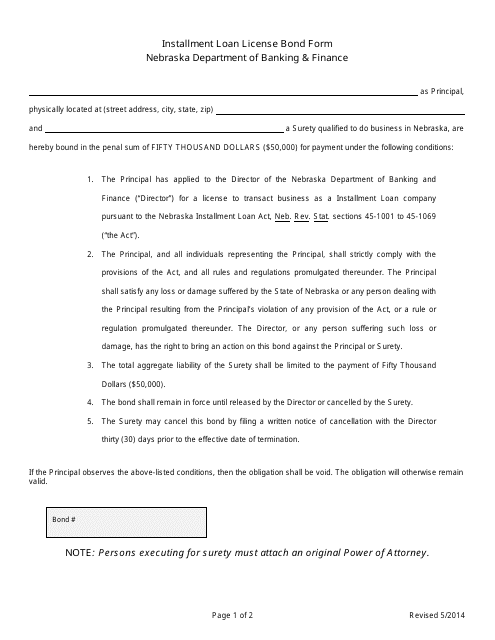

This document is for obtaining an installment loan license bond in the state of Nebraska.

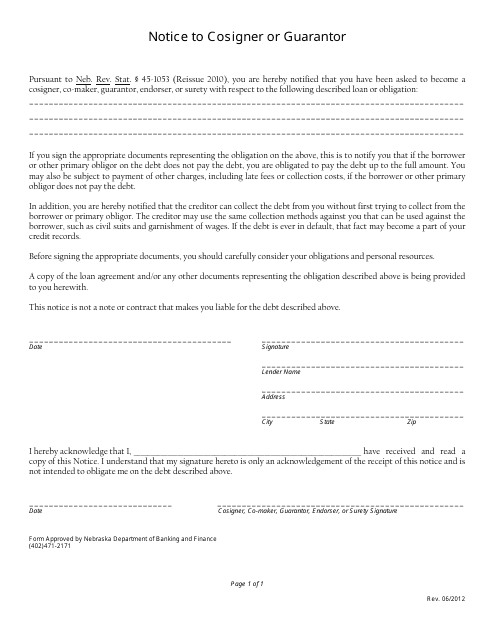

This document notifies a cosigner or guarantor in Nebraska of their responsibilities and obligations. It outlines the implications and consequences of not fulfilling their financial commitment.

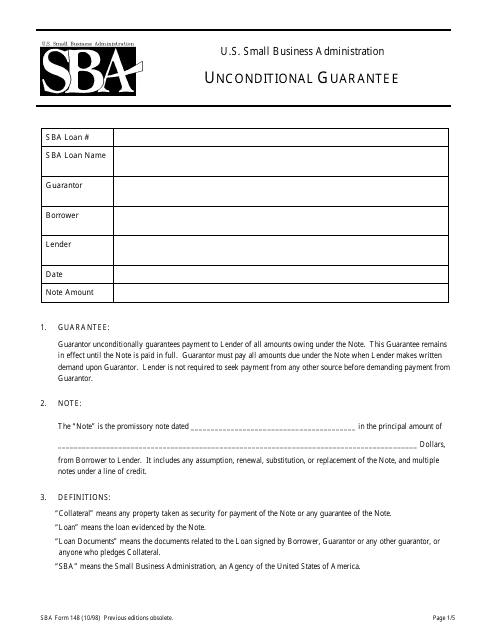

Use this document if you are a lender and the guarantor is liable for the repayment of the entire amount of the borrower's loan.

This document is used as a promise by the borrower to pay a certain amount to the lender, as well as any interest and other amounts on the unpaid principal balance owing.

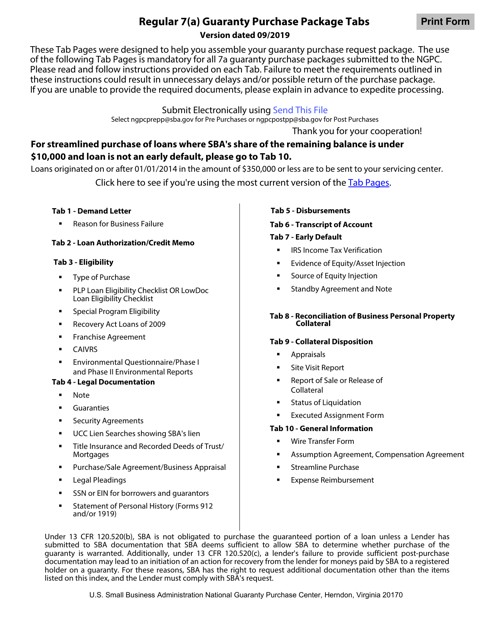

This Form is used for businesses to agree to comply with certain regulations or requirements set by the Small Business Administration (SBA).

This form is used for creating a legally binding agreement between a borrower and a lender to secure a loan or credit with specified collateral.

This Form is used for establishing a Deposit Fund Control Agreement for a Loan Loss Reserve Fund through the Small Business Administration (SBA). It outlines the terms and conditions for the management and distribution of funds to cover potential loan losses.

This form serves as evidence of a 504 Loan from the proceeds of a 504 Debenture. The Certified Development Company (CDC) signs this Note to assign it to the Small Business Administration (SBA).

Use this document to formalize a subordination of lien rights of the Standby Creditor to the Small Business Administration (SBA) Lender's rights in the collateral.

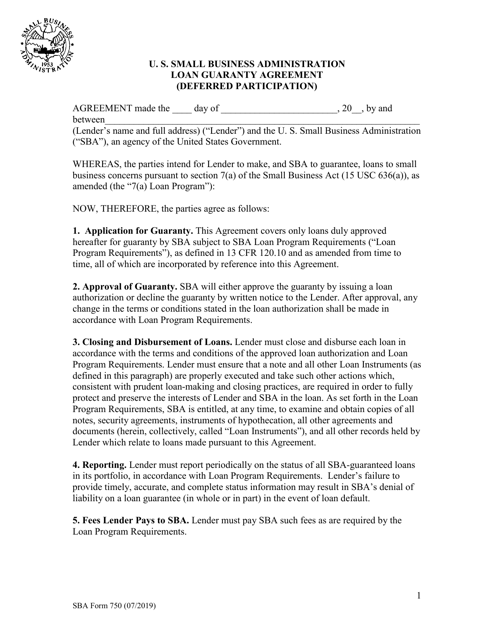

This document is used for the Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans under the Small Business Administration (SBA) program.

This Form is used for the Supplemental Guaranty Agreement for the Export Working Capital Program offered by the Small Business Administration (SBA).

This form is used for the Supplemental Loan Agreement for the Export Express program. It is a document that borrowers need to complete when applying for a loan under the program.

This form is used for a supplemental loan guaranty agreement in the SBA Express Program.

This document is used for the Third Party Lender Agreement with the Small Business Administration (SBA).

This document is used for applying for an early stage current pay debenture with the Small Business Administration (SBA).

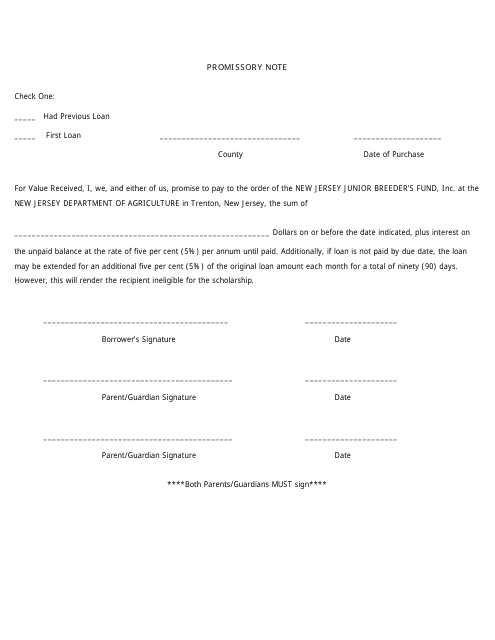

This type of document, known as a Promissory Note, is commonly used in New Jersey. It is a legal agreement that outlines the terms and conditions of a loan or debt. The note contains information such as the amount borrowed, the repayment schedule, and any interest involved. It serves as a written promise to repay the borrowed amount according to the agreed terms.

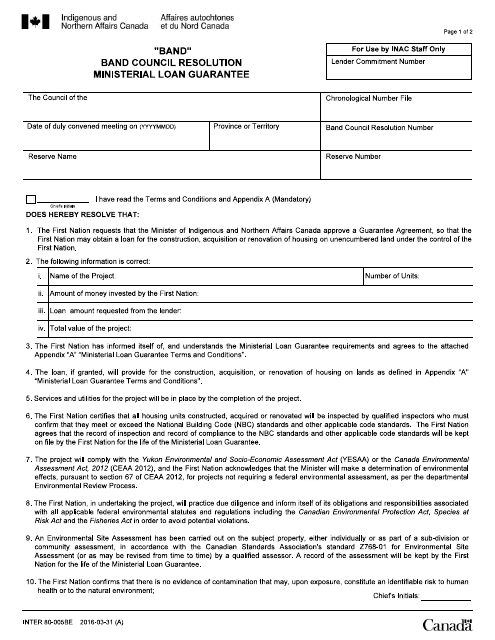

This Form is used for a Band Council Resolution in Canada to obtain a Ministerial Loan Guarantee.

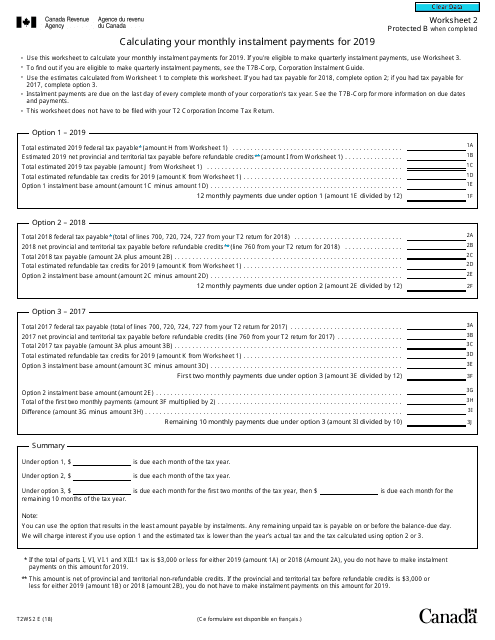

This form is used for calculating your monthly installment payments in Canada. It helps you determine how much you need to pay each month for various types of loans or financing arrangements.

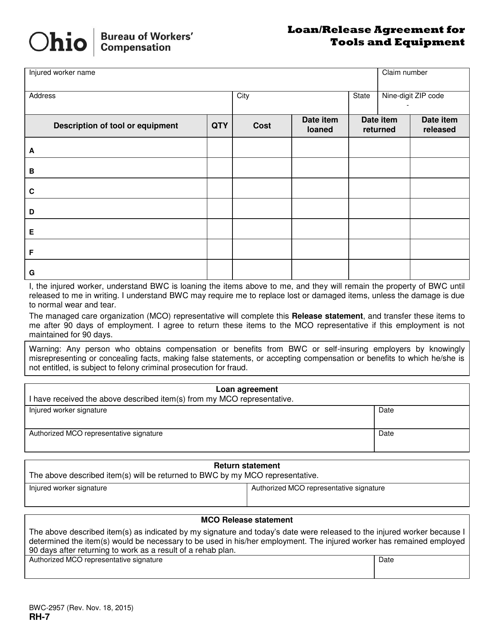

This form is used for loaning or releasing tools and equipment in the state of Ohio.

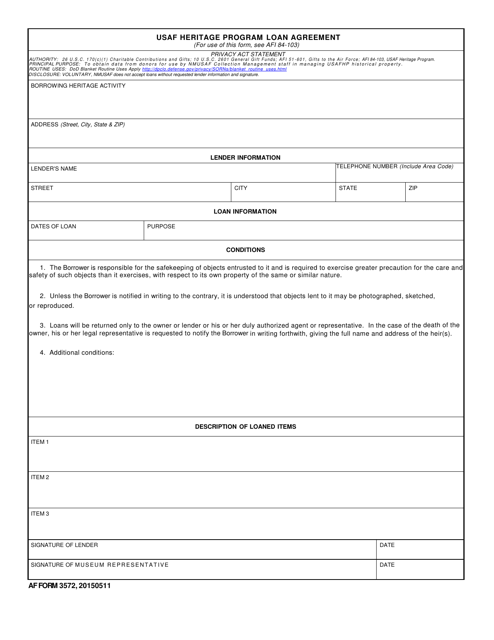

This document is a loan agreement specific to the USAF Heritage Program. It outlines the details and terms of loaning items for display or exhibition purposes.

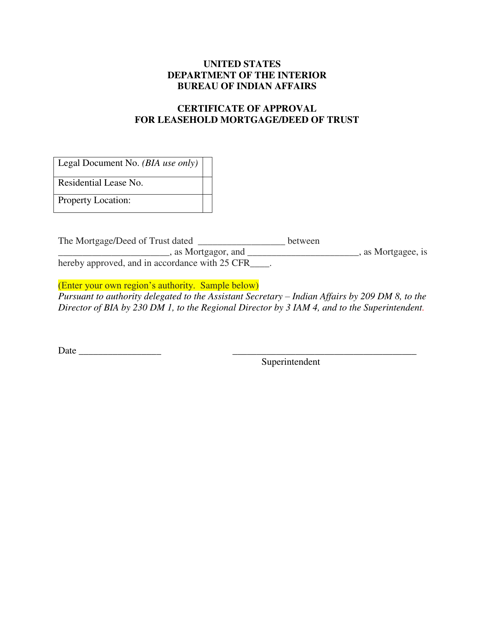

This document is used for obtaining approval for a leasehold mortgage or deed of trust. It provides a certificate of approval for the arrangement.

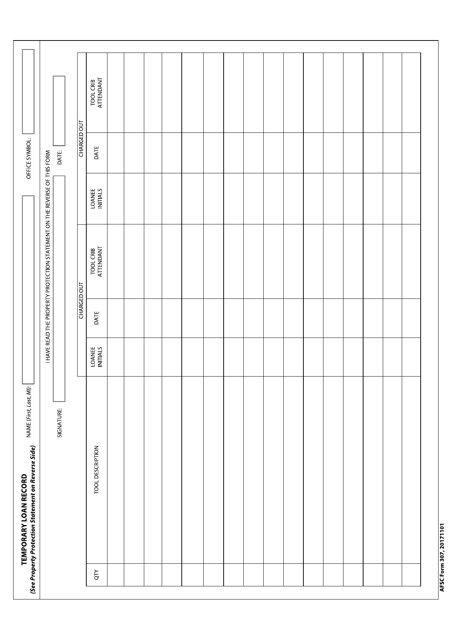

This document is used for recording temporary loans made through the Air Force Services Center (AFSC).

This document is used for a corporation to provide collateral and indemnify the bond issuer.

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

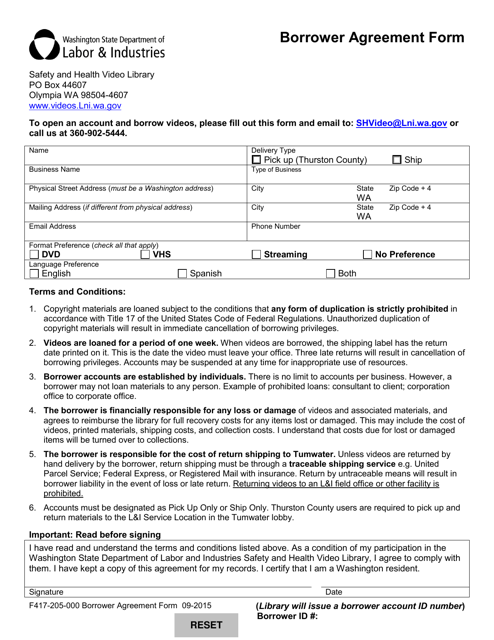

This form is used for borrowers in the state of Washington to enter into an agreement.

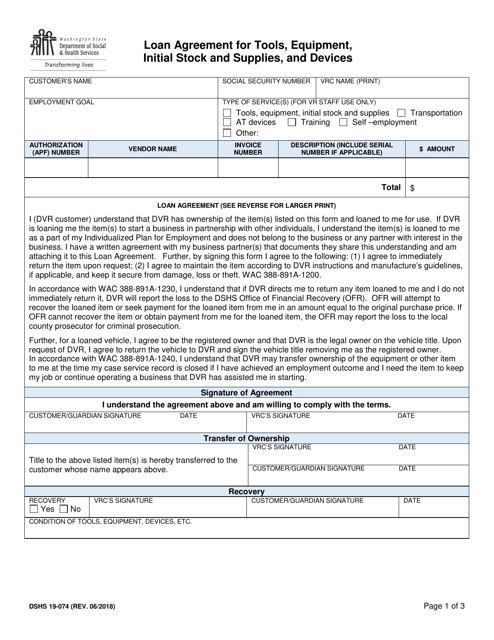

This form is used for creating a loan agreement for tools, equipment, initial stock and supplies, and devices in the state of Washington. It is for individuals or businesses who need to borrow these items and outlines the terms and conditions of the loan.

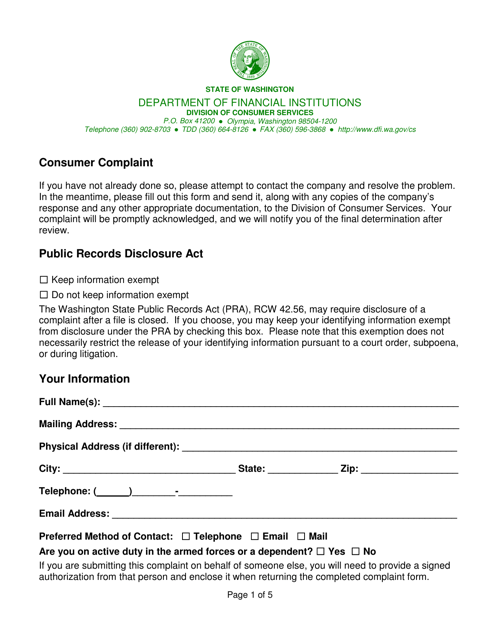

This form is used for filing a complaint related to loans in the state of Washington.

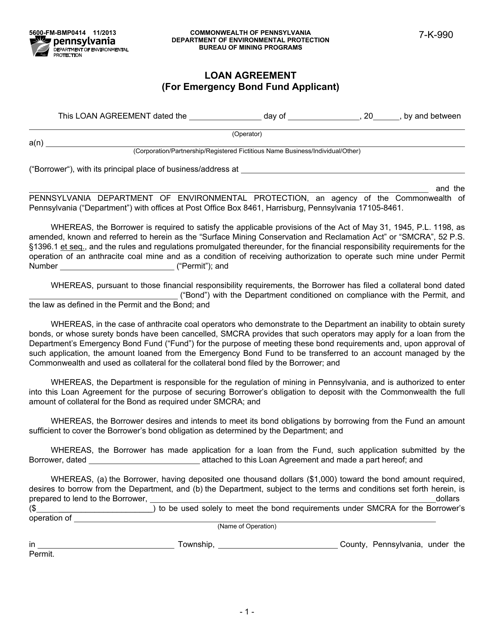

This form is used for applying for a loan agreement under the Emergency Bond Fund in Pennsylvania.

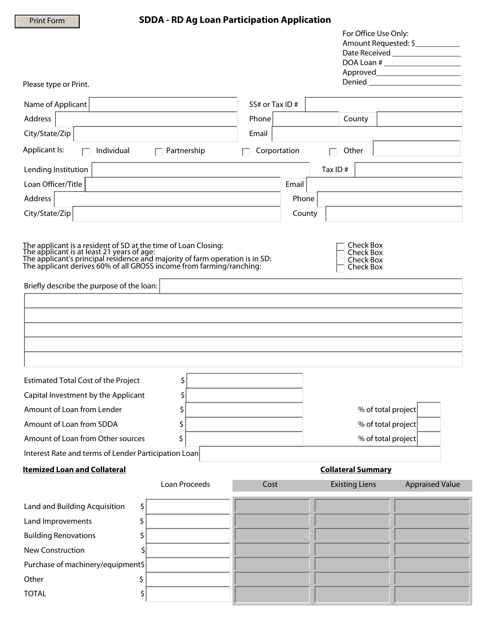

This form is used for applying for a loan participation program in South Dakota specifically for agricultural purposes.

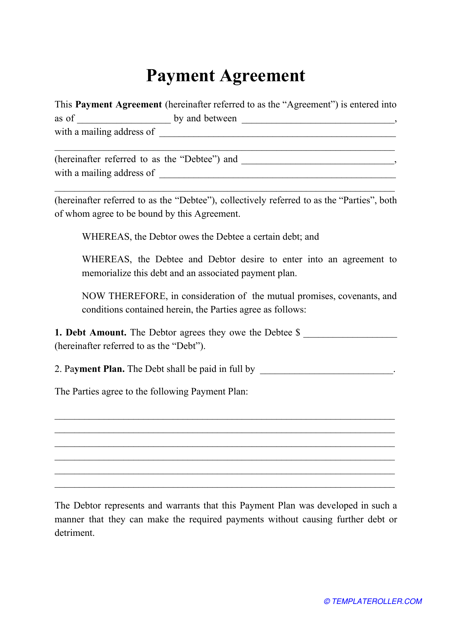

This legal contract is signed by a lender and a borrower and specifies the conditions of the payment, the details of the loan, interest rates, and payment periods.

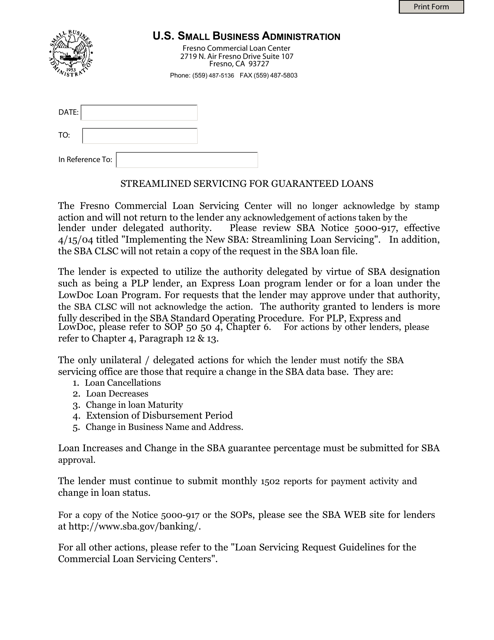

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.