Free Income Statement Templates

Documents:

220

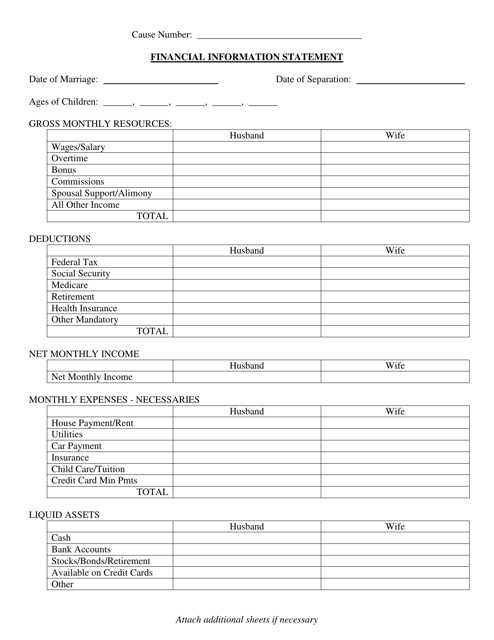

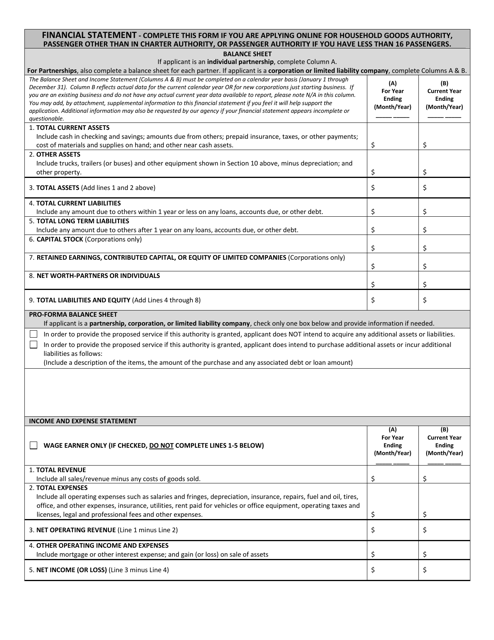

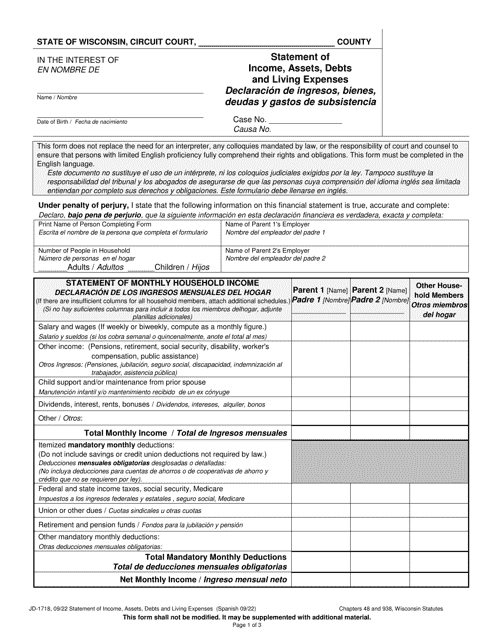

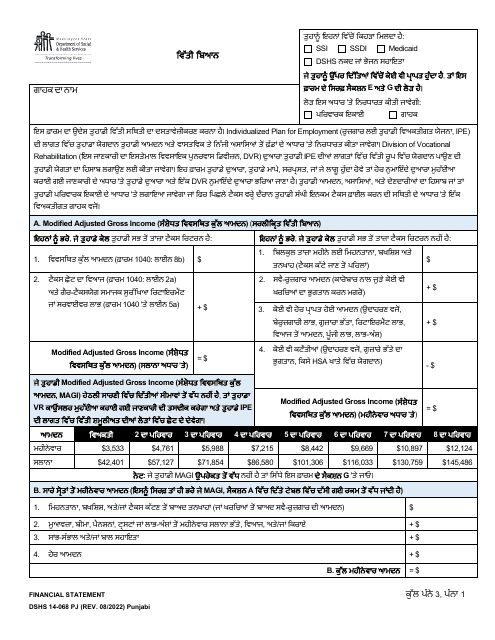

This document is used for providing financial information to Collin County, Texas. It helps assess the financial status of individuals or businesses for various purposes such as taxation, eligibility for government programs, or loan applications.

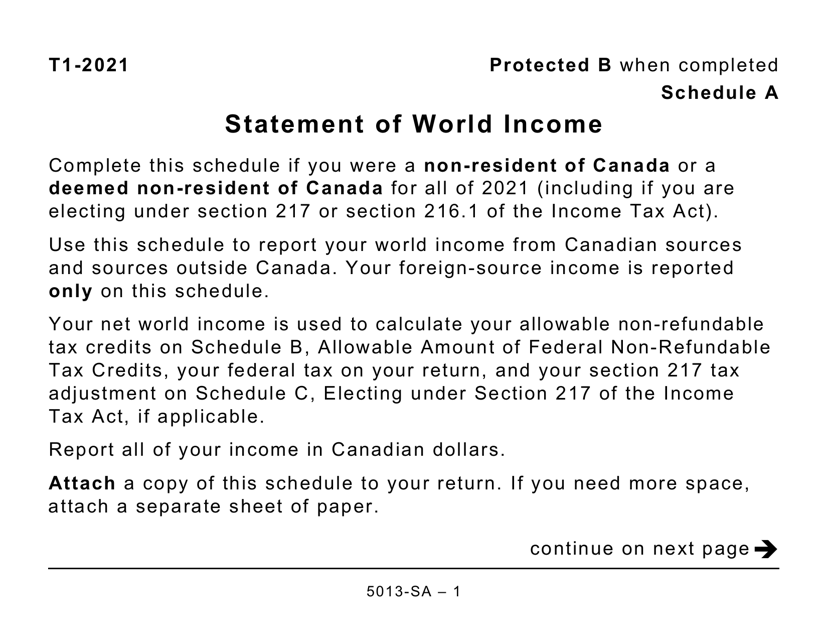

This form is used for reporting world income for Canadian taxpayers who are visually impaired and require a large print format. It is specifically for Schedule A of Form 5013-SA.

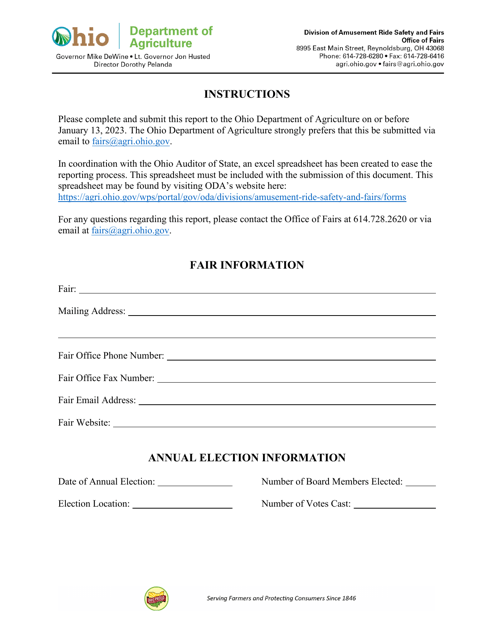

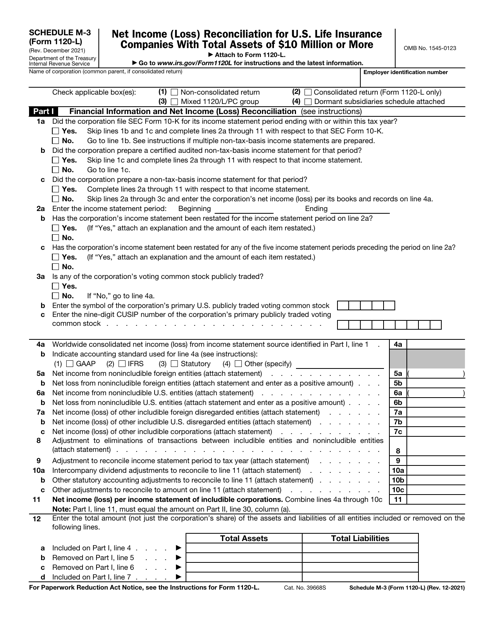

This document is the annual financial report for the state of Ohio. It provides an overview of Ohio's financial performance, including revenue, expenses, and budgetary information.

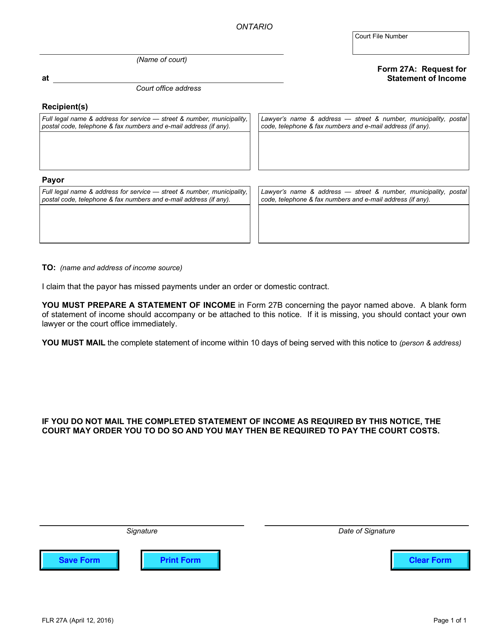

This form is used for requesting a statement of income in the province of Ontario, Canada. It is necessary to fill out this form when you need to obtain an official record of your income for various purposes, such as applying for loans or government assistance programs.

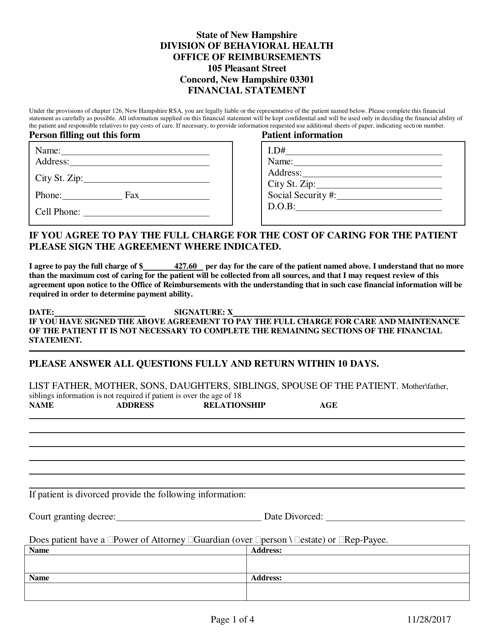

This document provides a summary of the financial activities and position of the state of New Hampshire. It includes details about revenues, expenditures, assets, and liabilities.

This document is used to provide a summary of the financial activities and position of an individual or organization in the state of Missouri. It includes information about income, expenses, assets, and liabilities.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

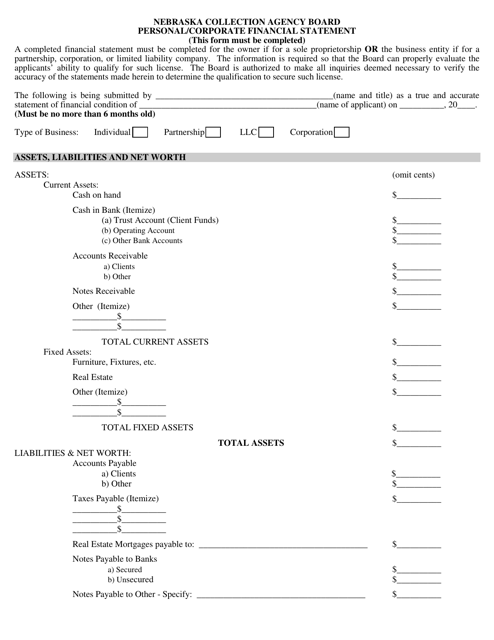

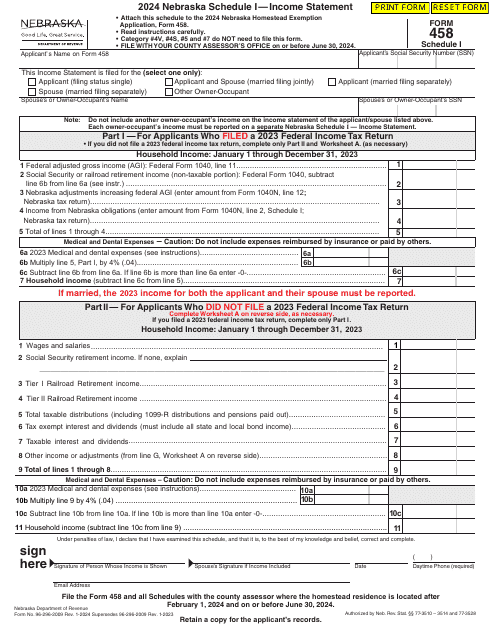

This document is used for assessing the financial standing of individuals or businesses in Nebraska. It includes details of assets, liabilities, income, and expenses.

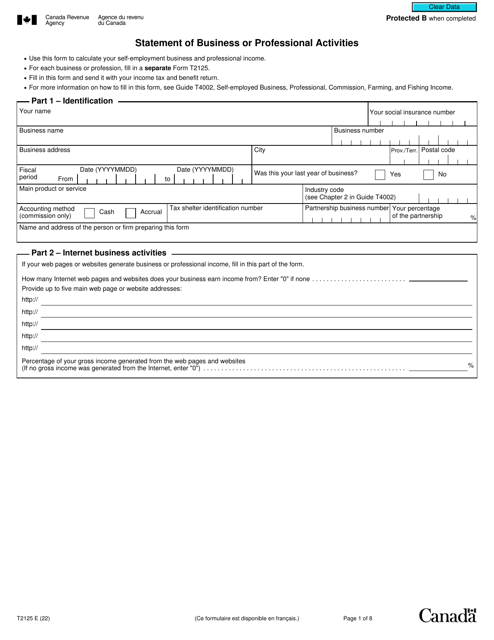

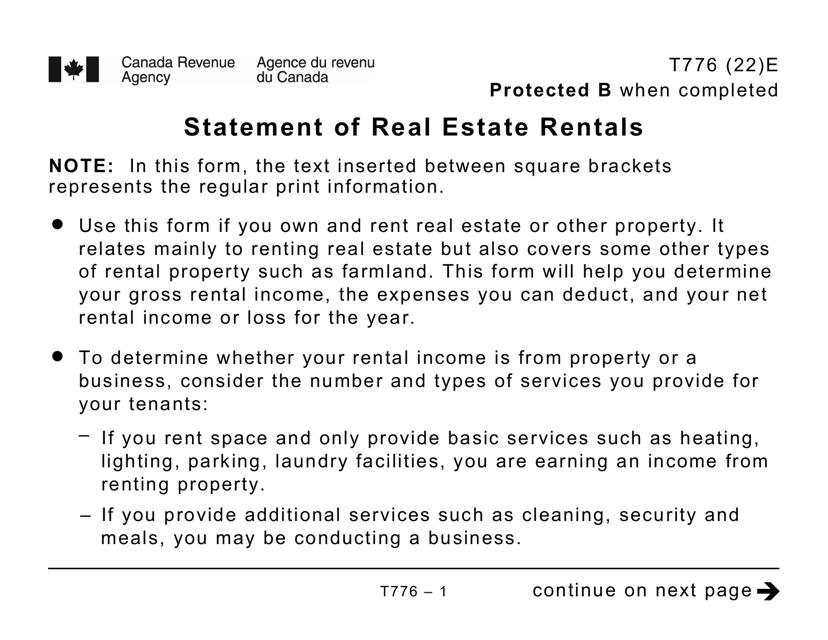

This a legal document that was specifically developed for Canadian taxpayers who receive self-employment business or professional income that they may use when they want to report their income.

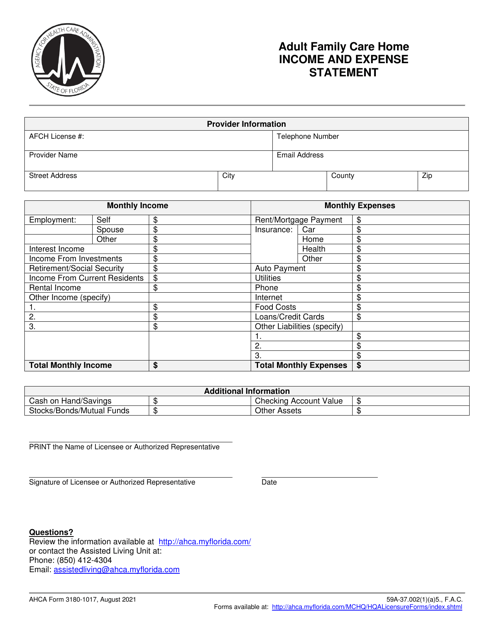

This document is used for reporting income and expenses in adult family care homes in Florida.

This document is for self-employed individuals in Maryland who are attesting to their employment status.

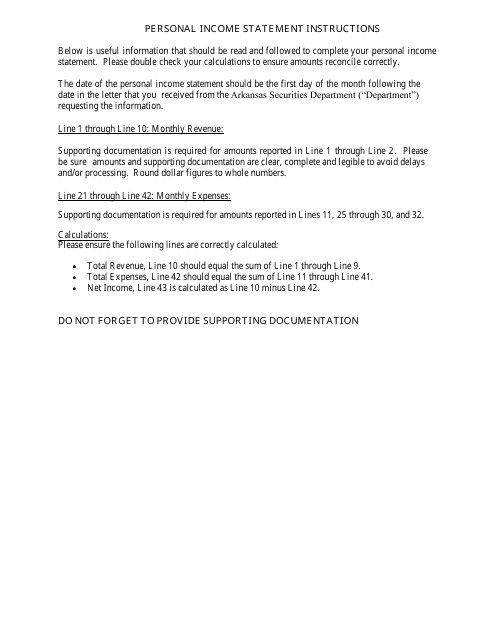

This document is used for preparing a personal income statement in the state of Arkansas. It provides instructions on how to accurately report your income and expenses.

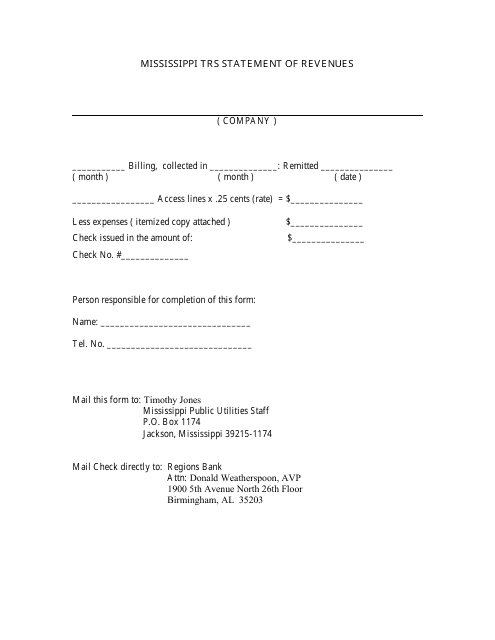

This document is used for reporting and summarizing the revenues generated in the state of Mississippi.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

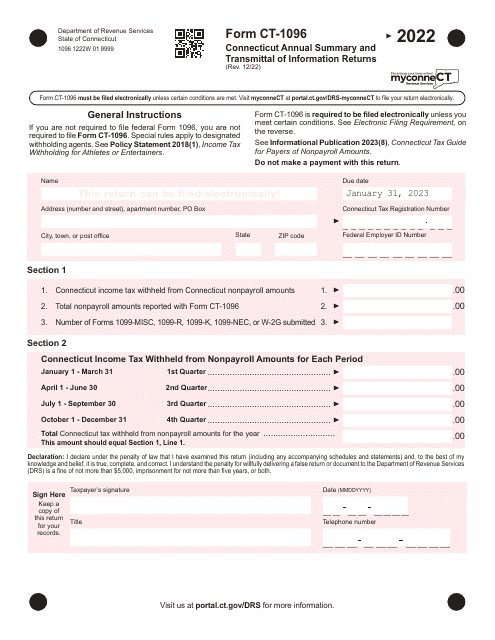

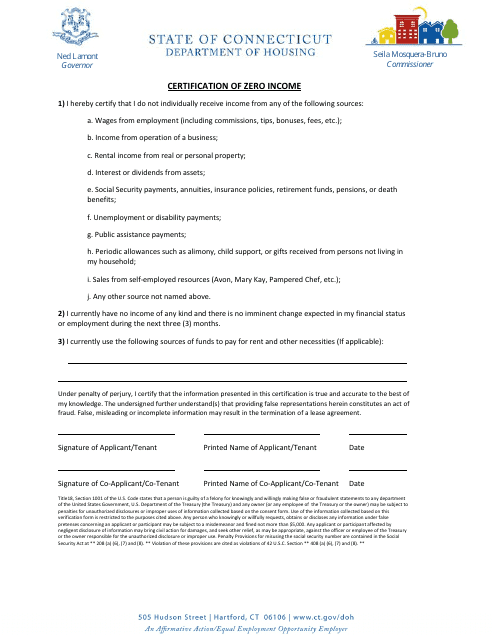

This form is used for individuals in Connecticut who have no income and need to certify it.

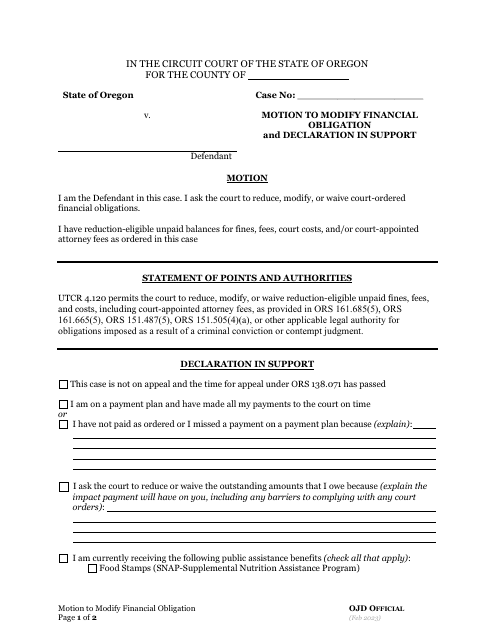

This document is used for requesting a change in the financial obligations and includes a supporting declaration.

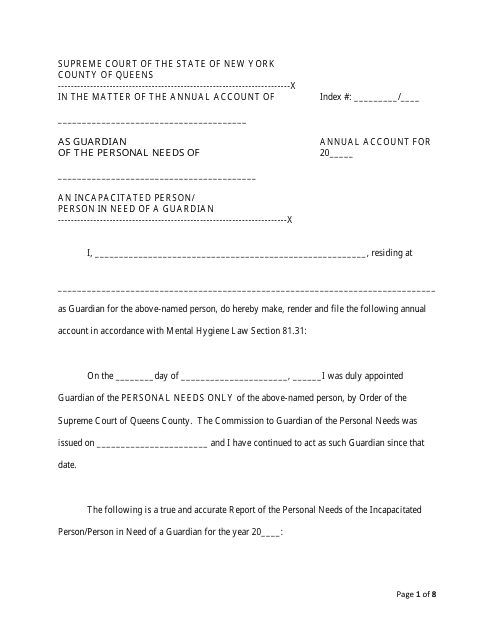

This document is used for filing annual accounts in New York. It provides a summary of a company's financial activities for the year.

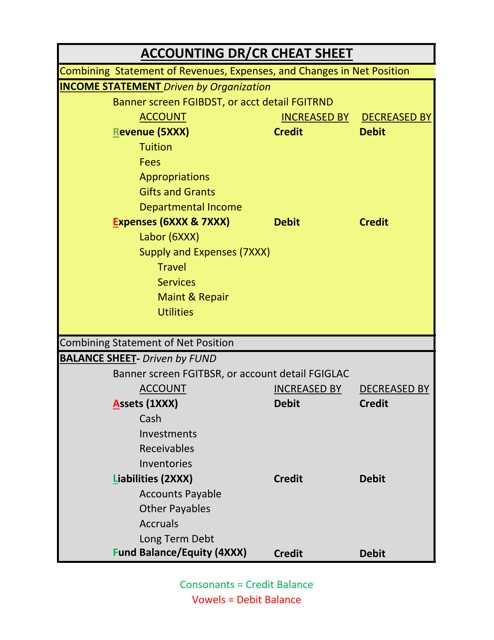

This cheat sheet provides a quick reference guide for understanding debits and credits in accounting. It helps to clarify which accounts are affected and whether they increase or decrease.