Free Income Statement Templates

Documents:

220

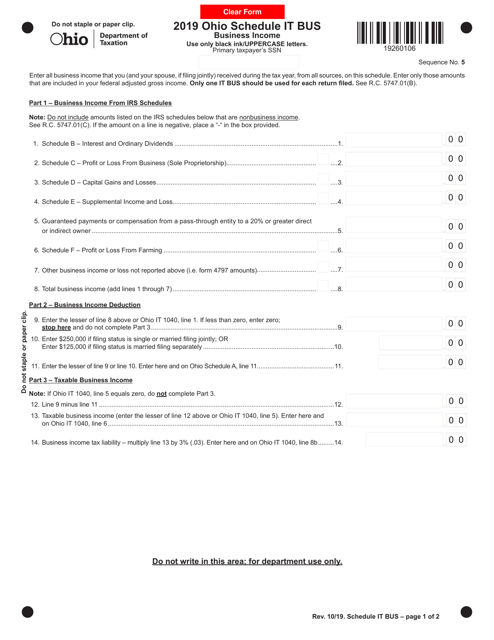

This document is used for reporting the business income of an IT company in the state of Ohio. It is necessary for tax purposes and helps the company accurately calculate their taxable income.

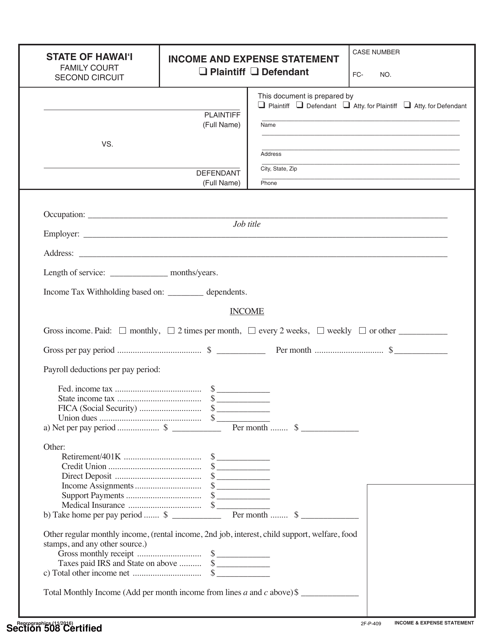

This document is used to report income and expenses in Hawaii.

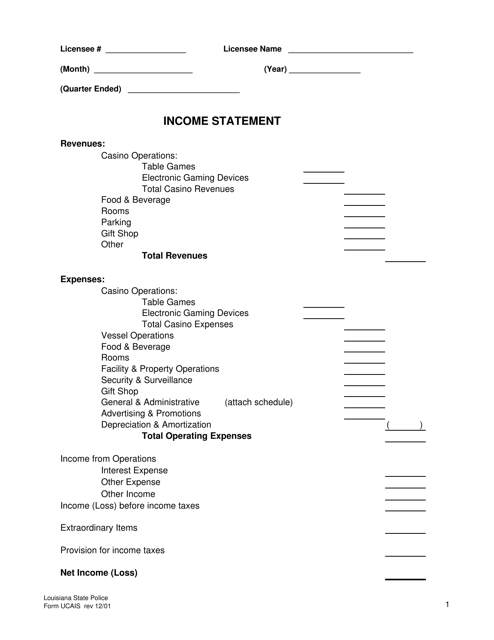

This Form is used for reporting income statements in the state of Louisiana.

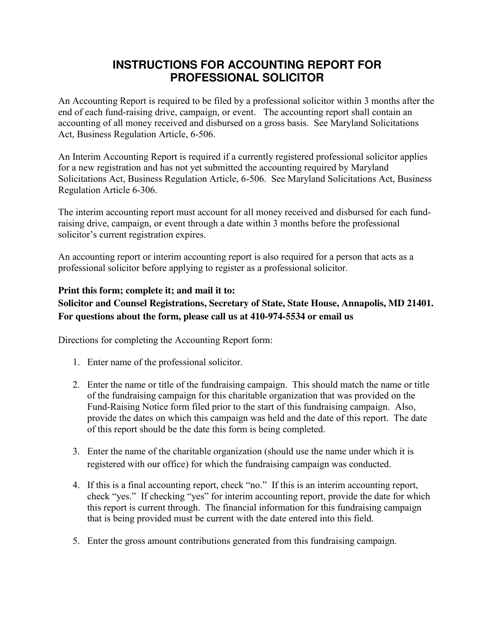

This accounting report is specifically designed for professional solicitors operating in the state of Maryland. It provides a detailed overview of financial activities and highlights compliance with Maryland's specific accounting requirements for solicitors.

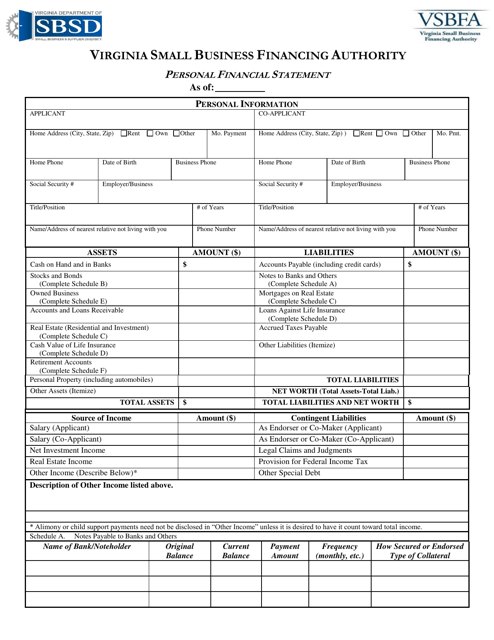

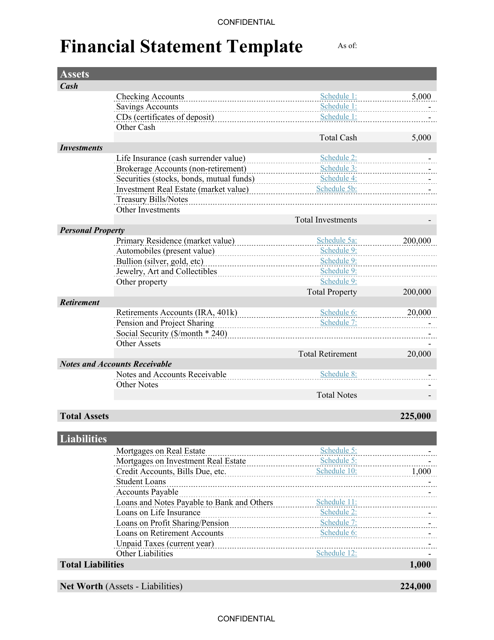

This document is used for summarizing an individual's financial situation in the state of Virginia. It includes details about assets, liabilities, income, and expenses.

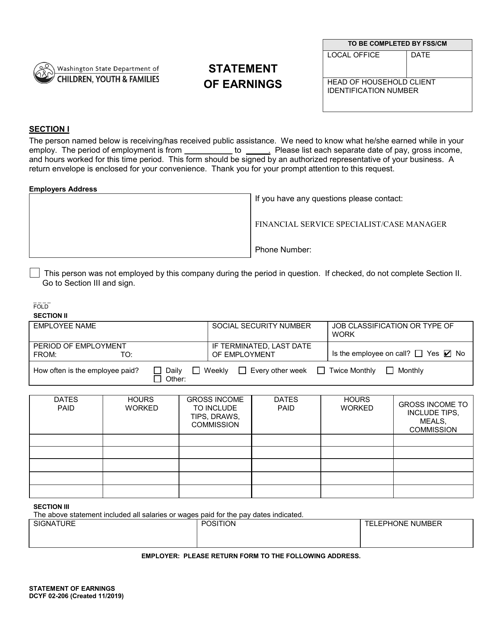

This form is used for reporting earnings in Washington State as part of the DCYF program. It is required to provide accurate financial information for the determination of benefits.

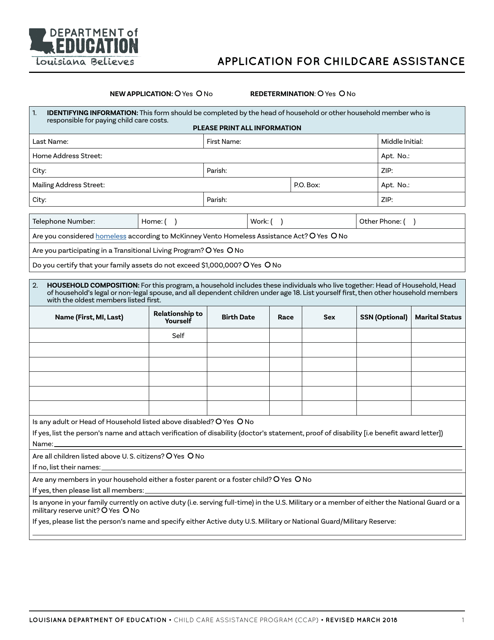

This form is used for applying for childcare assistance in the state of Louisiana. It is intended to help families with the cost of childcare services.

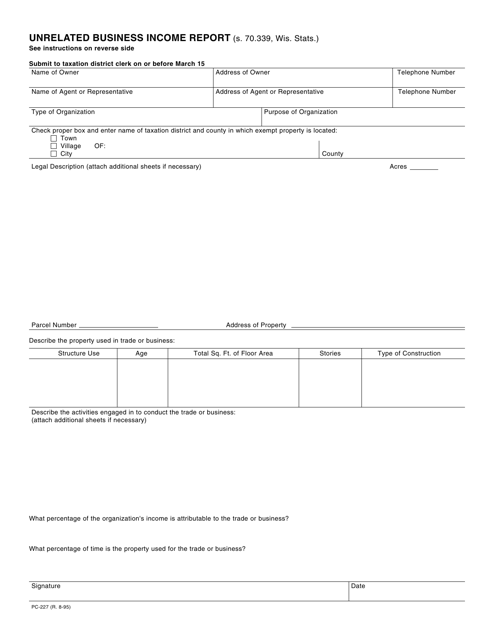

This Form is used for reporting unrelated business income in the state of Wisconsin.

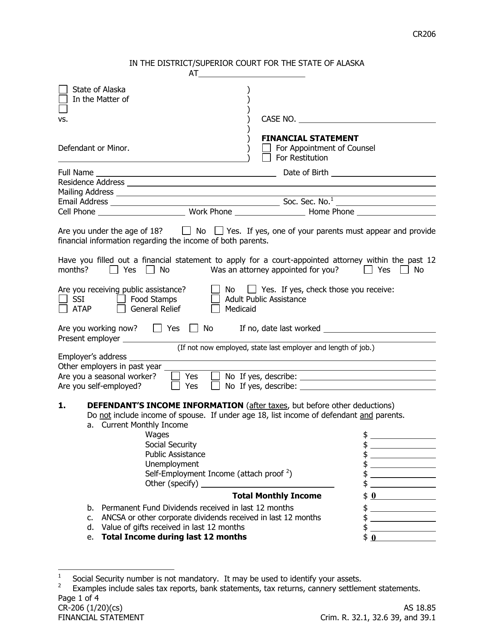

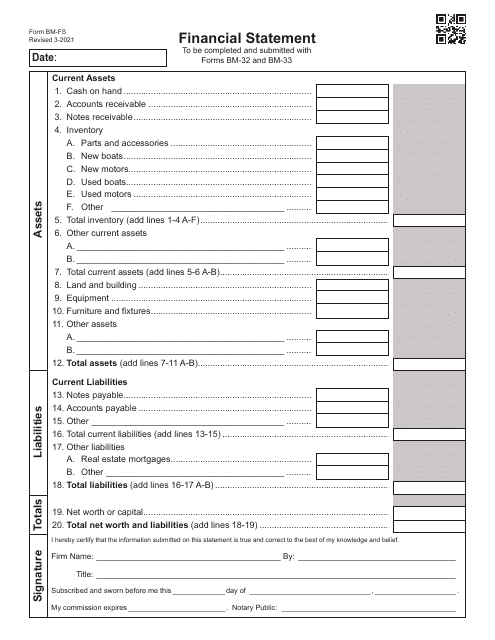

This form is used for completing a financial statement in the state of Alaska. It includes information about your income, expenses, and assets.

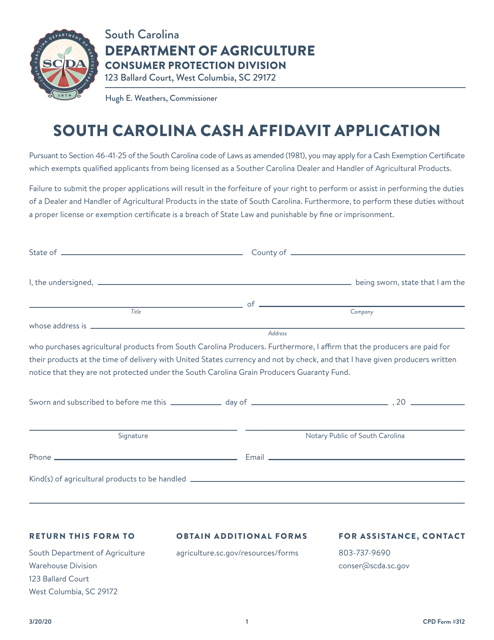

This Form is used for applying for a cash affidavit in South Carolina. It is used to provide information and evidence regarding financial details.

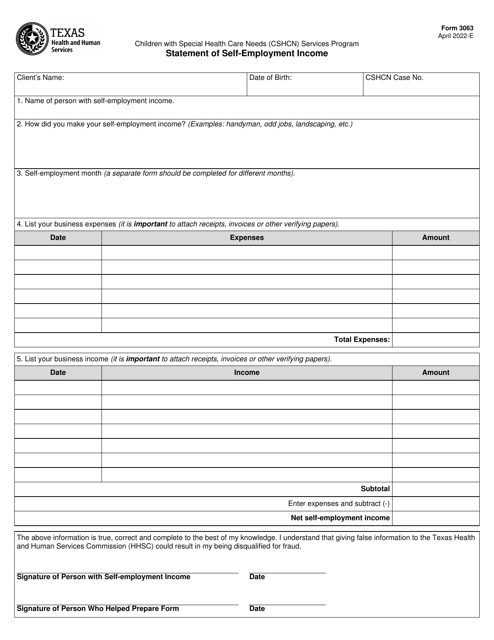

This form is used for clients in Texas to declare their self-employment income. It helps the state determine eligibility for certain assistance programs.

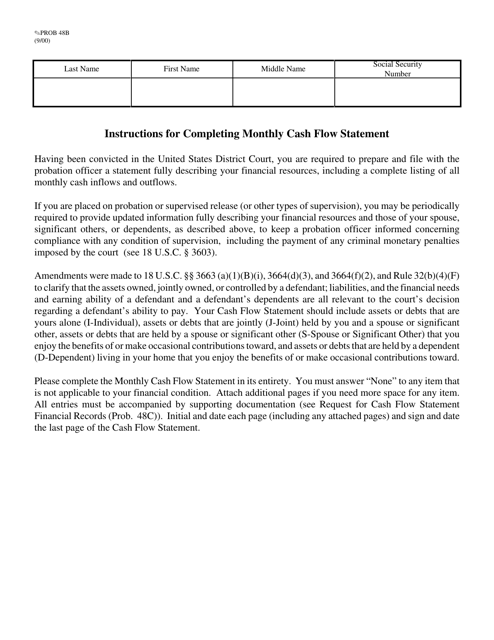

This form is used for recording and analyzing the monthly cash flow of a business or organization. It helps track the inflows and outflows of cash to monitor financial health and make informed decisions.

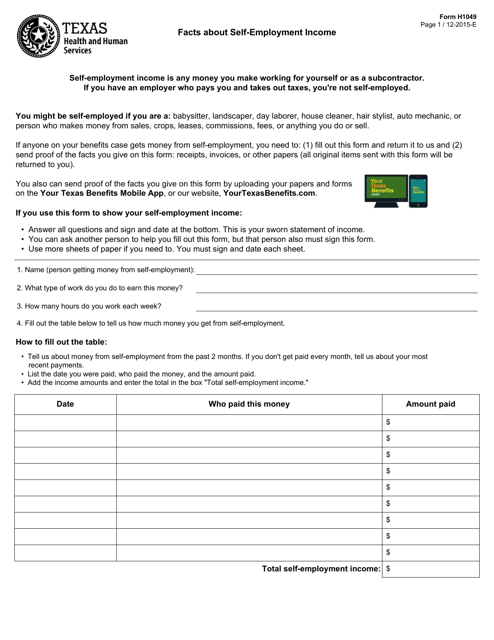

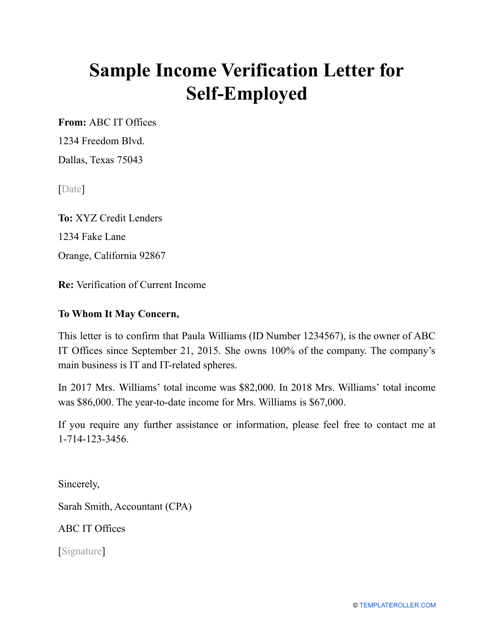

This letter verifies the amount of money an individual receives as a self-employed worker.

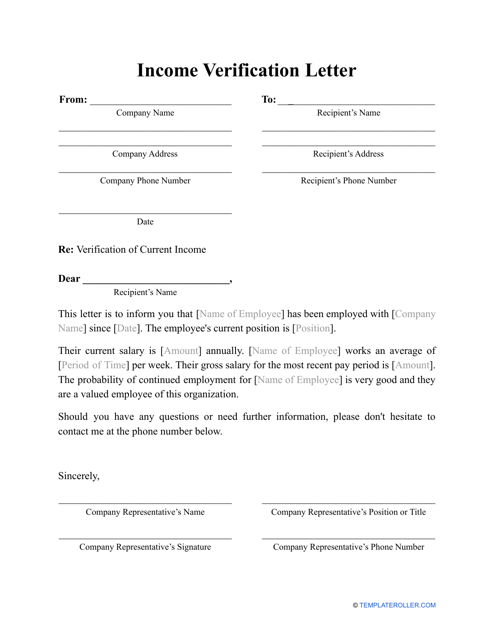

This letter provides legal proof of income of an individual applying for a bank account, credit card, loan, or lease.

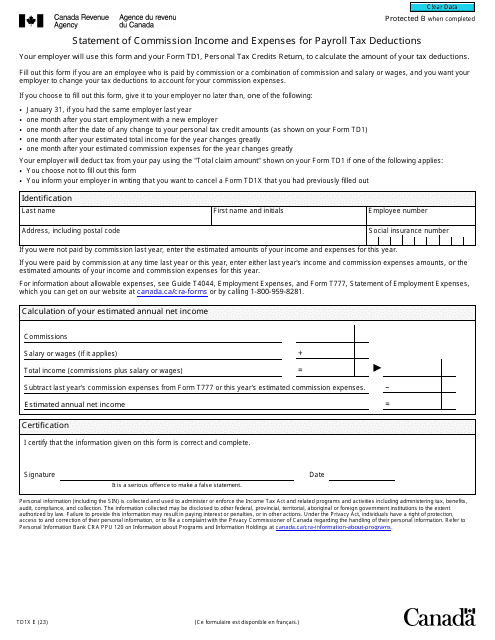

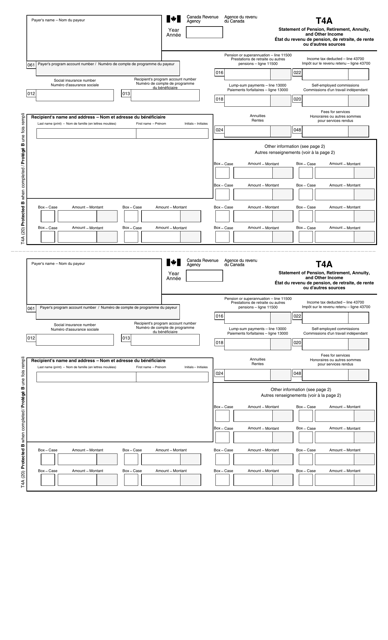

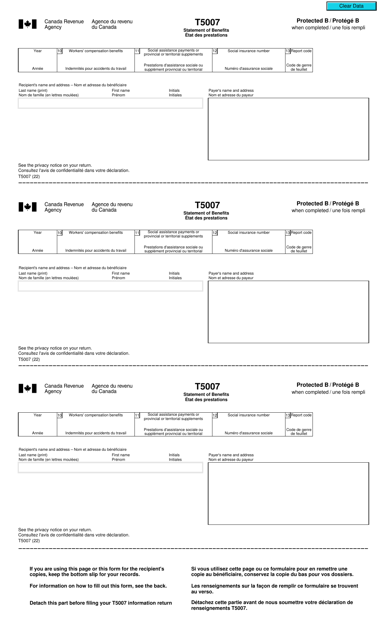

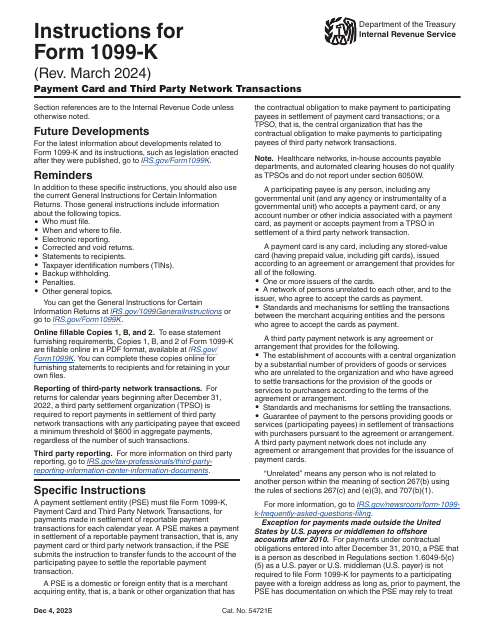

Canadian individuals may use this form when they are filing their taxes to report additional income that does not come from wages earned from completing work.

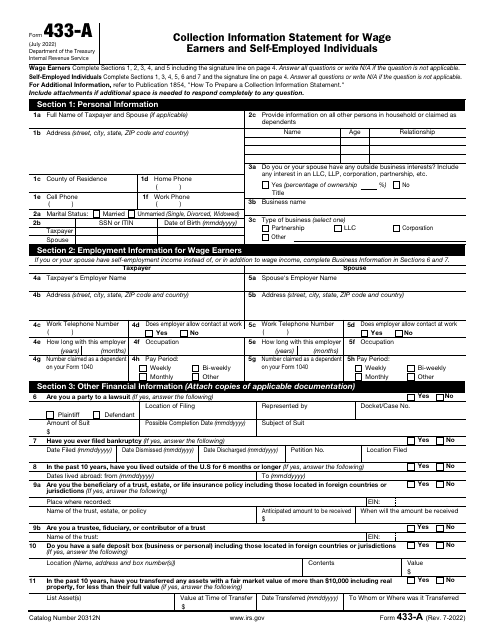

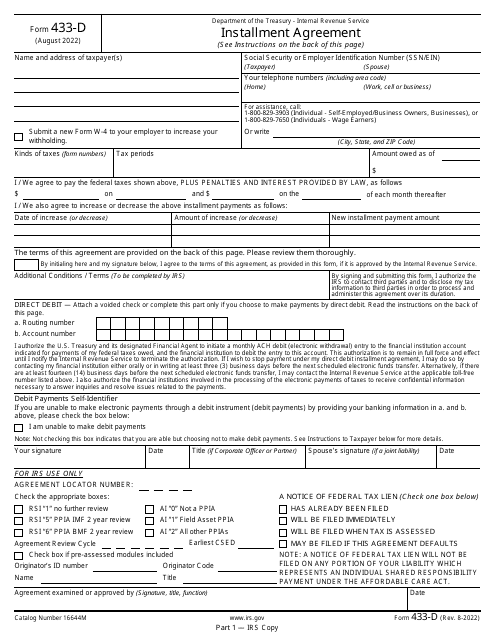

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

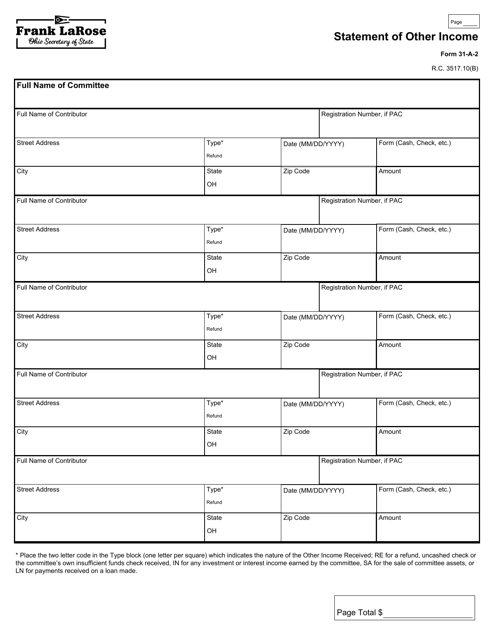

This form is used for reporting other sources of income in the state of Ohio.

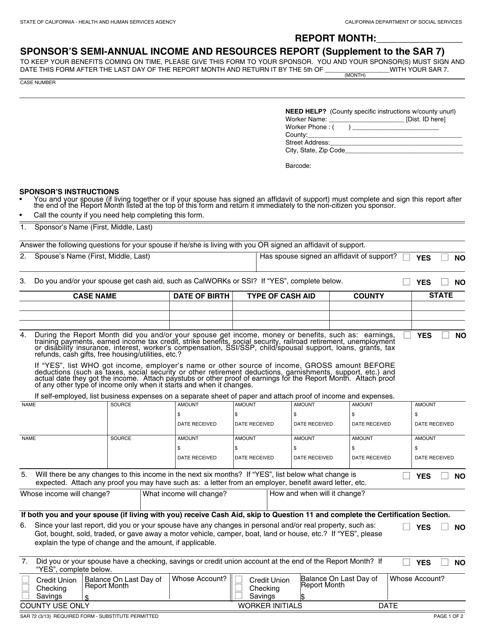

This form is used for reporting the sponsor's income and resources semi-annually in the state of California.

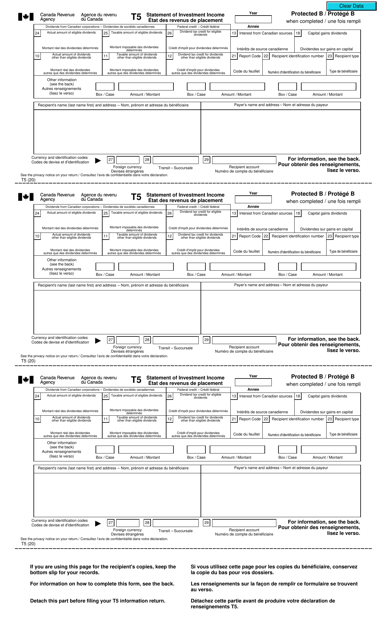

Individuals may use this form when they wish to provide information about certain investment income payments they have made to a Canadian resident, or if they are a Canadian resident who has received certain investment income payments.

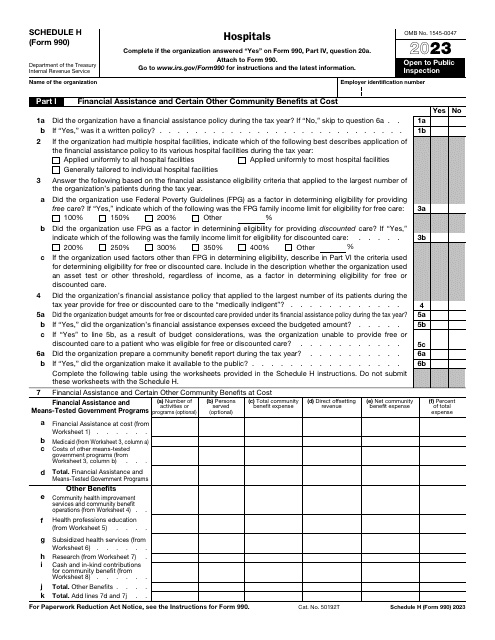

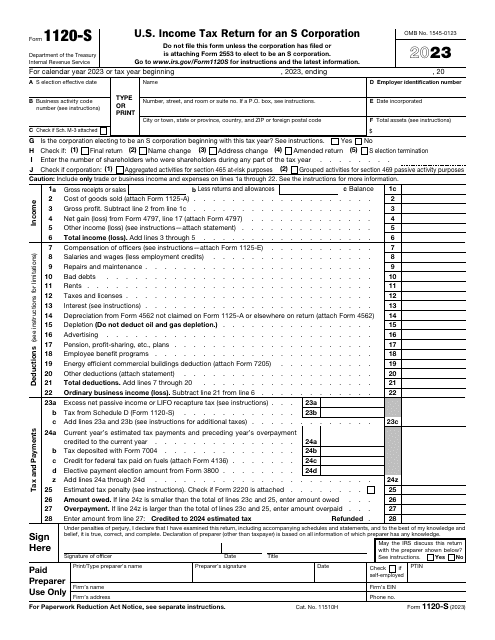

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

This is a written record that conveys the activities and the financial performance of your business or company.

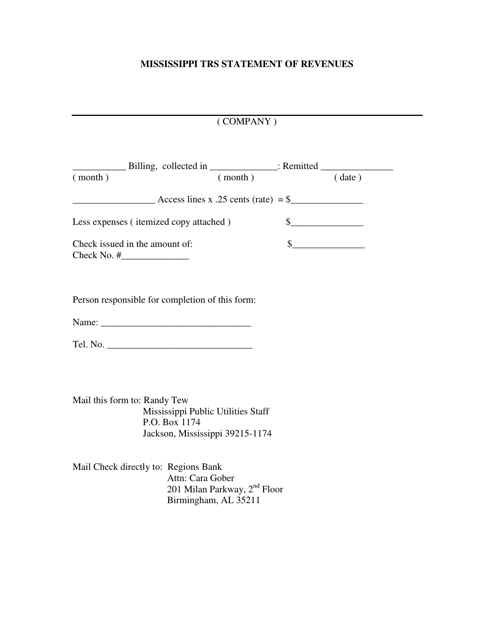

This type of document, known as the TRS Statement of Revenues, provides detailed information about the revenues generated by the state of Mississippi.

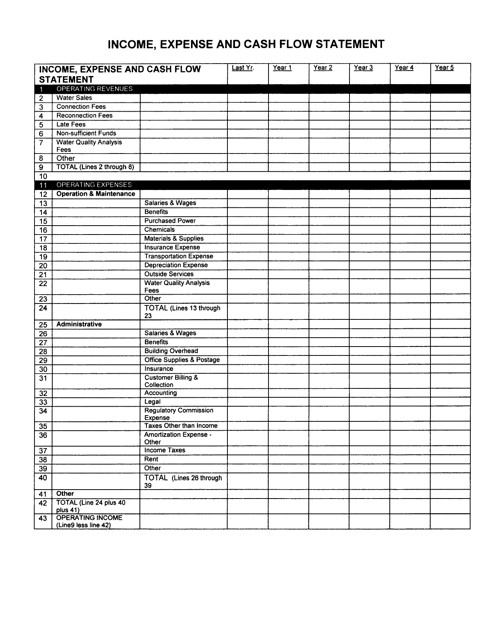

This document displays the income, expenses, and cash flow of an individual or business located in Mississippi. It provides a clear breakdown of the financial transactions and helps in analyzing the overall financial health.