Free Income Statement Templates

What Is an Income Statement?

An Income Statement is an important formal financial record prepared by a business. It is a summary of the financial operations’ results of a company, detailing the revenues earned and the expenses incurred in its operating activities over a set period of time. This period may be a quarter, a month, or, usually, a year. The concept may seem overwhelming at first, but the records provide valuable information for the company.

Alternate Name:

- Profit and Loss Statement.

This document measures how the business has performed by looking at the total revenues and comparing that to the total expenses. The difference between income and expenses results in a net income. If the net income amount is positive, then the result for the period is actual income, and if the result is negative, it means that the company did not make a profit and resulted in a loss.

If you want to analyze your operating activity over a particular period to see if a profit or loss was made by your business, you can download our printable Income Statement templates through the link below.

Income Statements are one of three key financial statements used by all companies, from small businesses to large corporations. When used together, the Income Statement, Cash Flow Statement, and Balance Sheet provide a clear picture to assess the financial position of the company. The information of these financial statements is essential for a business and is a helpful tool for analysis, planning, and decision-making.

Related Forms and Topics:

Documents:

220

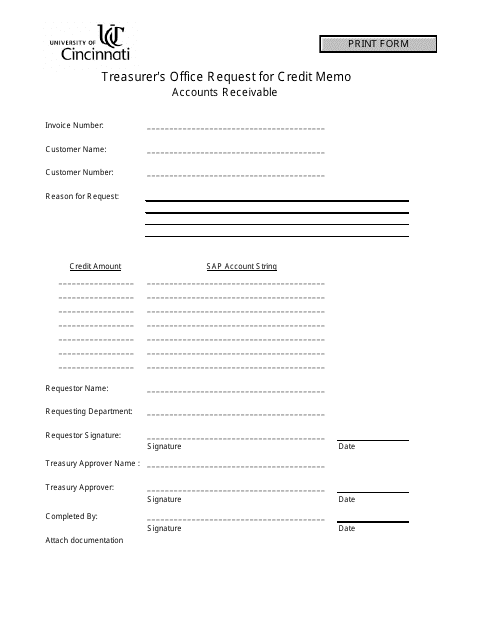

This Form is used for requesting a credit memo from the Treasurer's Office at the University of Cincinnati.

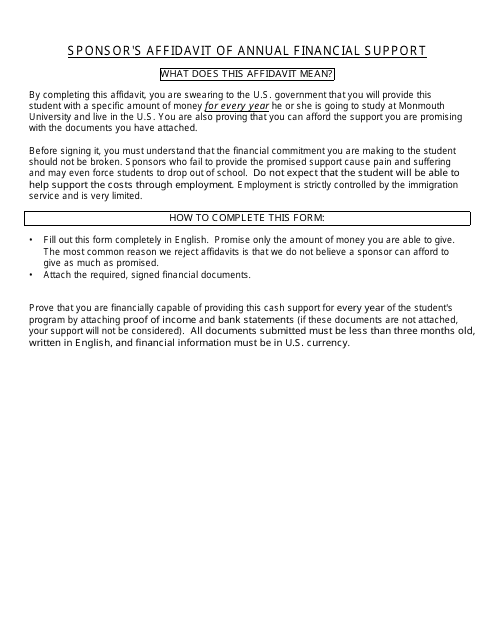

This document is used for proving that a person has the financial means to support themselves or another individual on an annual basis. It is often required for various immigration or educational purposes.

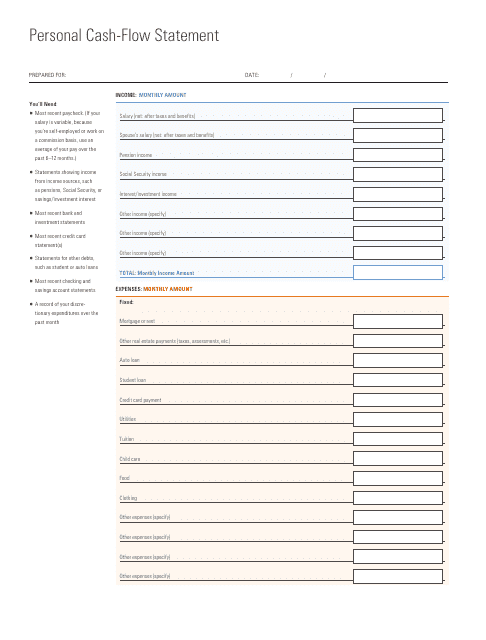

This document is a personal cash flow statement template that can help individuals track their income and expenses on a monthly basis.

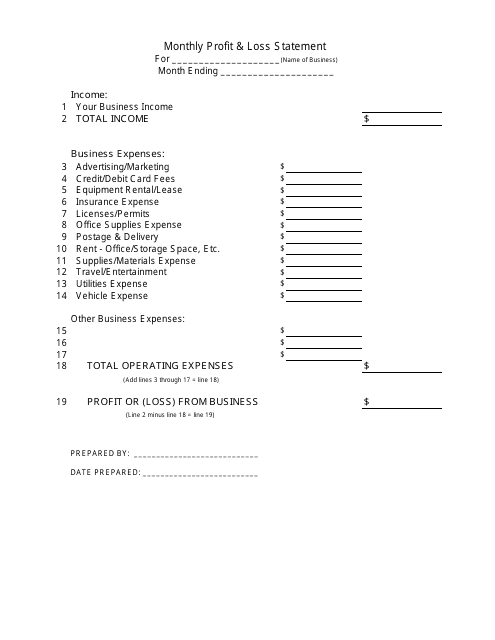

This document is a template for creating a monthly profit and loss statement. It helps businesses track their income, expenses, and overall financial performance on a monthly basis.

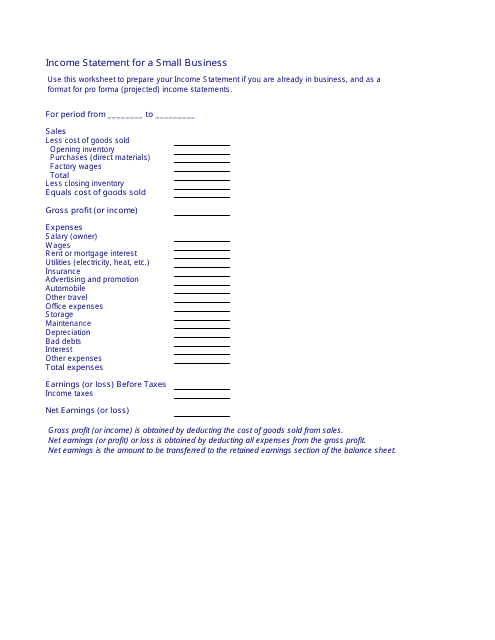

This template is used to create an income statement for small businesses. It helps summarize the revenue, expenses, and net income for a specific period of time. Use it to track the financial performance of your small business.

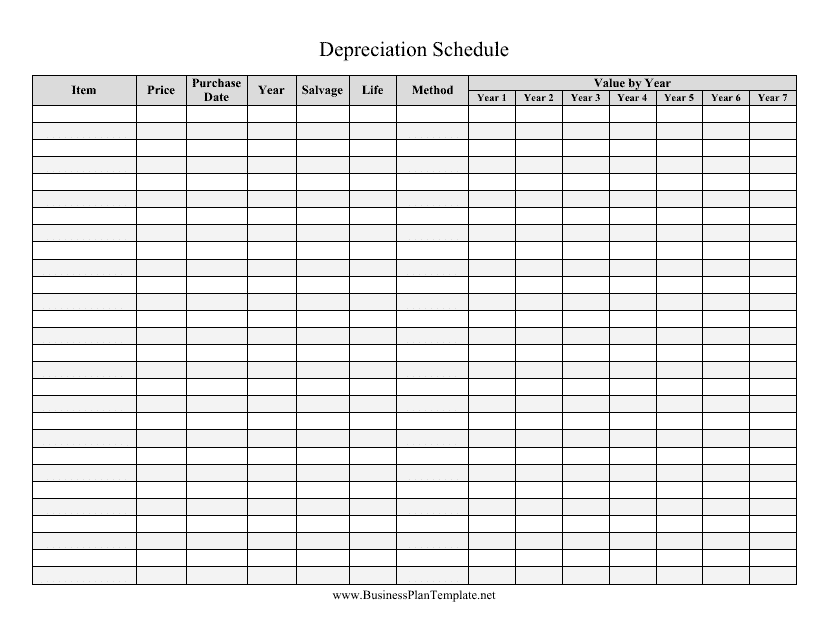

This document provides a template for creating a schedule that determines the depreciation of assets over time. It is useful for businesses to track the decrease in value of their assets for accounting and tax purposes.

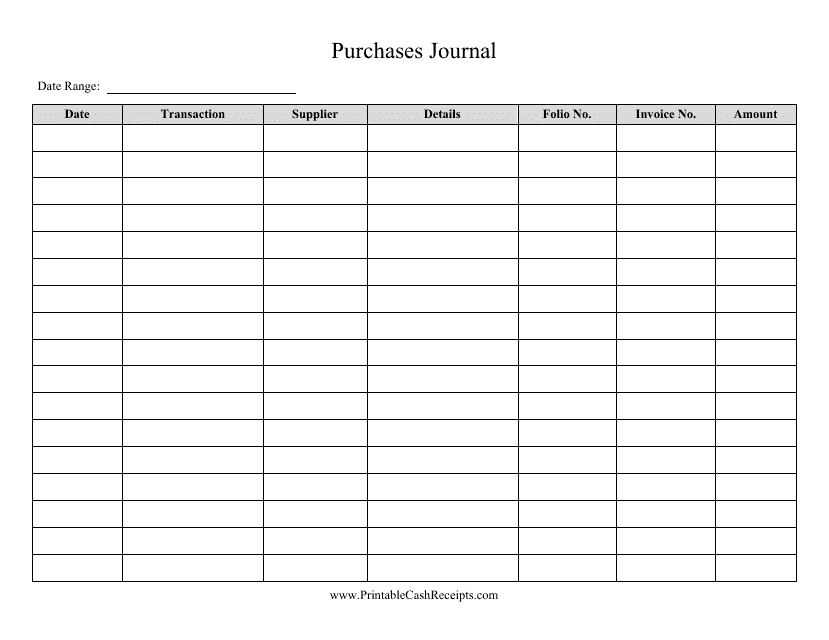

This document is a template for recording purchases made by a company. It includes columns for the date of purchase, vendor name, description of the item purchased, quantity, unit price, and total cost. The template is designed to help organize and track all purchases made by the company.

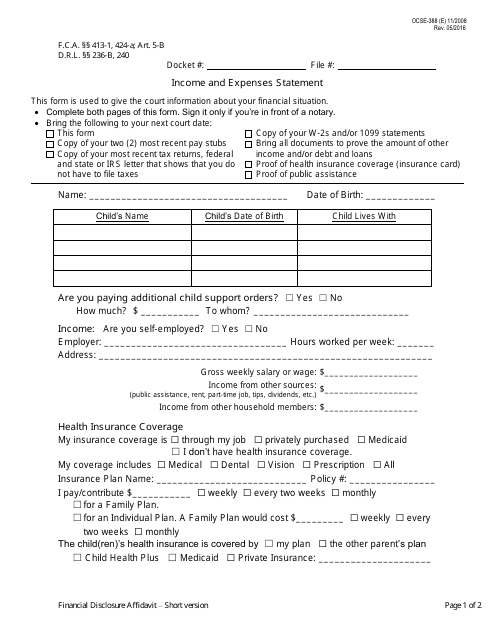

This form is used for reporting income and expenses in New York City for the purpose of child support calculations.

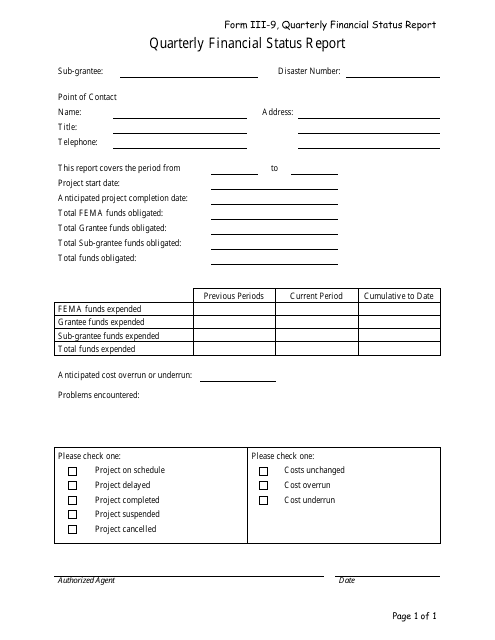

This document template is used for creating a quarterly report that provides an overview of the financial status of an organization. It includes key financial metrics and analysis to keep stakeholders informed about the financial performance.

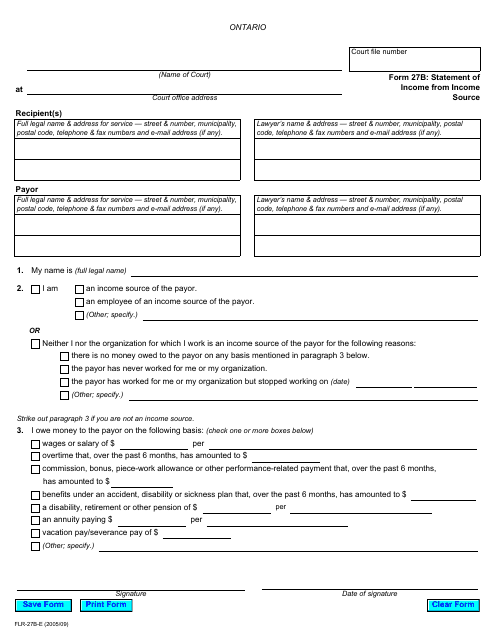

This document is used for reporting income from different sources in the province of Ontario, Canada. It is an essential form for tax filing purposes.

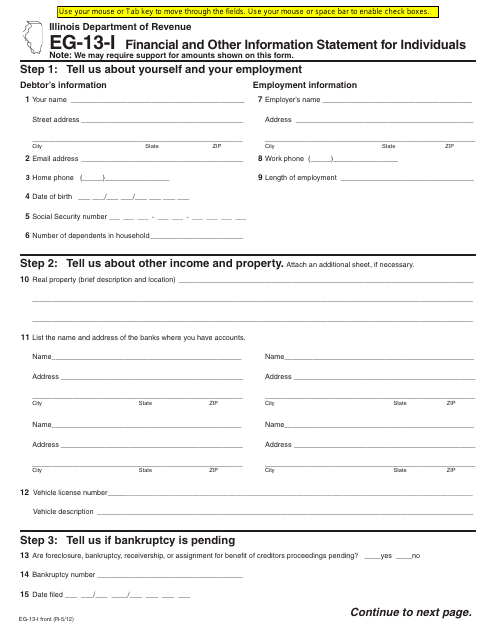

This form is used for providing financial and other information for individual residents of Illinois. It is used to gather details about the person's financial situation and other relevant information.

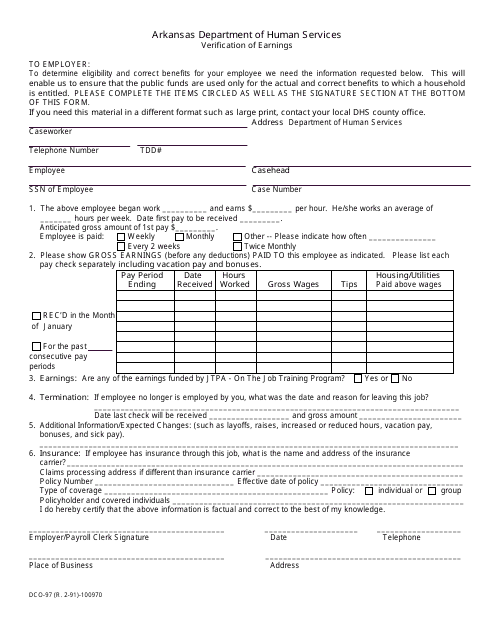

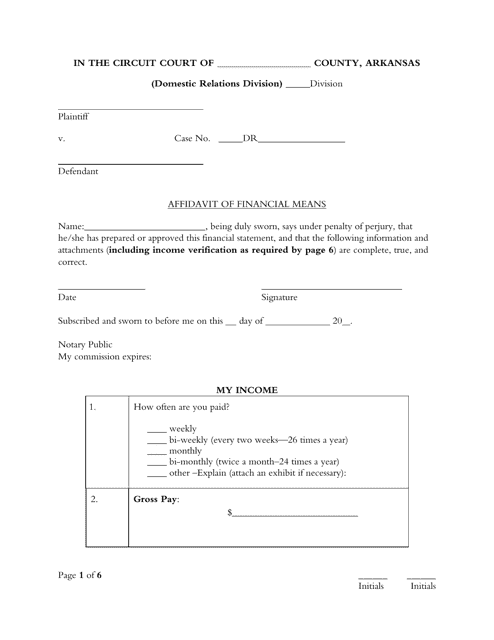

This form is used for verifying earnings in the state of Arkansas.

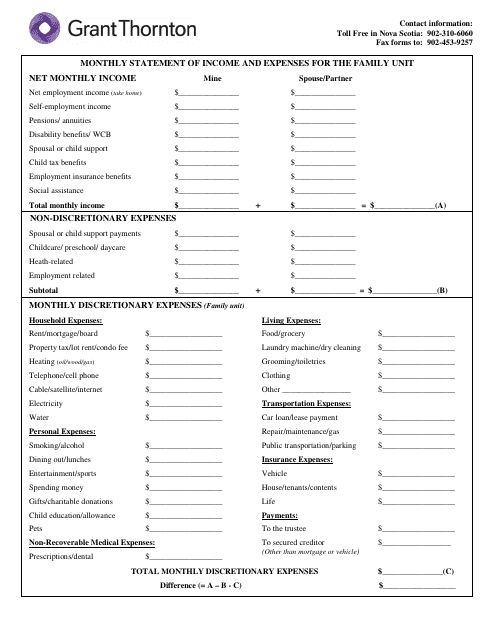

This document is a template provided by Grant Thornton for residents of Nova Scotia, Canada. It helps individuals or families track their monthly income and expenses.

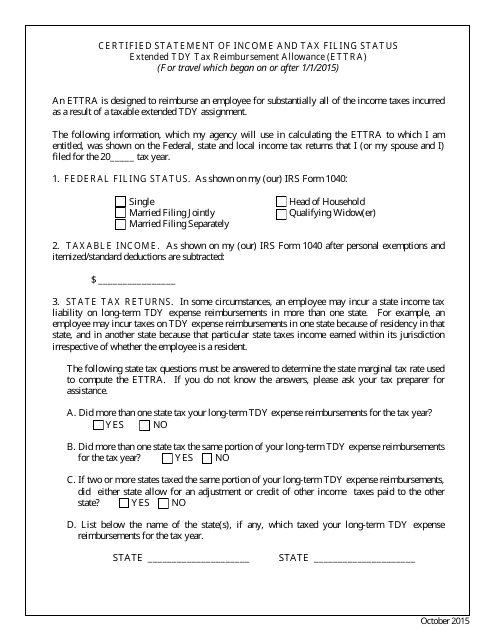

This Form is used for individuals who are on extended temporary duty (TDY) and need to claim tax reimbursement allowance (ETTRA). It certifies their income and tax filing status.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

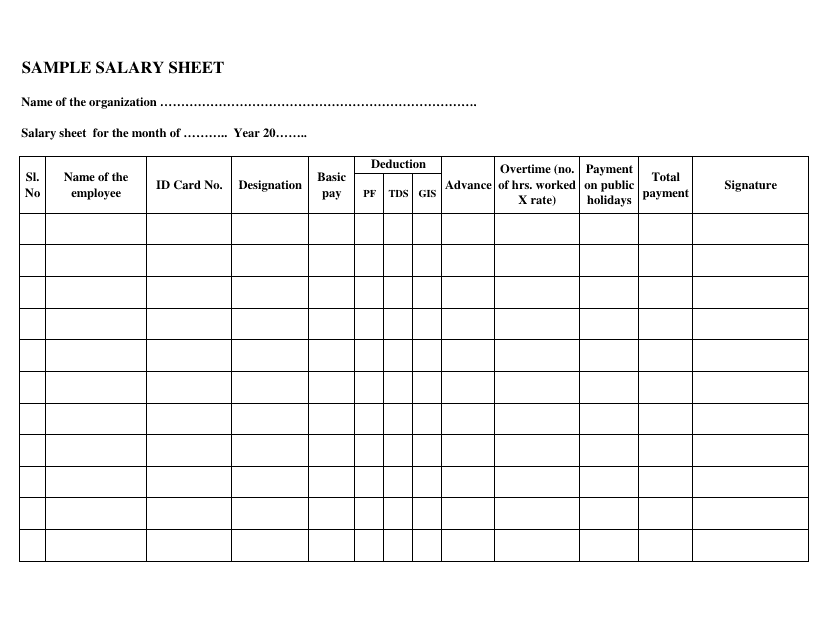

This document is a template that is used to create a salary sheet. It helps to organize and calculate the salaries of employees in a company or organization.

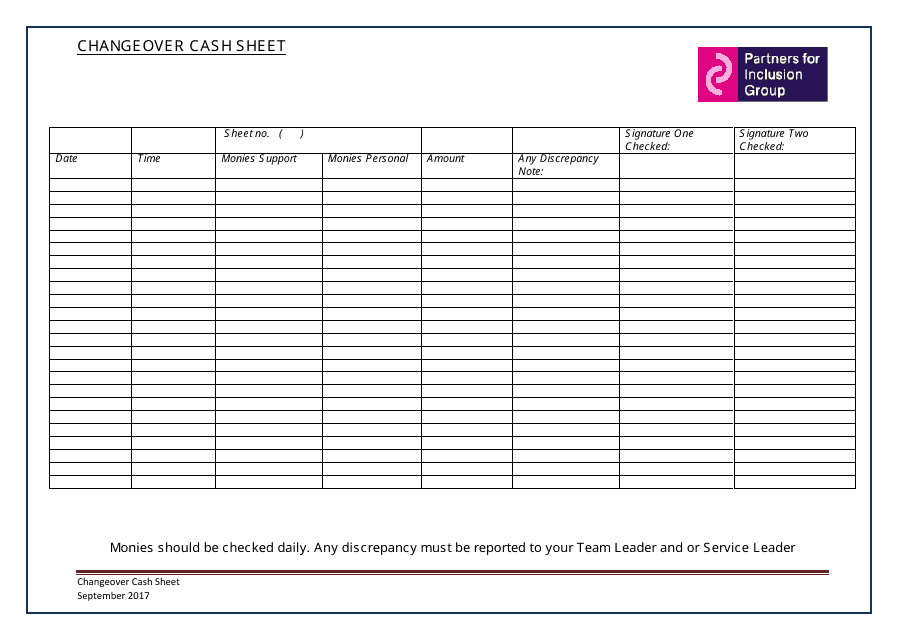

This document is a template for keeping track of cash during a changeover process. It helps to ensure accuracy and accountability when transferring cash between shifts or employees.

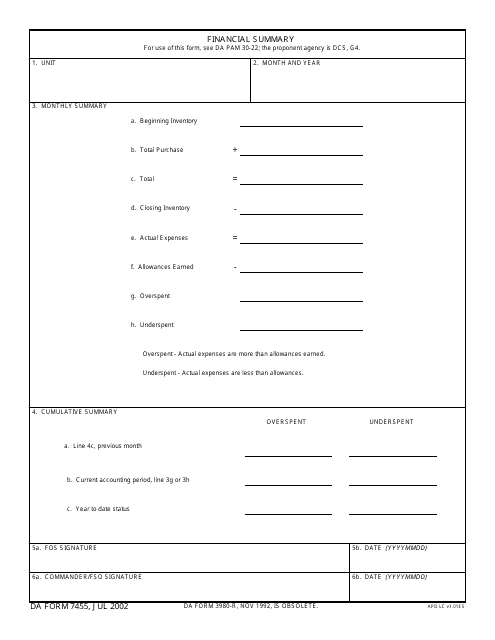

This document is used for providing a financial summary in a certain format.

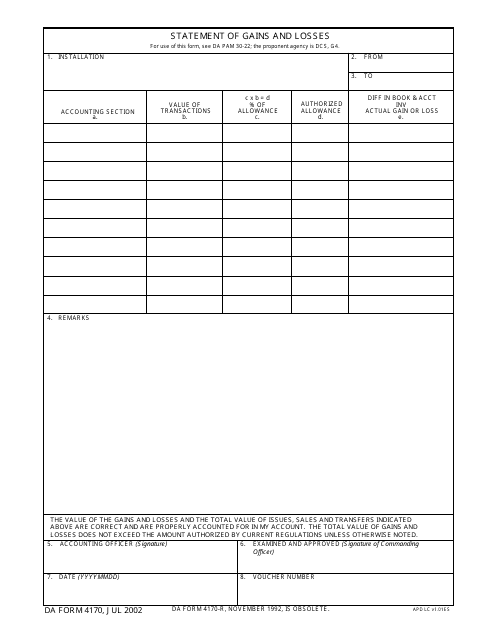

This form is used for documenting gains and losses in assets or property for the Department of the Army.

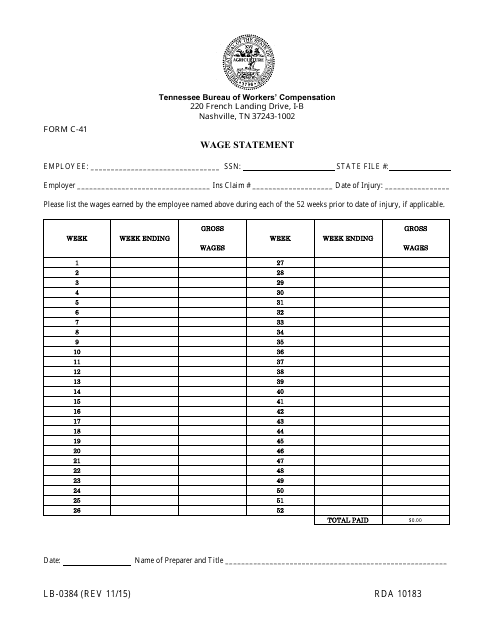

This Form is used for reporting wage information in Tennessee. It is used by employers to provide a detailed statement of wages and deductions to their employees.

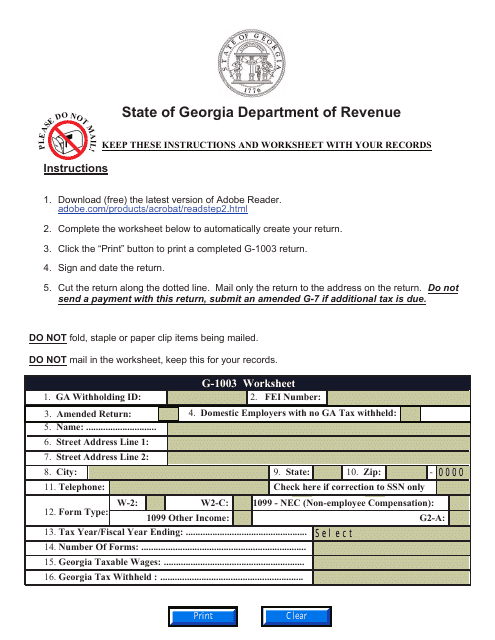

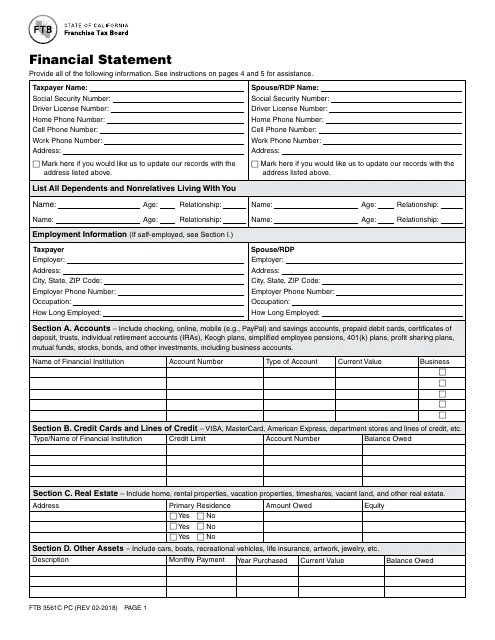

This form is used for filing a financial statement in California.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

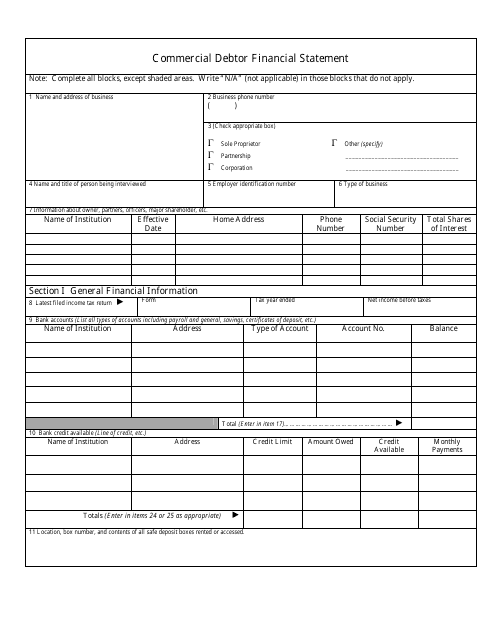

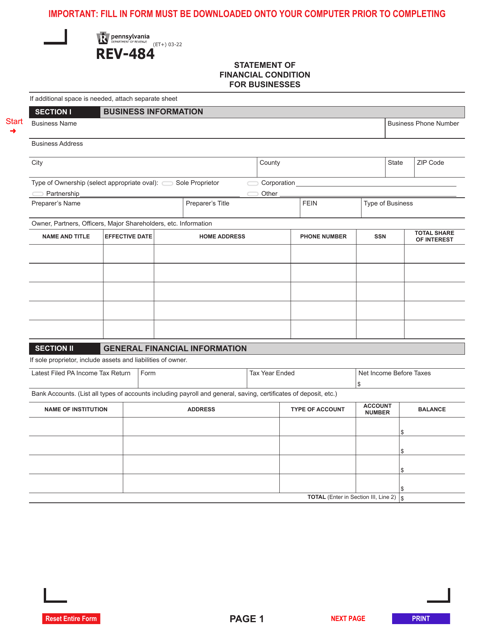

This document is used for assessing the financial health of a commercial debtor. It provides information about the debtor's assets, liabilities, and income.

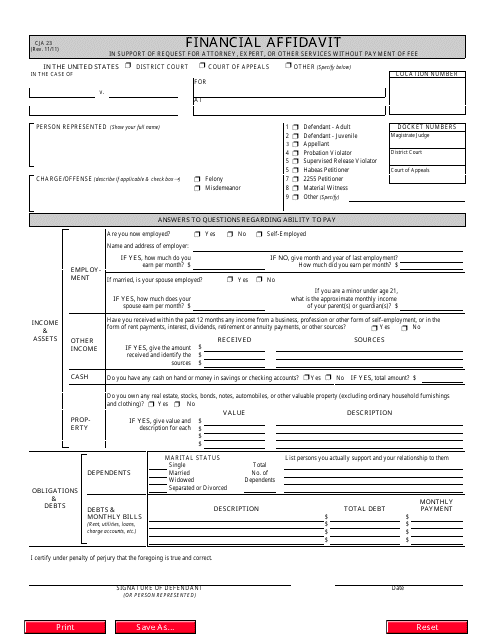

This form is used to provide a financial affidavit in court proceedings related to criminal cases. It is used to disclose the financial information of a defendant or a defendant's family for determining eligibility for court-appointed counsel or for assessing the amount of fees to be paid.

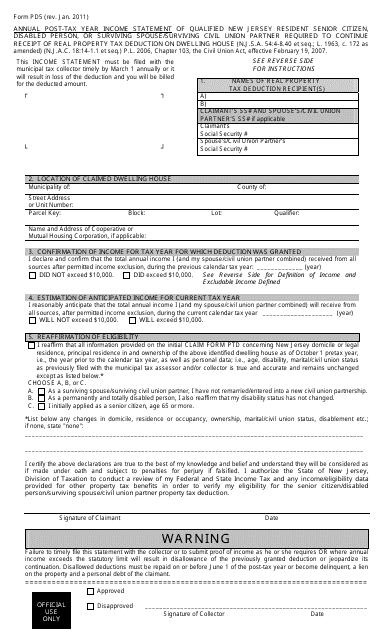

This form is used for reporting annual post-tax year income for residents of New Jersey.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

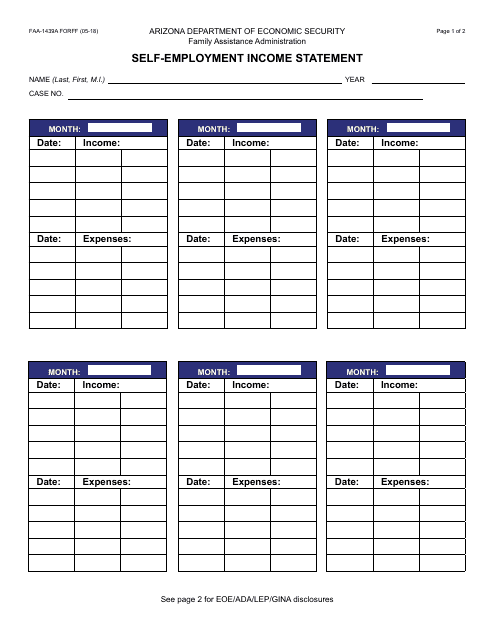

This form is used for reporting self-employment income in the state of Arizona.

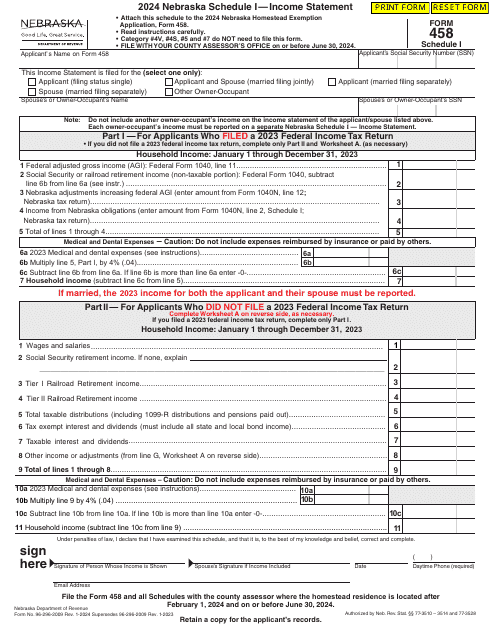

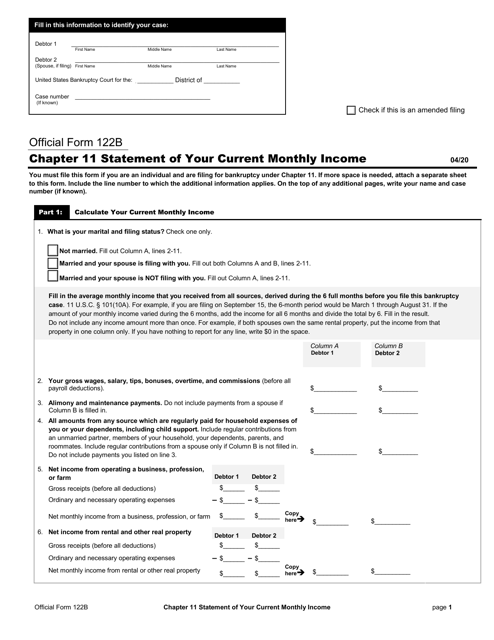

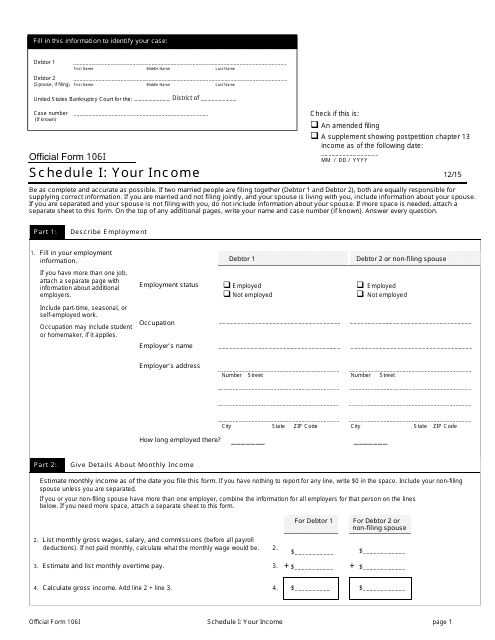

This Form is used for reporting your income on Schedule I.

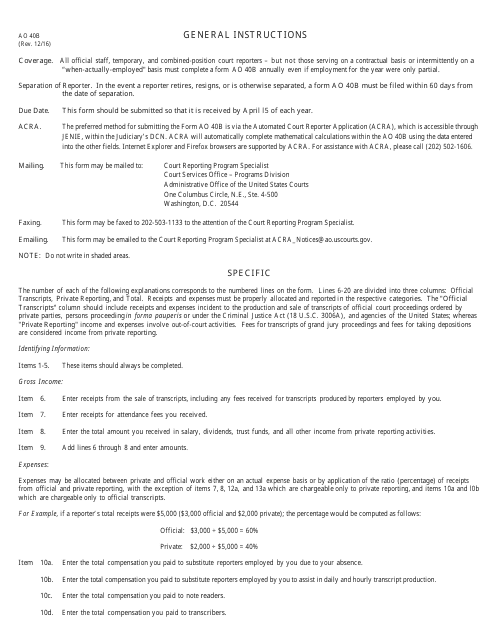

This Form is used for reporting the earnings of United States Court Reporters. It provides instructions on how to accurately fill out the form.

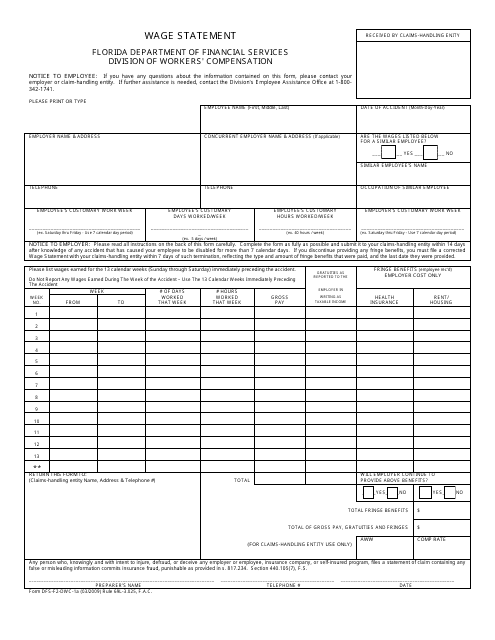

This Form is used for Wage Statement purposes in the state of Florida. It is a document that reports an employee's wages and other compensation.

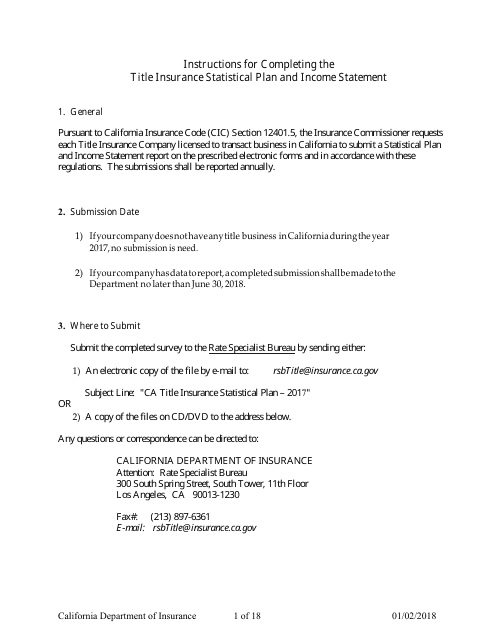

This document is used for reporting statistical information and income statement for title insurance companies in California. It provides instructions on how to fill out the required form.

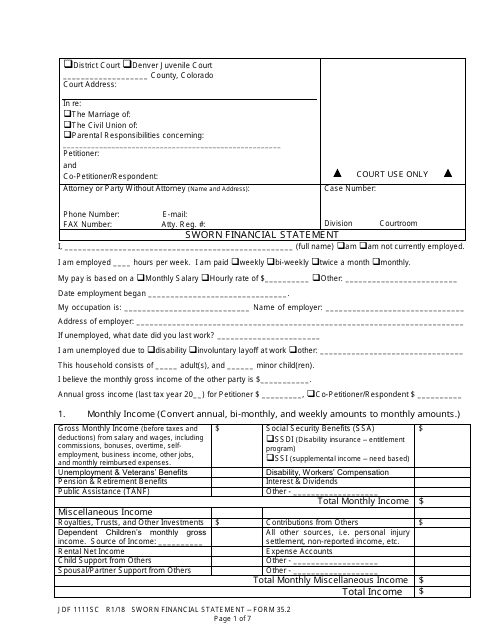

This document is used for declaring financial information under oath in the state of Colorado. It provides a detailed account of a person's income, expenses, assets, and liabilities.

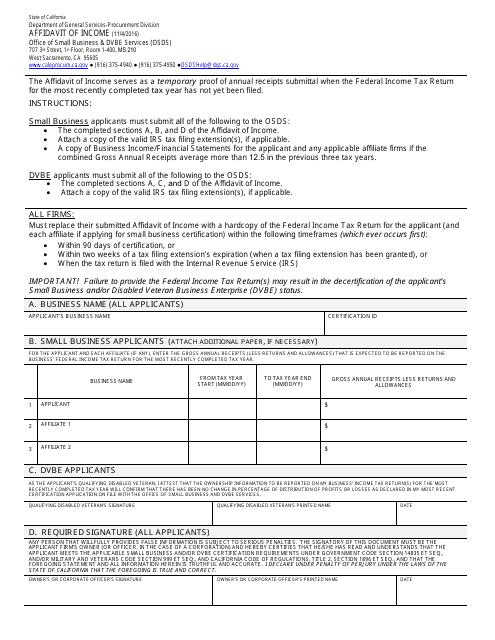

This document is used in California to provide a sworn statement of income.

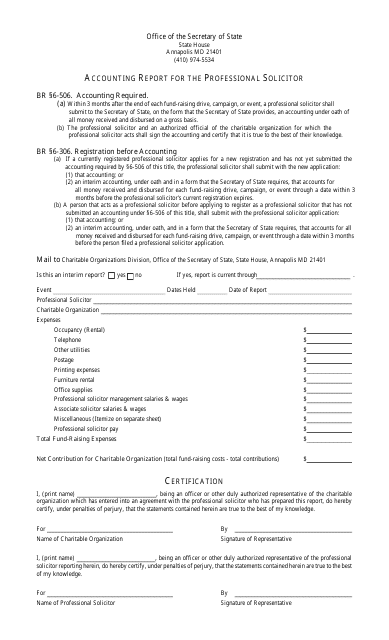

This document is an accounting report specifically designed for professional solicitors in the state of Maryland. It provides a detailed summary of financial transactions and any funds raised or disbursed by the solicitor.