Fill and Sign Oklahoma Legal Forms

Documents:

4386

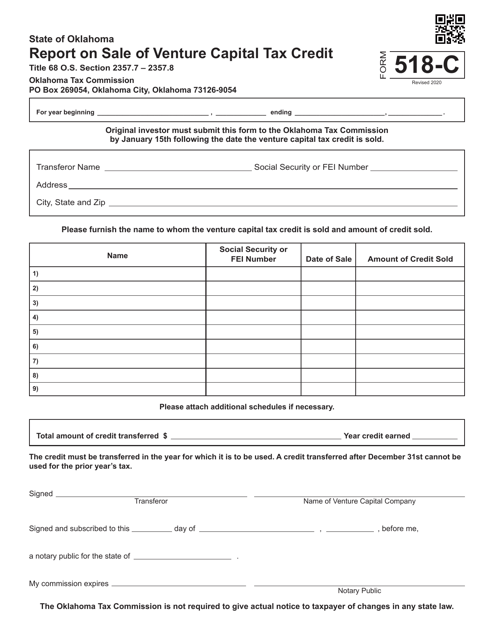

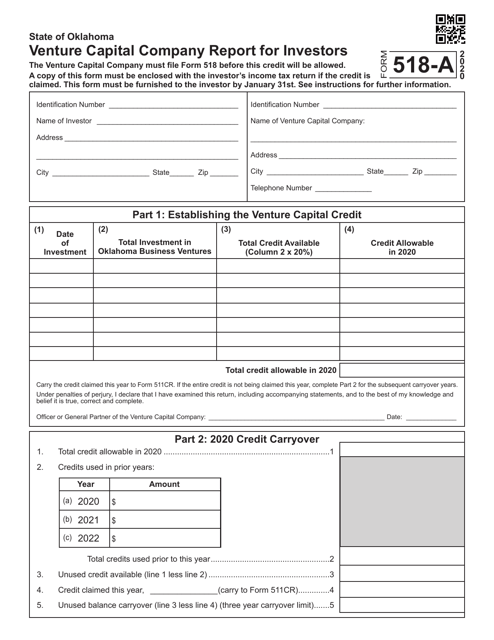

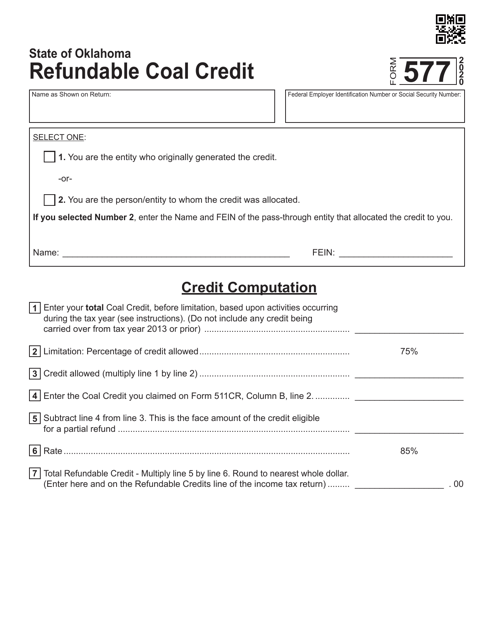

This form is used for reporting the sale of venture capital tax credit in the state of Oklahoma.

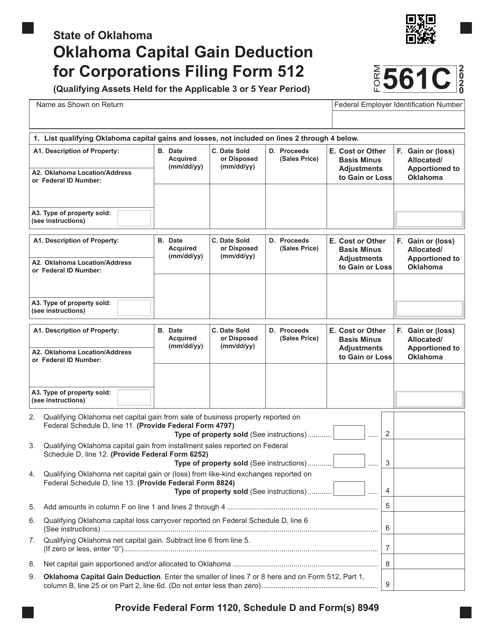

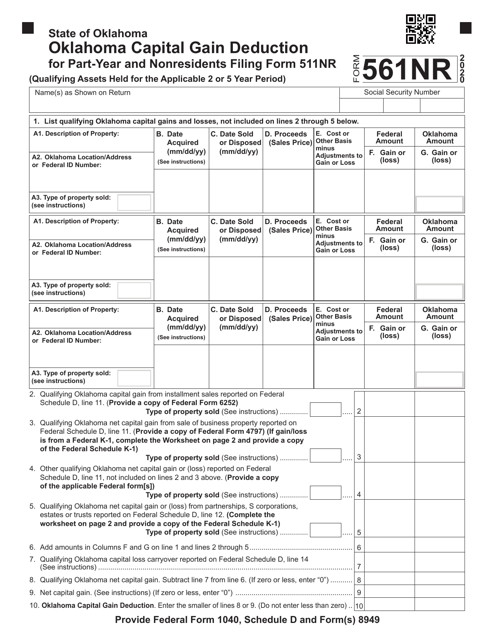

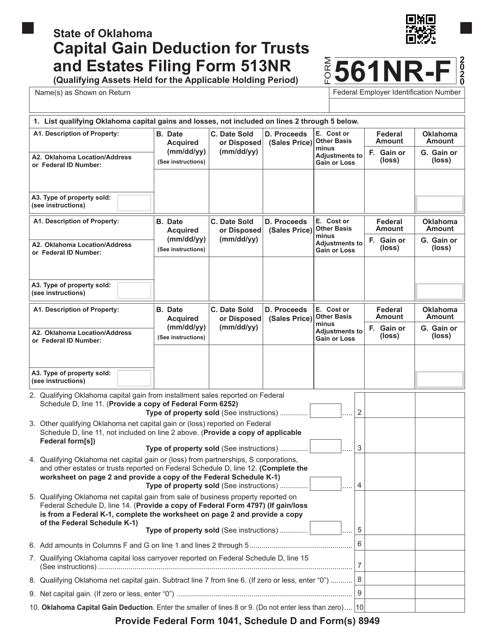

This Form is used for claiming capital gain deduction for trusts and estates filing Form 513nr in Oklahoma.

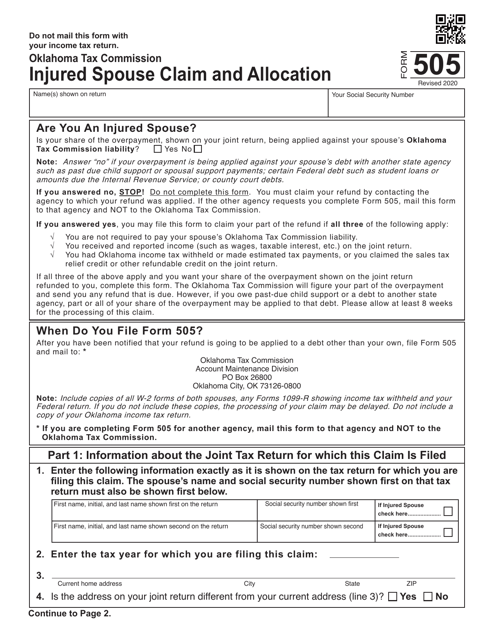

This Form is used for Oklahoma residents who are filing an injured spouse claim and allocation.

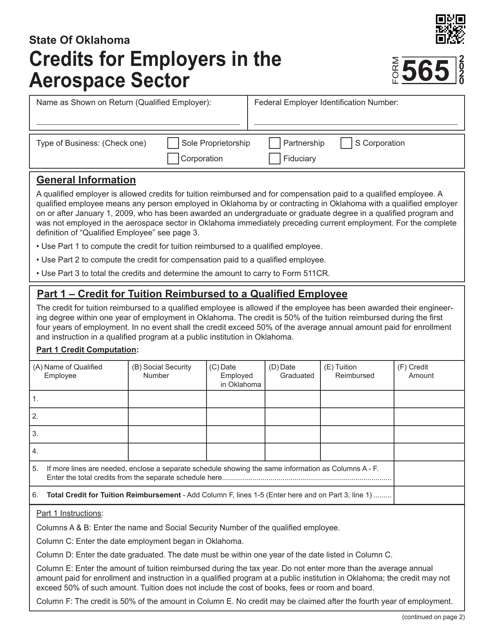

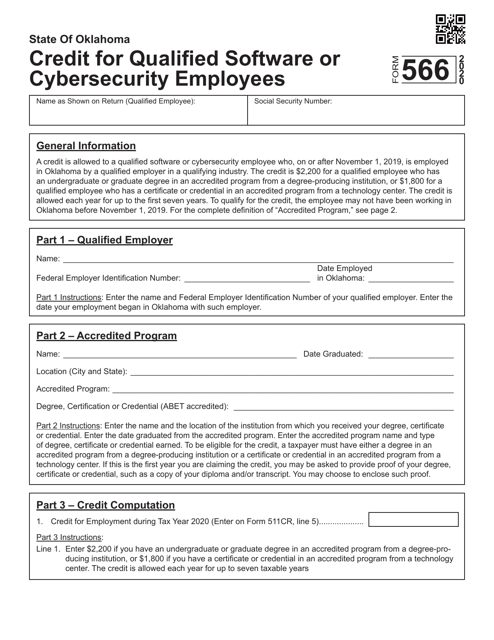

This form is used for claiming the Credit for Qualified Software or Cybersecurity Employees in Oklahoma. It allows eligible employers to receive a tax credit for hiring qualified employees in the software or cybersecurity fields.

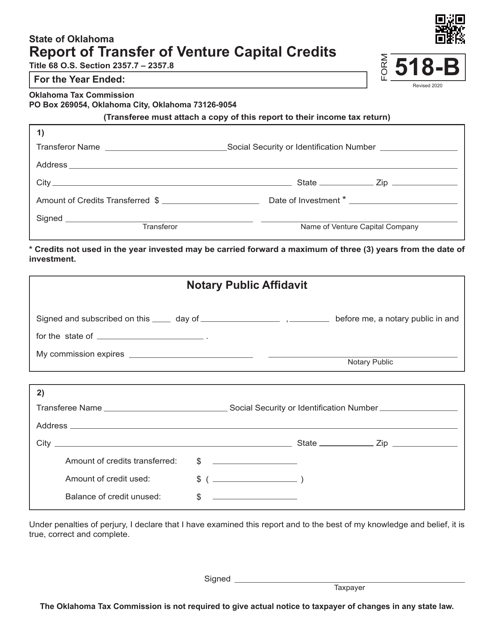

This document is used for reporting the transfer of venture capital credits in the state of Oklahoma.

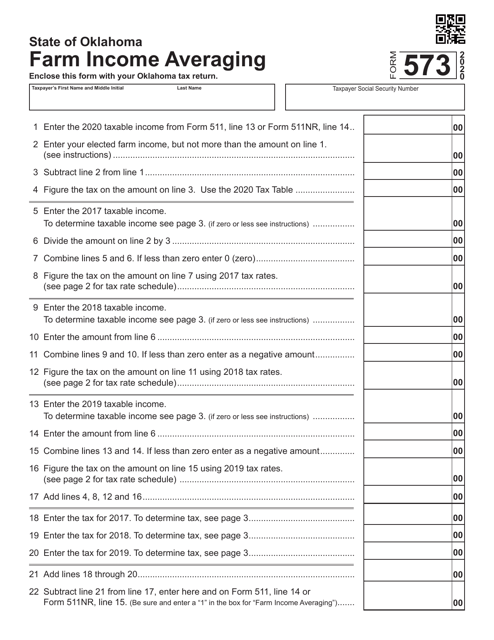

This form is used for farm income averaging in Oklahoma. It helps farmers in calculating their average income over a period of time to reduce tax liability.

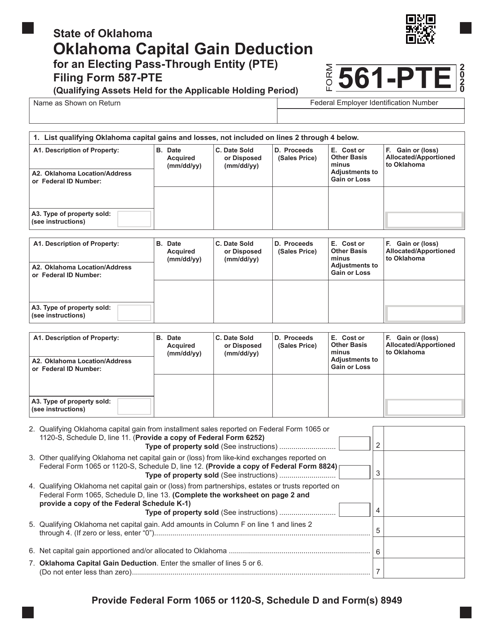

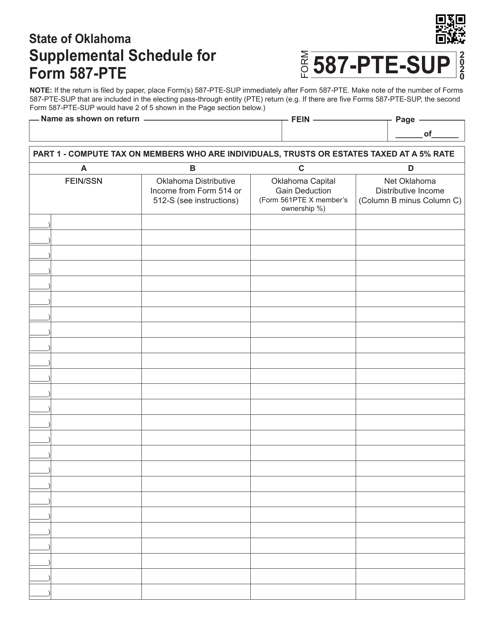

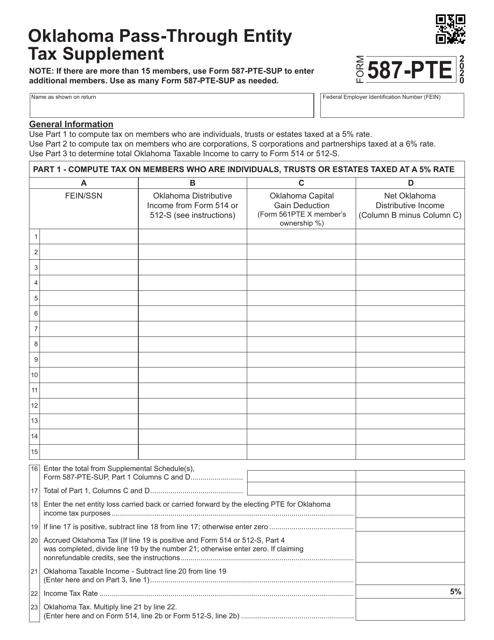

This form is used as a supplemental schedule for Form 587-PTE in the state of Oklahoma.

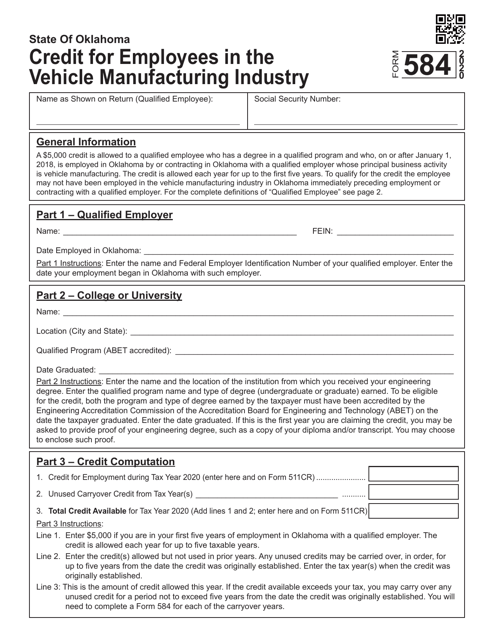

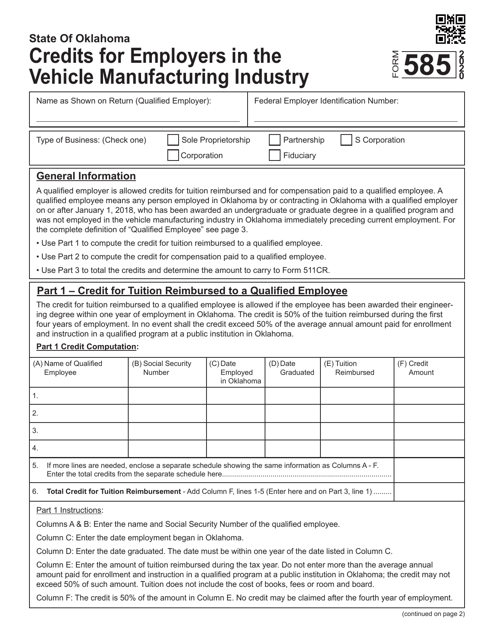

This Form is used for employers in the vehicle manufacturing industry in Oklahoma to claim credits.

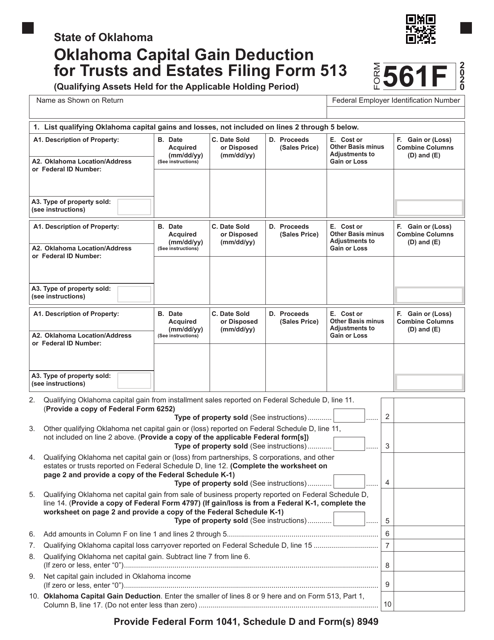

This Form is used for claiming capital gain deduction for trusts and estates filing Oklahoma Form 513. It allows trusts and estates to reduce their taxable income by deducting capital gains from the sale of certain assets.

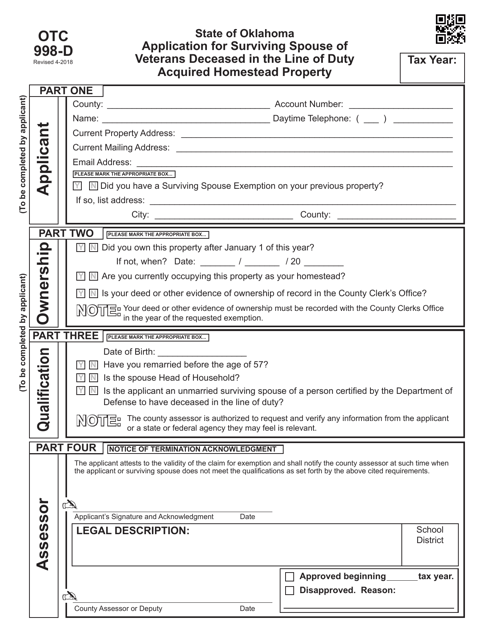

This form is used for surviving spouses of veterans who acquired homestead property in Oklahoma through the line of duty.

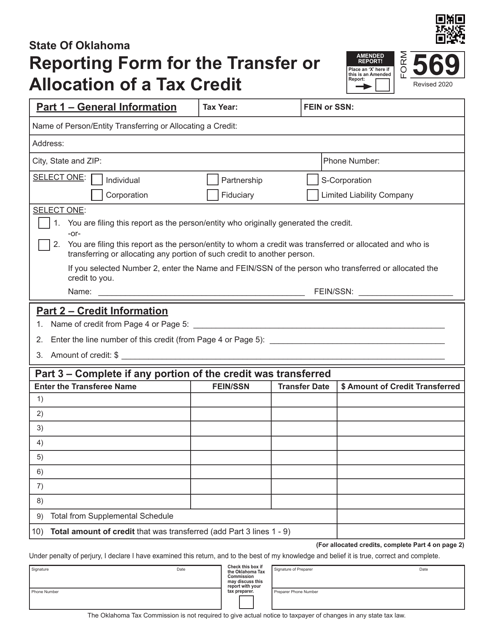

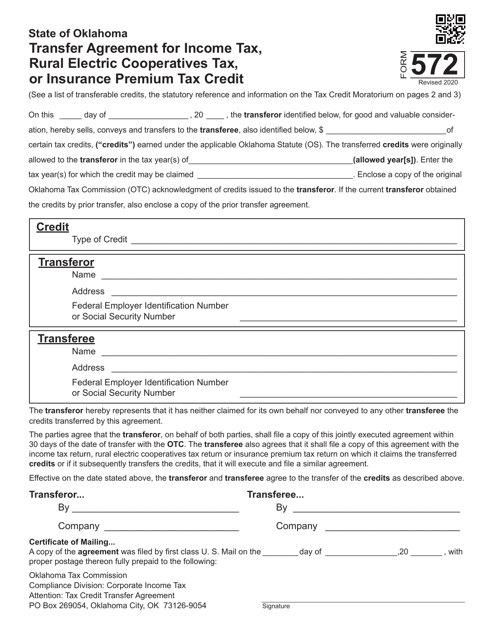

This Form is used for transferring agreements related to income tax, rural electric cooperatives tax, or insurance premium tax credit in the state of Oklahoma.

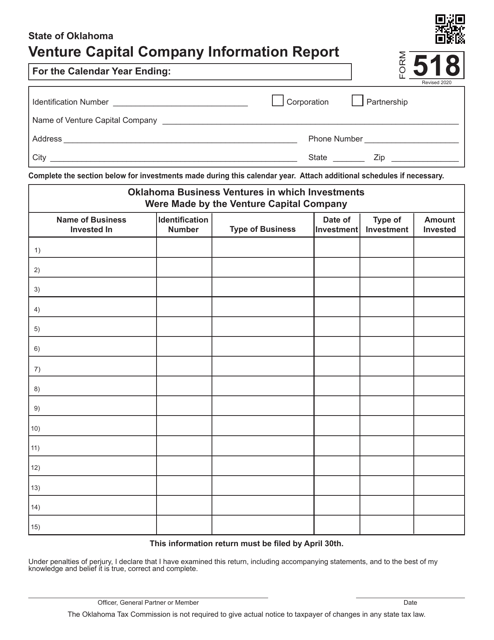

This form is used for reporting information about venture capital companies in Oklahoma.

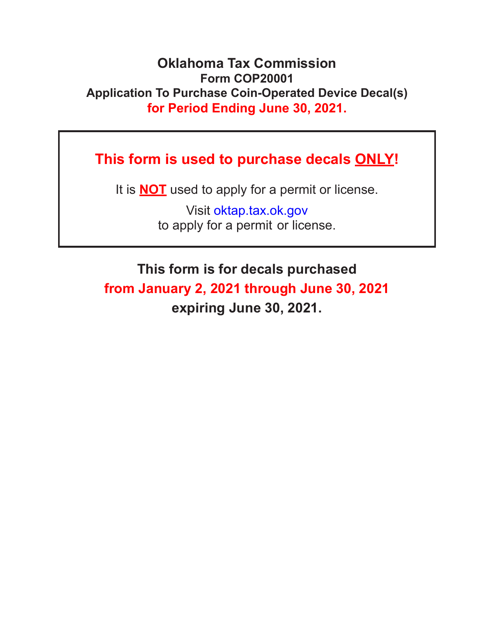

This form is used for ordering coin-operated device decals in the state of Oklahoma.

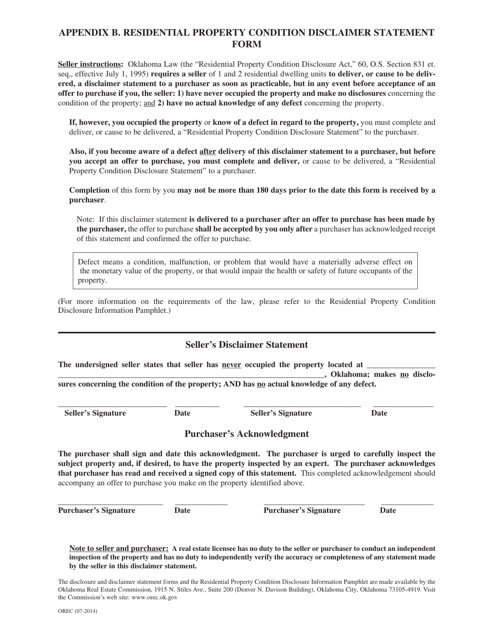

This Form is used for disclaiming residential property condition in Oklahoma.

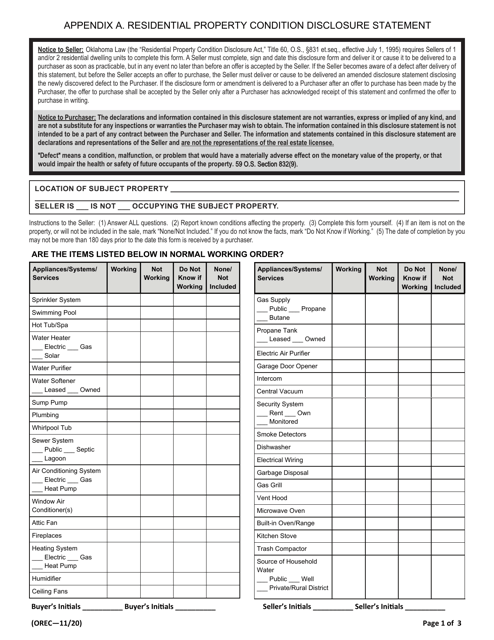

This document is used for disclosing the condition of a residential property in the state of Oklahoma. It provides important information about the property's condition to potential buyers.

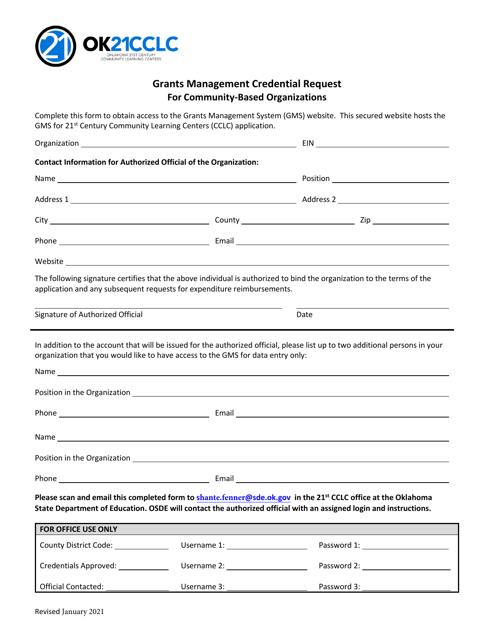

This document is for community-based organizations in Oklahoma to request grants management credentials. It is used to establish the organization's eligibility and qualifications for receiving grants from the state.

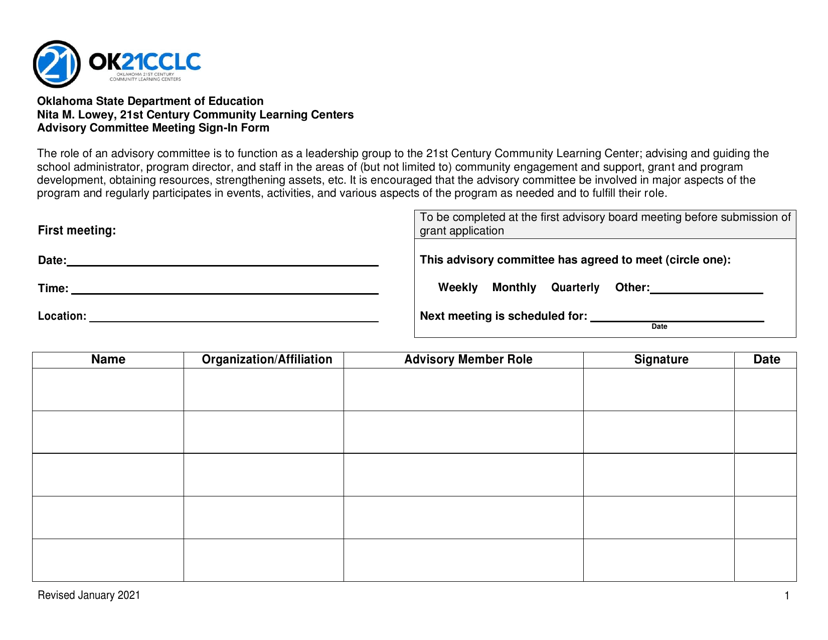

This Form is used for recording attendance at Advisory Committee Meetings in Oklahoma.