Fill and Sign Oklahoma Legal Forms

Documents:

4386

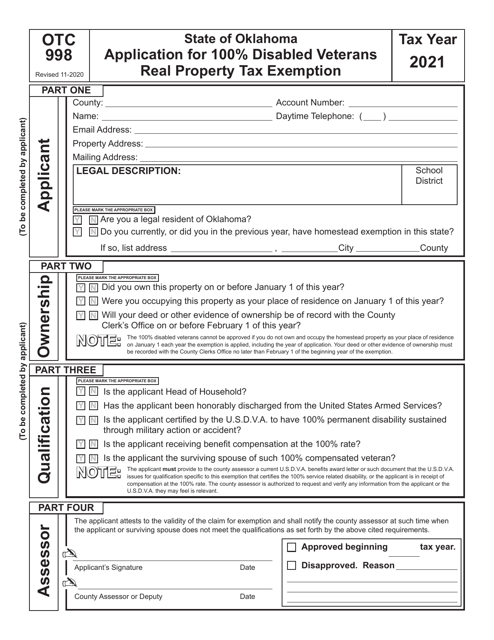

This type of document is used for applying for a 100% Disabled Veterans Real Property Tax Exemption in the state of Oklahoma.

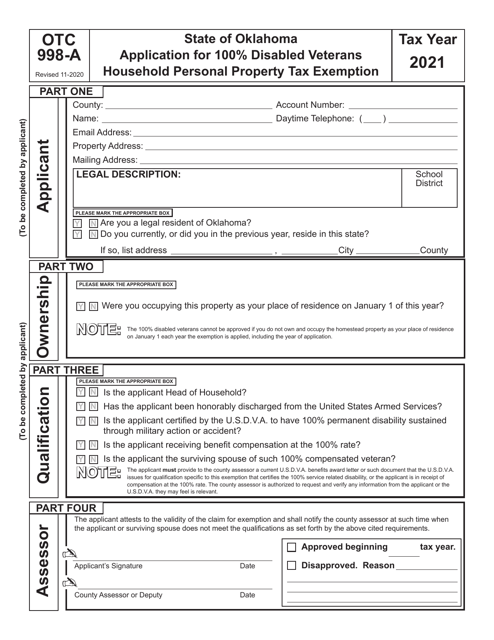

This form is used for applying for a 100% Disabled Veterans Household Personal Property Tax Exemption in Oklahoma.

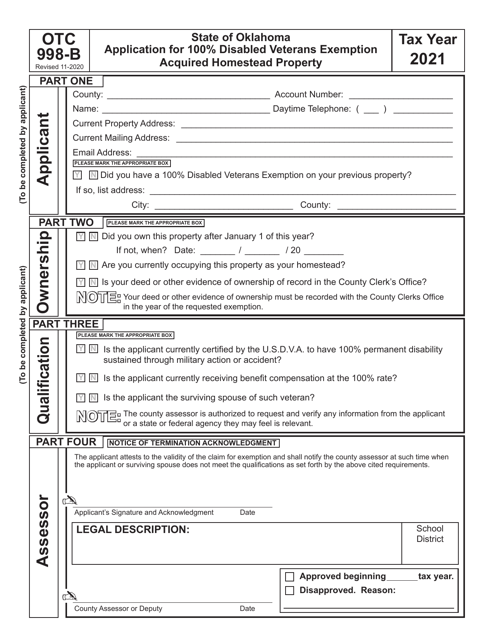

This form is used for applying for a property tax exemption for 100% disabled veterans in Oklahoma who have acquired a homestead property.

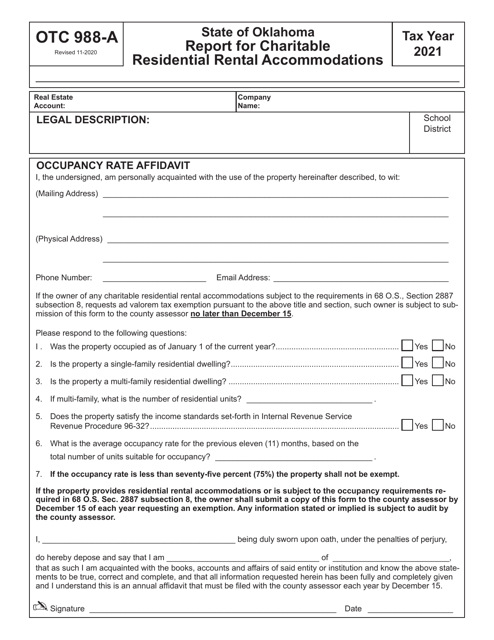

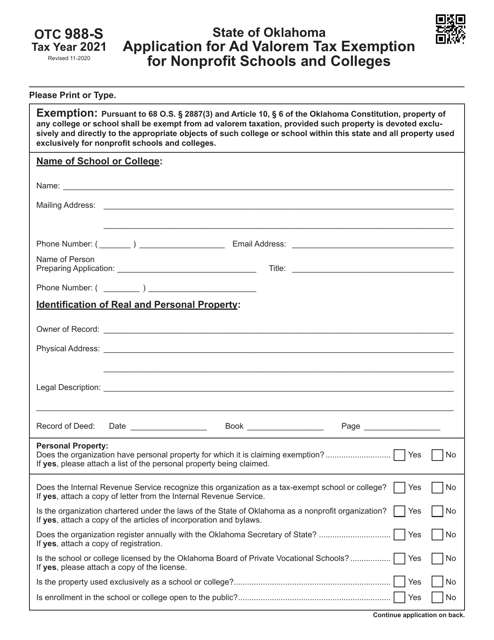

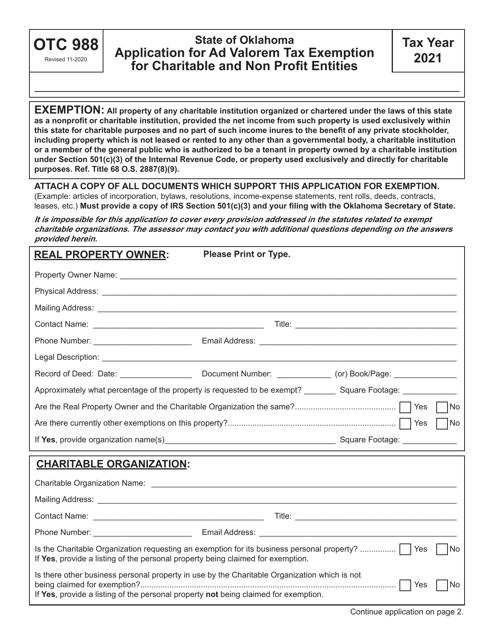

This form is used for applying for a tax exemption on property taxes for charitable and non-profit entities in Oklahoma. It helps these organizations reduce their financial burden and allocate more resources towards their charitable endeavors.

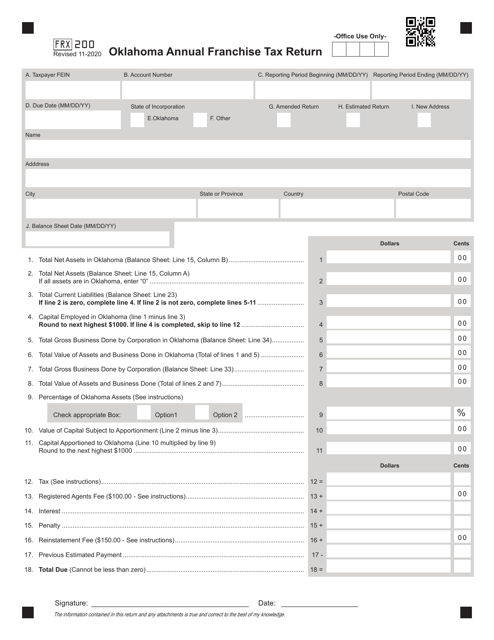

This Form is used for filing the annual franchise tax return in Oklahoma.

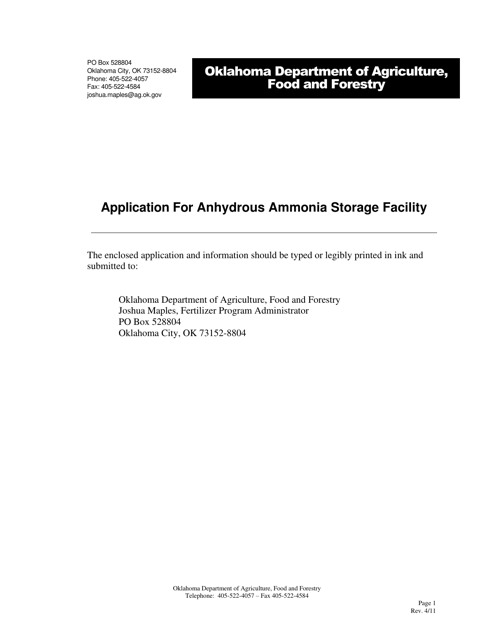

This document is an application for the construction and operation of an Anhydrous Ammonia Storage Facility in the state of Oklahoma.

This document is an application for obtaining a permit to establish a bulk dry fertilizer storage facility in Oklahoma. It outlines the necessary information and requirements for setting up such a facility.

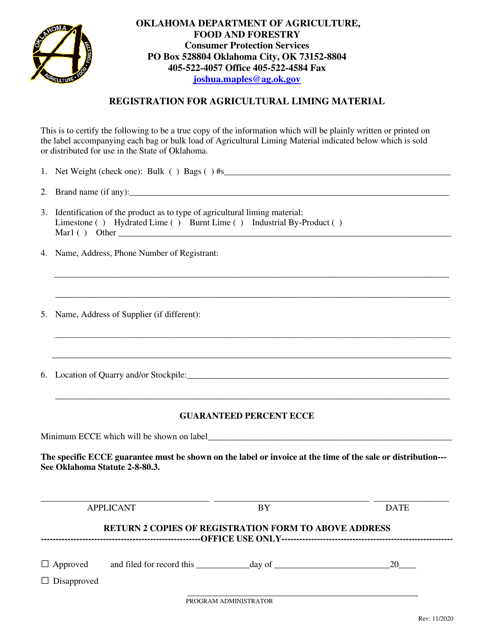

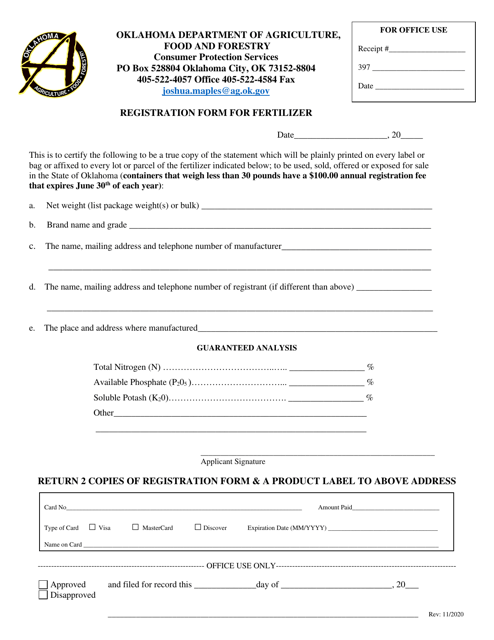

This form is used for registering fertilizers in the state of Oklahoma. It is required for companies selling or distributing fertilizers to submit this form to the appropriate regulatory agency for approval.

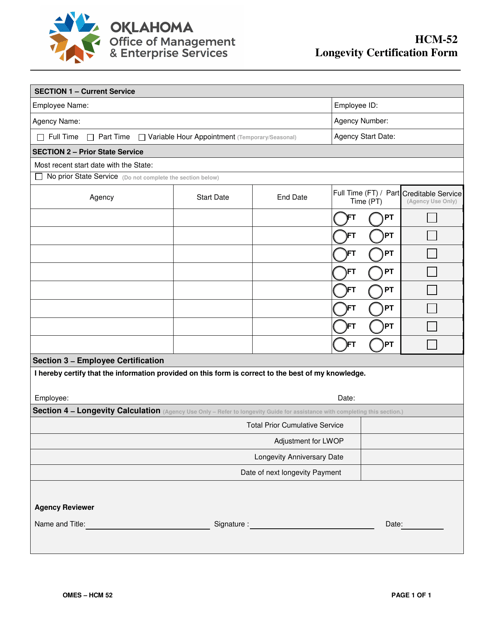

This Form is used for Longevity Certification in the state of Oklahoma. It is used to certify the length of service of an employee for the purpose of calculating longevity pay.

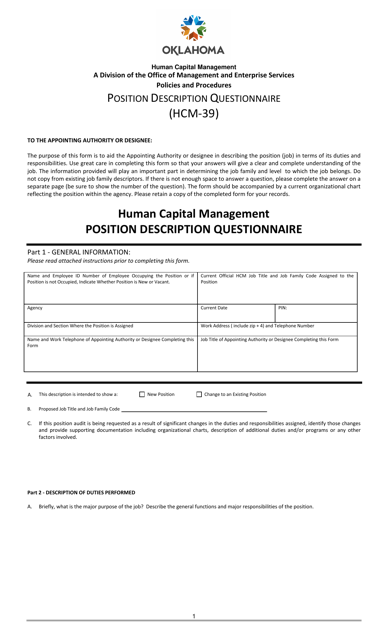

This Form is used for completing a Position Description Questionnaire in the state of Oklahoma.

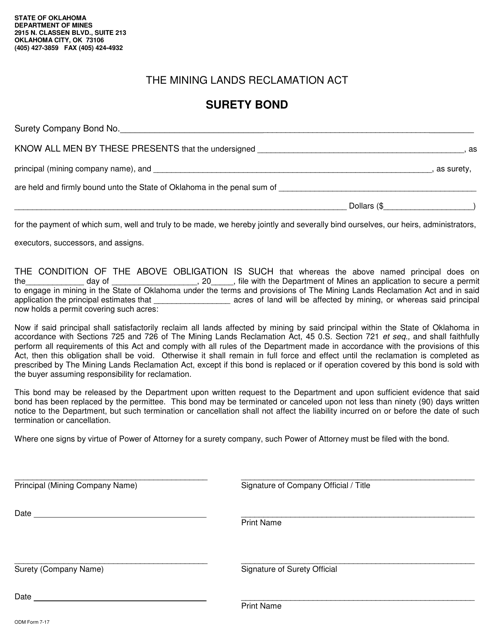

This document is a Surety Bond used in the state of Oklahoma. It is a financial guarantee provided by a third party to ensure that a specific obligation will be fulfilled.

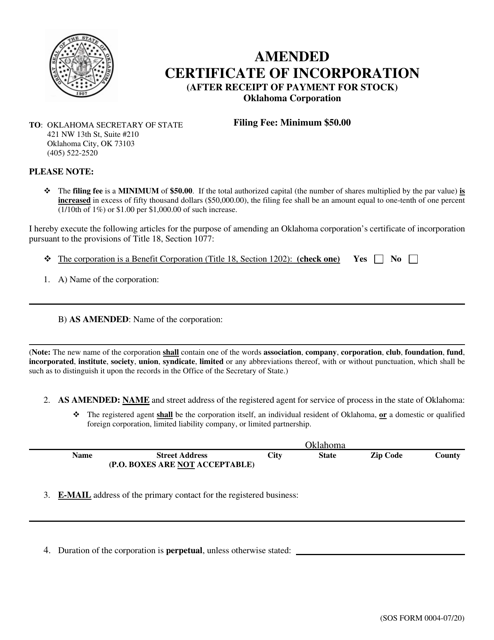

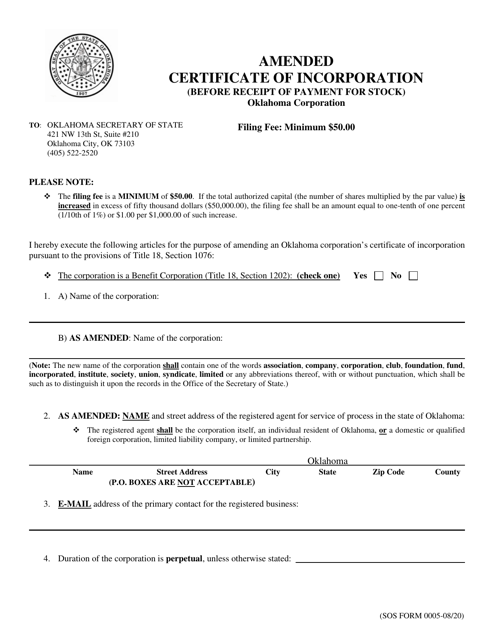

This Form is used for filing an amended certificate of incorporation in Oklahoma after receiving payment for stock.

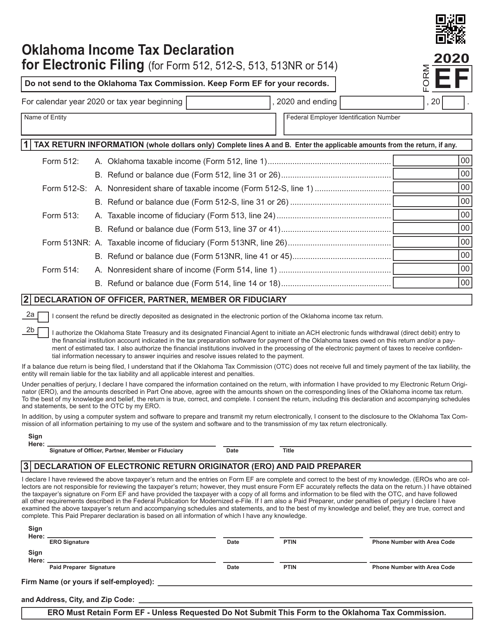

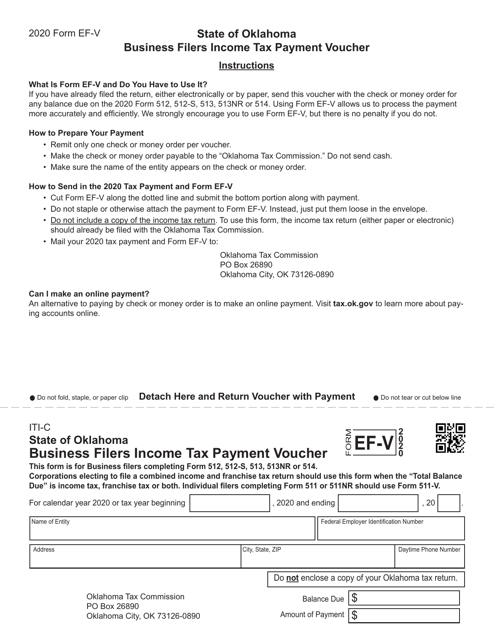

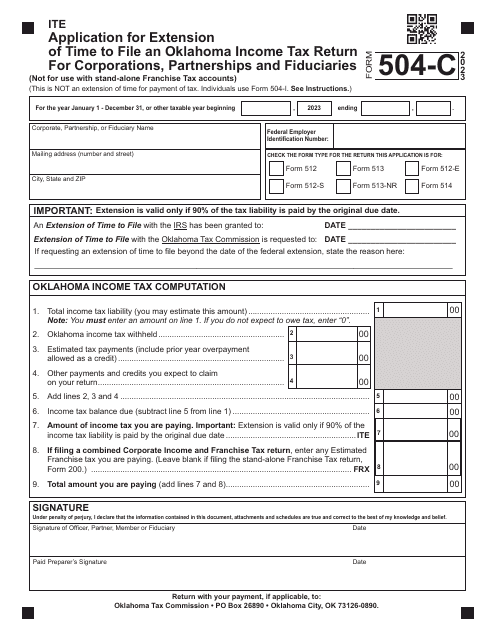

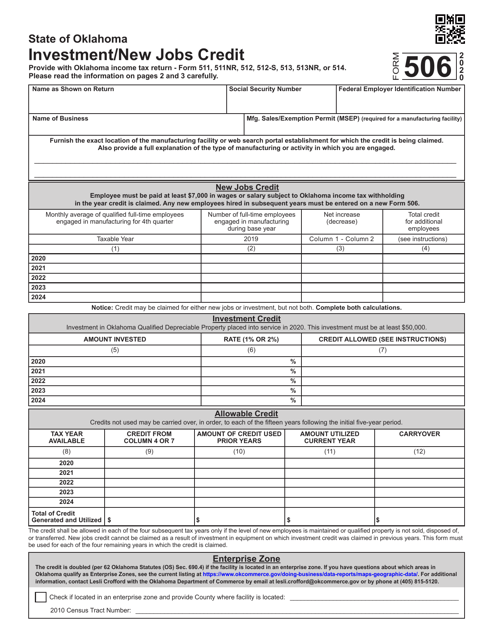

This form is used for electronically filing Oklahoma state income tax returns for forms 512, 512-s, 513, 513-nr, or 514.

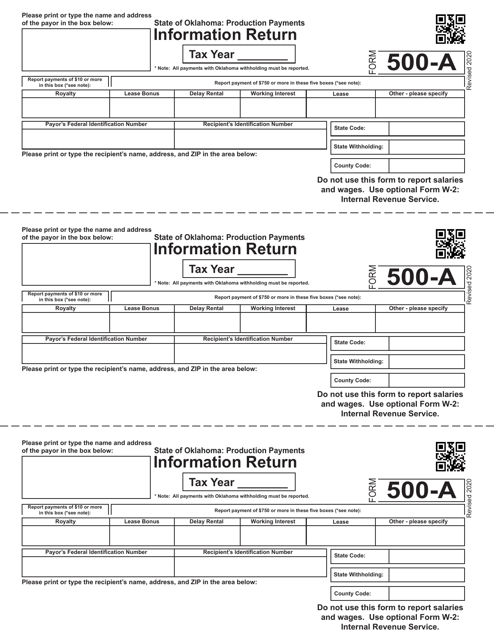

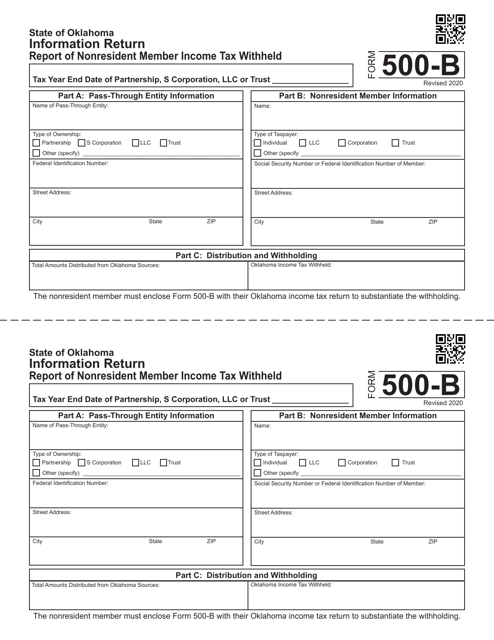

This Form is used for reporting information on production payments in the state of Oklahoma.

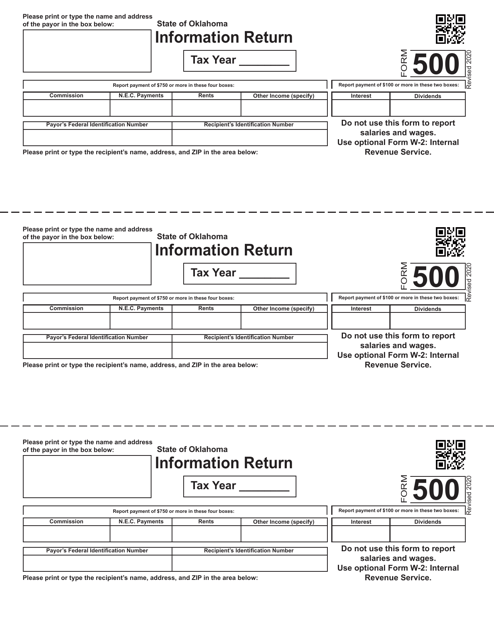

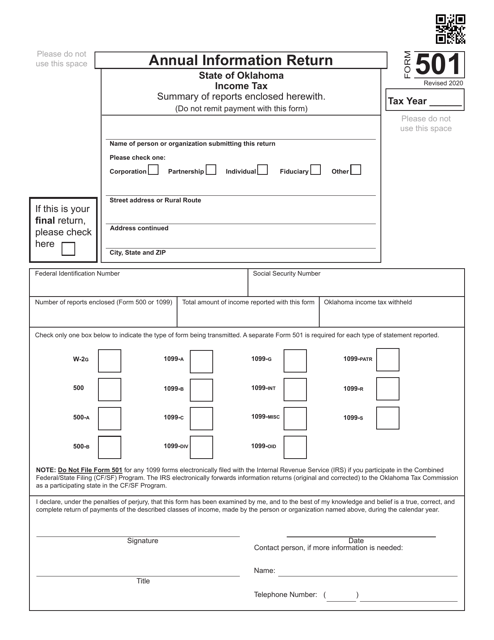

This document is used for filing an information return in the state of Oklahoma. It includes detailed information about various income sources and expenses.

This Form is used for submitting the Annual Information Return for businesses operating in the state of Oklahoma. It is a requirement for companies to report various information about their operations and financials to the Oklahoma Tax Commission.

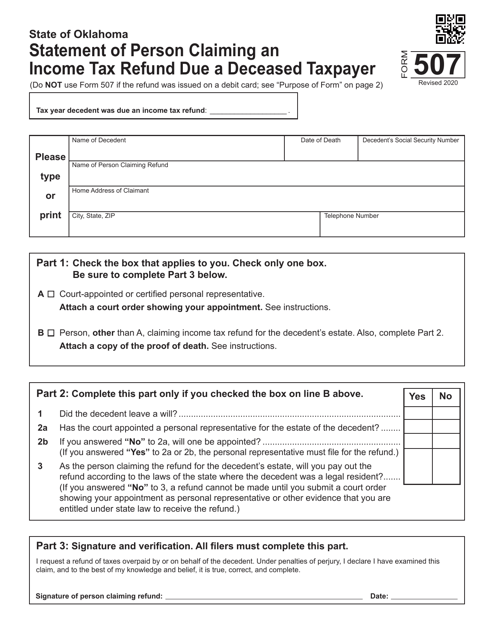

This form is used for making a statement to claim an income tax refund on behalf of a deceased taxpayer in Oklahoma.