IRS 1095 Forms and Instructions for 2021

What Are IRS Forms 1095?

The IRS 1095 Forms are used to report the information about individuals that have been qualified for minimum essential health coverage, inform the employees about the offers of health coverage and their existing and potential enrollment in insurance plans to the Internal Revenue Service (IRS) . The IRS Form 1095 series includes three forms:

- IRS Form 1095-A, Health Insurance Marketplace Statement, is the main form in the series needed to inform the IRS about people enrolled in a qualified health plan via the Health Insurance Marketplace. Health Insurance Marketplace helps people without health care insurance find necessary information about insurance options and alternatives and purchase health care insurance for themselves, their relatives, and businesses. The health marketplace tax form is also used to allow the individuals to adjust and coordinate the credit on their returns with advance credit payments, to help them to claim the premium tax credit – a credit that lets individuals and their close relatives pay for the premiums for their health insurance, and to submit a proper tax return.

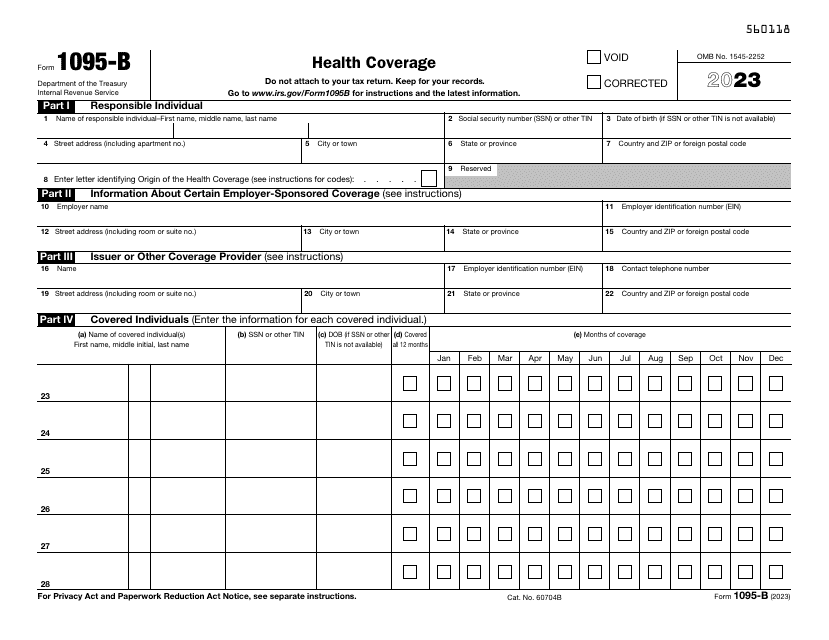

- IRS Form 1095-B, Health Coverage, is a document used to send to the IRS and the taxpayer's information about the individuals that are not liable for the individual shared responsibility payment because they have minimum essential coverage - individual market plans, plans sponsored by eligible employers, and programs sponsored by the government.

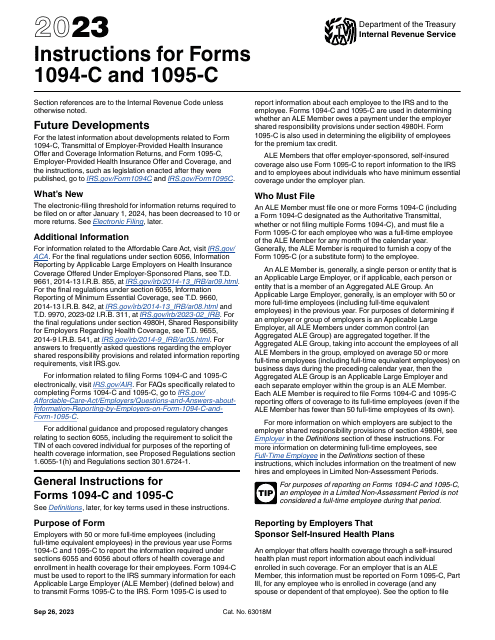

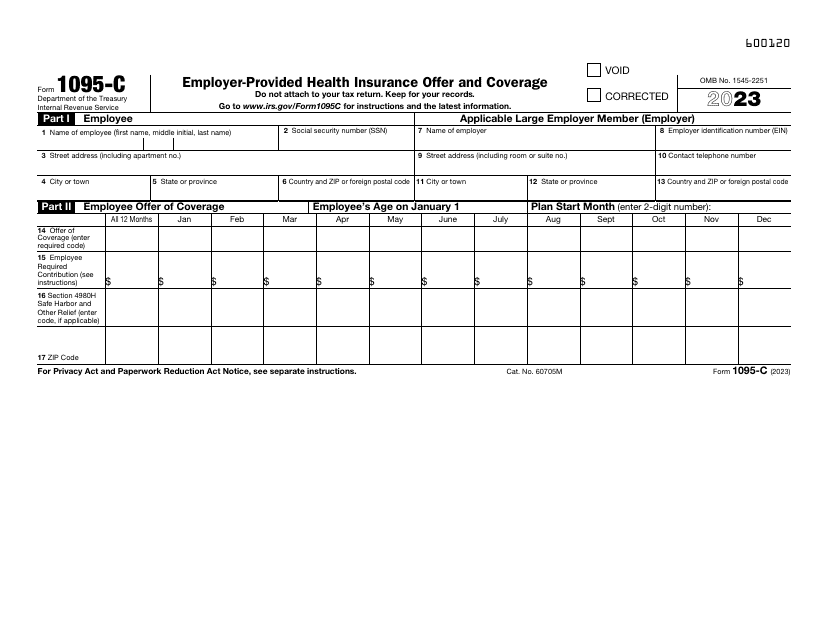

- IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is a form submitted by employers with 50 or more full-time employees to provide information about health coverage and offers of health coverage for the aforementioned employees. This form must be sent by the employer, not by the IRS, and it is complementary to other health insurance forms – 1095-A and 1095-B.

IRS Forms 1094 and 1095

IRS Form 1094-B, Transmittal of Health Coverage Information Returns, is a form used by the IRS to obtain information about individuals that have health coverage meeting the standards of the Affordable Care Act. It must be filed with the Form 1095-B. The IRS 1094-B (transmittal) is supplementary to the Form 1095-B (returns). The IRS 1094-B is used as a cover sheet that the insurance provider needs to identify itself, state the number of the IRS 1095-B forms submitted to the IRS, and the name and telephone number of the responsible party for the IRS to contact.

Just like Form 1094-B, Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, serves as a cover sheet for Form 1095-C and it is sent only to the IRS.

When Are Forms 1095 Due?

Form 1095-A must be submitted on or before the last day of the first calendar month of the year. If the due date is a Saturday, Sunday, or a legal holiday, the document must be sent by the next business day. The annual report has to be filed with the IRS on or before that date for coverage in the previous calendar year.

Form 1095-B and Form 1095-C due date is the last day of February if you file it in hard copy and if you file it electronically, the last day of March of the year that follows the calendar year of coverage.

Related Articles

Documents:

7

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

This form is also known as the healthcare marketplace tax form. It is used to inform the IRS about individuals and families enrolled in a health plan via the Health Insurance Marketplace.

This form is filed by employers with 50 or more full-time employees in order to provide information about their enrollment in health coverage required under sections 6055 and 6056 of the Internal Revenue Code.