North Dakota Tax Forms and Templates

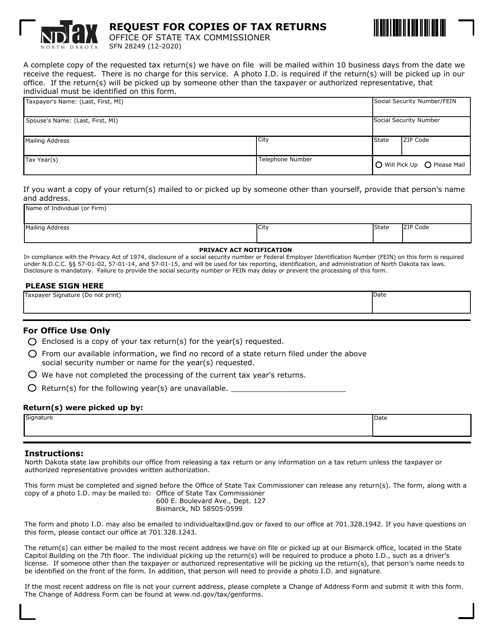

North Dakota tax forms are used for reporting and paying taxes to the state of North Dakota. These forms cover various types of taxes, such as income tax, sales tax, fuel tax, and others. Individuals, businesses, and organizations may need to use these forms to fulfill their tax obligations in North Dakota.

Documents:

56

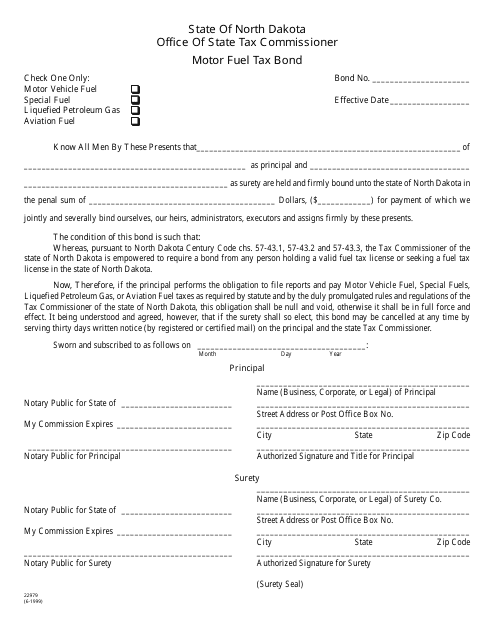

This Form is used for obtaining a motor fuel tax bond in North Dakota.

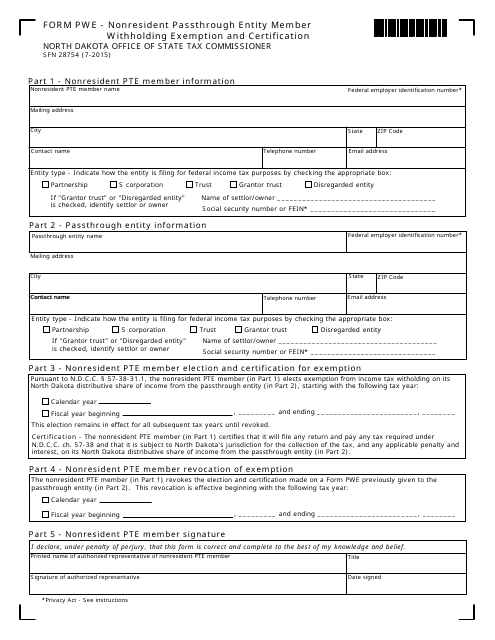

This form is used for nonresident members of a passthrough entity to claim withholding exemption in North Dakota.

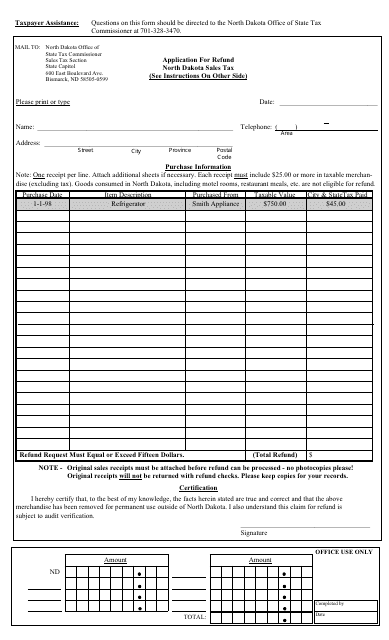

This Form is used for requesting a refund in the state of North Dakota.

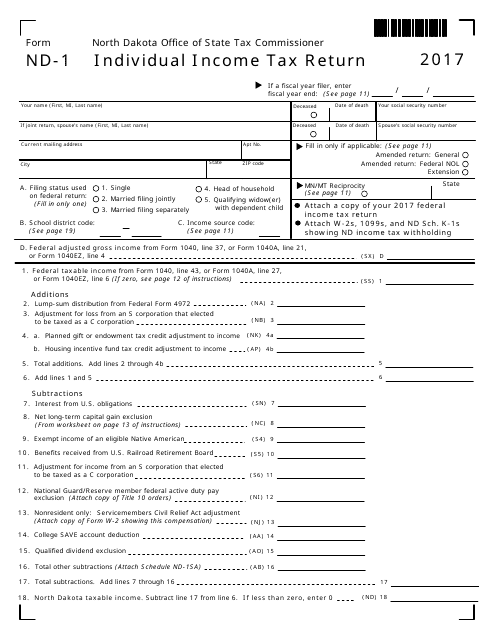

This form is used for filing individual income tax returns in the state of North Dakota.

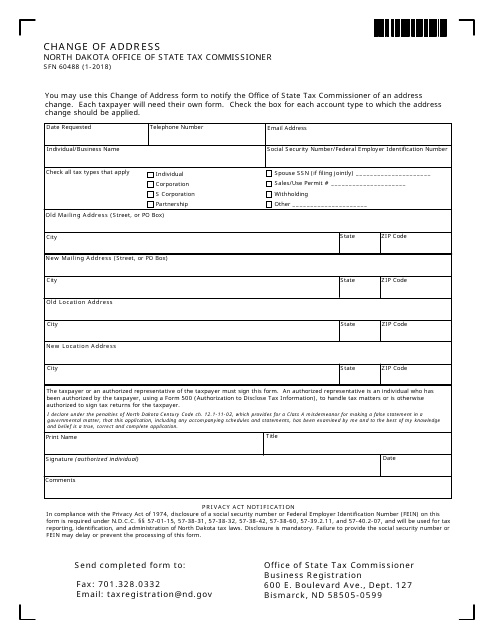

This form is used for changing your address in North Dakota.

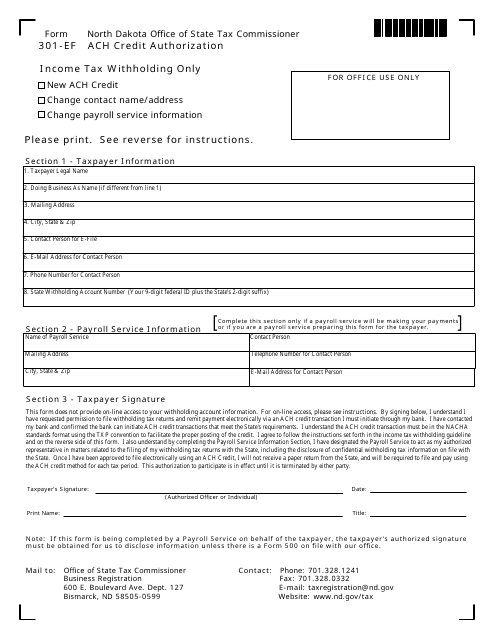

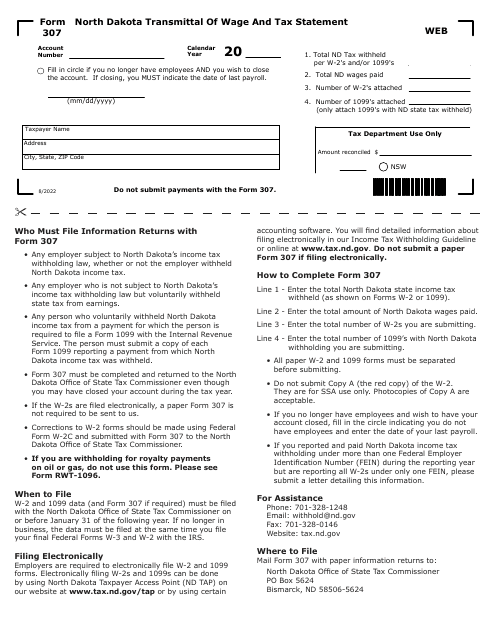

This form is used for applying for withholding and authorizing ACH credits in North Dakota.

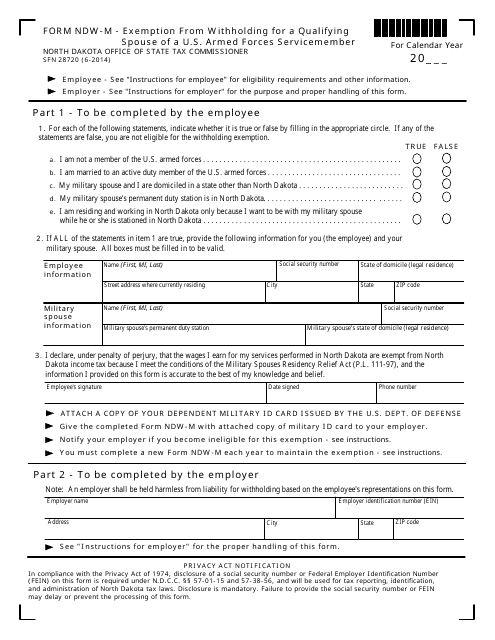

This form is used for claiming exemption from withholding for a qualifying spouse of a U.S. Armed Forces servicemember in North Dakota.

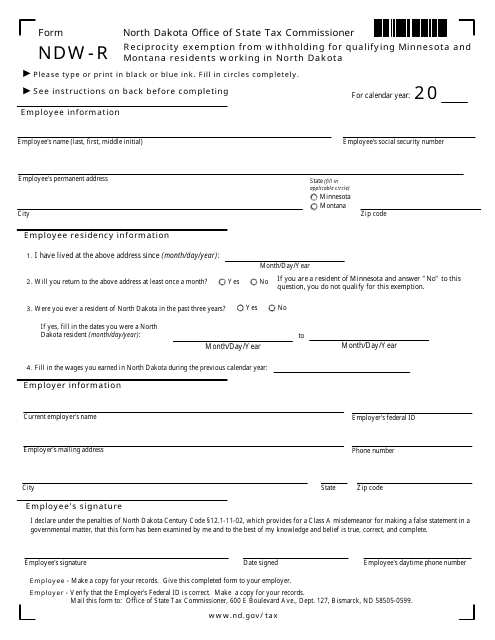

This form is used by qualifying residents of Minnesota and Montana who are working in North Dakota to claim an exemption from withholding taxes.

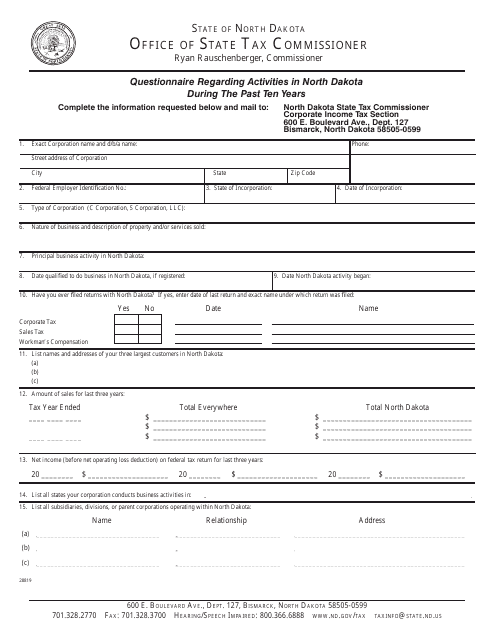

This form is used to collect information about activities that have taken place in North Dakota over the past ten years.

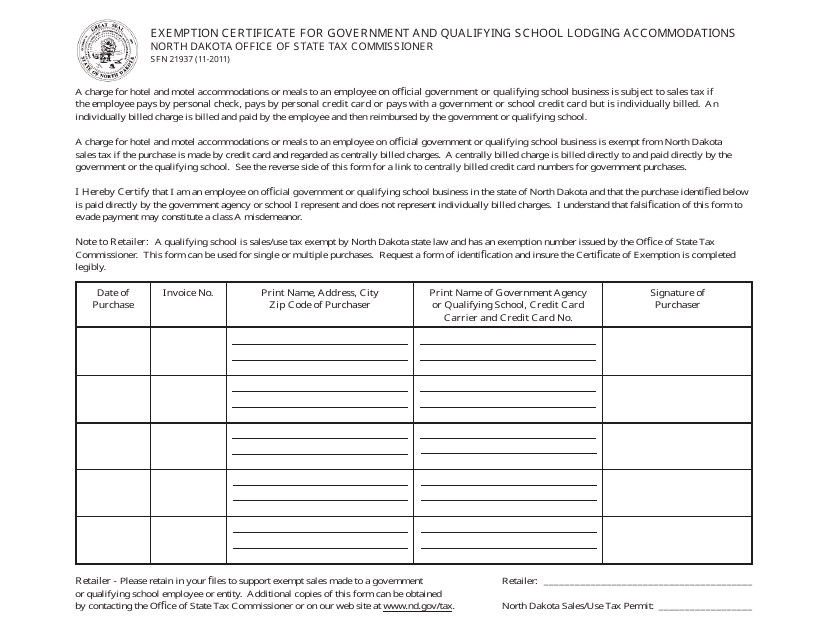

This form is used for requesting an exemption certificate for government and qualifying school lodging accommodations in North Dakota.

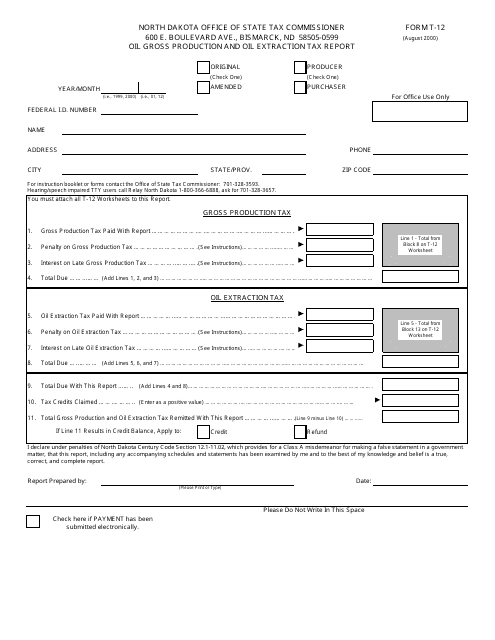

This form is used for reporting oil gross production and oil extraction taxes in North Dakota.

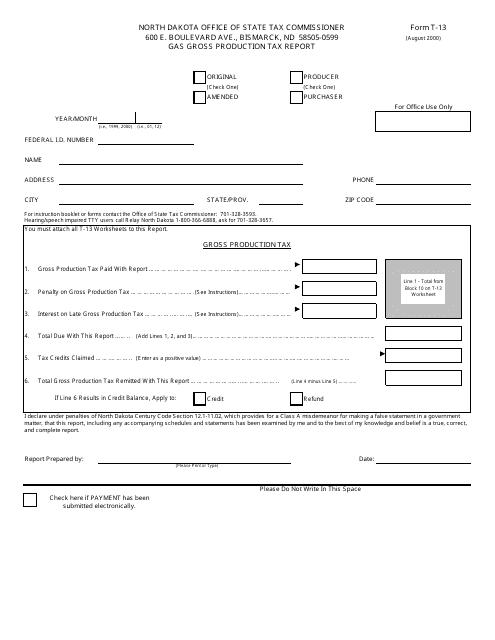

This Form is used for reporting gas gross production tax in North Dakota.

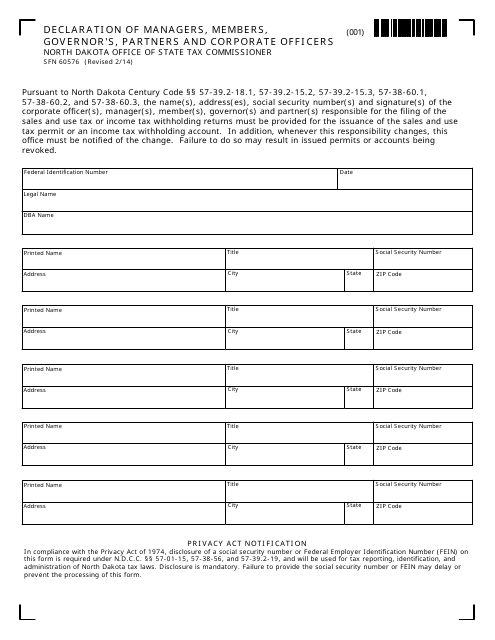

This form is used for declaring the managers, members, governor's, partners, and corporate officers in North Dakota.

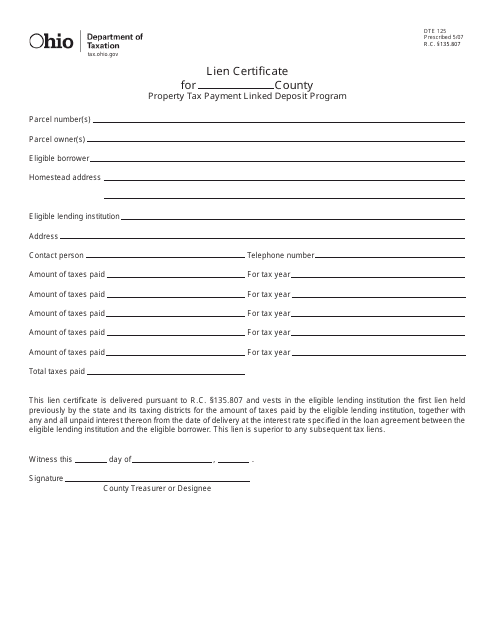

This form is used for applying for a lien certificate for the Property Tax Payment Linked Deposit Program in Ohio.

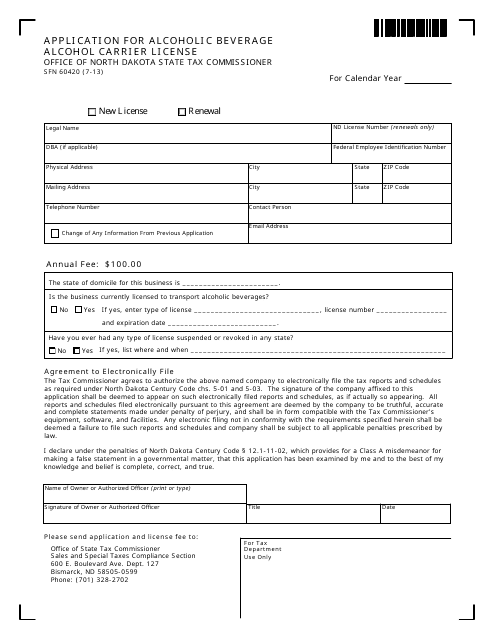

This form is used for applying for an alcoholic beverage alcohol carrier license in North Dakota.

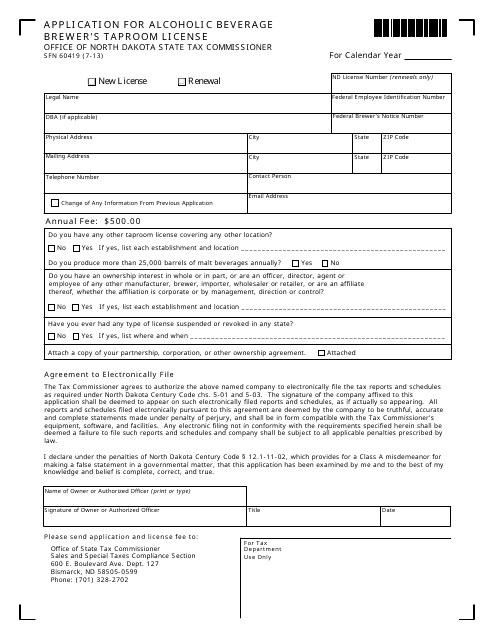

This form is used for applying for an Alcoholic Beverage Brewer's Taproom License in North Dakota.

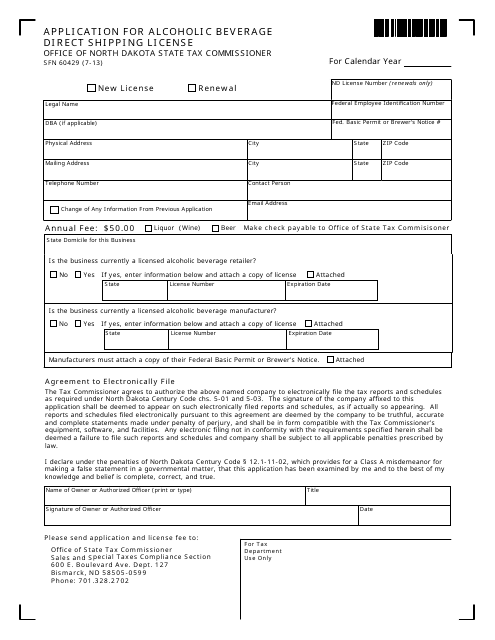

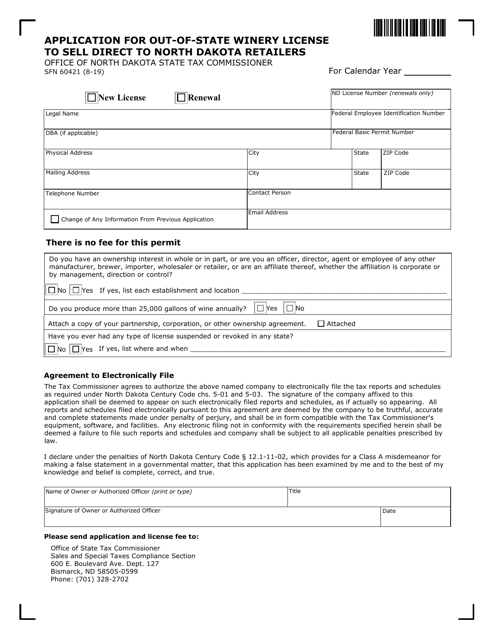

This form is used for applying for an Alcoholic Beverage Direct Shipping License in North Dakota.

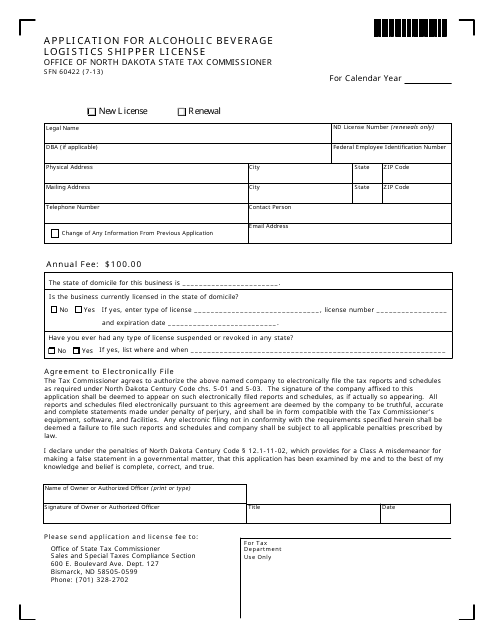

This form is used for applying for an alcoholic beverage logistics shipper license in North Dakota.

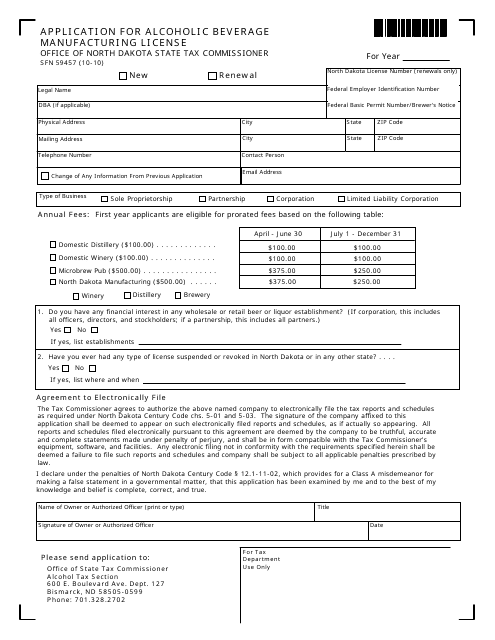

This Form is used for applying for an alcoholic beverage manufacturing license in North Dakota.

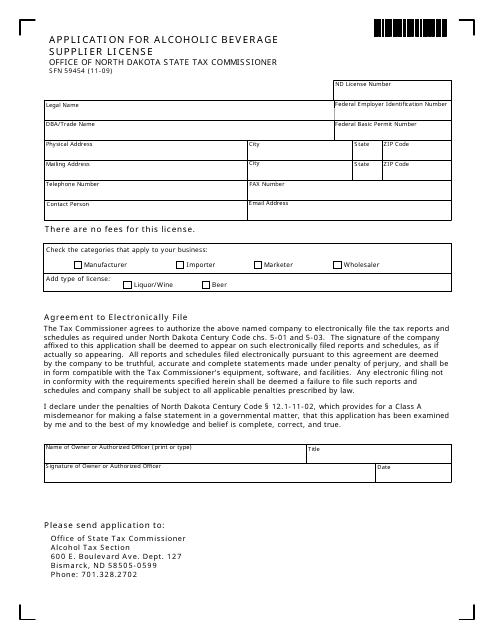

This Form is used for applying for an Alcoholic Beverage Supplier License in North Dakota. It is necessary for businesses that want to supply alcoholic beverages in the state.

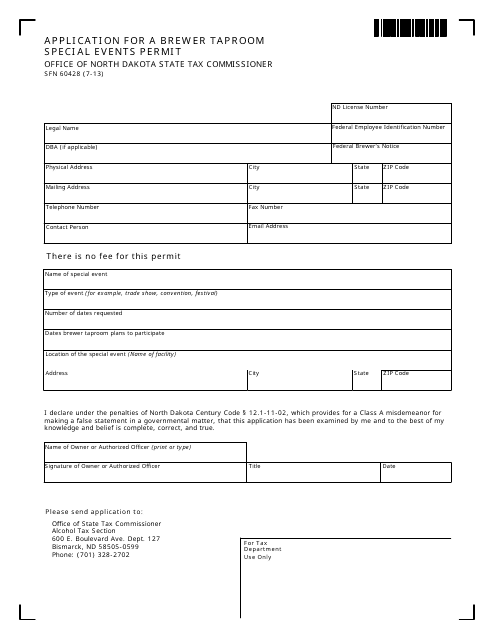

This form is used for applying for a Brewer Taproom Special Events Permit in North Dakota.

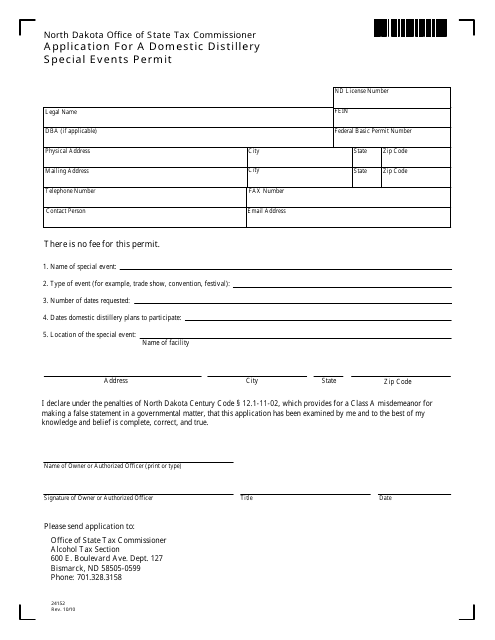

This form is used for applying for a Domestic Distillery Special Events Permit in North Dakota.

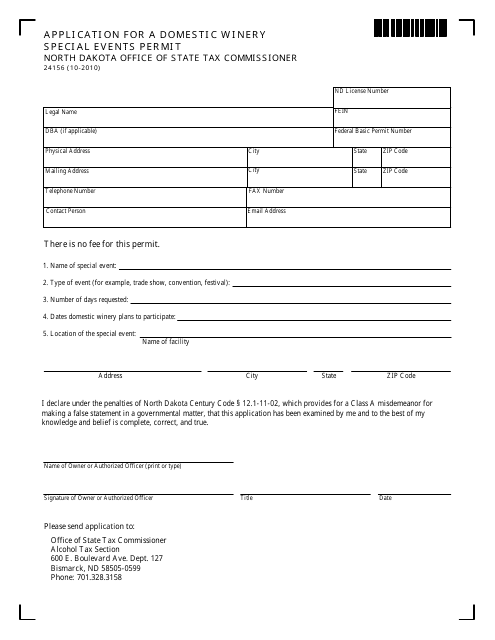

This form is used for applying for a special events permit for domestic wineries in North Dakota.

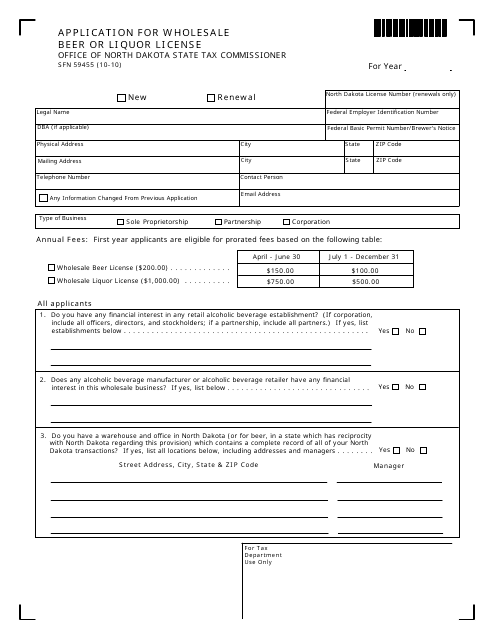

This Form is used for applying for a wholesale beer or liquor license in North Dakota.

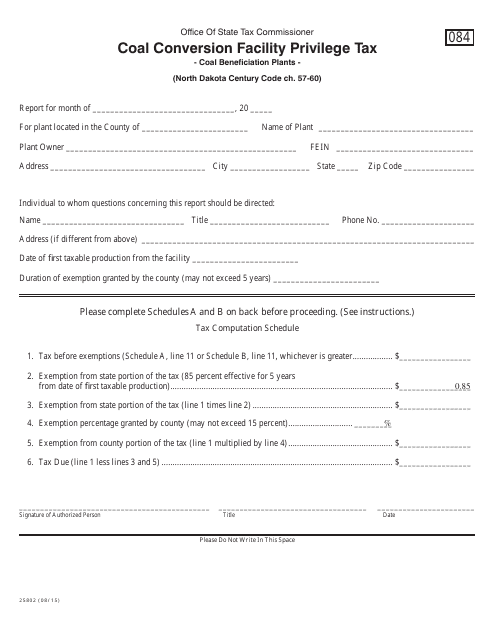

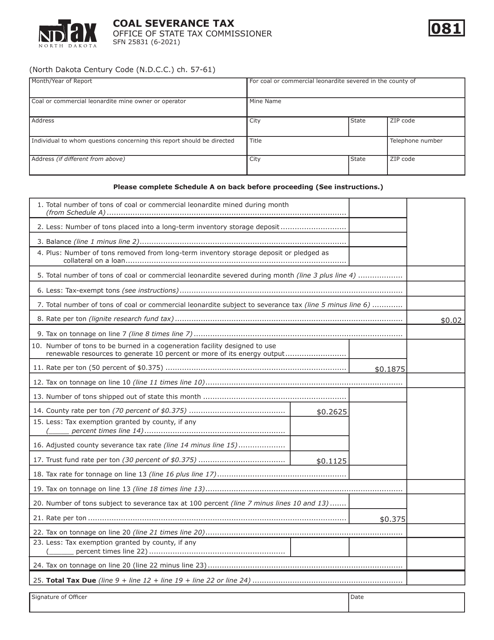

This form is used for reporting and paying the Coal Conversion Facility Privilege Tax in North Dakota.

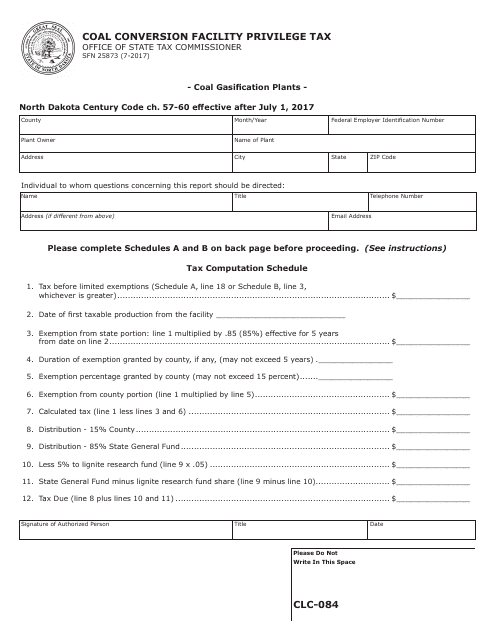

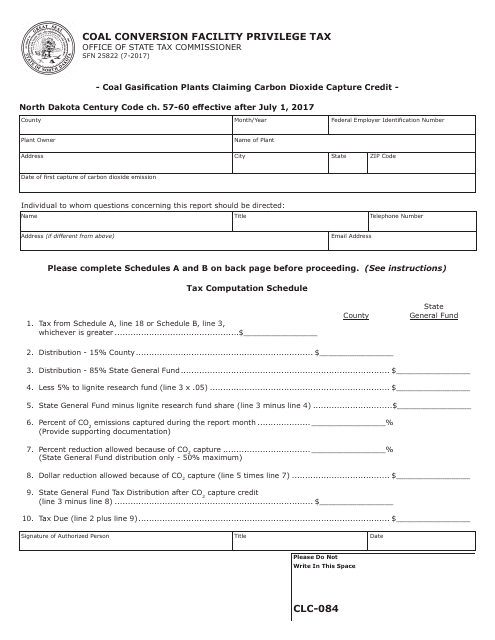

This Form is used for reporting and paying the Coal Conversion Facility Privilege Tax for Coal Gasification Plants in North Dakota.

This form is used for coal gasification plants in North Dakota to claim the carbon dioxide capture credit and privilege tax related to coal conversion facilities.

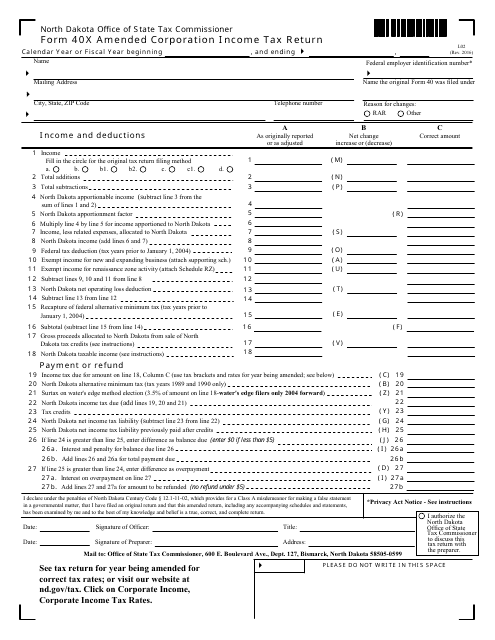

This document is used for filing an amended corporation income tax return in North Dakota. It is the Form L02 (40X).

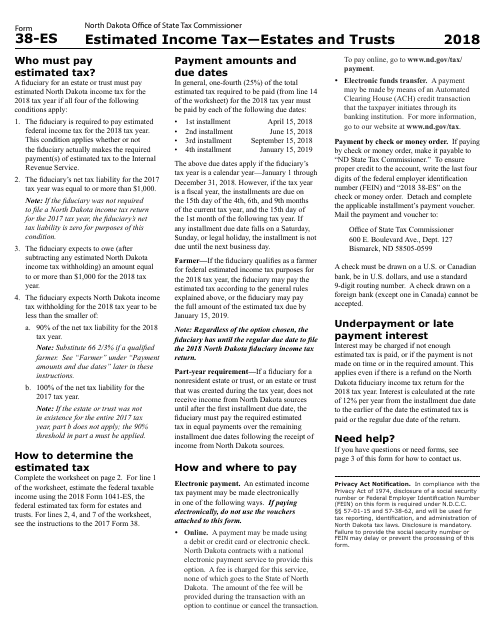

This Form is used for estimating income tax for estates and trusts in North Dakota.

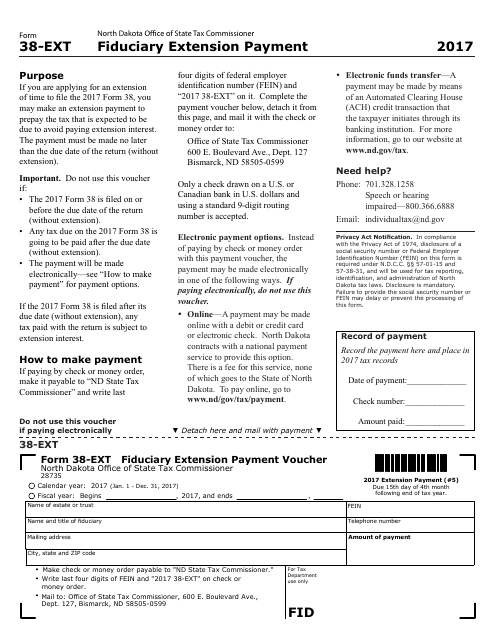

This Form is used for making an extension payment as a fiduciary in North Dakota.

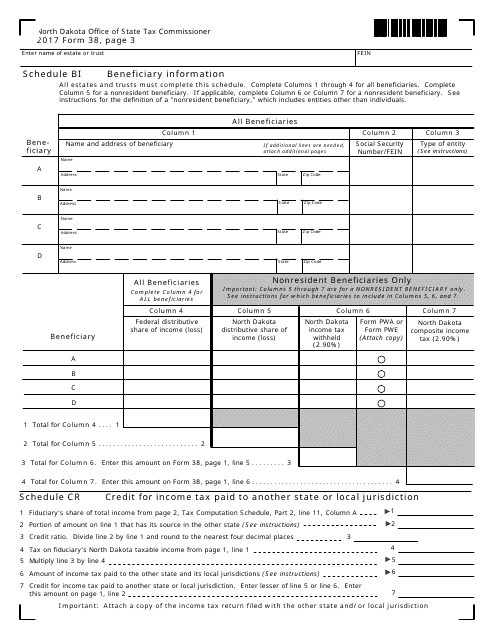

This form is used for providing beneficiary information in North Dakota.

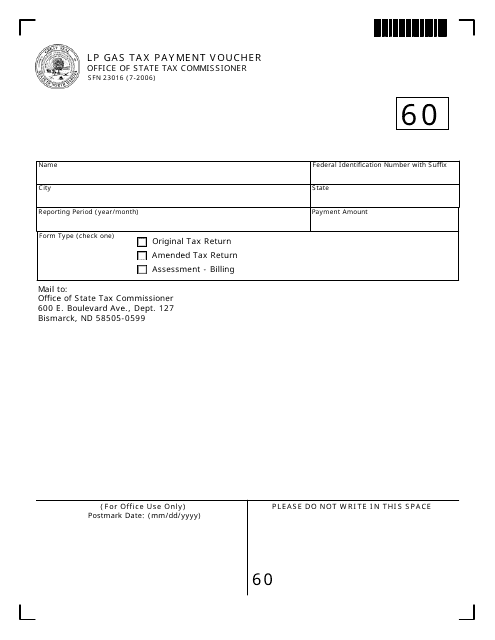

This form is used for making LP gas tax payments in North Dakota.

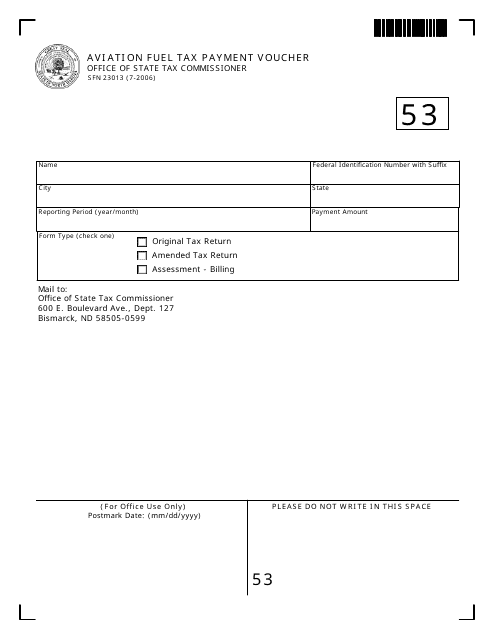

This Form is used for paying aviation fuel tax in North Dakota.

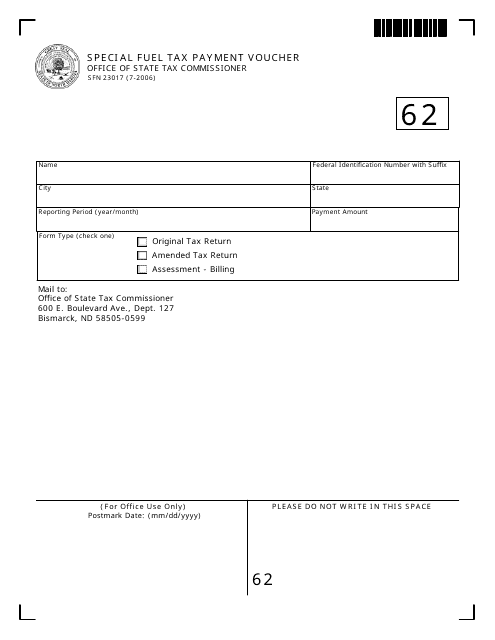

This form is used for making special fuel tax payments in North Dakota.

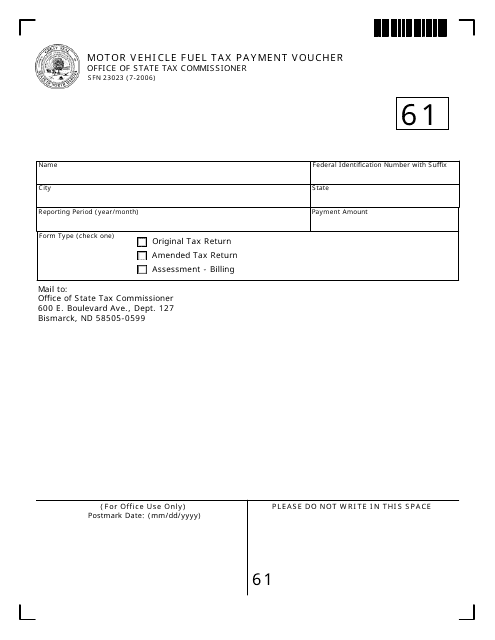

This form is used for submitting motor vehicle fuel tax payments in North Dakota.

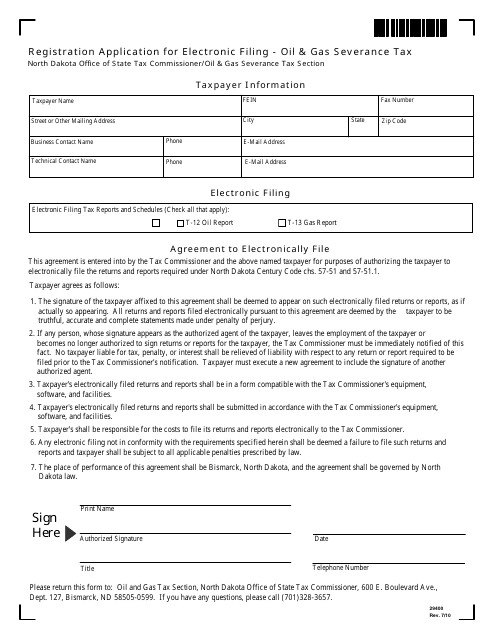

This Form is used for registering electronic filing of oil & gas severance tax in North Dakota.