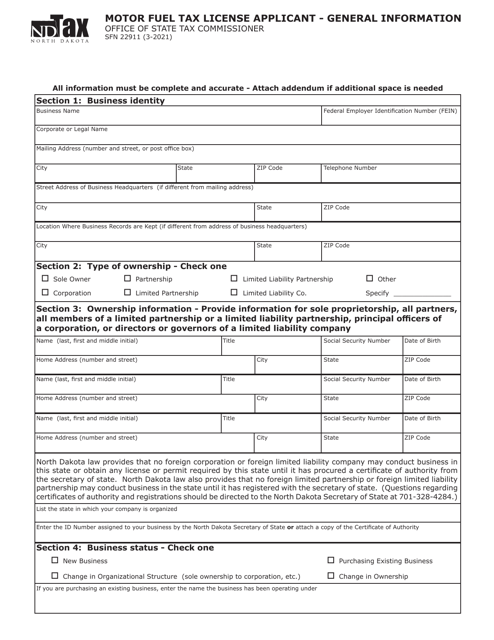

North Dakota Tax Forms and Templates

Documents:

56

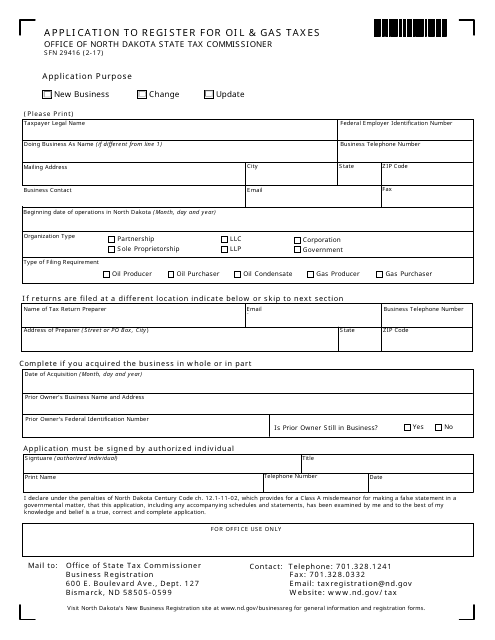

This form is used for registering for oil and gas taxes in North Dakota.

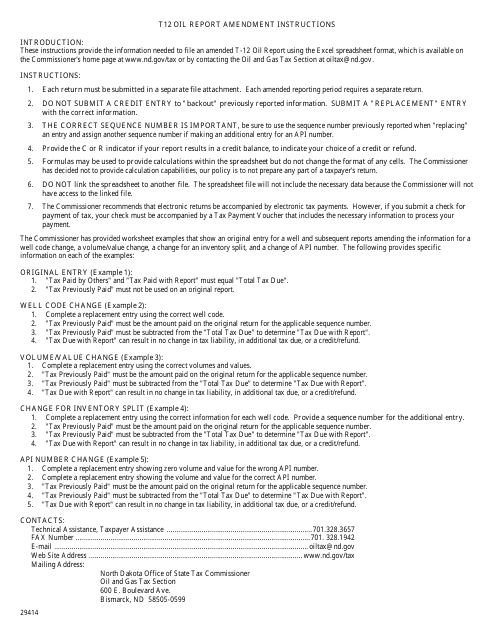

This Form is used for reporting amendments to oil reports in North Dakota. It provides instructions on how to correctly fill out and submit the Form T12 Oil Report Amendment.

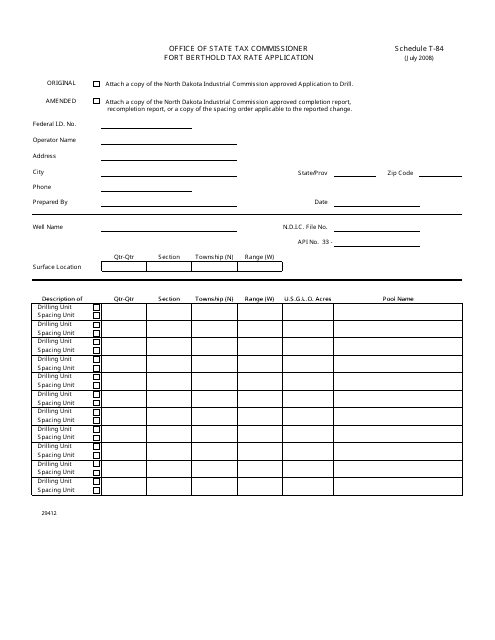

This document is used to apply for tax rates in Fort Berthold, North Dakota for Schedule T-84.

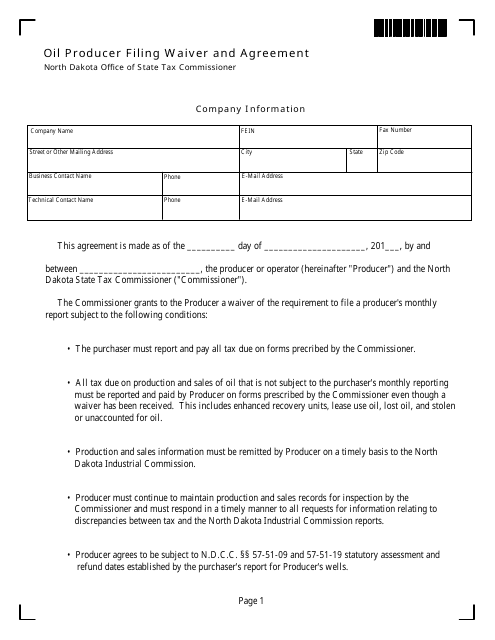

This Form is used for oil producers in North Dakota to file a waiver and agreement.

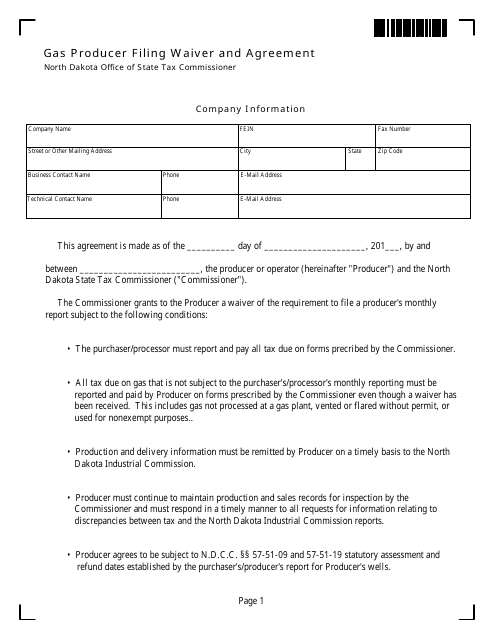

This Form is used for gas producers in North Dakota to file a waiver and agreement.

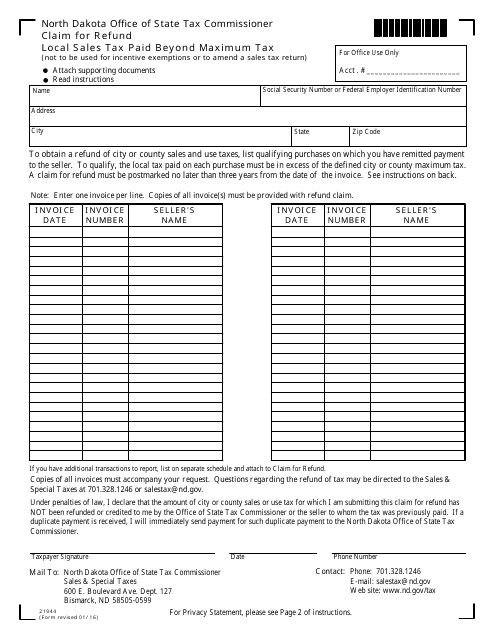

This Form is used for claiming a refund on local sales tax paid beyond the maximum tax amount in North Dakota.

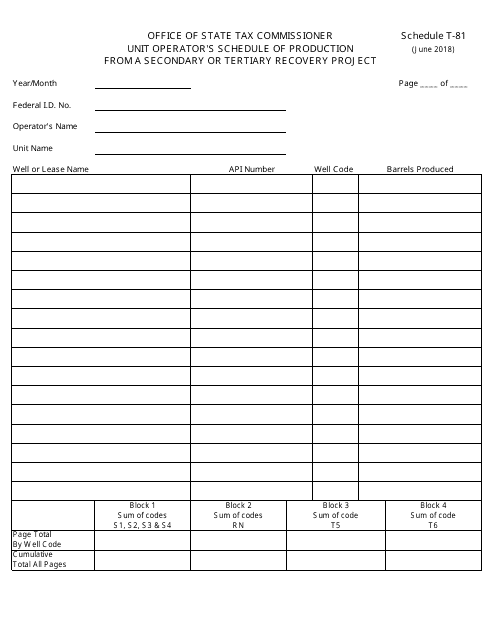

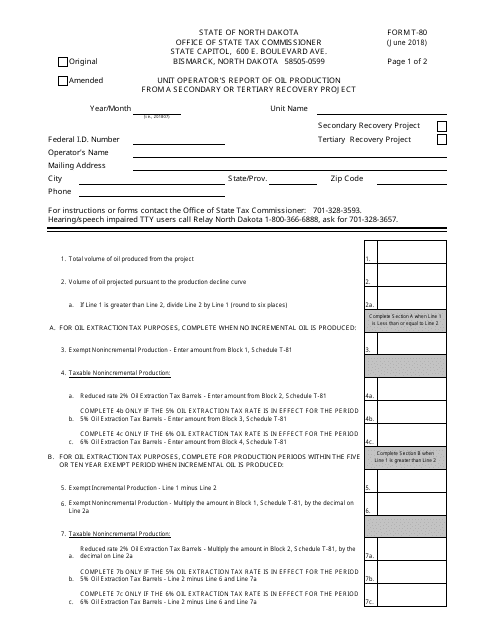

This form is used for reporting the production from a secondary or tertiary recovery project in North Dakota. It is specifically designed for unit operators to submit their schedule of production.

This document provides instructions for reporting oil and gas taxes specifically for the Fort Berthold Reservation in North Dakota. It guides individuals or businesses on how to properly report and pay taxes related to oil and gas operations on the reservation.

This document provides instructions on how to file and pay oil and gas taxes in North Dakota. It includes information on reporting requirements, deadlines, and payment methods.

This form is used for reporting oil production from secondary or tertiary recovery projects in North Dakota.

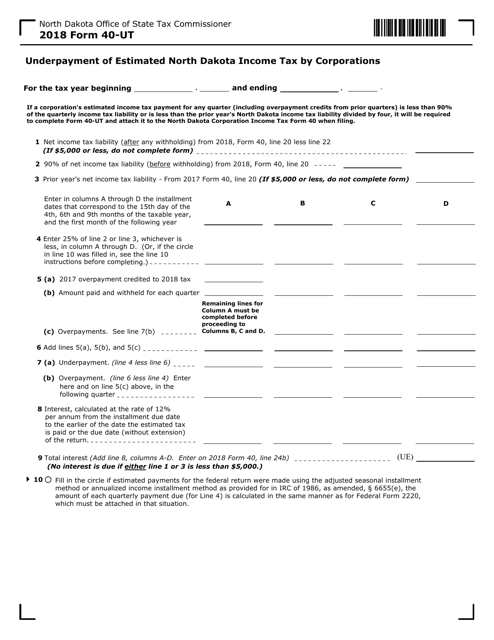

This form is used for corporations in North Dakota to report underpayment of estimated income tax.