Payroll Deduction Form Templates

Documents:

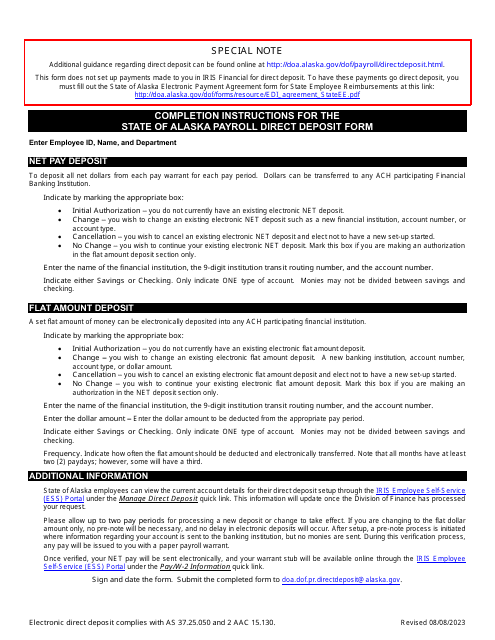

70

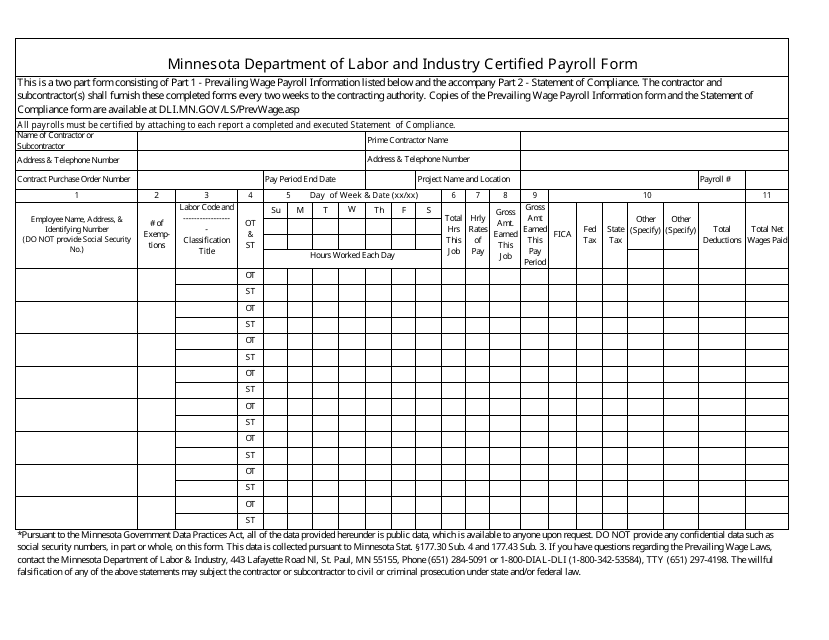

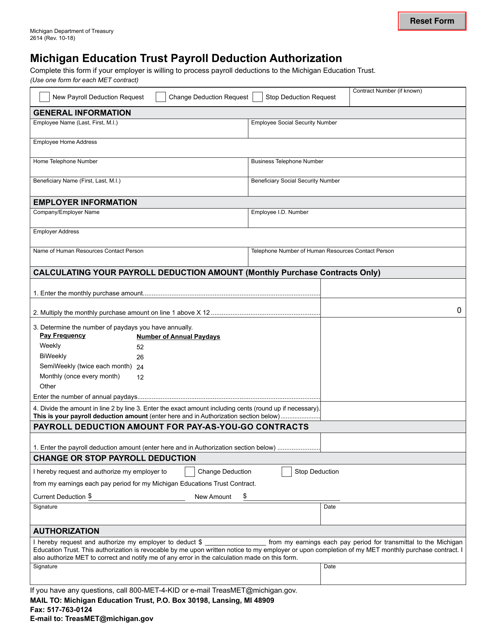

This Form is used for certified payroll reporting in the state of Minnesota. It helps ensure that contractors and subcontractors on public works projects comply with prevailing wage laws.

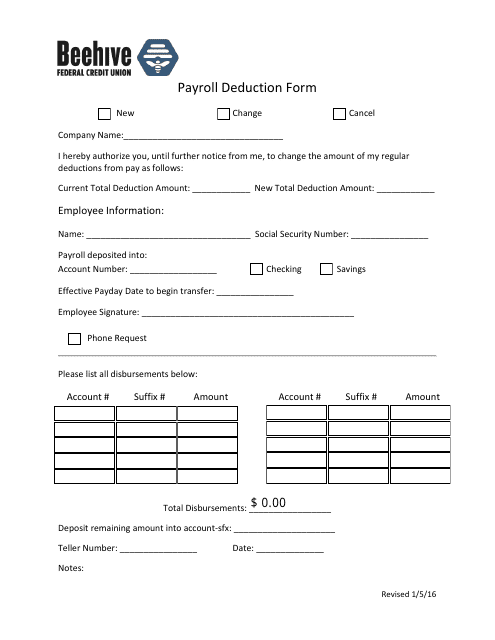

This form is used for authorizing payroll deductions for Beehive Federal Credit Union.

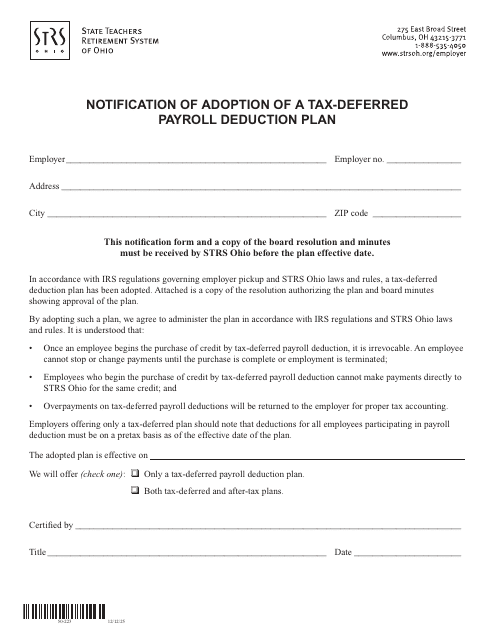

This document is a notification of the adoption of a tax-deferred payroll deduction plan by the State Teachers Retirement System of Ohio. It provides information about the plan and how it will affect Ohio teachers' retirement savings.

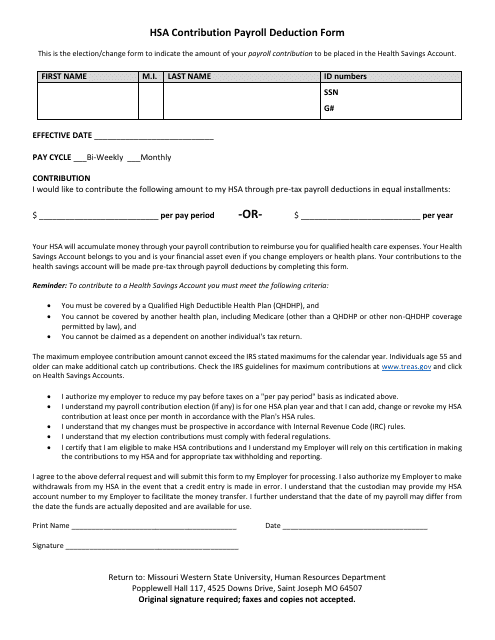

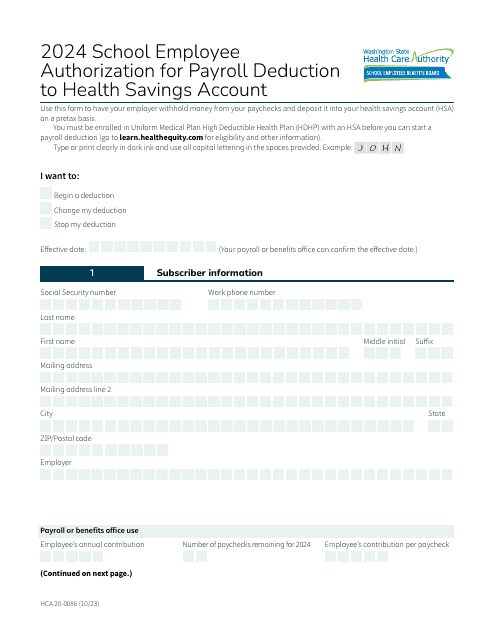

This Form is used for making payroll deductions towards your HSA contributions at Missouri Western State University.

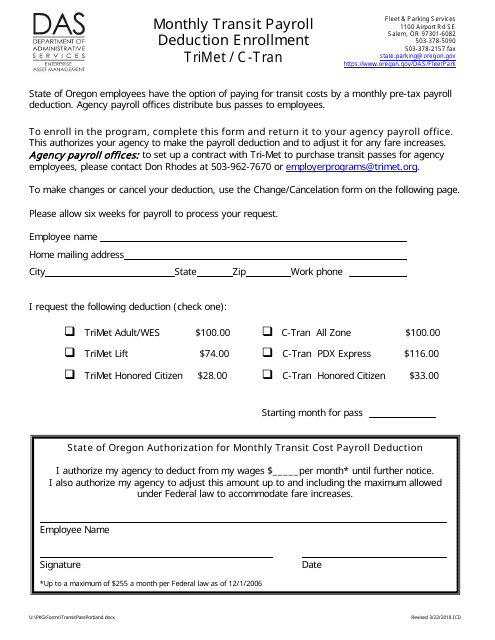

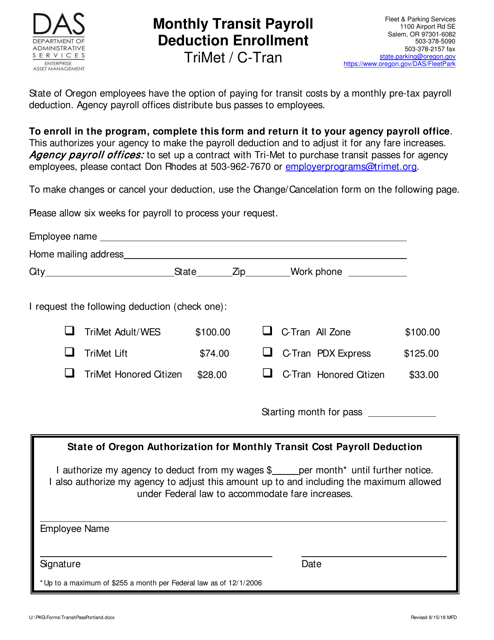

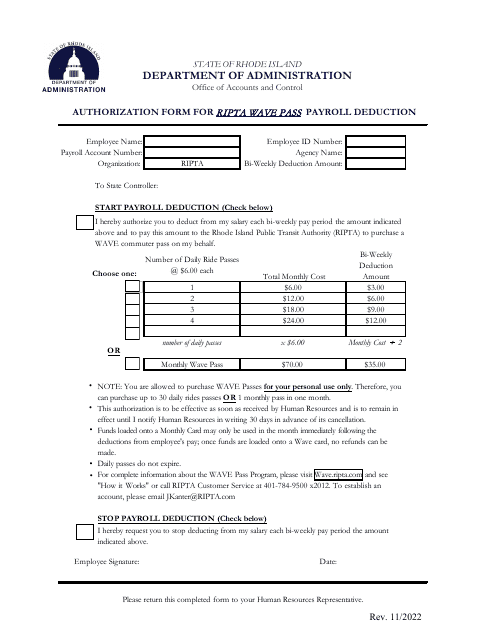

This document is for enrolling in monthly transit payroll deductions for the Trimet or C-Tran transit systems in Oregon. It allows employees to have their transit fares automatically deducted from their paychecks.

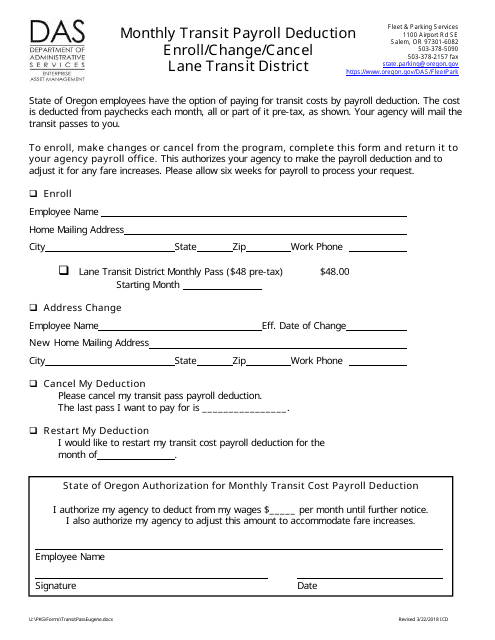

This Form is used for enrolling, changing or canceling the monthly transit payroll deduction for Lane Transit District in Oregon.

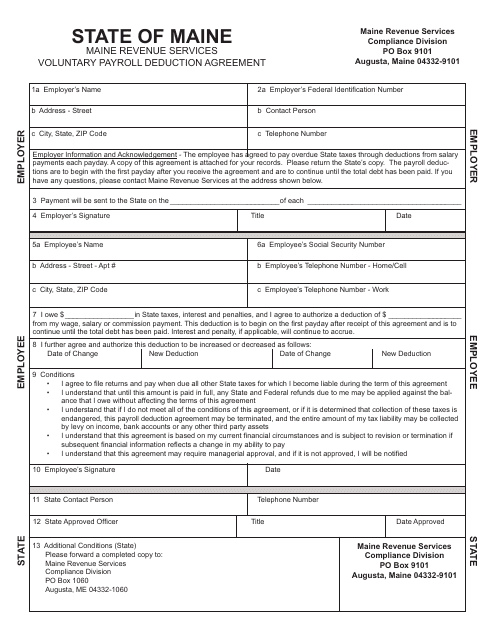

This Form is used for employees in Maine who want to voluntarily have deductions from their paycheck for various purposes such as retirement savings or charitable donations.

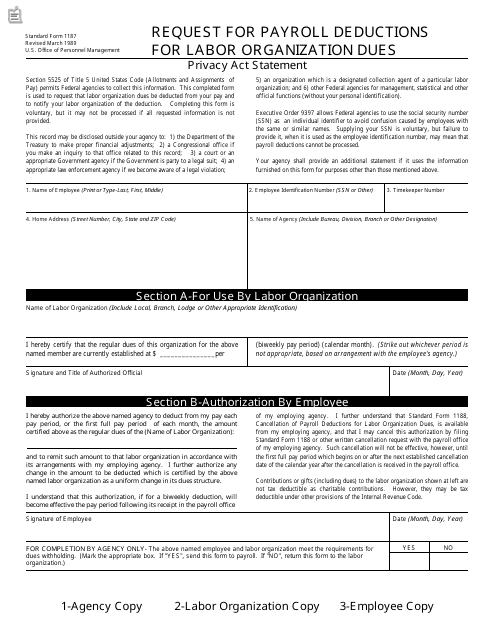

This form is used for requesting payroll deductions for labor organization dues.

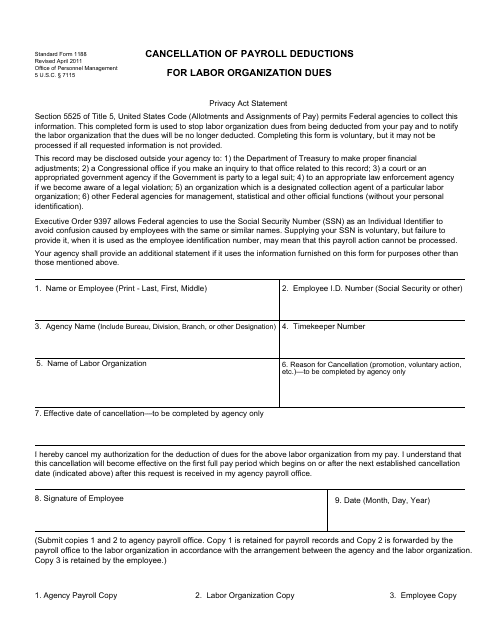

This form is used for canceling payroll deductions for labor organization dues.

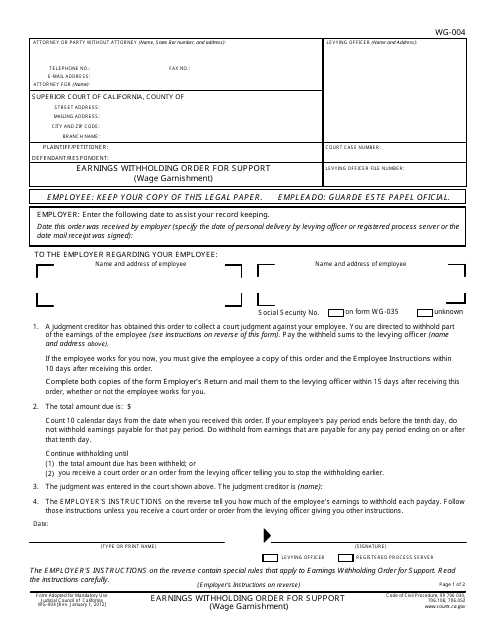

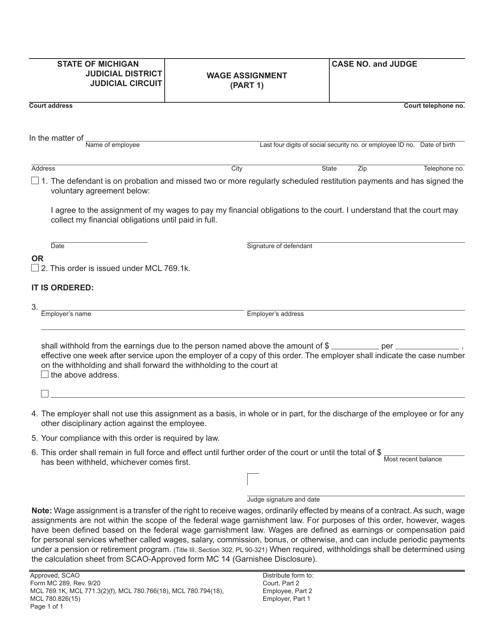

This form is used for wage garnishment in California to collect support payments.

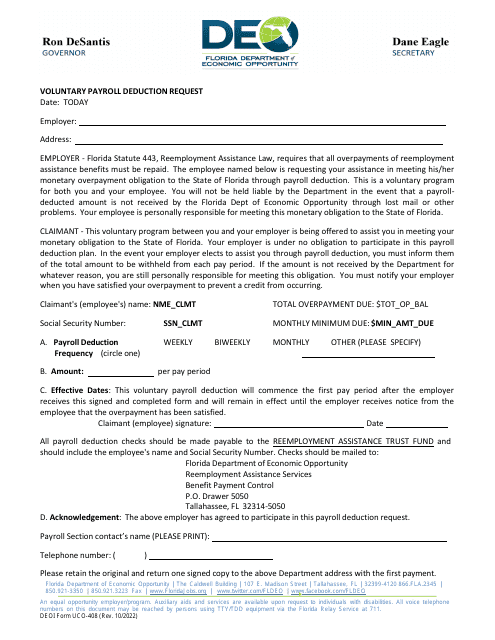

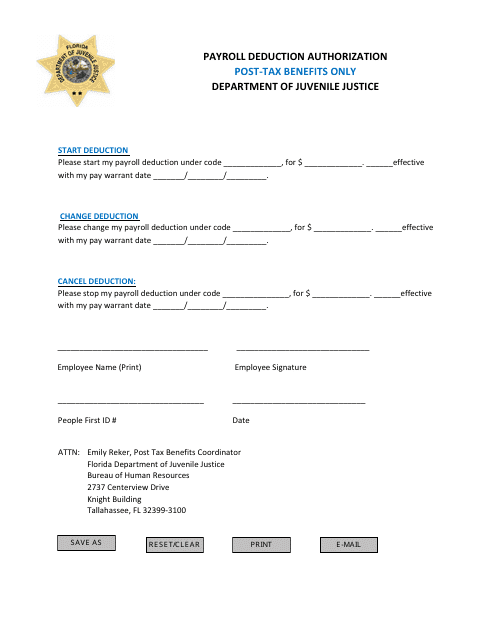

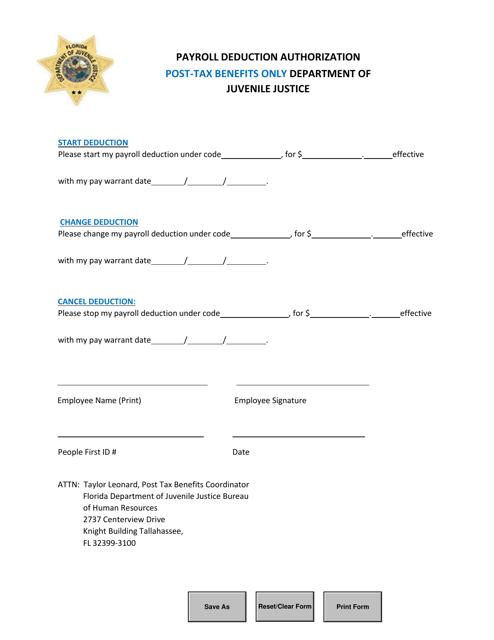

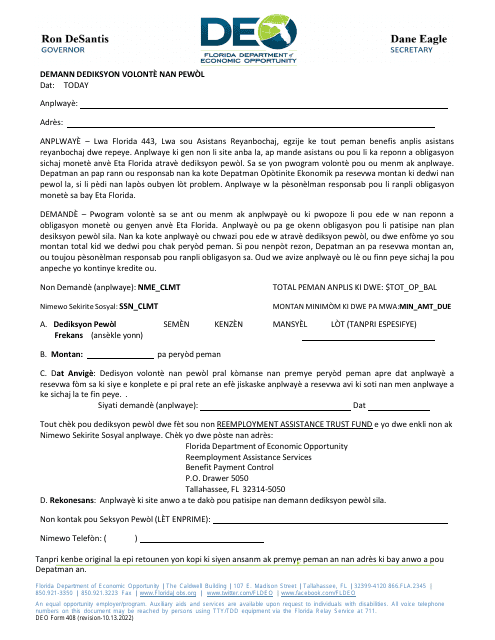

This Form is used for authorizing payroll deductions for post-tax benefits only in Florida.

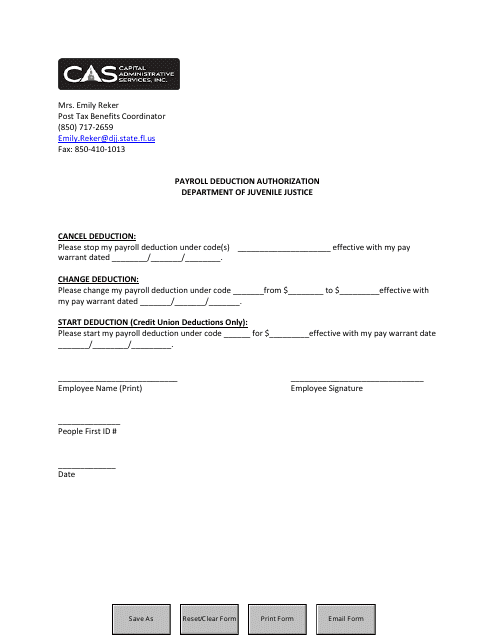

This form is used for authorizing payroll deductions in the state of Florida. It allows employees to specify the amount of money to be deducted from their paycheck for various purposes such as retirement contributions, insurance premiums, or charitable donations.

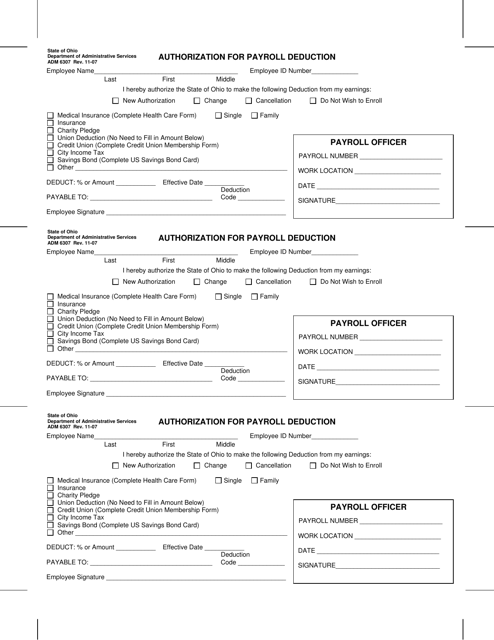

This Form is used for authorizing payroll deductions in Ohio. It allows employees to consent to specific deductions from their wages, such as union dues or voluntary contributions to charitable organizations.

This document is for enrolling in monthly transit payroll deductions for Trimet and C-Tran in Oregon.

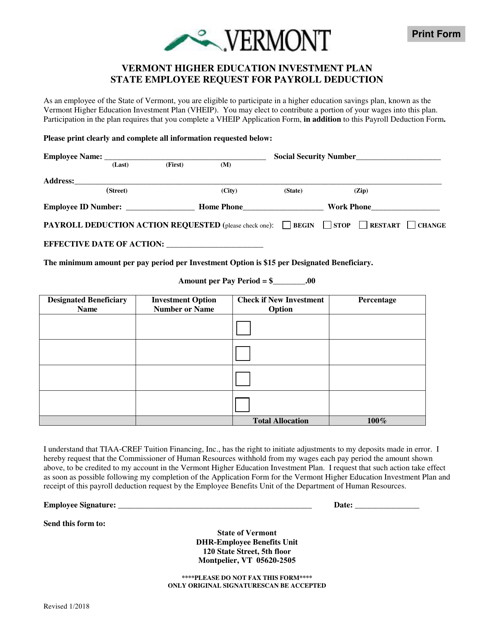

This document is used for Vermont state employees to request payroll deduction for the Vermont Higher Education Investment Plan.

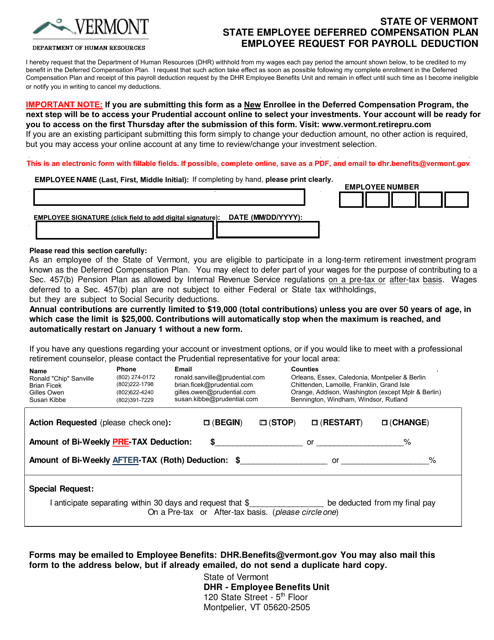

This Form is used for Vermont state employees to request payroll deduction for the Deferred Compensation Plan.

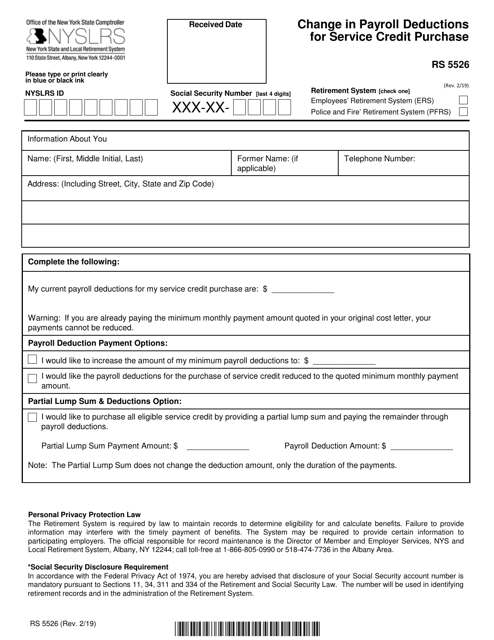

This form is used for making changes to payroll deductions related to the purchase of service credit in the state of New York.

This form is used for authorizing payroll deductions for post-tax benefits in the state of Florida.

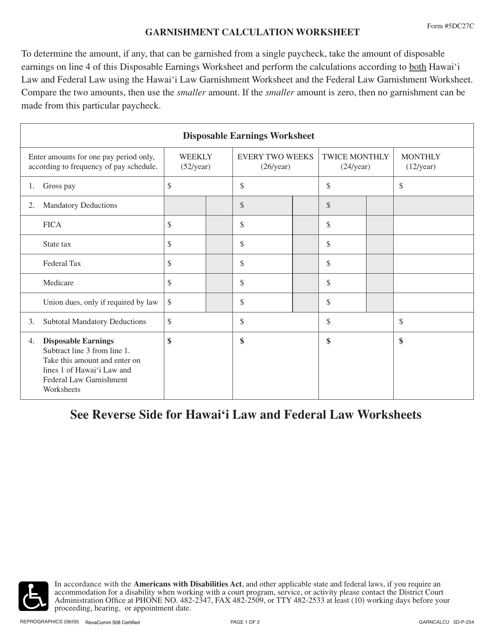

This type of document is used for calculating garnishment amounts in the state of Hawaii.

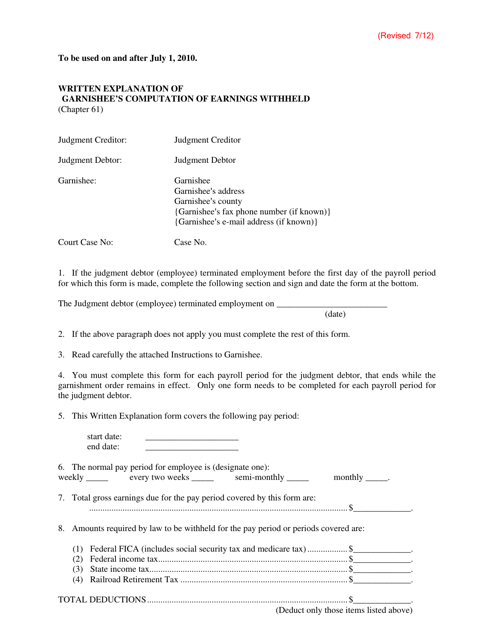

This document provides a written explanation of how a garnishee calculates the amount of earnings to be withheld from a person's paycheck in the state of Kansas.

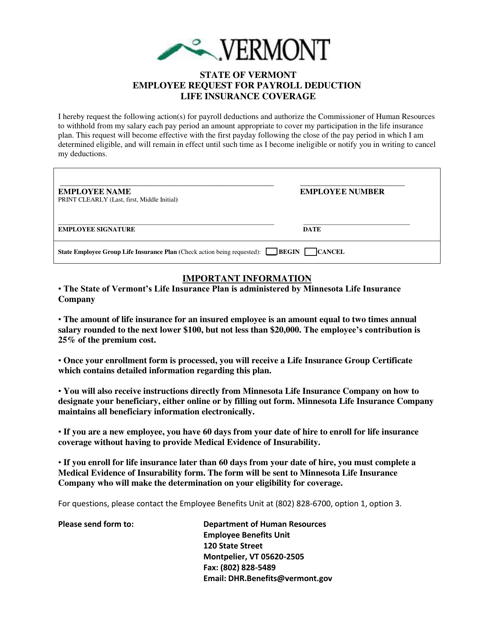

This document is used for employees in Vermont to request payroll deduction life insurance coverage.

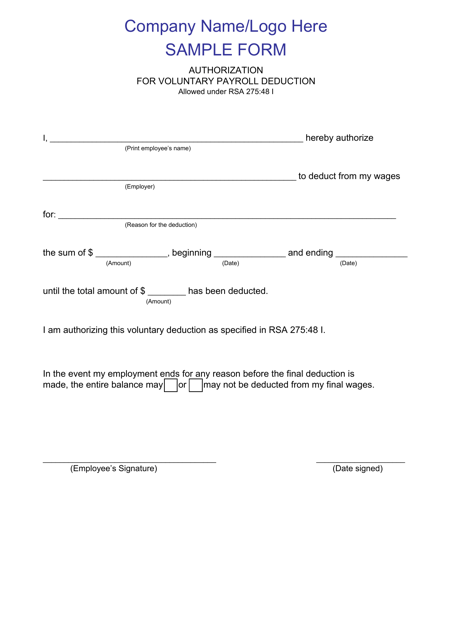

This Form is used for authorizing a voluntary payroll deduction in the state of New Hampshire.

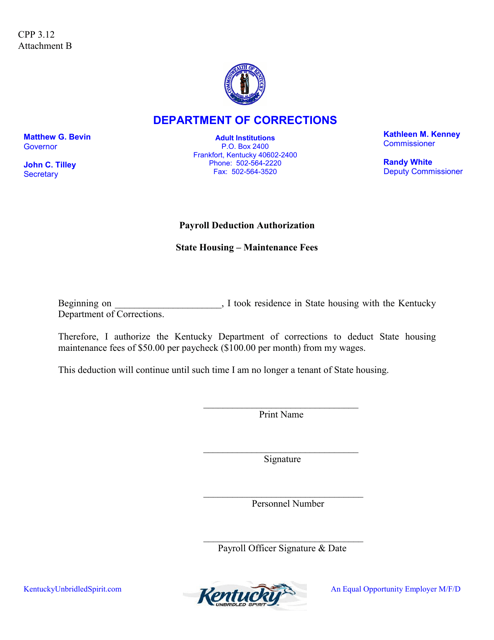

This document authorizes payroll deductions in the state of Kentucky. It outlines the details and requirements for deducting money from an employee's paycheck.

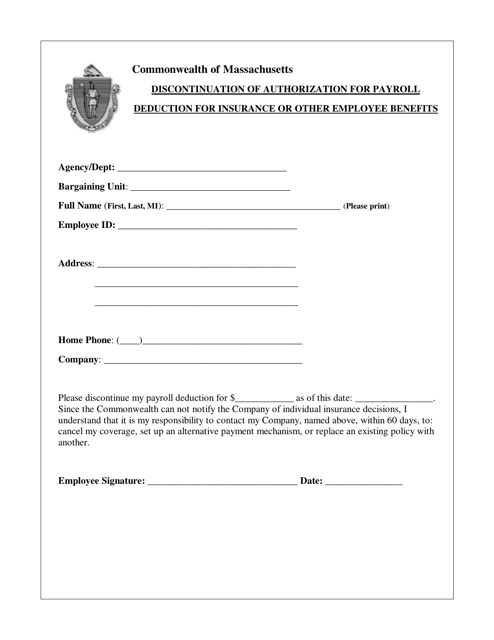

This Form is used for discontinuing the authorization for payroll deduction for insurance or other employee benefits in Massachusetts.

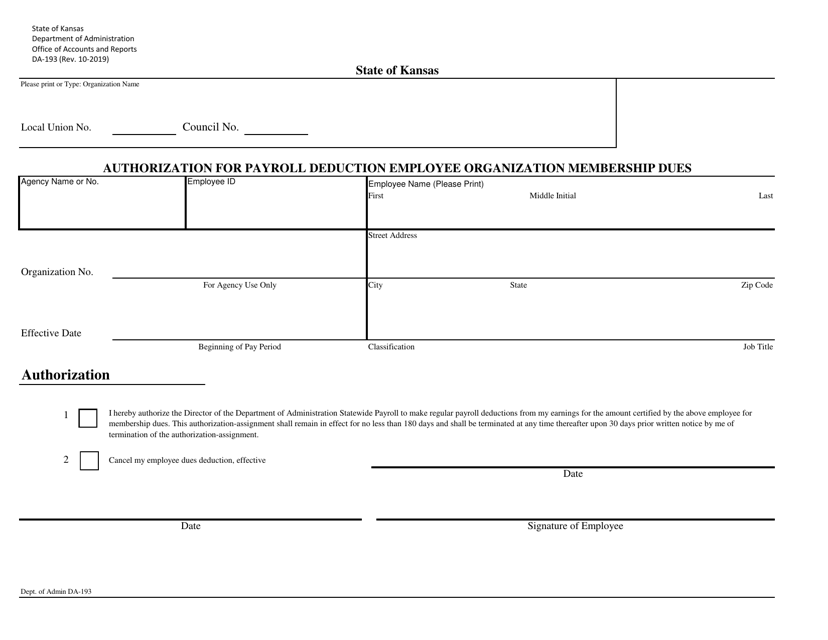

This form is used for authorizing payroll deduction for employee organization membership dues in the state of Kansas.

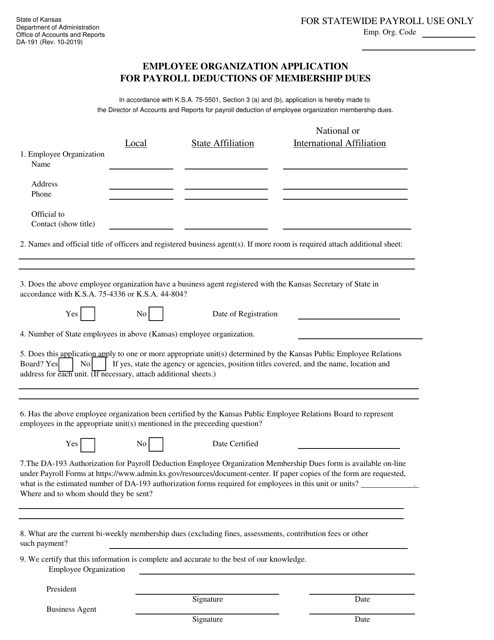

This form is used for employees in Kansas to apply for payroll deductions of membership dues for employee organizations.

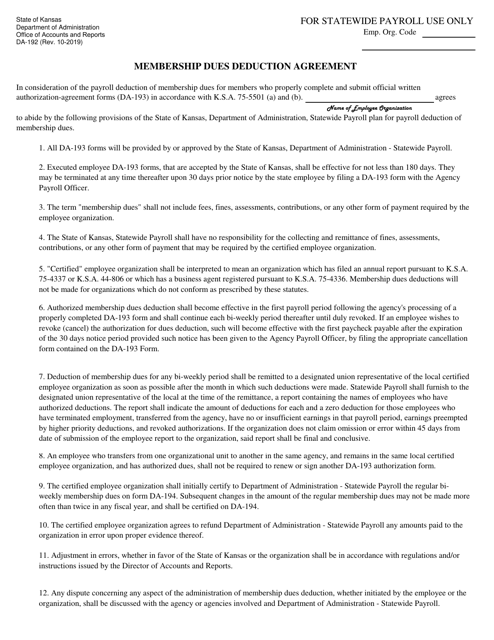

This form is used for the Membership Dues Deduction Agreement in Kansas.

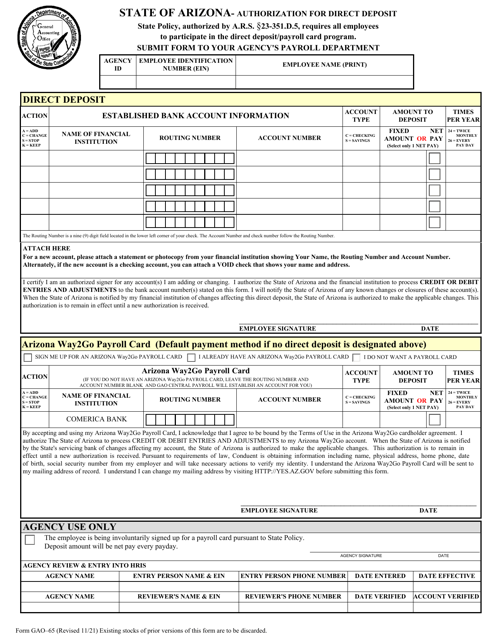

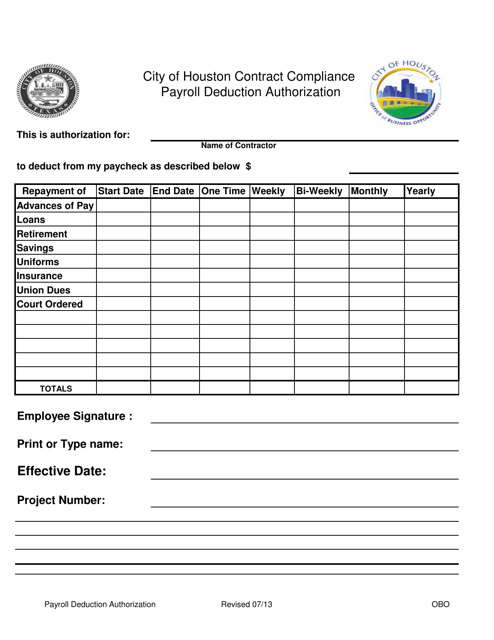

This document is used for authorizing payroll deductions for employees of the City of Houston, Texas. It allows employees to designate a portion of their salary to be deducted for various purposes such as benefits, taxes, or charitable contributions.