Payroll Deduction Form Templates

Documents:

70

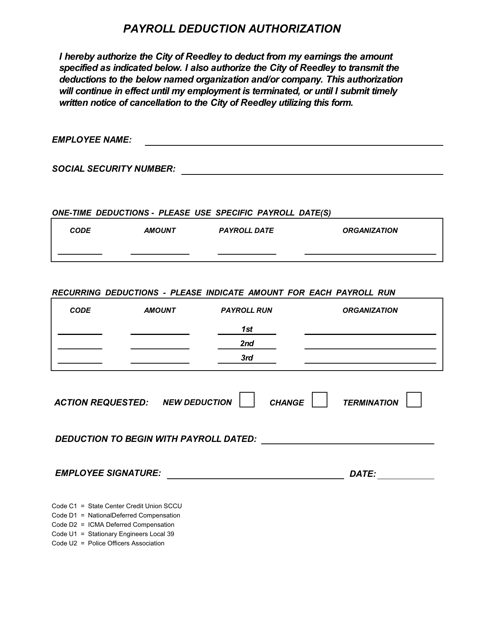

This Form is used for authorizing payroll deductions for employees of the City of Reedley, California.

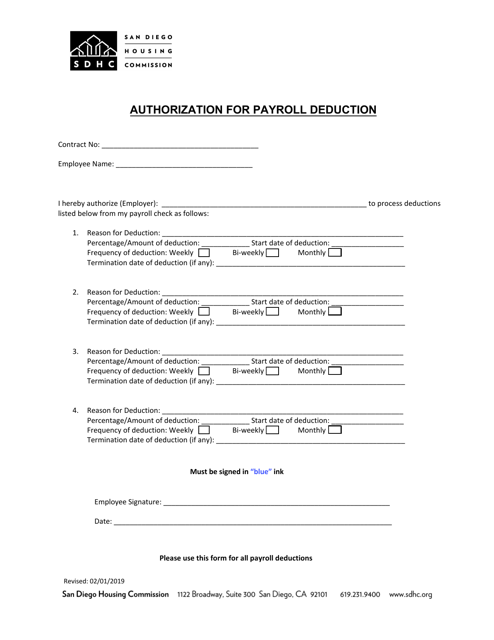

This document is used by employees of the City of San Diego, California to authorize payroll deductions for various purposes such as taxes, retirement contributions, or other authorized deductions.

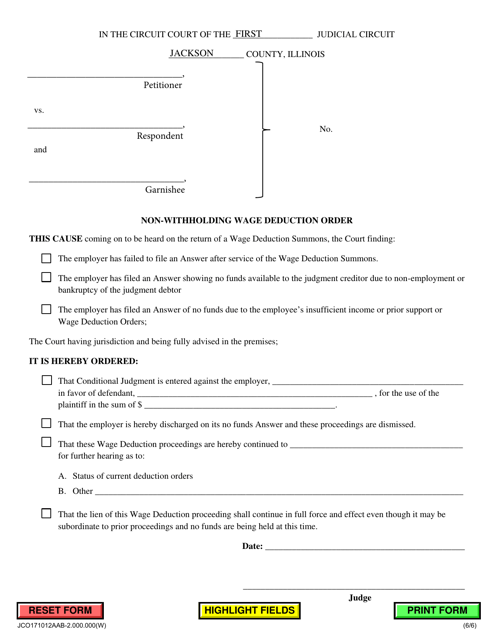

This document is used for a non-withholding wage deduction order in Jackson County, Illinois. It outlines instructions for deducting wages from an individual's paycheck to satisfy a debt or support obligation.

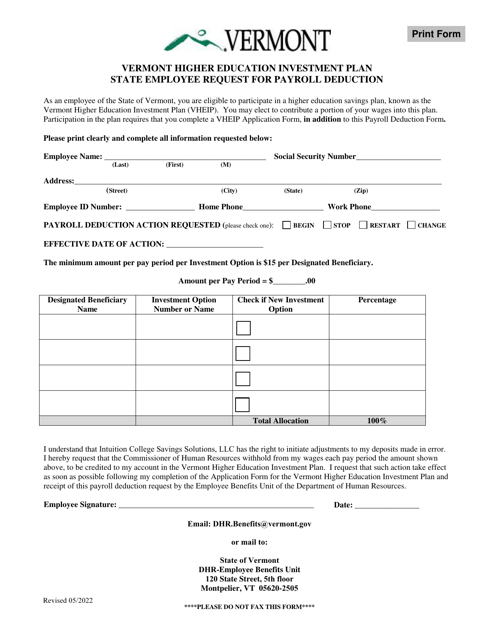

This document is used by state employees in Vermont to request payroll deduction for the Vermont Higher Education Investment Plan. It allows employees to conveniently contribute to their education savings plan directly from their paycheck.

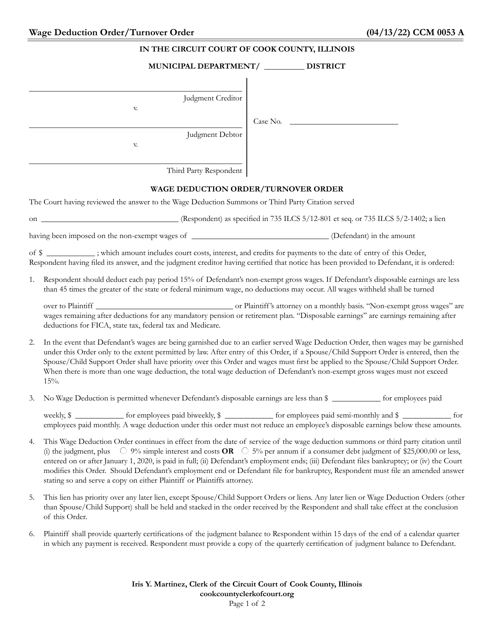

This form is used for requesting a court order to deduct wages or turnover assets in Cook County, Illinois.

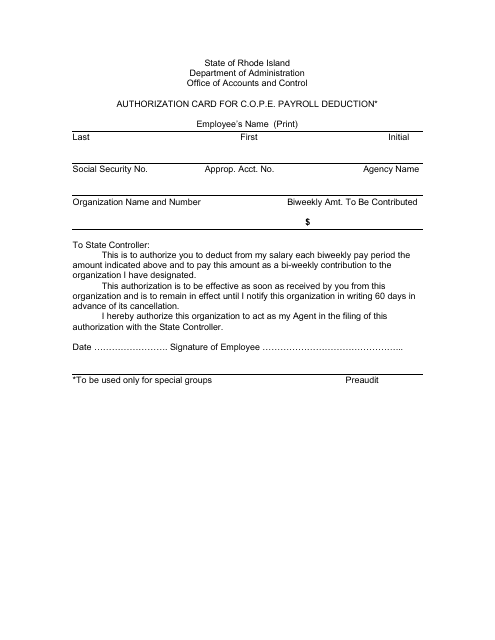

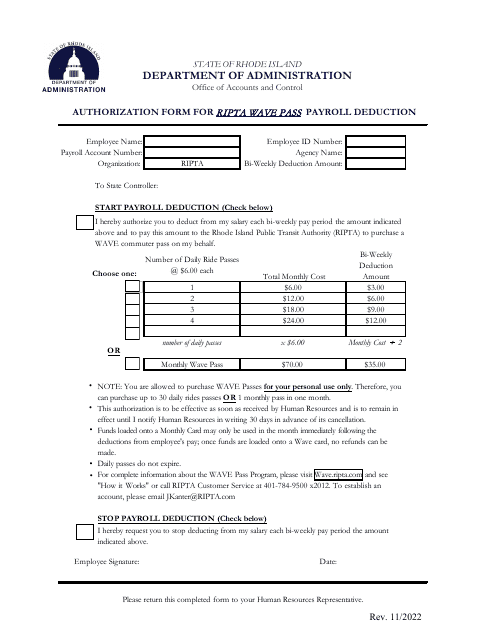

This document is used for authorizing payroll deduction for C.O.P.E. (Committee on Political Education) in Rhode Island.

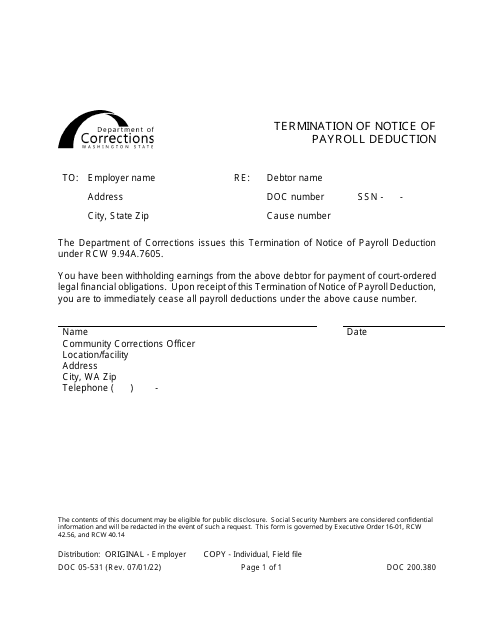

This form is used for terminating a notice of payroll deduction in Washington.

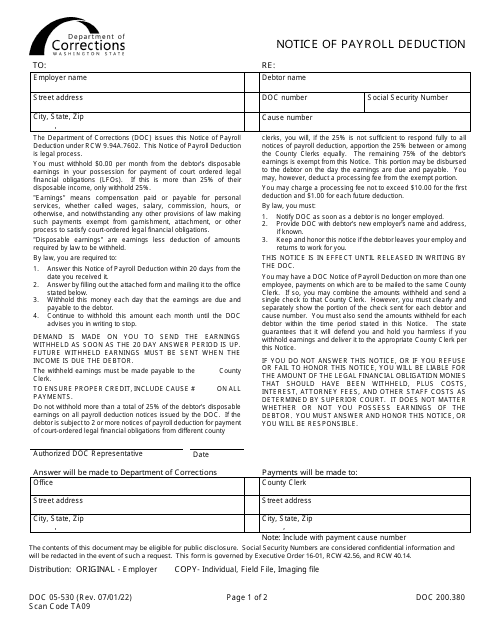

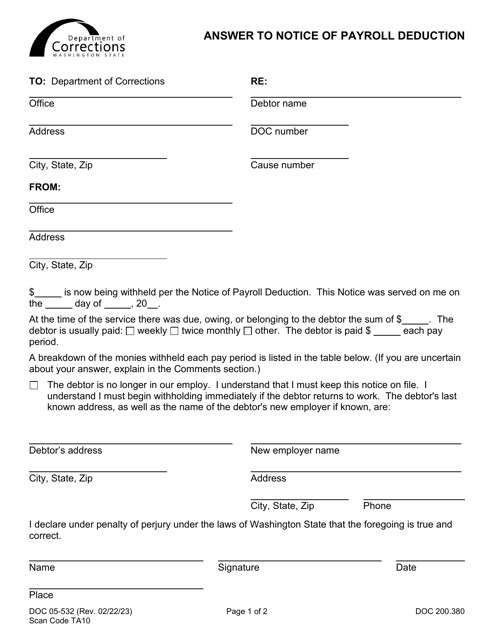

This form is used for informing employees in Washington about upcoming payroll deductions.

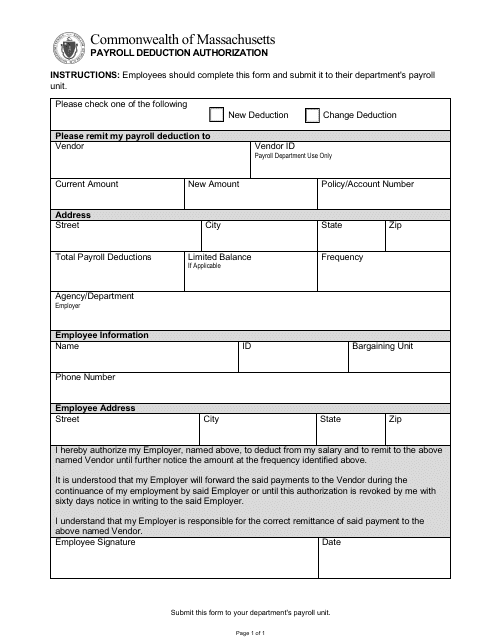

This document allows an employer in Massachusetts to deduct certain expenses from an employee's paycheck.

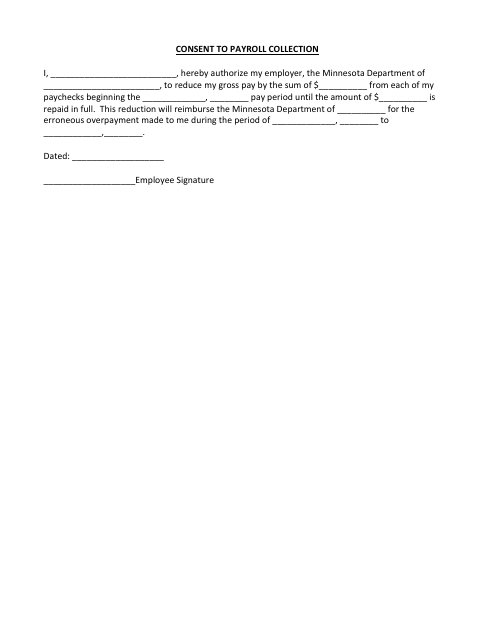

This document is used for obtaining consent from employees in Minnesota to collect and process their payroll information. It ensures that the employer has the necessary authorization to deduct and manage employee wages.