Fill and Sign West Virginia Legal Forms

Documents:

1933

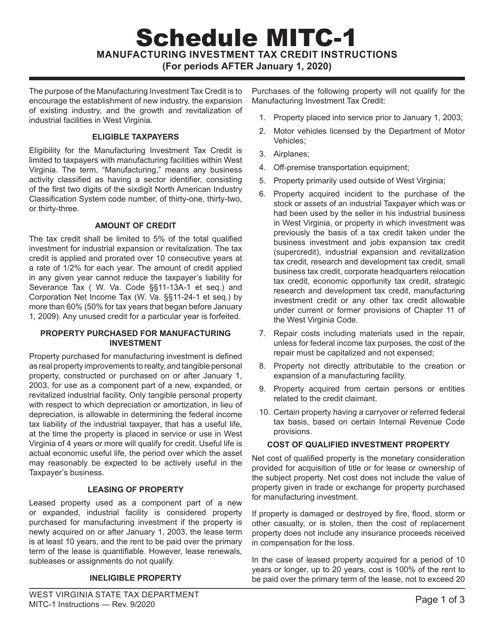

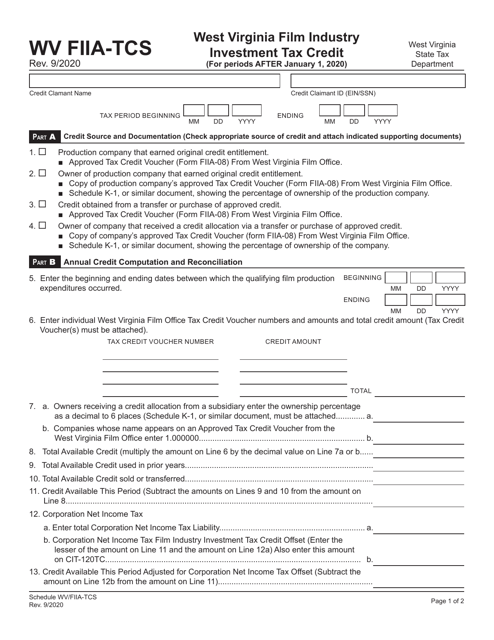

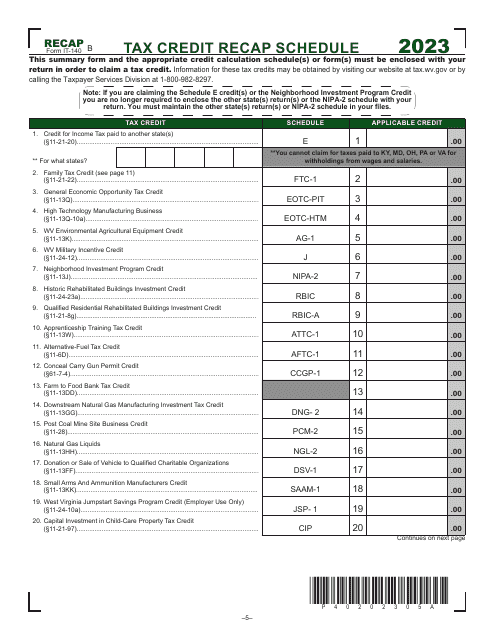

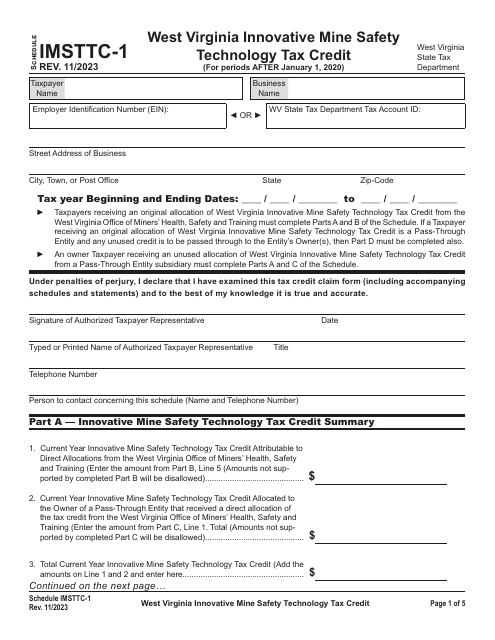

This document provides instructions for filling out Schedule WV/MITC-1, which allows businesses in West Virginia to claim a tax credit for manufacturing investments. It outlines the necessary information and steps to complete the form accurately.

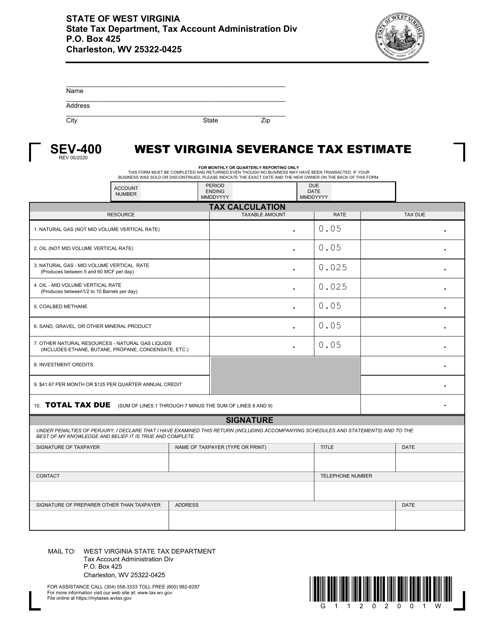

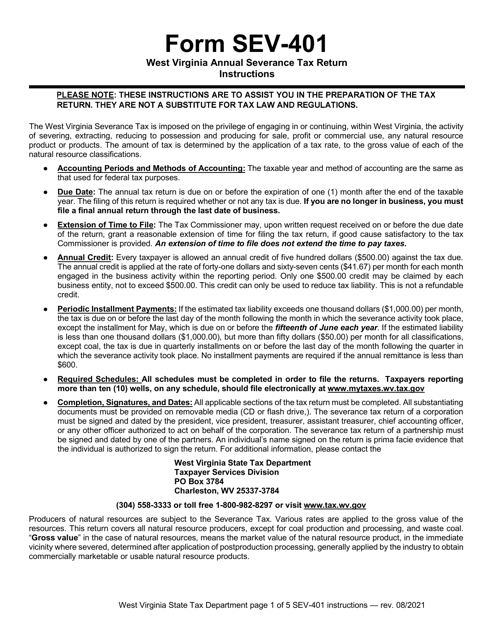

This Form is used for estimating the severance tax in West Virginia. It is used by individuals or businesses involved in extracting natural resources such as coal, oil, or gas.

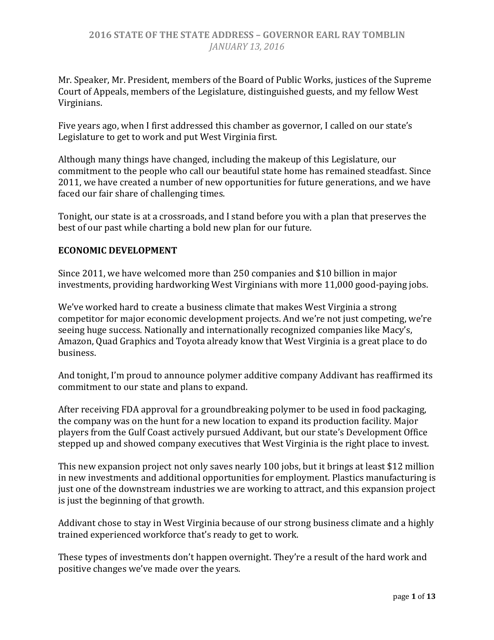

This document is the State of the State Address delivered by Governor Earl Ray Tomblin of West Virginia. It provides an overview of the current state of the state and outlines the governor's priorities and agenda for the coming year.

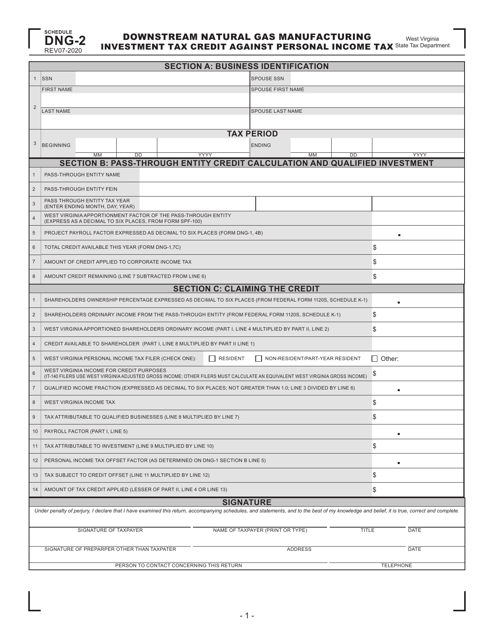

This Form is used for claiming the Downstream Natural Gas Manufacturing Investment Tax Credit Against Personal Income Tax in West Virginia.

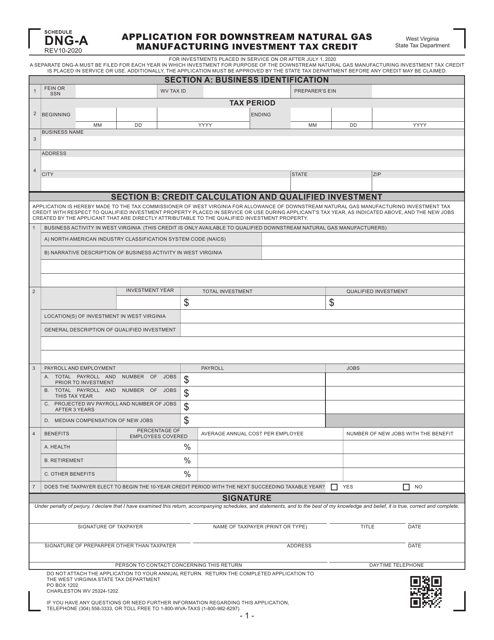

This Form is used for applying for the Downstream Natural Gas Manufacturing Investment Tax Credit in West Virginia.

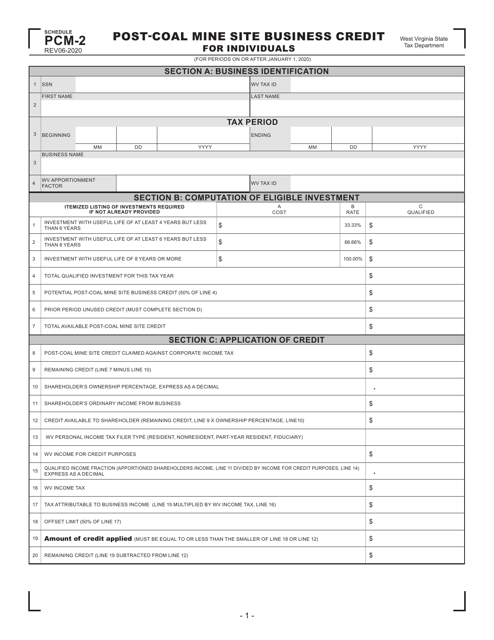

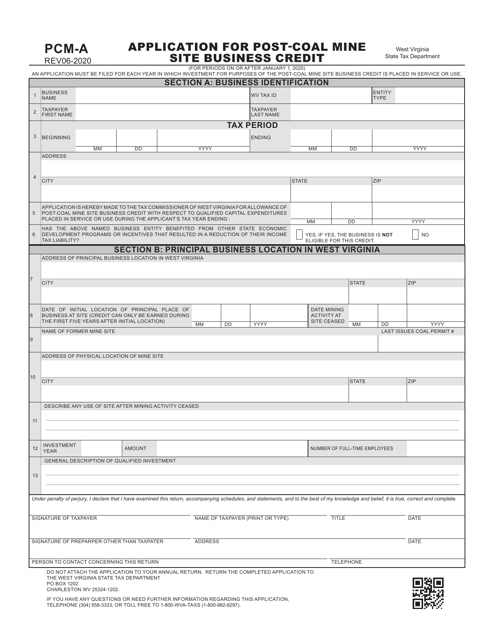

This document is used for scheduling PCM-2 Post-coal Mine Site Business Credit for Individuals in West Virginia. It provides information and instructions on how to apply for and schedule this type of credit.

This form is used for applying for post-coal mine site business credit in West Virginia. It allows businesses to apply for financial support for projects related to reclamation and redevelopment of former coal mining sites.

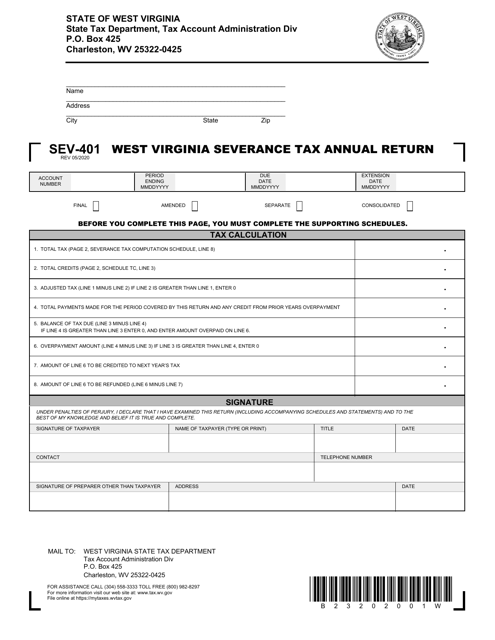

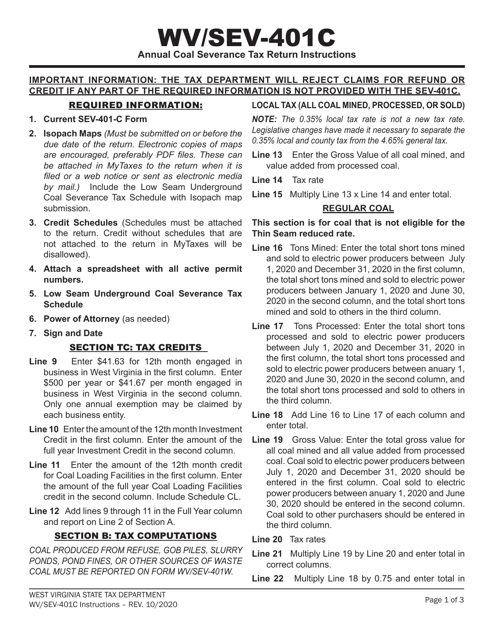

This Form is used for filing the West Virginia Severance Tax Annual Return in West Virginia.

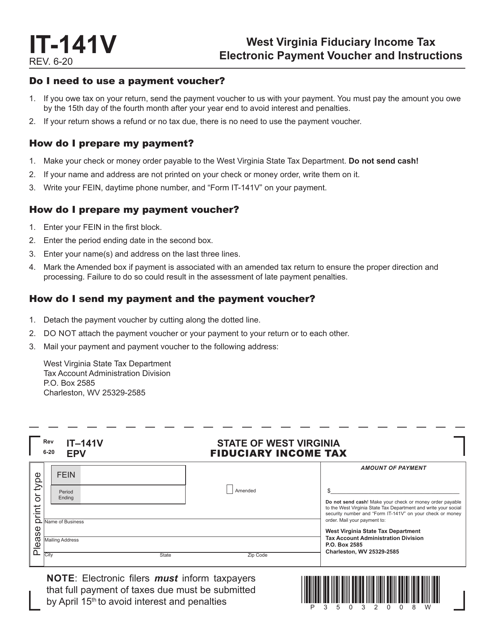

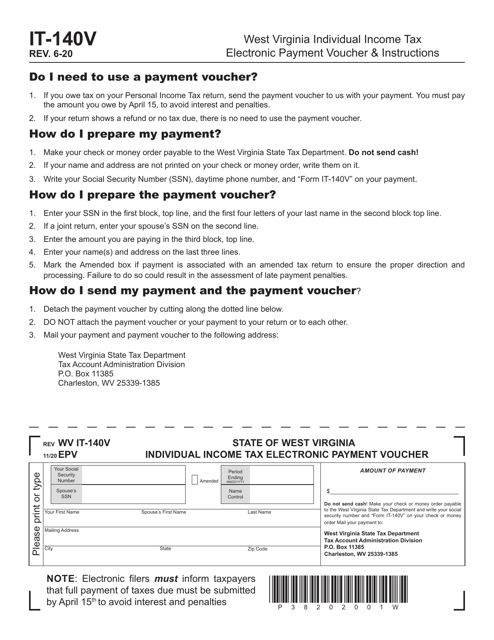

Form IT-140V State of West Virginia Individual Income Tax Electronic Payment Voucher - West Virginia

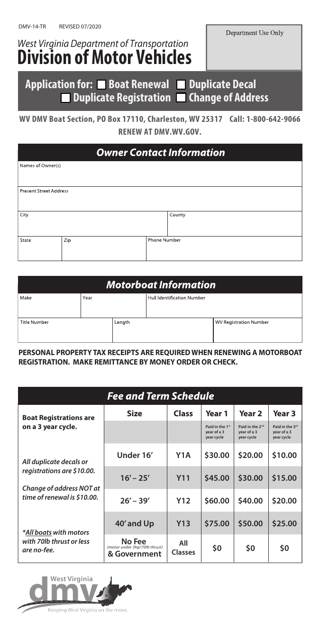

This form is used for applying for boat renewal, duplicate decal, duplicate registration, or change of address in West Virginia.

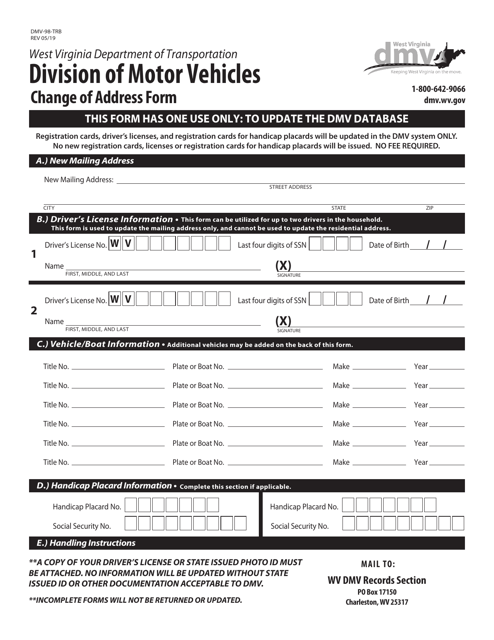

This form is used for changing your address with the Department of Motor Vehicles in West Virginia.

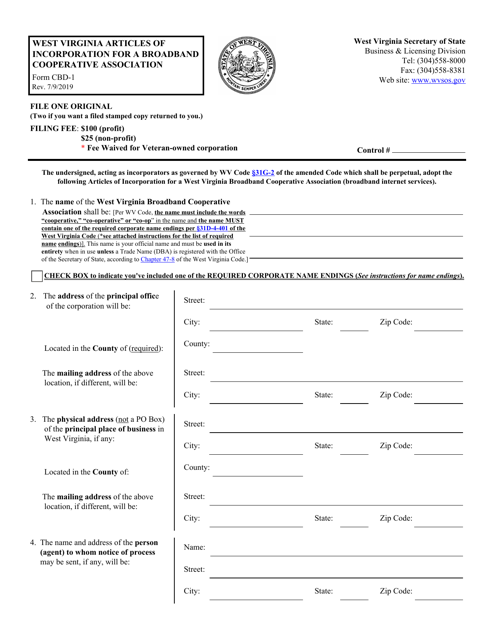

This form is used for filing the Articles of Incorporation for a broadband cooperative association in West Virginia. It is required to establish a legally recognized organization for providing broadband services in the state.

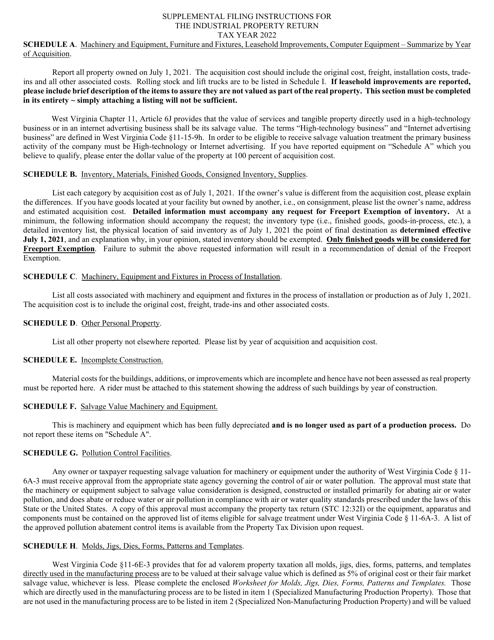

This Form is used for filing the Industrial Business Property Return in West Virginia. The STC-12:32I form is specifically for businesses that own industrial properties and need to report their property details and value for tax purposes. It provides instructions on how to accurately complete the form and submit it to the appropriate tax authorities.

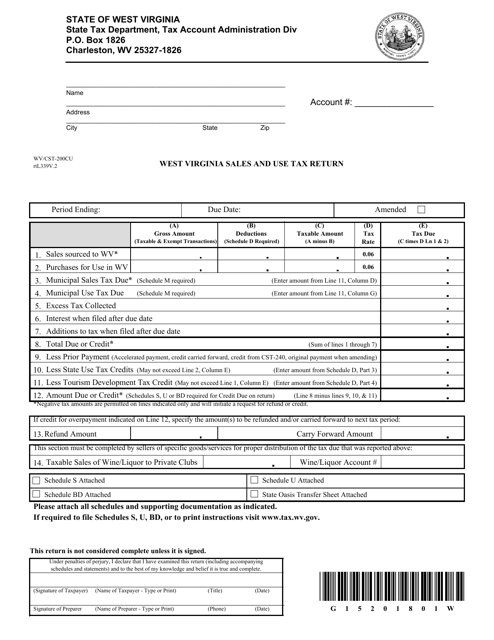

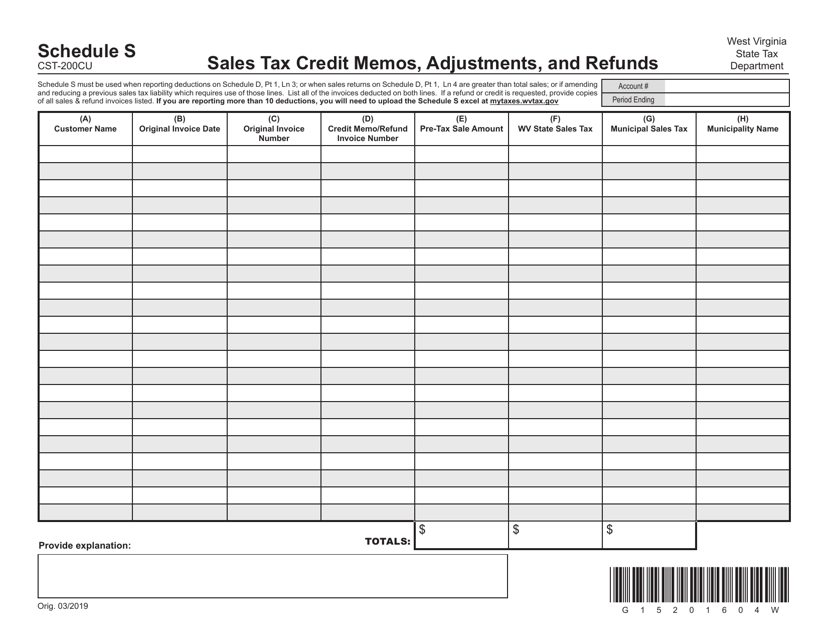

This Form is used for filing the West Virginia Sales and Use Tax Return in the state of West Virginia.

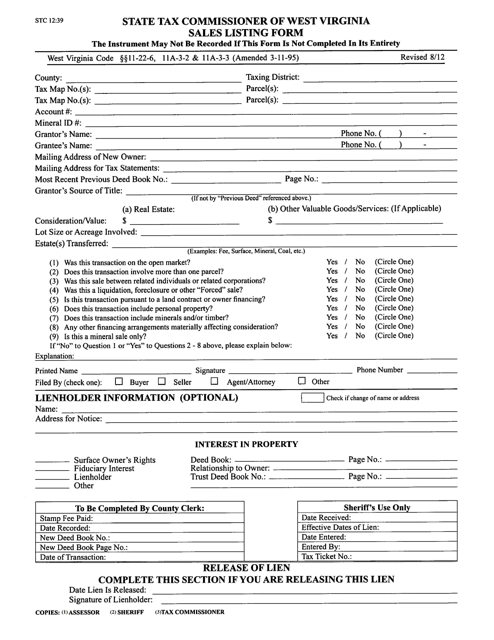

This form is used for reporting sales listings in the state of West Virginia.