Fill and Sign West Virginia Legal Forms

Documents:

1933

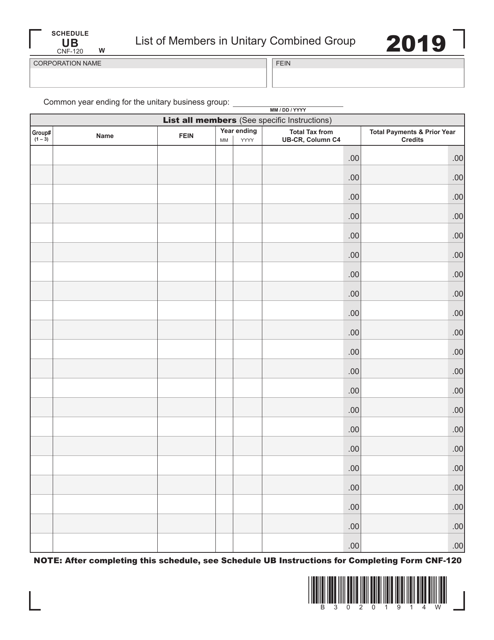

This form is used for listing the members in a unitary combined group in West Virginia for tax purposes.

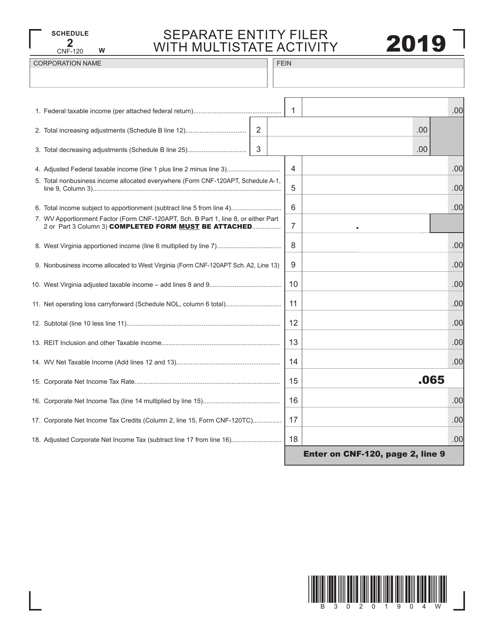

This form is used for filing taxes for separate entities with multistate activity in West Virginia.

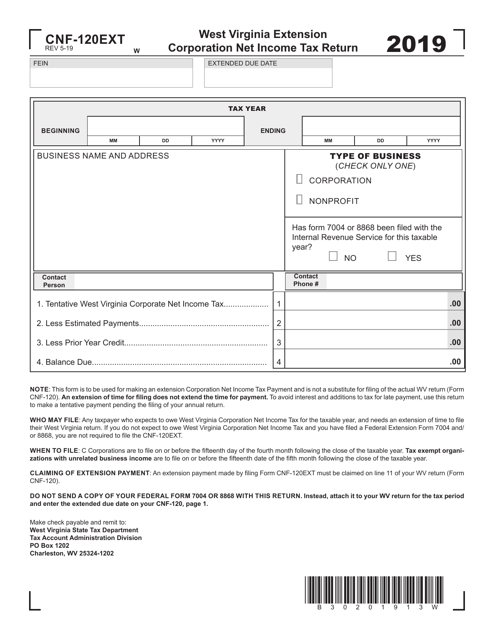

This Form is used for filing the West Virginia Extension Corporation Net Income Tax Return in West Virginia.

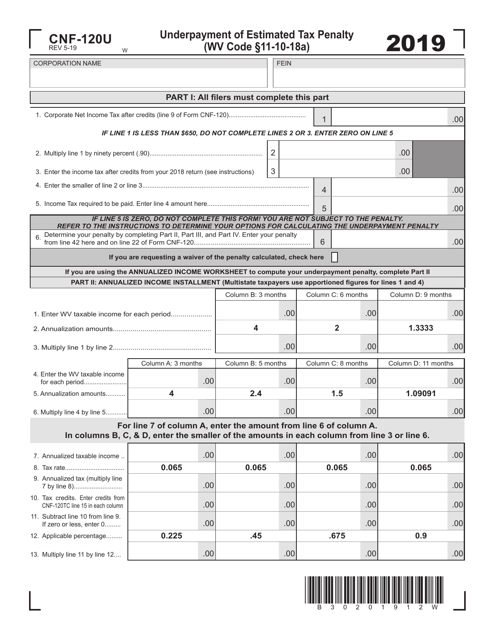

This form is used for calculating and paying the underpayment of estimated tax penalty in West Virginia.

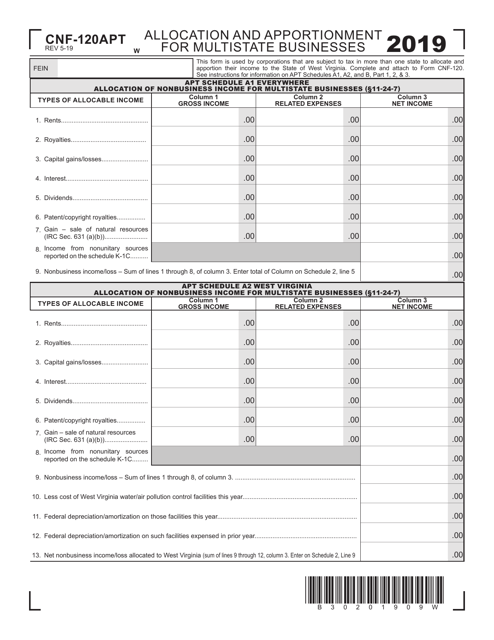

This form is used for allocating and apportioning income for multistate businesses in West Virginia.

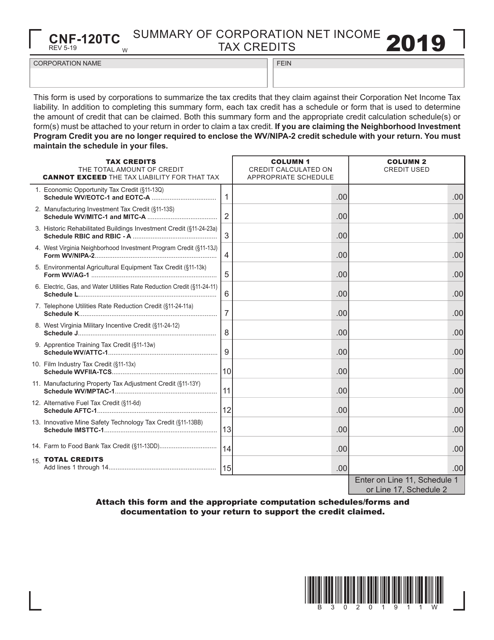

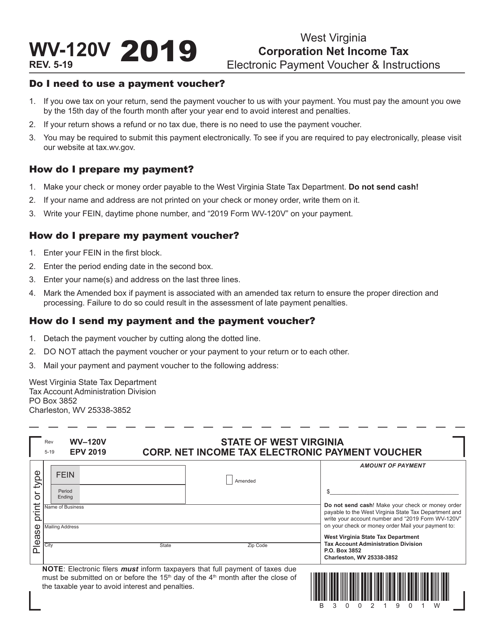

This Form is used for reporting and paying net income tax for corporations in West Virginia. The form, CNF-120, must be filled out and submitted to the West Virginia Department of Revenue. It includes instructions on how to calculate and report your corporation's net income tax liability.

This document provides information and guidance on how to run for political office in the state of West Virginia. It includes instructions on candidate eligibility, filing requirements, and campaign finance regulations.

This document provides information on running for office in West Virginia. It includes details on the process, requirements, and deadlines for candidates interested in holding public office in the state.

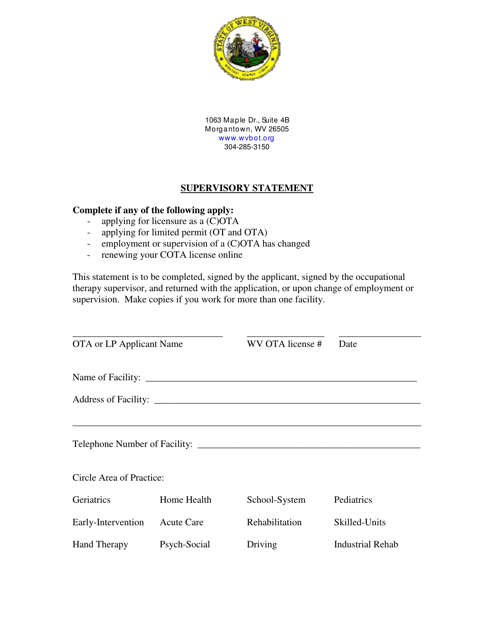

This document provides guidelines and instructions for supervisory activities in the state of West Virginia. It outlines the responsibilities and requirements for supervisors overseeing various industries or sectors.

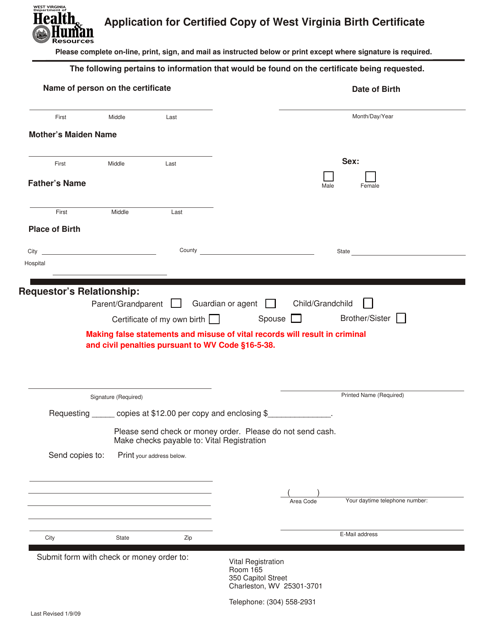

This form is used for applying for a certified copy of a birth certificate in the state of West Virginia.

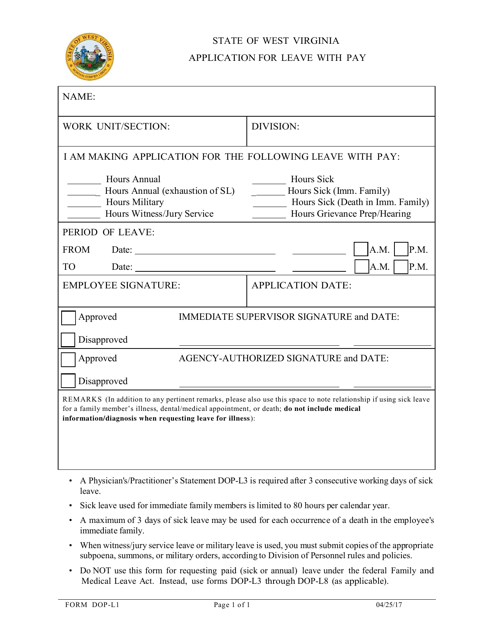

This form is used for employees in West Virginia to apply for leave with pay.

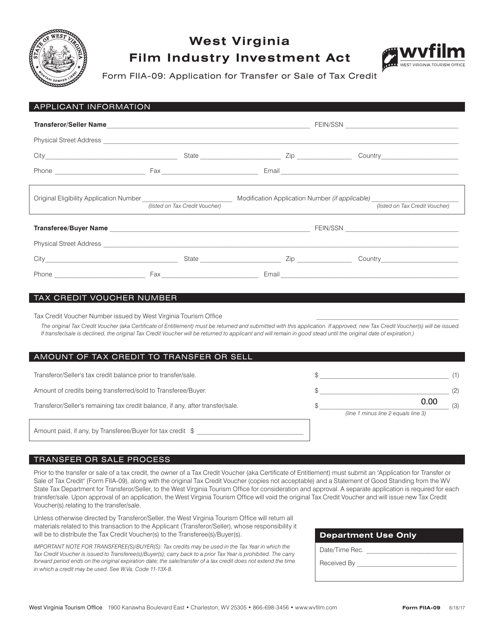

This form is used for applying to transfer or sell tax credits in West Virginia.

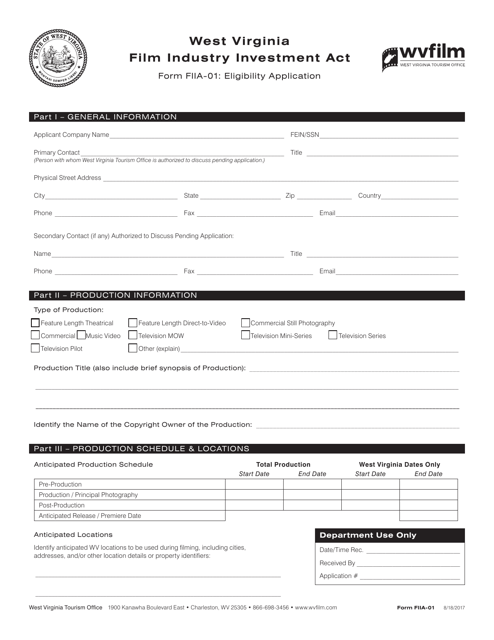

This form is used for applying for eligibility in West Virginia. It is intended for individuals who are seeking approval for certain benefits or programs in the state.

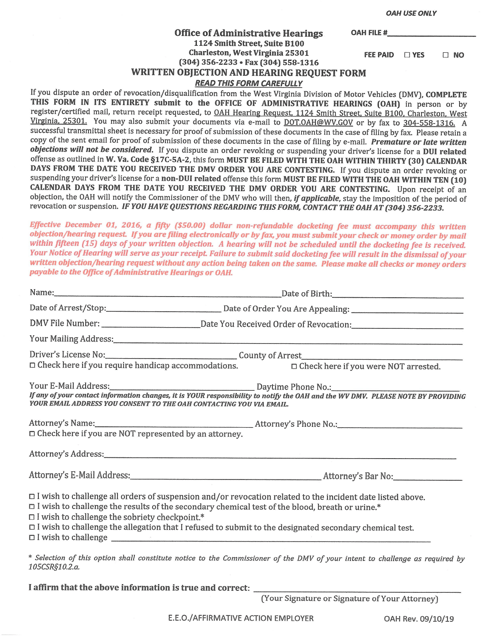

This document is used for filing a written objection and requesting a hearing in the state of West Virginia.

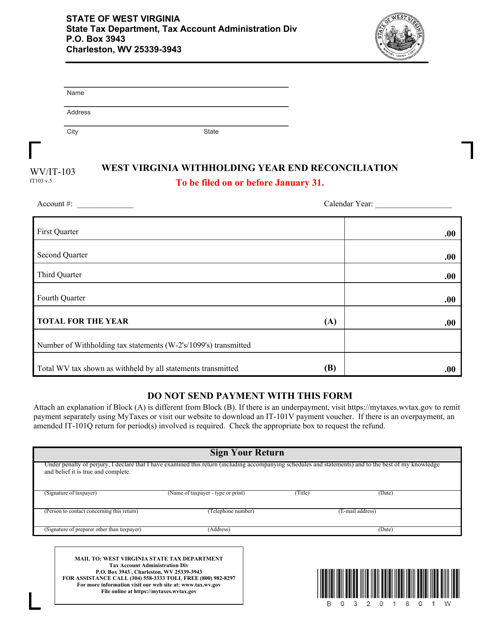

This form is used for the year-end reconciliation of withholding taxes in West Virginia.

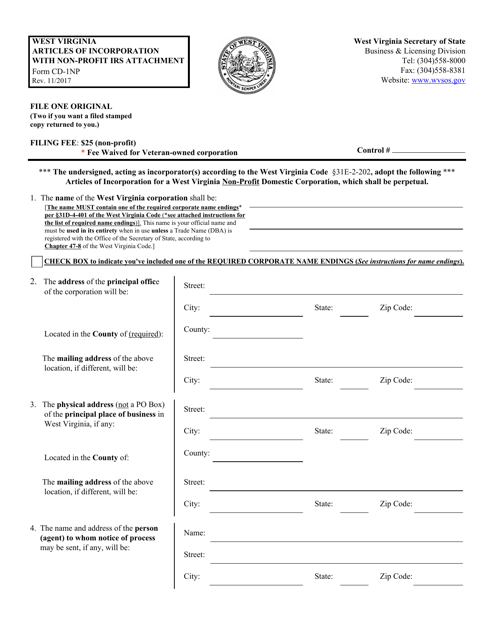

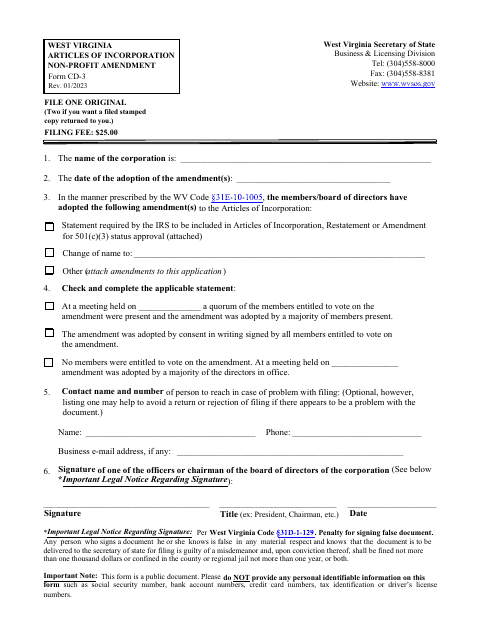

This Form is used for filing Articles of Incorporation with Non-profit IRS Attachment in West Virginia for organizations seeking non-profit status.

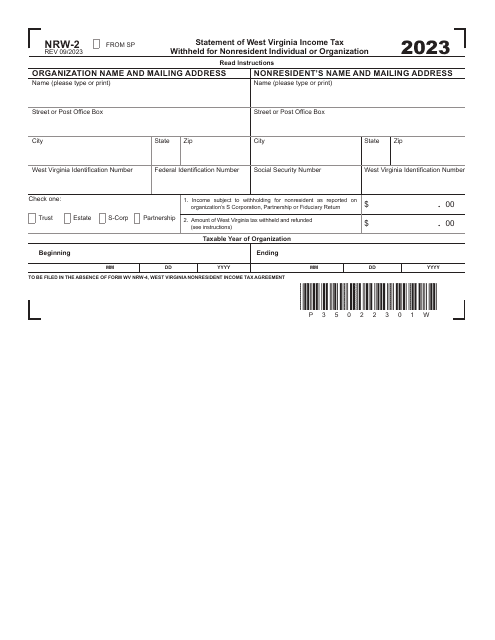

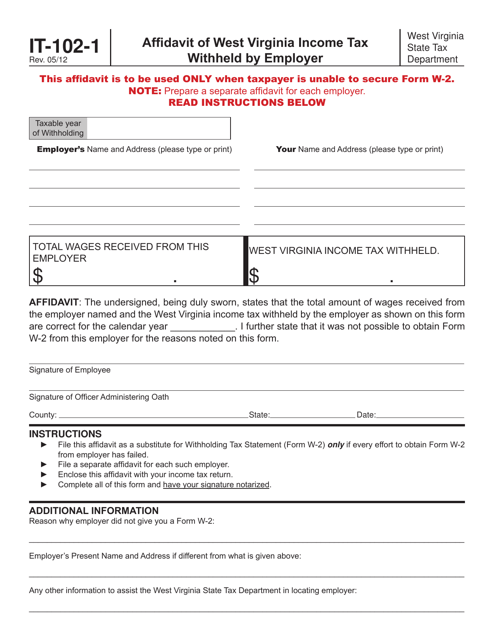

This form is used for reporting West Virginia income tax withheld by an employer in West Virginia.

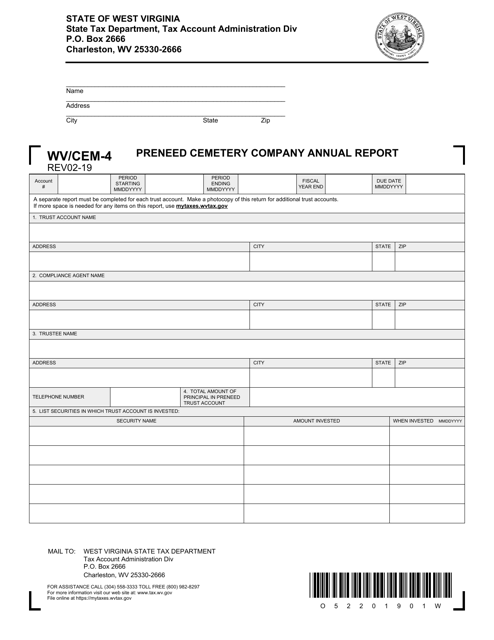

This form is used for filing the Preneed Cemetery Company Annual Report in West Virginia.

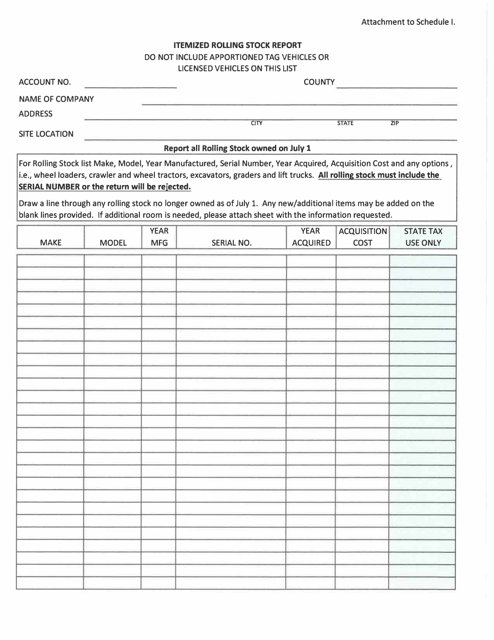

This document is an attachment to Schedule I and is called the Itemized Rolling Stock Report. It is specific to the state of West Virginia.

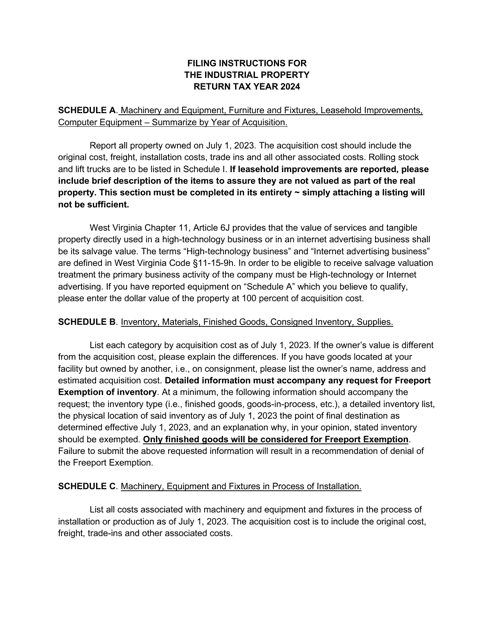

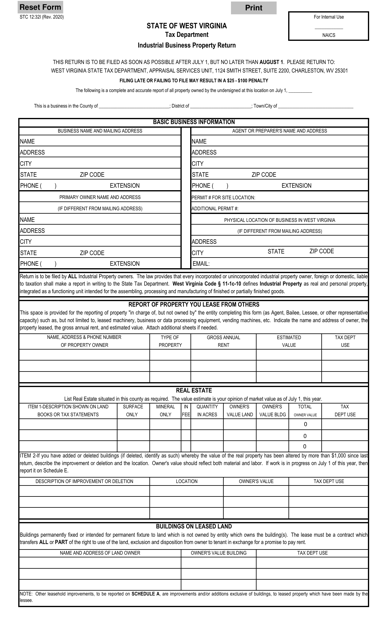

This form is used for reporting industrial business property in West Virginia. It must be filled out by property owners to provide information about their industrial assets for tax purposes.

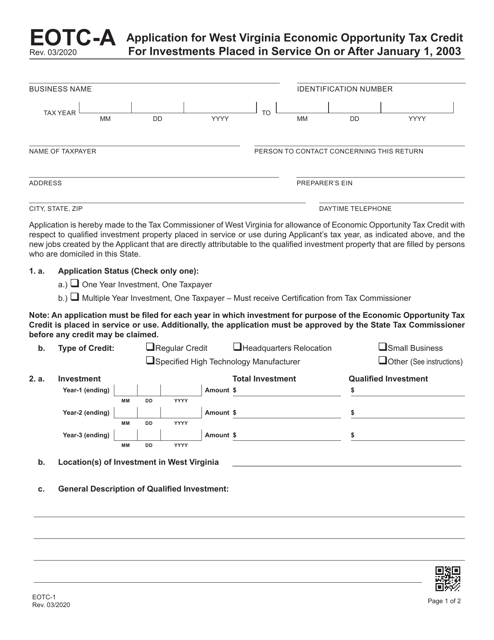

This form is used for applying for the West Virginia Economic Opportunity Tax Credit for investments made after January 1, 2003.

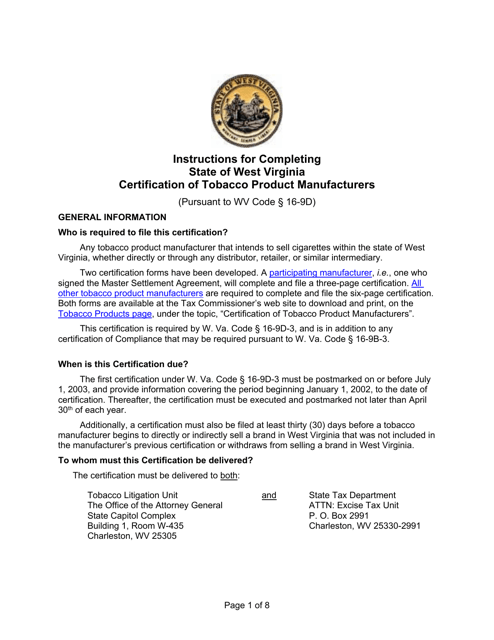

This document provides instructions for tobacco product manufacturers in West Virginia to certify their products. It outlines the requirements and procedures for obtaining certification.

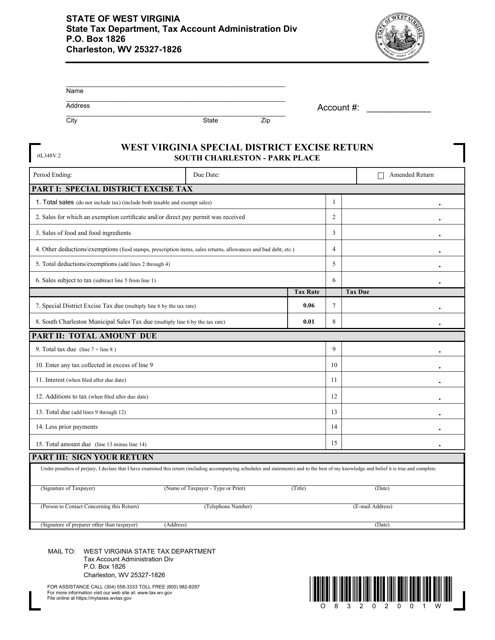

This form is used for filing the West Virginia Special District Excise Return for businesses located in South Charleston - Park Place area of South Charleston, West Virginia.

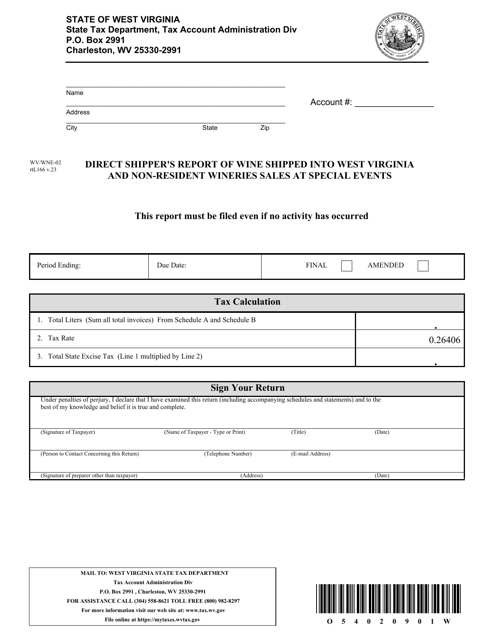

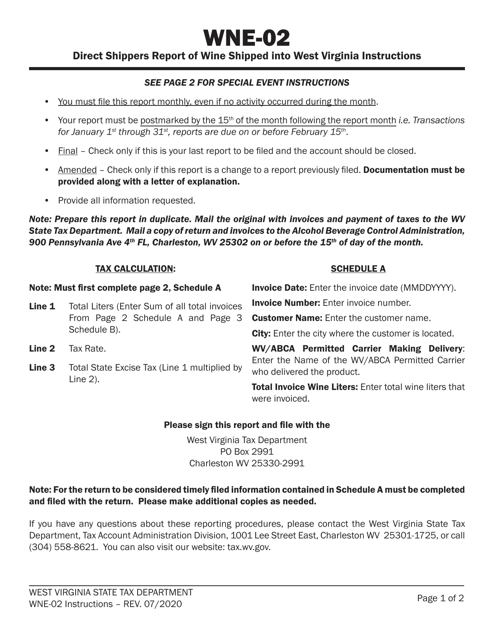

This Form is used for reporting the shipment of wine into West Virginia by direct shippers and the sales made by non-resident wineries at special events in West Virginia.

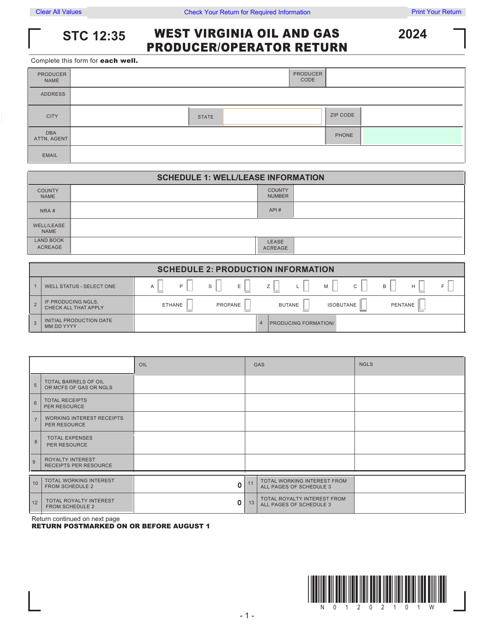

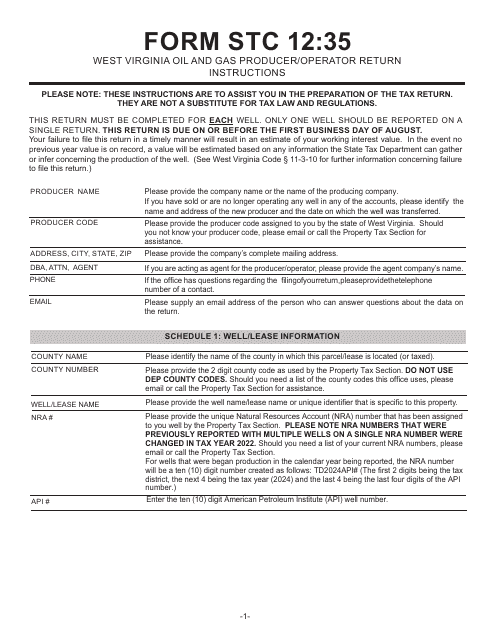

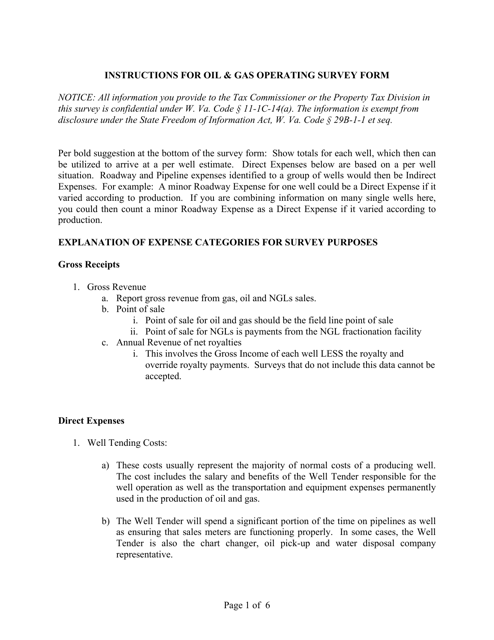

This Form is used for conducting surveys related to oil and gas operations in West Virginia. It provides instructions on how to properly fill out the survey form.