Vermont Tax Forms and Templates

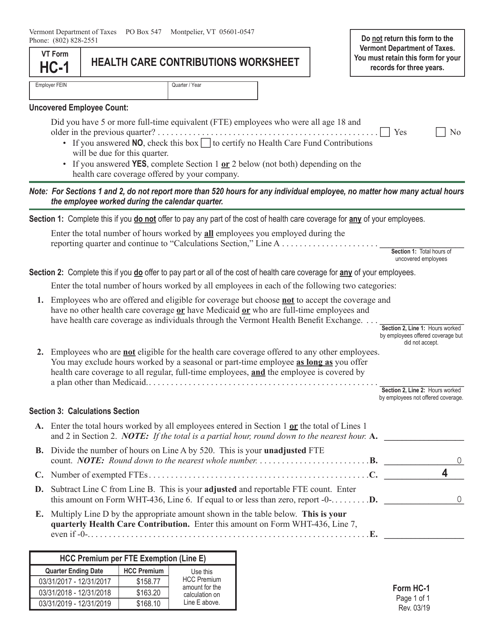

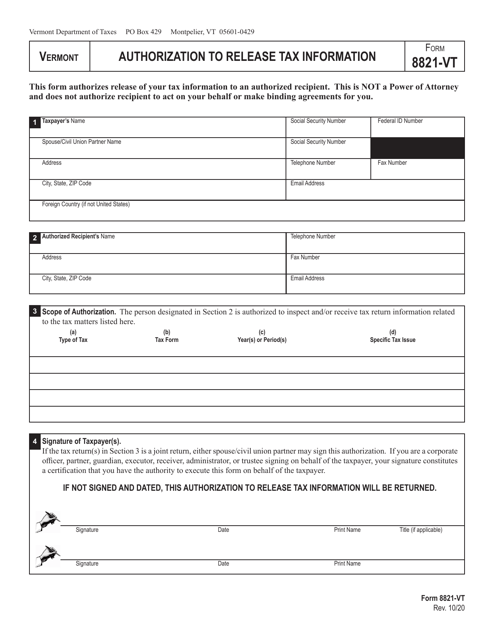

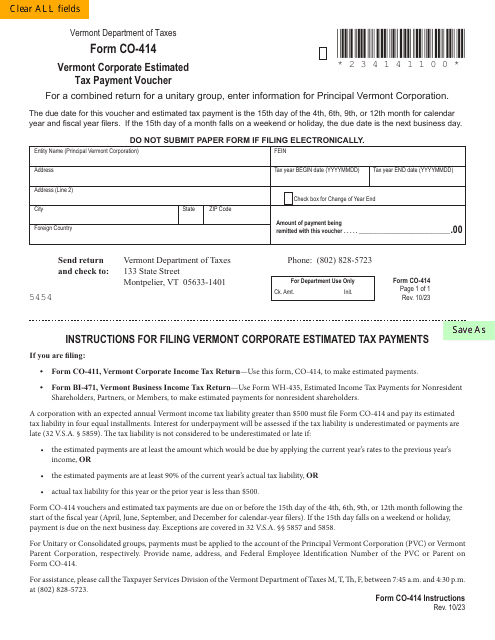

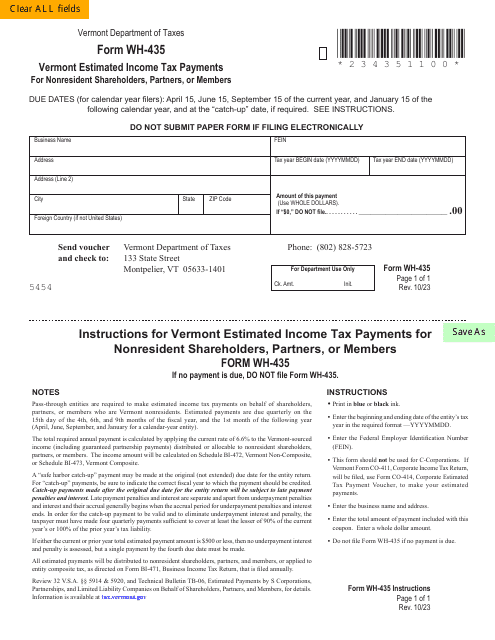

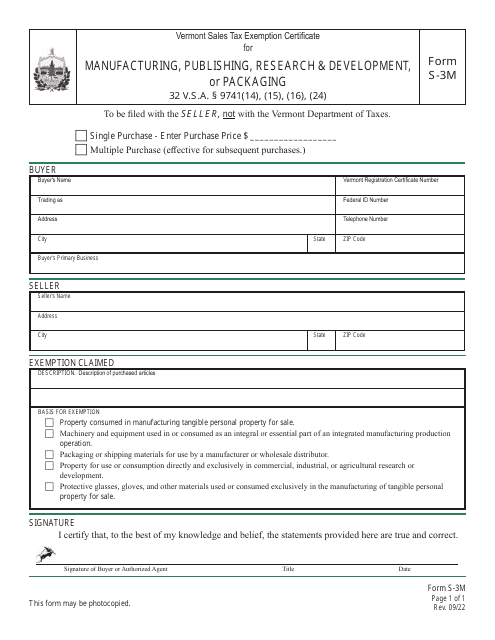

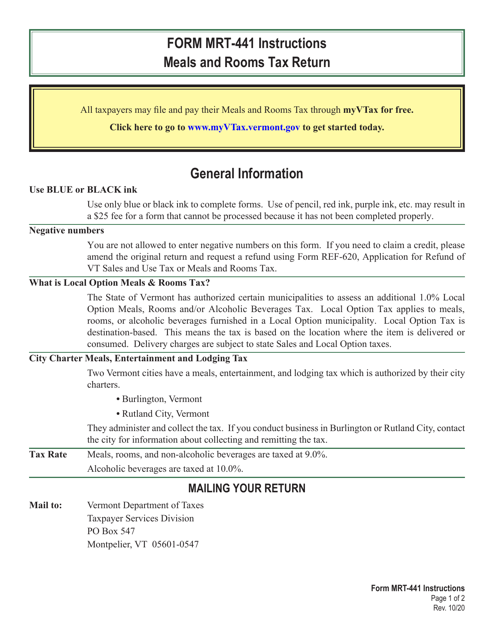

Vermont Tax Forms are documents that individuals and businesses in the state of Vermont use to report their income, calculate their tax liability, and claim any applicable deductions, credits, or exemptions. These forms are used to file Vermont state tax returns and comply with the state's tax laws and regulations. They cover various types of taxes, such as income tax, sales tax, use tax, meals and rooms tax, and miscellaneous taxes.

Documents:

155

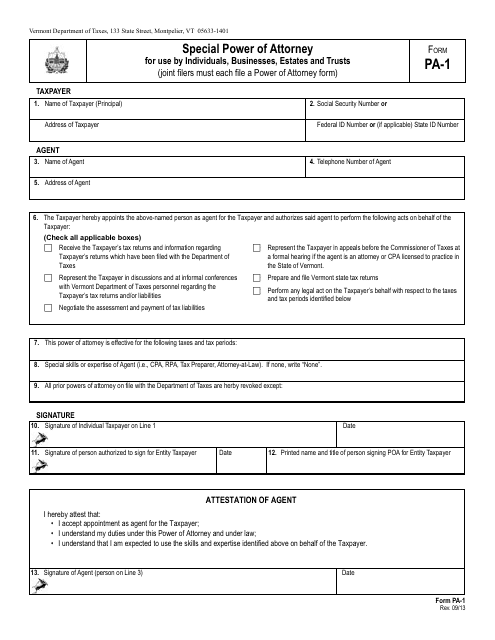

This document is a special power of attorney form that can be used by individuals, businesses, estates, and trusts in the state of Vermont. It grants someone the authority to act on behalf of the person or entity that is granting the power of attorney.

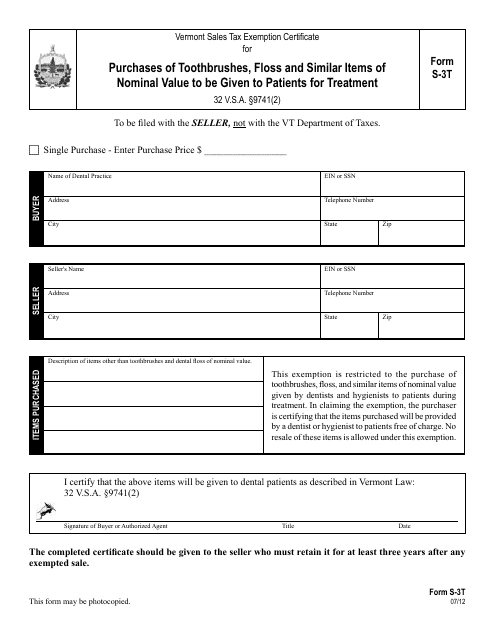

This form is used for claiming sales tax exemption on purchases of toothbrushes, floss, and similar items that are given to patients for treatment in Vermont.

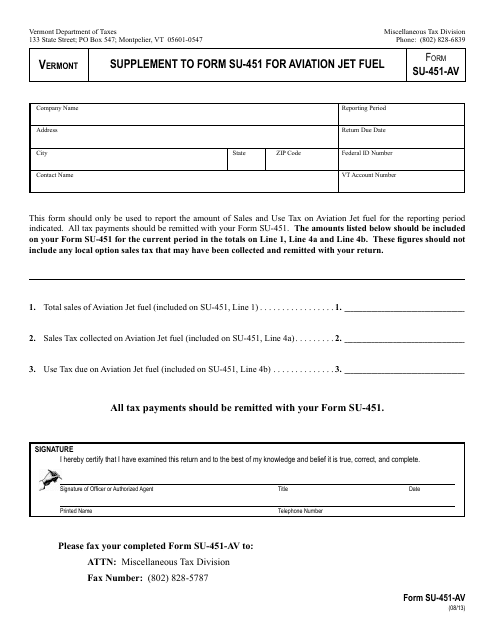

This Form is used for supplementing Form SU-451 for aviation jet fuel in Vermont.

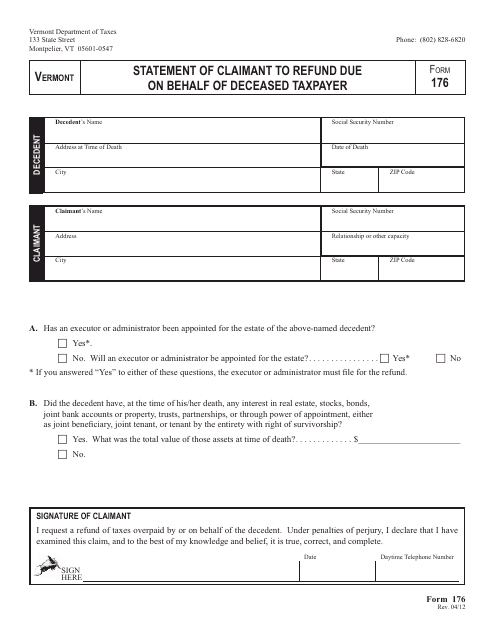

This document is used for making a claim for a refund on behalf of a deceased taxpayer in the state of Vermont.

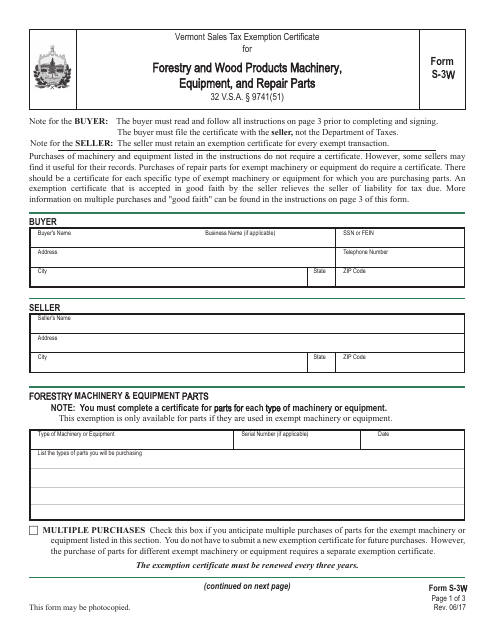

This Form is used for reporting forestry and wood products machinery, equipment, and repair parts in the state of Vermont.

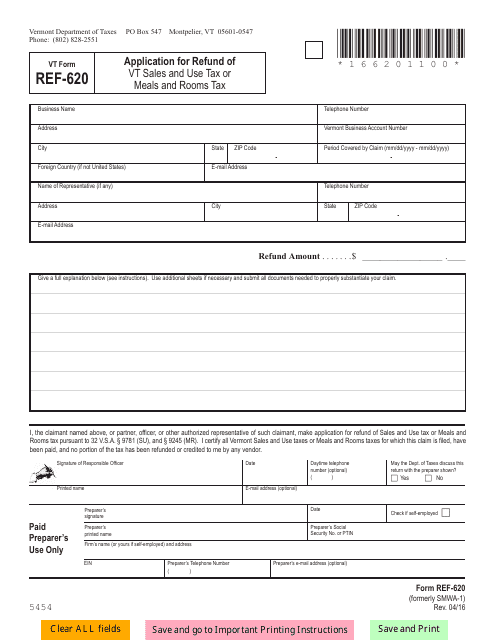

This Form is used for applying for a refund of Vermont Sales and Use Tax or Meals and Rooms Tax in Vermont.

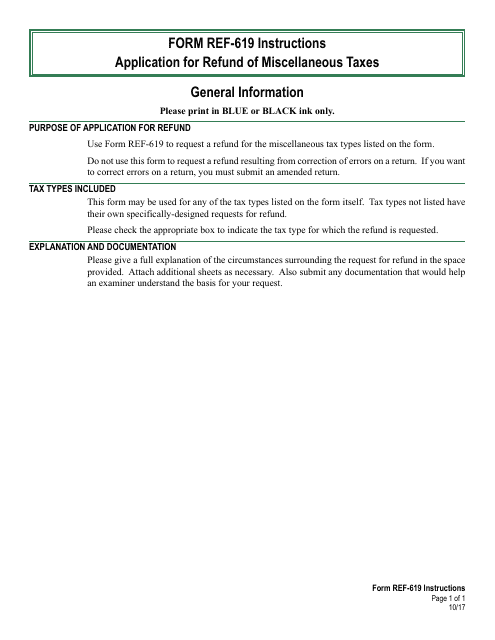

This Form is used for applying for a refund of miscellaneous taxes paid in the state of Vermont.

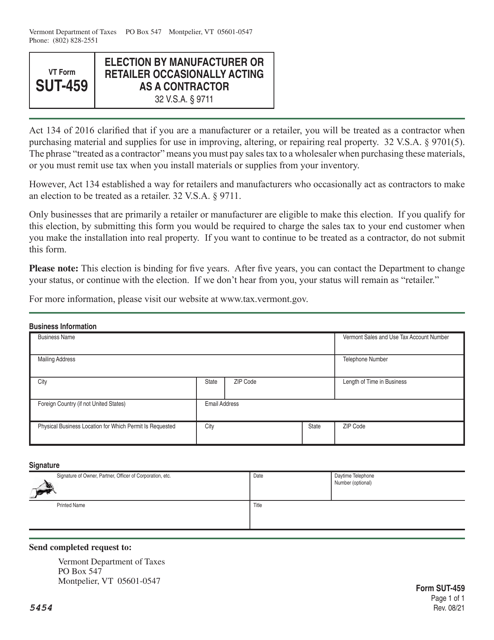

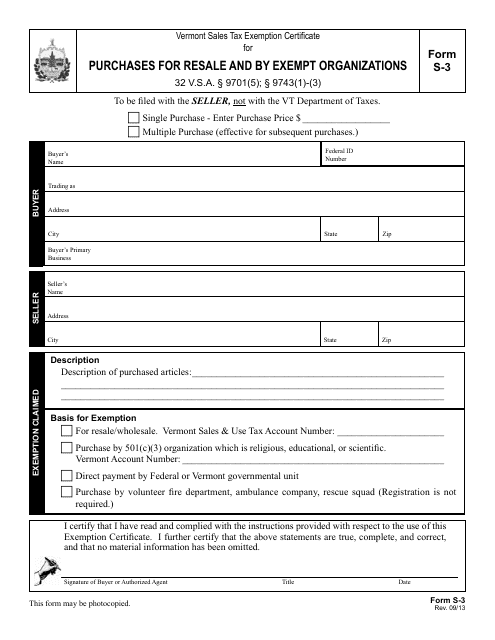

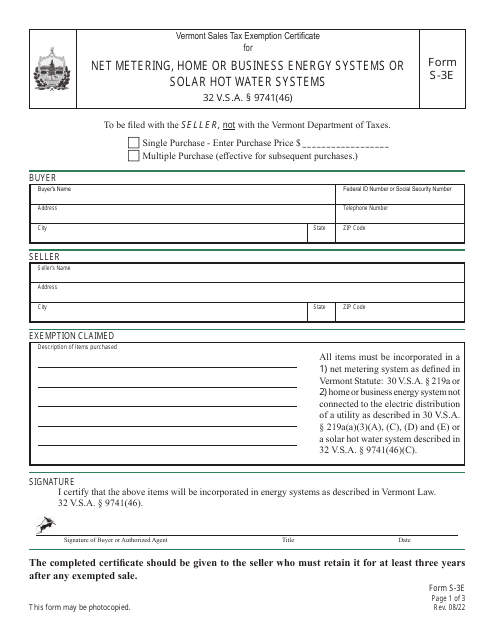

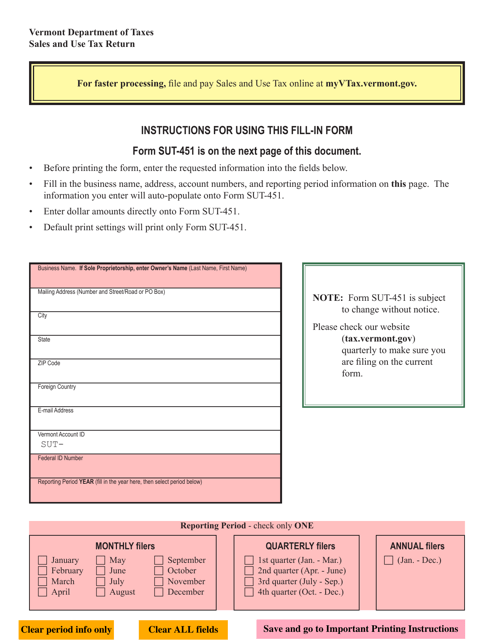

This Form is used for reporting purchases made for resale or by exempt organizations in the state of Vermont.

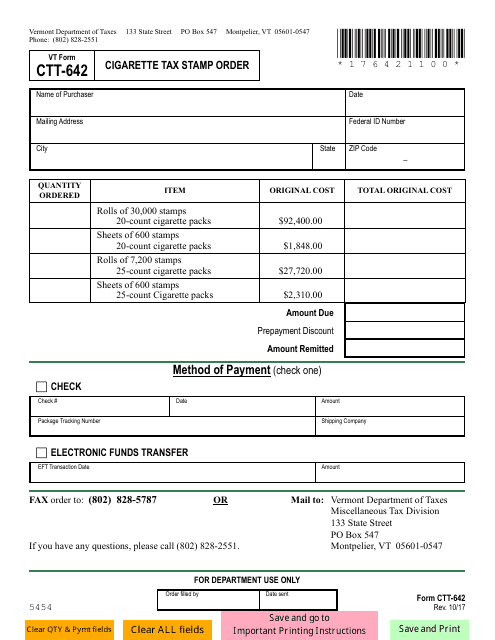

This Form is used for ordering cigarette tax stamps in Vermont.

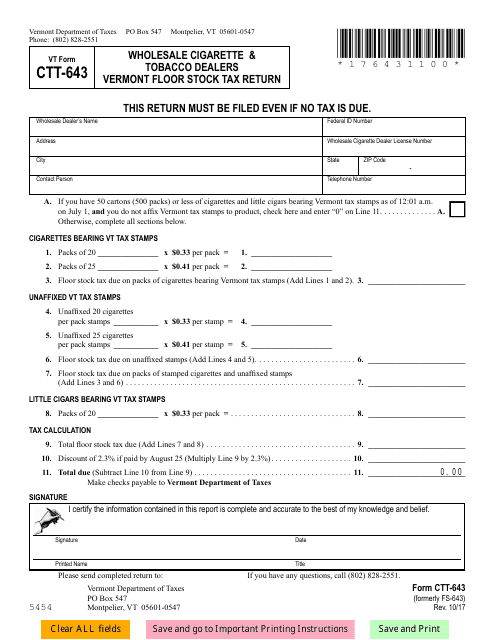

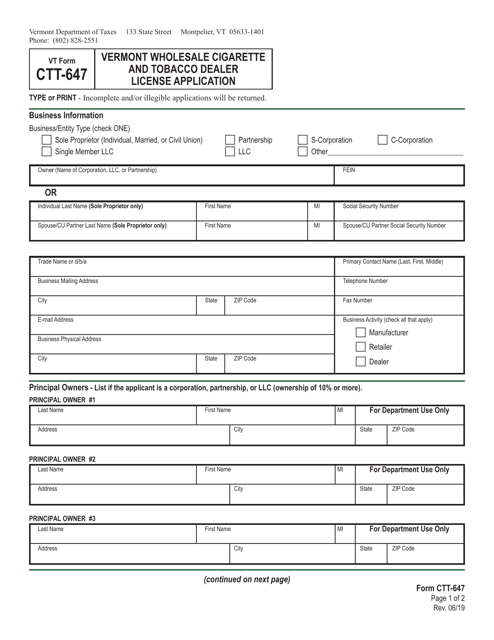

This document is used for filing the Vermont Floor Stock Tax Return for wholesale cigarette and tobacco dealers in Vermont.

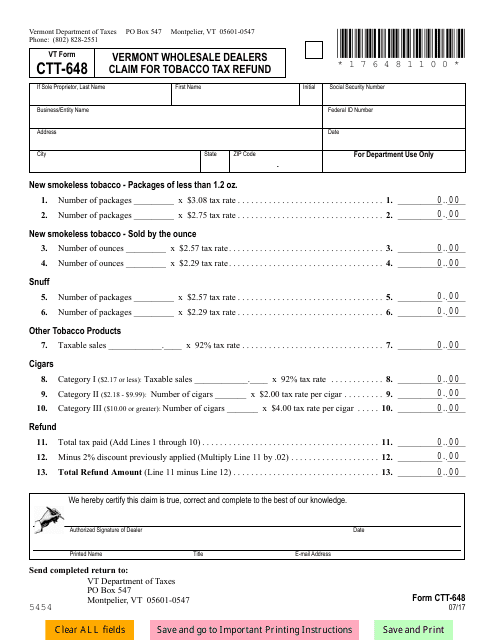

This form is used for Vermont wholesale dealers to claim a refund on tobacco tax.

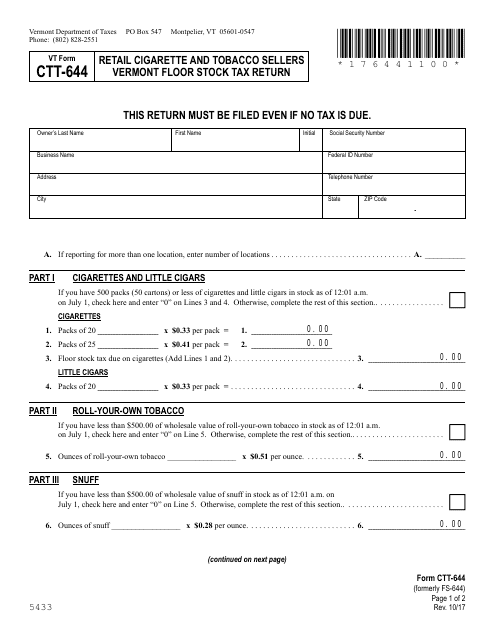

This Form is used for retailers selling cigarettes and tobacco in Vermont to file their floor stock tax return. The form is used to calculate and remit the tax due on the remaining inventory of cigarettes and tobacco products at the end of the tax period.

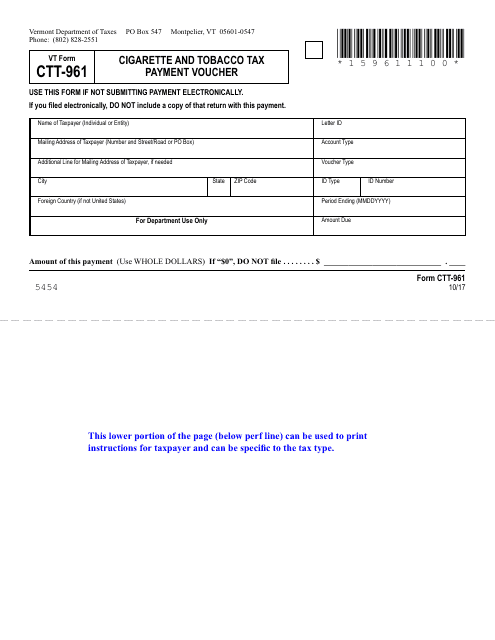

This form is used for making cigarette and tobacco tax payments in Vermont.

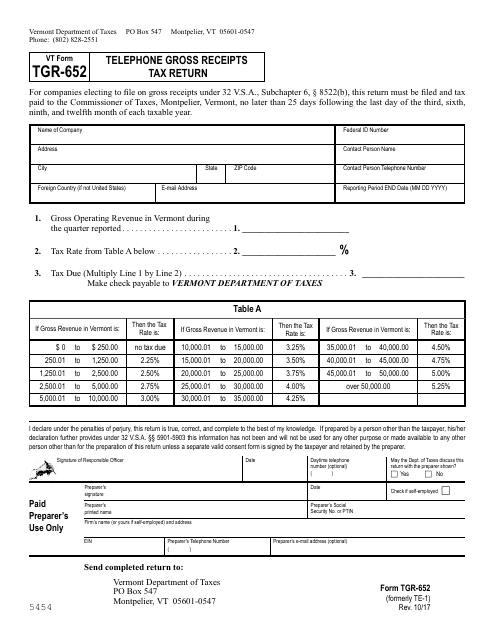

This Form is used for reporting telephone gross receipts for tax purposes in the state of Vermont.

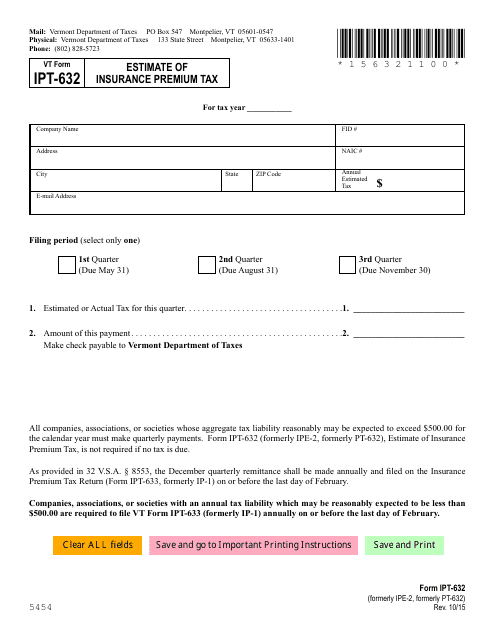

This form is used for estimating insurance premium tax in Vermont.