Vermont Tax Forms and Templates

Documents:

155

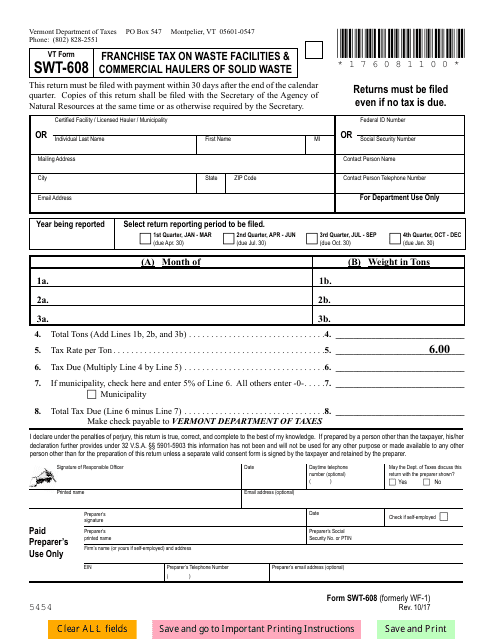

This Form is used for reporting and paying franchise tax on waste facilities and commercial haulers of solid waste in the state of Vermont.

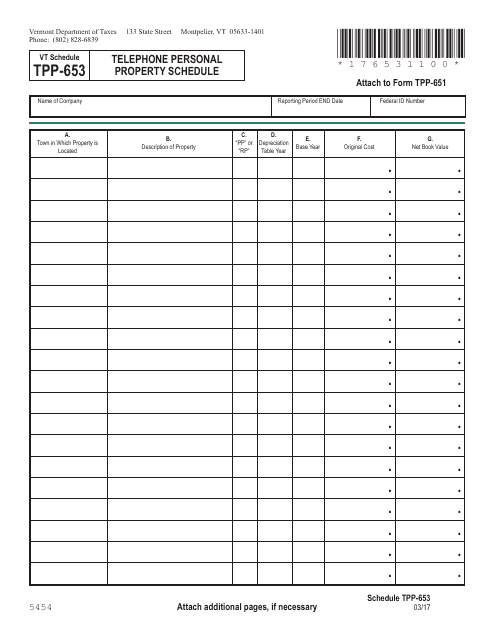

This Form is used for reporting telephone personal property in Vermont.

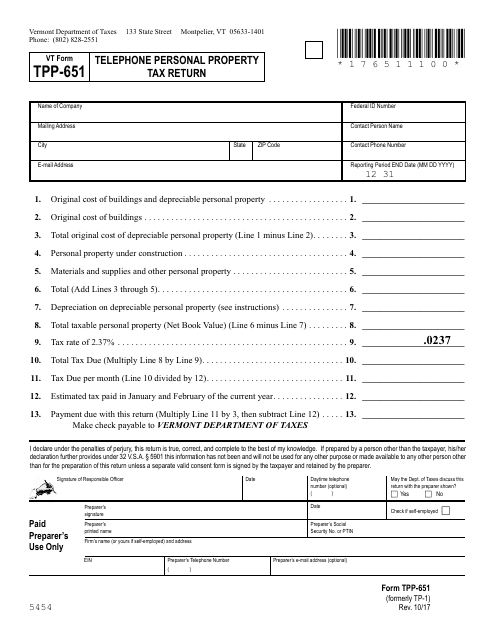

This document is used for filing the Telephone Personal Property Tax Return in the state of Vermont.

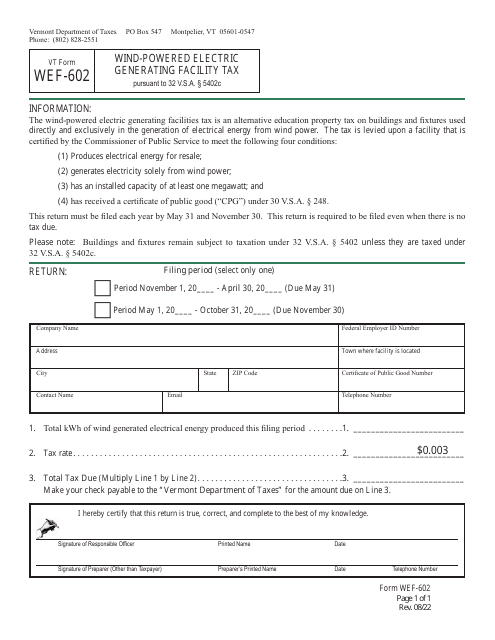

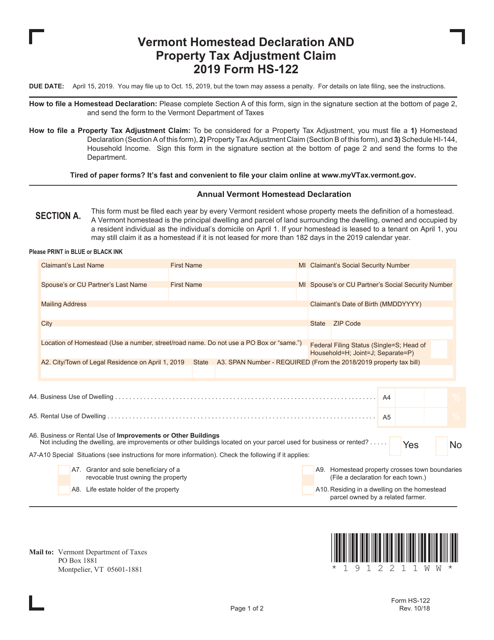

This form is used for residents of Vermont to declare their homestead and claim property tax adjustments.

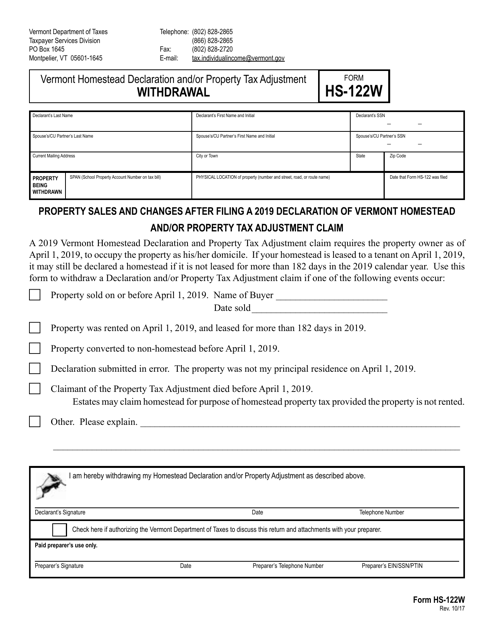

This Form is used for withdrawing the Vermont Homestead Declaration and/or Property Tax Adjustment in Vermont.

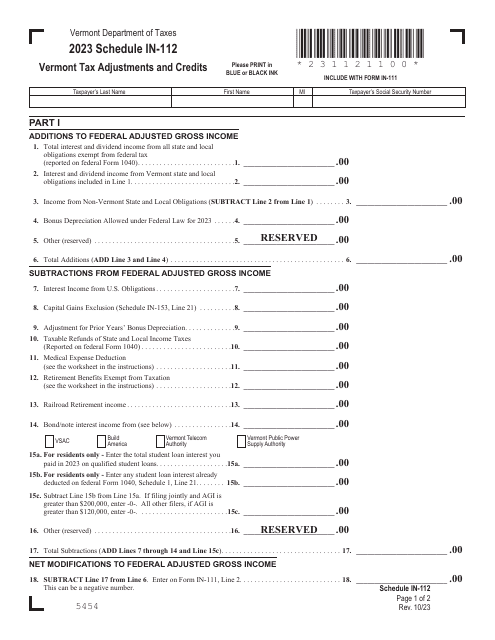

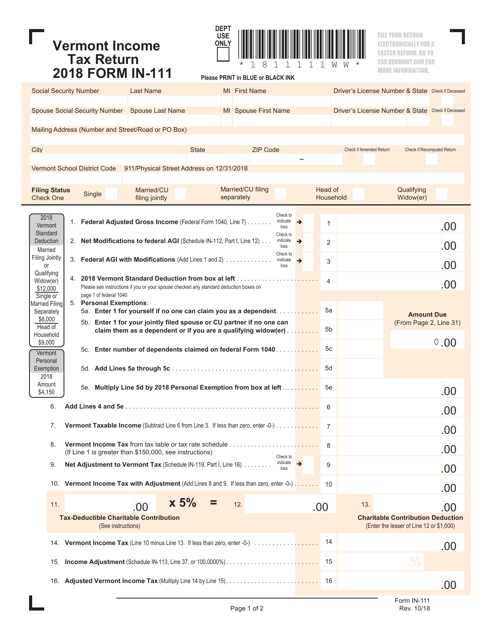

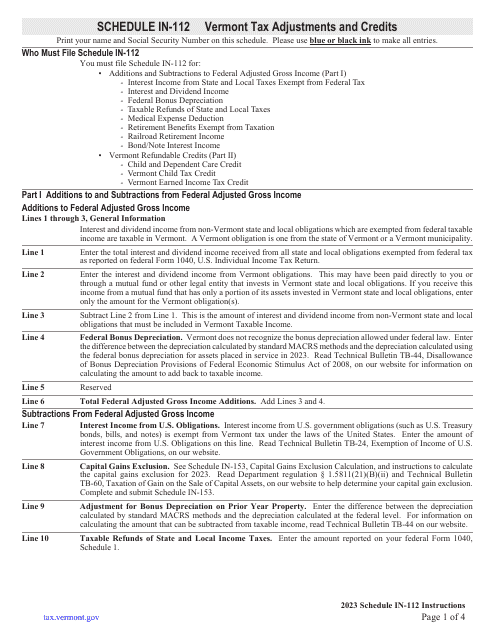

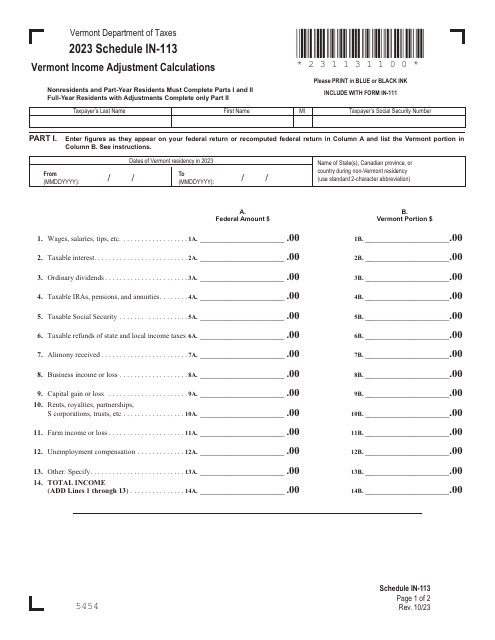

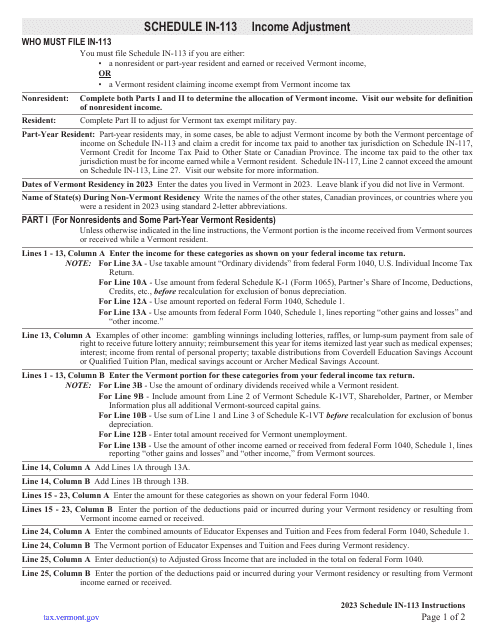

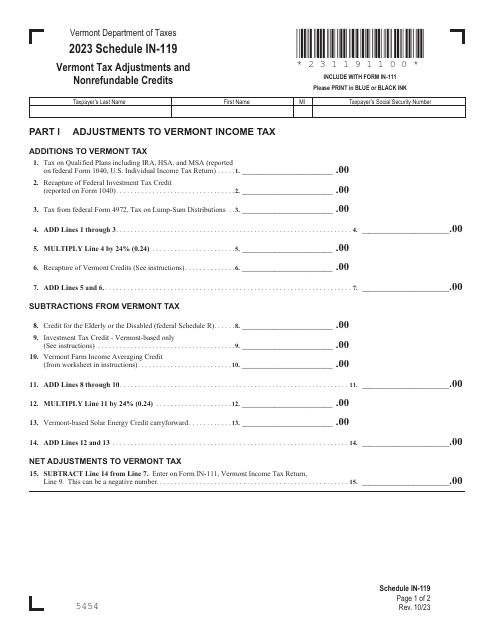

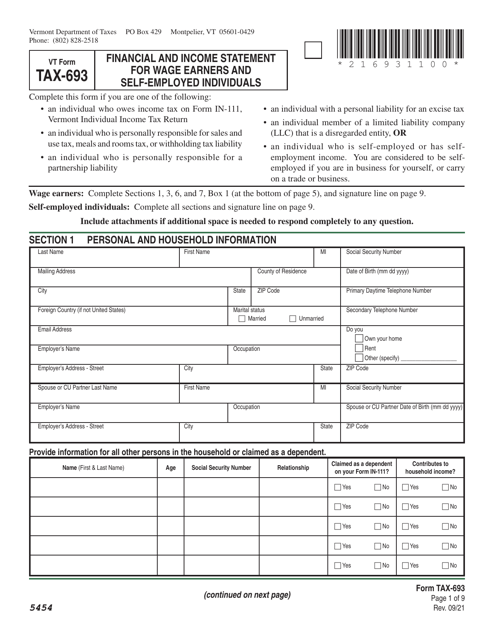

This Form is used for filing income tax returns in the state of Vermont.

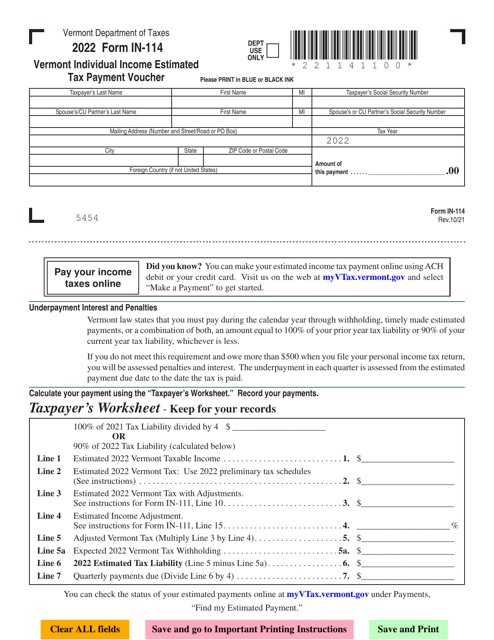

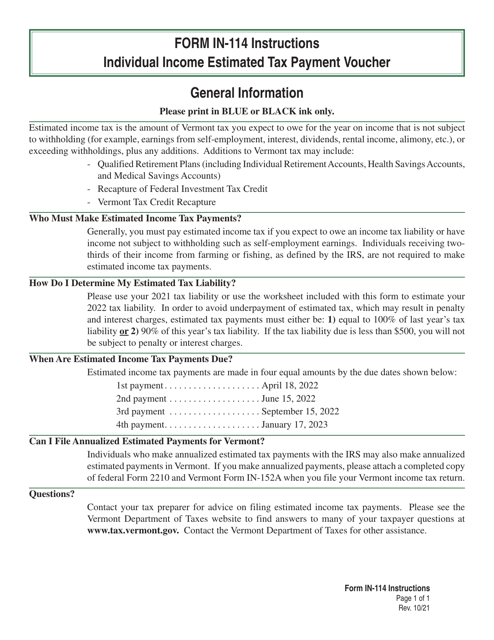

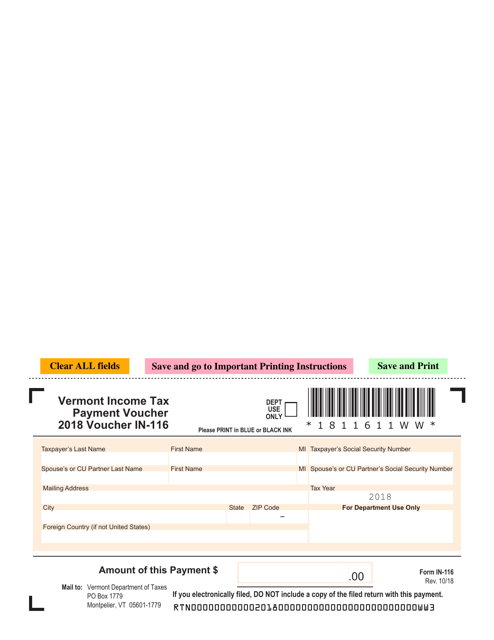

This document is used for making income tax payments in the state of Vermont.

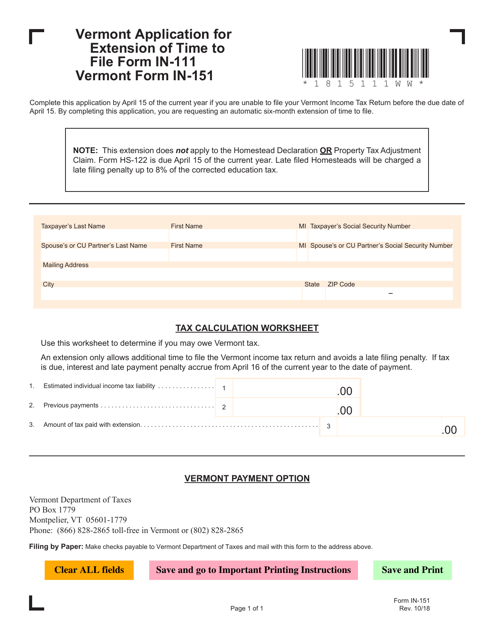

This Form is used for filing an application to request an extension of time to file Form IN-111 in the state of Vermont.

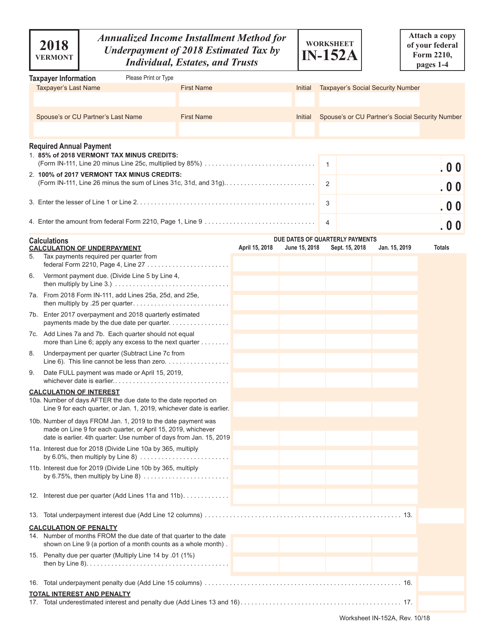

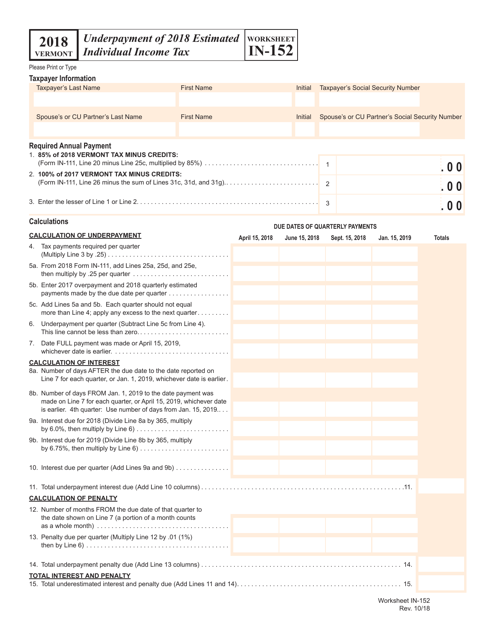

This document is a worksheet that individuals, estates, and trusts in Vermont can use to calculate their annualized income installment for the underpayment of estimated tax for the year 2018. It helps determine if any additional tax needs to be paid to avoid penalties.

This form is used for calculating and reporting any underpayment of estimated individual income tax in Vermont for the year 2018.

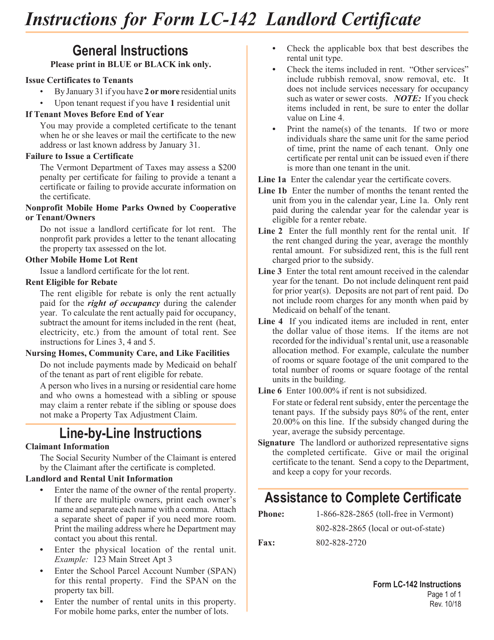

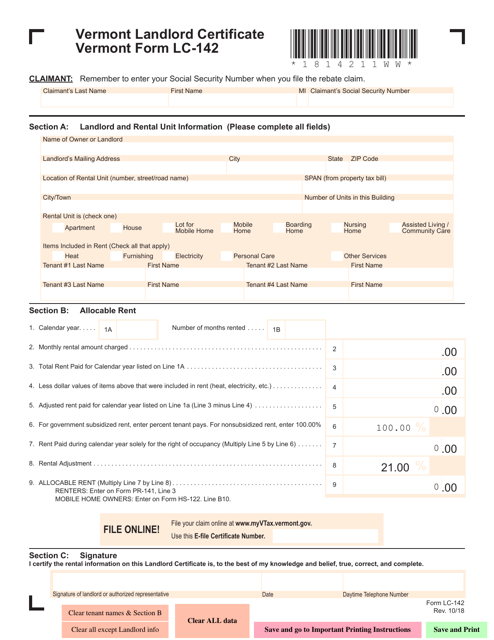

This document is used for obtaining a landlord certificate in Vermont. It provides instructions on how to fill out the VT Form LC-142.

This Form is used for a landlord to provide certification in Vermont.

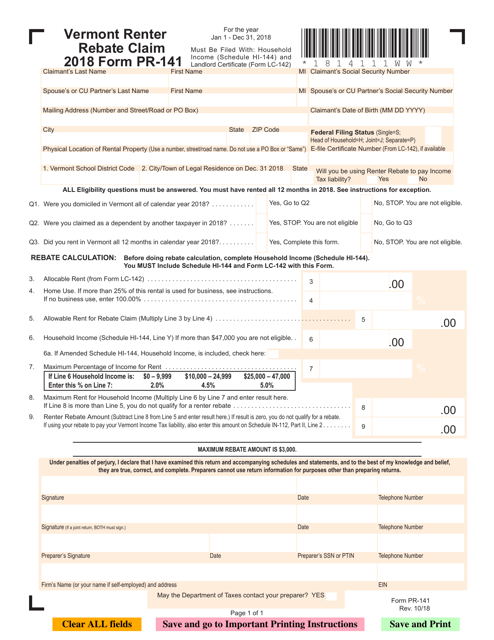

This Form is used for claiming a renter rebate in the state of Vermont.

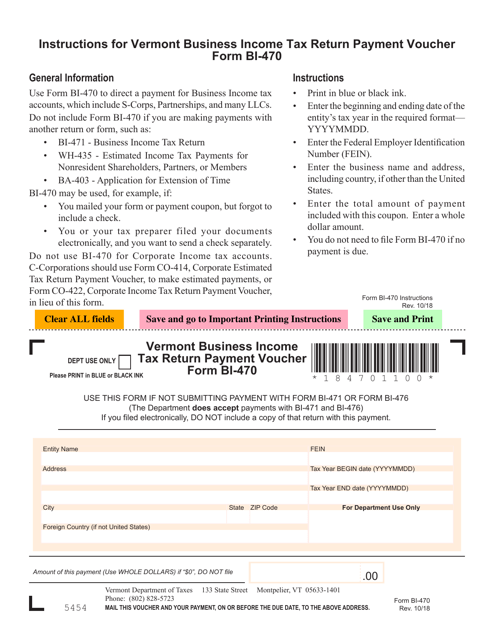

This Form is used for making a payment for the Vermont Business Income Tax Return.