Fill and Sign Connecticut Legal Forms

Documents:

3177

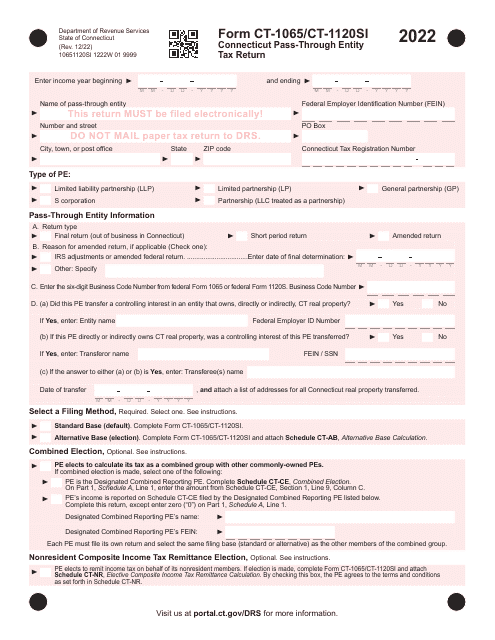

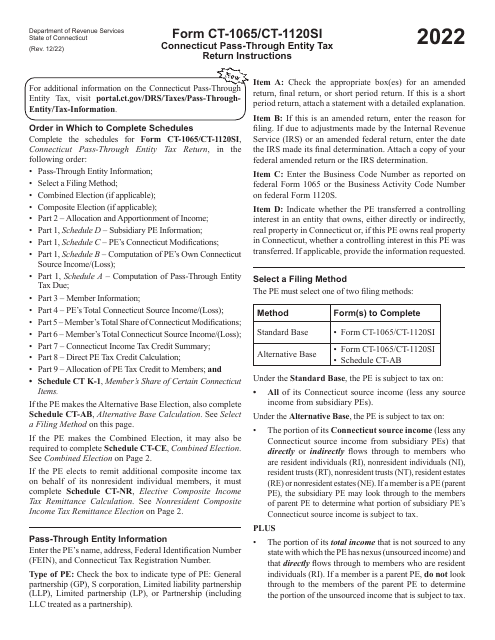

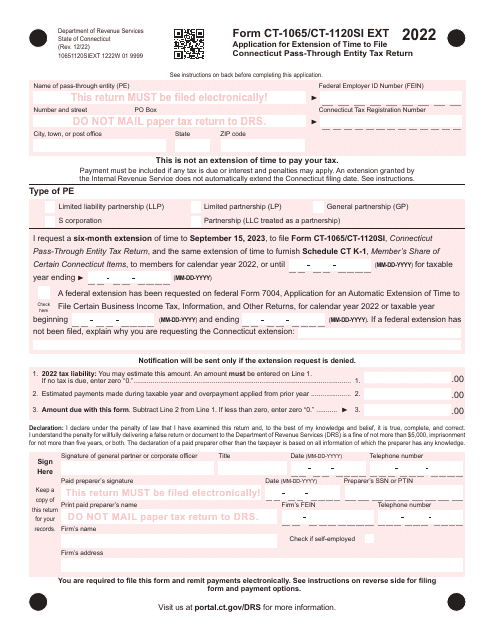

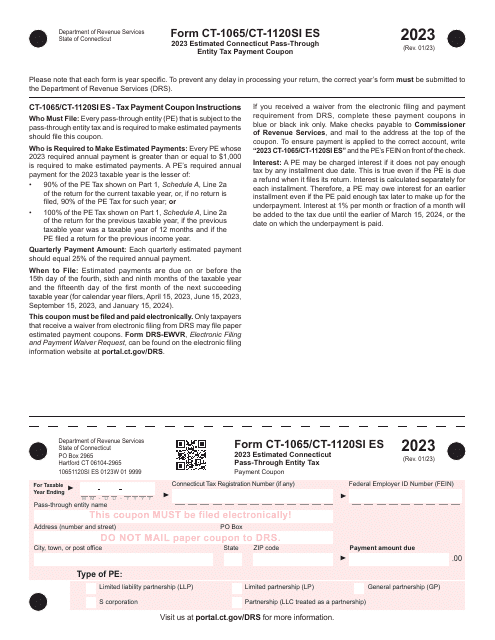

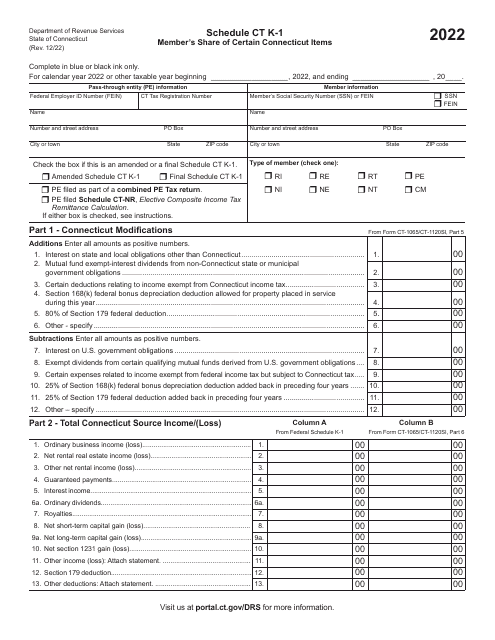

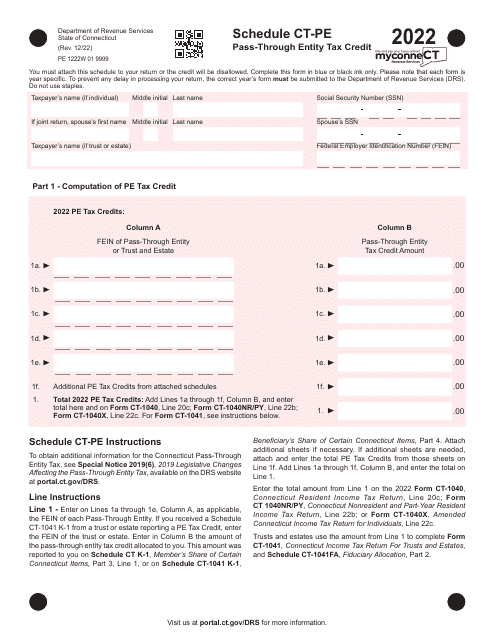

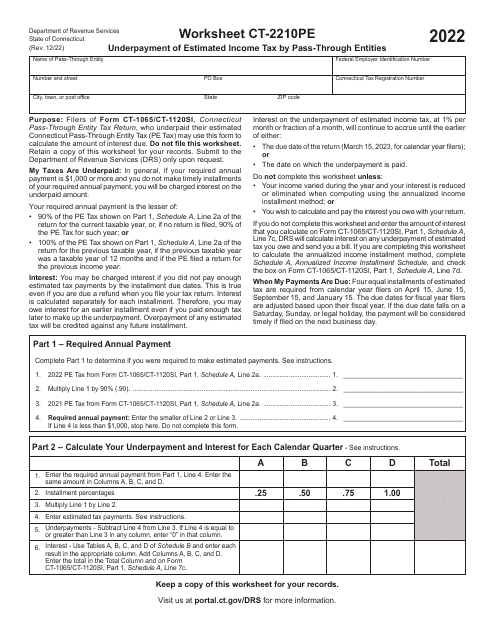

This Form is used for filing the Connecticut Pass-Through Entity Tax Return for Connecticut residents.

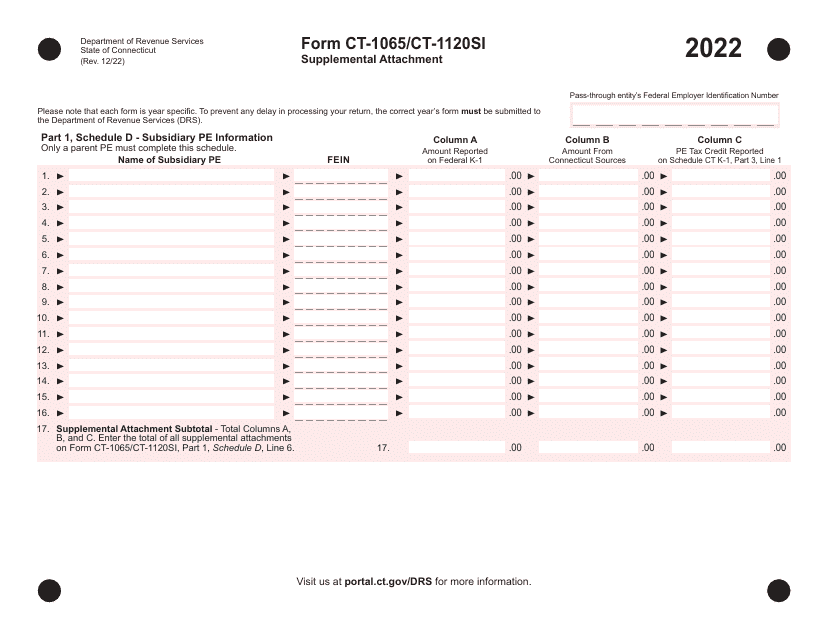

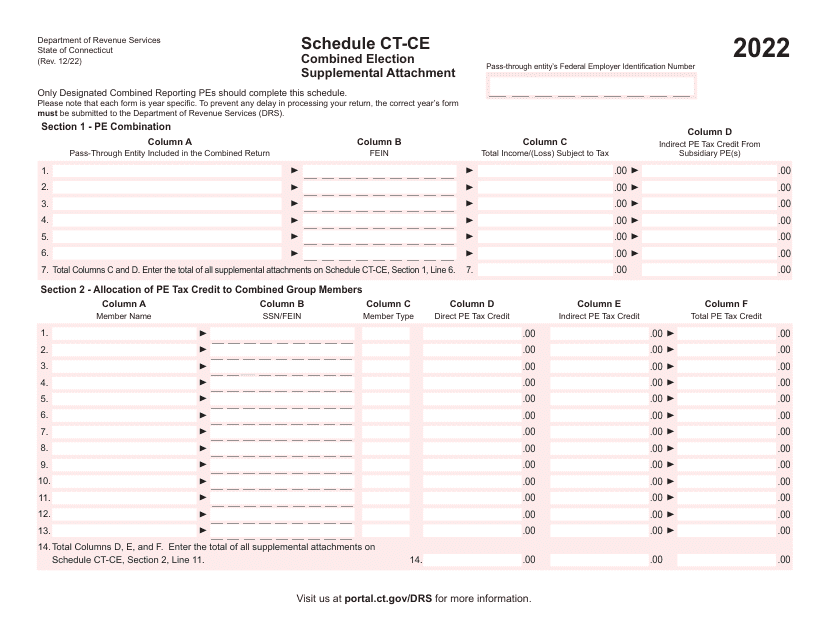

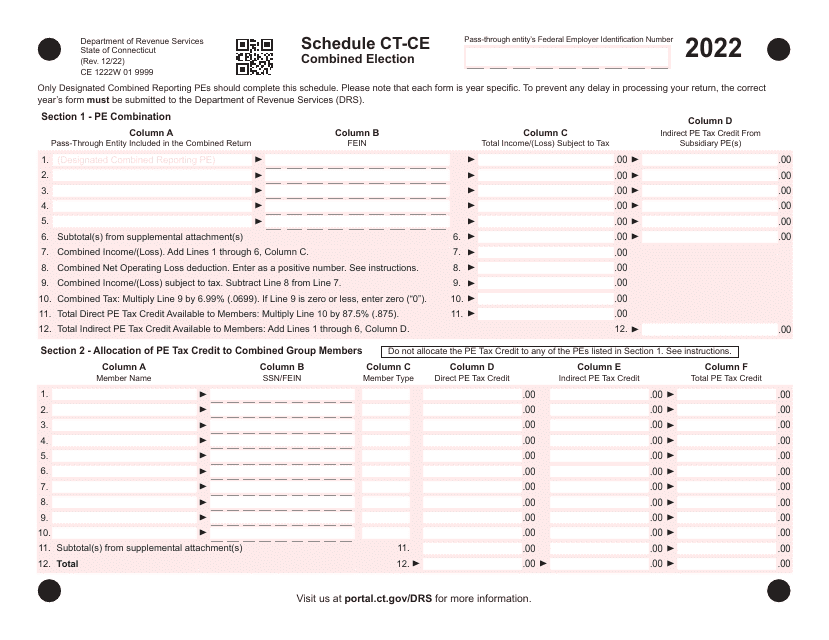

This document is used as a supplemental attachment for the CT-CE Combined Election Schedule. It provides additional information and details that are necessary for completing the election schedule.

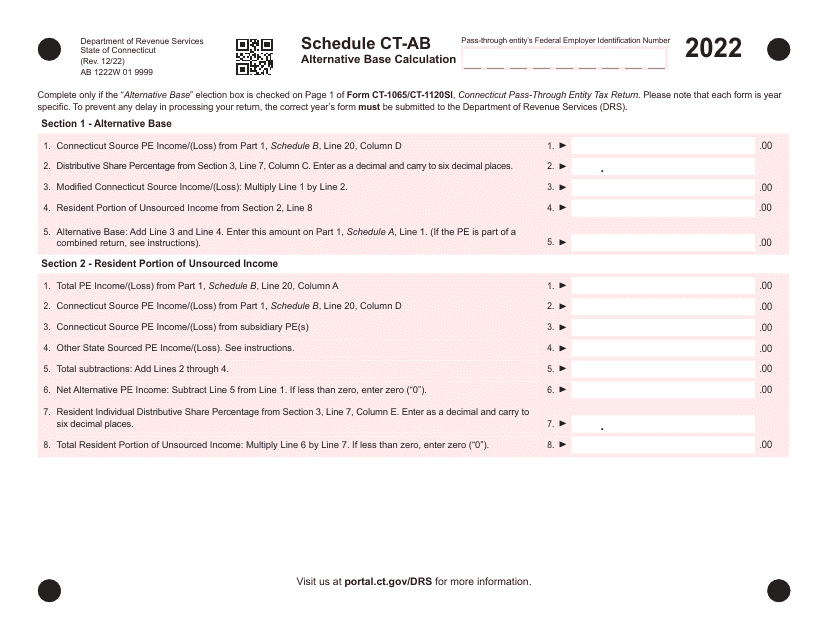

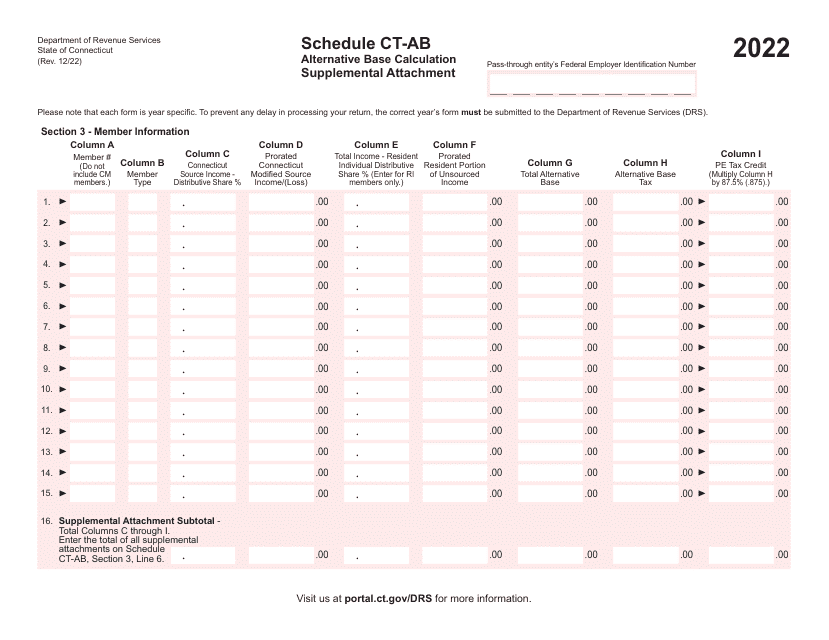

This document is used for submitting a supplemental attachment for the Alternative Base Calculation (CT-AB) in Connecticut. It provides additional information to support the alternative base calculation.

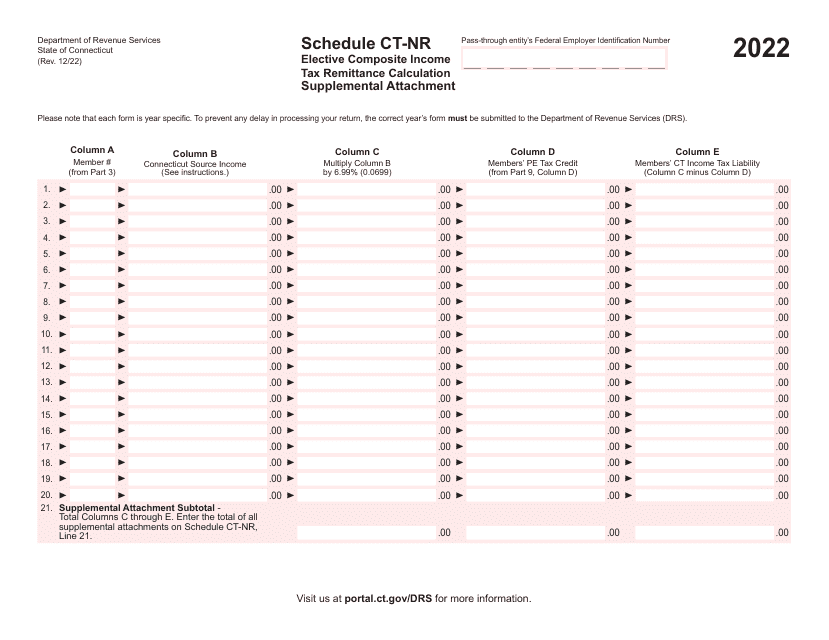

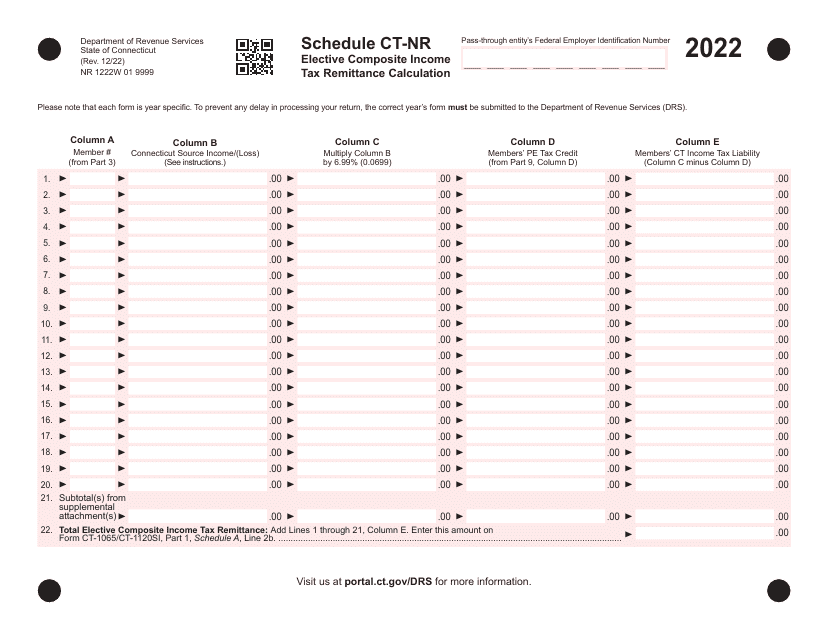

This document is a supplemental attachment used for the calculation of elective composite income tax remittance in Connecticut. It is used in conjunction with Schedule CT-NR.

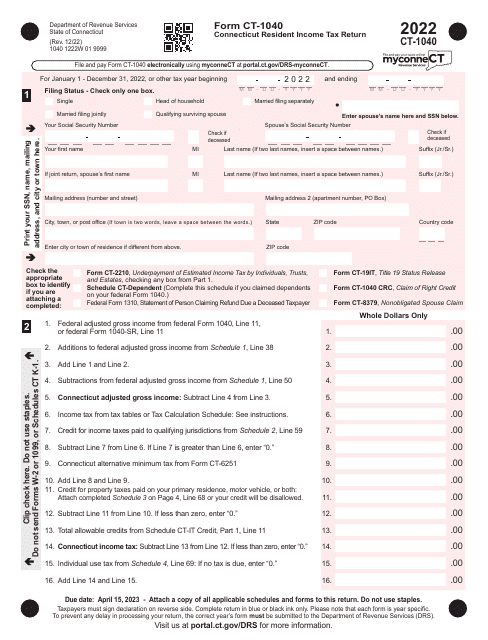

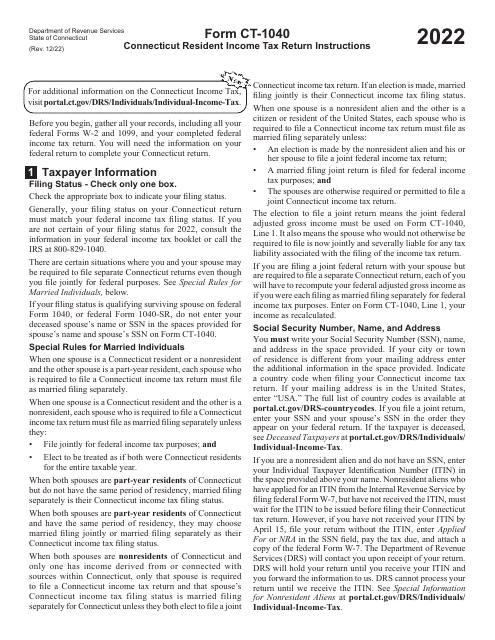

This Form is used for filing your Connecticut state income tax return if you are a resident of Connecticut. It provides instructions and guidance on how to accurately report your income, deductions, and credits. Make sure to read the instructions carefully and follow them to ensure the accurate completion of your tax return.

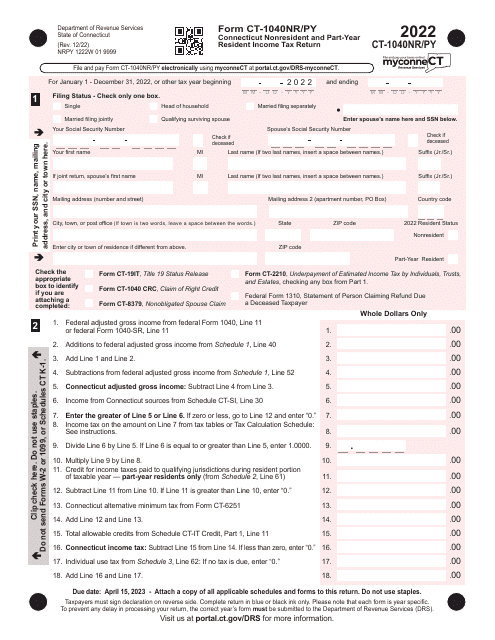

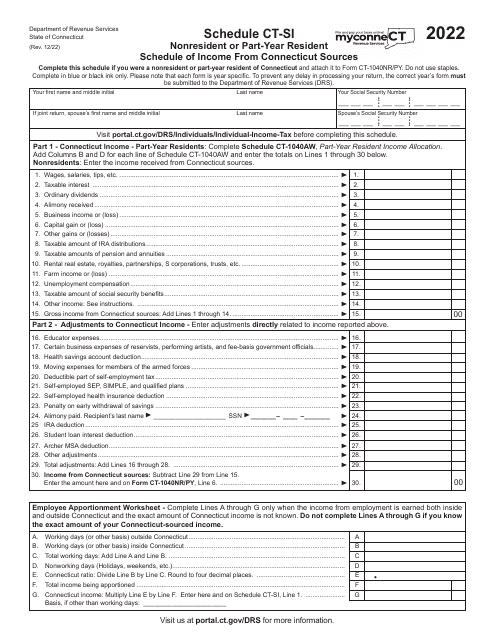

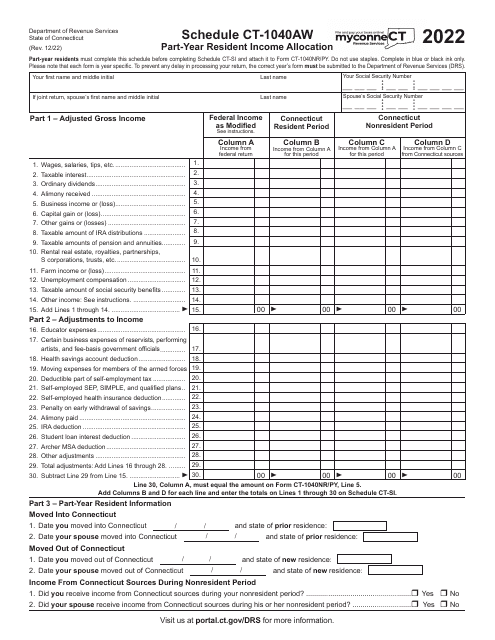

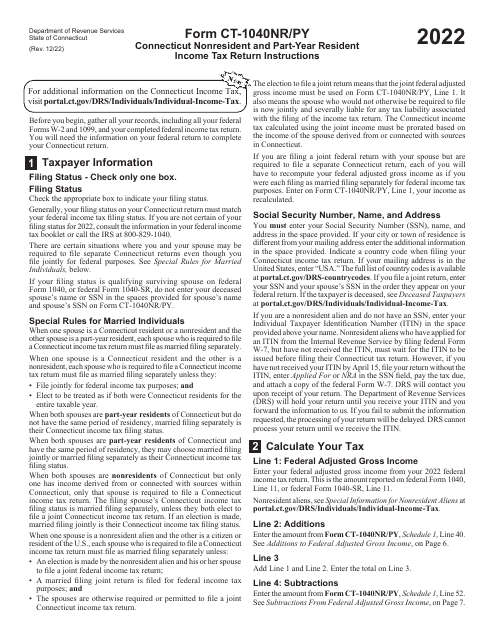

This Form is used for filing the Connecticut Nonresident and Part-Year Resident Income Tax Return for individuals who are nonresidents or part-year residents in Connecticut. It provides instructions on how to accurately complete and submit the CT-1040NR/PY form.

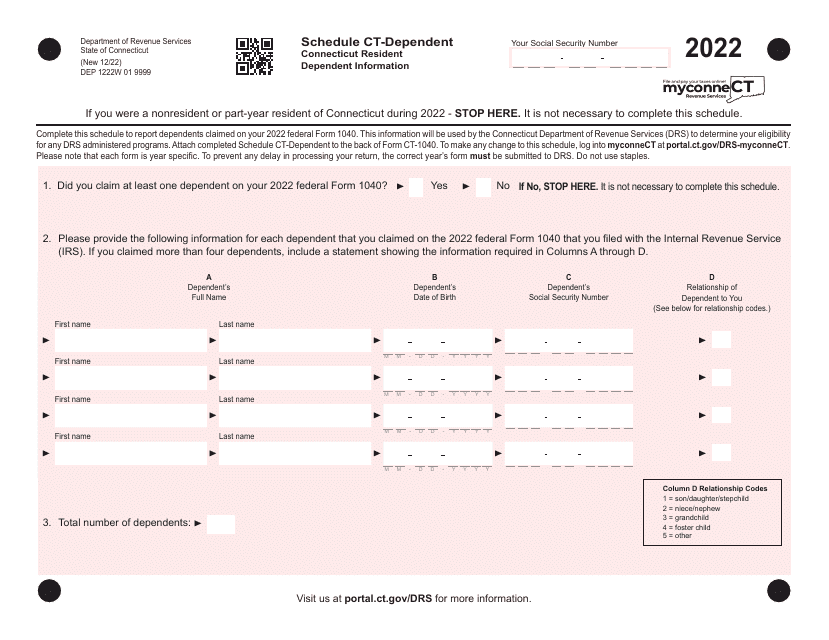

This form is used for providing information about a dependent resident in the state of Connecticut.