Fill and Sign Connecticut Legal Forms

Documents:

3177

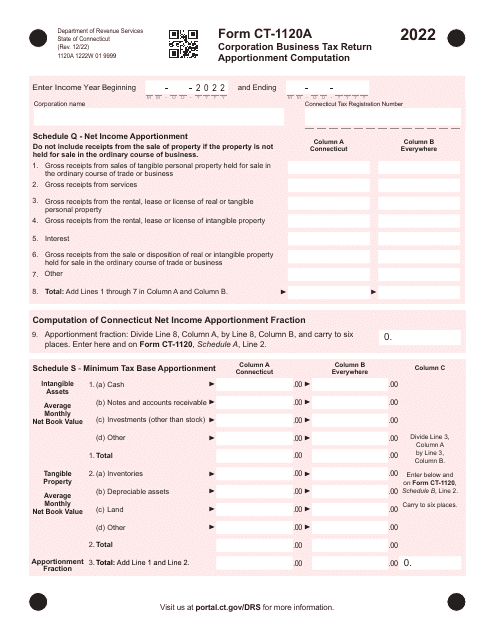

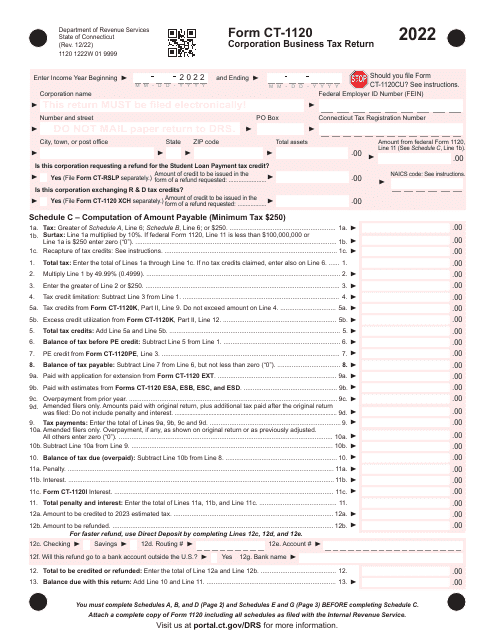

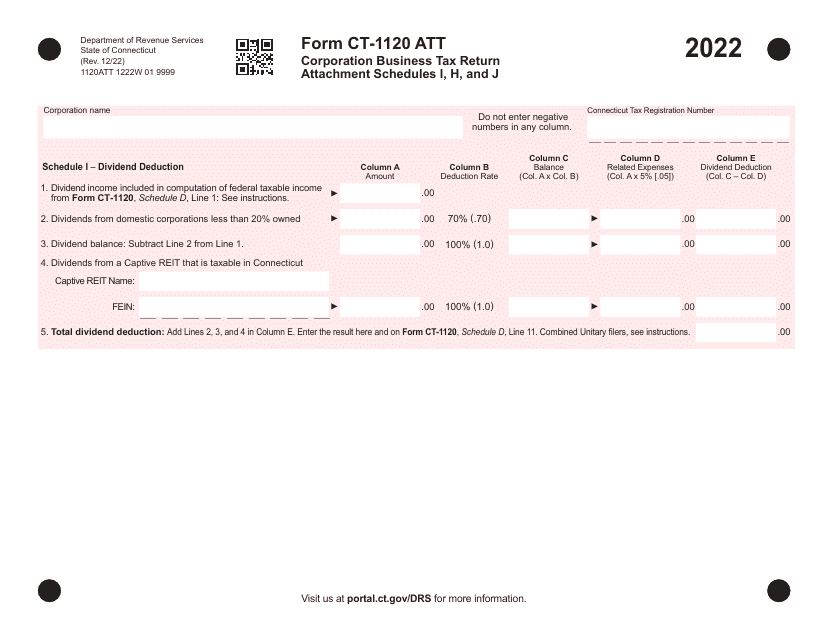

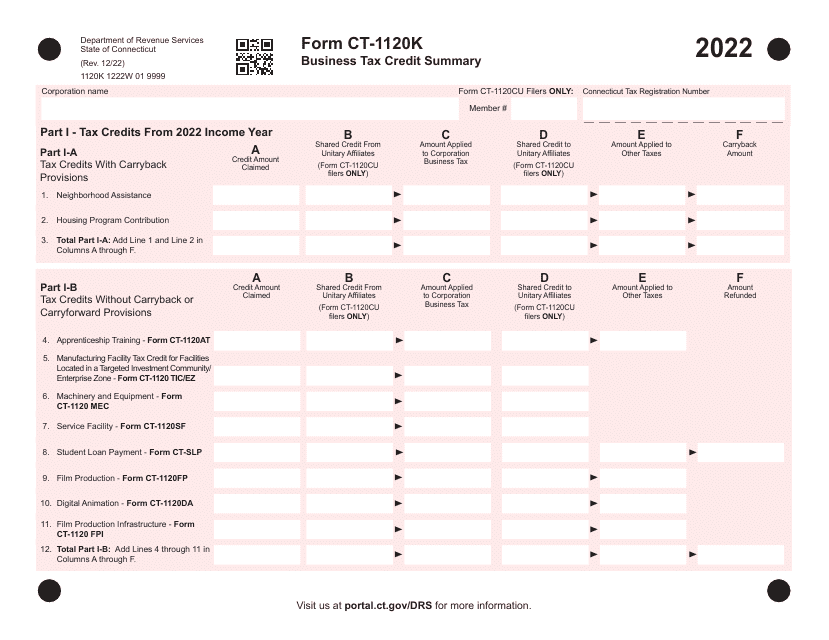

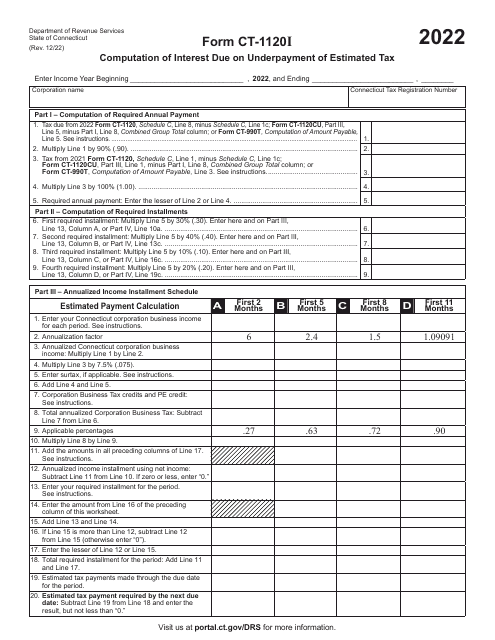

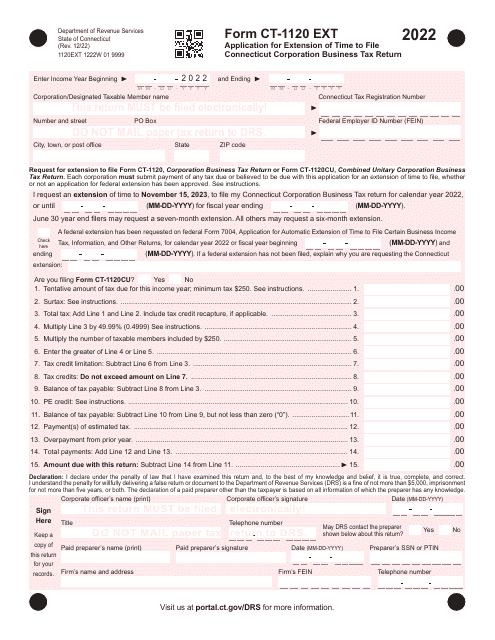

This Form is used for filing the Corporation Business Tax Return in the state of Connecticut for ATT Corporation.

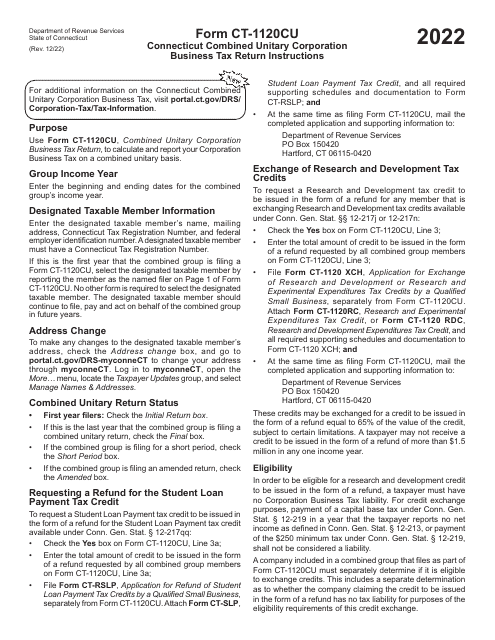

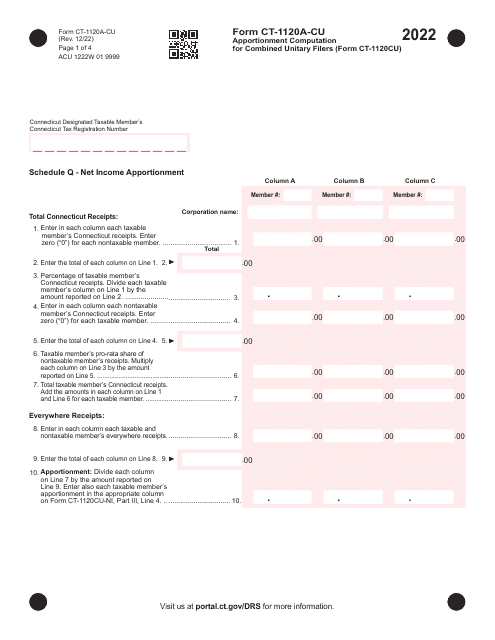

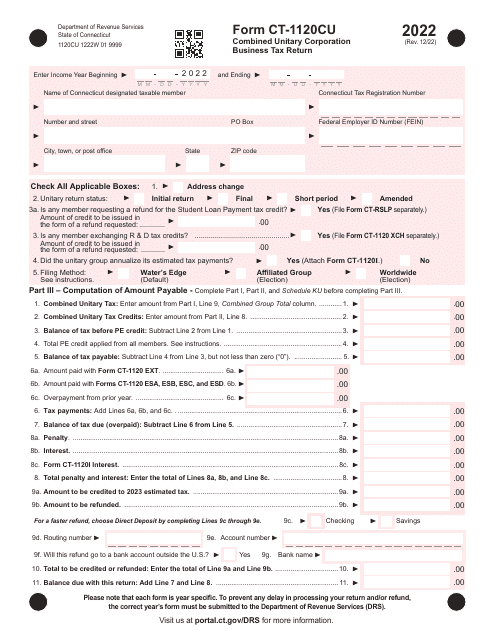

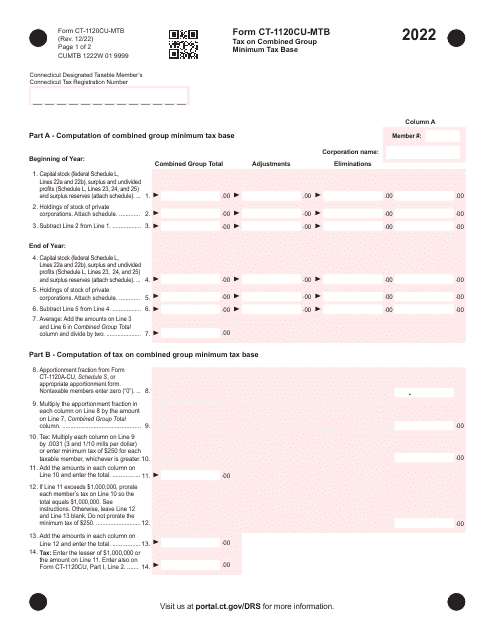

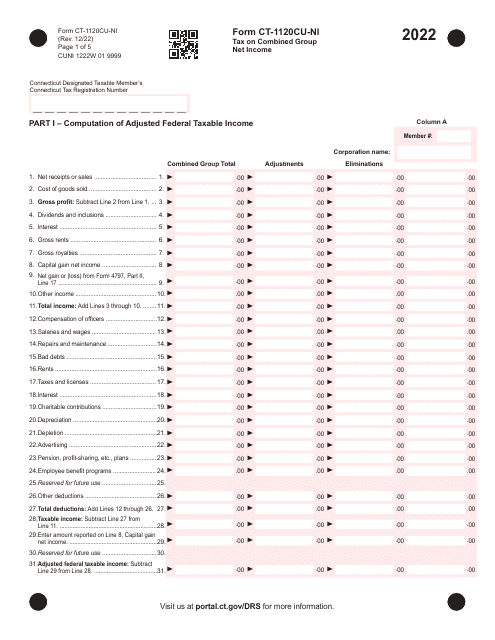

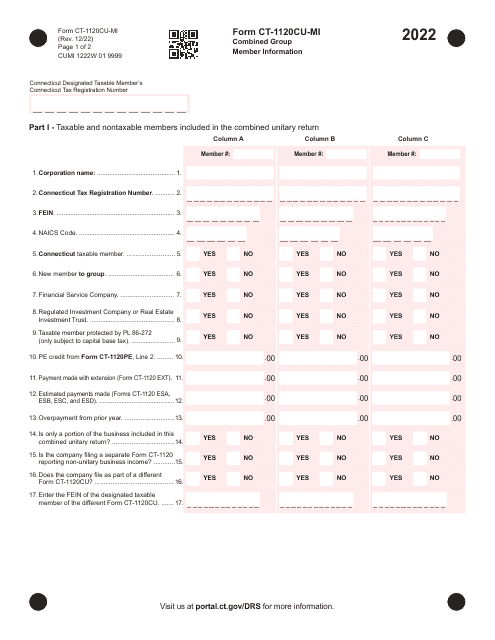

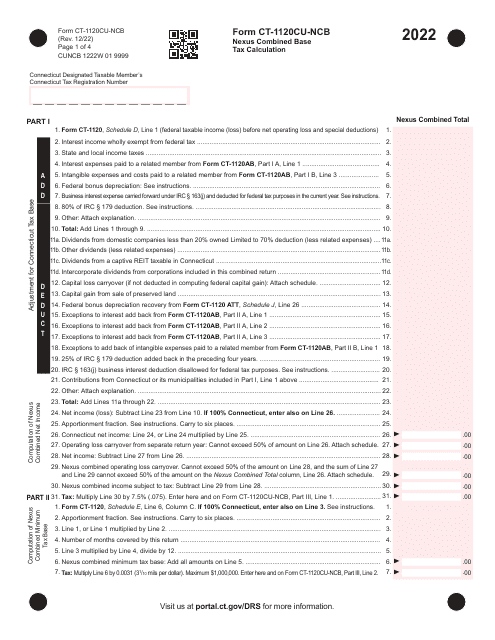

Instructions for Form CT-1120CU Combined Unitary Corporation Business Tax Return - Connecticut, 2022

This Form is used for filing the Combined Unitary Corporation Business Tax Return in Connecticut. It provides instructions on how to complete the form and file taxes for a unitary corporation in the state.

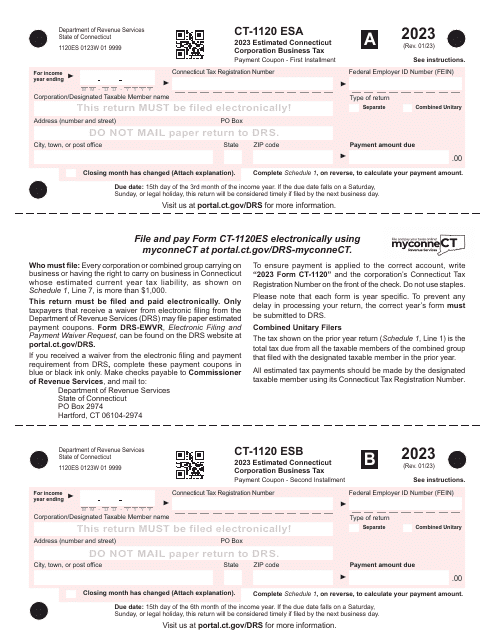

This form is used for making estimated corporation business tax payments in Connecticut.

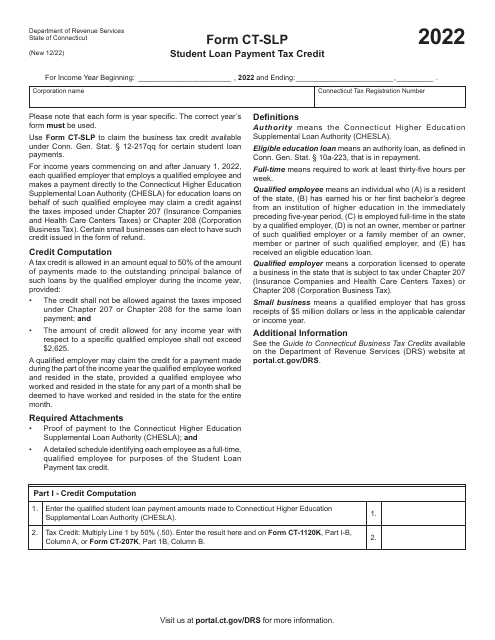

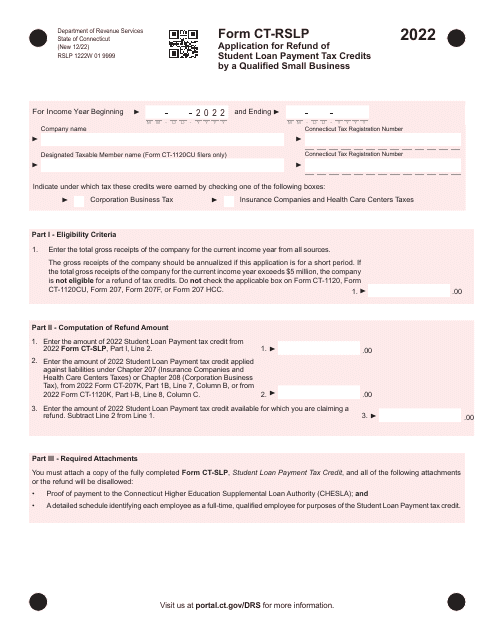

This Form is used for claiming a tax credit for student loan payments in the state of Connecticut.

This document is used to apply for a refund of student loan payment tax credits by a qualified small business in Connecticut.

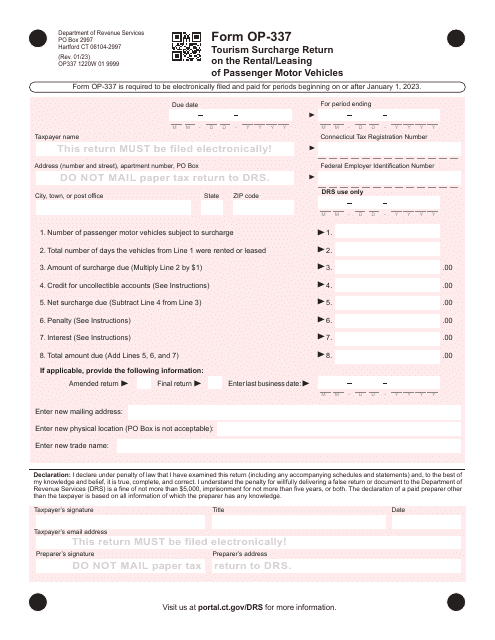

Form OP-337 Tourism Surcharge Return on the Rental/Leasing of Passenger Motor Vehicles - Connecticut

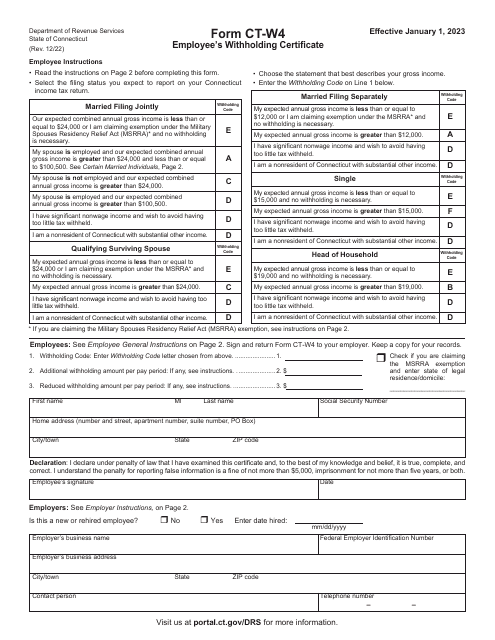

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

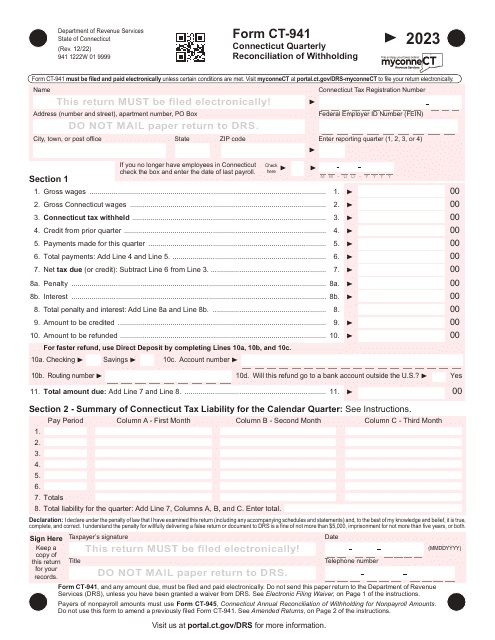

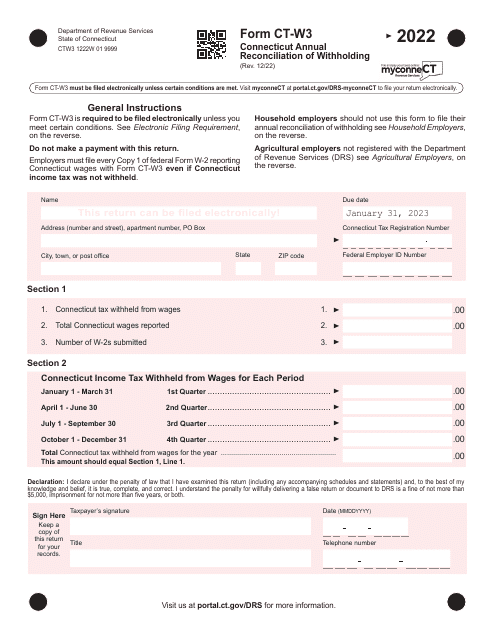

This Form is used for reporting annual withholding tax reconciliations in Connecticut.