U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

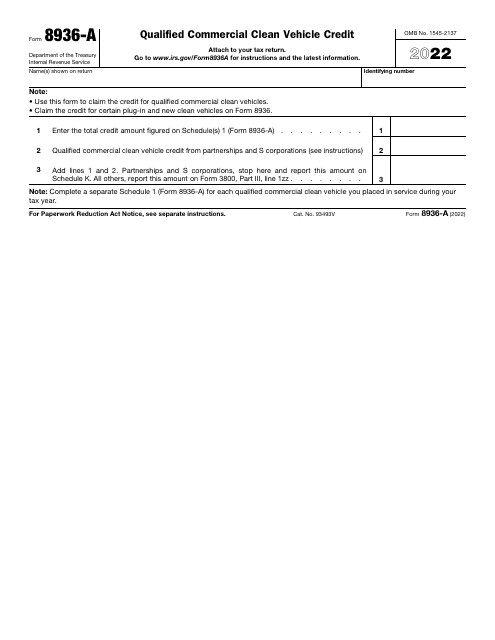

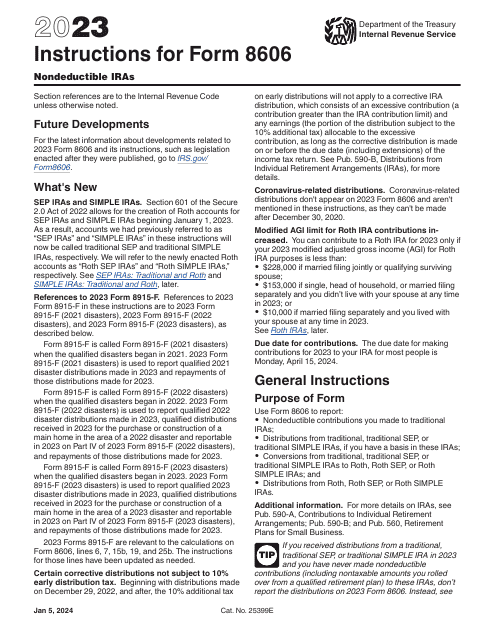

This form is used for claiming a tax credit for the purchase of a qualified commercial clean vehicle.

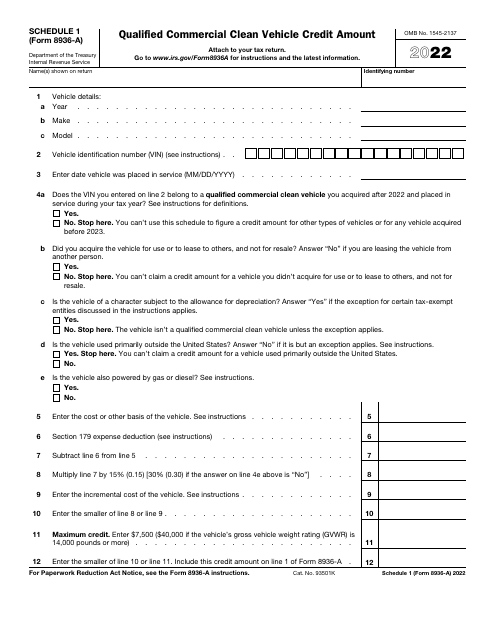

This form is used for calculating and claiming the Qualified Commercial Clean Vehicle Credit Amount on your taxes. It is used for individuals or businesses that have purchased qualified clean vehicles for commercial purposes.

This form is used for reporting additional information related to IRS Form 8936, which is used to claim the qualified plug-in electric drive motor vehicle credit. Schedule 1 provides instructions on how to report specific details that may be required for the credit claim.

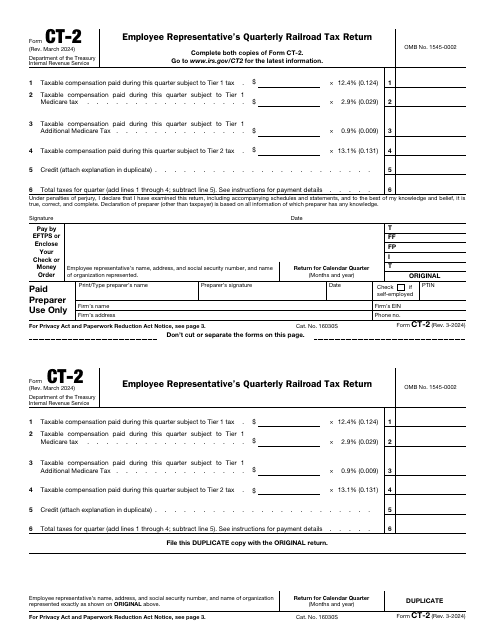

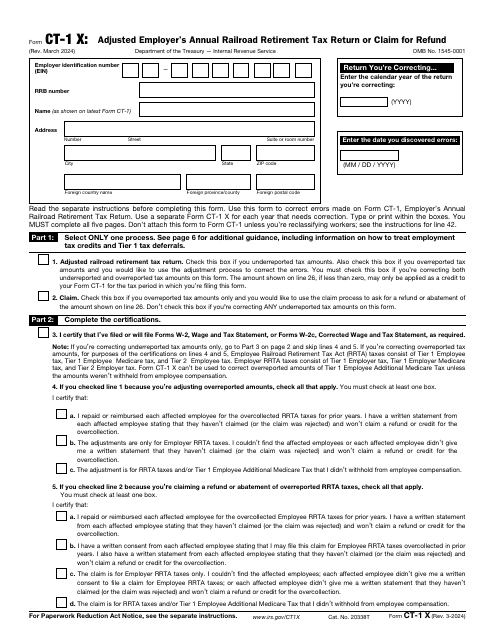

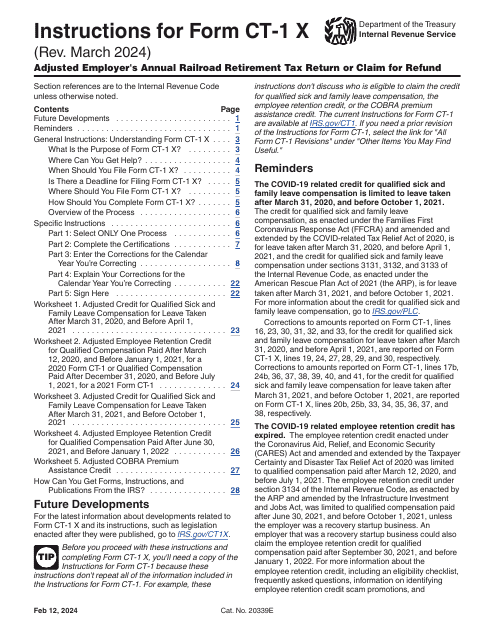

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

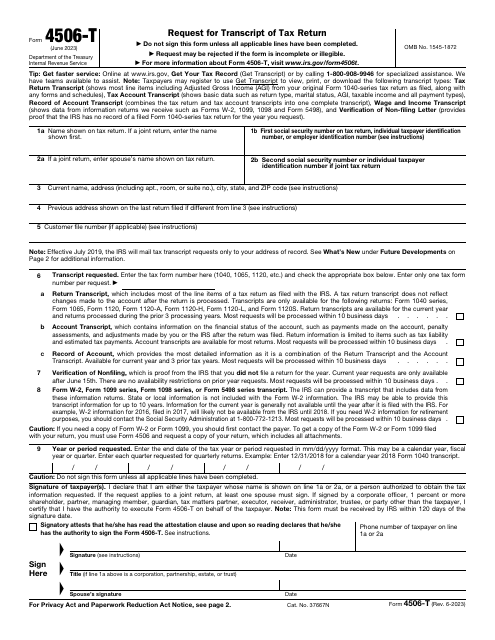

Fill in this form if you would like to request tax return information, such as different types of transcripts, a record of an account, and/or verification of nonfiling.

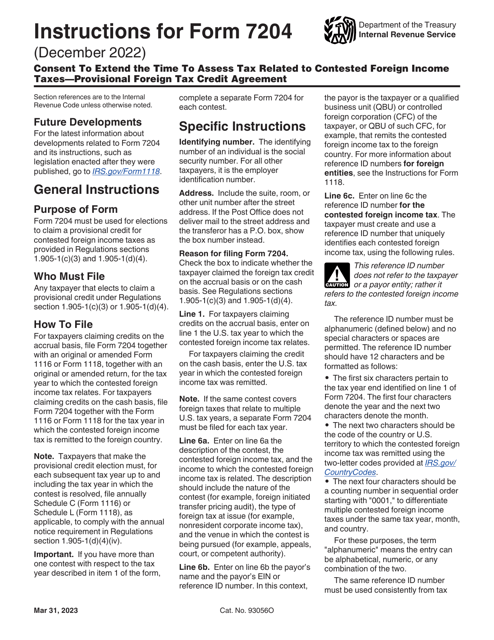

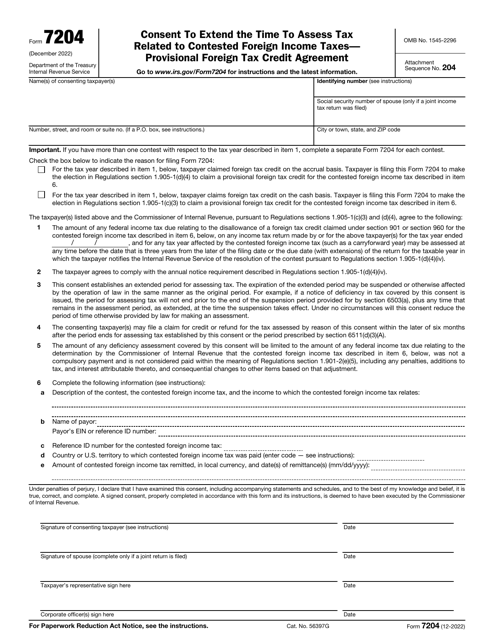

This Form is used to request an extension of time for assessing tax related to contested foreign income taxes. It involves a provisional foreign tax credit agreement.

This document is used for requesting an extension of time to assess tax related to contested foreign income taxes. It also includes a provisional foreign tax credit agreement.

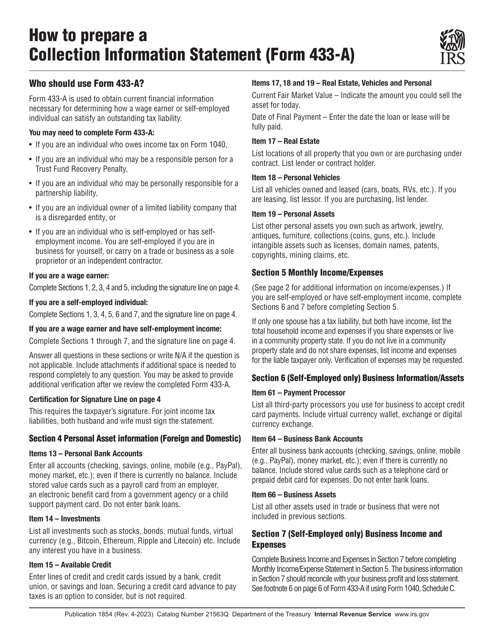

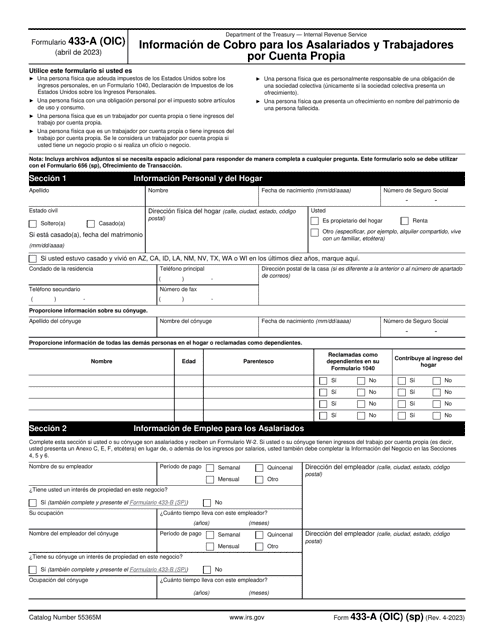

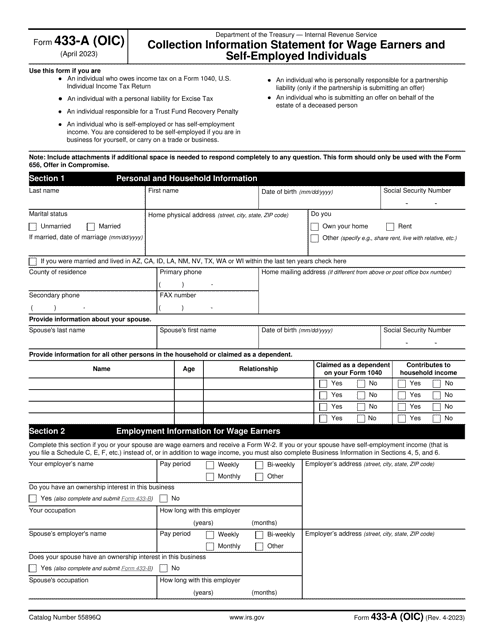

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

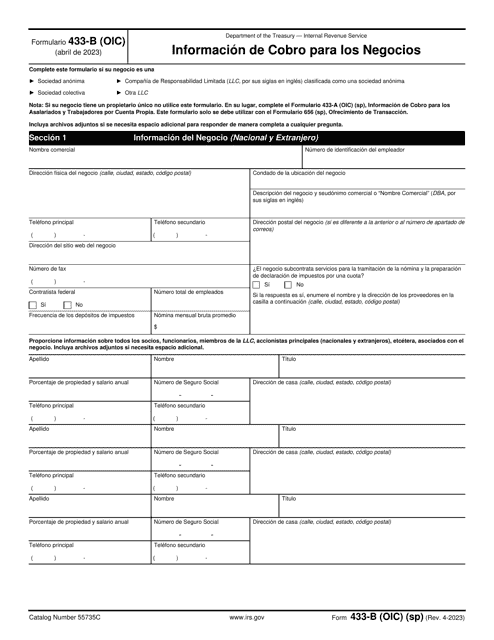

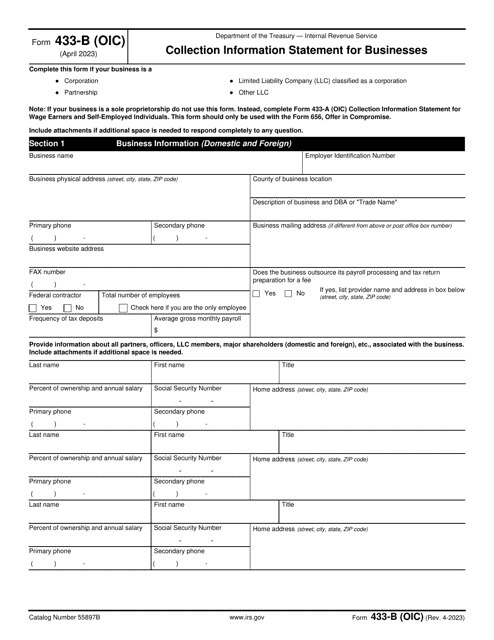

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

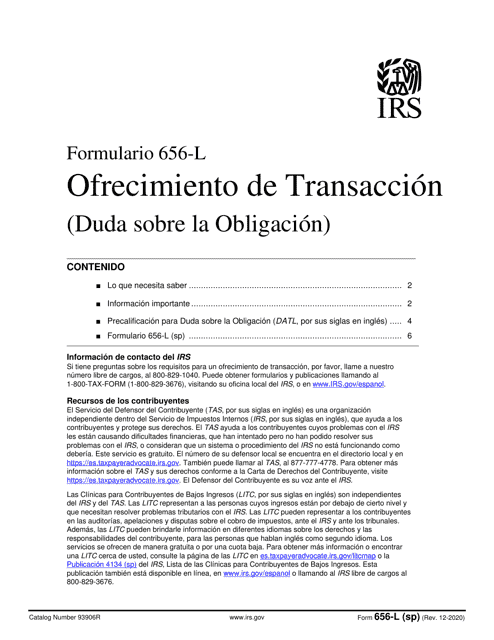

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.