U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

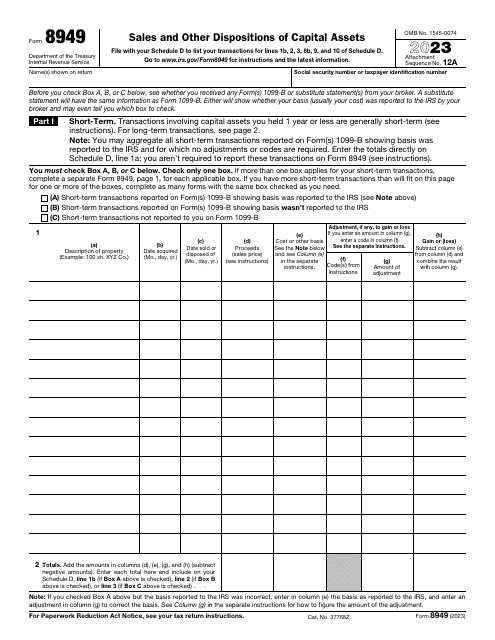

This is a legal document used to report exchanges and sales of capital assets, both long- and short-term capital gains and losses, to the IRS.

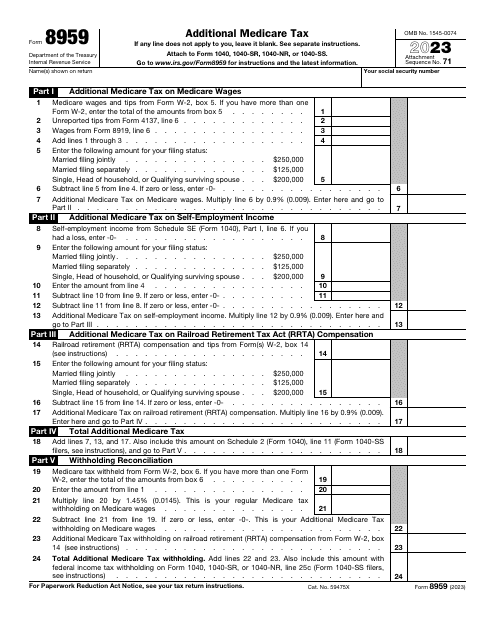

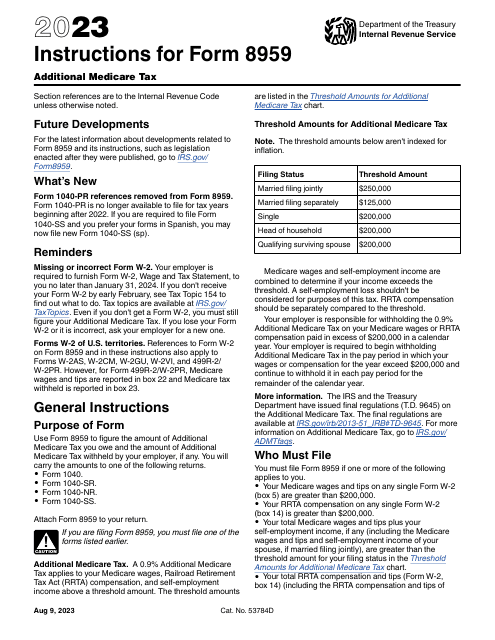

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

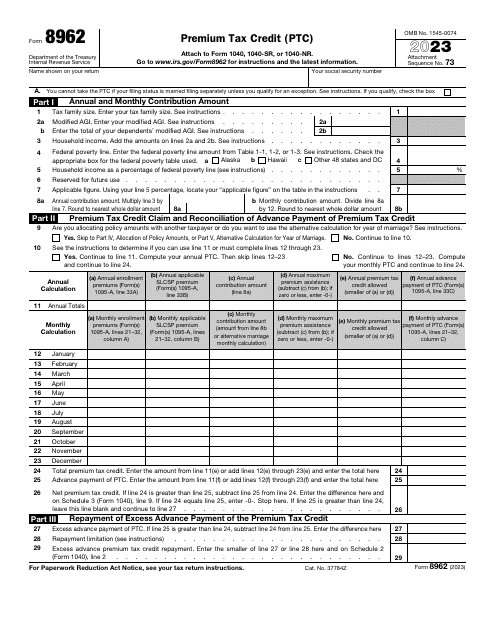

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.

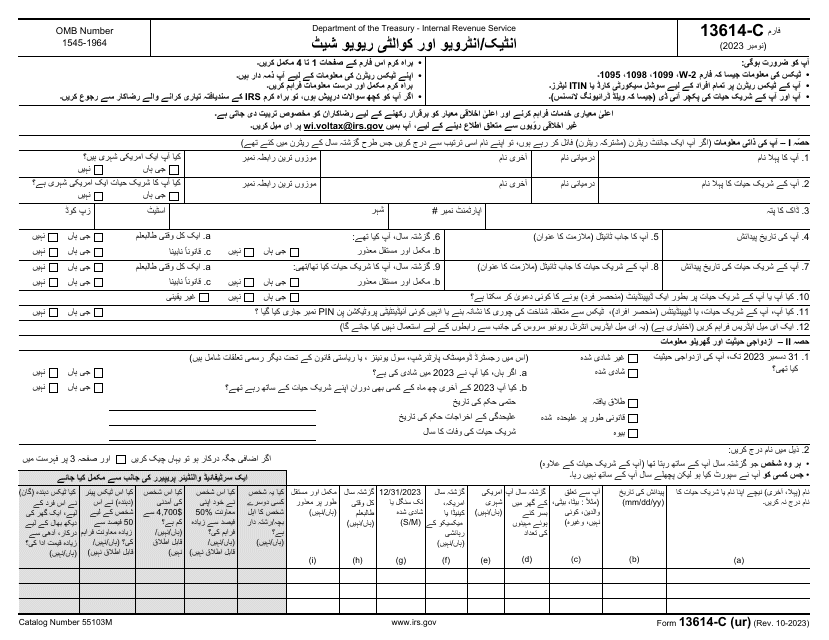

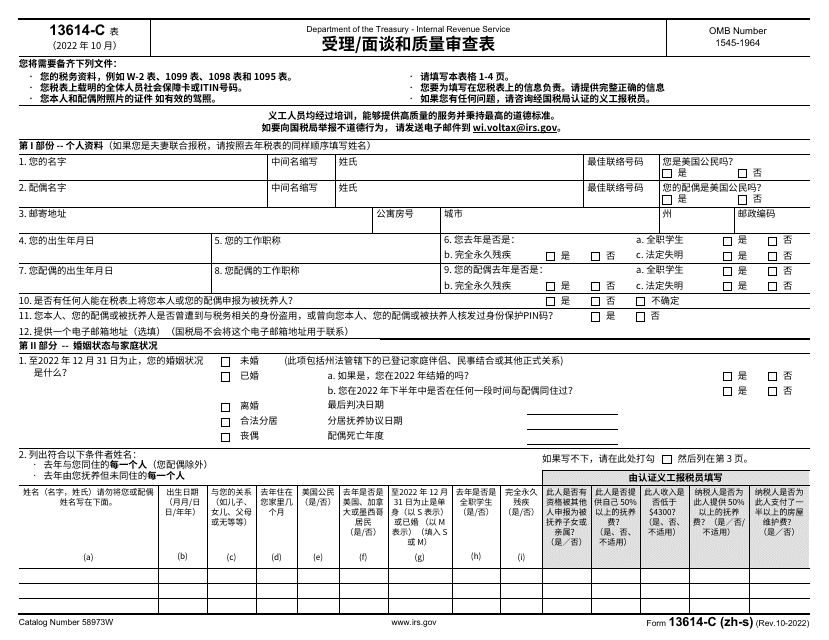

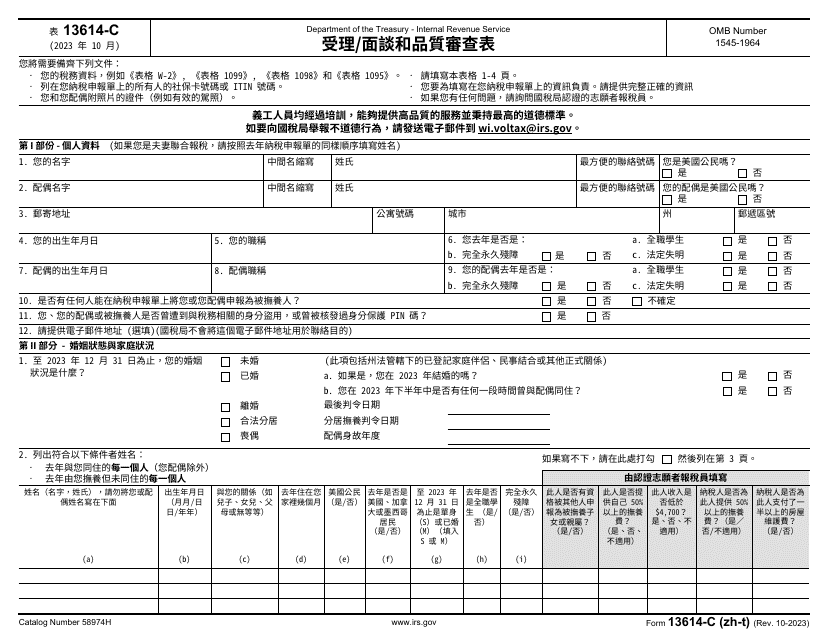

IRS Form 13614-C (ZH-C) is an Intake/Interview & Quality Review Sheet provided by the Internal Revenue Service. This form is specifically designed for Chinese Simplified speakers or individuals who prefer to communicate in this language. It is used to collect important information during intake interviews and quality reviews for tax purposes.

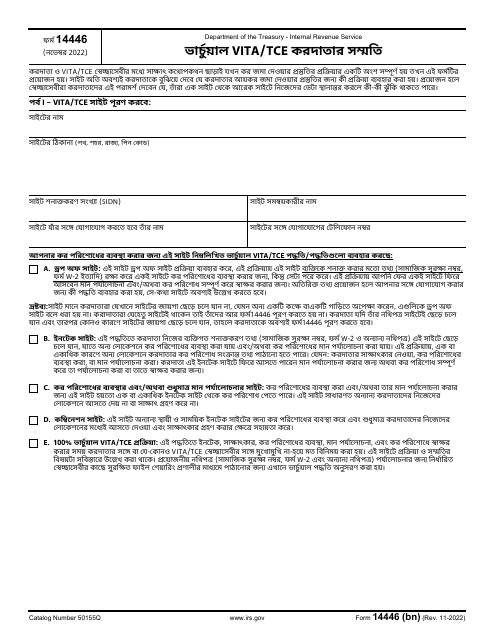

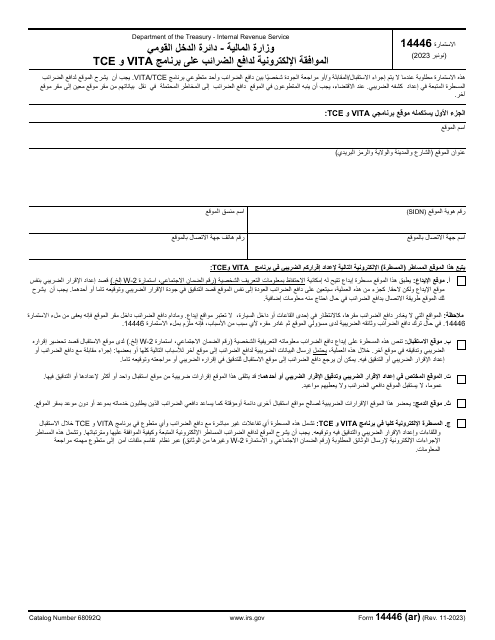

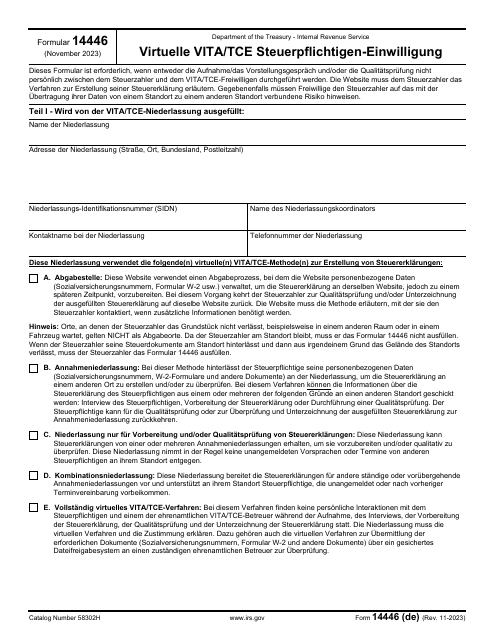

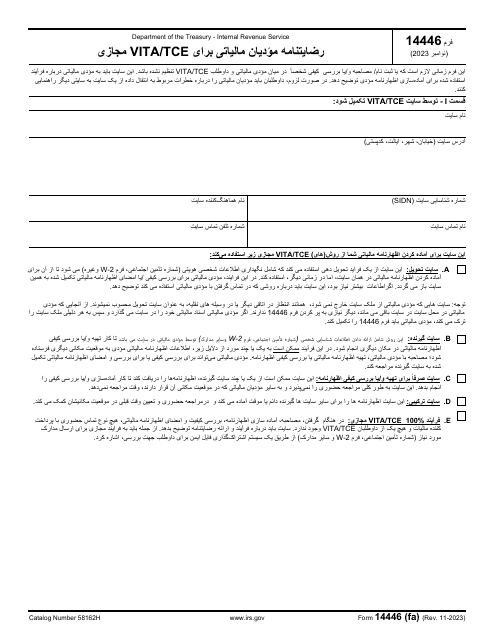

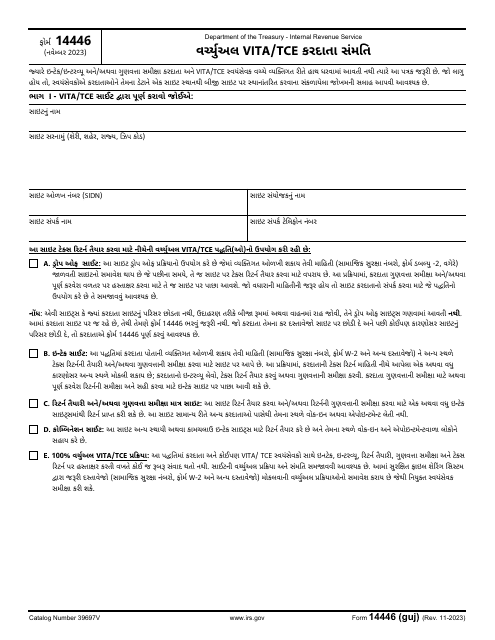

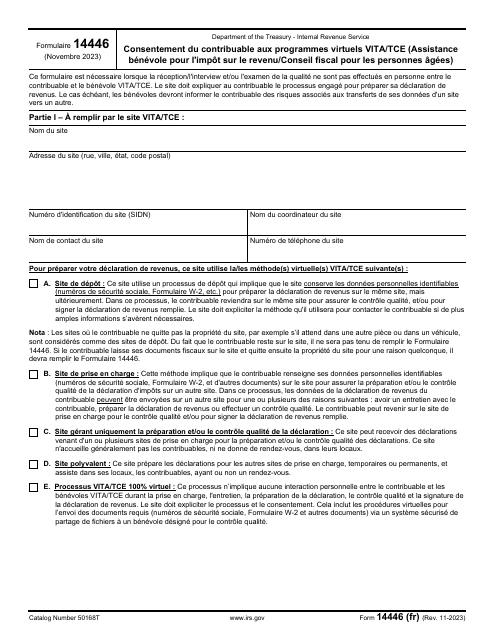

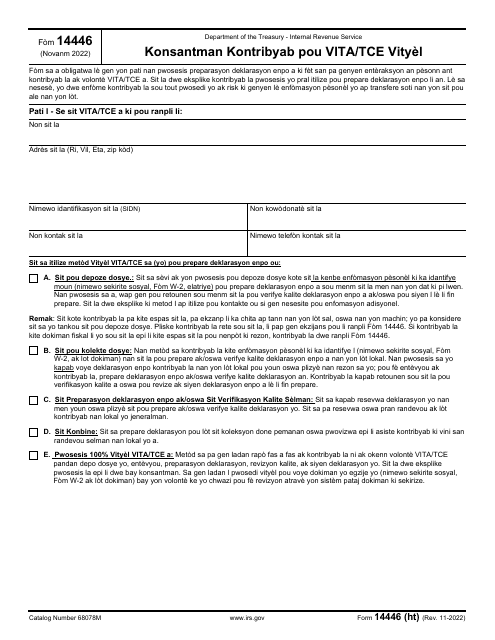

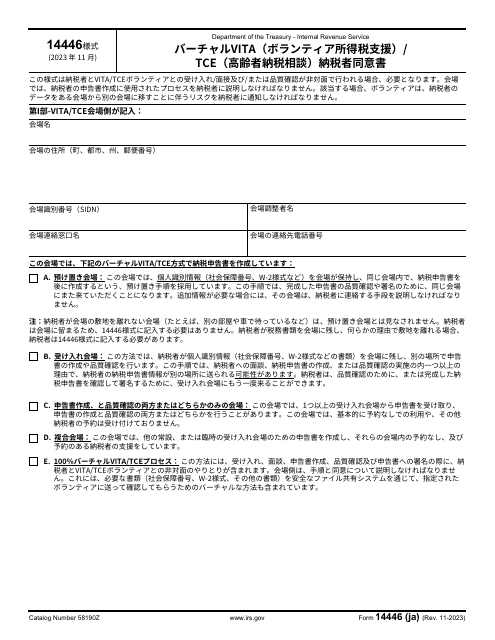

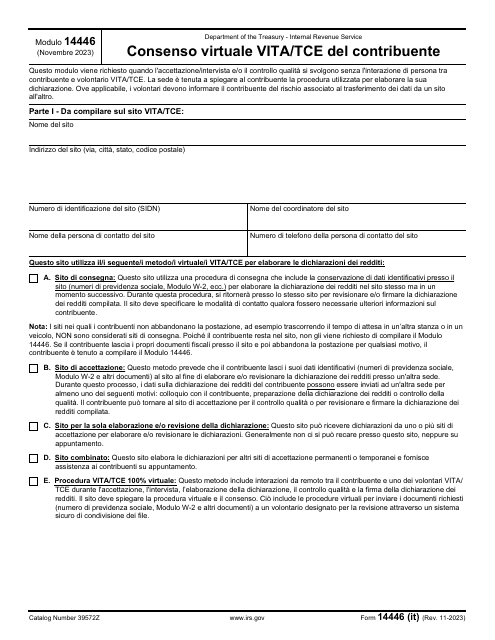

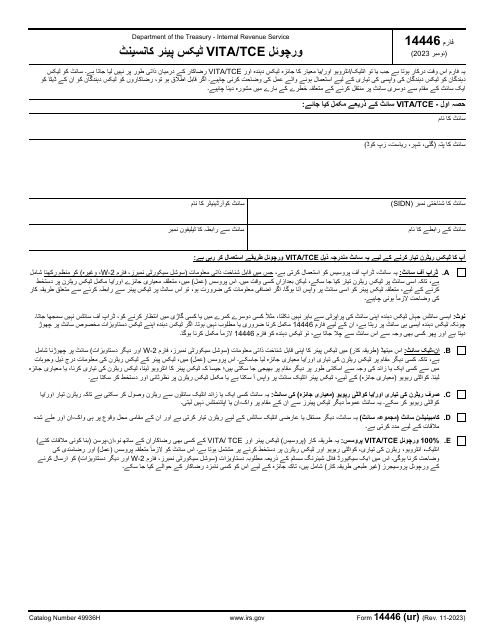

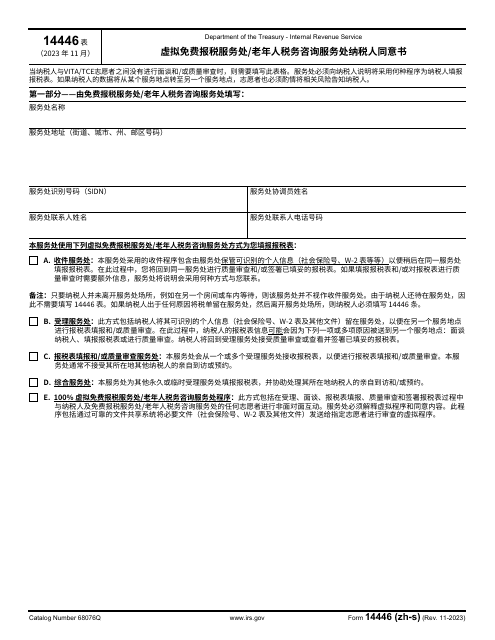

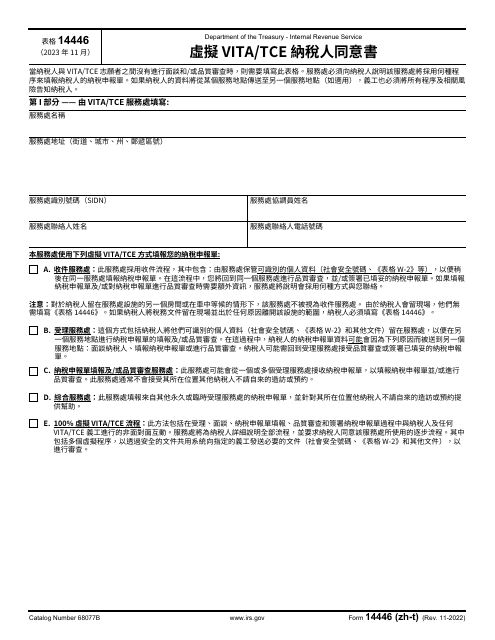

This form is used for obtaining taxpayer consent in Bengali language for the Virtual Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs conducted by the IRS.

This document is used for obtaining taxpayer consent in the Portuguese language for the IRS Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs conducted virtually.