U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

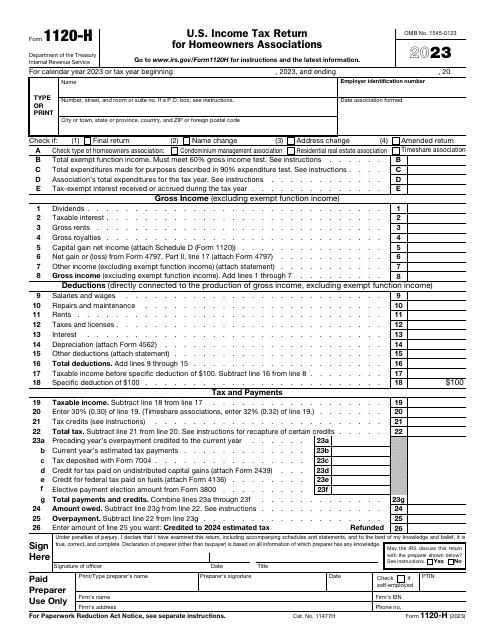

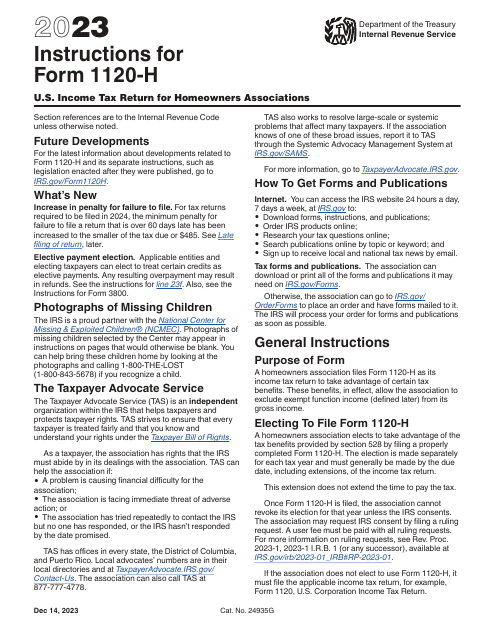

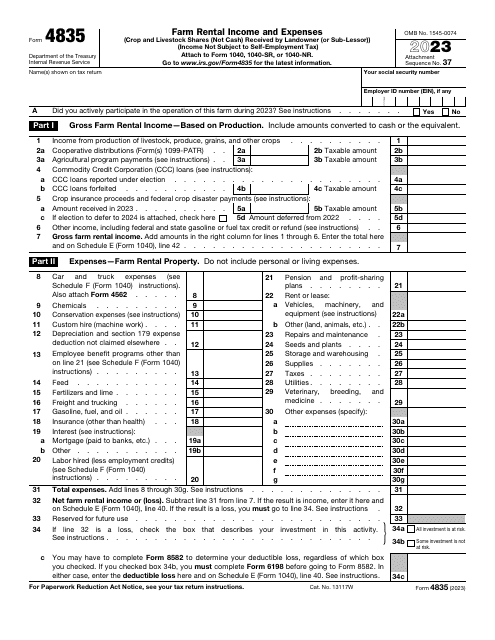

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

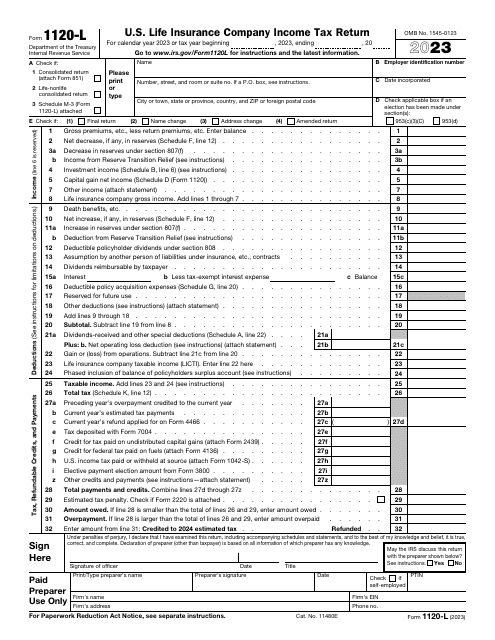

File this form if you are the owner of a domestic life insurance company to report to the IRS on your income, deductions, and credits for the tax year, and to figure your income tax liability.

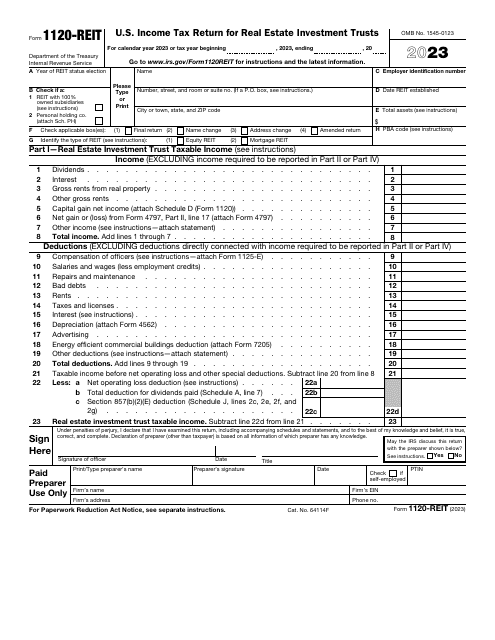

File this form if you are a corporation, trust, or an association electing to be treated as Real Estate Investment Trusts (REITs) in order to report your income, deductions, credits, penalties, as well as your income tax liability.

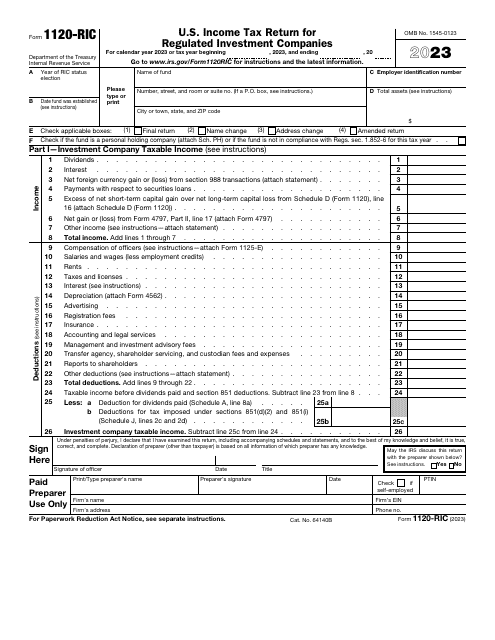

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

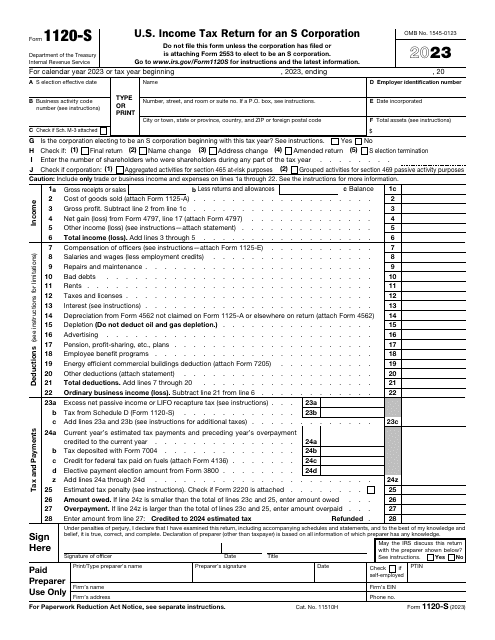

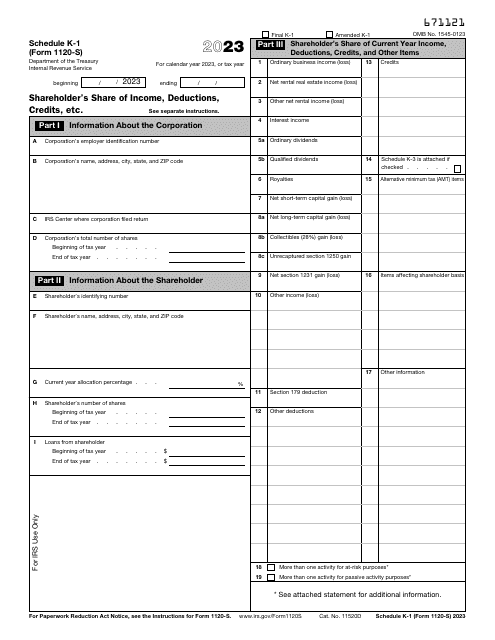

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

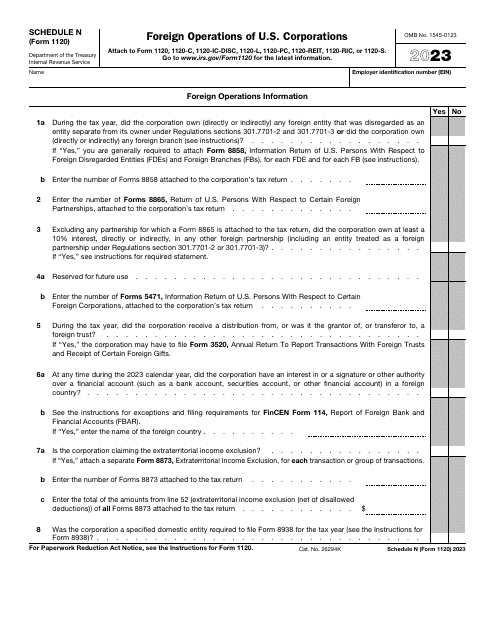

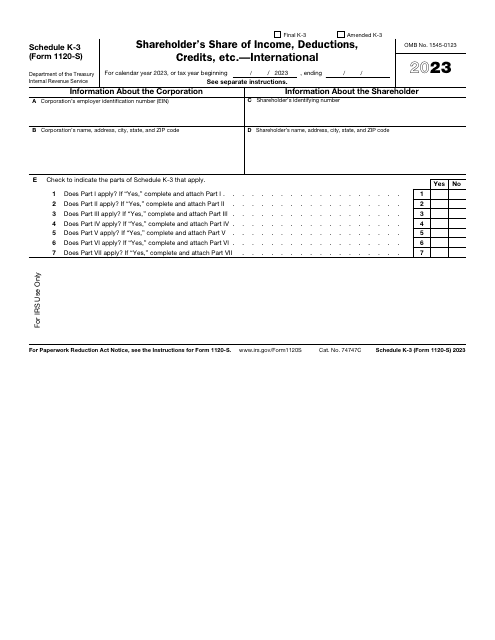

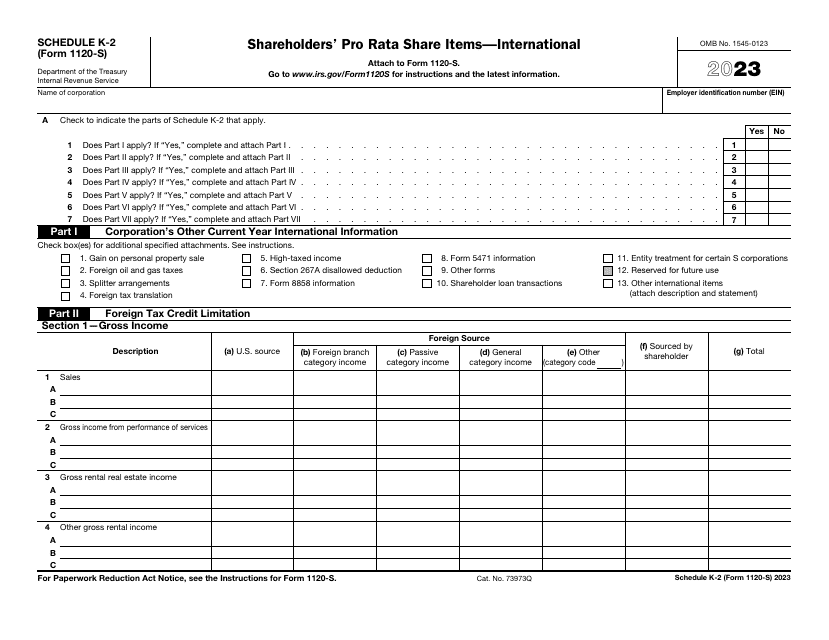

This is a fiscal form filled out by S corporations to inform the tax authorities about their international operations that are subject to tax.

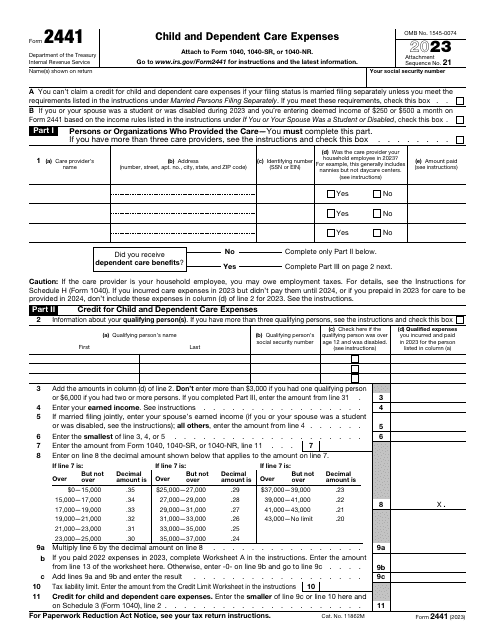

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

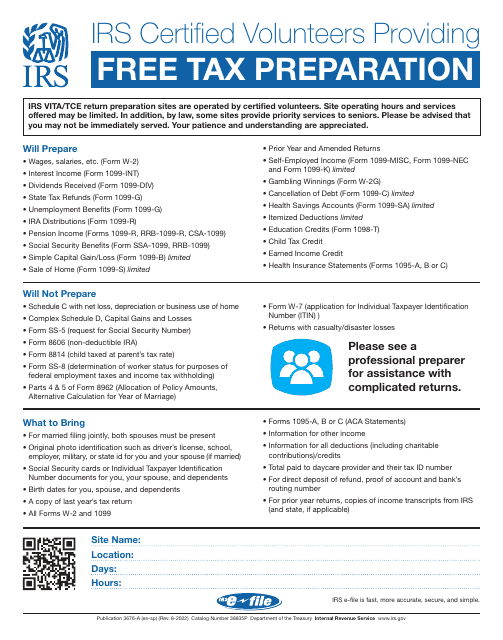

This document provides information about IRS-certified volunteers who offer free tax preparation services in both English and Spanish.

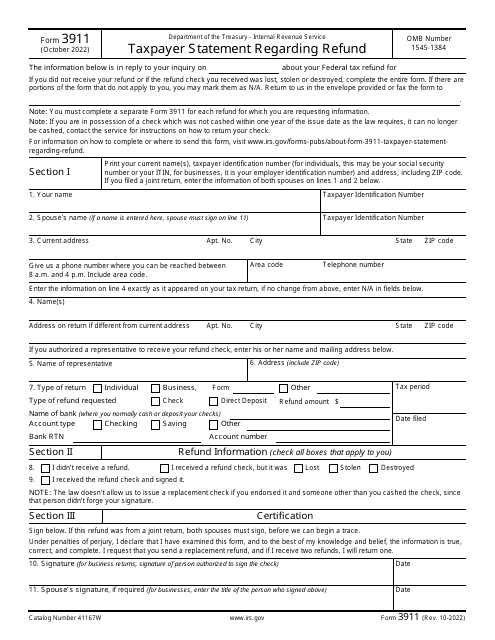

This is an IRS legal document completed by individuals who want to inquire about the status of an expected tax refund.

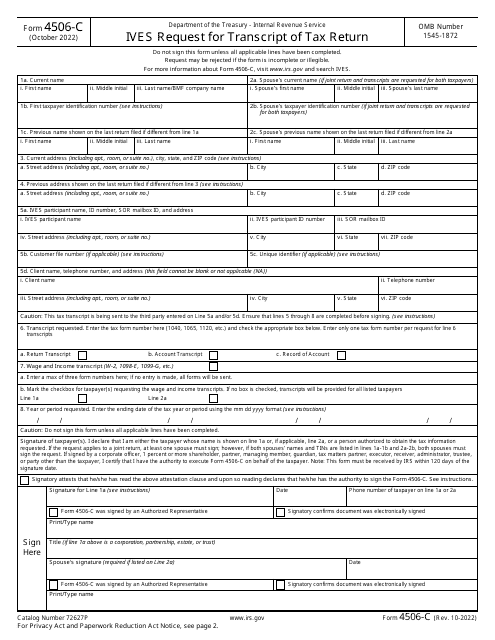

This is a legally binding form prepared by borrowers (individuals and companies alike) that are willing to provide their lenders with their tax return information coming from the tax authorities.

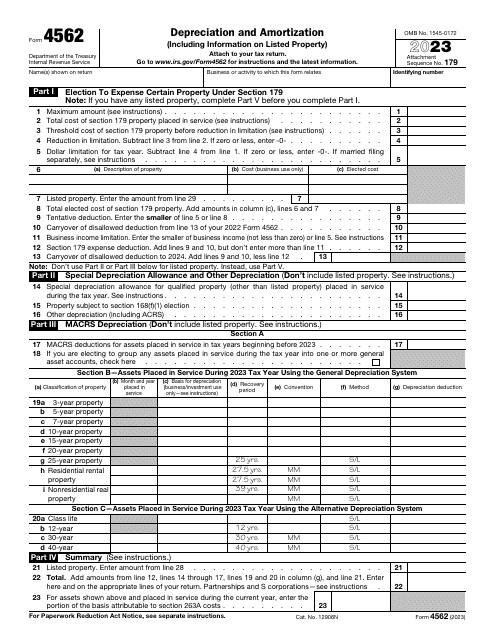

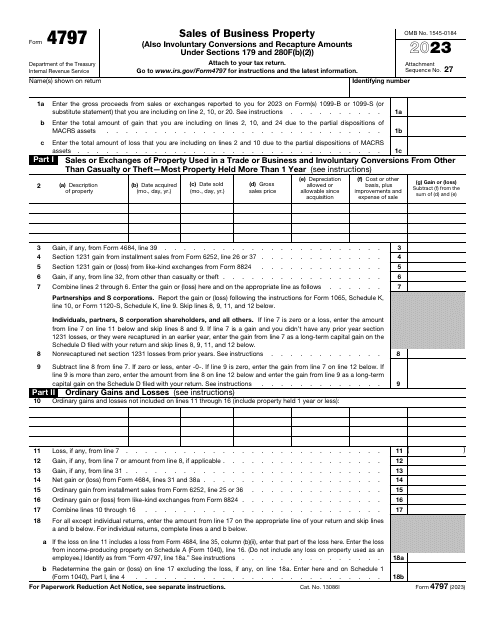

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

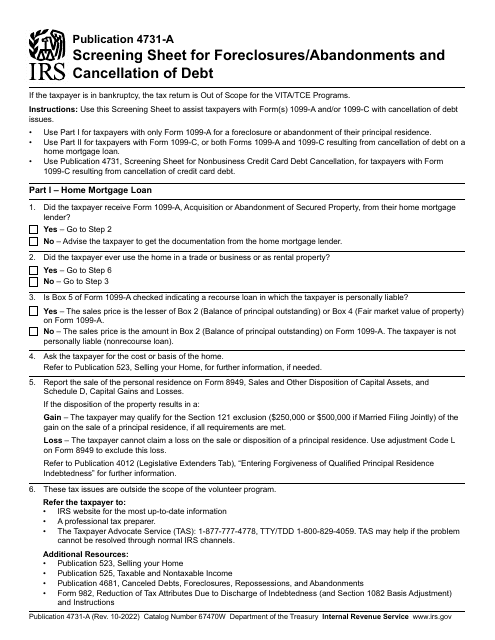

This form is used for screening foreclosures/abandonments and cancellation of debt for tax purposes.

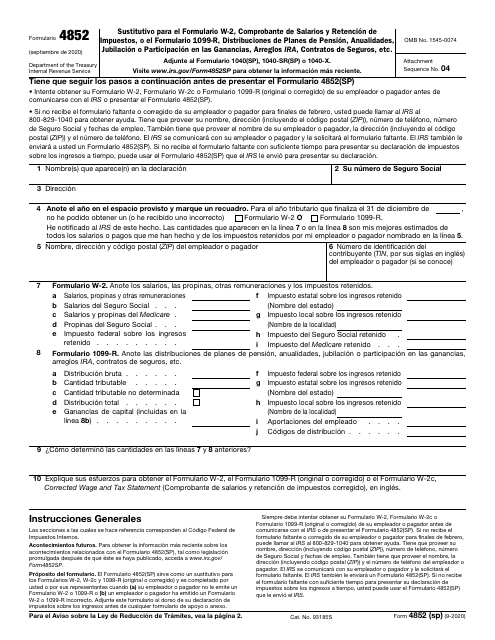

This Form is used for reporting wages and tax withholdings. It can also be used for reporting pension distributions, annuities, retirement income, IRA arrangements, insurance contracts, etc.

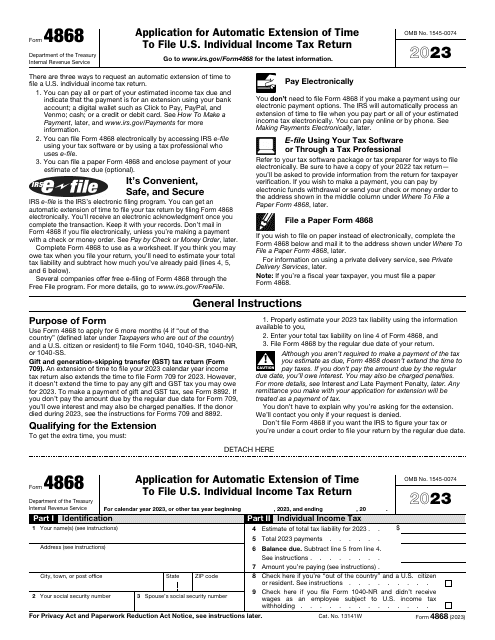

This is an IRS form that needs to be filled out to request an automatic extension to submit income tax return forms.

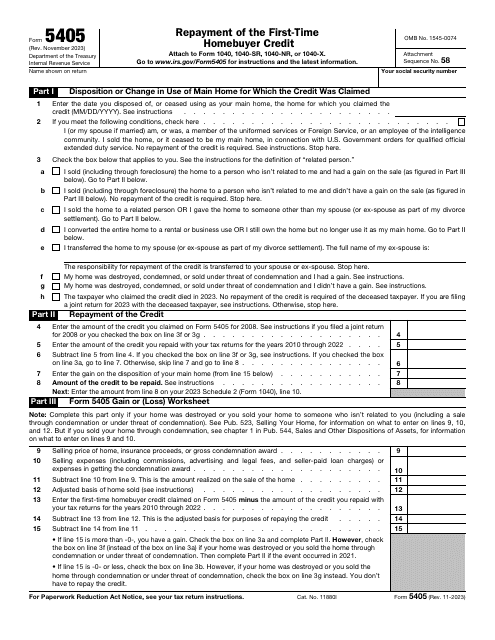

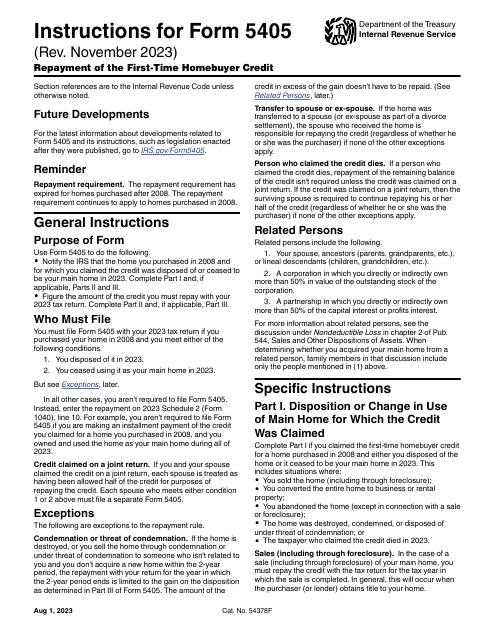

This is a fiscal instrument used by taxpayers who are responsible for computing and repaying the credit they used to purchase residential property in the past.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.