U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

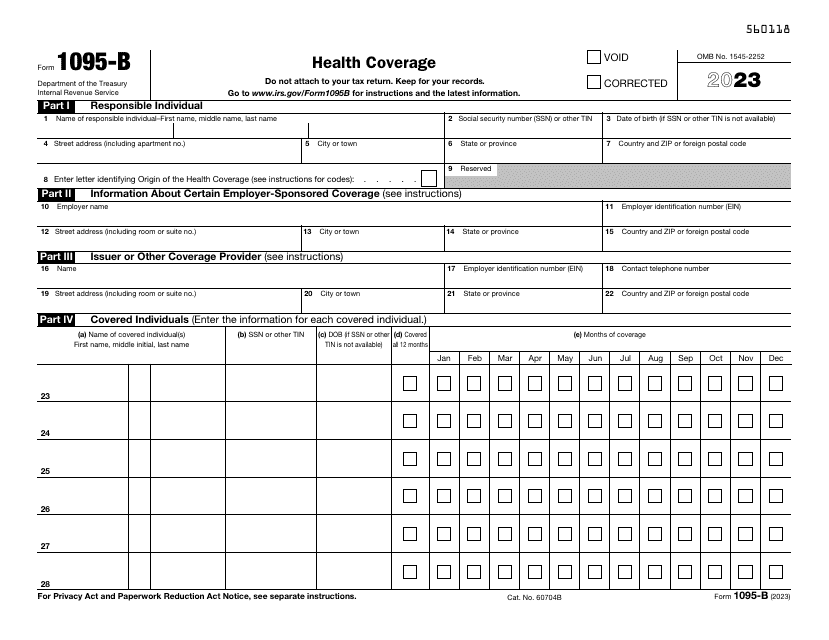

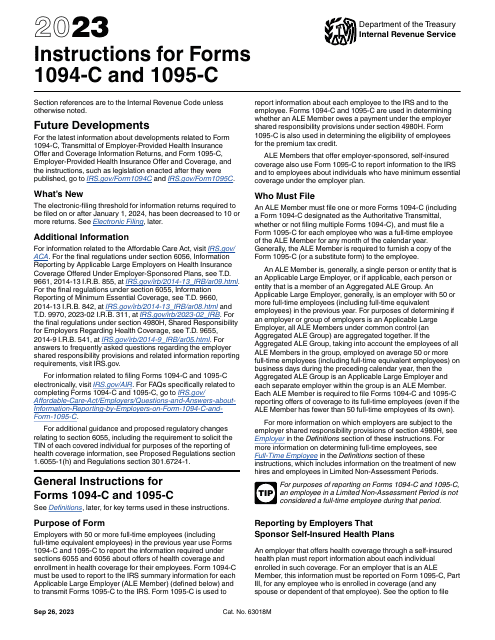

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

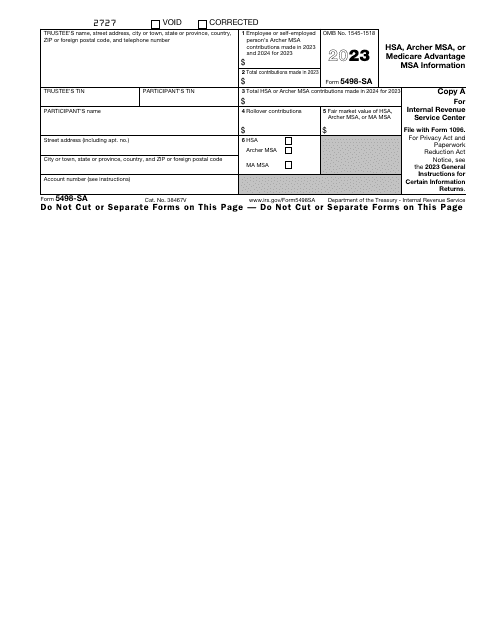

This is a formal document used by particular healthcare-related savings account custodians and trustees to furnish information about the contributions made to those accounts.

This is an IRS form that includes the details of an installment sale.

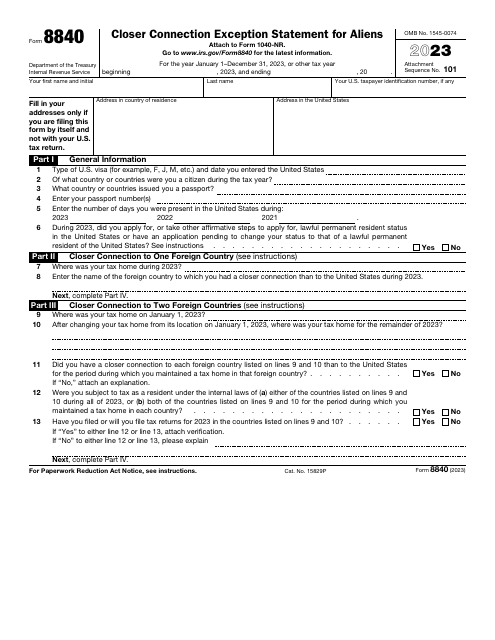

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

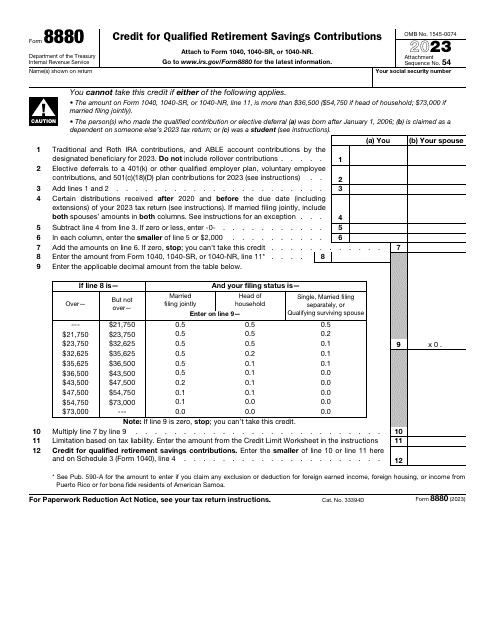

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

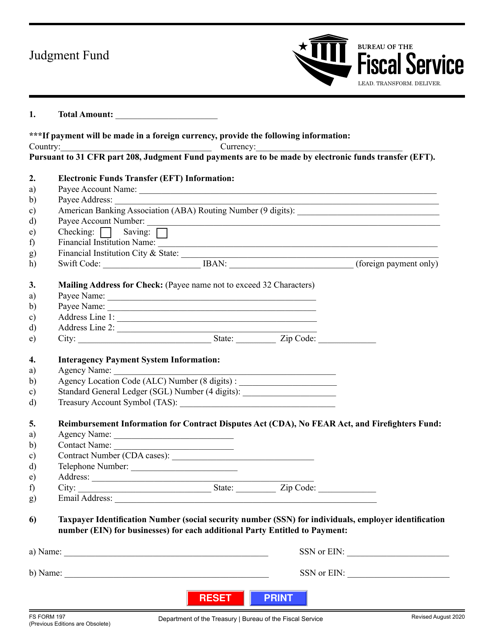

This document is used for submitting a voucher for payment from the Judgment Fund.

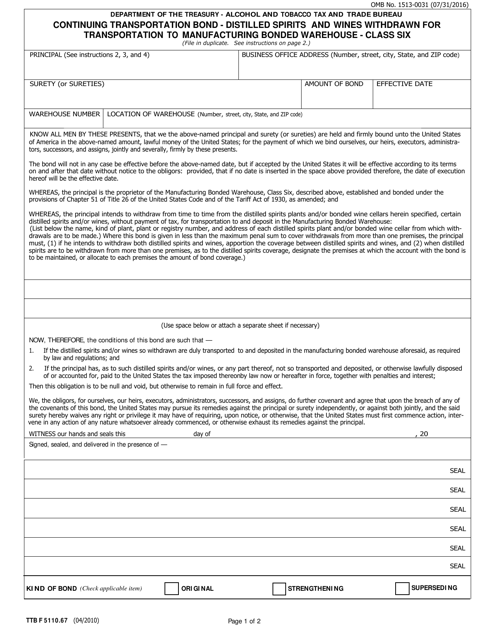

This form is used for continuing transportation bonds for distilled spirits and wines that are being withdrawn for transportation to a manufacturing bonded warehouse.

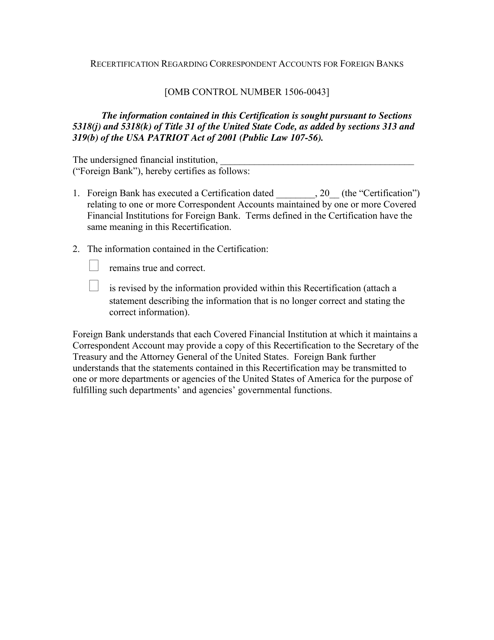

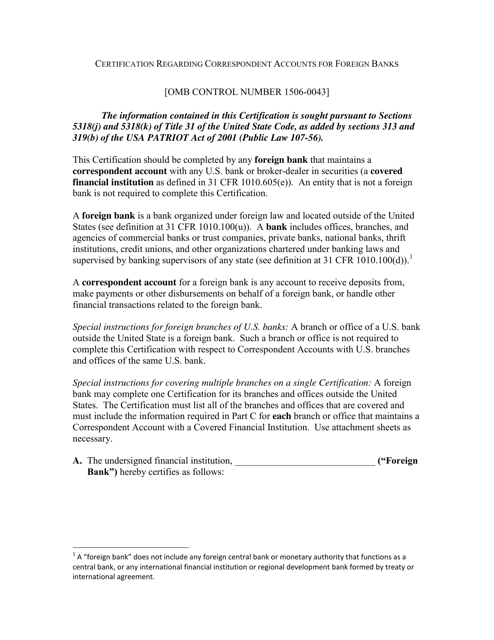

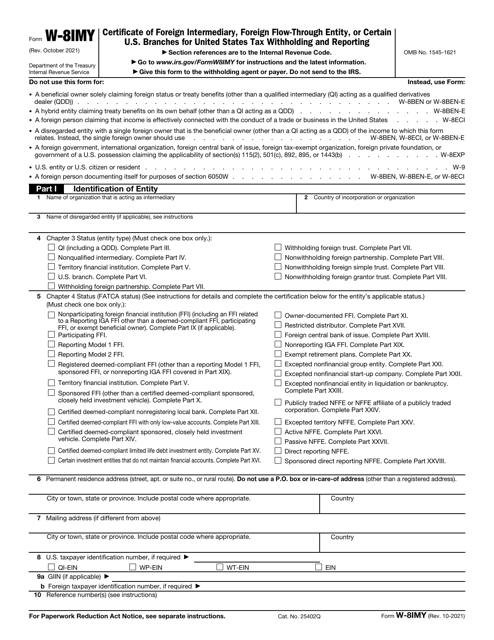

This document is used for recertifying correspondent accounts held by foreign banks.

This document certifies the existence of correspondent accounts for foreign banks in the United States. It ensures compliance with regulatory requirements for these accounts.

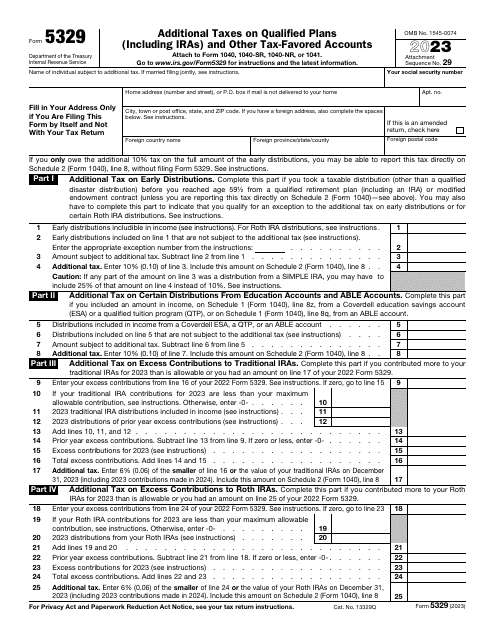

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

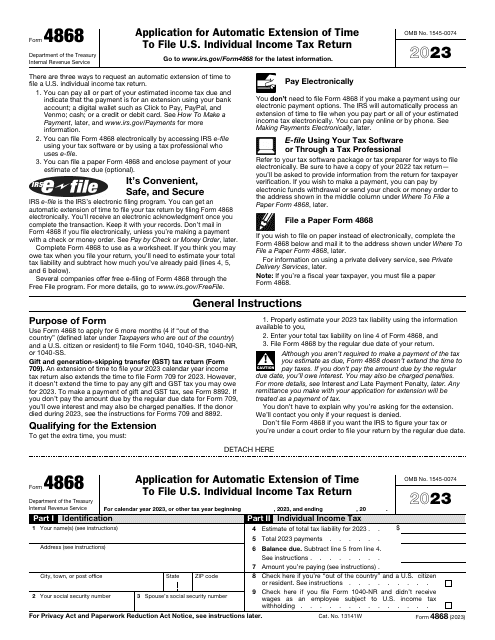

This is an IRS form that needs to be filled out to request an automatic extension to submit income tax return forms.

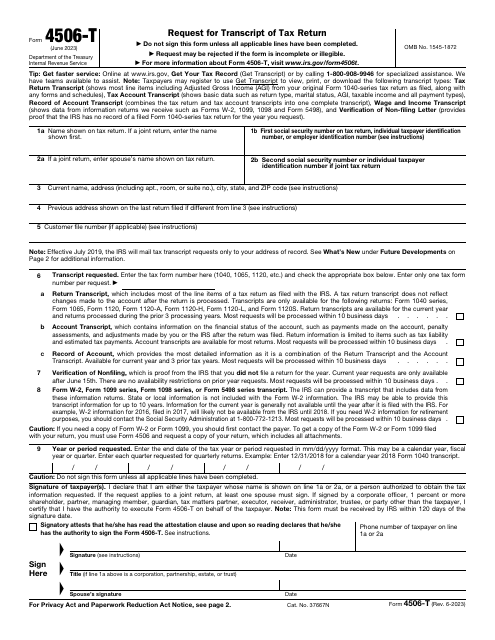

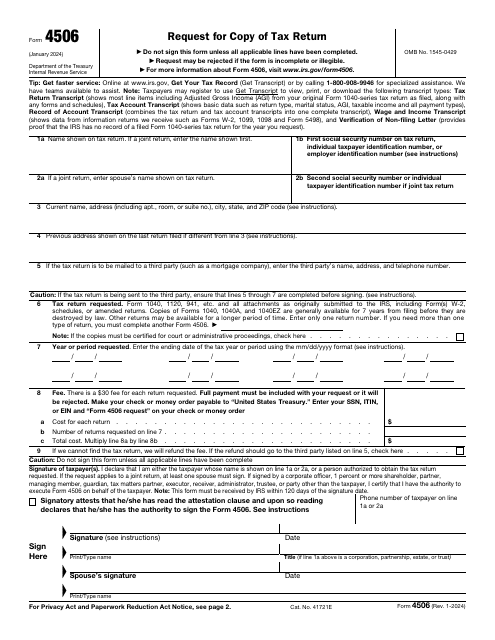

Fill in this form if you would like to request tax return information, such as different types of transcripts, a record of an account, and/or verification of nonfiling.

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.