Fill and Sign FIRPTA Forms

What Is the FIRPTA Withholding Tax?

A " FIRPTA Form " is an umbrella term for all paperwork related to a situation when a foreign citizen (also called a transferor) disposes of a United States real property interest and, consequently, pays taxes. The Foreign Investment in Real Property Tax Act of 1980 (or FIRPTA) is the law that authorizes the United States to withhold income tax on foreign persons when they dispose of United States real property interests. A disposition includes - but is not limited to - a sale, gift, transfer, liquidation, redemption, etc.

This federal law was designed to ensure that income taxes are collected when foreign owners sell real estate or foreign investors sell shares in entities that own real property.

Buyers or transferees are required to find out if the transferor is a foreign citizen and, if that is the case, to withhold 15 percent (10 percent for dispositions prior to February 17, 2016) of the amount realized on the disposition. If the buyer fails to withhold, they may be held liable for the tax. When a United States business disposes of a United States real property interest, the business entity itself shall be the withholding agent.

There are two FIRPTA forms the buyer must use to report and pay any tax withheld on these acquisitions to the Internal Revenue Service after registering and receiving the required certification:

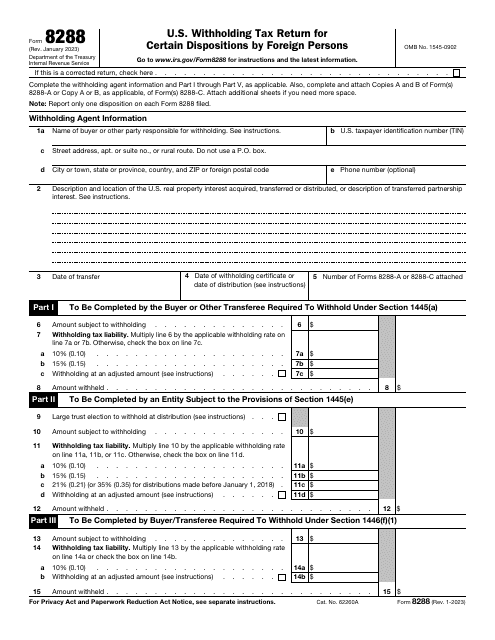

- IRS Form 8288, U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests;

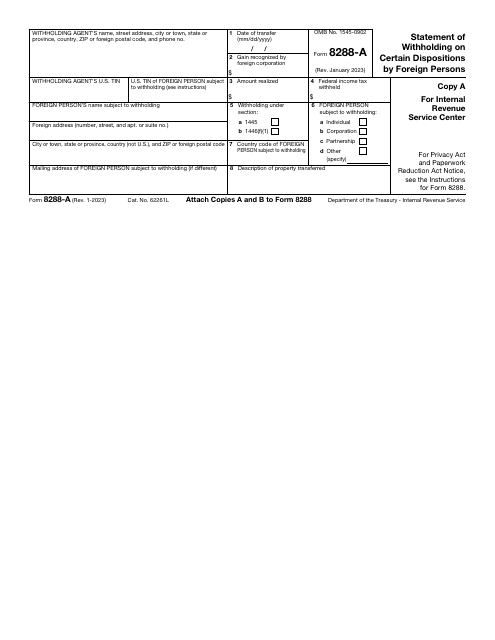

- IRS Form 8288-A, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests.

In general, the buyer or withholding agent must file Form 8288 by the 20th day after the date of the transfer and prepare a Form 8288-A for each person from whom the tax has been withheld.

Related Articles

Documents:

4

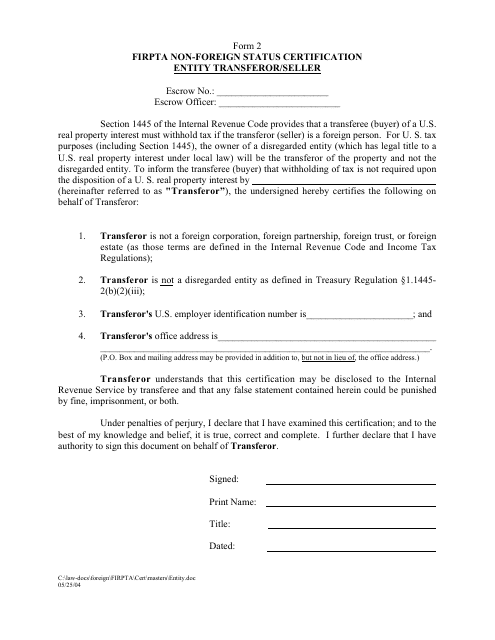

This document certifies the non-foreign status of an entity that is selling or transferring a property under the Foreign Investment in Real Property Tax Act (FIRPTA).

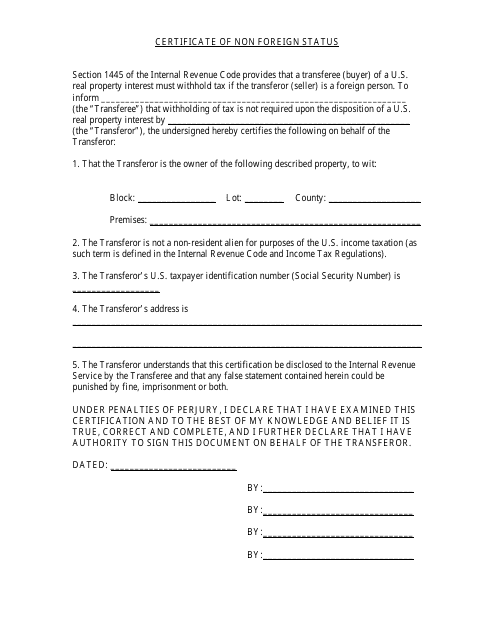

This document is used to certify that the seller of a US real estate property is a non-foreign person for tax purposes. It helps ensure compliance with the Foreign Investment in Real Property Tax Act (FIRPTA).

This is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.