Maine Tax Forms and Templates

Maine Tax Forms are used to report and calculate income, deductions, and taxes owed to the state of Maine. These forms are necessary for individuals and businesses who have taxable income in Maine to accurately report their financial information and determine their state tax liability.

Documents:

96

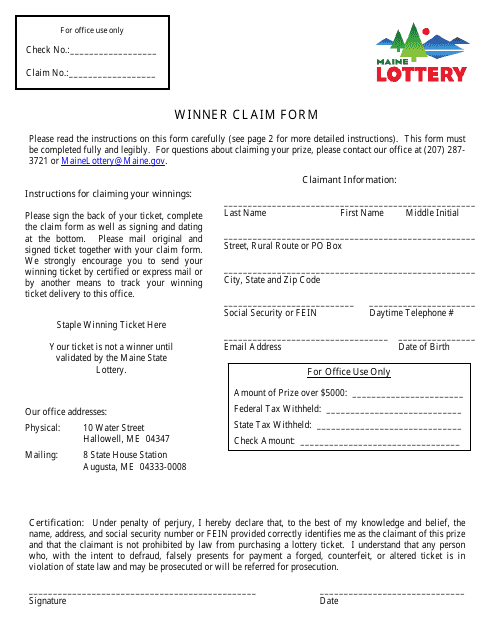

This document is used to claim winnings from the Maine State Lottery in the state of Maine.

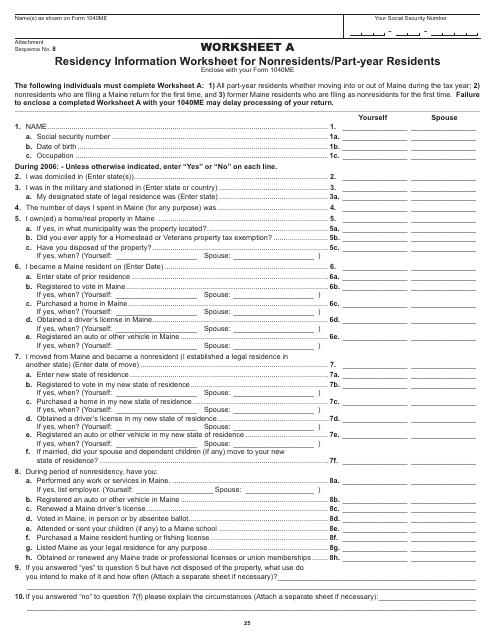

This document is a worksheet for nonresidents or part-year residents in Maine to provide information about their residency status. It helps determine their tax obligations.

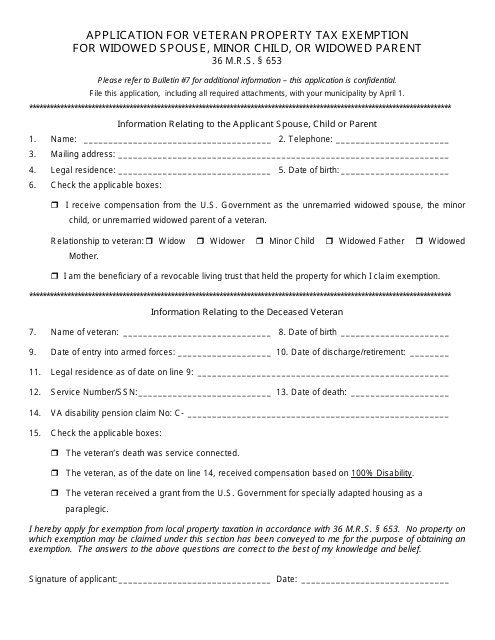

This form is used for applying for a property tax exemption in Maine for the widowed spouse, minor child, or widowed parent of a veteran.

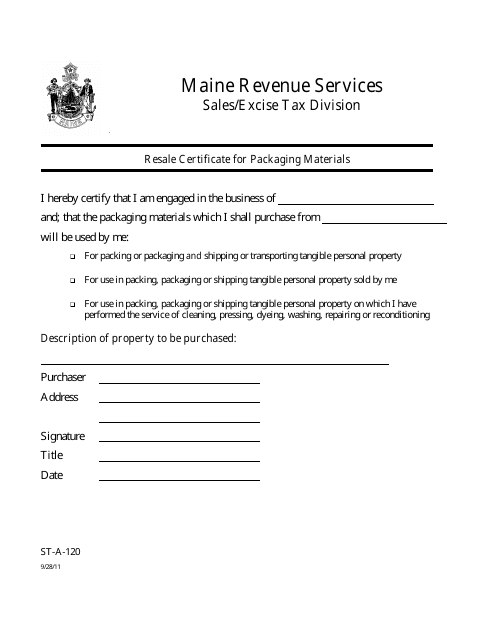

This form is used for obtaining a resale certificate to exempt sales tax on packaging materials in the state of Maine.

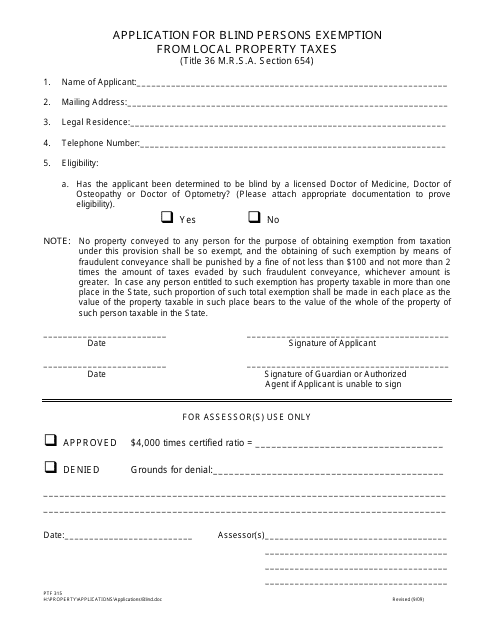

This form is used for applying for an exemption from local property taxes in Maine for blind persons.

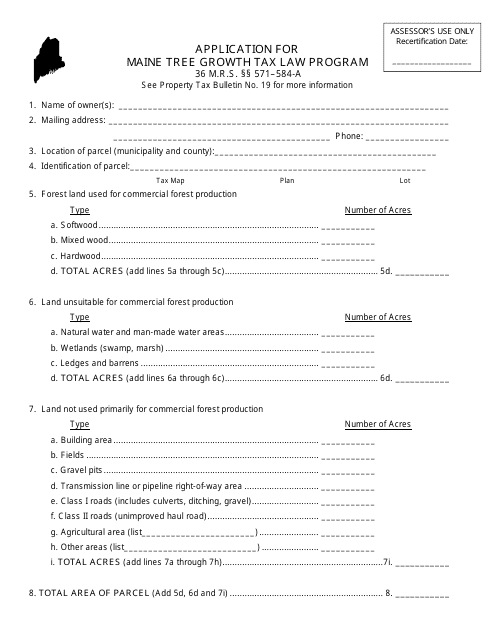

This document is an application form for the Maine Tree Growth Tax Law Program, a program in the state of Maine that provides tax incentives for landowners who actively manage their forest lands for timber production.

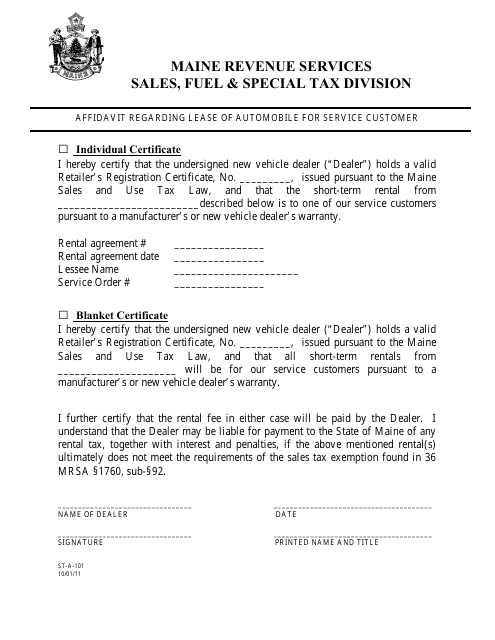

This form is used for documenting an affidavit regarding the lease of an automobile for a service customer in the state of Maine.

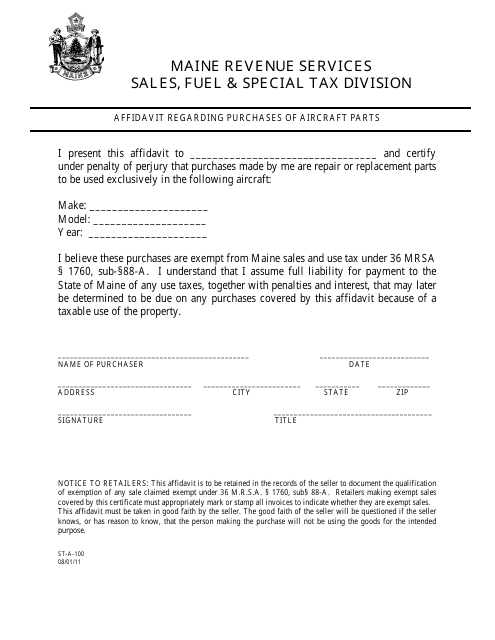

This form is used for filing an affidavit regarding purchases of aircraft parts in the state of Maine. It is required when purchasing aircraft parts and helps ensure compliance with tax laws.

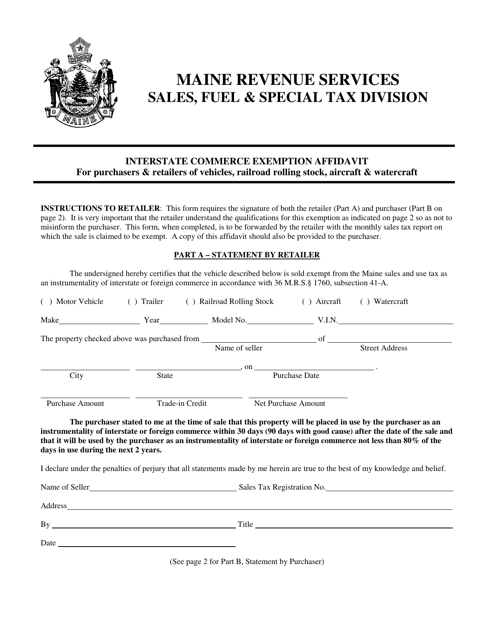

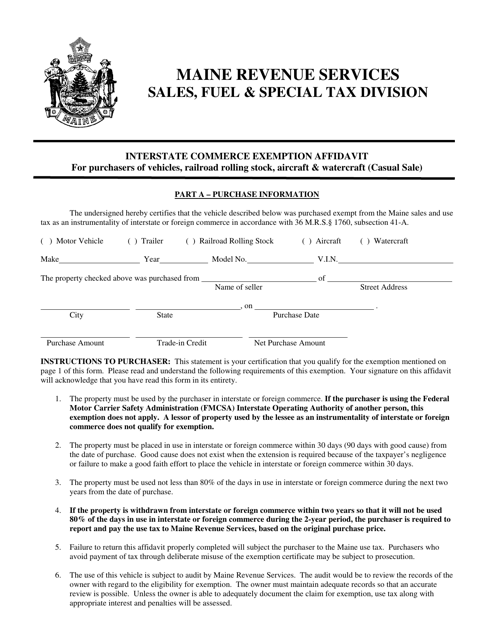

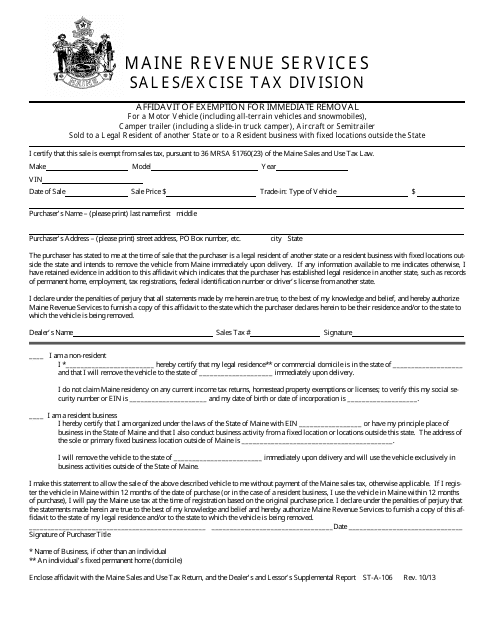

This form is used for requesting an exemption for immediate removal in the state of Maine. It is an affidavit that must be filled out to argue for the exemption.

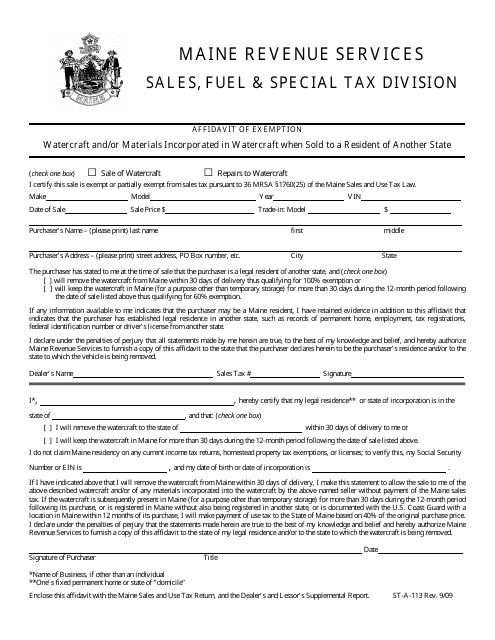

This form is used for individuals in Maine to declare their watercraft as exempt from certain requirements or fees.

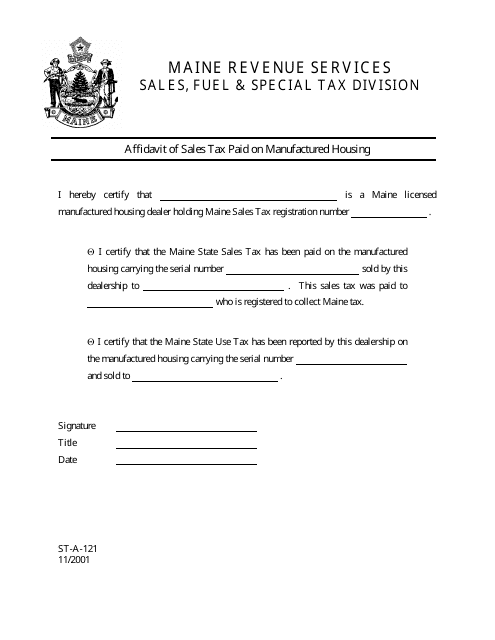

This Form is used for declaring the sales tax paid on manufactured housing in the state of Maine.

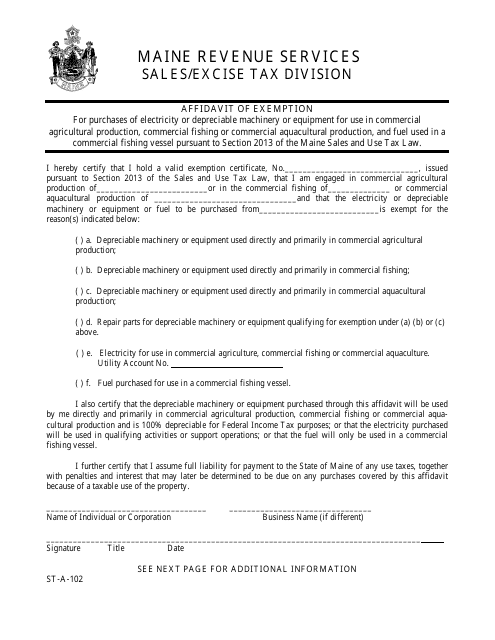

This form is used for filing an affidavit of exemption in the state of Maine. It is a document that allows individuals to claim exemption from certain requirements or obligations.

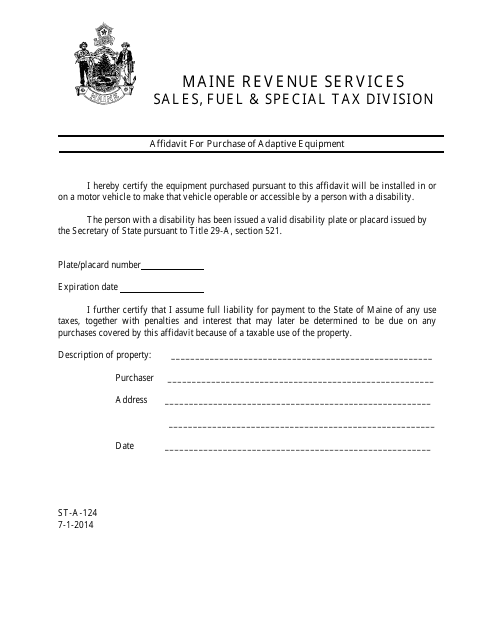

This form is used for submitting an affidavit when purchasing adaptive equipment in the state of Maine.

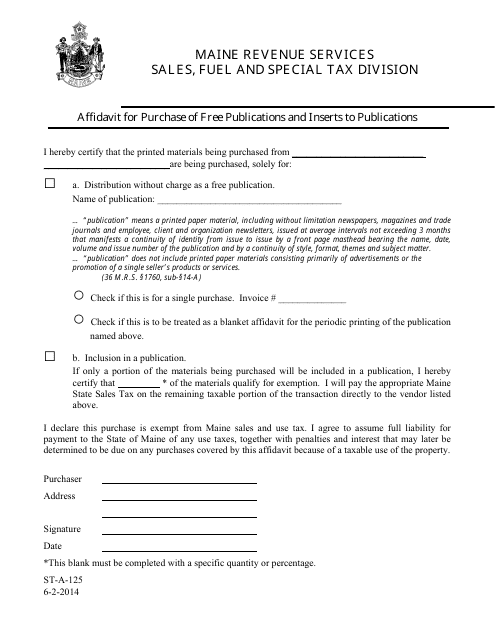

This Form is used for filing an affidavit for the purchase of free publications and inserts to publications in the state of Maine.

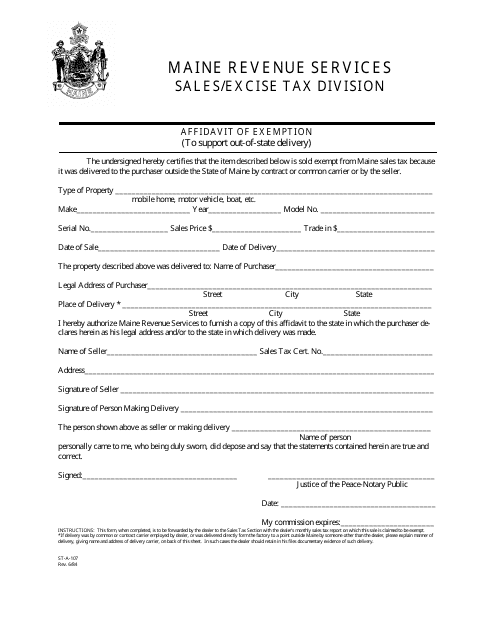

This document is used for claiming an exemption from sales tax for out-of-state deliveries in Maine.

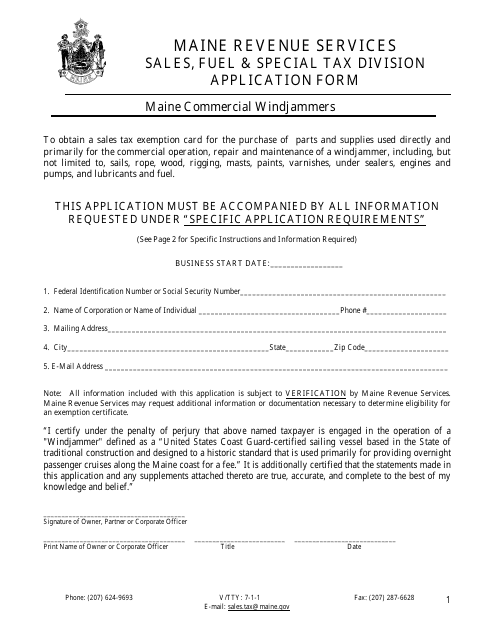

This form is used for applying for an exemption for Maine Commercial Windjammers in Maine.

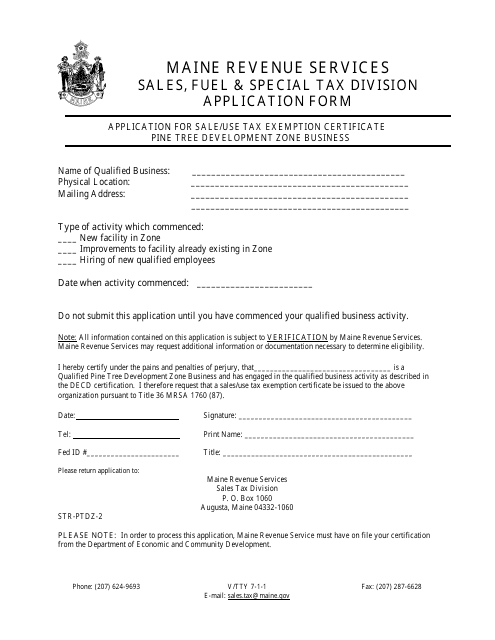

This form is used for applying for a Sale/Use Tax Exemption Certificate for Pine Tree Development Zone businesses in Maine.

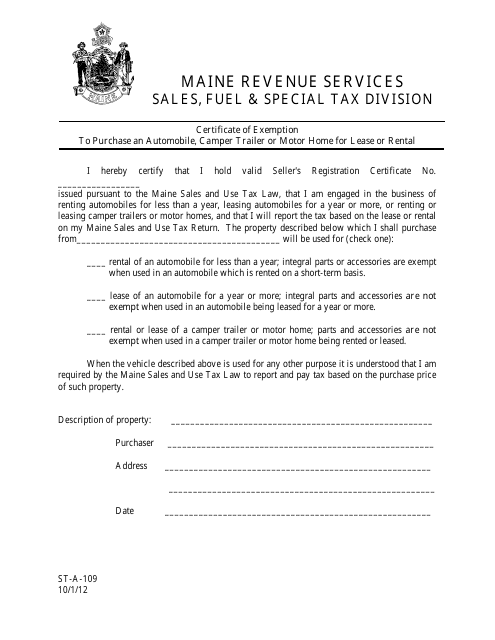

This form is used for obtaining a certificate of exemption to purchase an automobile, camper trailer, or motor home for lease or rental purposes in the state of Maine.

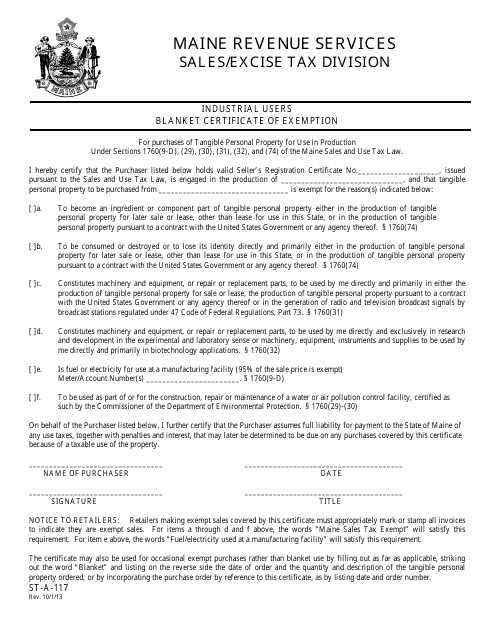

This Form is used for Industrial Users to claim exemption from certain taxes in the state of Maine.

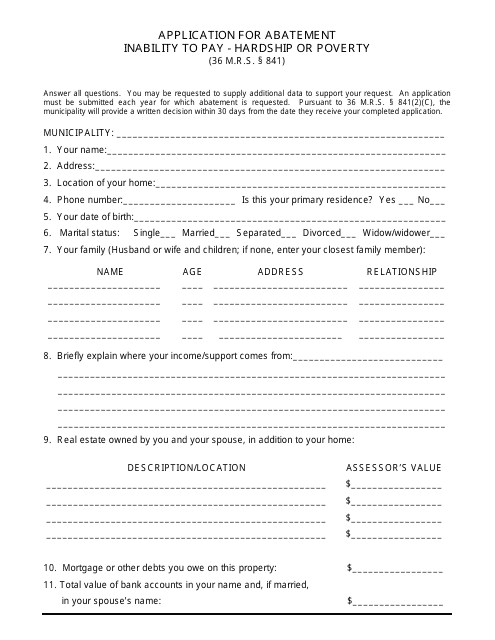

This Form is used for requesting a reduction or elimination of taxes owed to the State of Maine due to financial hardship or poverty.

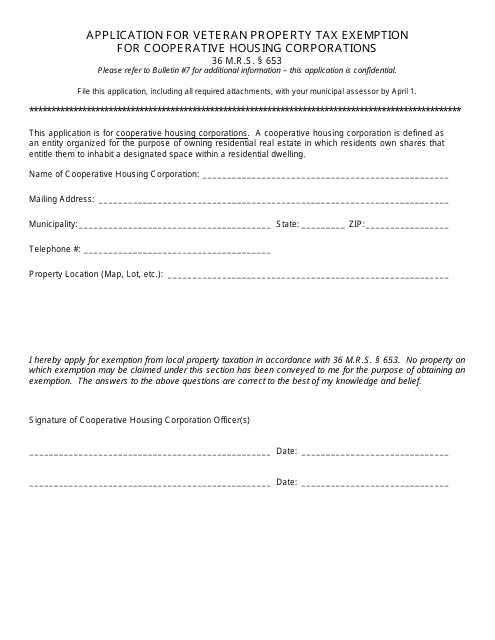

This form is used for applying for a property tax exemption for veteran residents of cooperative housing corporations in the state of Maine.

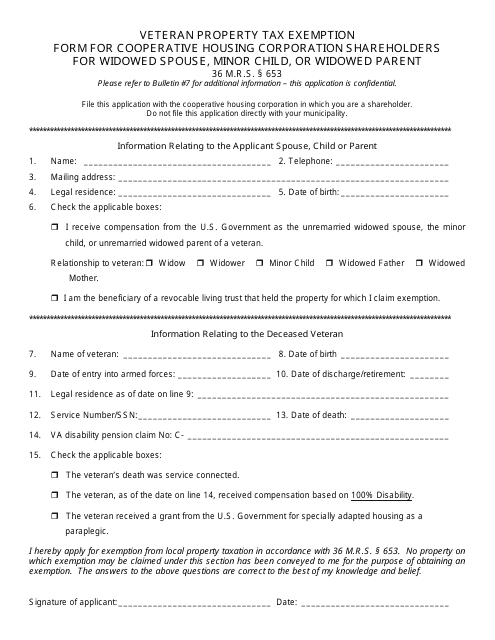

This Form is used for claiming property tax exemption for widowed spouses, minor children, or widowed parents who are shareholders of cooperative housing corporations in Maine.

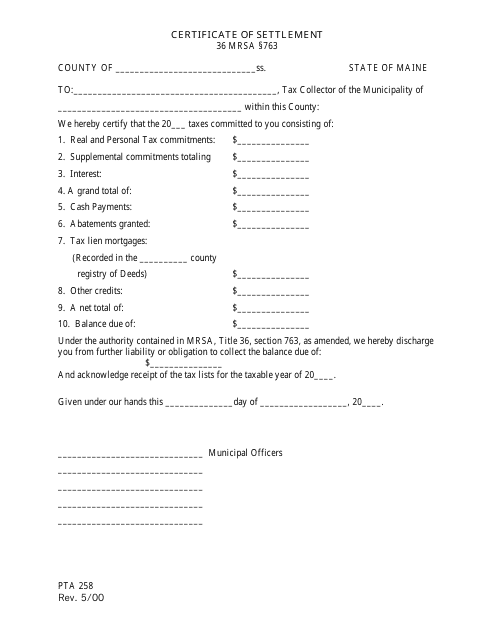

This form is used for applying for a Certificate of Settlement in the state of Maine. It is required in order to finalize the settlement of a legal case.

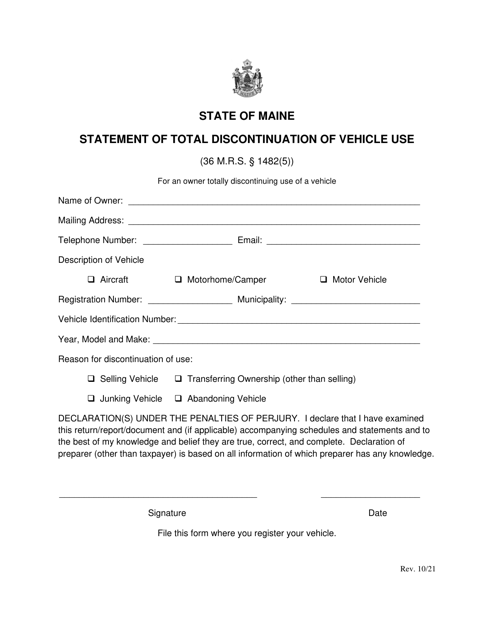

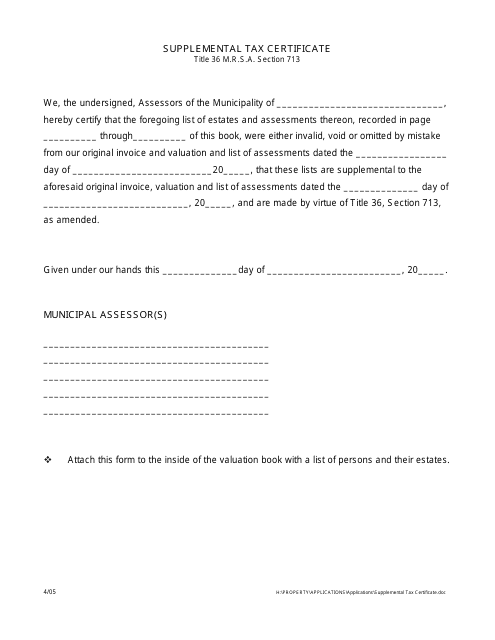

This type of document is used for reporting supplemental taxes in the state of Maine.

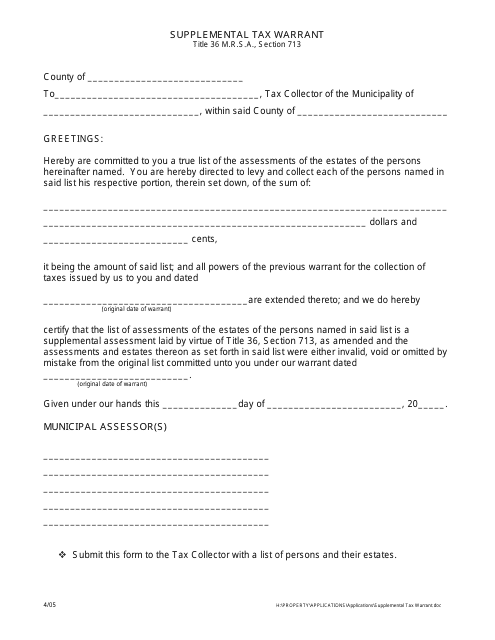

This document is a supplemental form used for tax warrants in the state of Maine. It provides additional information or updates to an existing tax warrant filing.

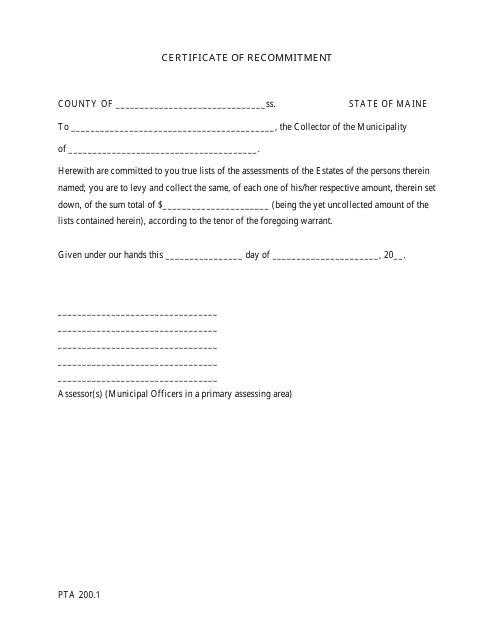

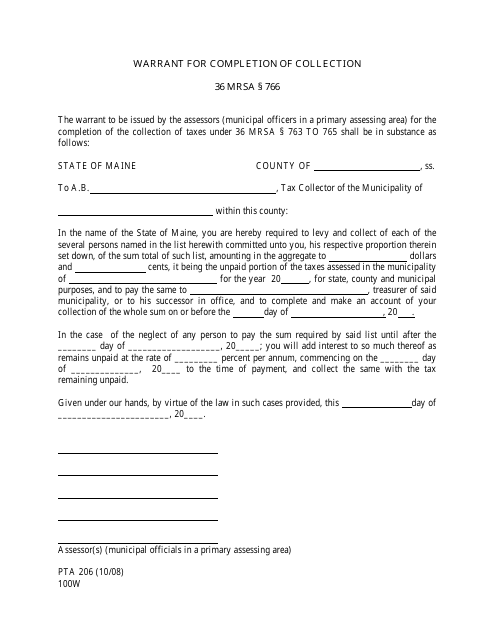

This form is used for obtaining a warrant to complete the collection process in the state of Maine. It helps to authorize the collection of outstanding debts or taxes by legal means.

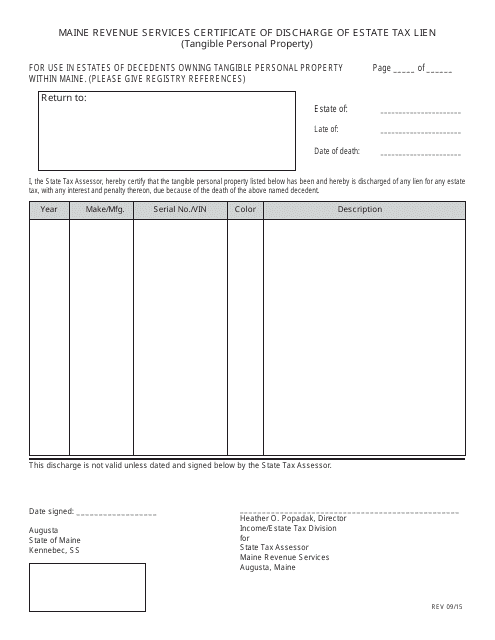

This type of document is used to discharge the estate tax lien on tangible personal property in the state of Maine.

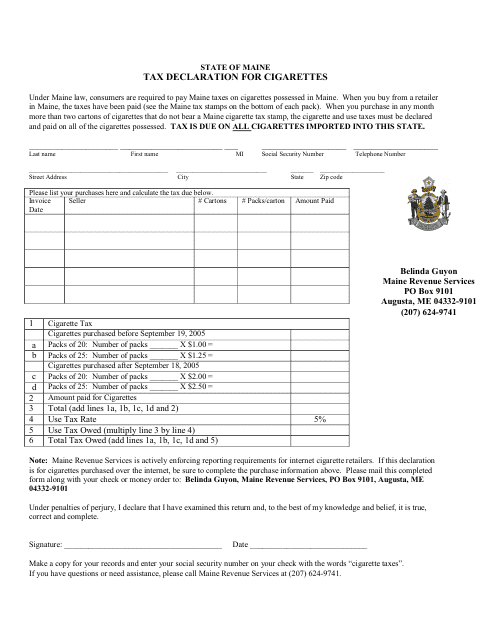

This Form is used for declaring and reporting taxes on cigarettes in the state of Maine.

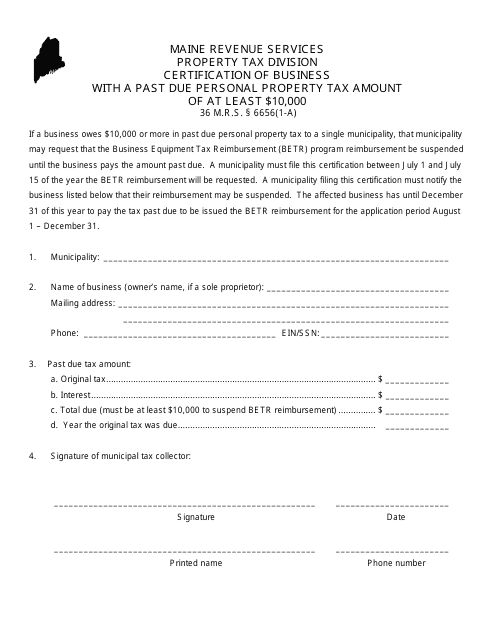

This document certifies a business with a past due personal property tax amount of at least $10,000 in the state of Maine.

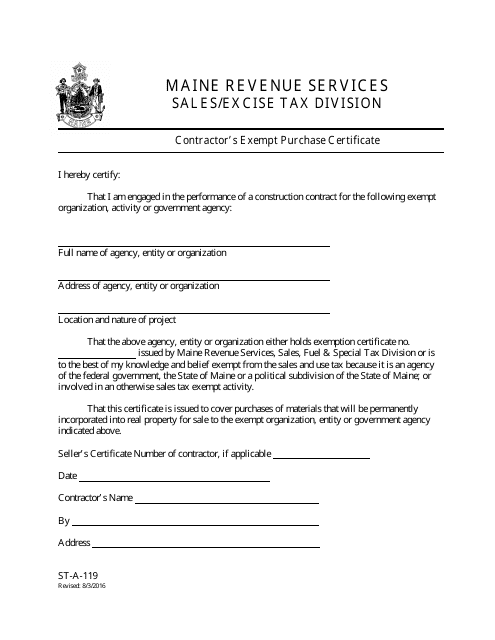

This form is used for contractors in Maine to claim exemption from sales tax when making purchases for use in a construction project.

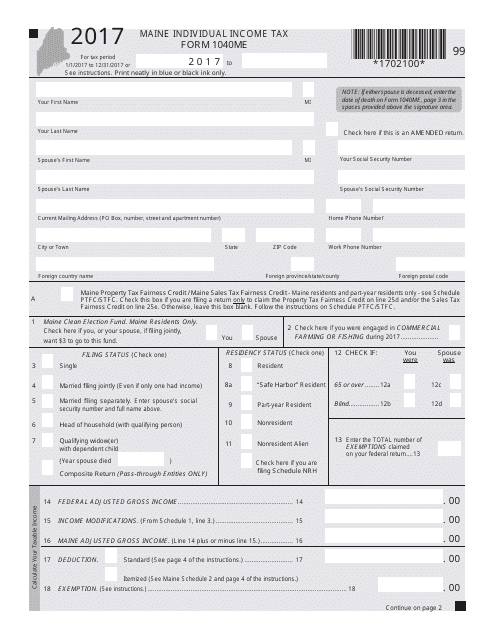

This Form is used for filing individual income tax in the state of Maine.