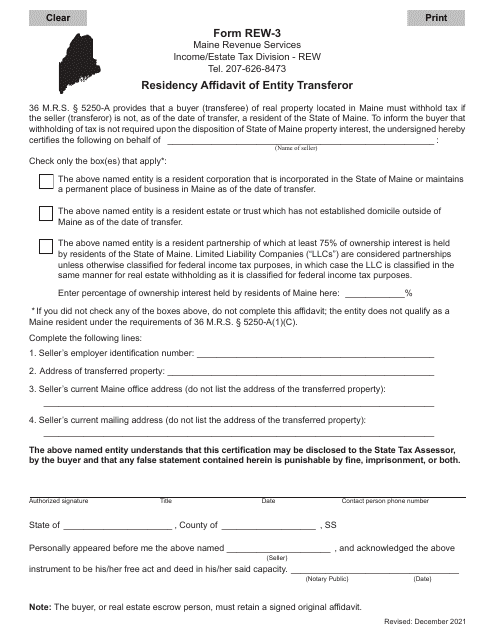

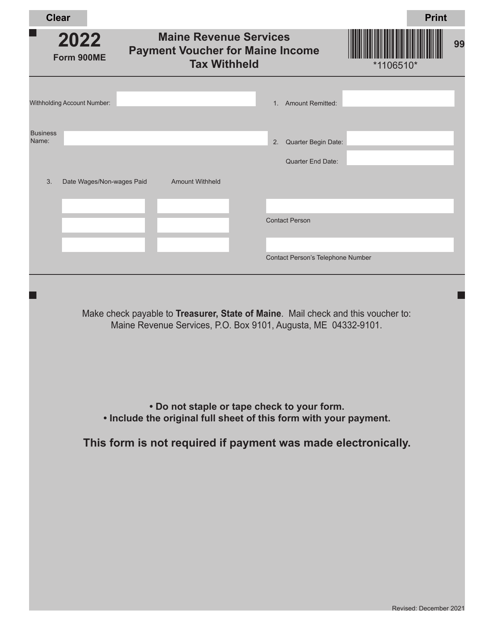

Maine Tax Forms and Templates

Documents:

96

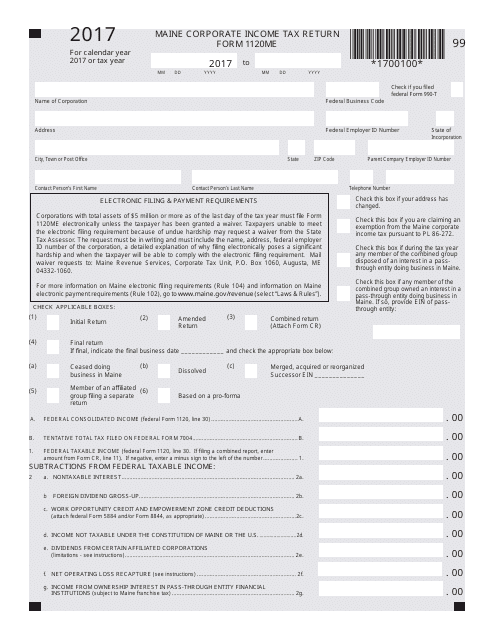

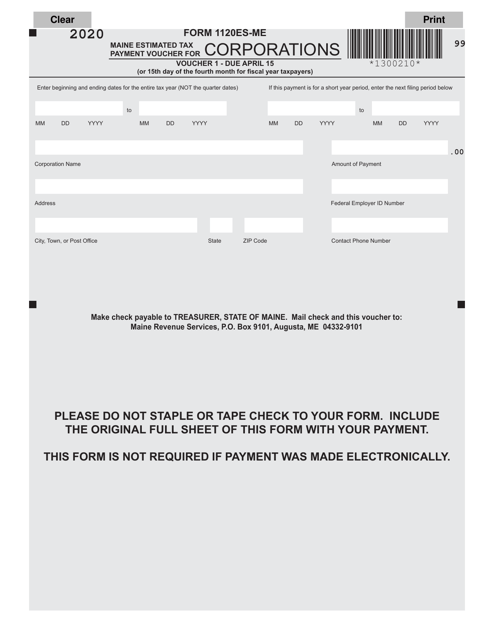

This form is used for filing the Maine Corporate Income Tax Return for businesses operating in Maine.

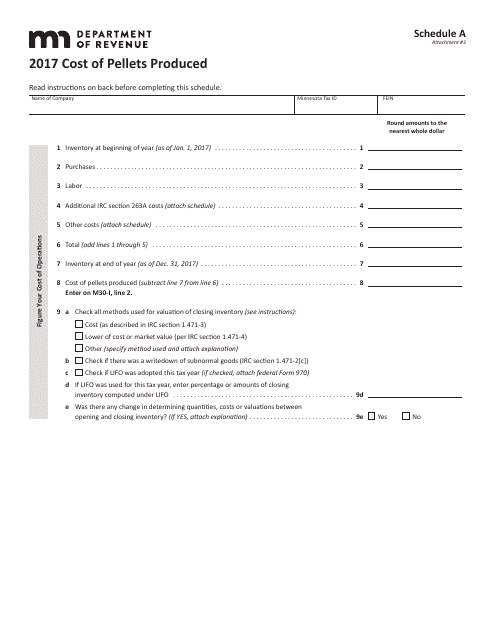

This document provides information about the cost of pellets produced in Minnesota. It includes details on the production process and factors that impact the cost.

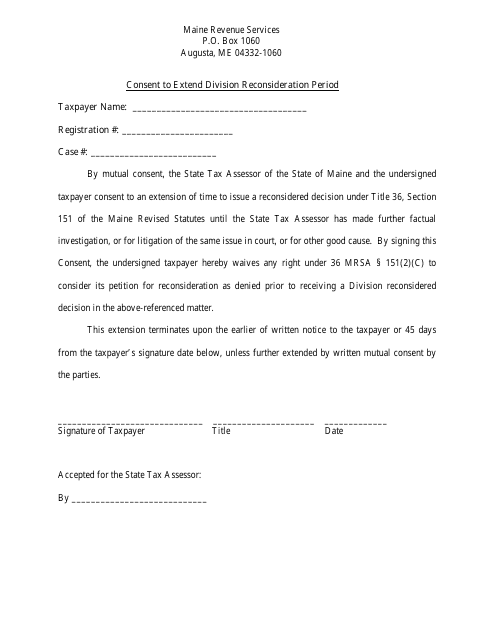

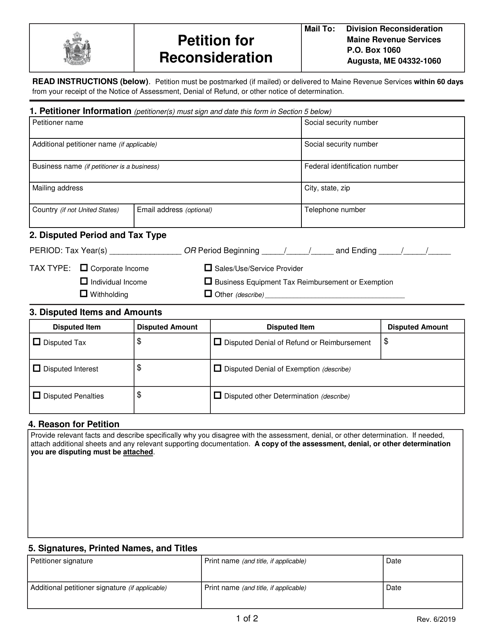

This document allows individuals in Maine to give consent to extend the division reconsideration period.

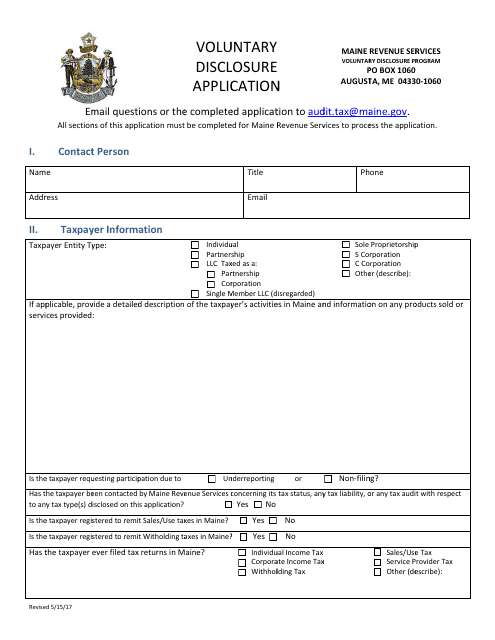

This form is used for the voluntary disclosure application in the state of Maine.

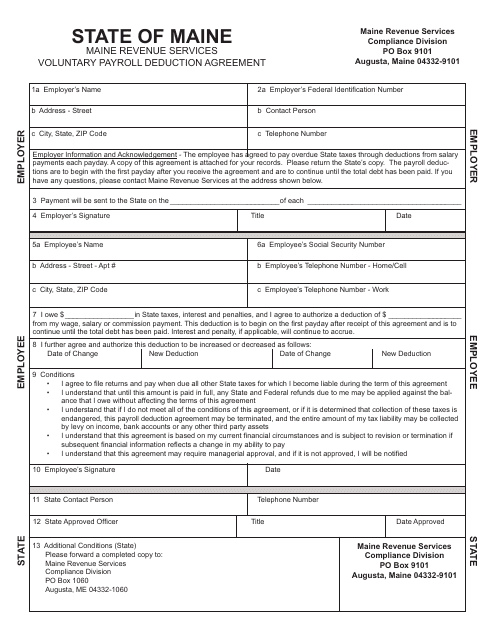

This Form is used for employees in Maine who want to voluntarily have deductions from their paycheck for various purposes such as retirement savings or charitable donations.

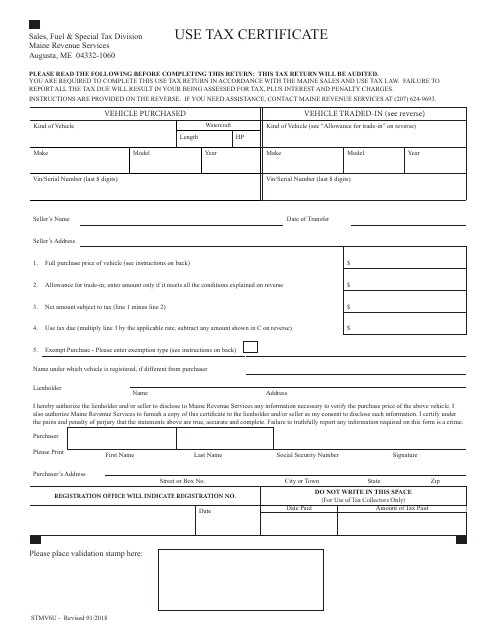

This form is used for certifying use tax payments in the state of Maine.

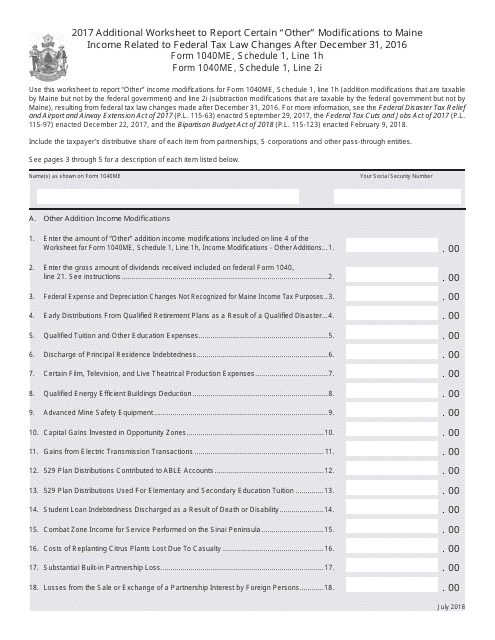

This document for reporting modifications to Maine income due to federal tax law changes after December 31, 2016 in Form 1040ME.

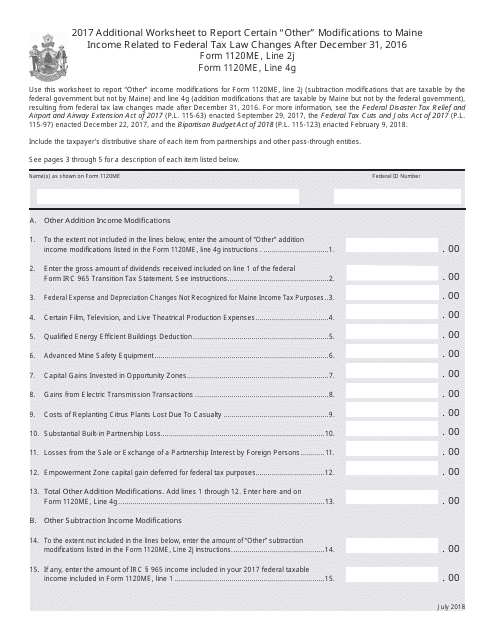

This form is used to report certain modifications to Maine income related to federal tax law changes that occurred after December 31, 2016.

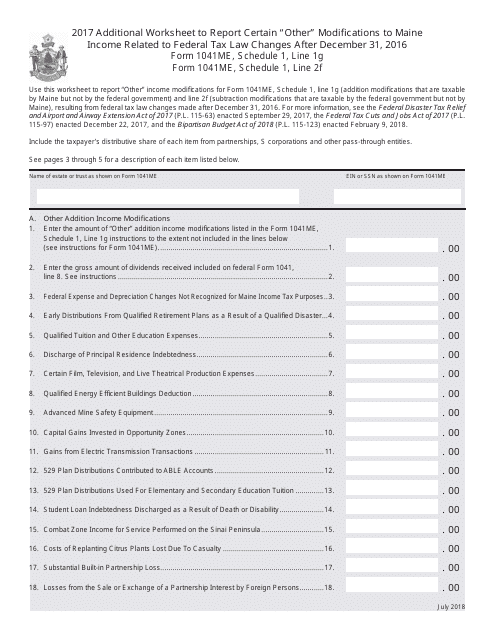

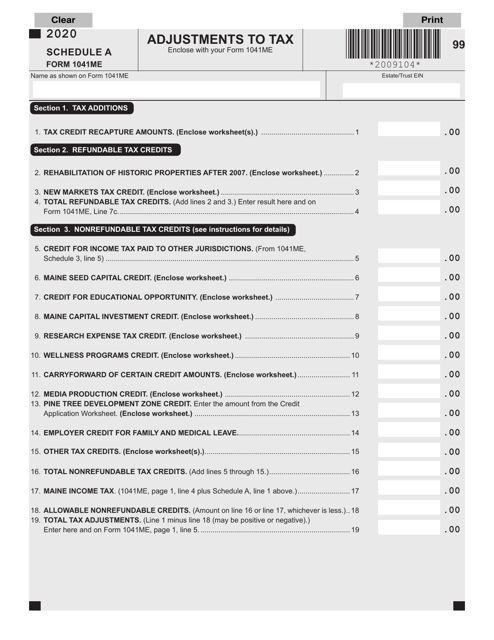

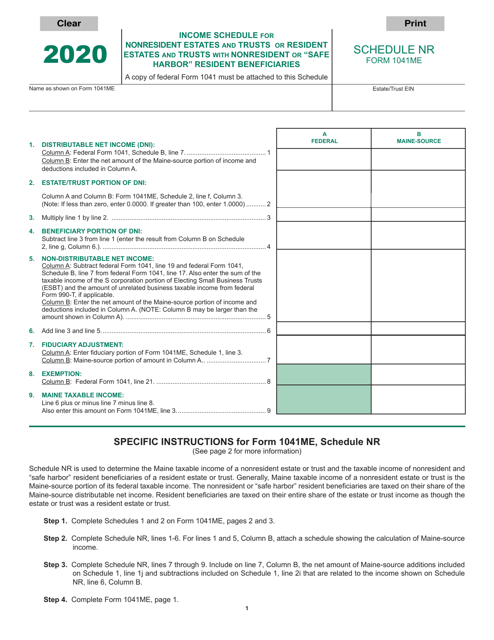

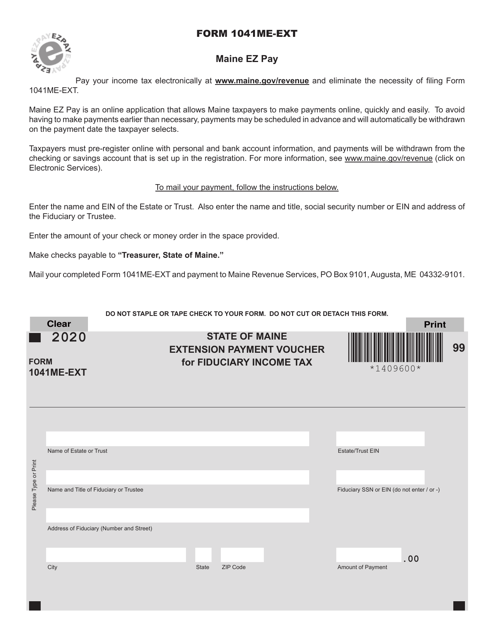

This Form is used for reporting certain modifications to Maine income related to federal tax law changes after December 31, 2016 in addition to Form 1041ME.

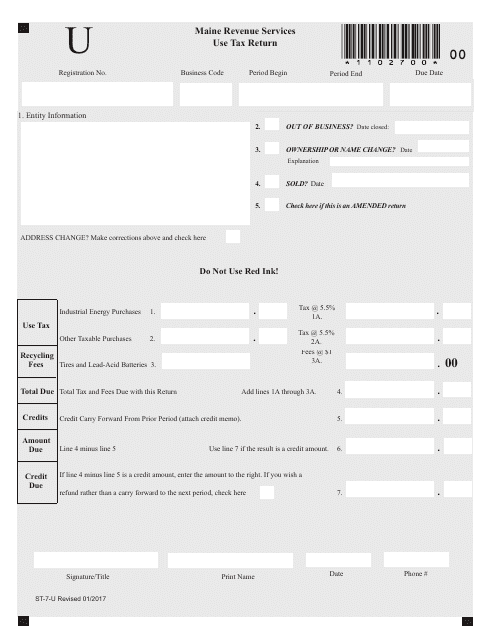

This form is used for reporting and paying use tax in the state of Maine. Use tax is a tax on purchases made outside of Maine but used within the state.

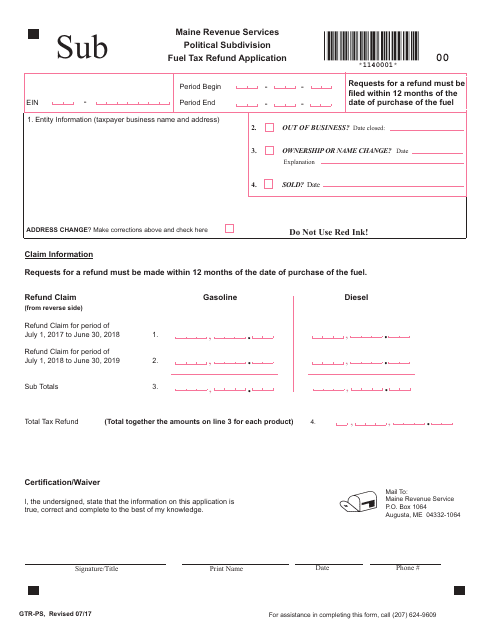

This form is used for applying for a fuel tax refund for political subdivisions in the state of Maine.

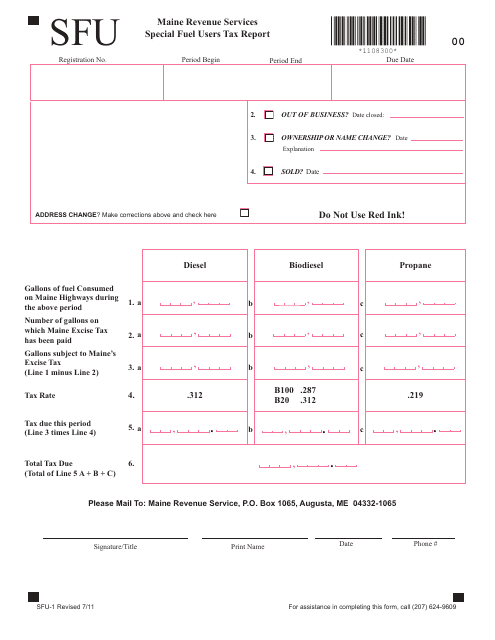

This form is used for reporting taxes on special fuel usage in the state of Maine. It is mandatory for businesses and individuals who use special fuel for their operations to file this report.

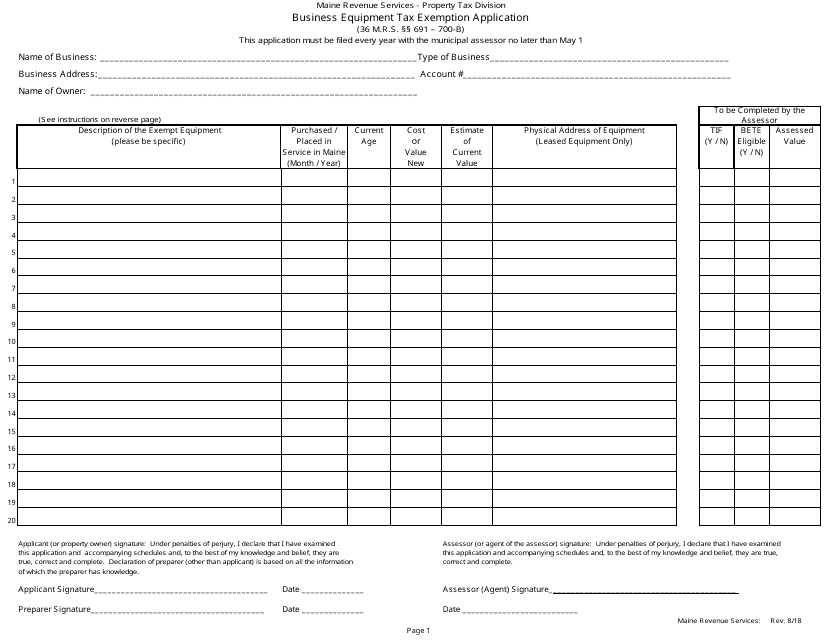

This Form is used for applying for a tax exemption on business equipment in the state of Maine.

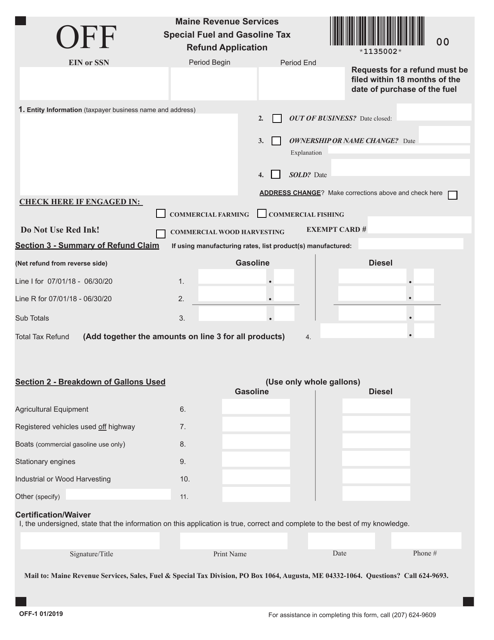

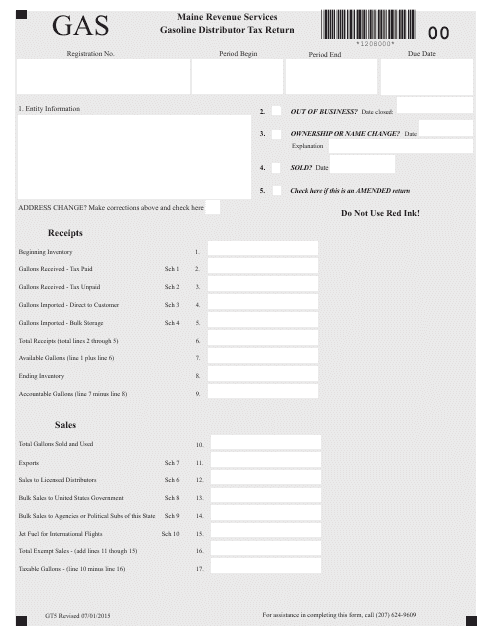

This form is used for filing the gasoline distributor tax return in the state of Maine. It is used by businesses that distribute gasoline in the state and must report and remit taxes owed.

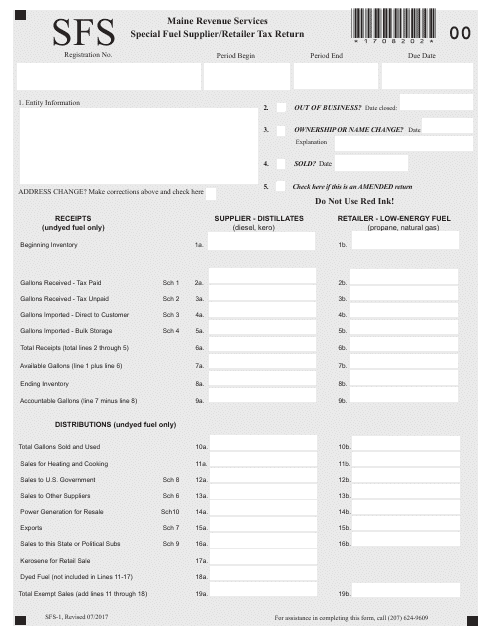

This form is used for filing the Special Fuel Supplier/Retailer Tax Return by businesses in Maine.

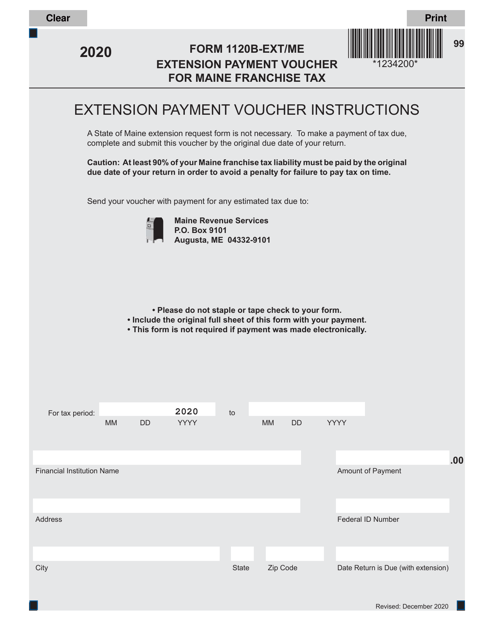

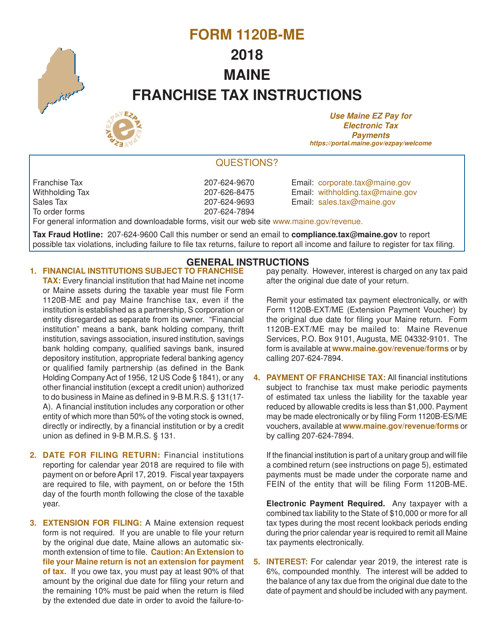

This form is used for Maine financial institutions to file their franchise tax return with the state.