New York State Tax Forms and Templates

New York State Tax Forms are used to report and pay taxes to the state of New York. These forms are used by individuals, businesses, and organizations to accurately calculate and report their state tax liabilities. The forms cover various aspects of taxation such as income tax, property tax, sales tax, and other taxes imposed by the state of New York.

Documents:

124

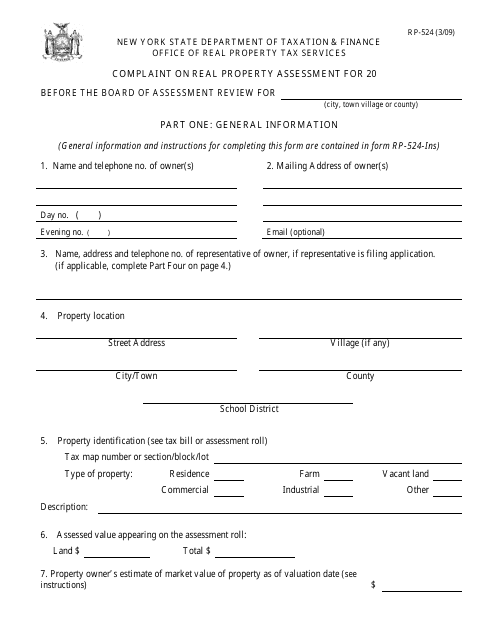

This Form is used for filing a complaint regarding real property assessment in New York. It allows property owners to challenge the assessed value of their property for tax purposes.

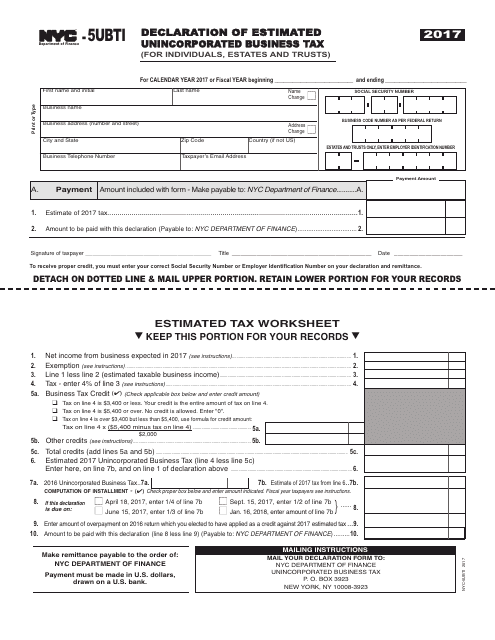

This Form is used for individuals, estates, and trusts in New York City to declare their estimated unincorporated business tax.

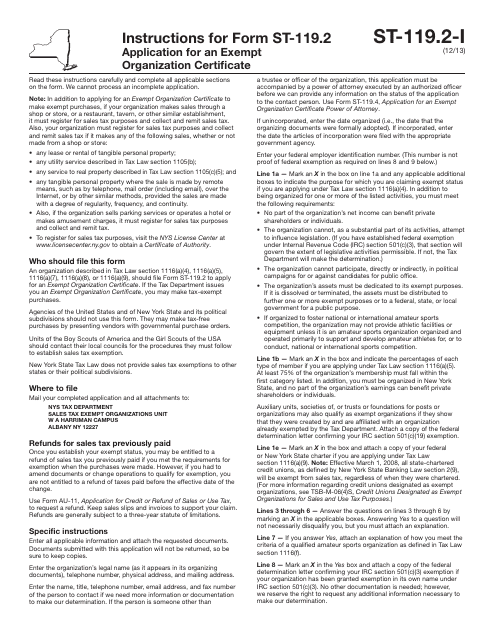

This document is used for applying for an Exempt Organization Certificate in New York.

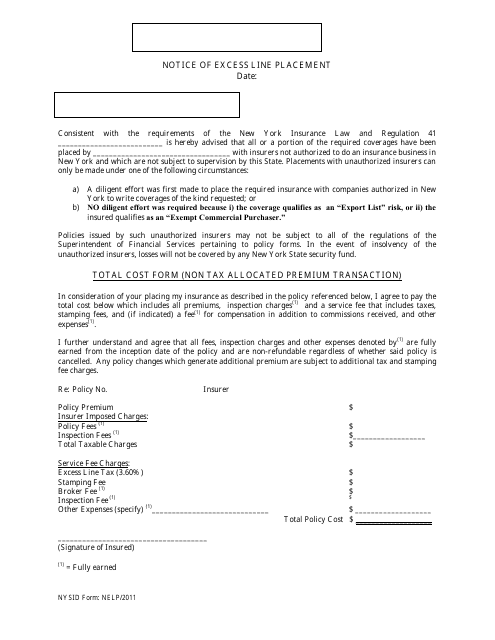

This document is used for notifying the Excess Line Association of New York about an excess line placement with the total cost.

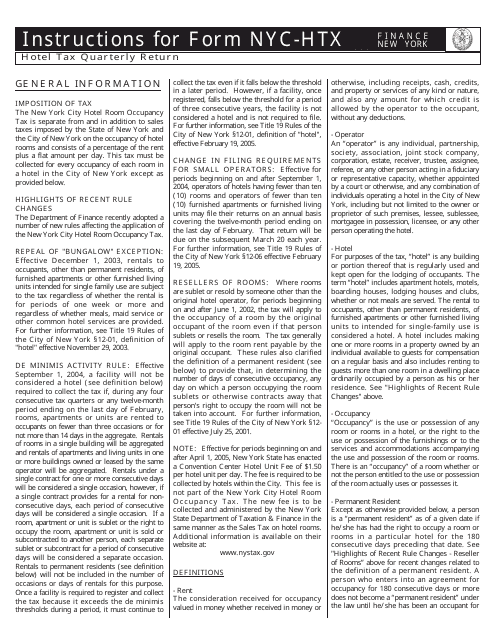

This form is used for reporting and paying hotel taxes on a quarterly basis in New York City. It provides instructions on how to complete the form and submit the necessary documentation.

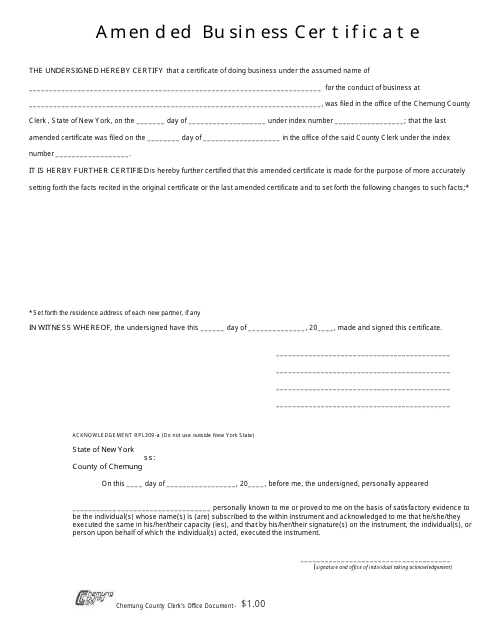

This form is used for making amendments to a business certificate in Chemung County, New York.

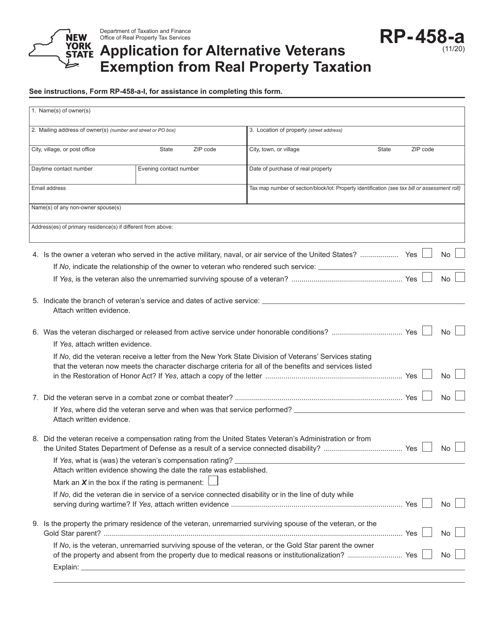

This Form is used for applying for the Volunteer Firefighters / Ambulance Workers Exemption in Westchester County, New York.

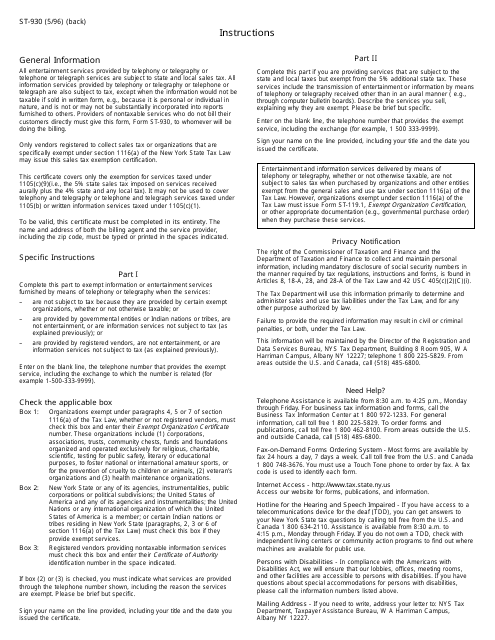

This Form is used to certify the tax status of information or entertainment services provided through telephony or telegraphy services in New York.

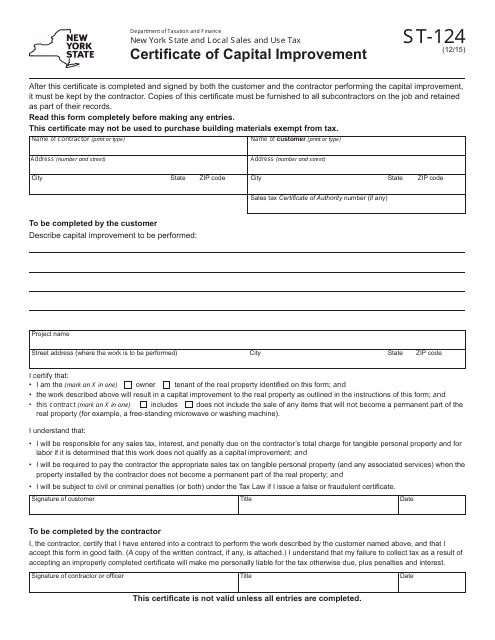

This form is used for certifying capital improvements made in the state of New York.

This Form is used for applying for a residential investment real property tax exemption in certain school districts in New York, specifically in Jamestown SD.

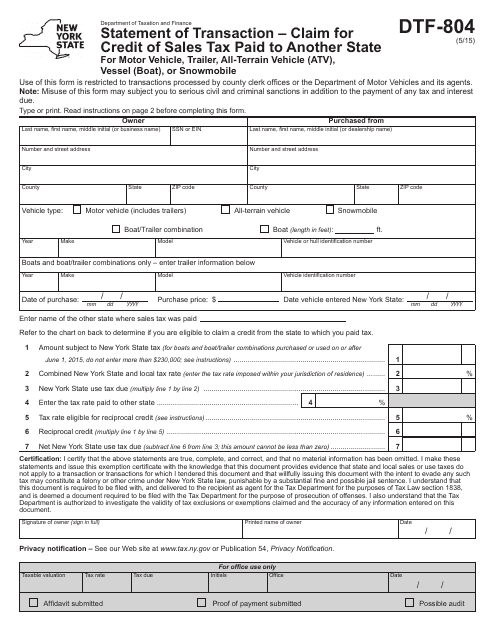

This Form is used for claiming credit of sales tax paid in another state for purchasing motor vehicles, trailers, all-terrain vehicles (ATV), vessels (boat), or snowmobiles in New York.

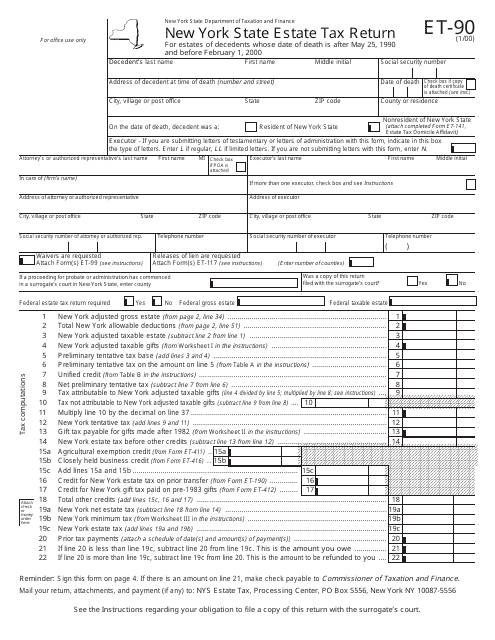

This form is used for reporting and paying estate taxes in the state of New York.

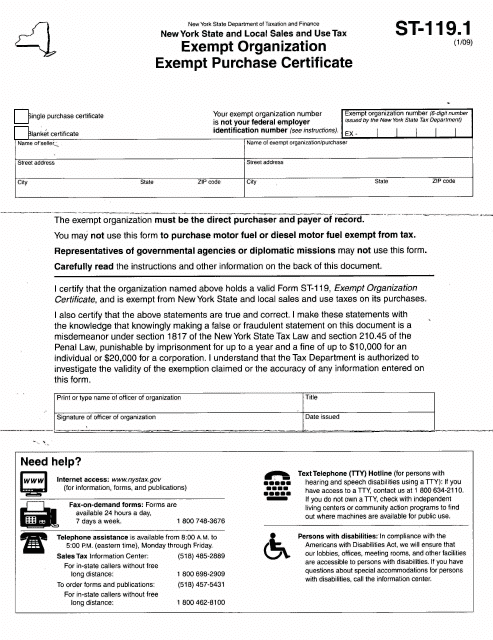

This form allows you to purchase tax-free products that are normally subject to sales tax. It is a state-specific document issued by the New York state (NY State Department of Taxation and Finance).

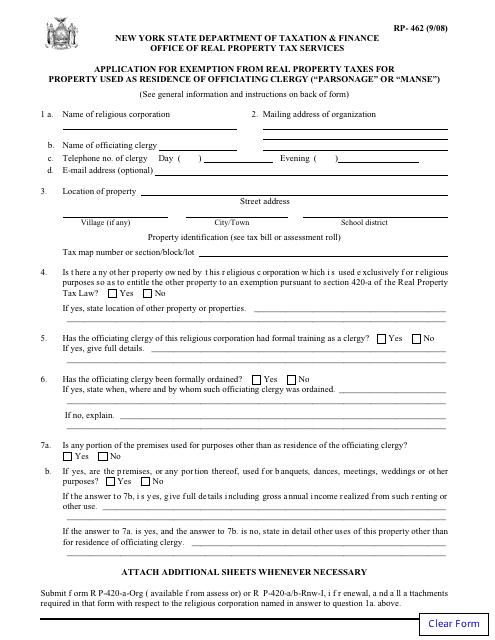

This form is used for applying for an exemption from real property taxes in New York for properties used as a residence by officiating clergy, such as a parsonage or manse.

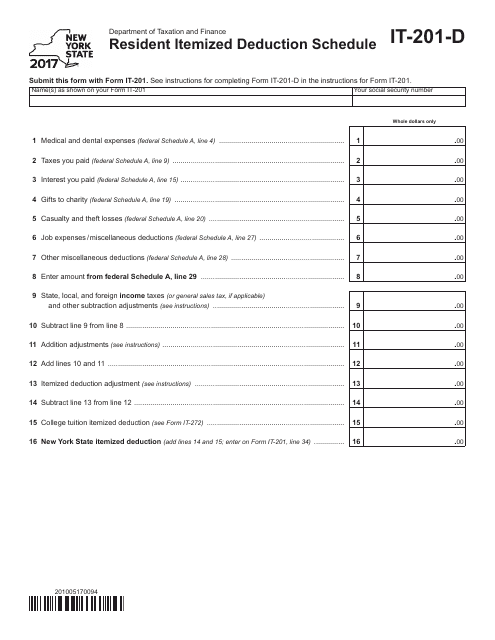

This form is used for reporting itemized deductions for residents of New York on their state tax return.

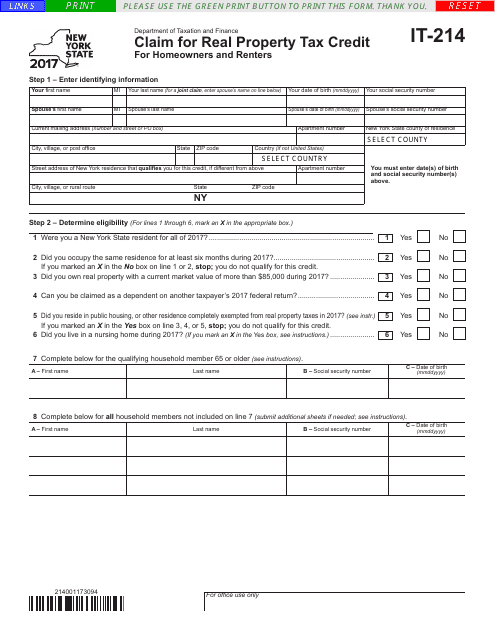

This form is used for claiming a real property tax credit in New York. It allows residents to receive a credit for the taxes they paid on their residential property.

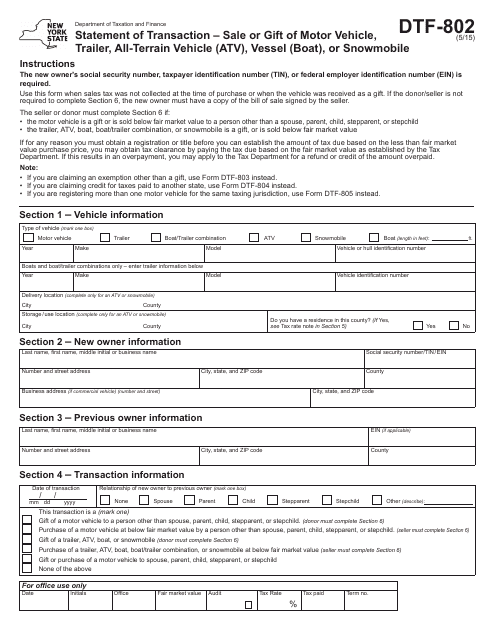

This form is a legal document signed in New York State when a vehicle is received as a gift or when sales tax was not collected at the time of the transaction.

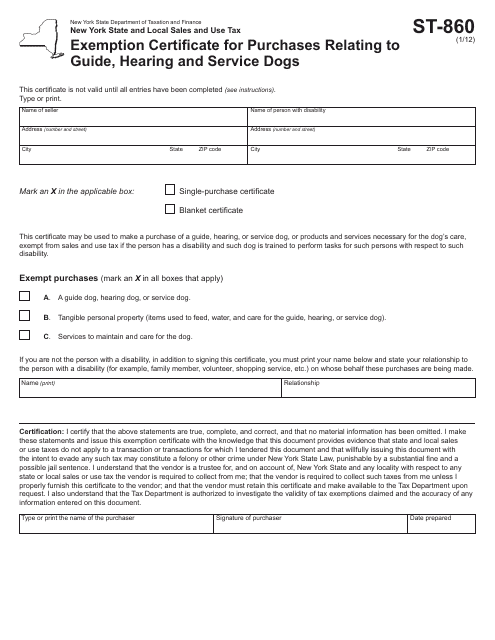

This form is used for claiming exemption from sales tax on purchases related to guide, hearing, and service dogs in New York.

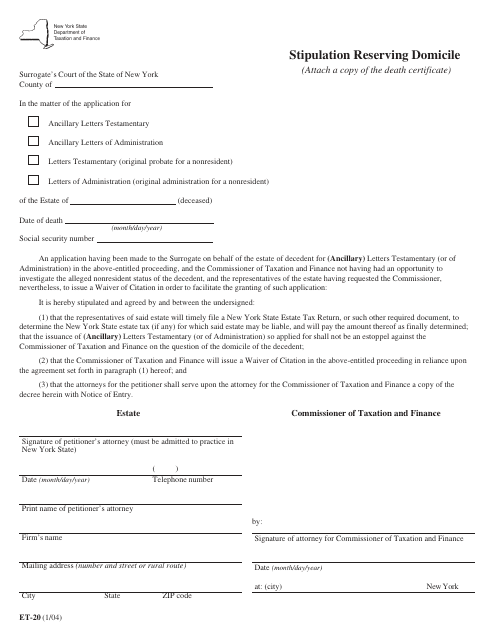

This form is used for stipulating and reserving domicile in the state of New York.

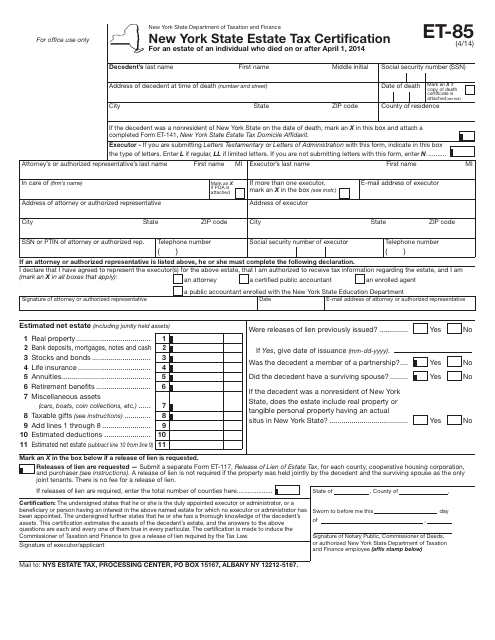

This document is used for certifying the estate tax in the state of New York.

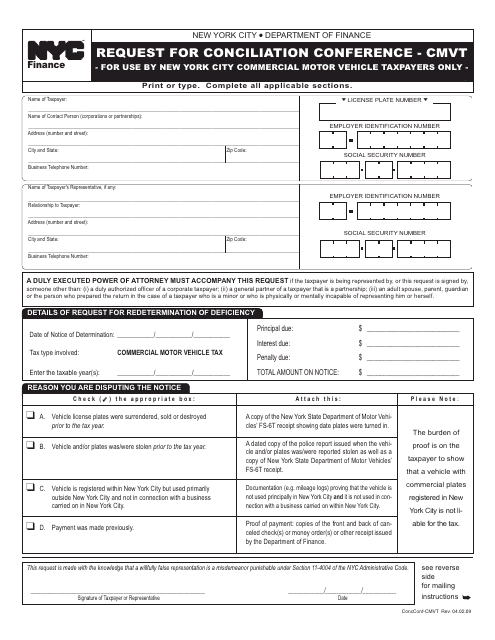

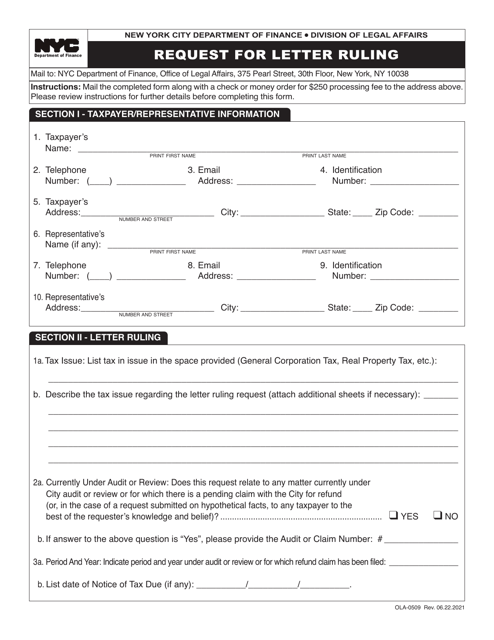

This document is a request for a conciliation conference in New York City. It is used to initiate a meeting between parties involved in a dispute in order to find a resolution through mediation.

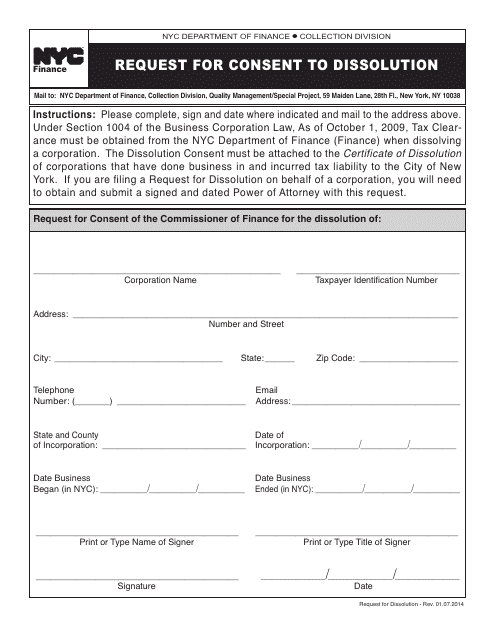

This document is used to request consent for the dissolution of a company in New York City.

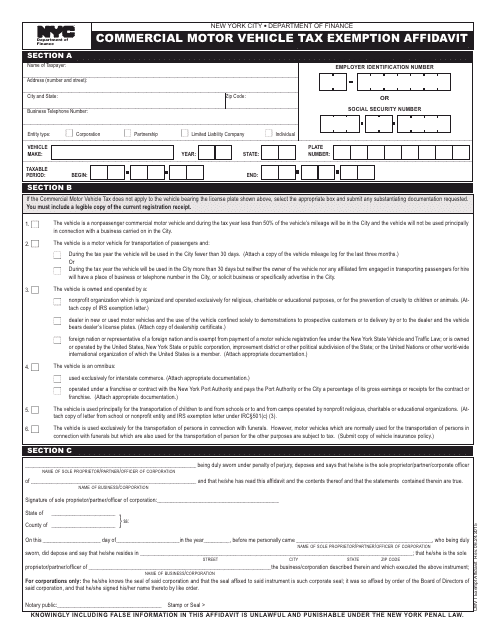

This form is used for applying for a tax exemption for commercial motor vehicles in New York City.

This Form is used for applying for the Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Putnam County, New York.

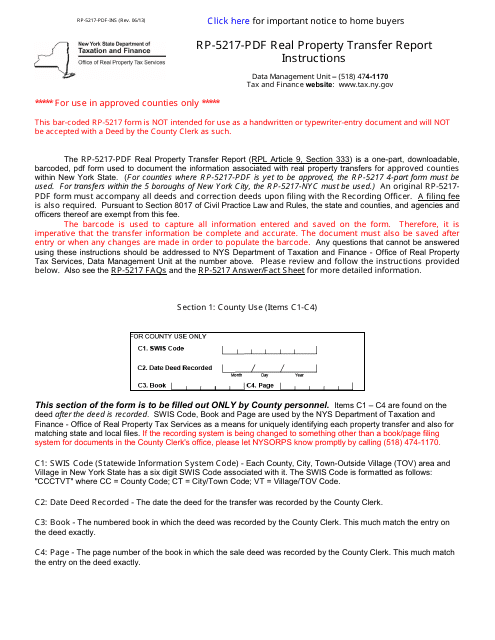

This form is used for reporting the transfer of real property in New York. It provides instructions on how to fill out the RP-5217-PDF form accurately and completely.

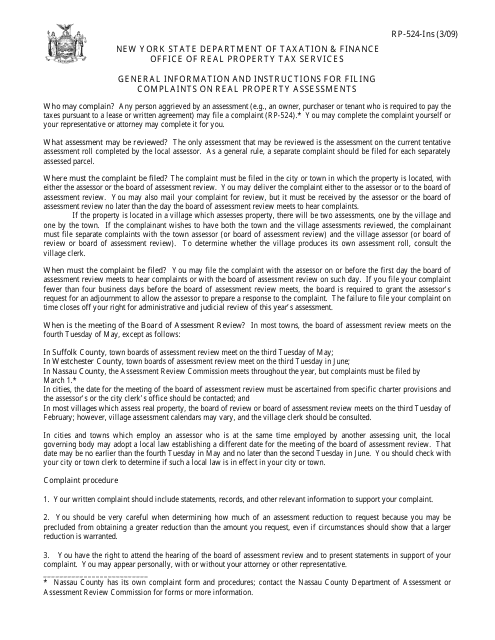

This Form is used for filing complaints regarding real property assessments in the state of New York. It provides instructions on how to submit a complaint and seek resolution for issues related to property assessments.

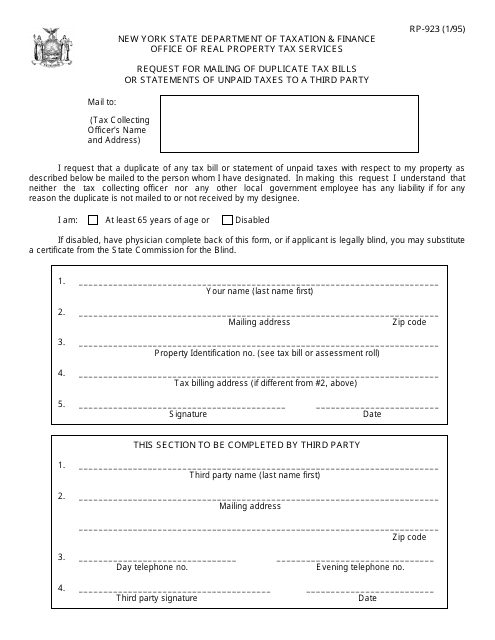

This form is used to request the mailing of duplicate tax bills or statements of unpaid taxes to a third party in New York.

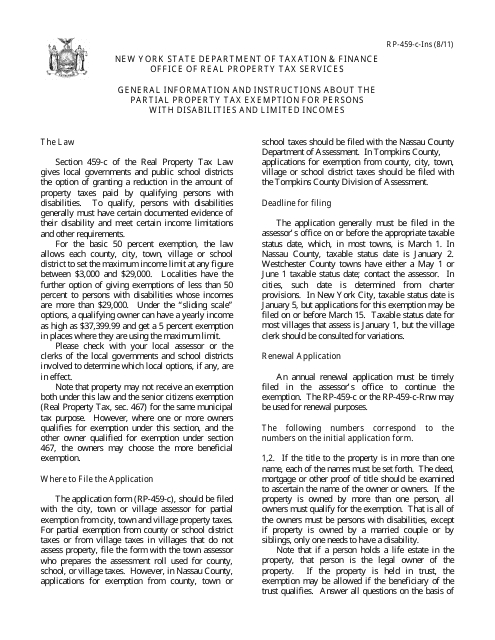

This Form is used for claiming a partial property tax exemption in New York for individuals with disabilities and limited incomes. It provides instructions on how to apply for the exemption and the documentation required.

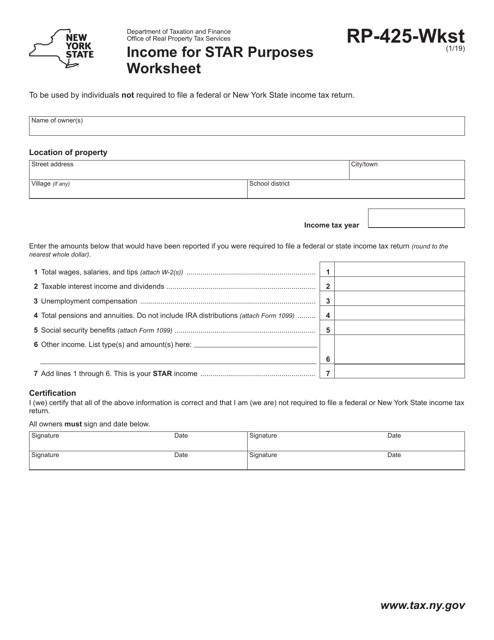

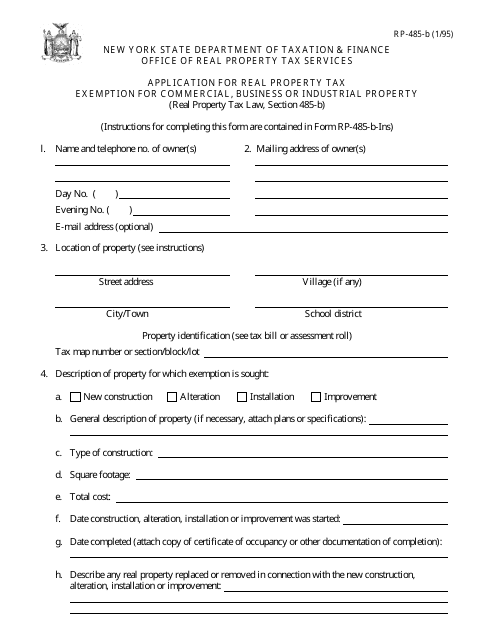

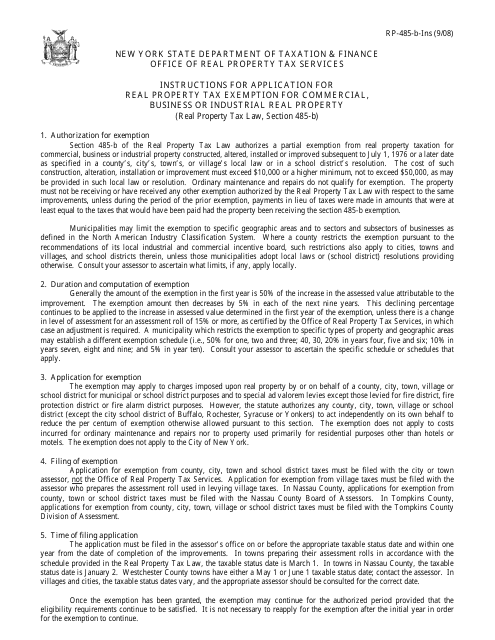

This form is used for applying for a real property tax exemption for commercial, business or industrial property in the state of New York. It allows property owners to potentially receive a tax exemption for their eligible properties.

This Form is used for applying for a real property tax exemption for commercial, business or industrial real property in New York.

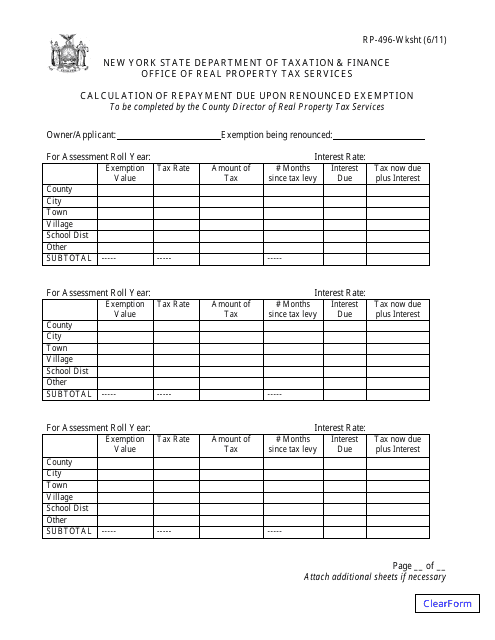

This form is used for calculating the repayment amount due upon renounced exemption in the state of New York.

This form is used for applying for a residential investment real property tax exemption in certain cities in New York.

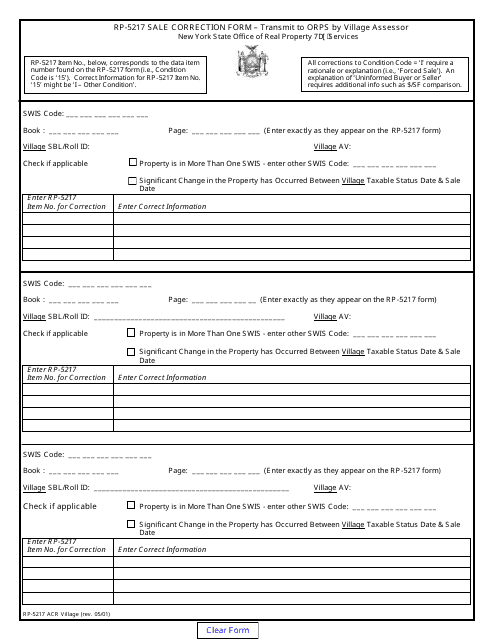

This form is used for correcting the sales information for a property in a village in New York.

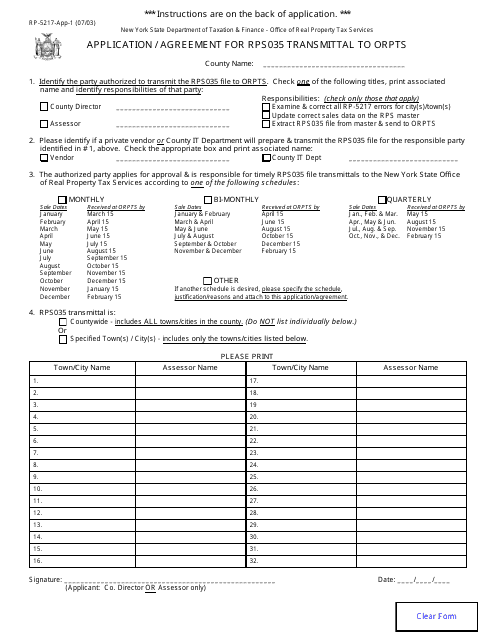

This form is used for submitting an application and agreement for the transmittal of RP-5217-APP-1 to the Office of Real Property Tax Services (ORPTS) in New York.

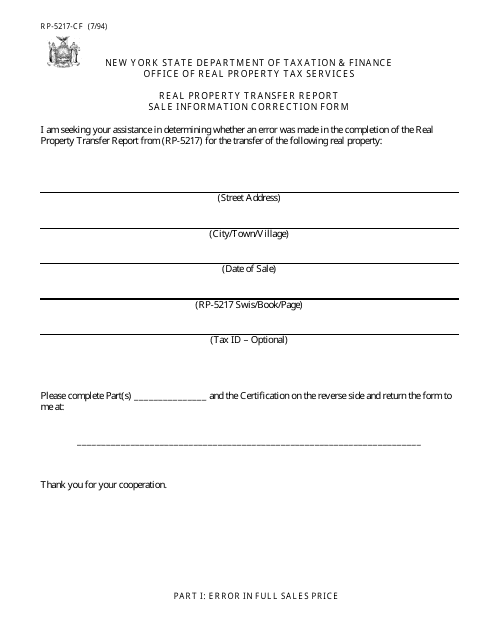

This form is used for correcting sale information on a real property transfer report in New York.

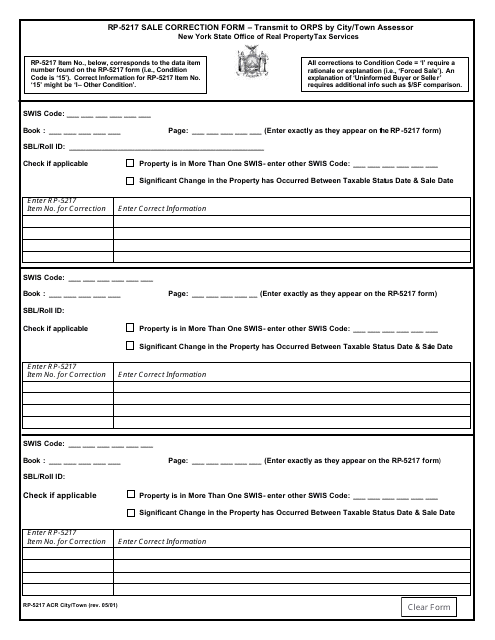

This Form is used for correcting the sale information for a property in a specific city or town in New York.

![Form RP-466-D [WESTCHESTER] Application Form for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Westchester County Only) - New York](https://data.templateroller.com/pdf_docs_html/359/3598/359812/form-rp-466-d-westchester-application-form-volunteer-firefighters-ambulance-workers-exemption-use-in-westchester-county-only-new-york_big.png)

![Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-466-C [PUTNAM] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Putnam County Only) - New York](https://data.templateroller.com/pdf_docs_html/1731/17310/1731027/form-rp-466-c-putnam-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-putnam-county-only-new-york_big.png)

![Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york_big.png)