New York State Tax Forms and Templates

Documents:

124

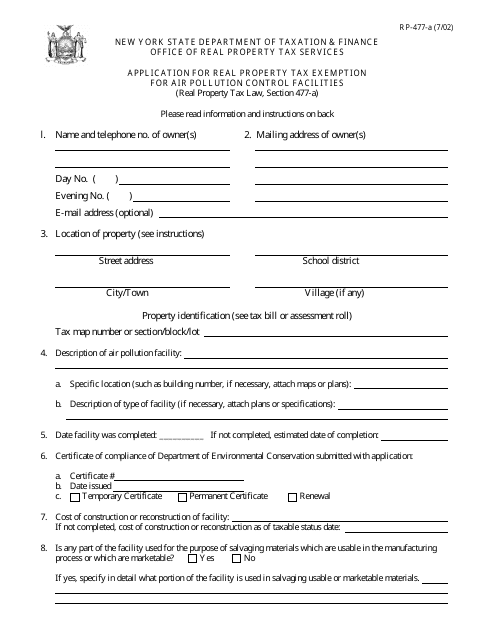

This form is used for applying for a real property tax exemption in New York for air pollution control facilities.

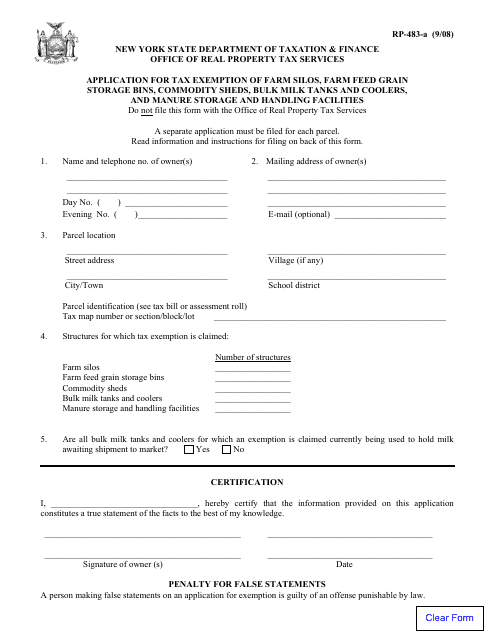

This form is used for applying for tax exemption of various agricultural storage and handling facilities in New York, such as farm silos, feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage facilities.

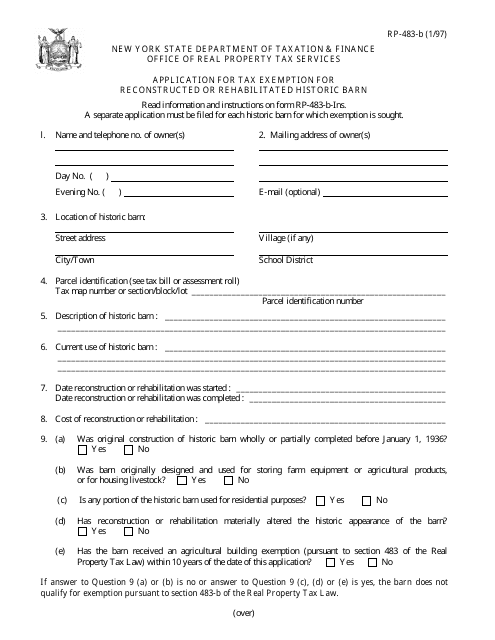

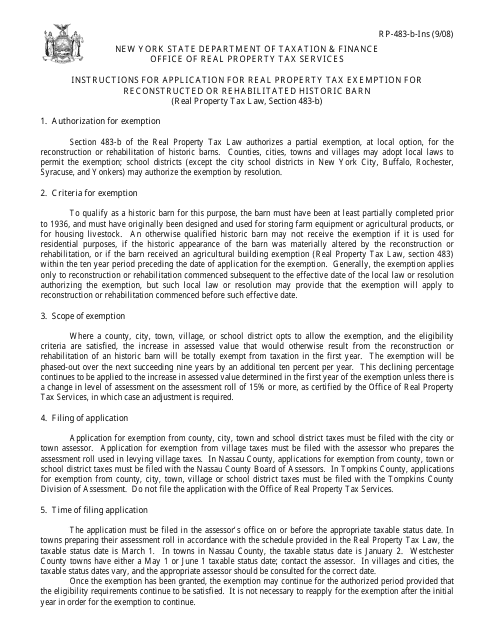

This form is used for applying for tax exemption for reconstructed or rehabilitated historic barns in the state of New York.

This Form is used for applying for real property tax exemption for reconstructed or rehabilitated historic barn in New York.

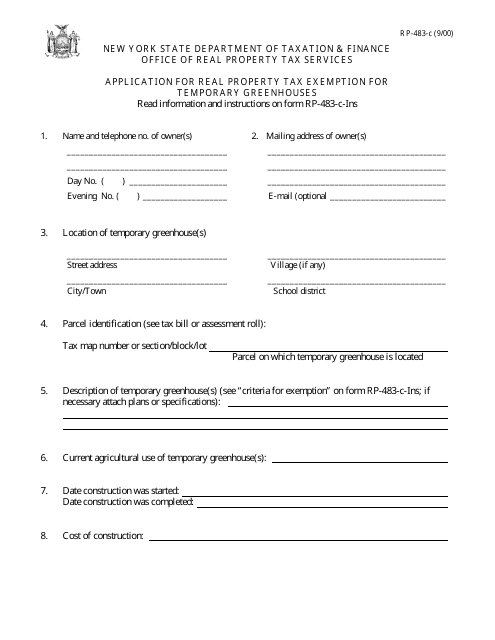

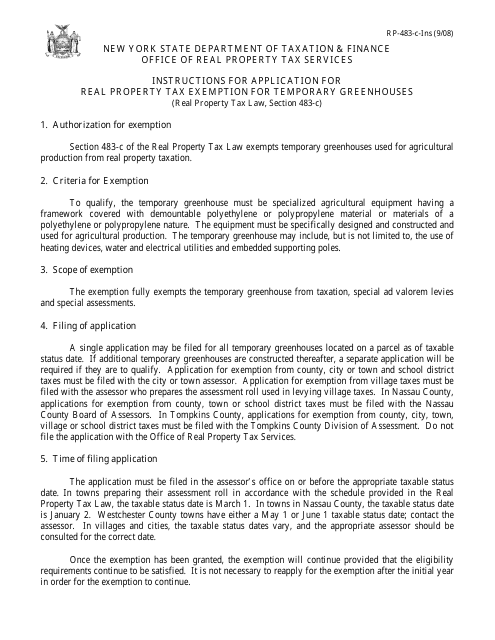

This form is used for applying for a real property tax exemption for temporary greenhouses in New York.

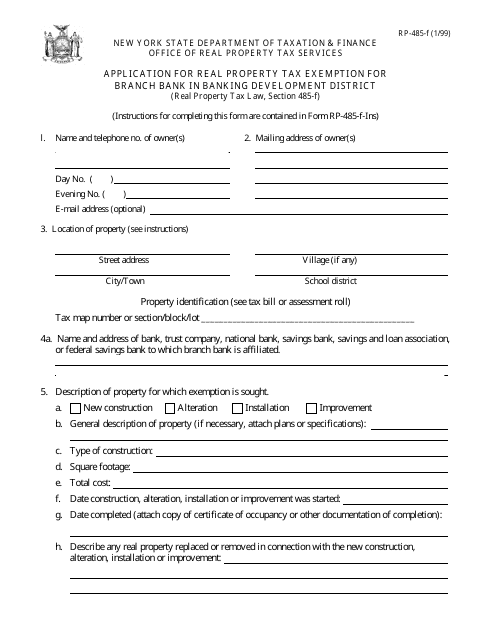

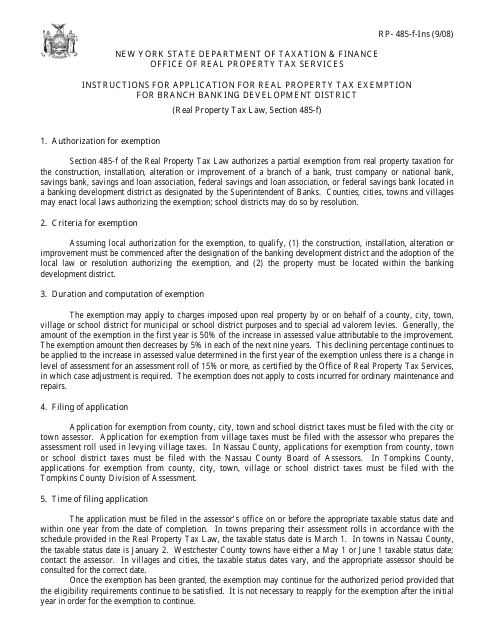

This form is used for applying for a real property tax exemption for a branch bank located in a banking development district in New York.

This Form is used for applying for a real property tax exemption for temporary greenhouses in New York.

This form is used for applying for a real property tax exemption for branch banking development districts in New York.

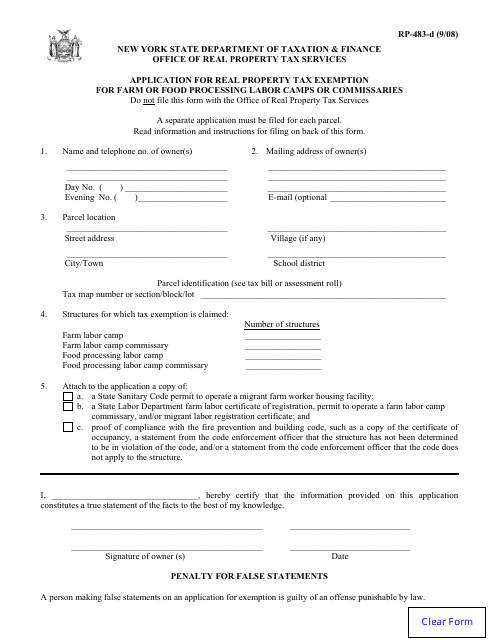

This form is used for applying for a real property tax exemption specifically for farm or food processing labor camps or commissaries in the state of New York.

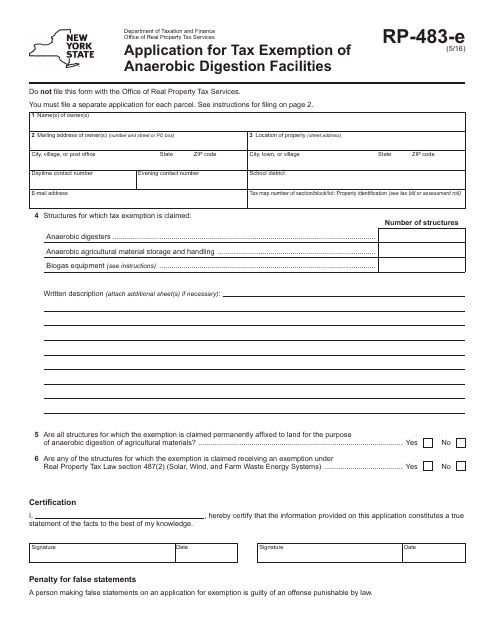

This form is used for applying for tax exemption for anaerobic digestion facilities in New York.

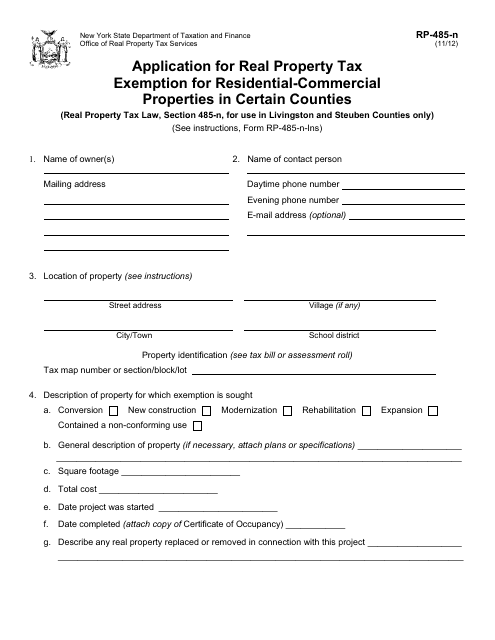

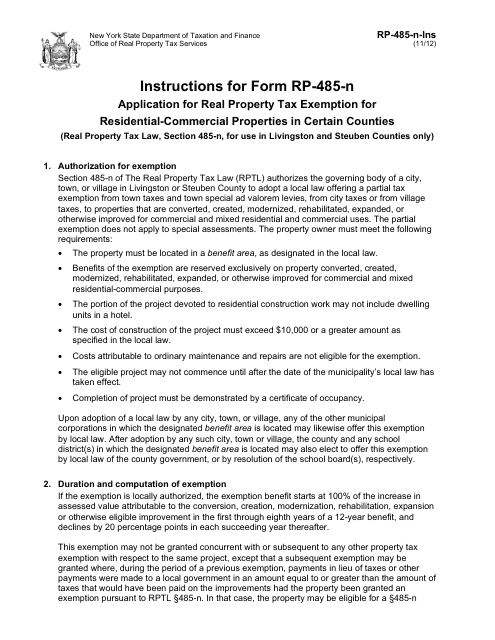

This form is used for applying for a real property tax exemption for residential-commercial properties in certain counties in New York.

This Form is used for applying for a tax exemption on residential-commercial properties in certain counties in New York. It provides instructions for completing the application process.

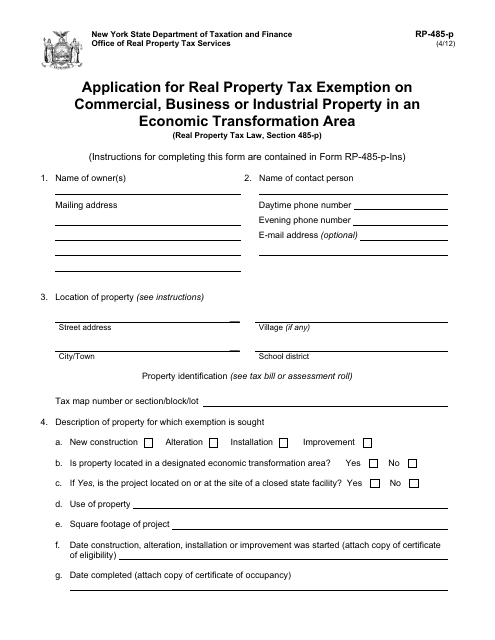

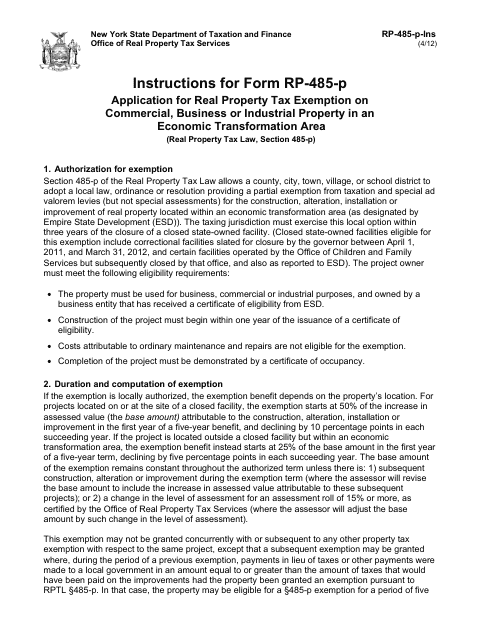

This Form is used for applying for a tax exemption on commercial, business, or industrial property located in an Economic Transformation Area in New York.

This Form is used for applying for a real property tax exemption on commercial, business or industrial property in an Economic Transformation Area in New York.

This form is used for applying for residential property improvement in certain towns in New York, specifically in Amherst.

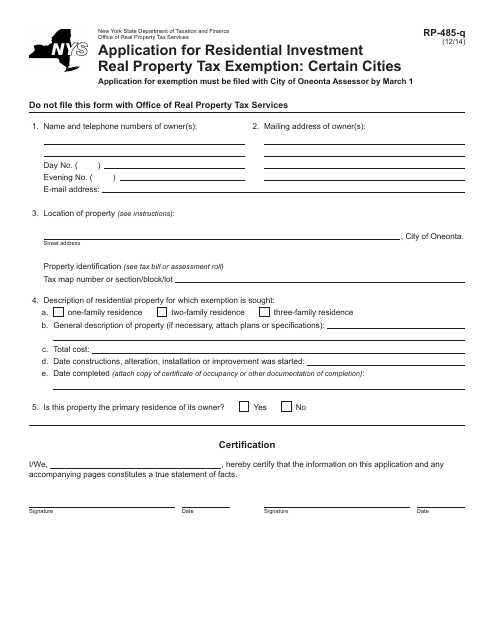

This Form is used for applying for a residential investment real property tax exemption in certain cities in New York.

This form is used for applying for a residential investment real property tax exemption in certain school districts in New York.

This form is used for applying for a tax exemption on residential investment properties in certain school districts in New York.

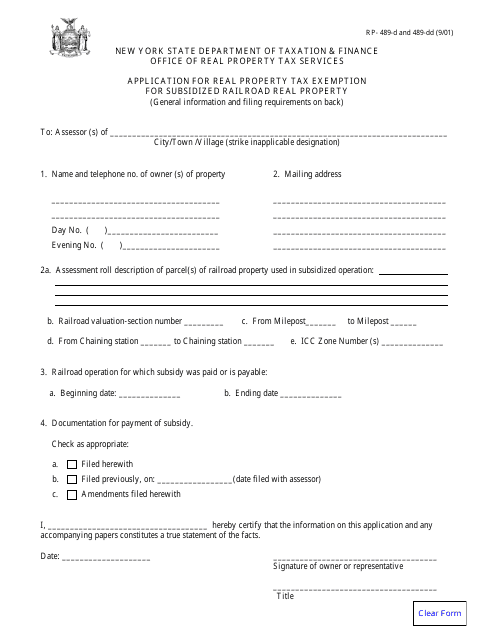

This Form is used for applying for a real property tax exemption for subsidized railroad real property in New York.

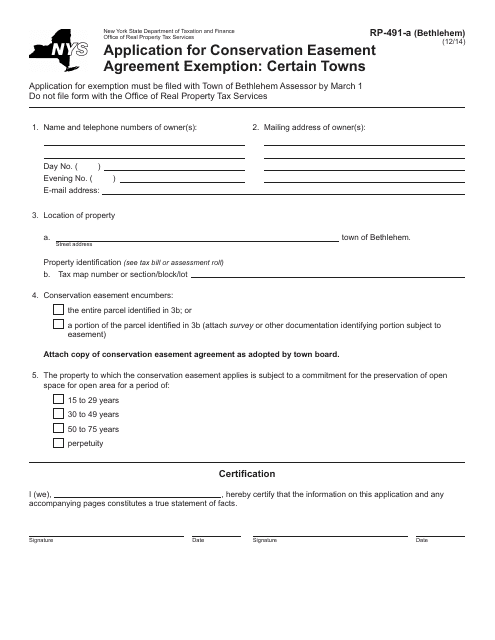

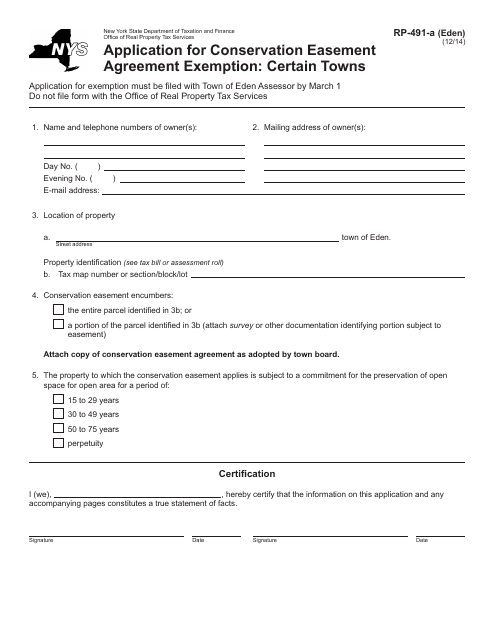

This form is used for applying for a conservation easement agreement exemption in certain towns in New York.

This Form is used for applying for an exemption on a Conservation Easement Agreement in certain towns in New York.

This Form is used for applying for a conservation easement agreement exemption in certain towns in New York, specifically Orchard Park. It allows individuals to request an exemption from certain requirements for conservation easements.

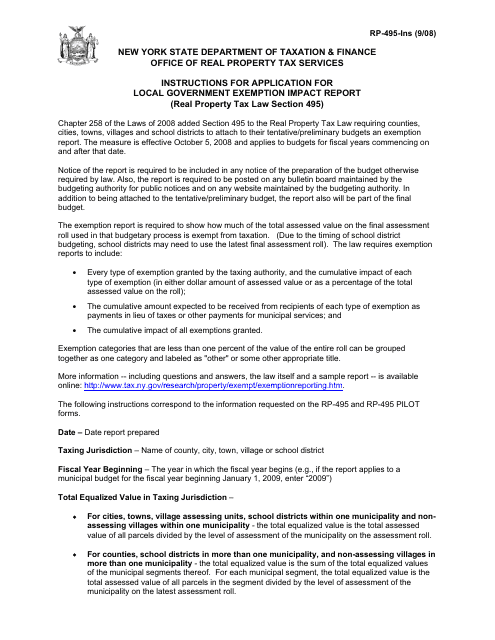

This document is used for applying for a local government exemption impact report in New York. It provides instructions on how to complete the Form RP-495.

This form is used for applying for a conservation easement agreement exemption in certain towns in New York, specifically Bethlehem.

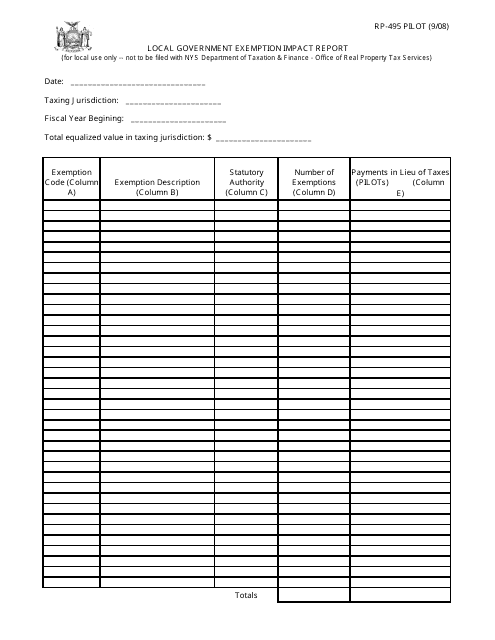

This form is used for reporting the impact of local government exemptions for the pilot program in New York.

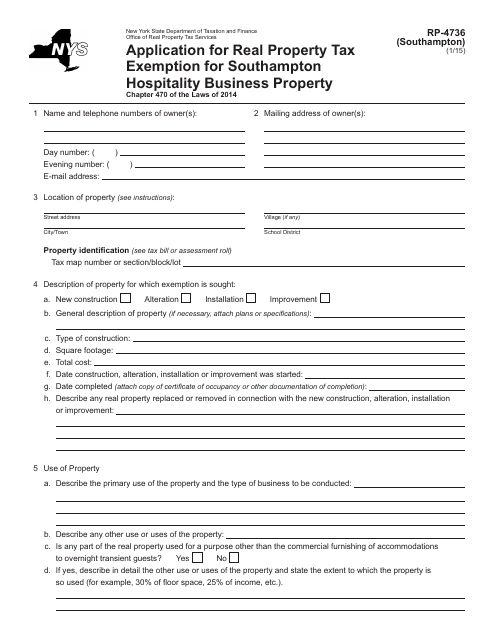

This form is used for applying for a real property tax exemption for hospitality businesses in Southampton, New York.

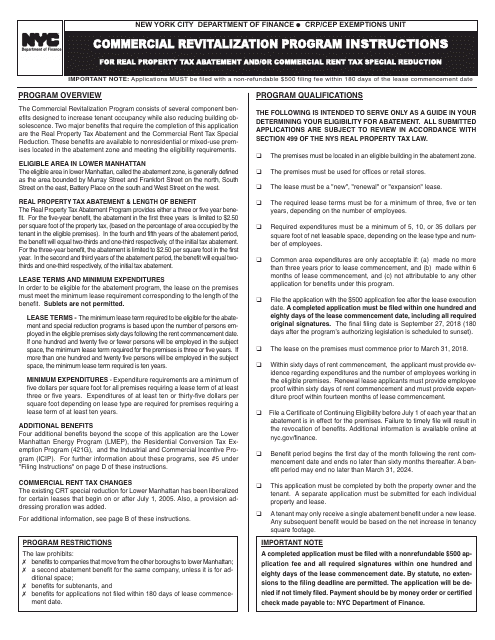

This document provides instructions for the Commercial Revitalization Program in New York City. It explains how to participate in the program and outlines the steps and requirements.

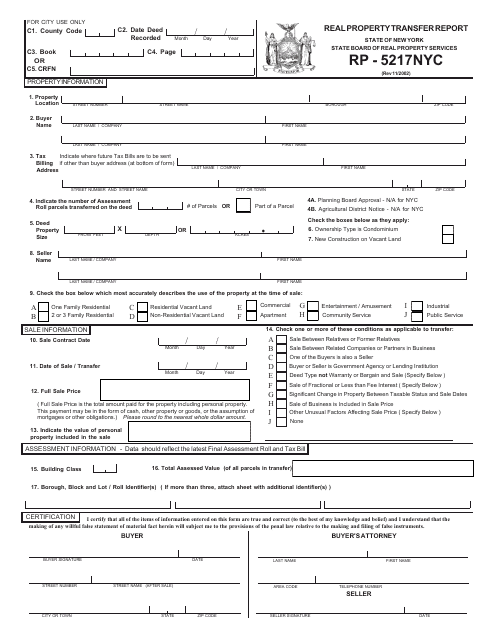

This form is used for reporting transfers of real property in New York City.

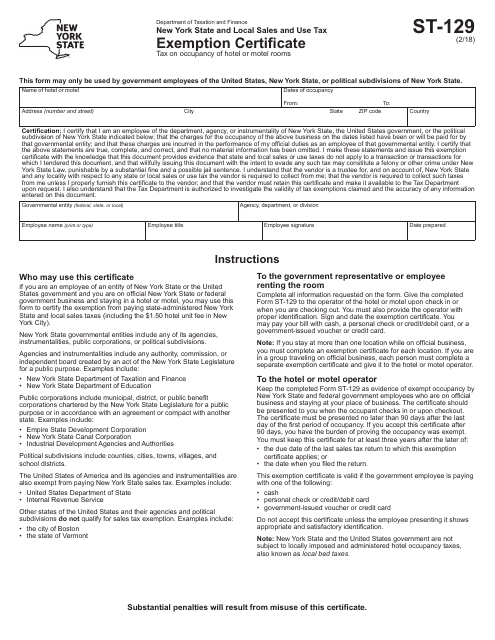

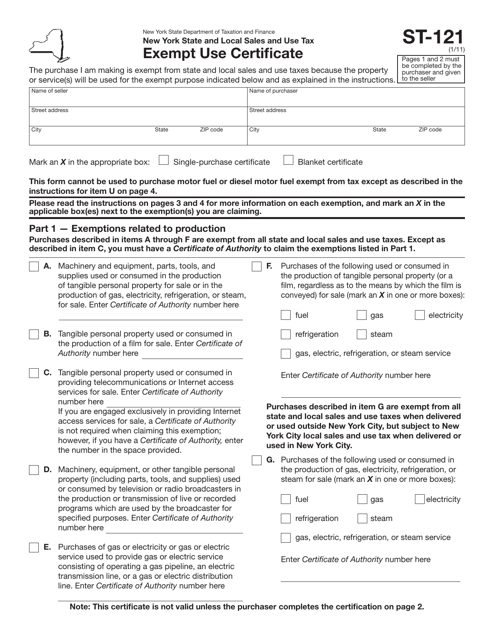

This Form is used for claiming a sales tax exemption in the state of New York.

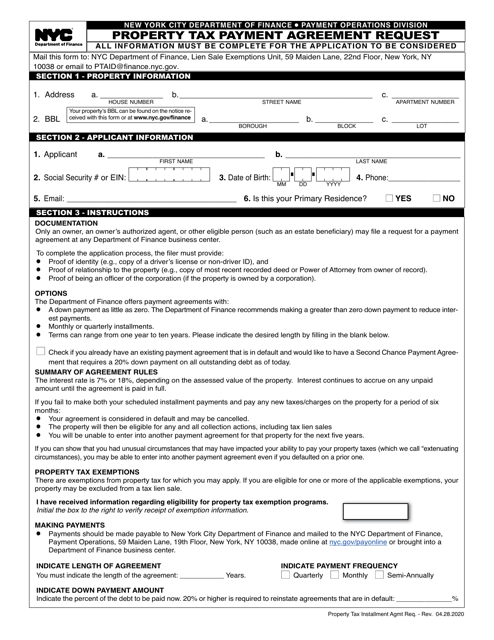

This form is used for applying for the Star Exemption Homeowner Tax Benefit in New York City for the year 2019/2020.

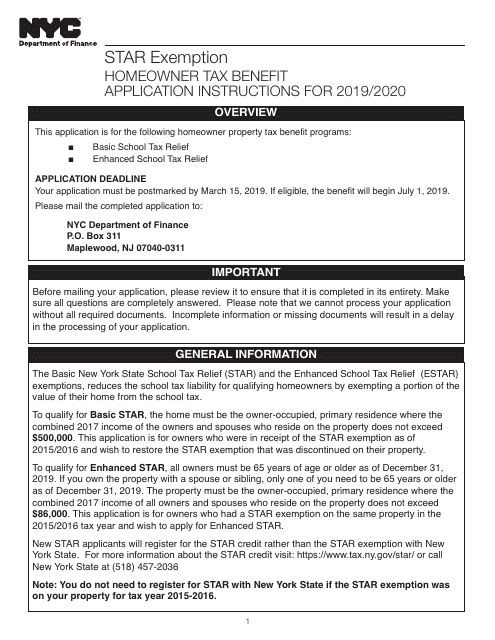

This form is used for obtaining an exemption certificate in New York for the purchase of a racehorse.

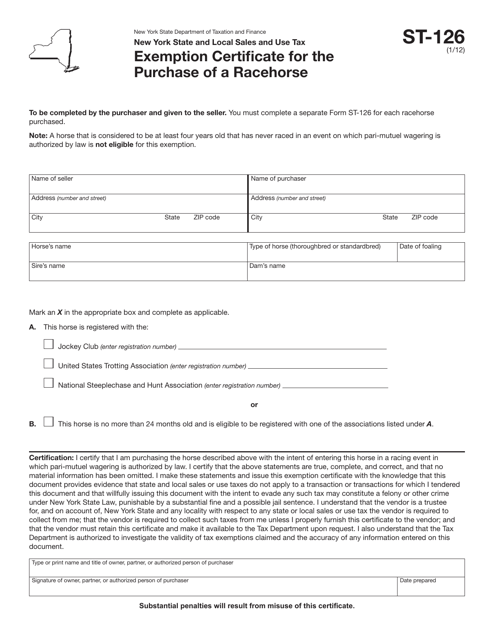

This form is used for certifying the residential use of energy purchases in the state of New York.

This form is used for claiming exemption from sales tax in the state of New York.

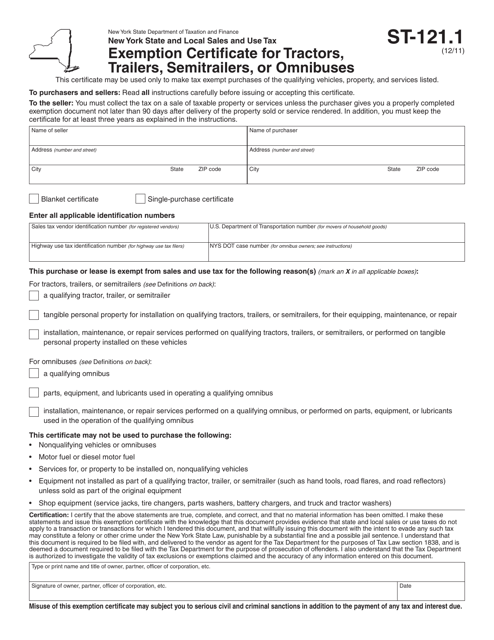

This Form is used for claiming an exemption from sales tax for tractors, trailers, semitrailers, or omnibuses in the state of New York.

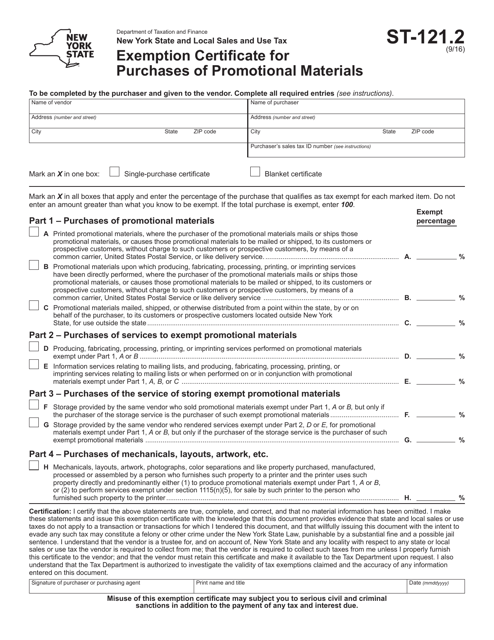

This form is used for requesting an exemption from sales tax when purchasing promotional materials in New York.

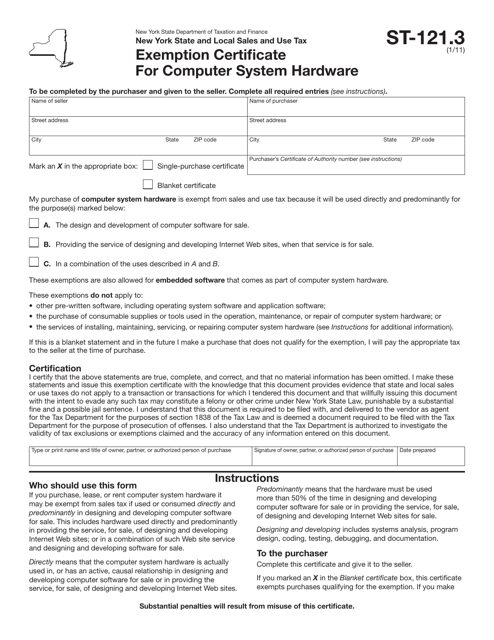

This form is used for applying for an exemption from sales tax on computer system hardware in the state of New York.

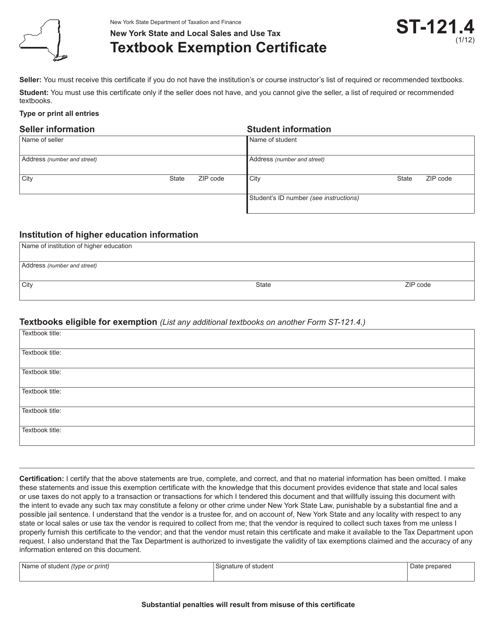

This form is used for claiming a sales tax exemption for textbooks in the state of New York.

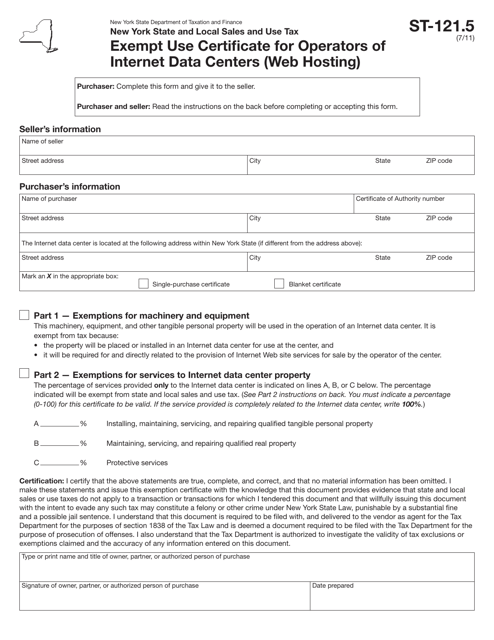

Form ST-121.5 Exempt Use Certificate for Operators of Internet Data Centers (Web Hosting) - New York

This Form is used for operators of internet data centers (web hosting) in New York to claim exemption from certain taxes.

![Form RP-485-L [AMHERST] Application for Residential Property Improvement; Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733926/form-rp-485-l-amherst-application-residential-property-improvement-certain-towns-new-york_big.png)

![Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-491 [ELMA] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733932/form-rp-491-elma-application-conservation-easement-agreement-exemption-certain-towns-new-york_big.png)

![Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york_big.png)