Virginia Tax Forms and Templates

Documents:

175

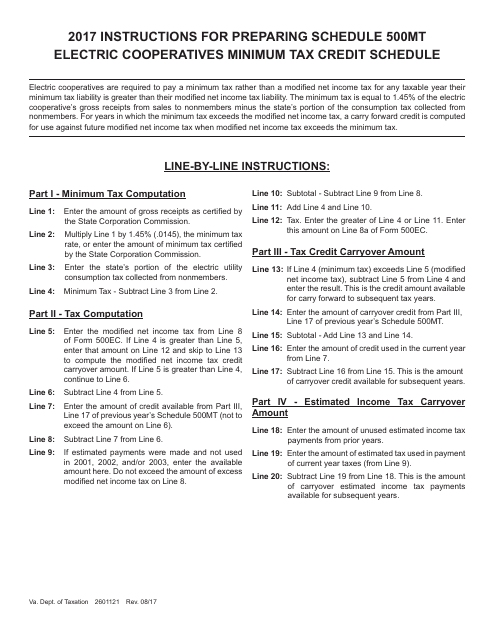

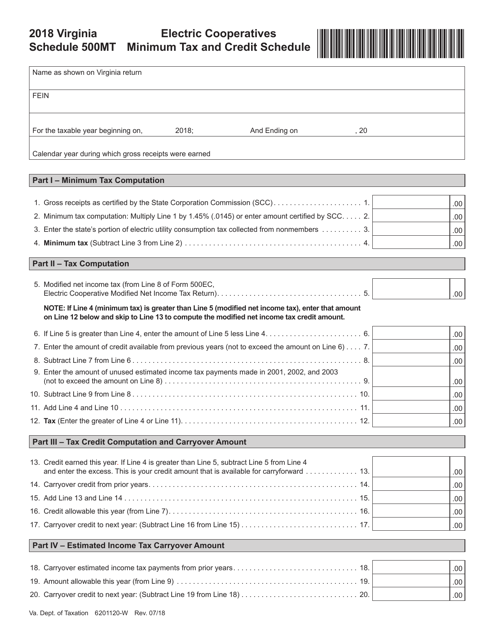

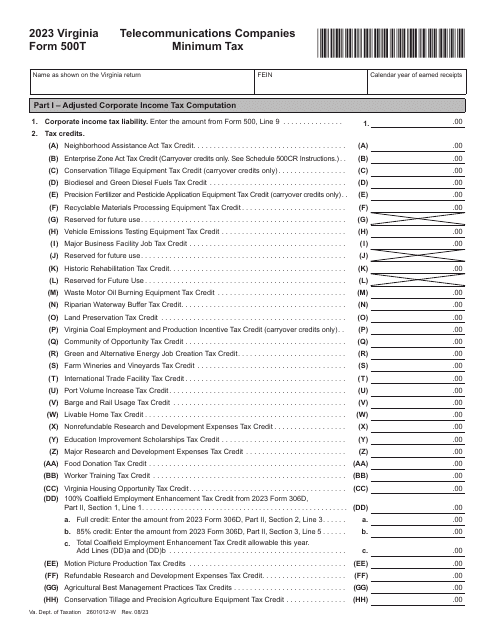

This Form is used for reporting the Minimum Tax Credit Schedule for Electric Cooperatives in Virginia.

Form 6201120-W Schedule 500MT Electric Cooperatives Minimum Tax and Credit Schedule - Virginia, 2018

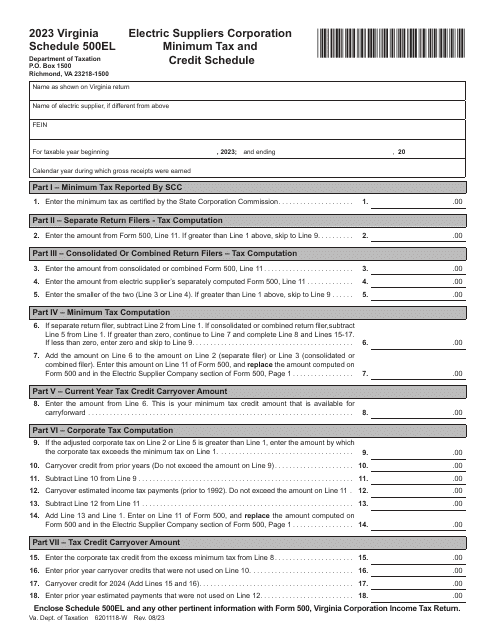

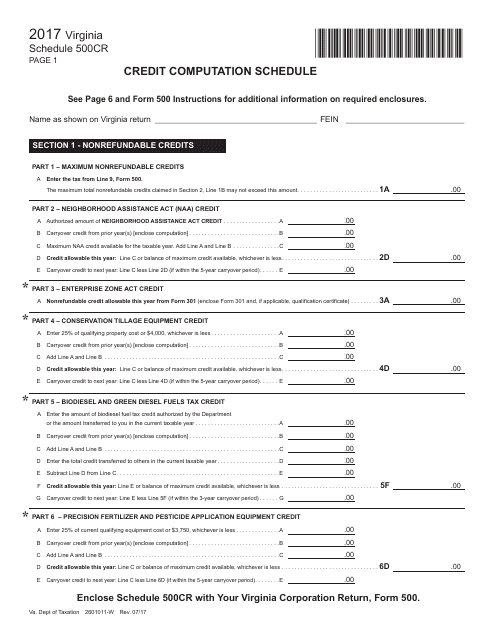

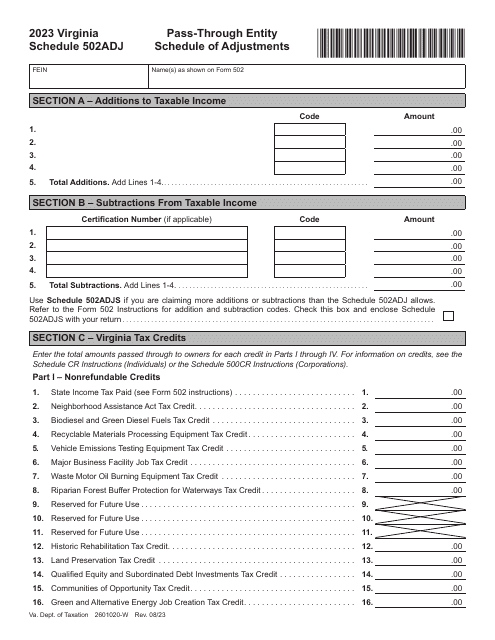

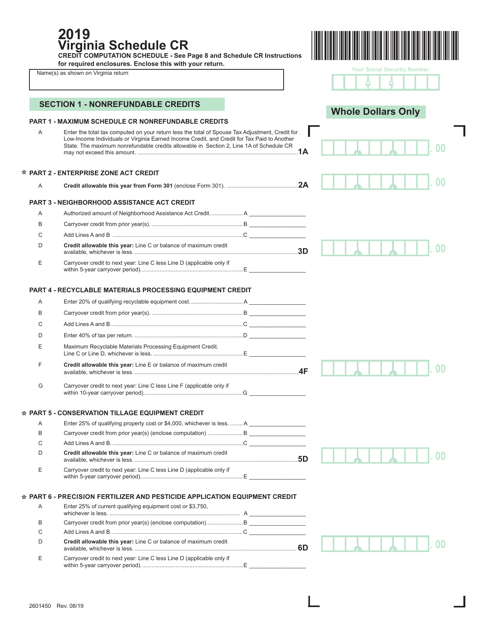

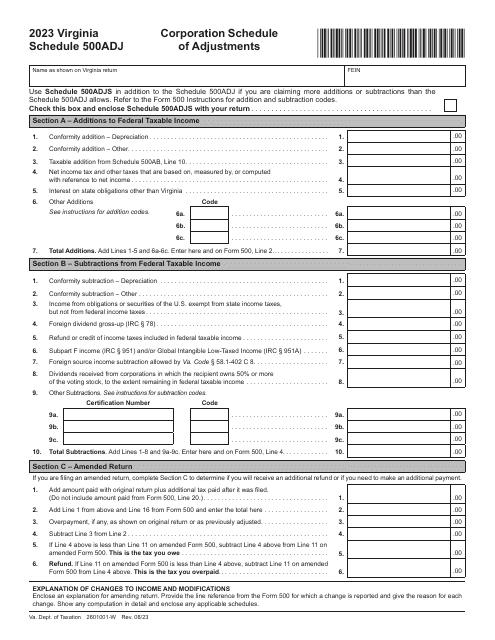

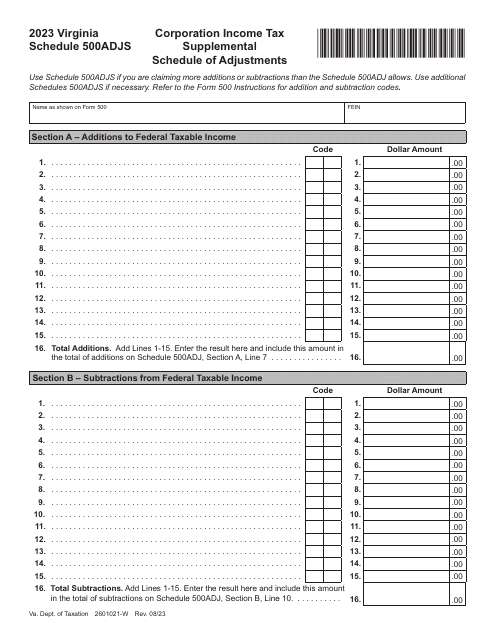

This Form is used for calculating the credit computation schedule for the state of Virginia.

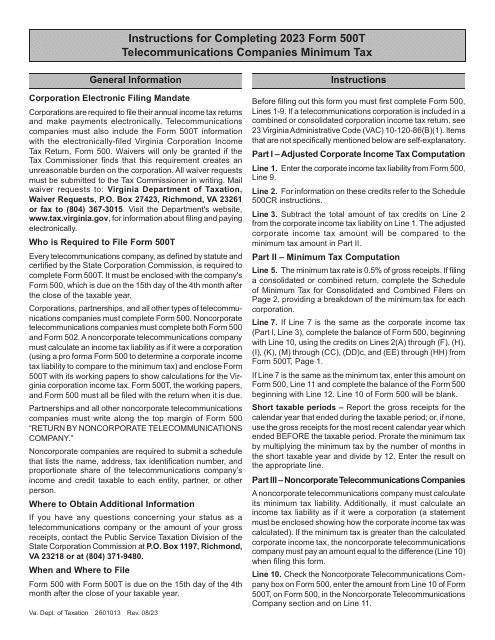

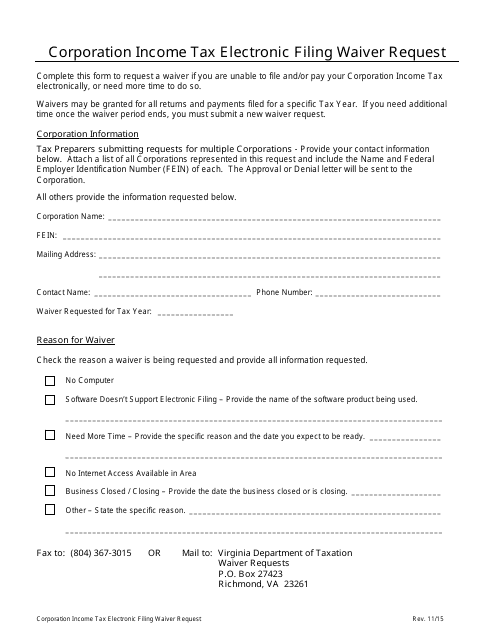

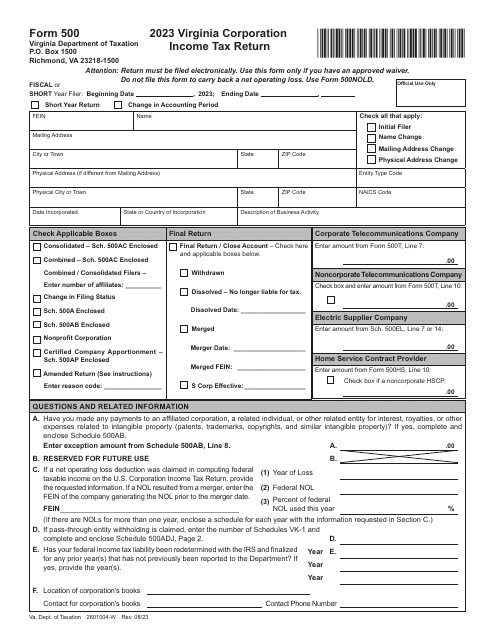

This document is used to request a waiver for electronic filing of corporation income tax in the state of Virginia.

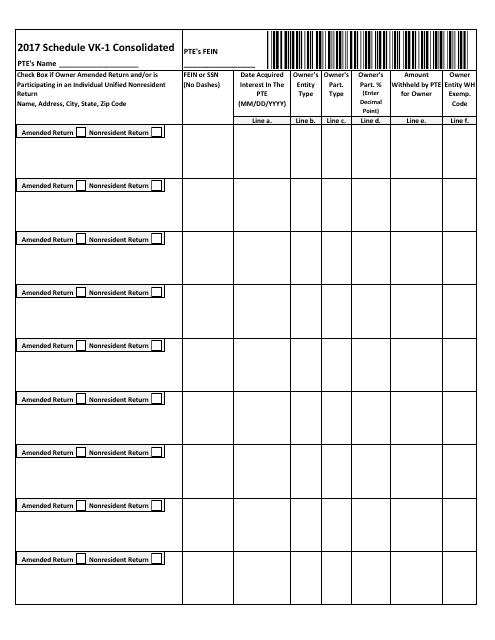

This document is used for reporting consolidated income and expenses in the state of Virginia.

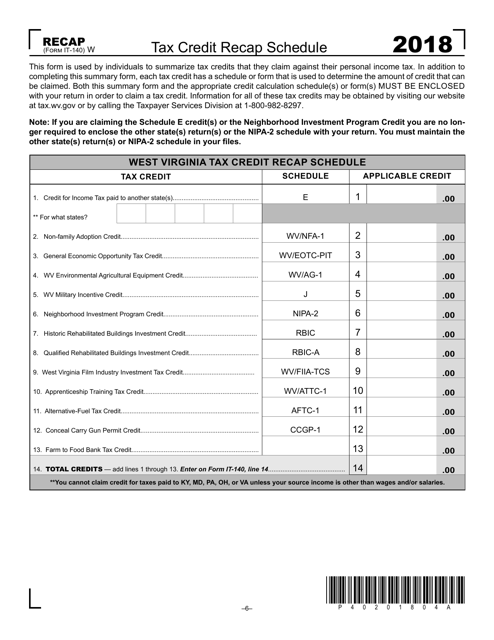

This form is used for summarizing tax credits in the state of Virginia. It helps individuals to calculate and report their tax credits in a concise manner.

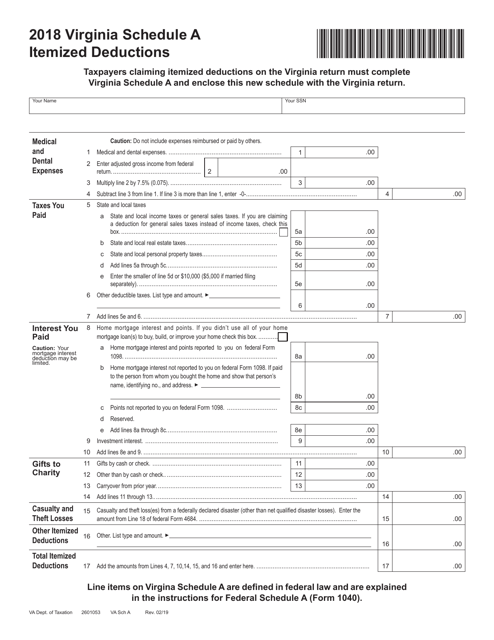

This form is used for reporting itemized deductions on your Virginia state tax return. It allows you to claim deductions such as medical expenses, mortgage interest, and charitable contributions to potentially reduce your taxable income.

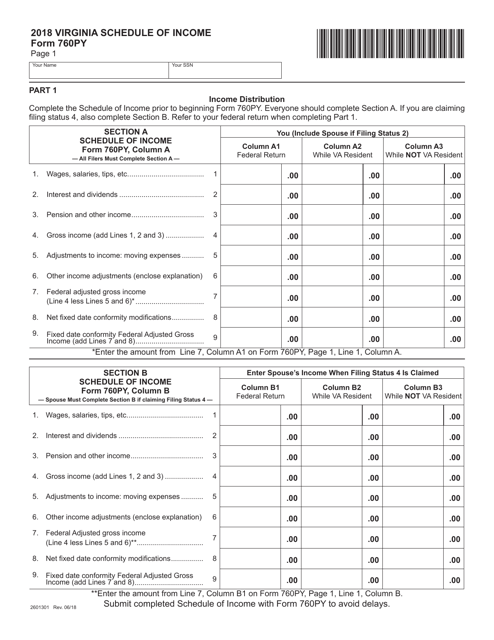

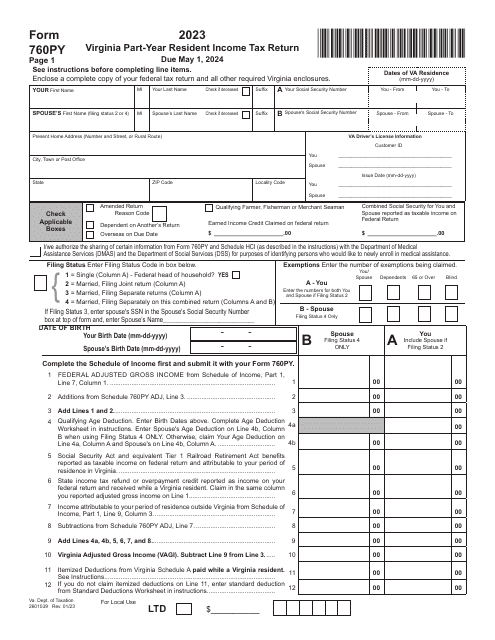

This document is used for reporting and summarizing income earned in the state of Virginia for tax purposes.

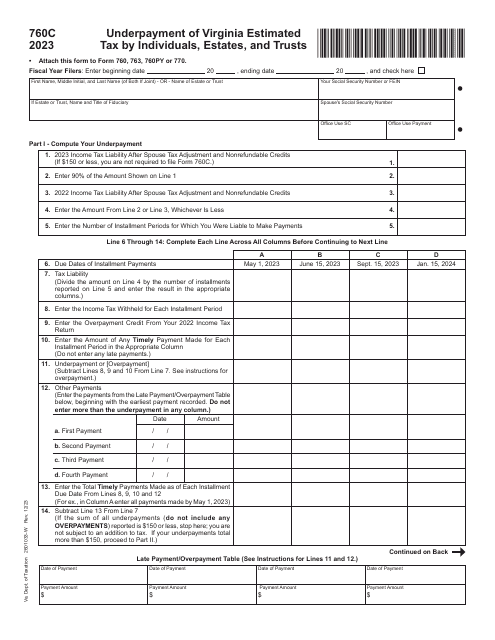

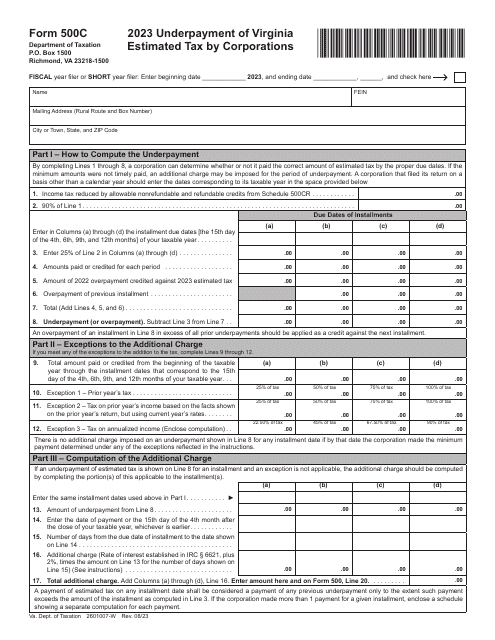

Form 760C Underpayment of Virginia Estimated Tax by Individuals, Estates and Trusts - Virginia, 2023

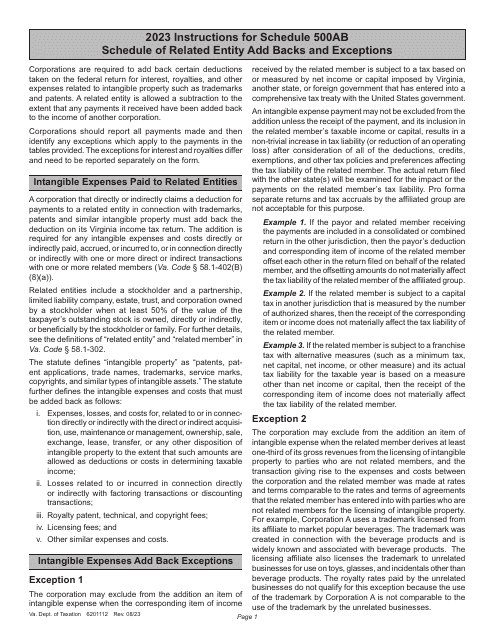

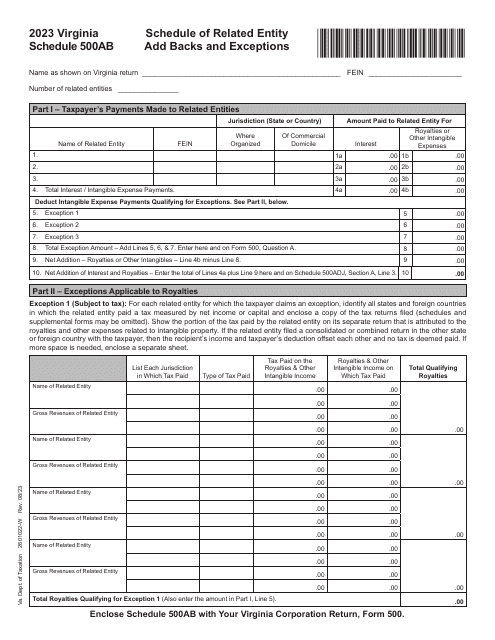

Instructions for Schedule 500AB Schedule of Related Entity Add Backs and Exceptions - Virginia, 2023