Virginia Tax Forms and Templates

Documents:

175

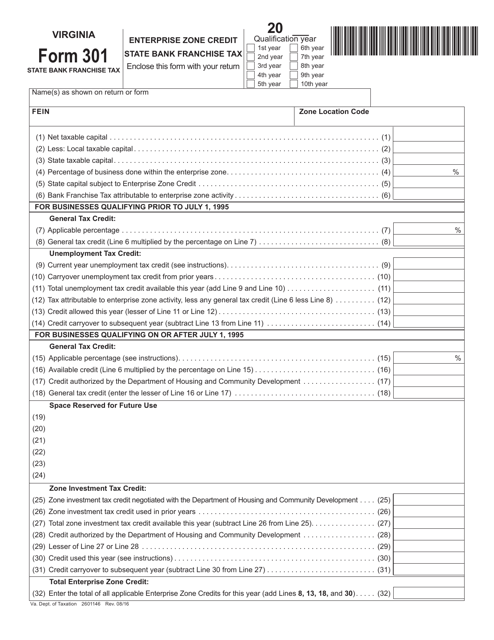

This form is used for claiming the Enterprise Zone Credit for Bank Franchise Tax in Virginia.

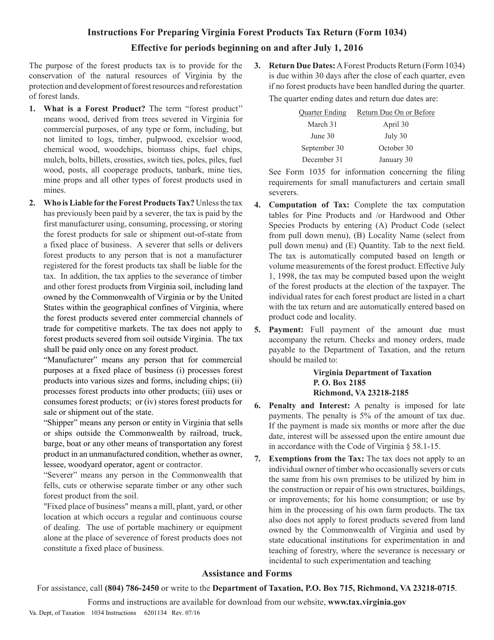

This Form is used for filing the Virginia Forest Products Tax Return in the state of Virginia. It provides instructions on how to report and pay taxes on forest products.

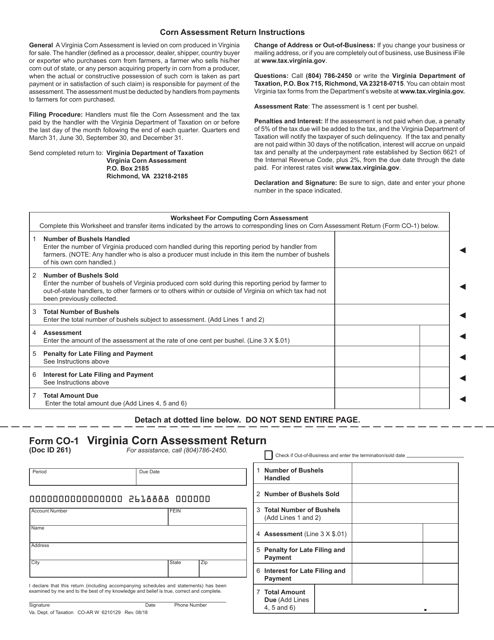

This Form is used for submitting the Virginia Corn Assessment Return in the state of Virginia.

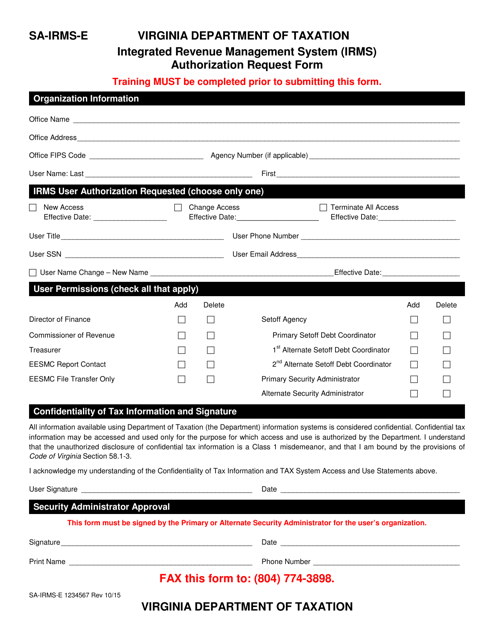

This form is used for requesting authorization for the Integrated Revenue Management System (Irms) in the state of Virginia.

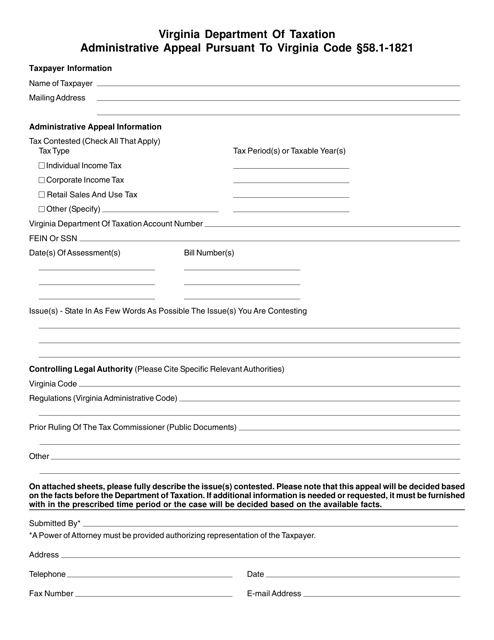

This document is used for filing an administrative appeal in the state of Virginia, specifically under Virginia Code 58.1-1821. The appeal process allows individuals to contest decisions made by the administrative authorities regarding tax matters.

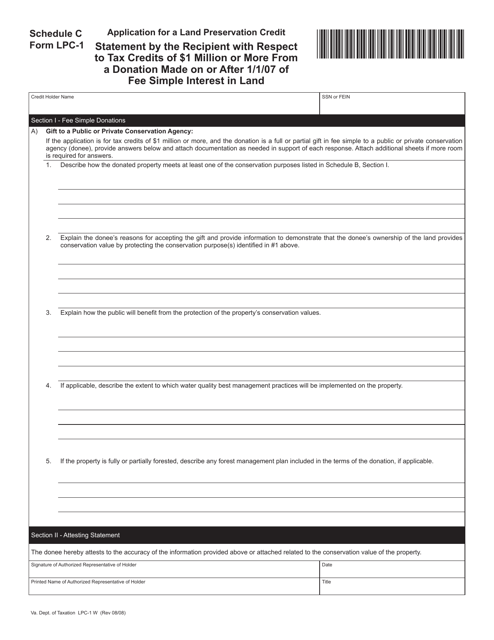

This Form is used for submitting a Schedule C statement in Virginia to report tax credits of $1 million or more received from a donation made on or after January 1, 2007, of fee simple interest in land.

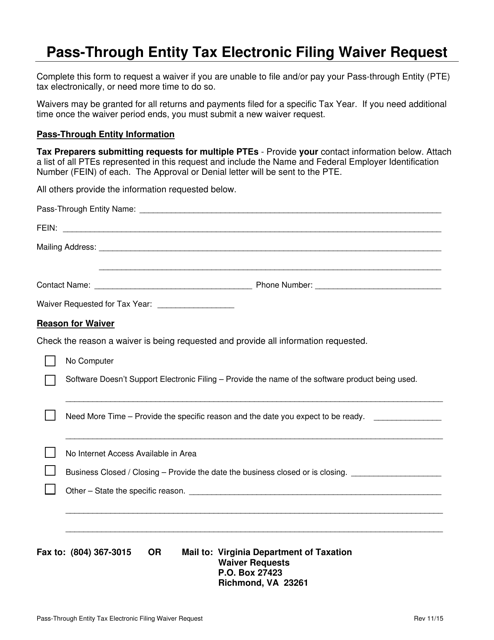

This Form is used for requesting a waiver to electronically file pass-through entity tax returns in the state of Virginia.

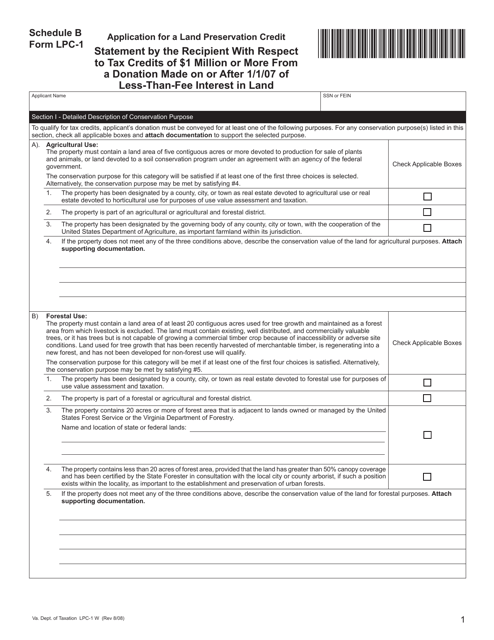

This document is for the recipient to provide a statement about tax credits of $1 million or more received from a donation of less-than-fee interest in land made in Virginia on or after 1/1/07.