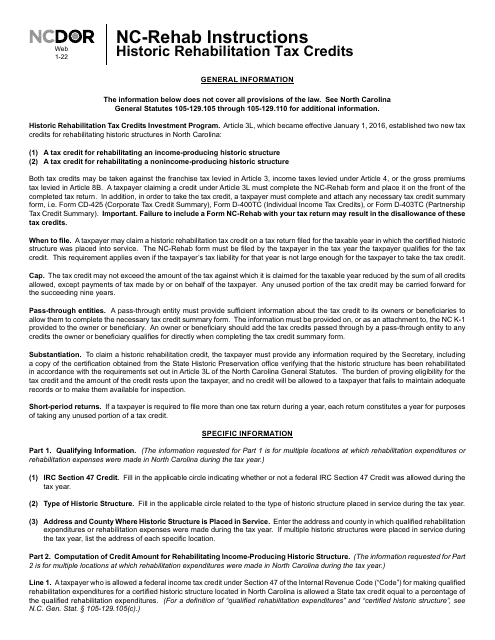

North Carolina Tax Forms and Templates

North Carolina Tax Forms are used for various purposes related to taxation in the state. These forms are used by individuals, businesses, and organizations to report their income, claim deductions and credits, calculate tax liabilities, and fulfill their tax obligations to the state. They are also used to apply for various tax exemptions and to provide necessary information to state tax authorities.

Documents:

122

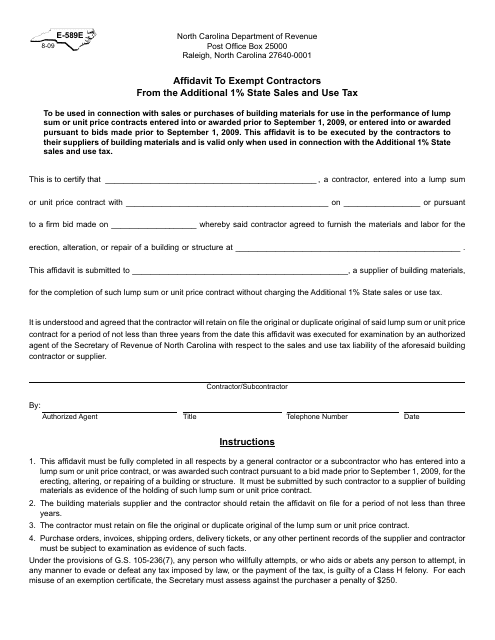

This form is used for contractors in North Carolina to request exemption from the additional 1% state sales and use tax.

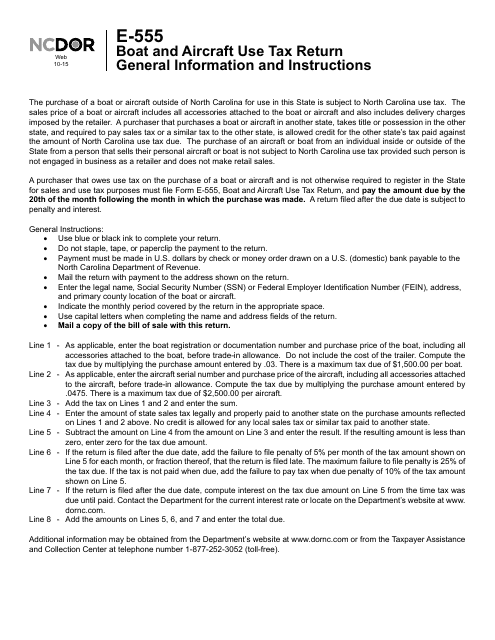

This Form is used for reporting and paying boat and aircraft use tax in North Carolina. It provides instructions on how to complete the tax return and ensure compliance with the state's tax laws for boats and aircraft.

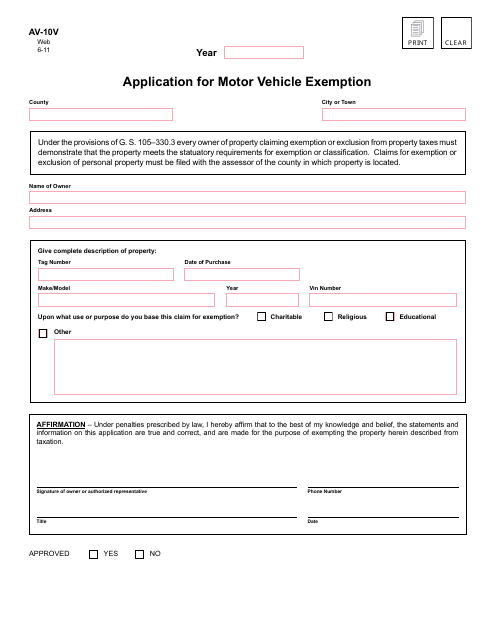

This Form is used for applying for motor vehicle exemption in North Carolina.

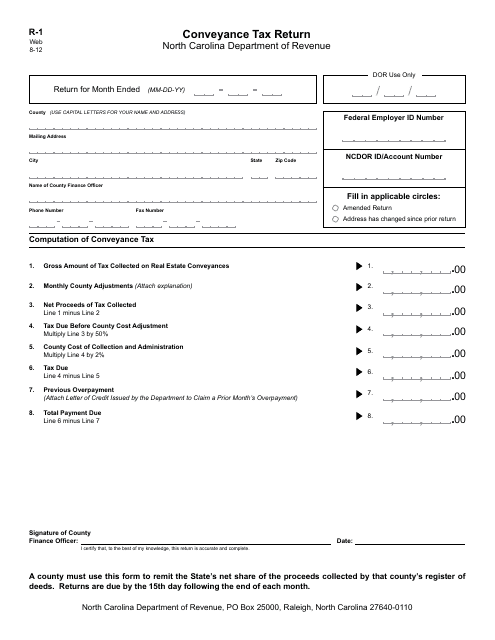

This Form is used for filing a Conveyance Tax Return in North Carolina.

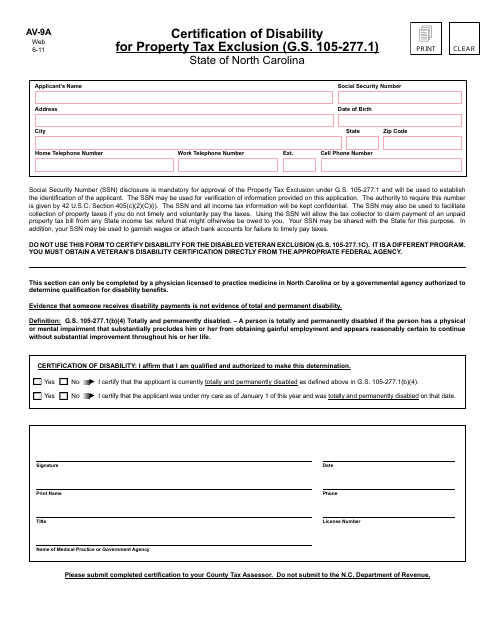

This Form is used for certifying disability for property tax exclusion in North Carolina.

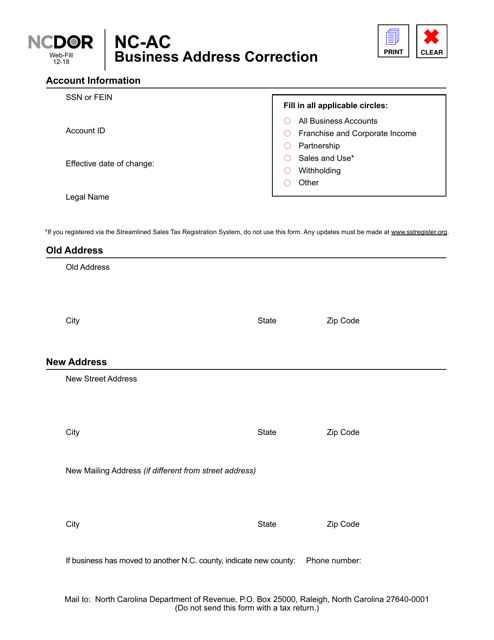

This form is used for correcting the business address in North Carolina.

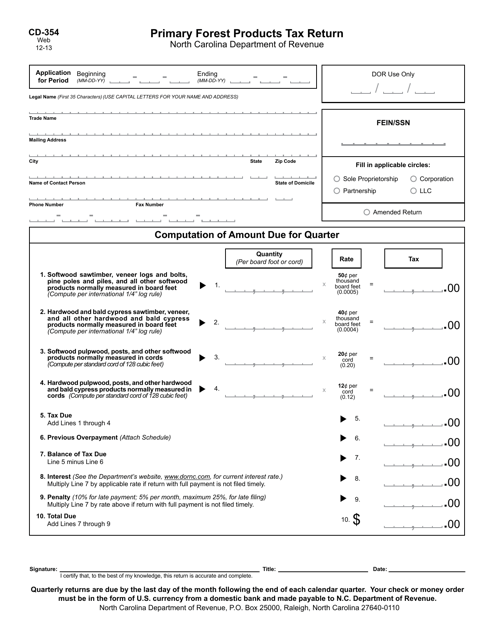

This form is used for reporting and paying taxes on primary forest products in North Carolina.

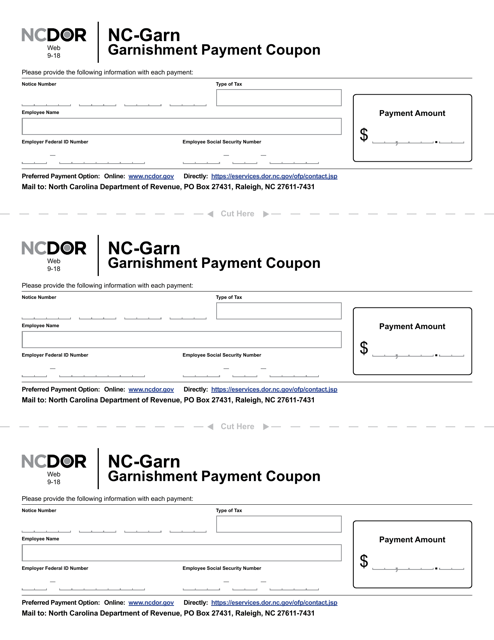

This form is used for submitting payment for garnishment in the state of North Carolina.

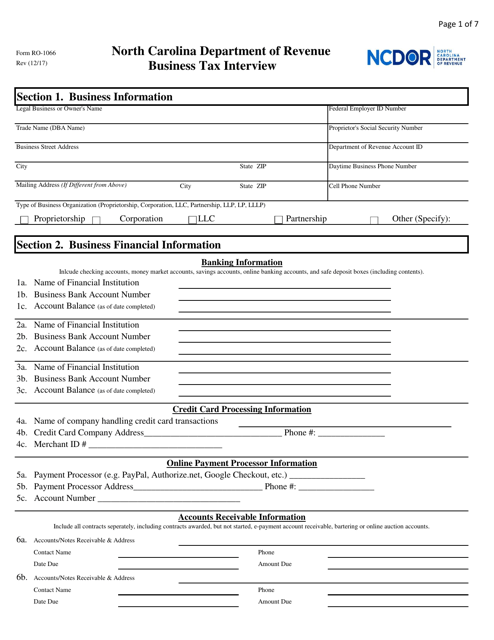

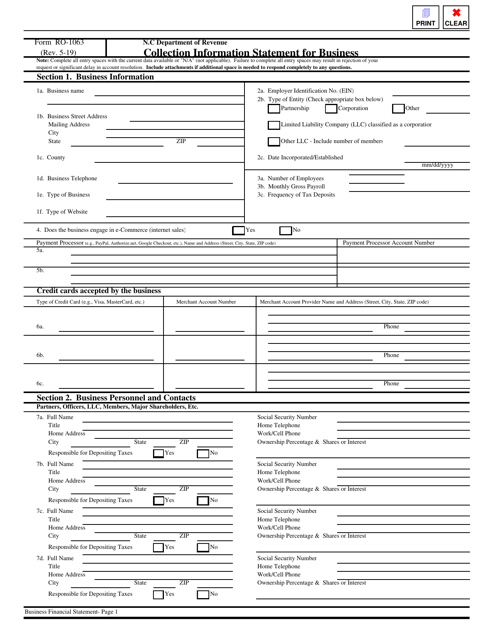

This form is used for conducting a business tax interview in North Carolina. It helps gather information related to business taxes and is an important step in the tax filing process for businesses in the state.

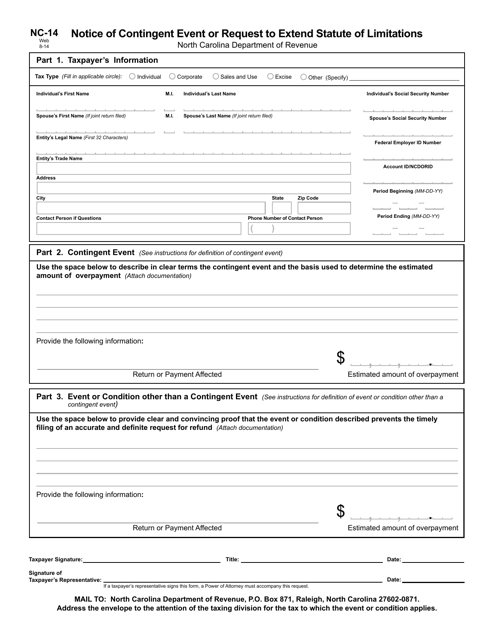

This Form is used for notifying a contingent event or requesting an extension of the statute of limitations in North Carolina.

This Form is used for claiming a refund of taxes paid in the state of North Carolina.

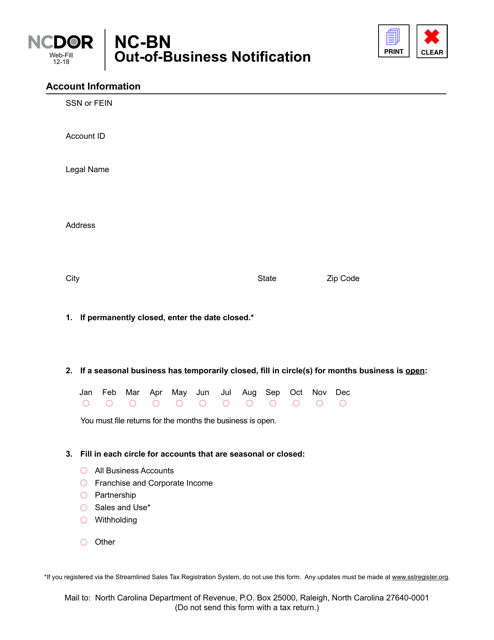

This Form is used for submitting an Out-of-Business Notification in the state of North Carolina.

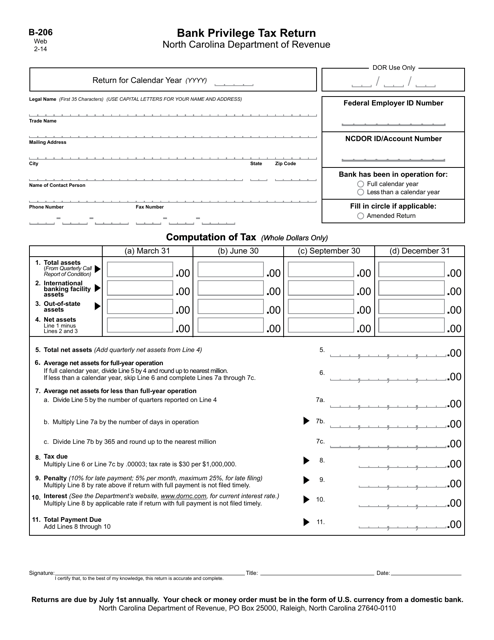

This Form is used for filing the Bank Privilege Tax Return in the state of North Carolina. The Bank Privilege Tax is a tax imposed on banks for the privilege of doing business in the state.

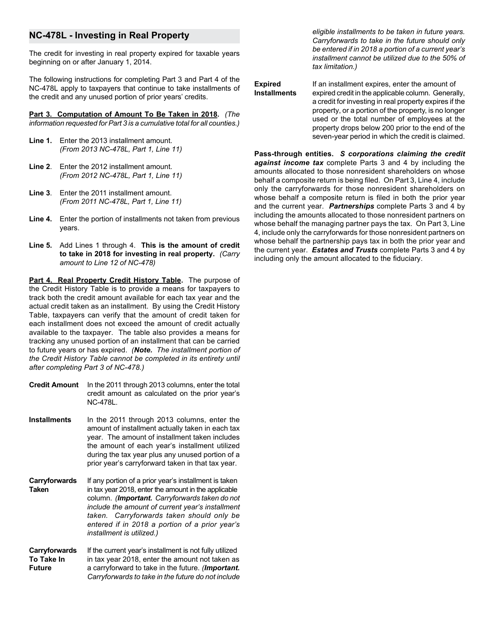

This form is used for reporting investments in real property in the state of North Carolina. It provides instructions on how to complete Form NC-478L.

This form is used for installment payment for life, accident, health, and title insurance companies in North Carolina.

This form is used for installment payment property and casualty companies in North Carolina.