North Carolina Tax Forms and Templates

Documents:

122

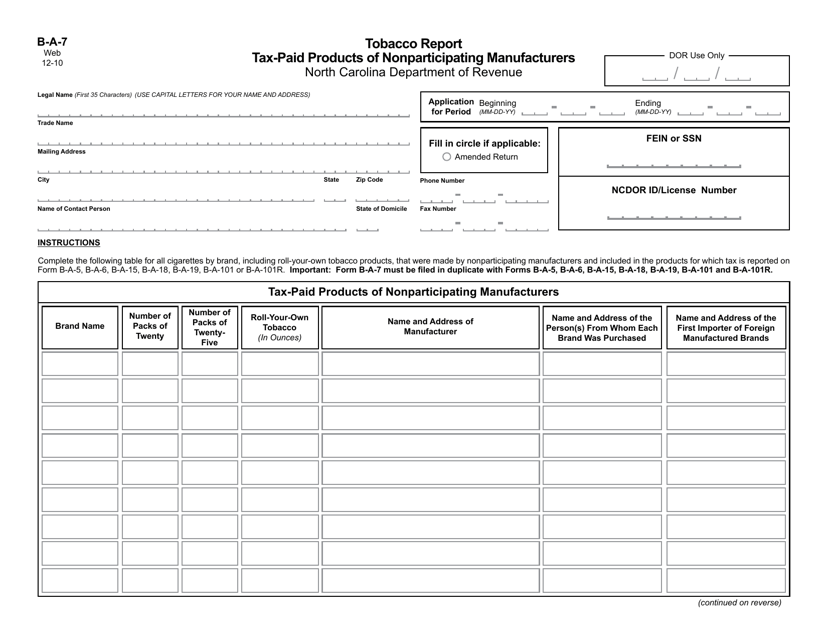

This form is used for reporting tax-paid tobacco products manufactured by nonparticipating manufacturers in North Carolina.

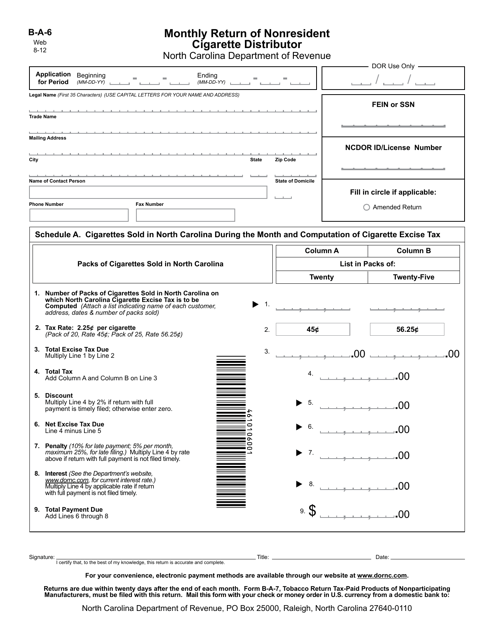

This form is used for nonresident cigarette distributors in North Carolina to report their monthly returns.

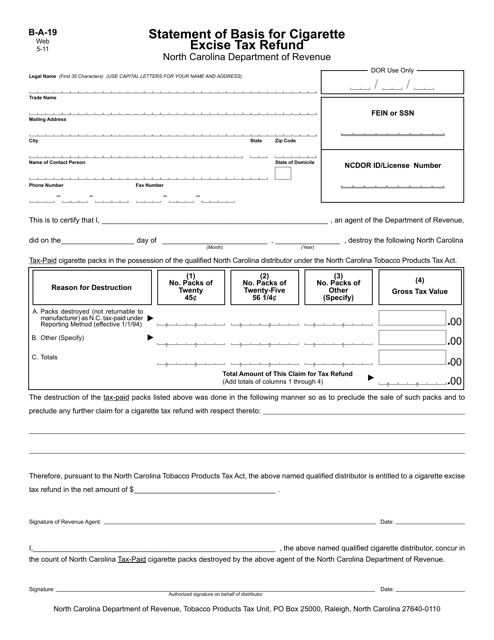

This form is used for filing a statement of basis to request a refund of cigarette excise tax in North Carolina.

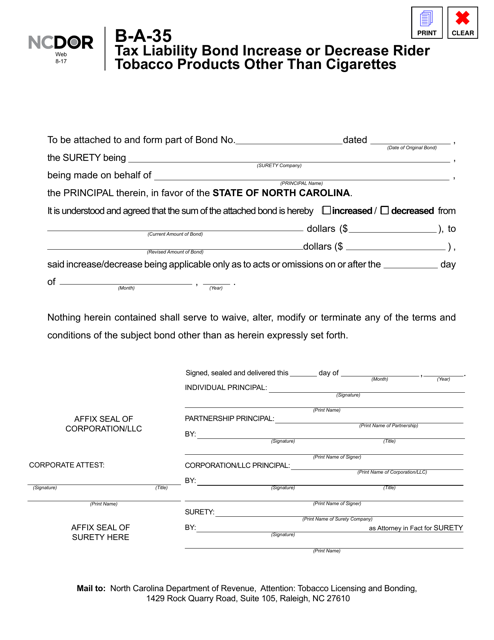

This form is used for increasing or decreasing the tax liability bond for tobacco products other than cigarettes in North Carolina.

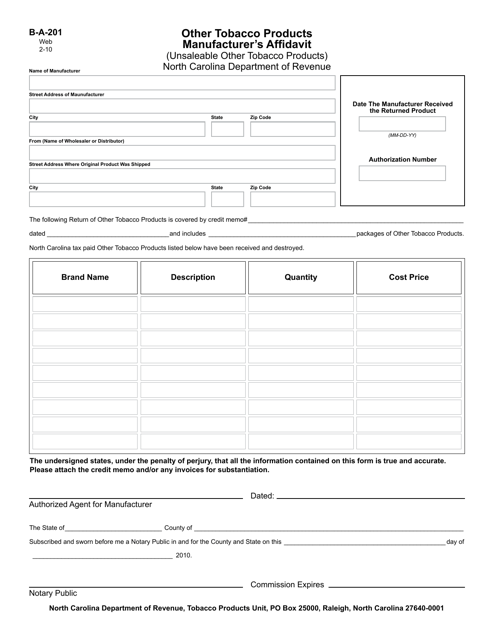

This form is used for other tobacco product manufacturers in North Carolina to submit an affidavit for unsaleable products.

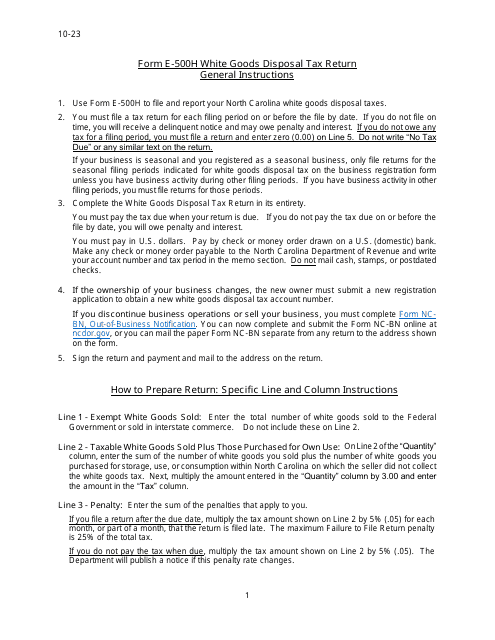

This form is used for claiming a refund of the White Goods Disposal Tax in North Carolina.

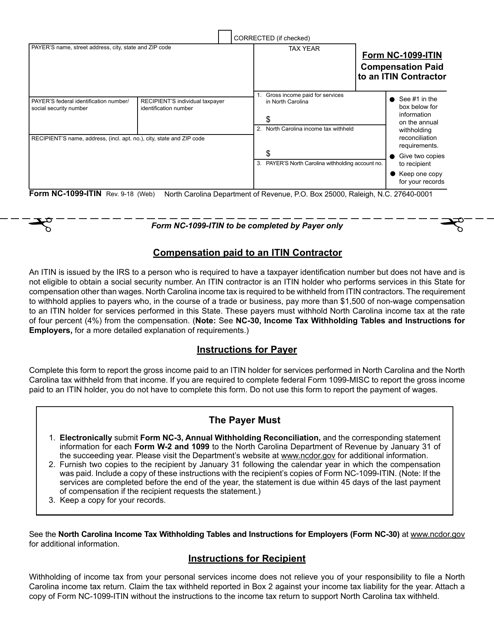

This Form is used for reporting compensation paid to an ITIN contractor in North Carolina.

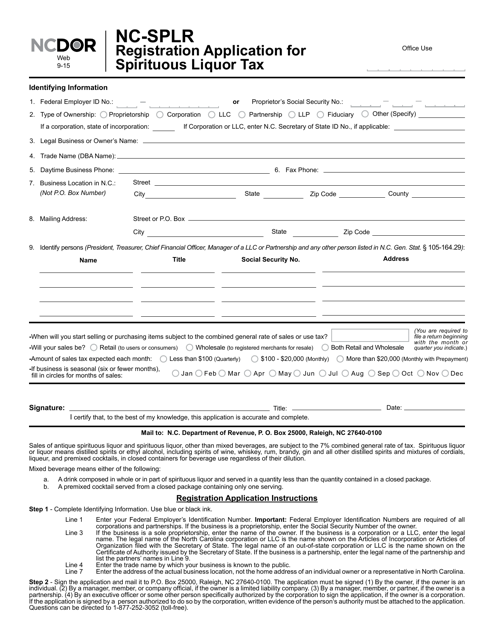

This form is used for registering and applying for the Spirituous Liquor Tax in the state of North Carolina.

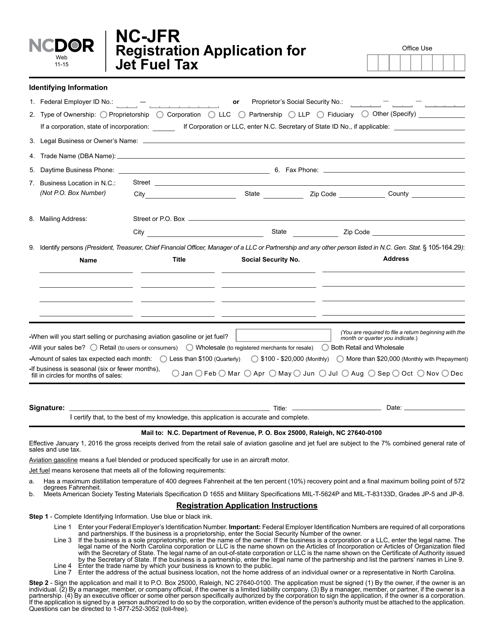

This form is used for registering and applying for jet fuel tax in the state of North Carolina.

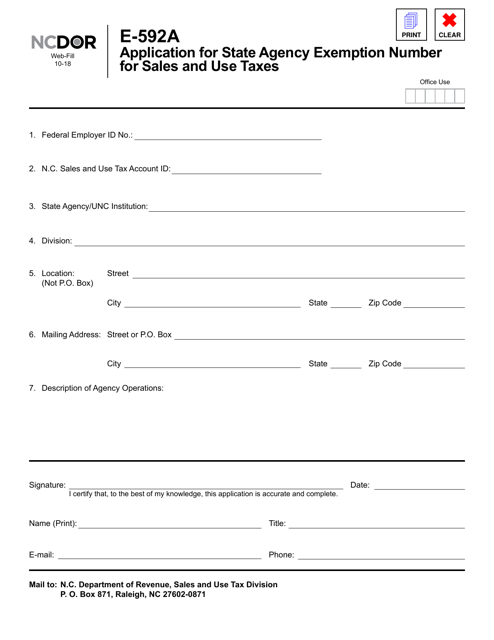

This form is used to apply for a State Agency Exemption Number for Sales and Use Taxes in North Carolina. It allows state agencies to be exempt from paying certain taxes when making purchases.

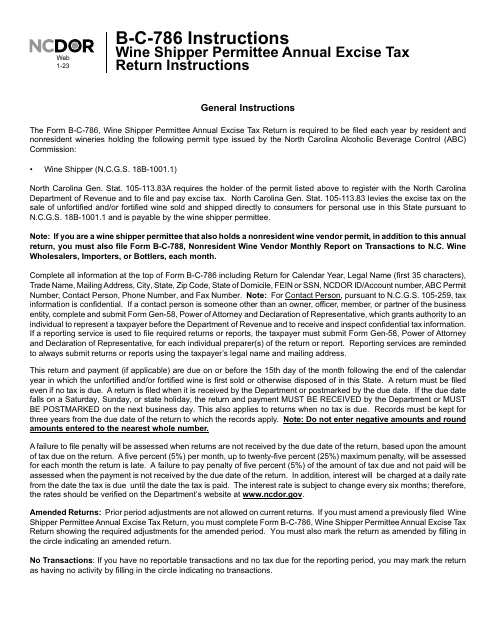

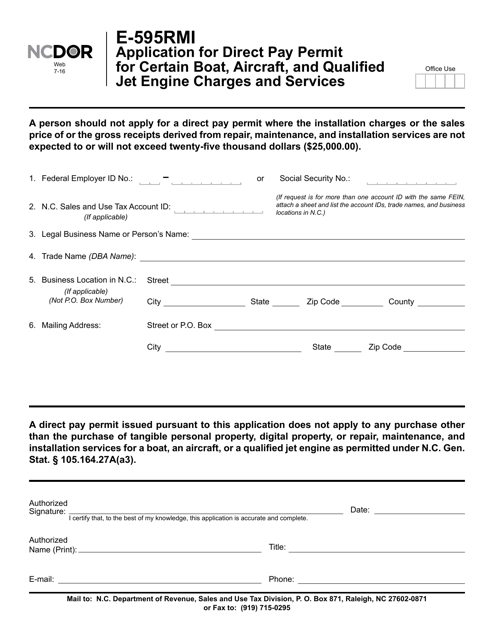

This Form is used for applying for a Direct Pay Permit in North Carolina for boat, aircraft, and qualified jet engine charges and services.

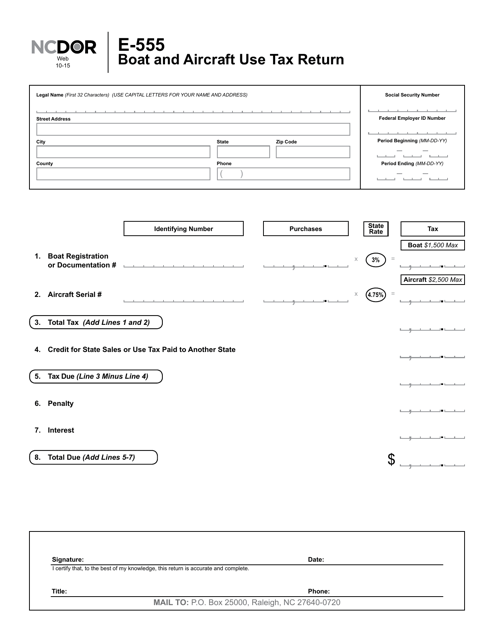

This form is used for reporting and paying use tax on boats and aircrafts in the state of North Carolina.

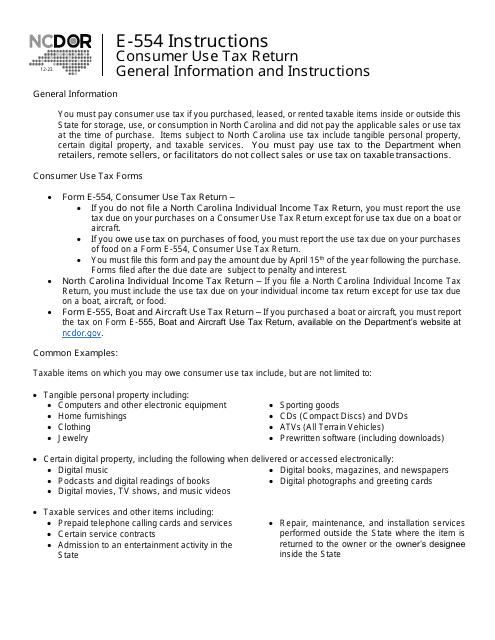

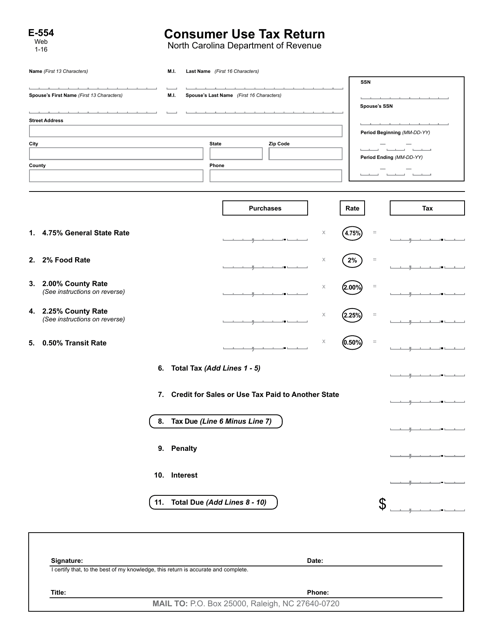

This form is used for reporting and remitting consumer use tax in the state of North Carolina. It is used by individuals who have made purchases out of state on which no sales tax was charged.

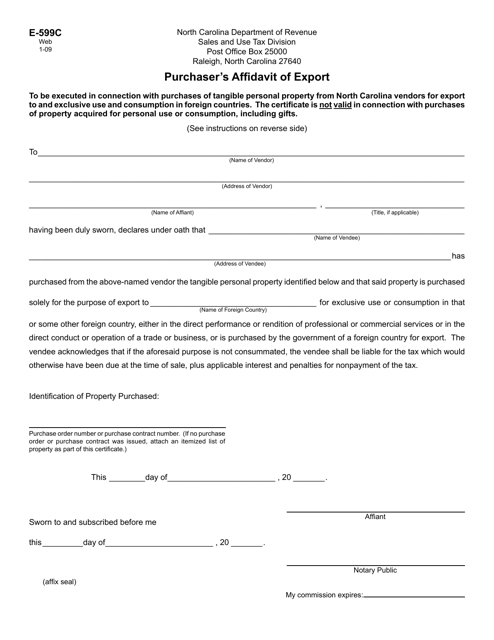

This Form is used for purchasers in North Carolina to declare that they are exporting the purchased items.

This form is used for state agency refunds of county and transit sales and use taxes in North Carolina.

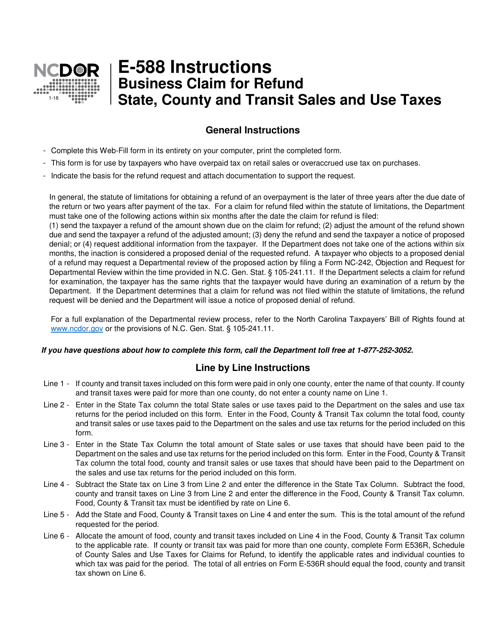

This document is for businesses in North Carolina who want to claim a refund for state, county, and transit sales and use taxes. It provides instructions on how to fill out and submit Form E-588.

This form is used for claiming a refund on state, county, and transit sales and use taxes in North Carolina.

This Form is used for businesses in North Carolina to claim a refund on state, county, and transit sales and use taxes.

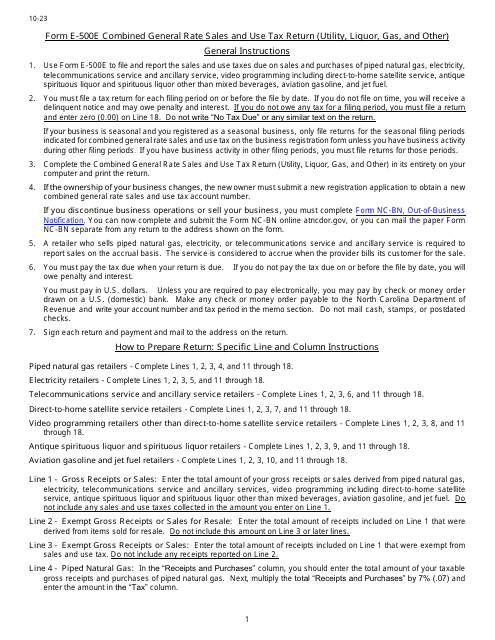

This form is used for interstate carriers to claim a refund of combined general rate sales and use taxes in North Carolina.

This form is used for claiming a refund for state, county, and transit sales and use taxes for certain cancelled service contracts in North Carolina. It provides instructions on how to fill out and submit the form to request a refund.

This document is for contractors in North Carolina who wish to exempt themselves from the local government sales and use tax.

This form is used for contractors in North Carolina to claim an exemption from the 1/4% county sales and use tax. It is an affidavit that contractors must complete in order to be exempt from this tax.

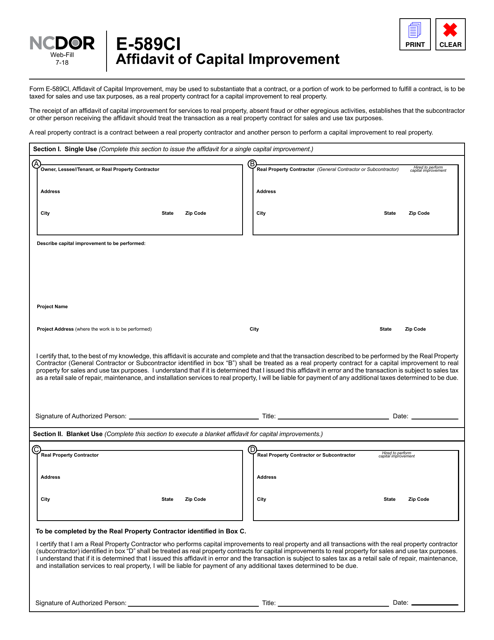

This form is used for filing an Affidavit of Capital Improvement in North Carolina. It is used to certify that certain construction or improvements have been made to a property in order to claim an exclusion or deferment from property taxes.

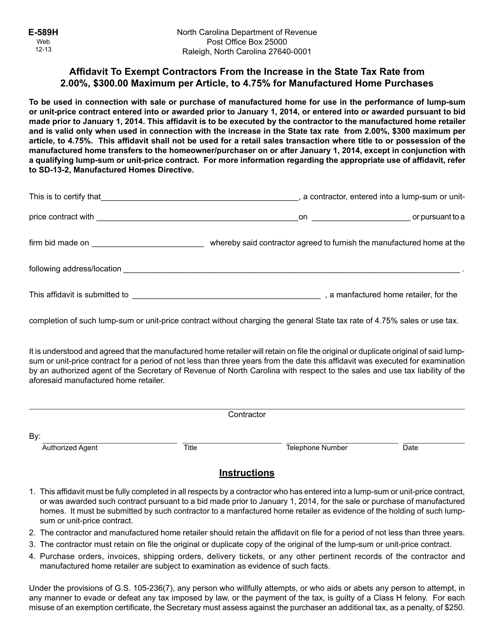

This form is used for contractors in North Carolina to claim an exemption from the increase in state tax rate for manufactured home purchases.

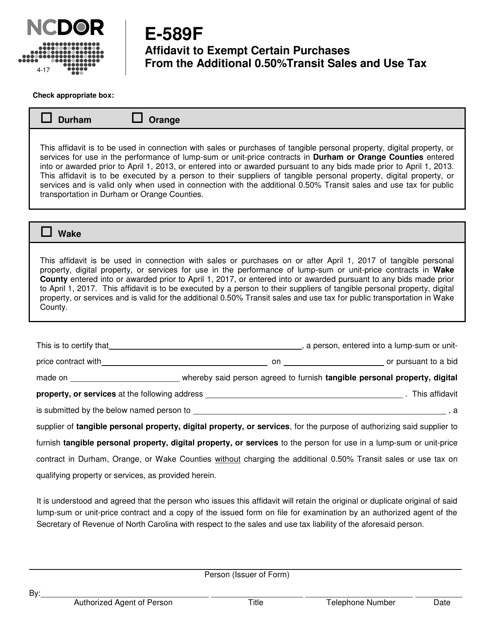

This form is used for requesting an exemption from the additional 0.50% transit sales and use tax on certain purchases in North Carolina.

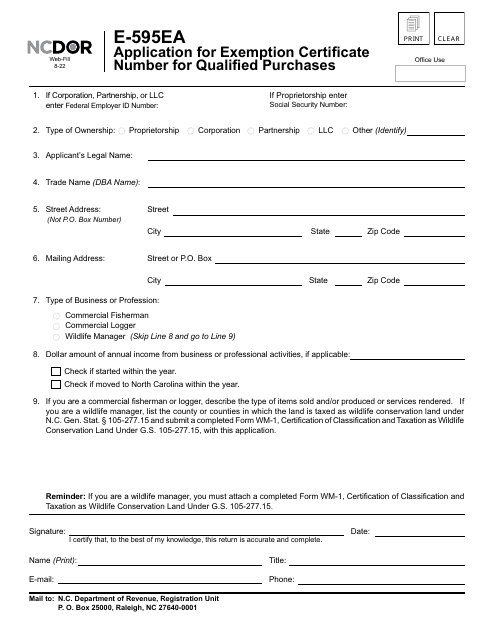

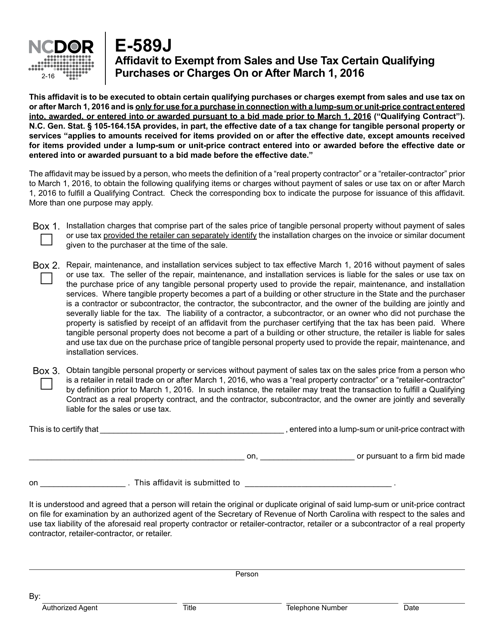

This form is used for individuals or businesses in North Carolina to claim an exemption from sales and use tax for certain qualifying purchases or charges made on or after March 1, 2016.