Fill and Sign Michigan Legal Forms

Documents:

6335

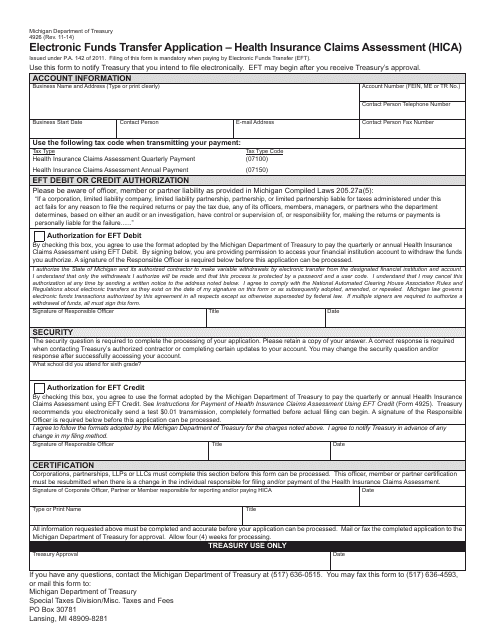

This form is used for applying for electronic funds transfer for health insurance claims assessment in the state of Michigan.

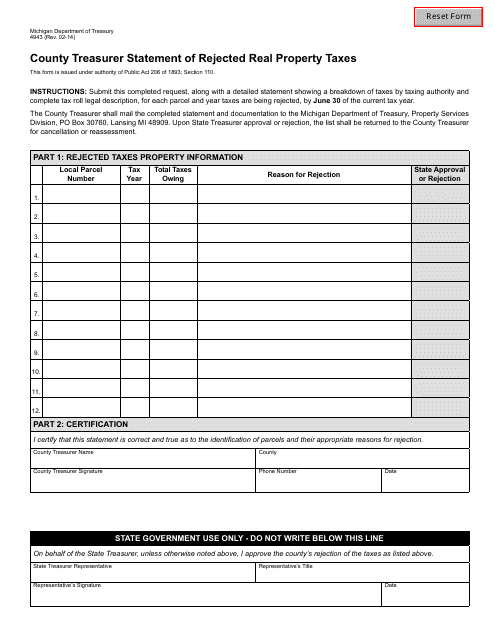

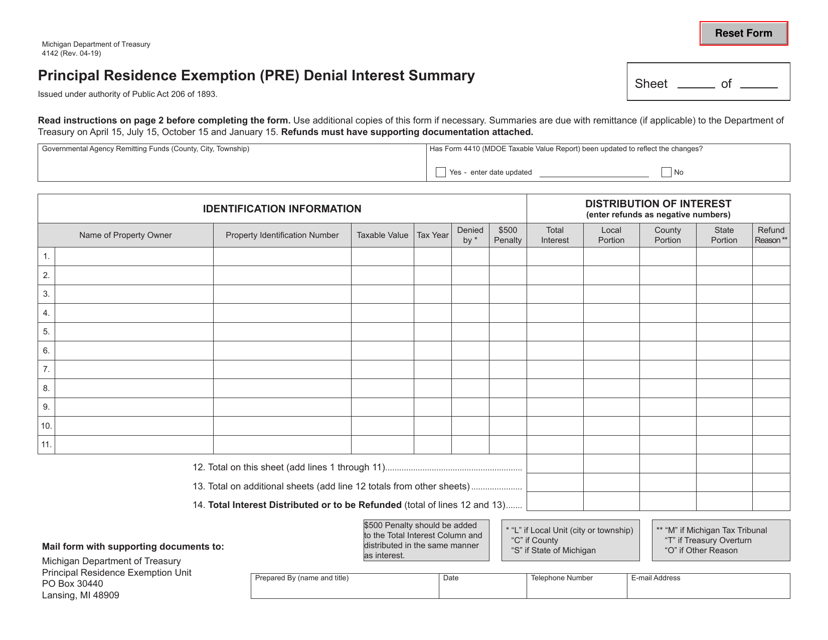

This Form is used for reporting rejected real property taxes to the County Treasurer in Michigan.

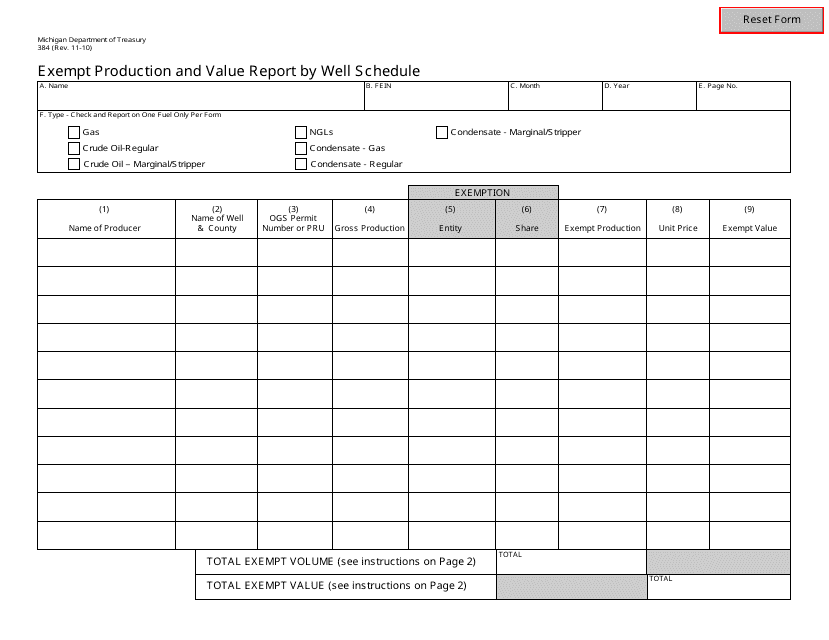

This form is used for reporting exempt production and value of oil and gas wells in Michigan.

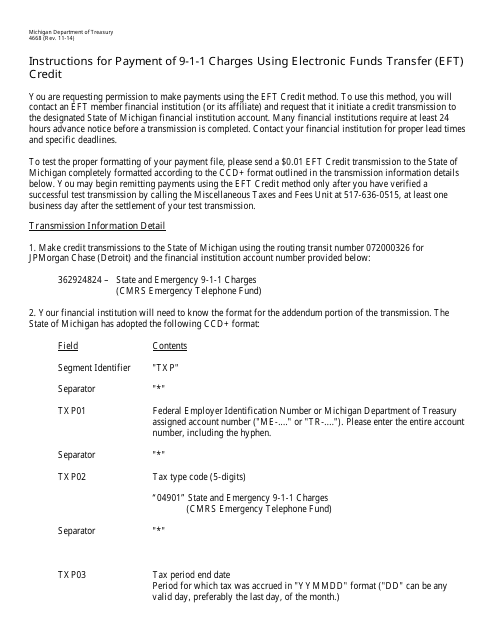

This Form is used for making electronic payments for 9-1-1 charges in Michigan.

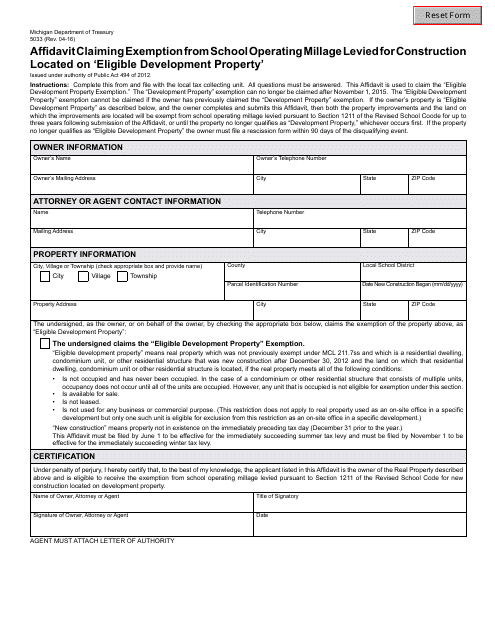

This form is used for claiming an exemption from school operating millage for constructions located on eligible development property in Michigan.

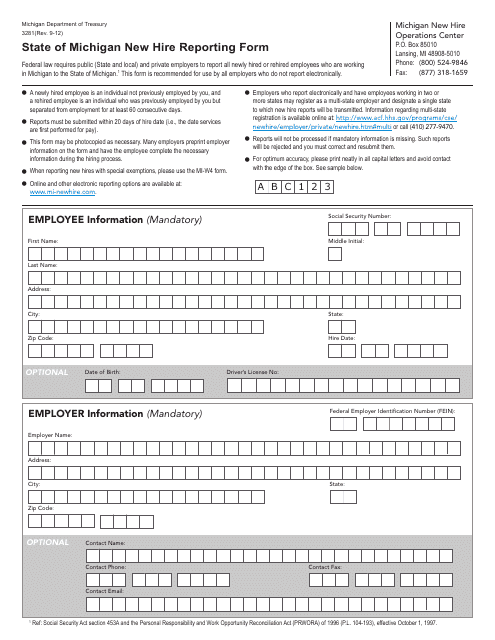

This is a legal document used by an employer to report information on newly hired employees to the Department of Treasury shortly after the date of hire in the state of Michigan.

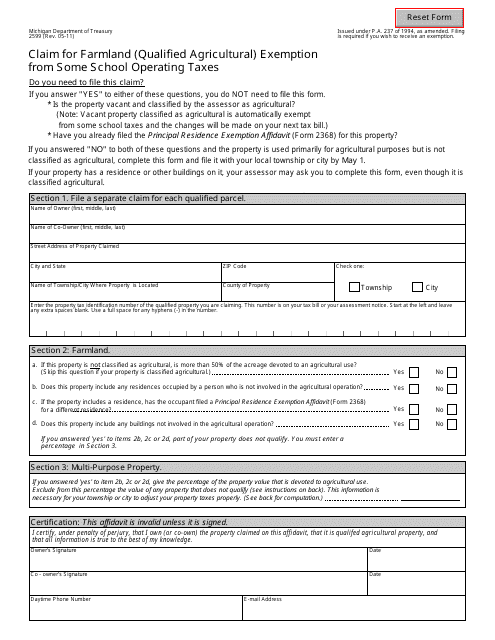

This form is used for claiming a farmland exemption from some school operating taxes in Michigan.

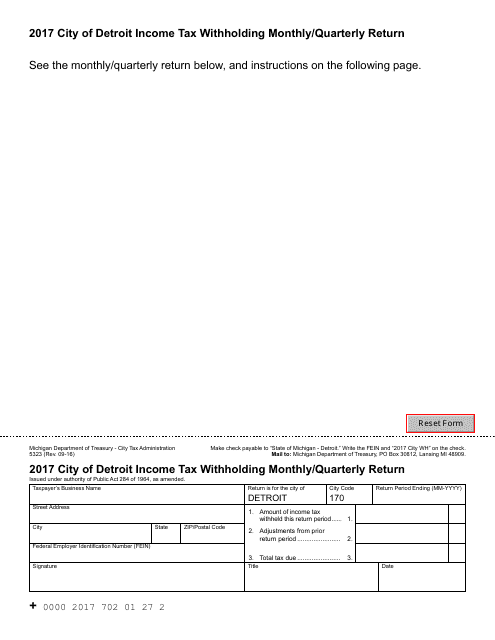

This form is used by businesses in the City of Detroit to report their monthly or quarterly income tax withholdings for employees.

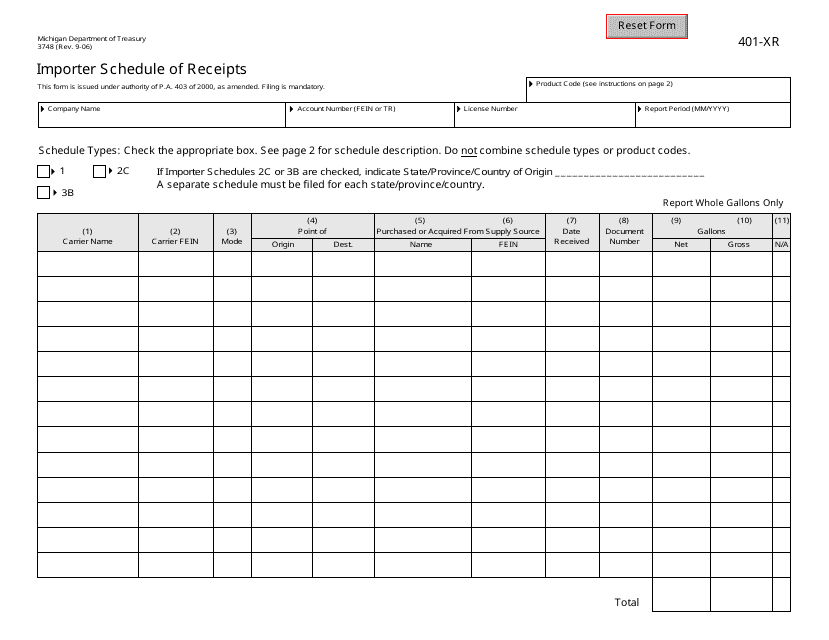

This form is used for Michigan importers to document their schedule of receipts.

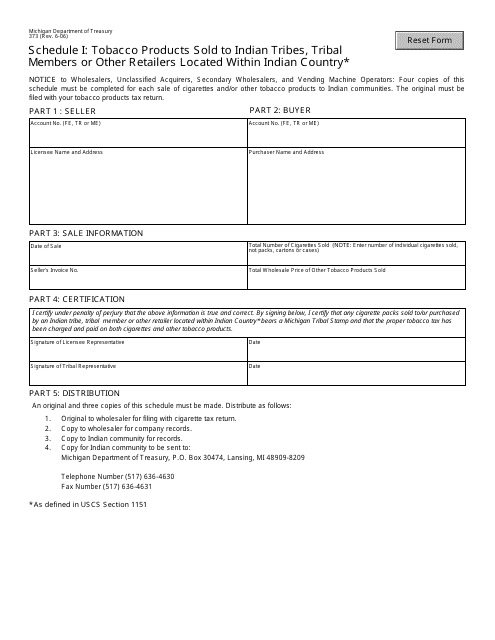

This Form is used for reporting tobacco products sold to Indian tribes, tribal members, or other retailers located within Indian Country in Michigan.

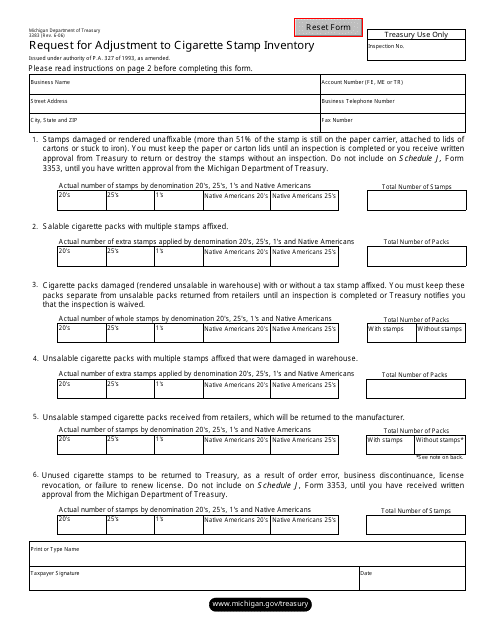

This form is used for requesting an adjustment to the cigarette stamp inventory in the state of Michigan.

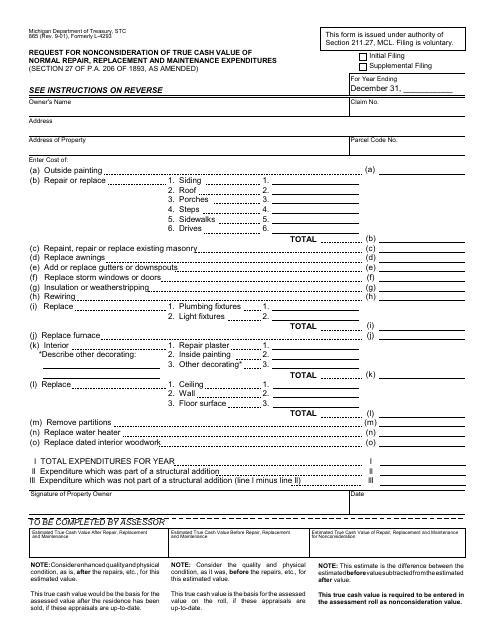

This Form is used for requesting nonconsideration of true cash value for normal repair, replacement, and maintenance expenditures in the state of Michigan.

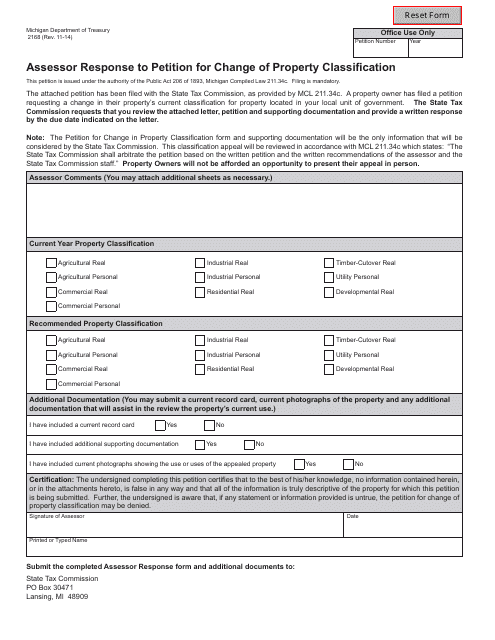

This form is used for assessors in Michigan to respond to a petition requesting a change in property classification.

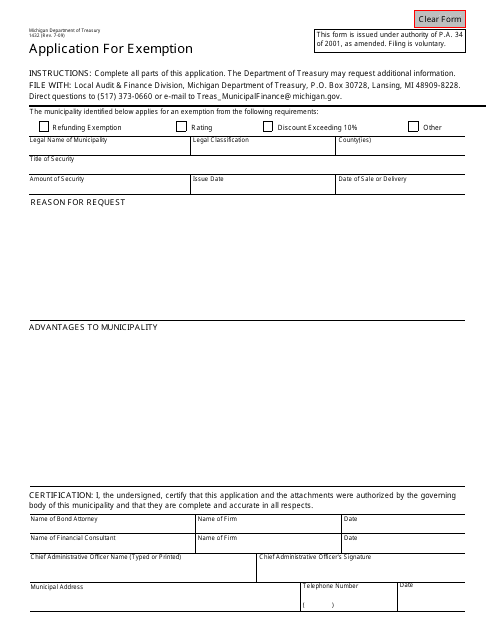

This form is used for applying for an exemption in Michigan. It is specifically for Form 1432.

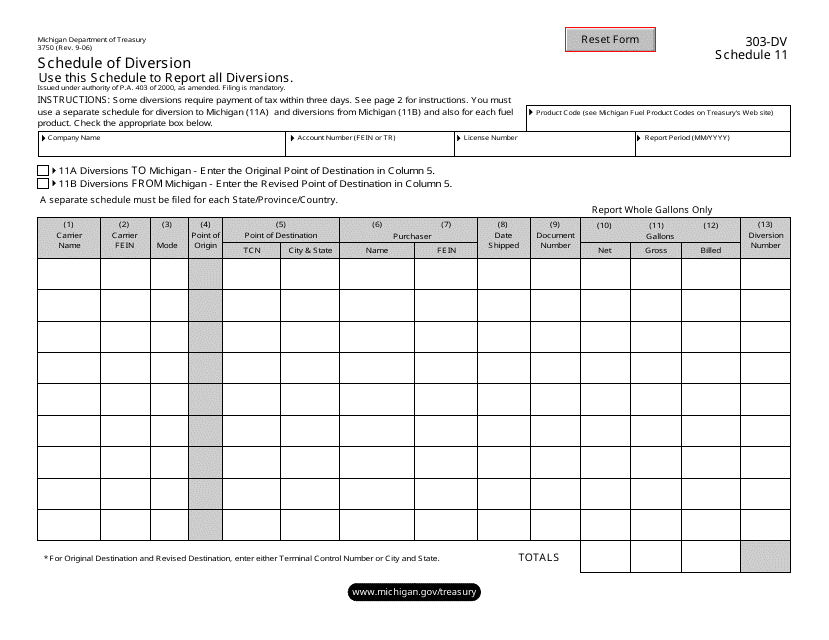

This form is used for reporting the schedule of diversion in Michigan. It is specifically designed for Form 3750 (303-DV) Schedule 11.

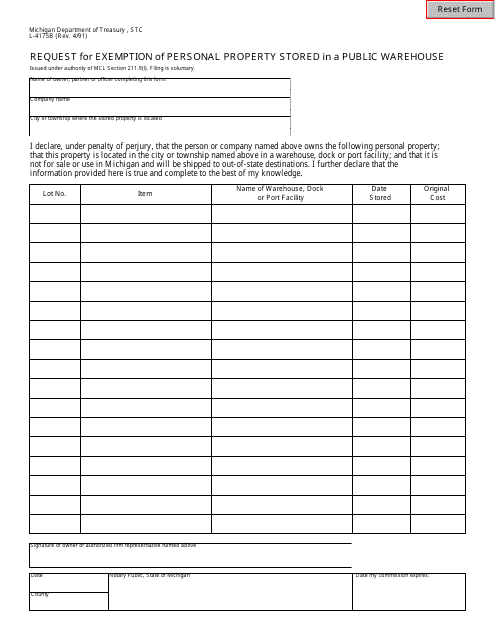

This form is used for requesting an exemption for personal property that is stored in a public warehouse in Michigan.

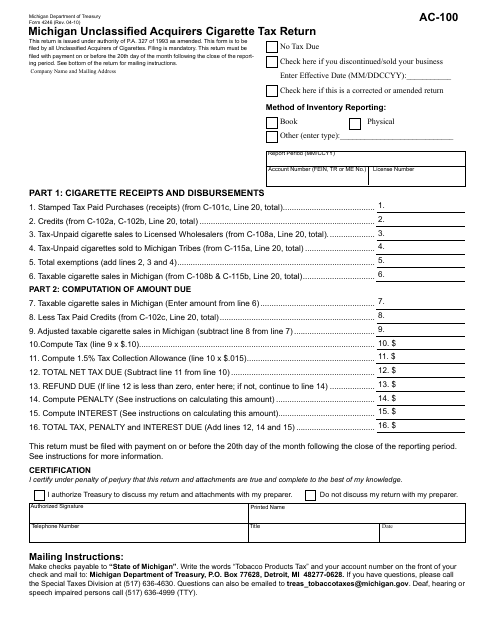

This form is used for Michigan unclassified acquirers to report and pay cigarette taxes.

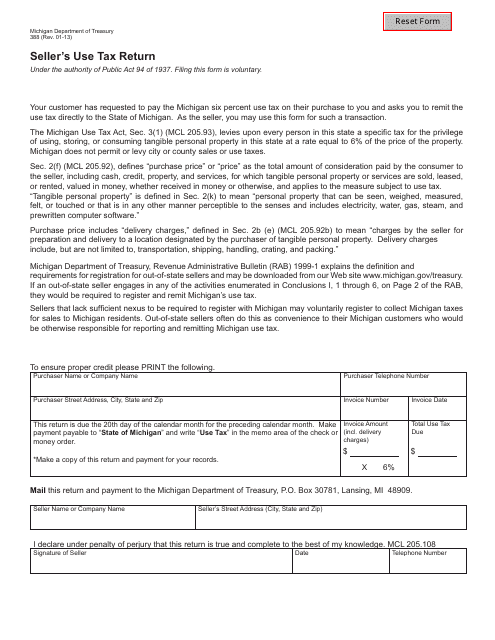

This form is used by sellers in Michigan to report and pay use tax owed on the purchase of items for resale or use in their business.

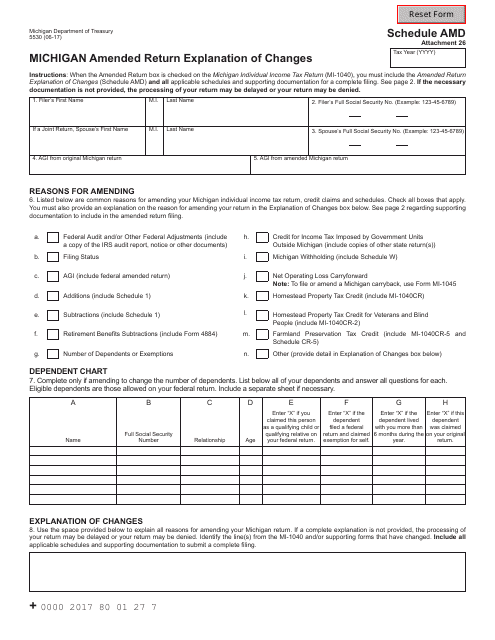

This form is used for explaining the changes made to an amended tax return in the state of Michigan.

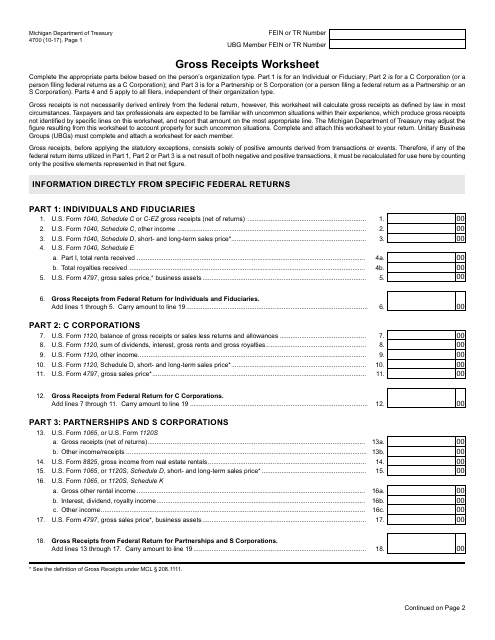

This form is used for calculating gross receipts in the state of Michigan. It helps businesses determine their total income for tax purposes.

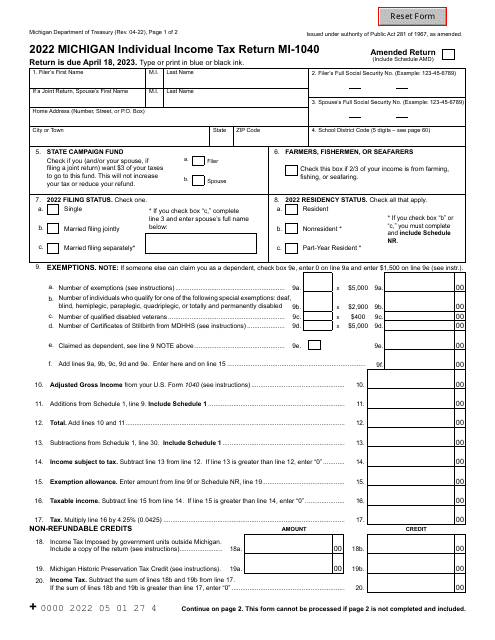

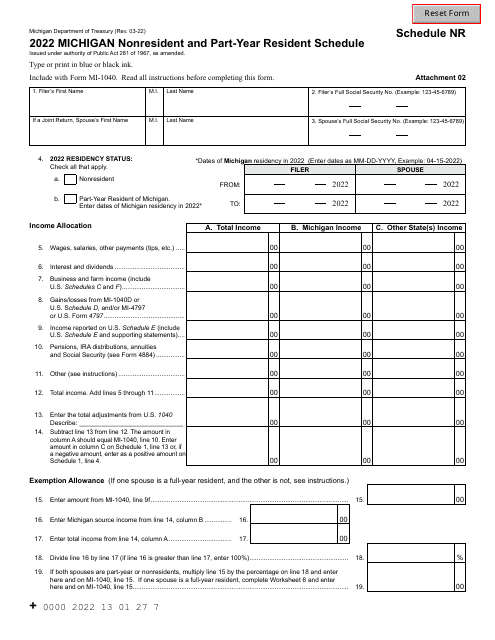

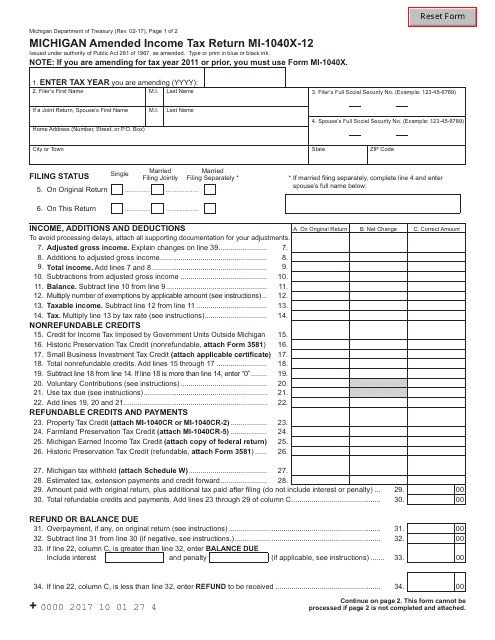

This form is used for filing an amended income tax return in the state of Michigan.

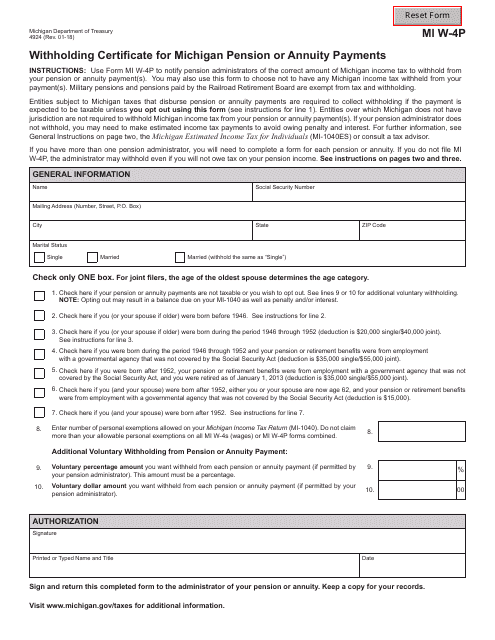

This form is used for declaring the amount of state income tax to be withheld from pension or annuity payments in Michigan. It is necessary for Michigan residents who receive pension or annuity income to ensure proper withholding of state taxes.

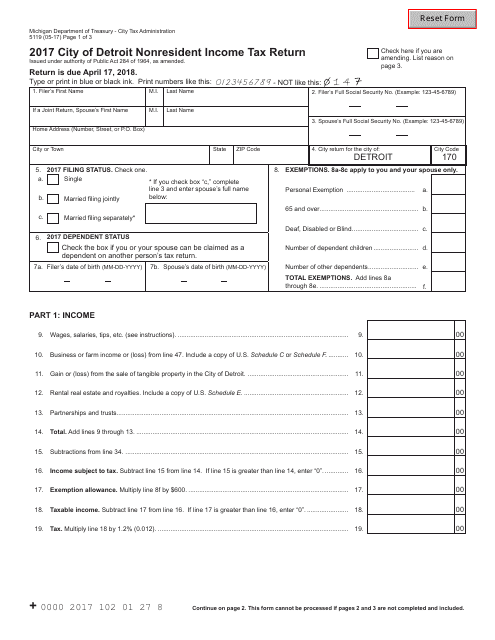

This form is used for filing your nonresident income tax return for the City of Detroit in the state of Michigan. It is specifically for individuals who live outside of Detroit but earned income within the city.

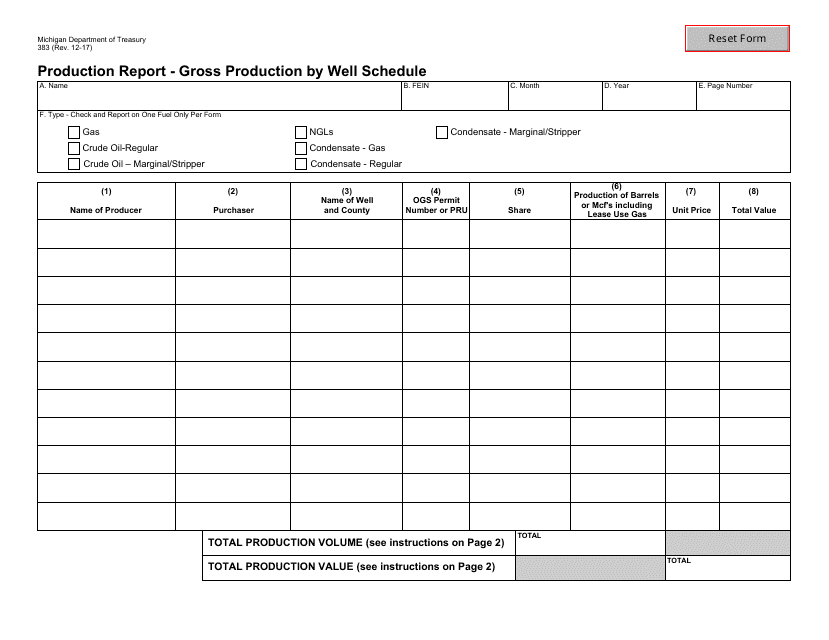

This Form is used for reporting the gross production by well schedule in the state of Michigan.

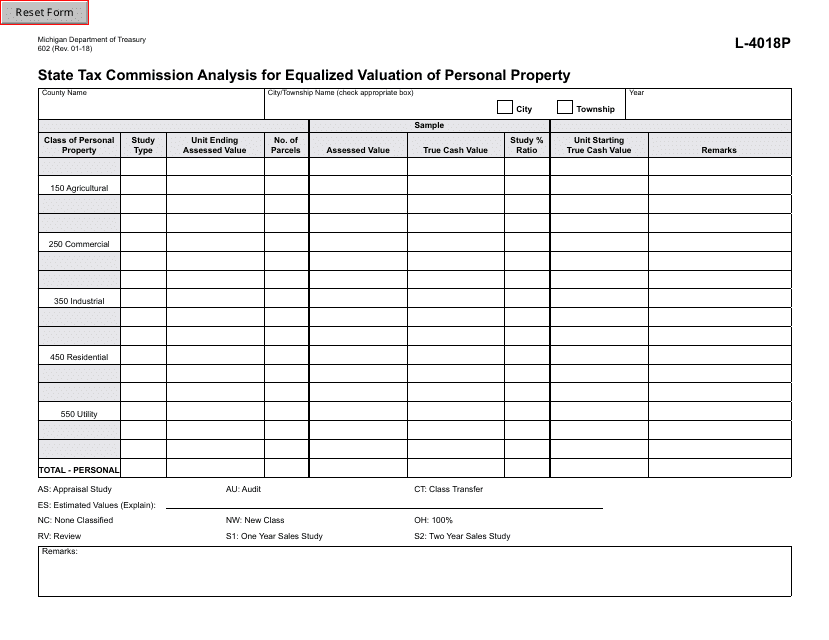

This form is used by the State Tax Commission in Michigan to analyze the equalized valuation of personal property for tax purposes. It helps determine the value of personal property owned by individuals and businesses in Michigan.

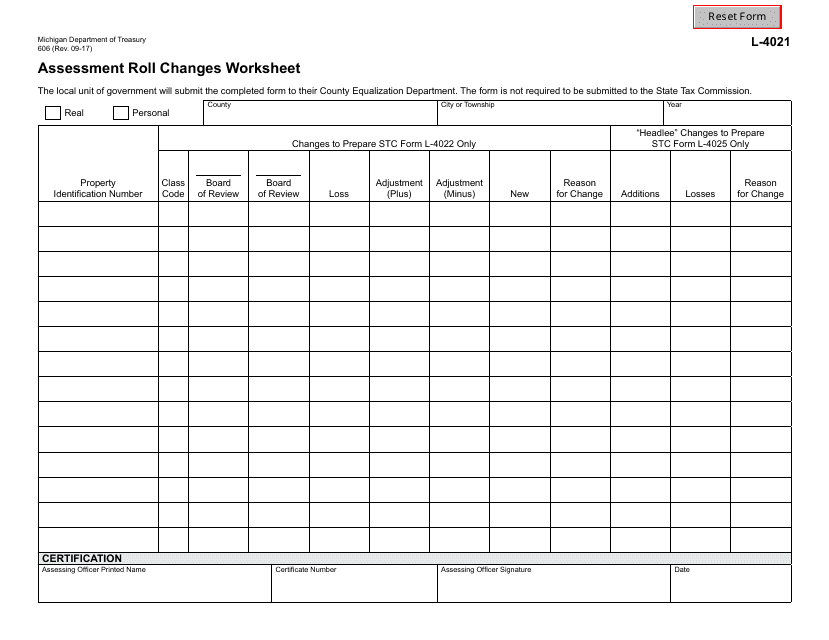

This document is used for recording changes made to the assessment roll in the state of Michigan. It is a worksheet that helps assessors track and document any modifications made to the property assessments.

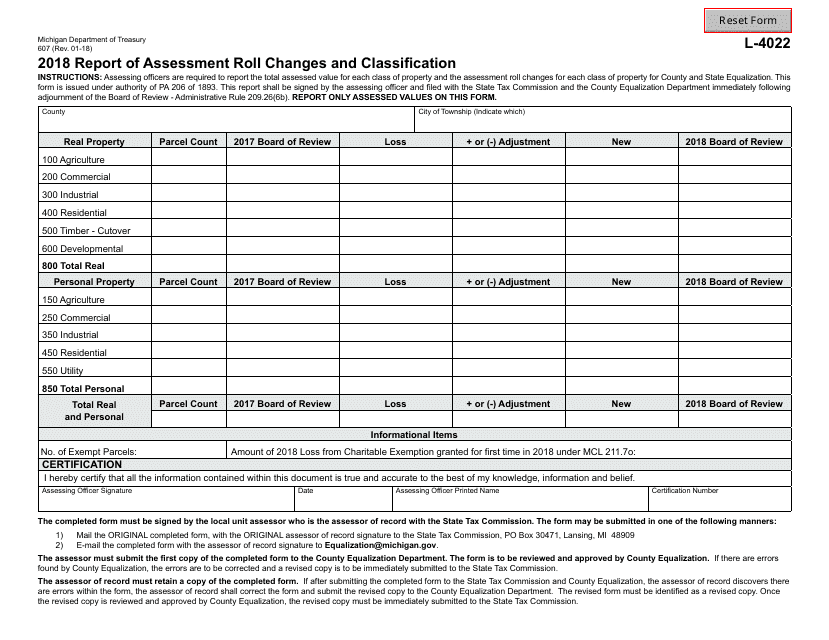

This Form is used for reporting assessment roll changes and classification in the state of Michigan.

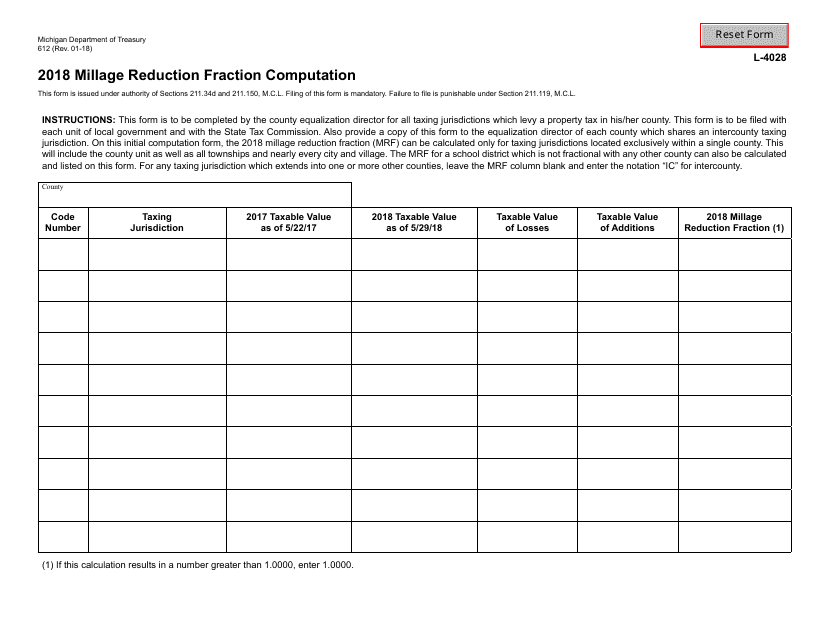

This form is used for calculating the millage reduction fraction in the state of Michigan.

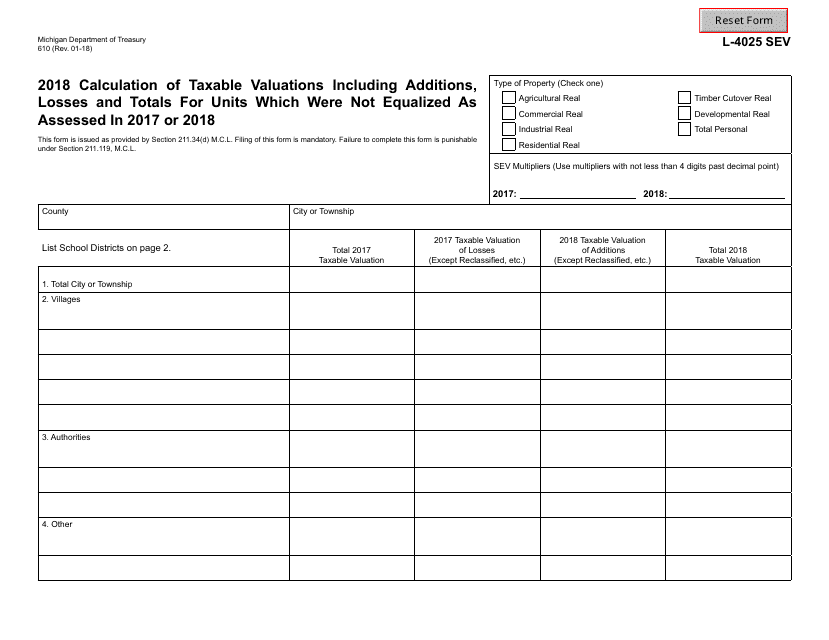

This Form is used for calculating the taxable valuations of units that were not equalized as assessed in 2017 or 2018 in the state of Michigan.

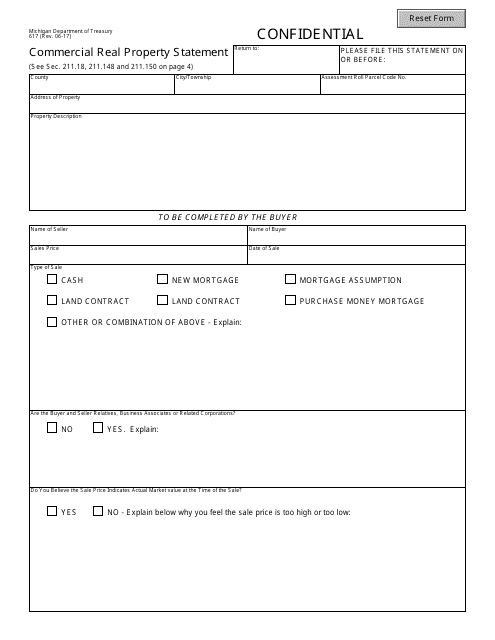

This Form is used for providing a statement of commercial real property in the state of Michigan. It is required for assessment and taxation purposes.