Fill and Sign Michigan Legal Forms

Documents:

6335

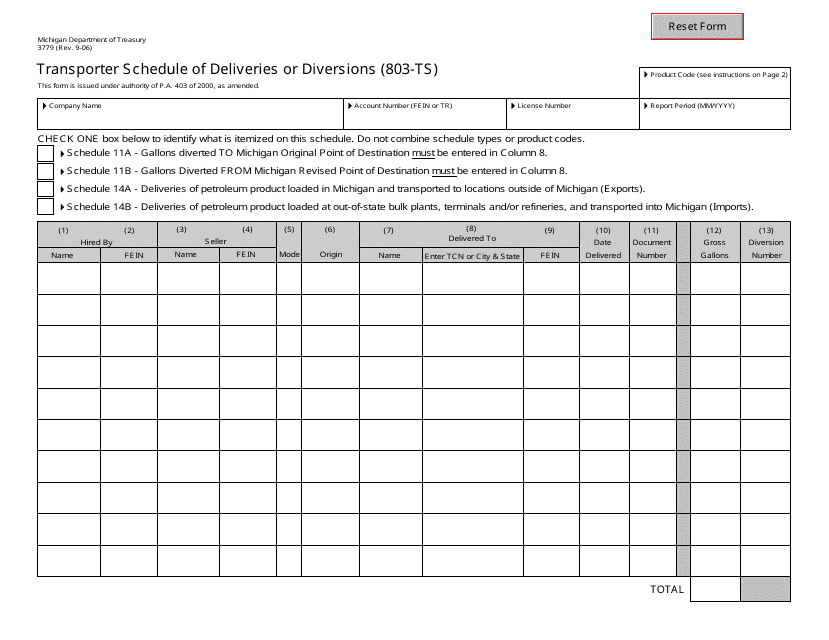

This form is used for scheduling and recording deliveries or diversions by transporters in the state of Michigan.

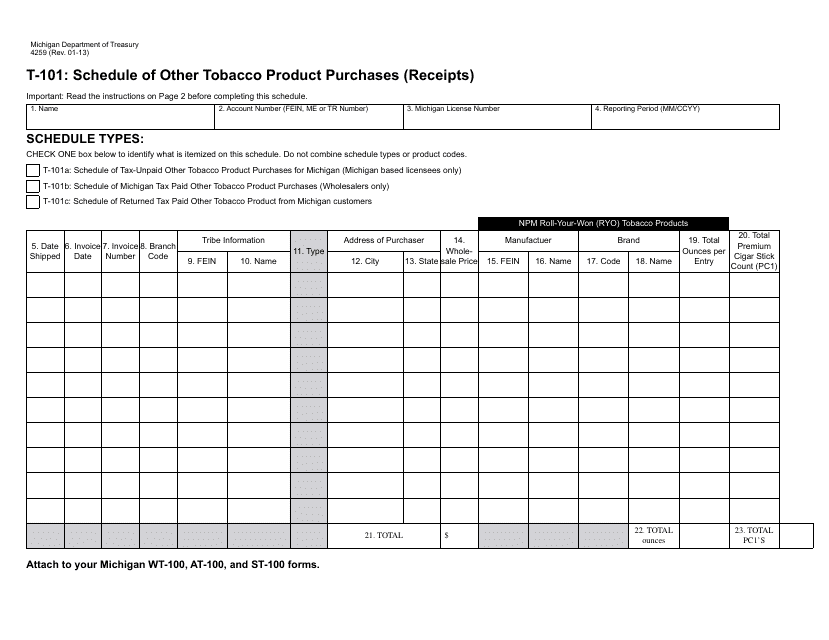

This form is used for reporting the purchase and receipt of other tobacco products in the state of Michigan.

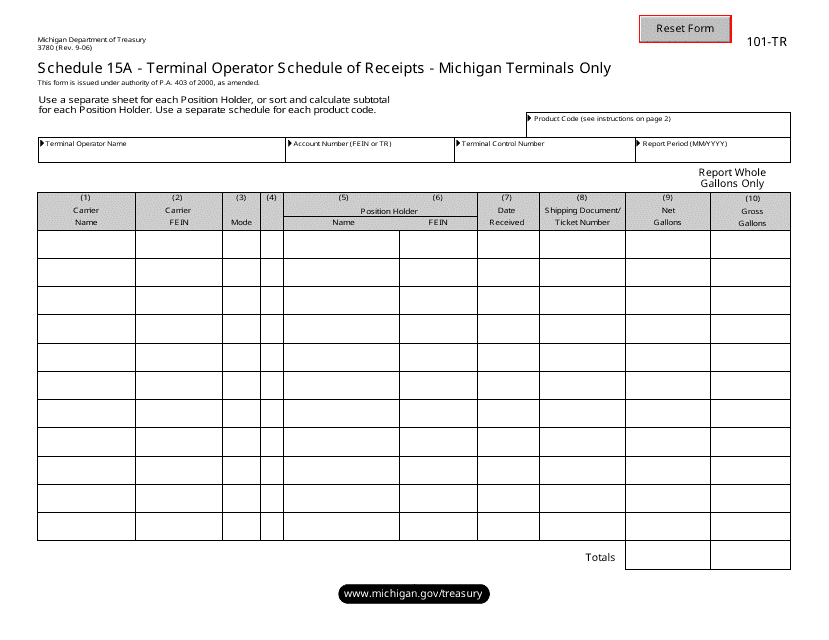

This form is used for Michigan terminals to report their schedule of receipts.

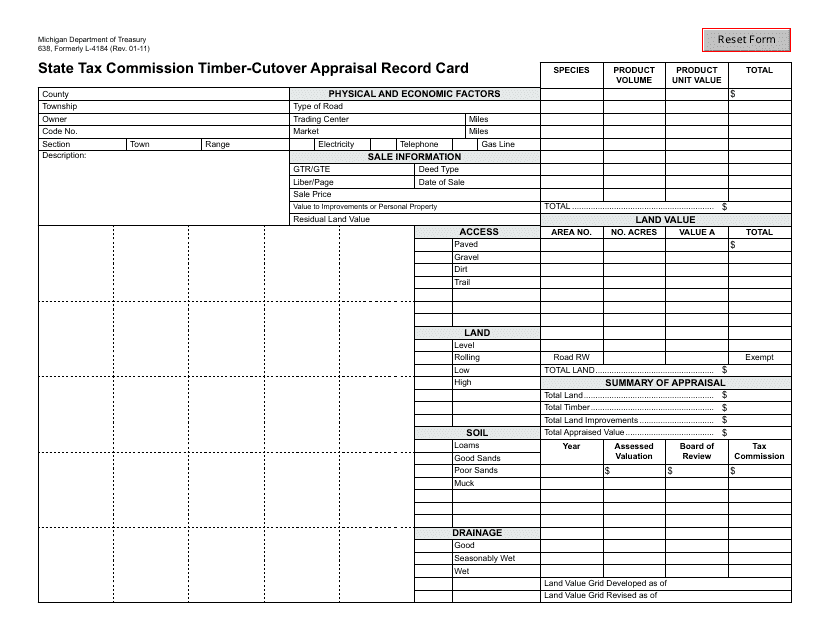

This form is used for recording information related to timber-cutover appraisal in Michigan for state tax commission purposes.

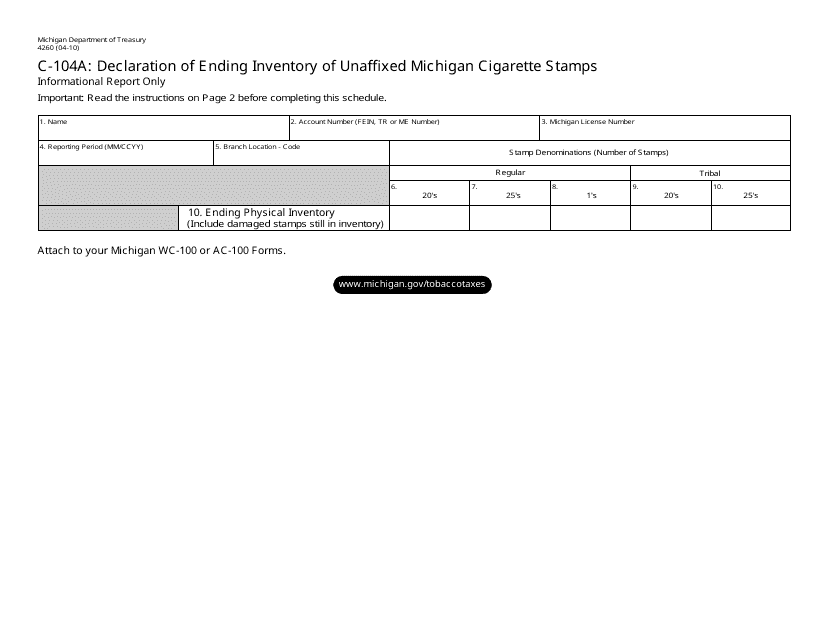

This form is used for declaring the ending inventory of unaffixed Michigan cigarette stamps in the state of Michigan.

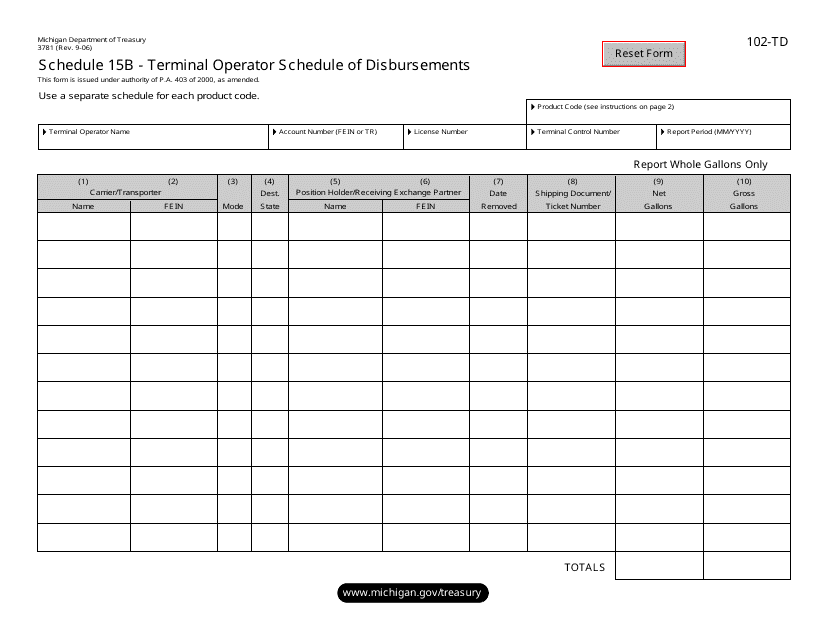

This form is used for reporting the schedule of disbursements for terminal operators in Michigan.

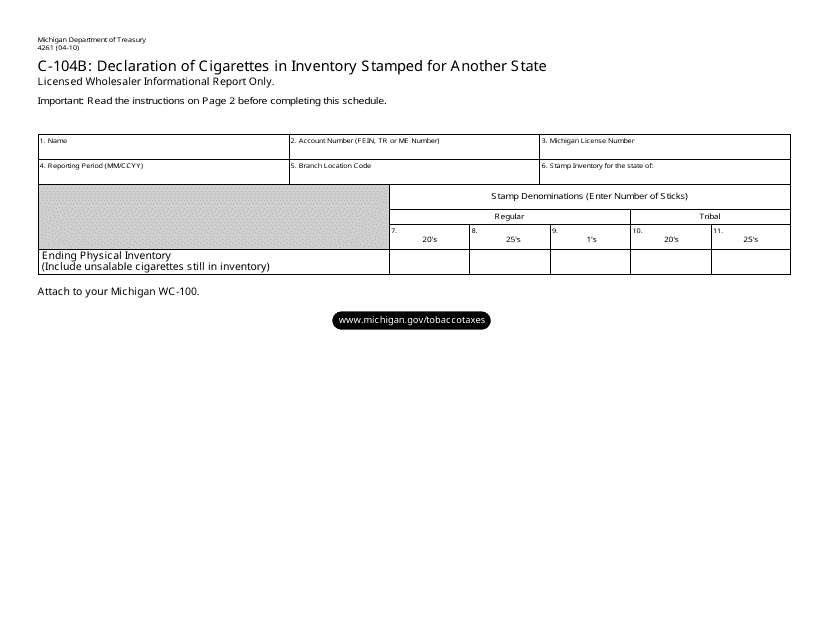

This Form is used for declaring cigarettes in inventory that are stamped for another state, specifically for the state of Michigan.

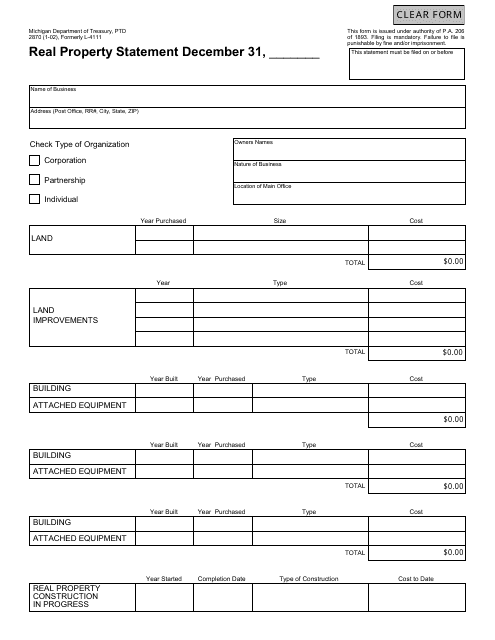

This form is used for filing a Real Property Statement in Michigan. It is also known as Form PTD2870 or Formerly L-4111.

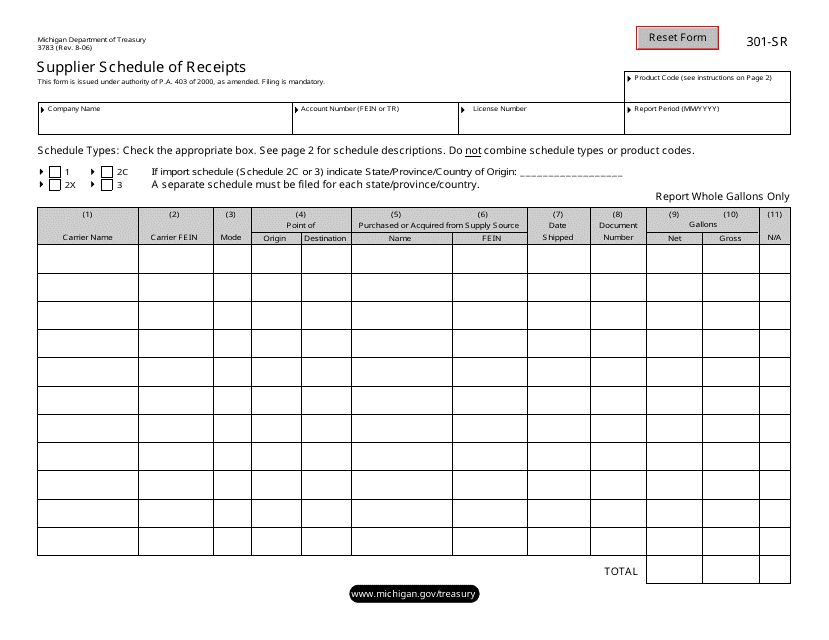

This form is used for suppliers in Michigan to provide a schedule of their receipts.

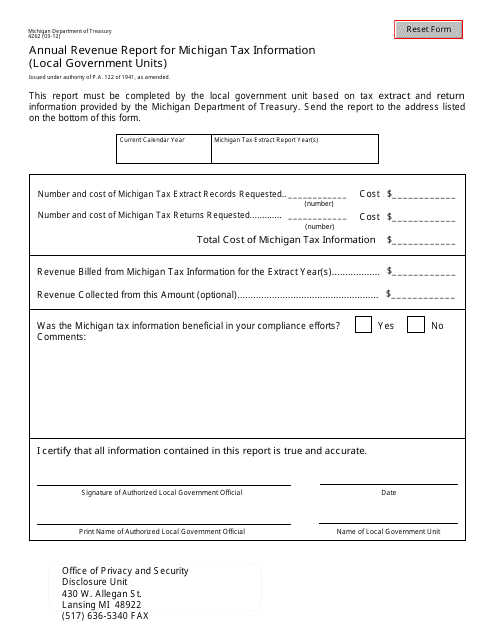

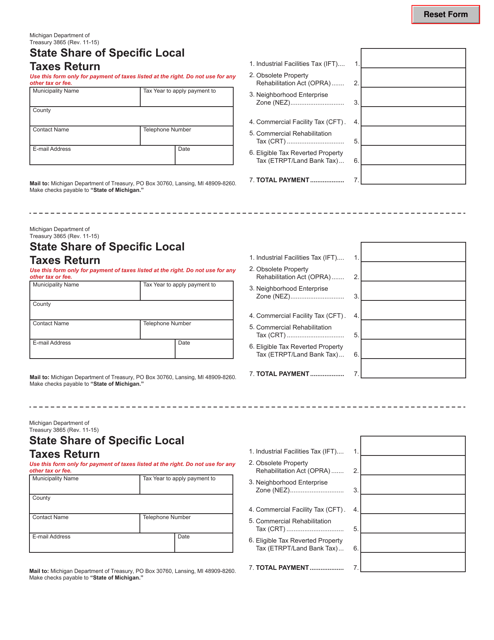

This form is used for reporting the annual revenue of local government units in Michigan for tax purposes.

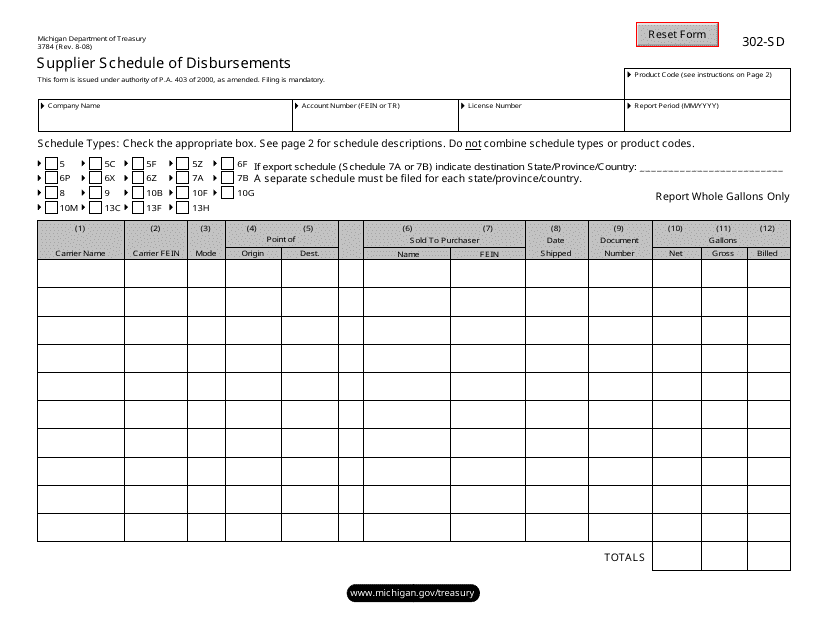

This form is used for suppliers in Michigan to provide a schedule of their disbursements.

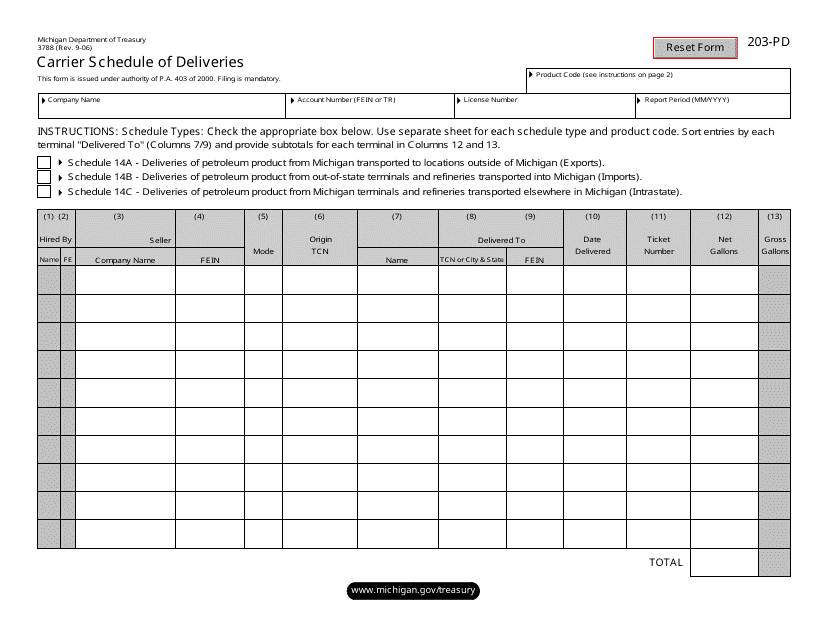

This form is used for carriers in Michigan to schedule their deliveries.

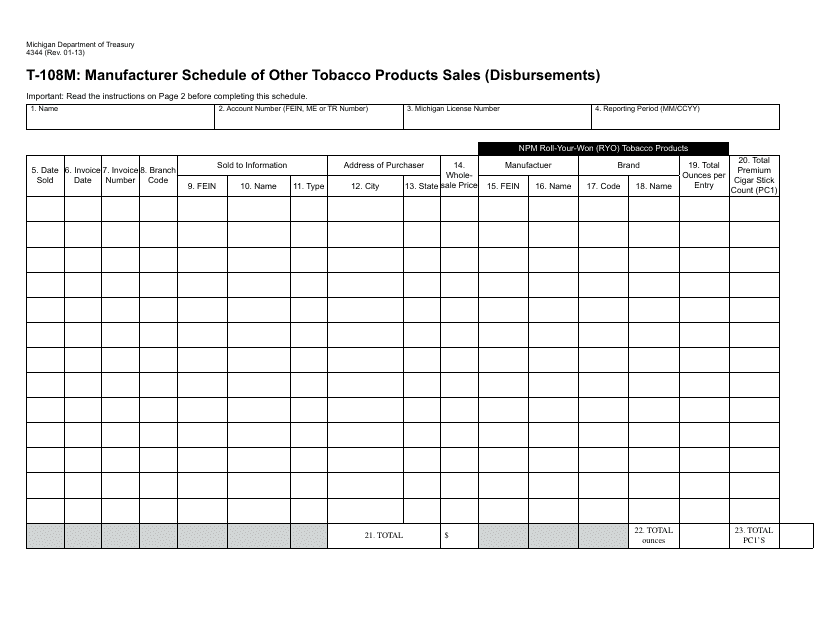

This Form is used for manufacturers in Michigan to report sales and disbursements of other tobacco products.

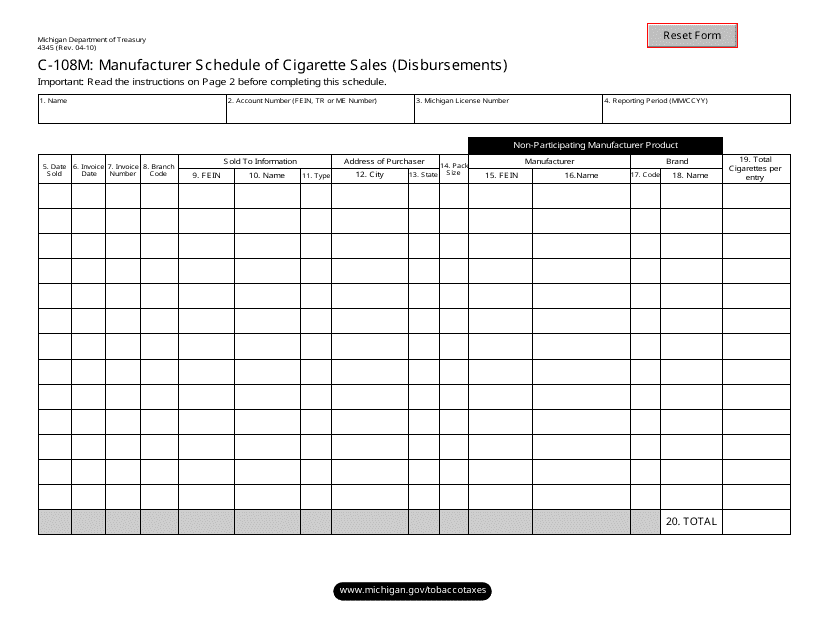

This form is used for reporting cigarette sales and disbursements by manufacturers in the state of Michigan.

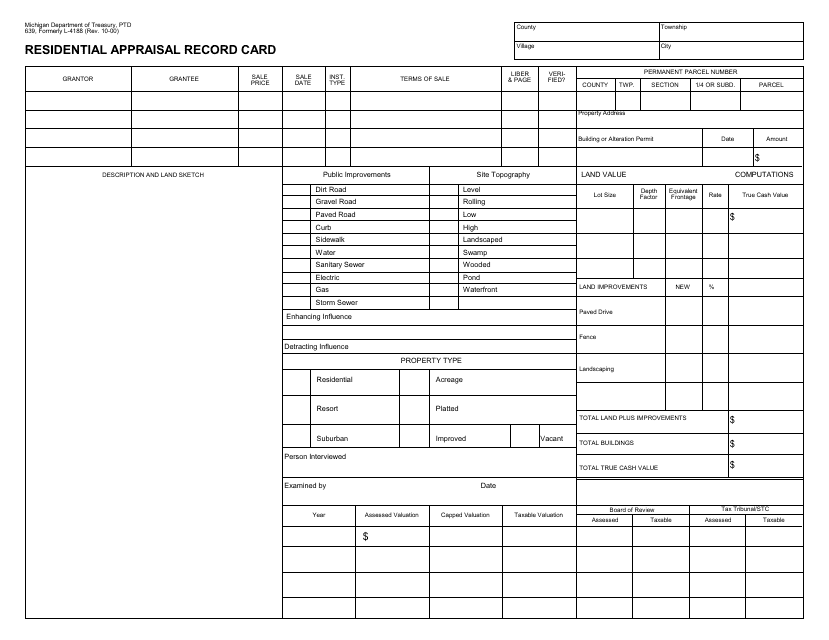

This form is used for recording residential property appraisals in Michigan.

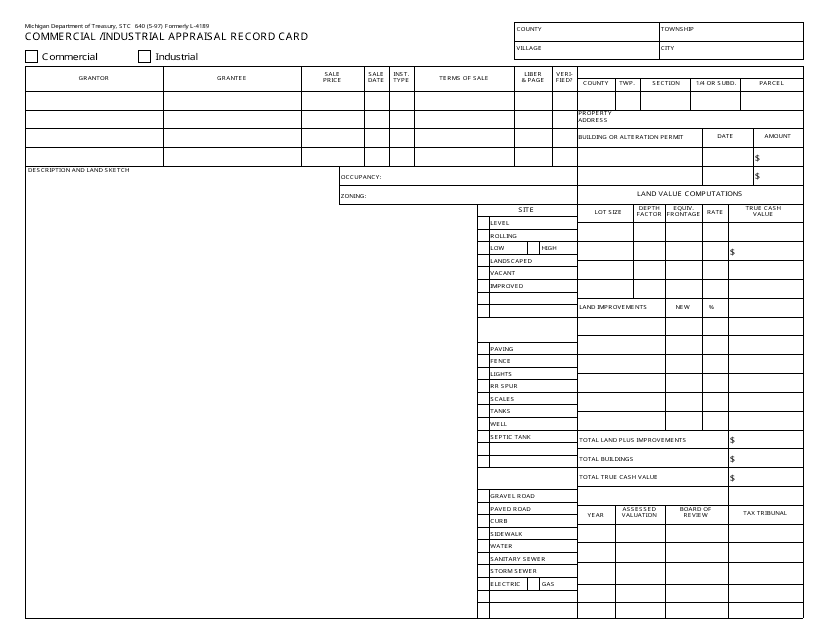

This form is used for recording the appraisal details of commercial/industrial properties in Michigan.

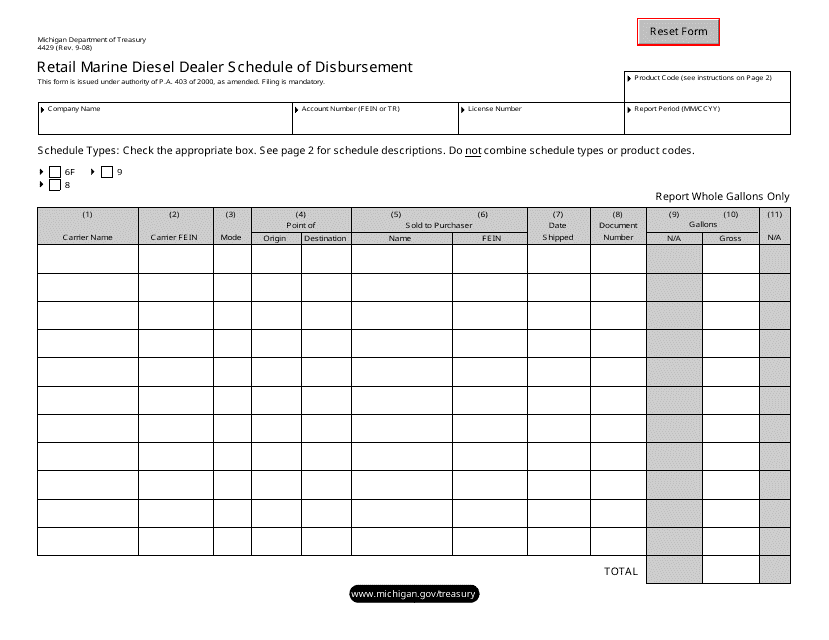

This form is used for retail marine diesel dealers in Michigan to provide a schedule of their disbursements.

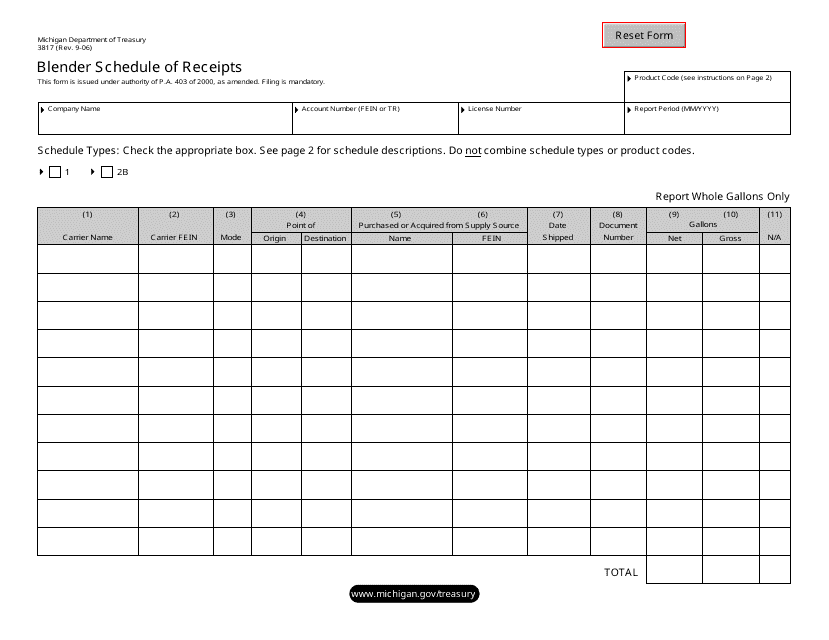

This form is used for keeping track of receipts for blenders in the state of Michigan.

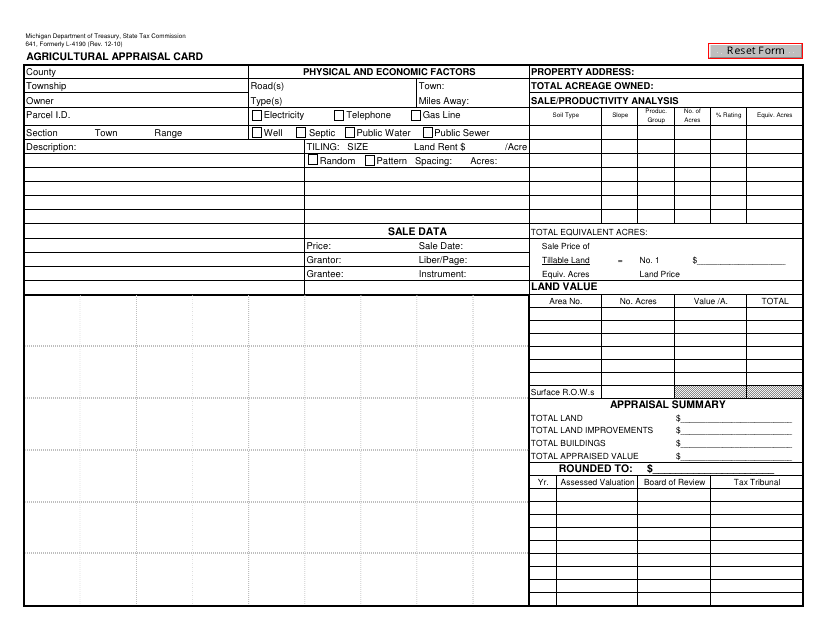

This form is used for agricultural property owners in Michigan to apply for a property tax assessment based on the agricultural use of their land.

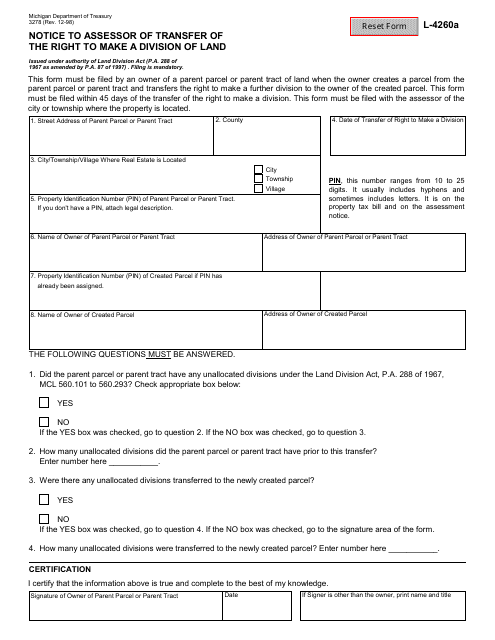

This Form is used for notifying the assessor in Michigan about the transfer of the right to make a division of land.

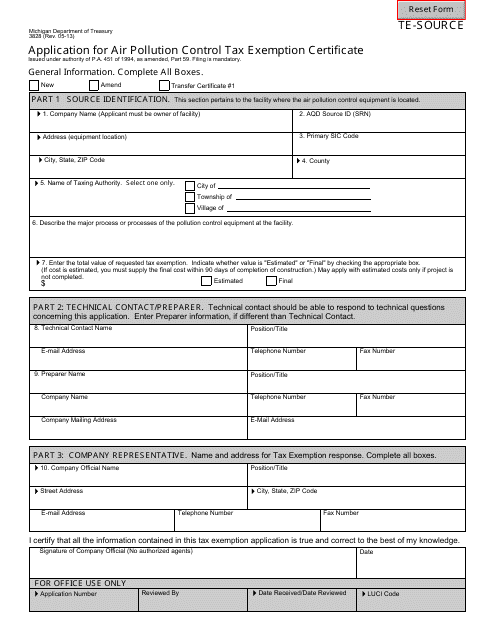

This form is used for applying for an air pollution control tax exemption certificate in Michigan. It allows businesses to request a tax exemption for equipment used to control air pollution.

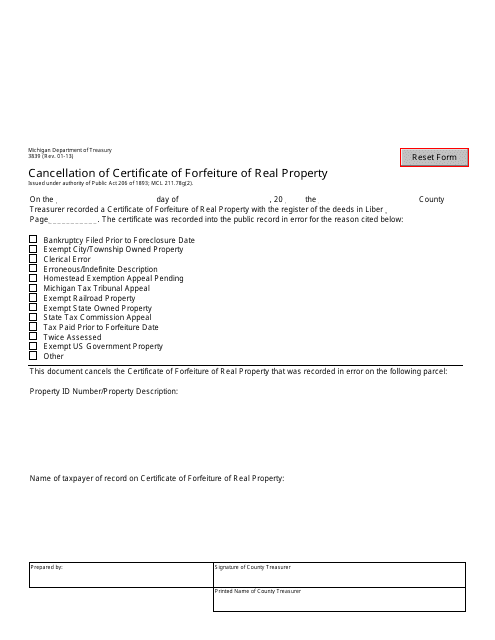

This Form is used for cancelling a certificate of forfeiture of real property in Michigan.

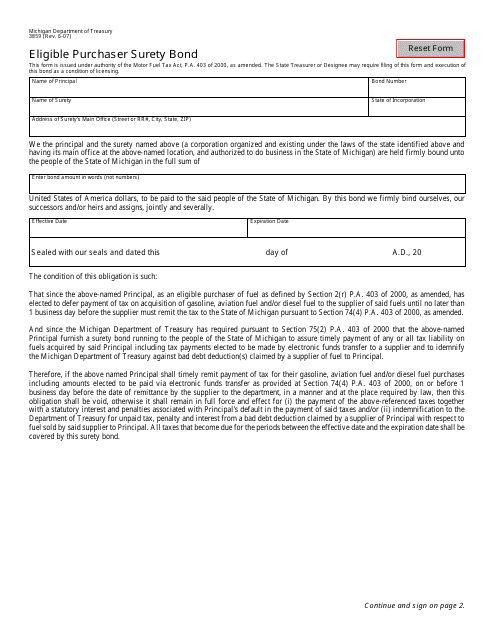

This form is used for obtaining a surety bond by eligible purchasers in the state of Michigan.

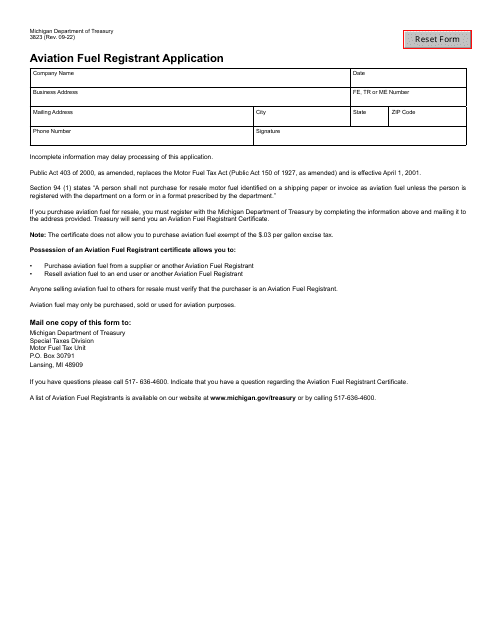

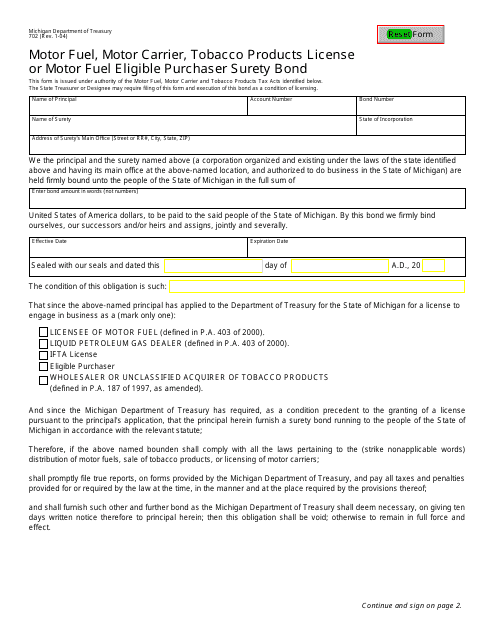

This Form is used for applying for a Motor Fuel, Motor Carrier, Tobacco Products License or Motor Fuel Eligible Purchaser Surety Bond in the state of Michigan.

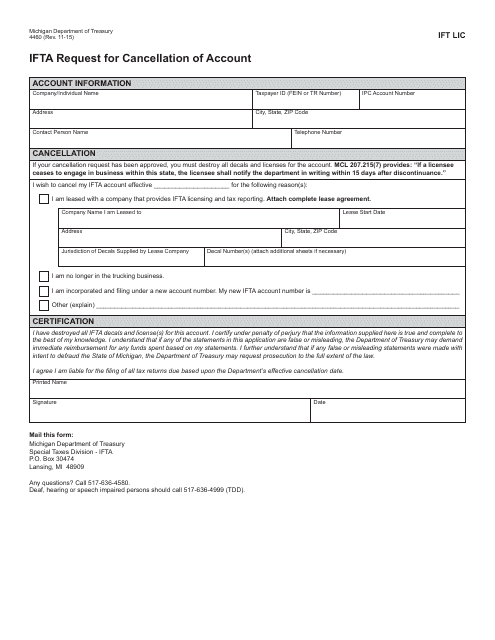

This form is used for submitting a request to cancel an IFTA (International Fuel Tax Agreement) account in the state of Michigan.

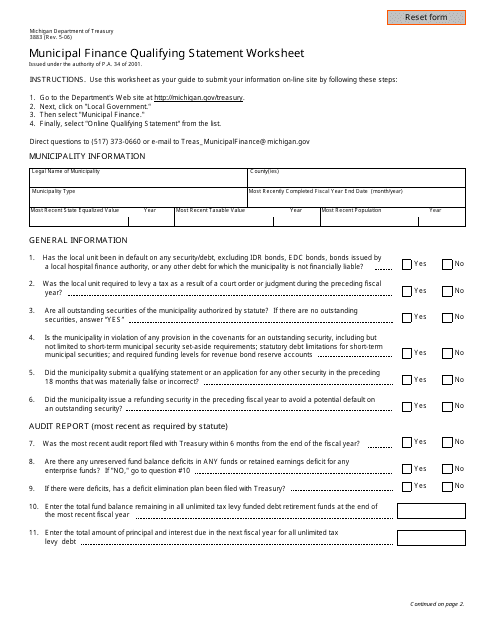

This form is used for completing the Municipal Finance Qualifying Statement Worksheet in the state of Michigan. It is used to determine the eligibility of a municipality for certain financial assistance programs.

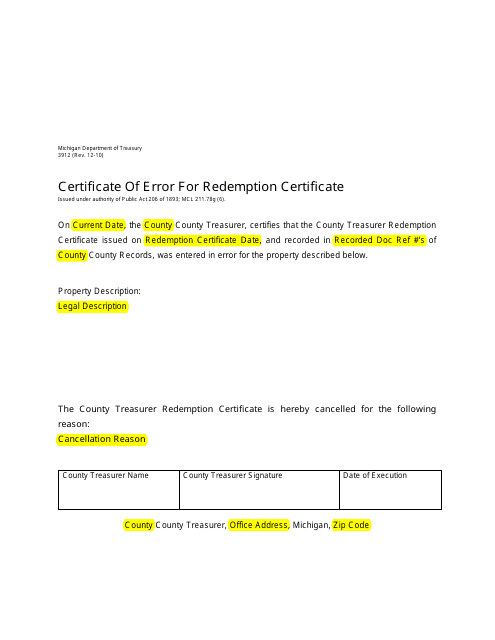

This Form is used for certifying errors in a redemption certificate in the state of Michigan.

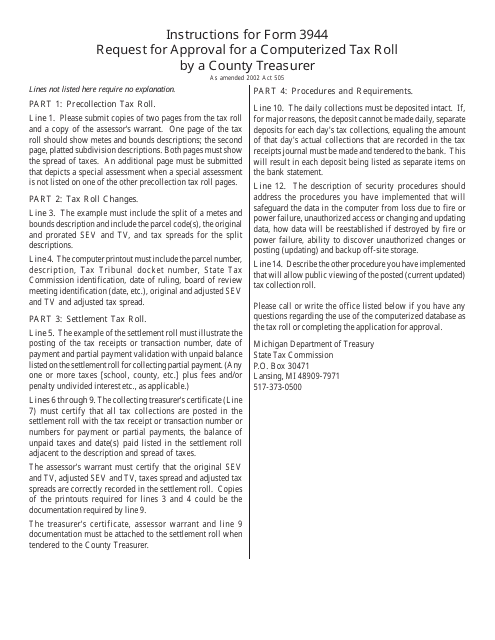

This Form is used for requesting approval for a computerized tax roll by a county treasurer in Michigan. It provides instructions on how to complete and submit the form.

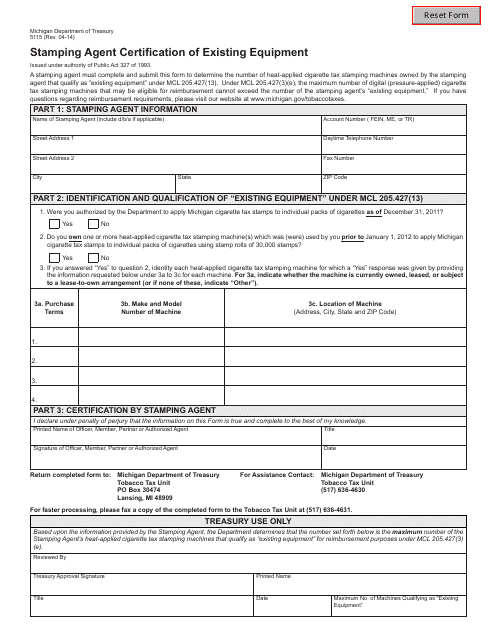

This form is used for the certification of existing equipment by stamping agents in Michigan.

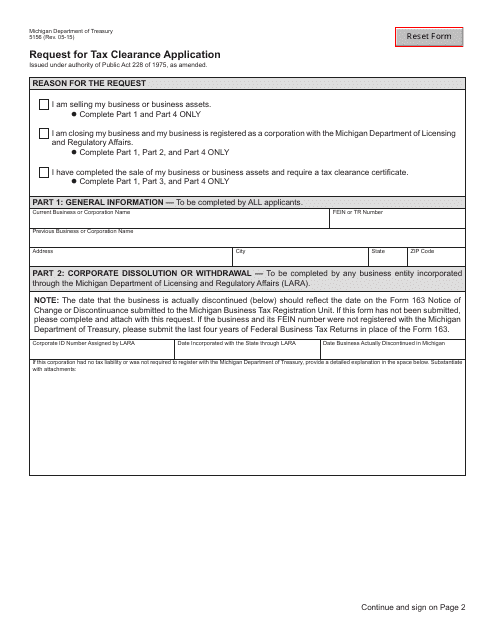

This form is used for requesting tax clearance in the state of Michigan.

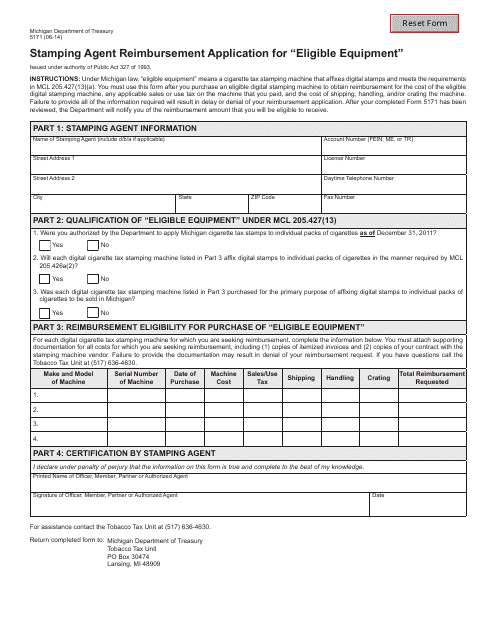

This form is used for applying for reimbursement as a stamping agent for eligible equipment in Michigan.

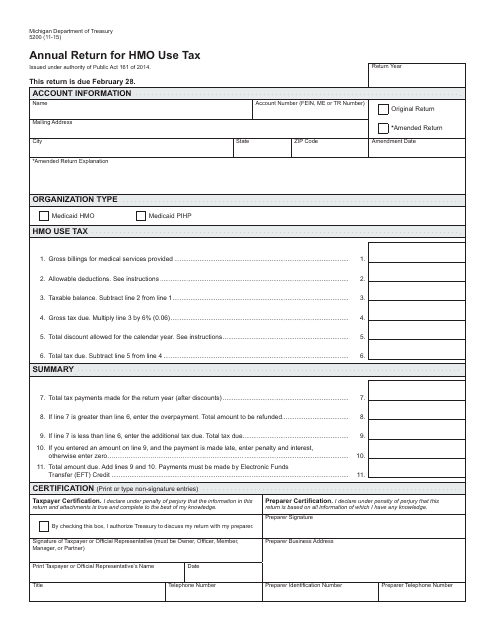

This form is used for filing the annual return for HMO use tax in the state of Michigan.

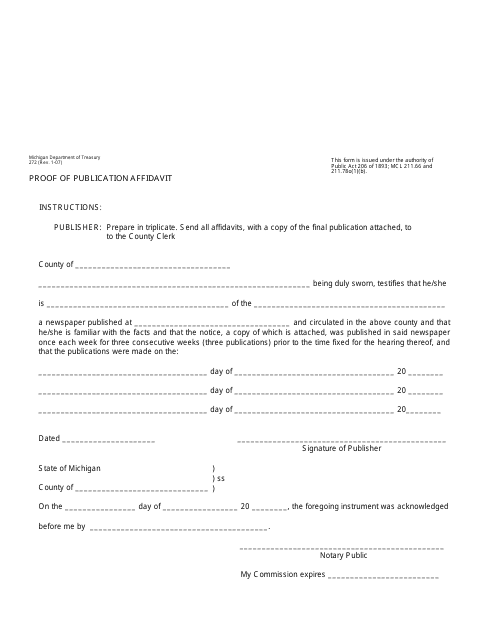

This form is used for verifying that a publication has been made in Michigan. It is used to provide proof of publication for legal purposes.

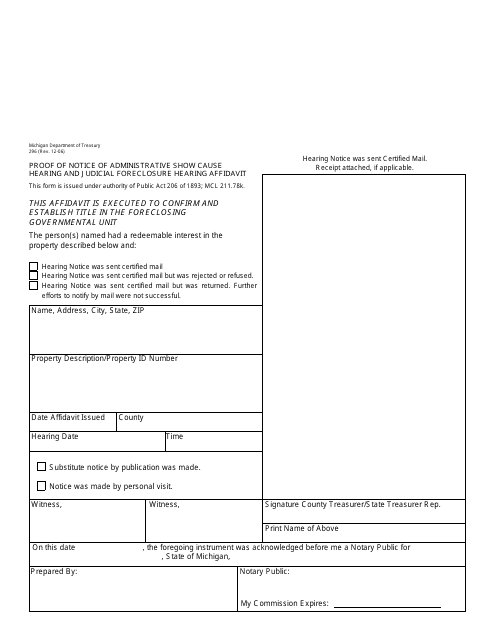

This form is used for providing proof of notice for an administrative show cause hearing and judicial foreclosure hearing in the state of Michigan.

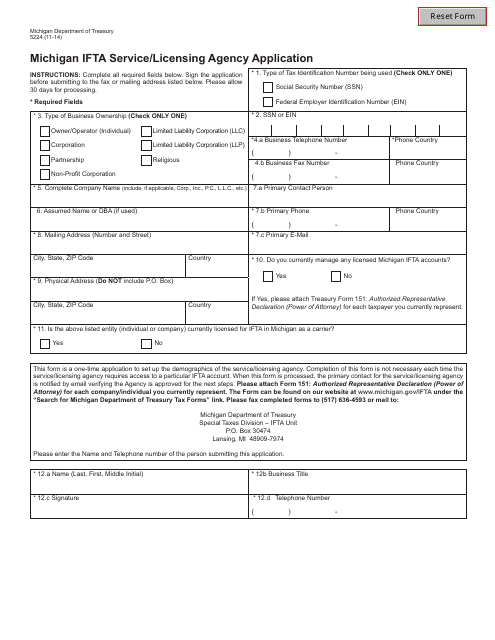

This form is used for applying for IFTA service and licensing from the Michigan agency.

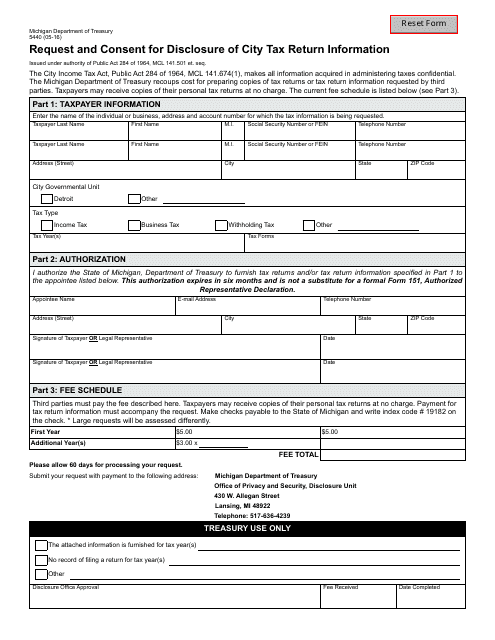

This document is used for requesting and giving consent to disclose information from a city tax return in Michigan.