Fill and Sign Virginia Legal Forms

Documents:

4626

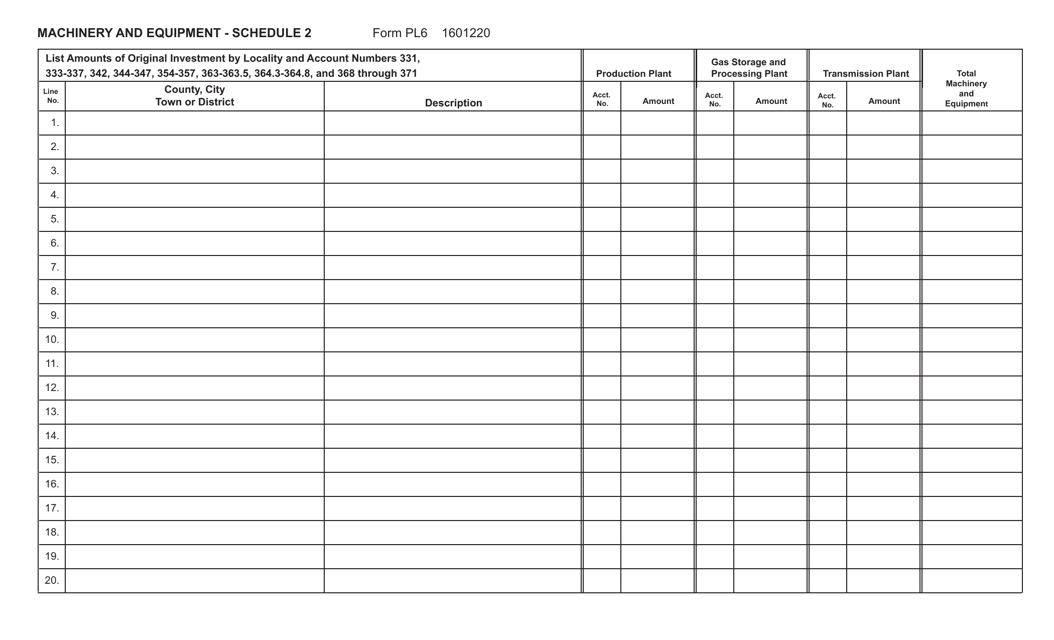

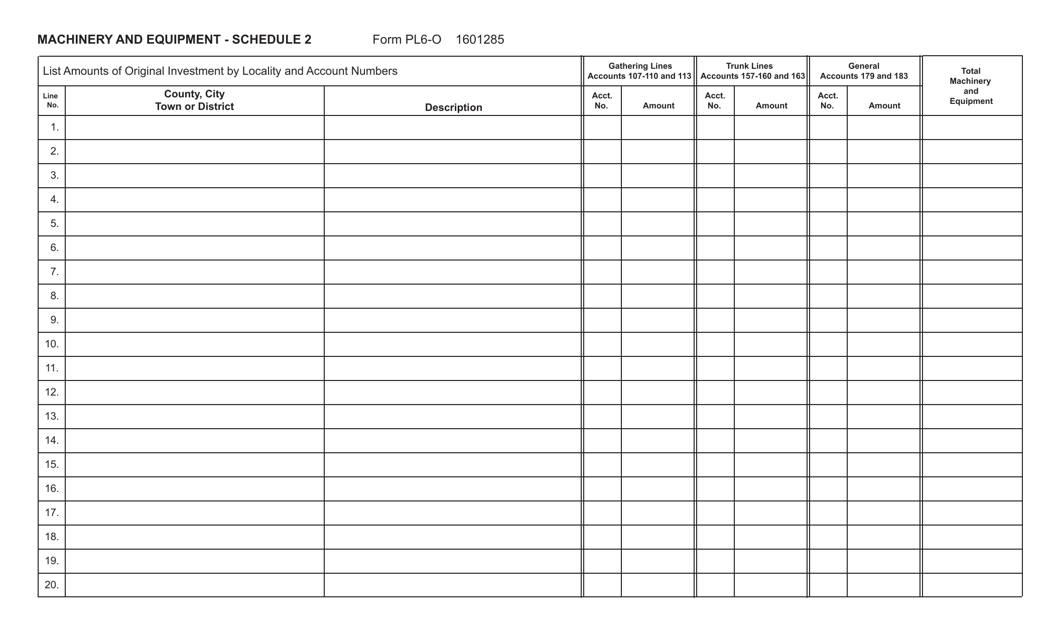

This Form is used for reporting machinery and equipment for tax purposes in Virginia.

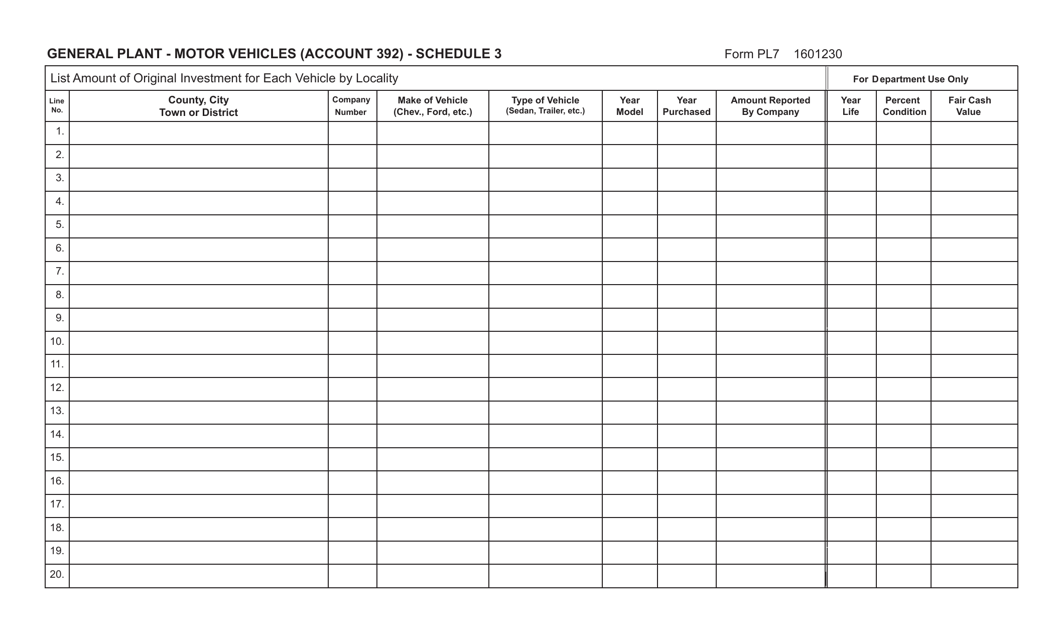

This Form is used for reporting general plant motor vehicles for account 392 in the state of Virginia.

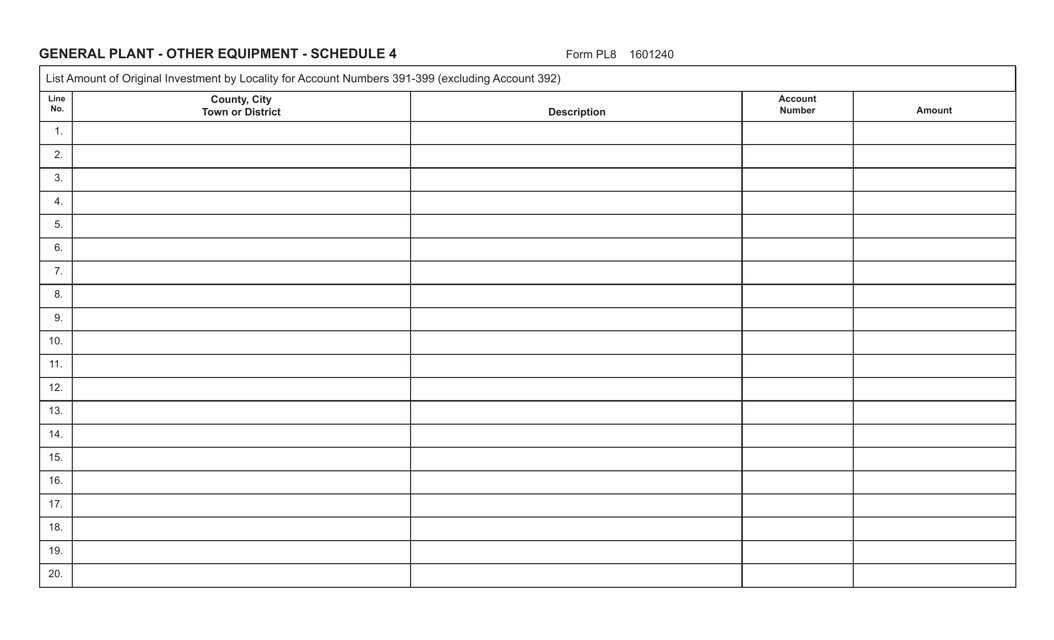

This form is used for reporting general plant and other equipment in the state of Virginia.

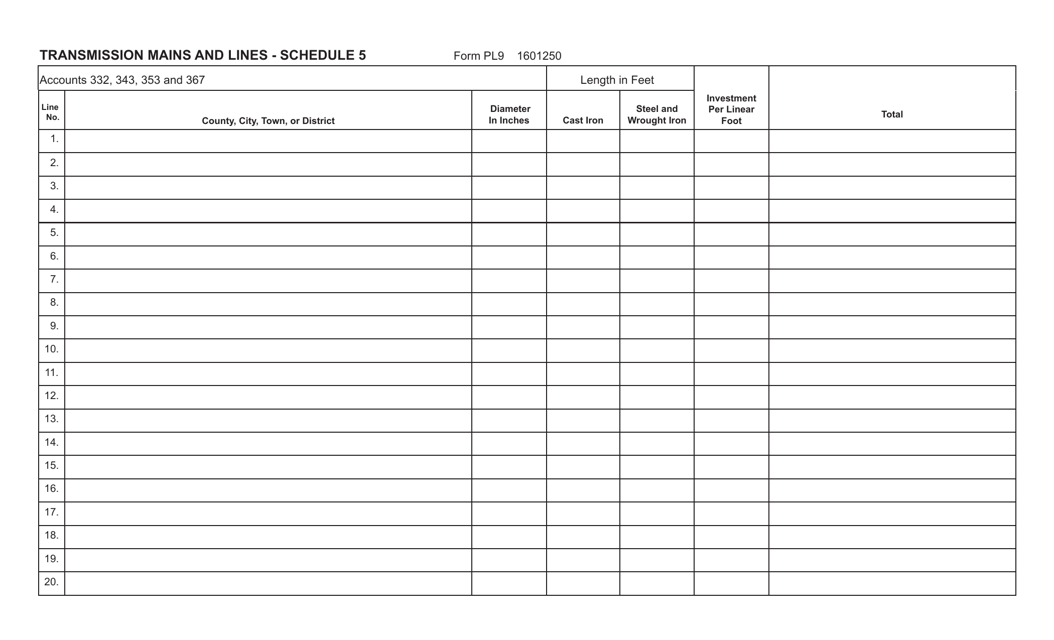

This Form is used for reporting and documenting the transmission mains and lines in the state of Virginia.

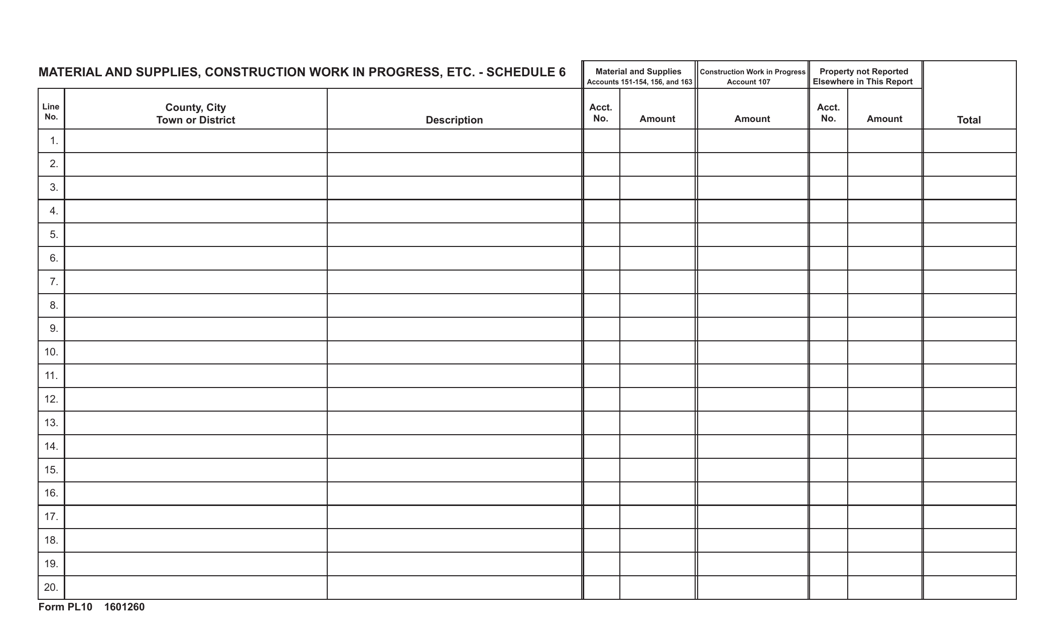

This Form is used for reporting material and supplies, construction work in progress, and other related information for tax purposes in the state of Virginia.

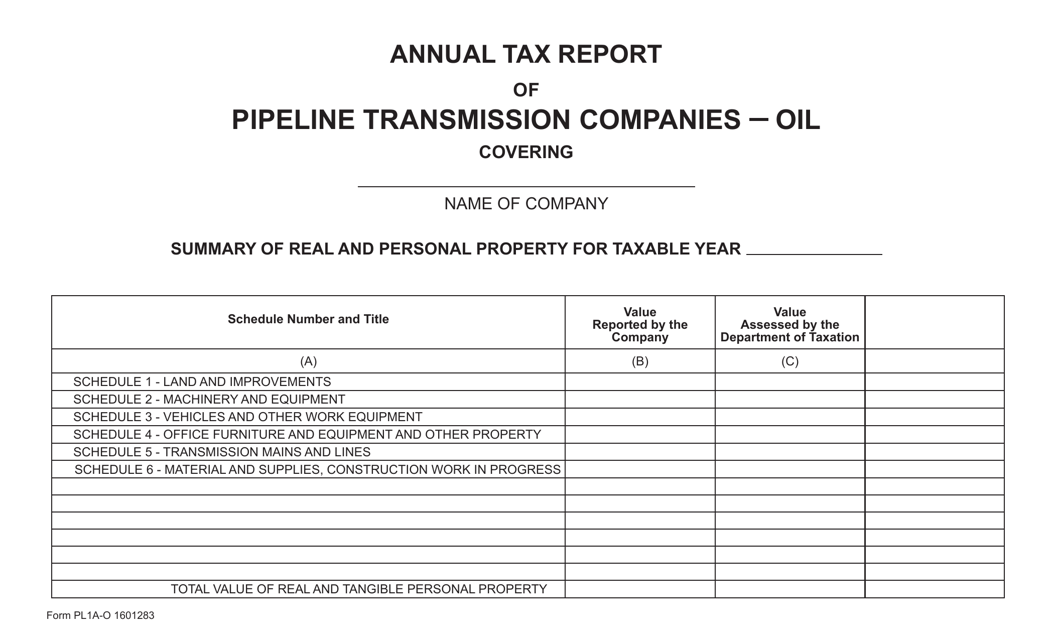

This form is used for pipeline transmission companies in Virginia to report their annual tax information related to the oil industry.

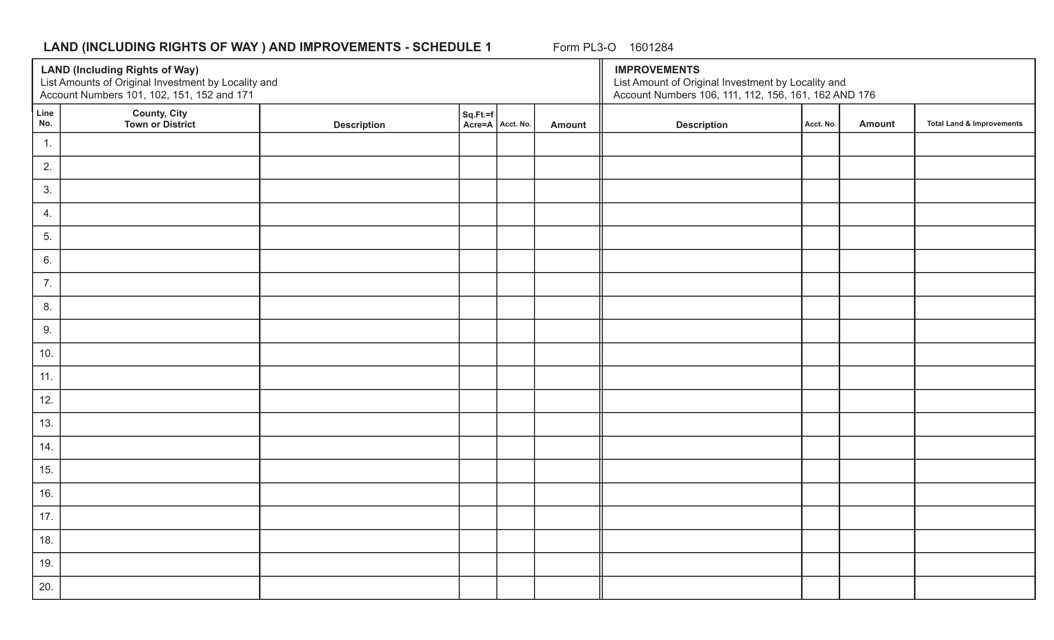

This form is used for reporting land, including rights of way, and improvements in the state of Virginia. It provides a detailed schedule for documenting these properties.

This form is used for reporting machinery and equipment in Virginia for tax purposes. It is part of Schedule 2 of Form PL6-O.

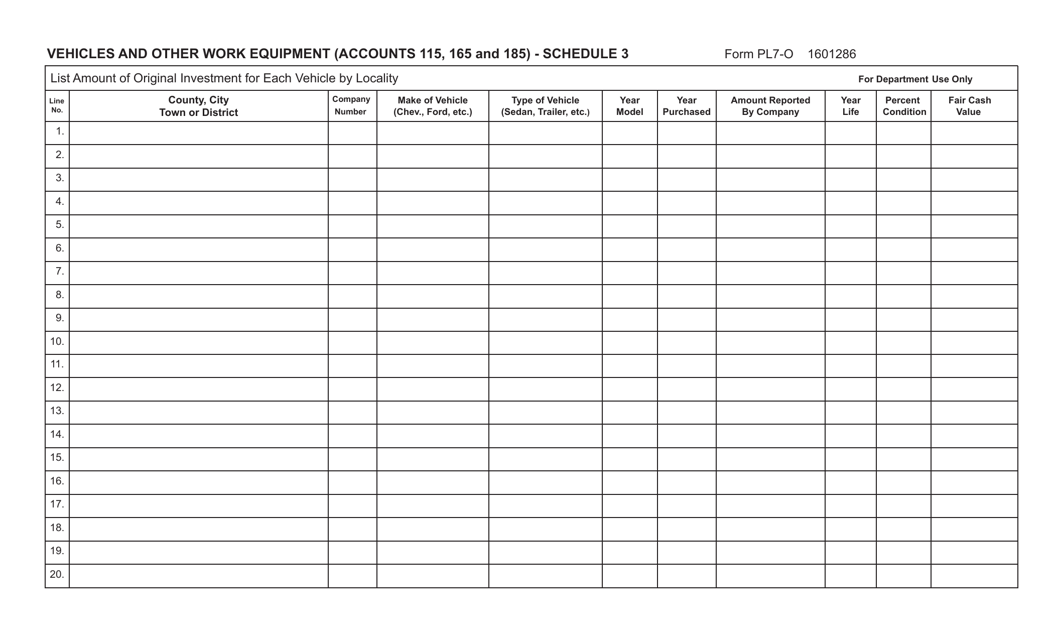

This Form is used for reporting vehicles and other work equipment for accounts 115,165 and 185 in Virginia.

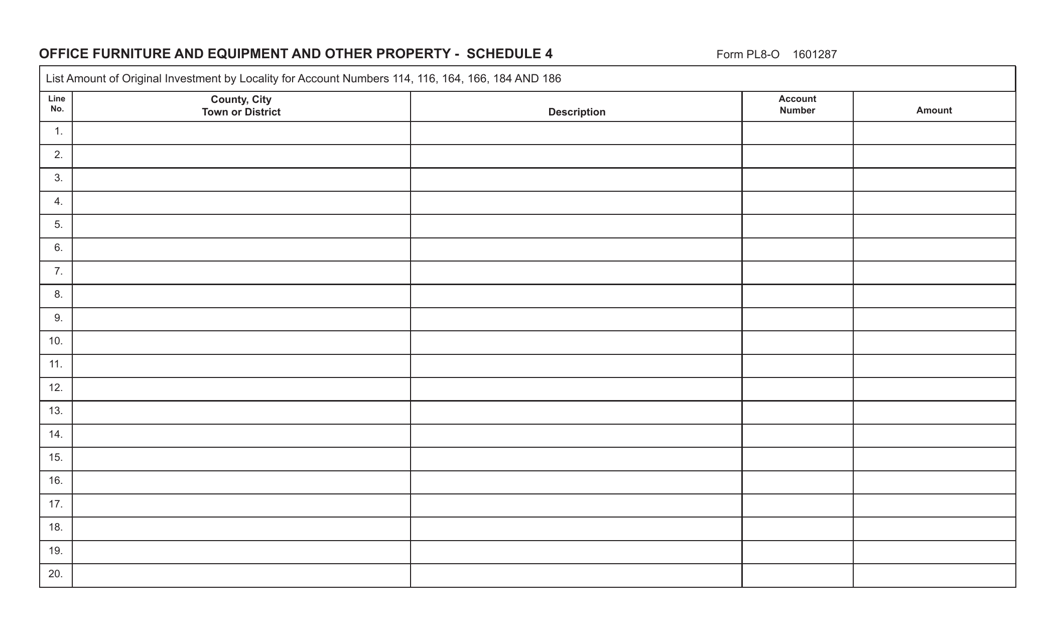

This form is used for reporting office furniture, equipment, and other property in the state of Virginia.

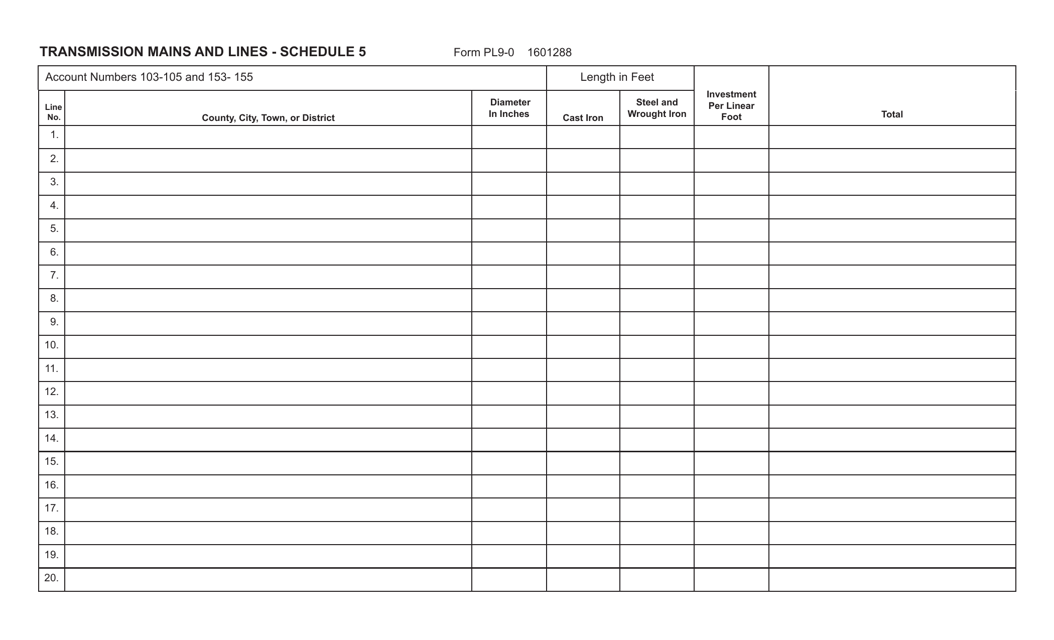

This Form is used for reporting and monitoring transmission mains and lines in the state of Virginia.

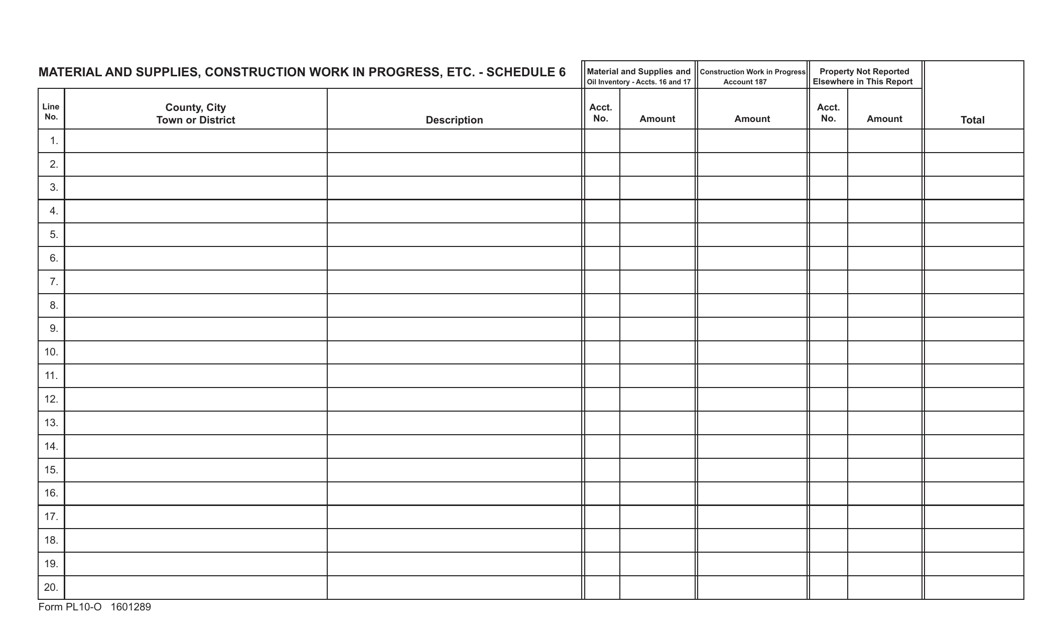

This document is used for reporting materials and supplies, construction work in progress, and other relevant details for construction projects in the state of Virginia.

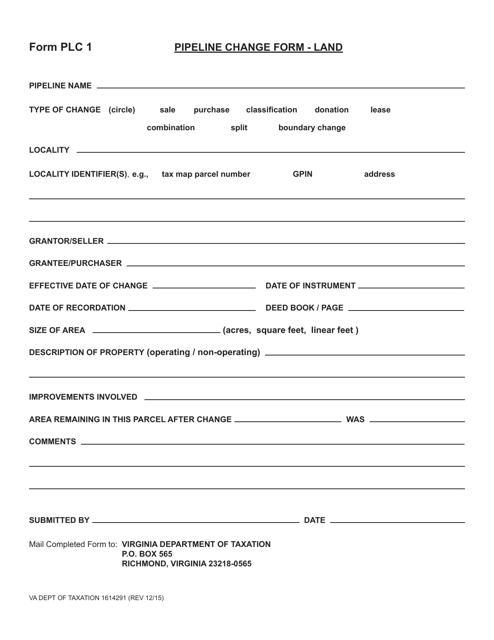

This Form is used for requesting a change to a pipeline on land in the state of Virginia.

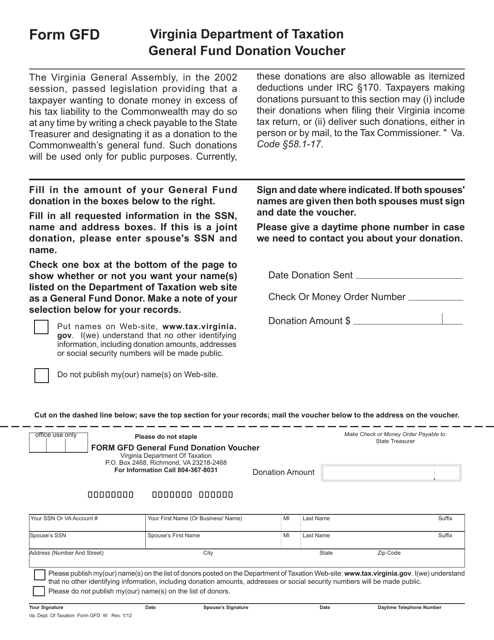

This Form is used for making a general fund donation in Virginia. It serves as a voucher to track the donation made to the general fund.

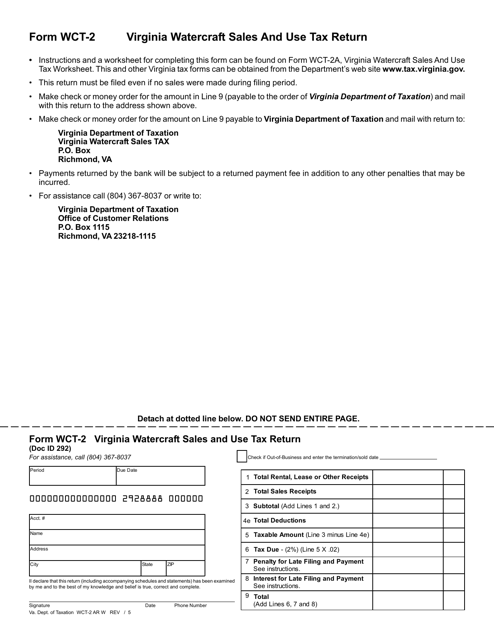

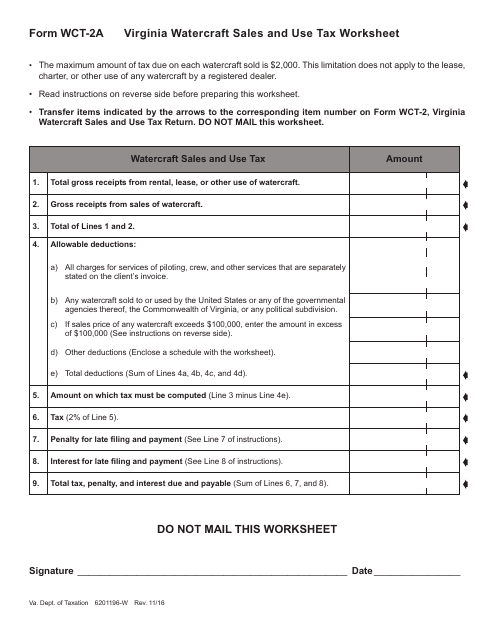

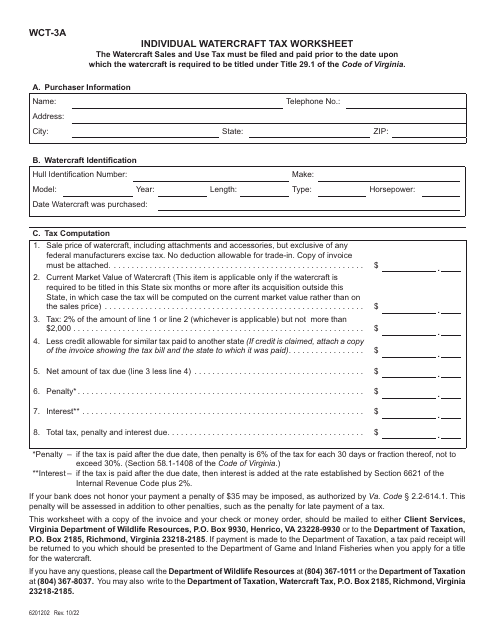

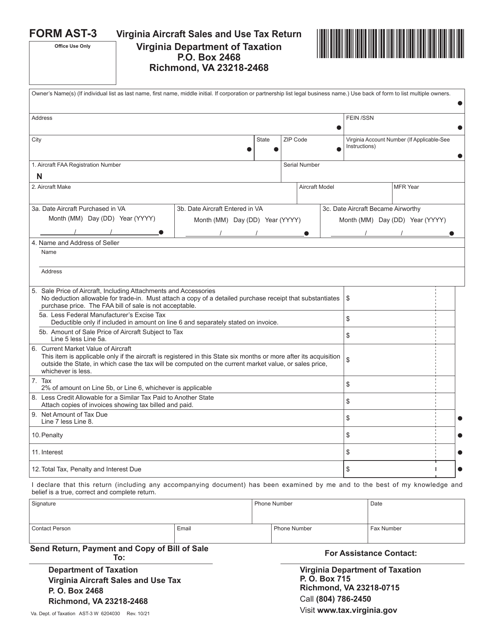

This form is used for reporting and paying sales and use tax on watercraft purchases in Virginia.

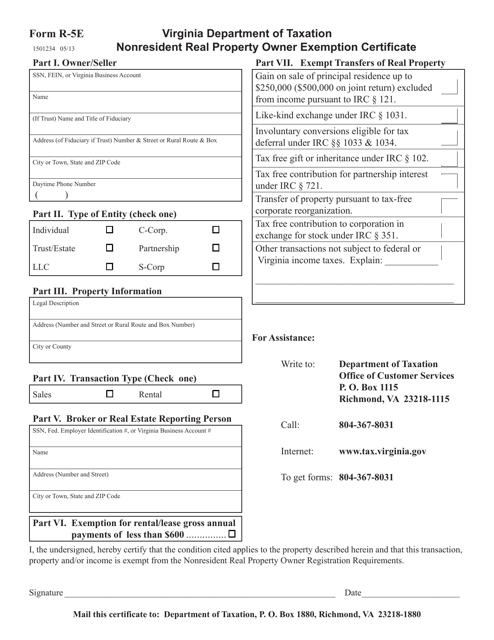

This form is used for nonresident property owners in Virginia to claim an exemption from real property taxes.

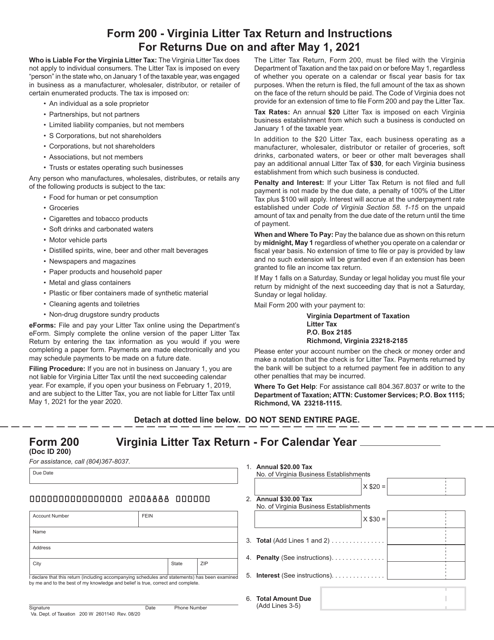

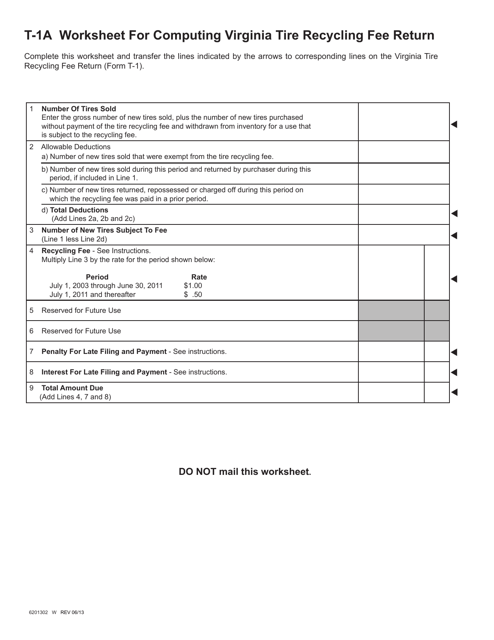

This Form is used for calculating the Virginia Tire Recycling Fee Return.

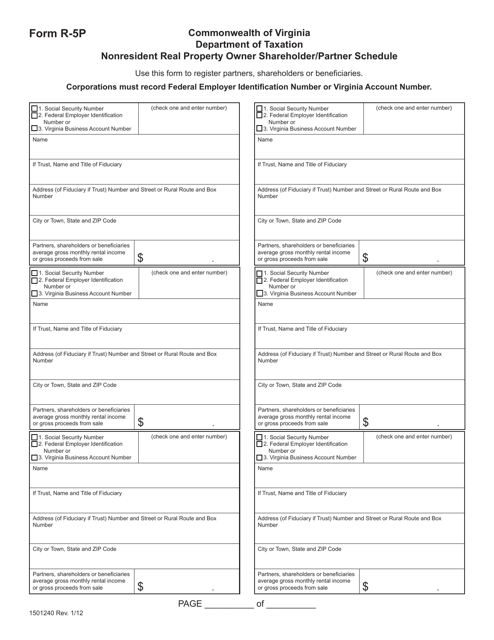

This form is used for nonresident real property owners in Virginia who are also shareholders or partners. It is used to report their ownership share in the property.

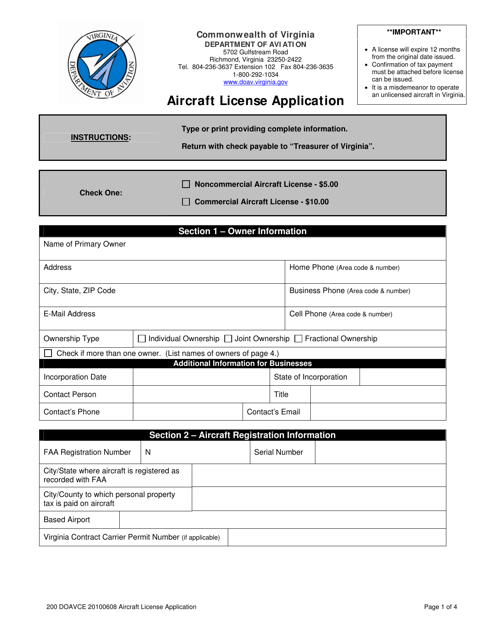

This form is used for applying for an aircraft license in the state of Virginia.

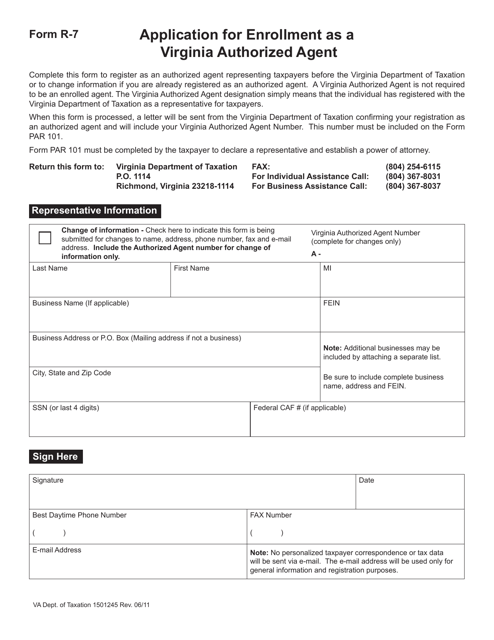

This Form is used for applying to become a Virginia Authorized Agent in the state of Virginia.

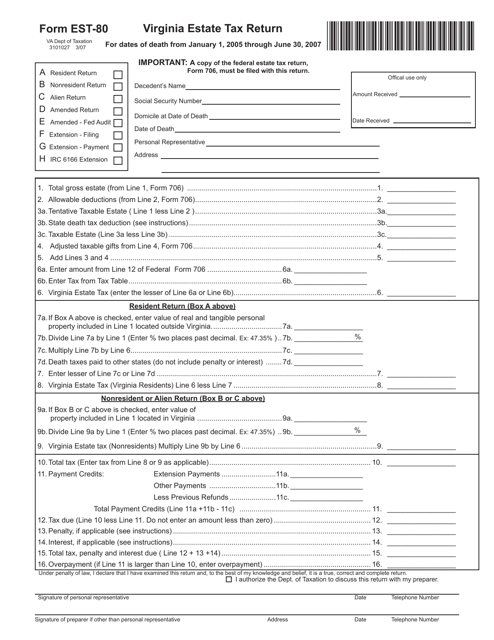

This form is used for filing the Virginia Estate Tax Return for individuals who have passed away between January 1, 2005, and June 30, 2007 in the state of Virginia.

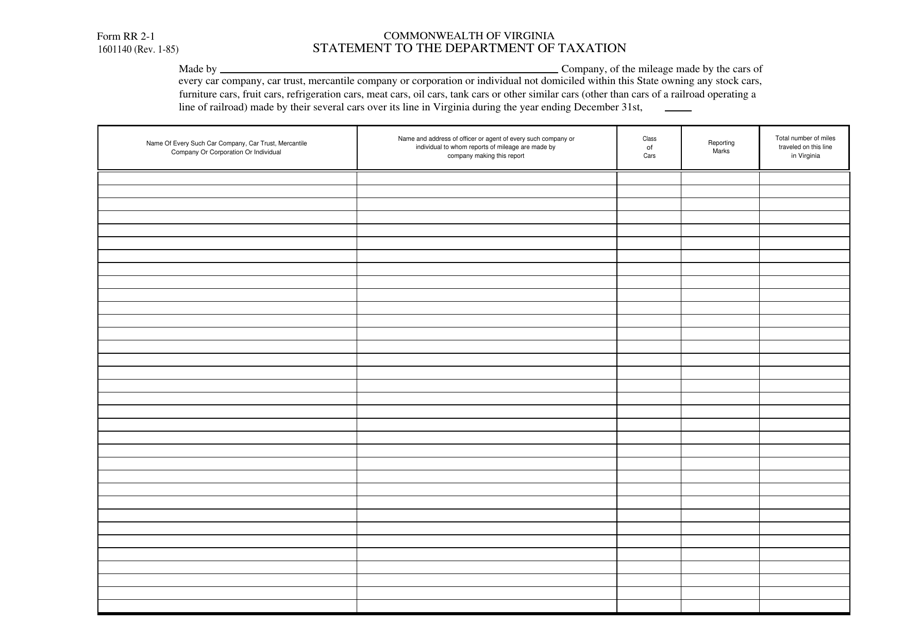

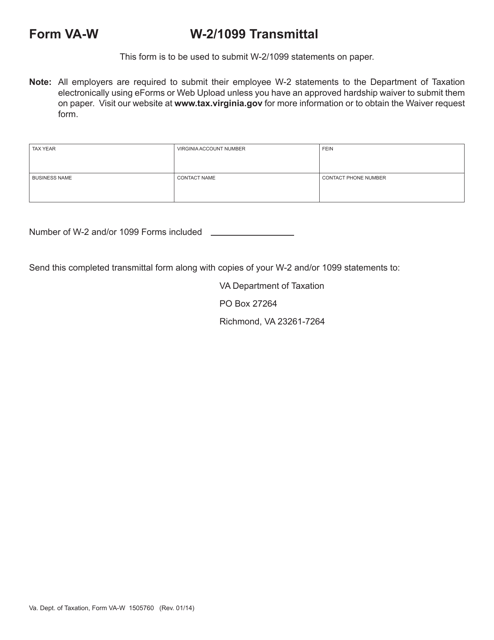

This form is used for submitting a statement to the Department of Taxation in Virginia.

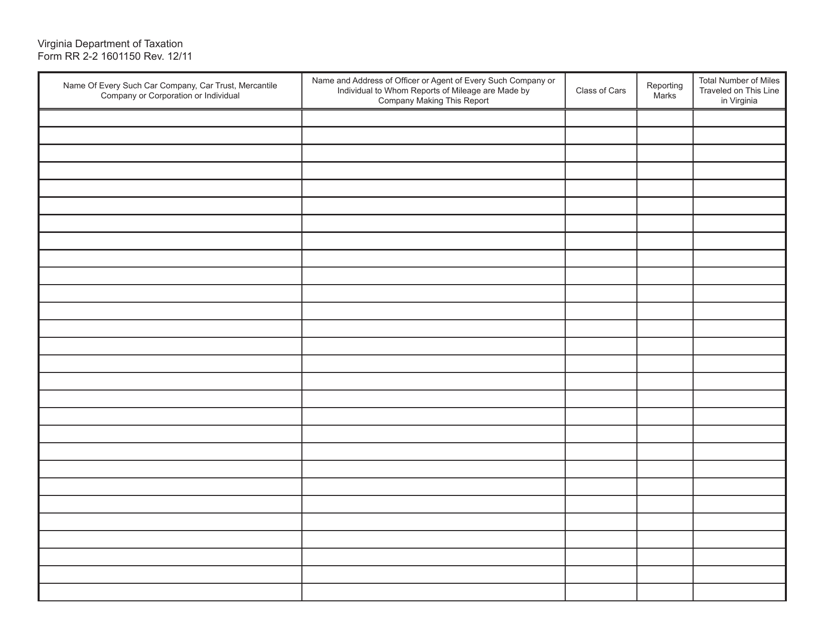

This document is a continuation of the Form RR2-2 Railroad Private Carline Mileage Return specifically for Virginia. It is used to report mileage information for private carlines in the state.

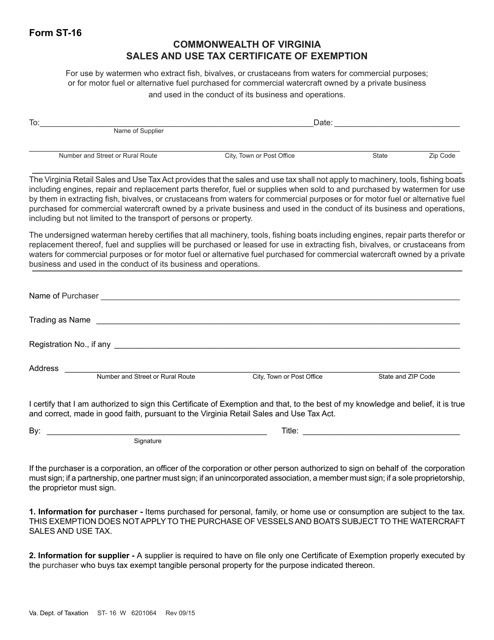

This form is used for the Sales and Use Tax Certificate of Exemption in Virginia.

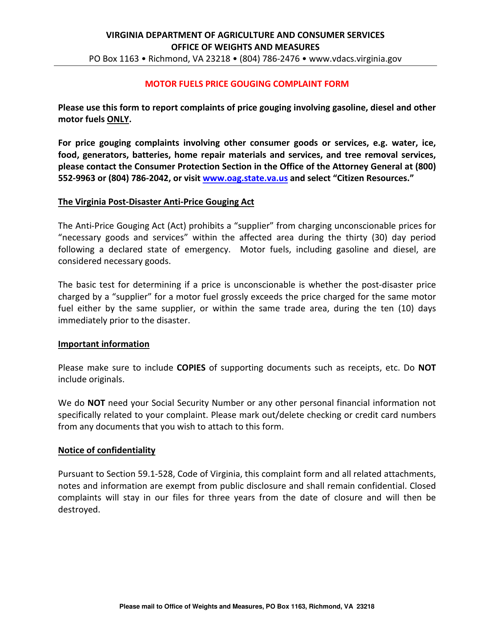

This Form is used for reporting complaints of motor fuels price gouging in Virginia. It allows consumers to report businesses that are charging excessive prices for gasoline or diesel fuel.

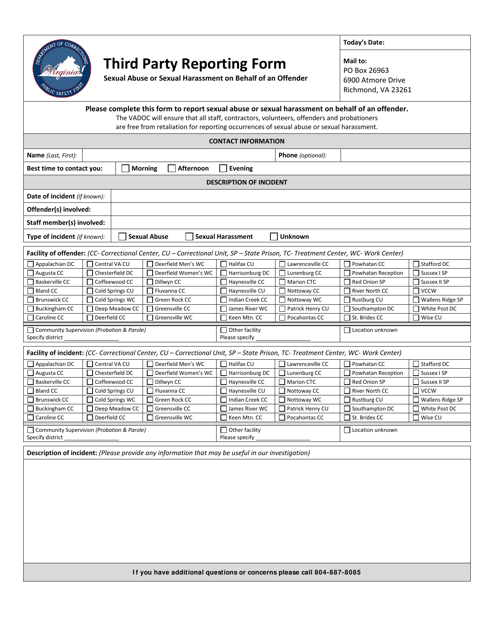

This document is used for reporting incidents involving a third party in the state of Virginia.

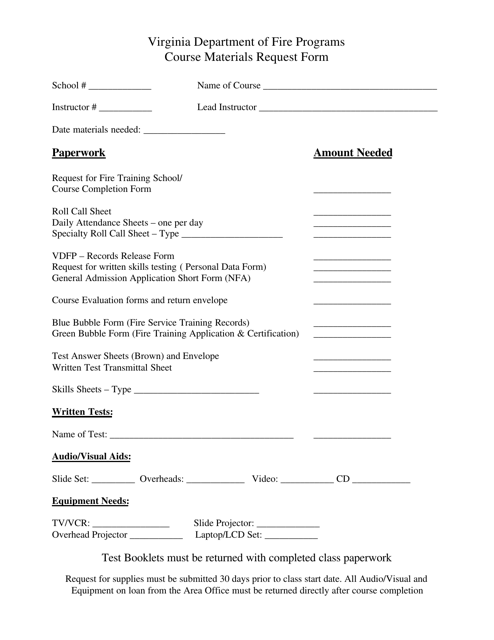

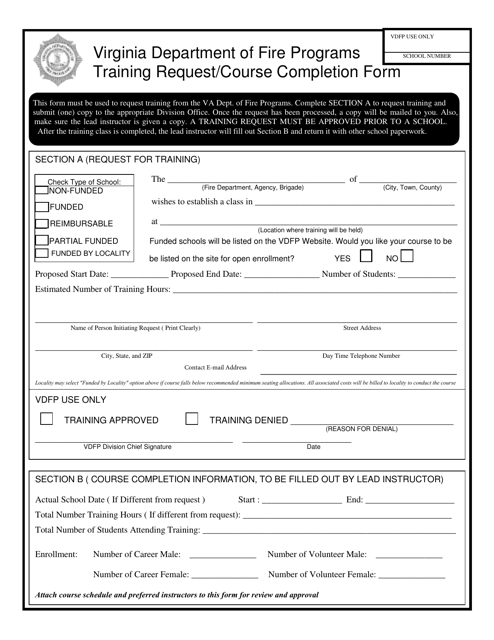

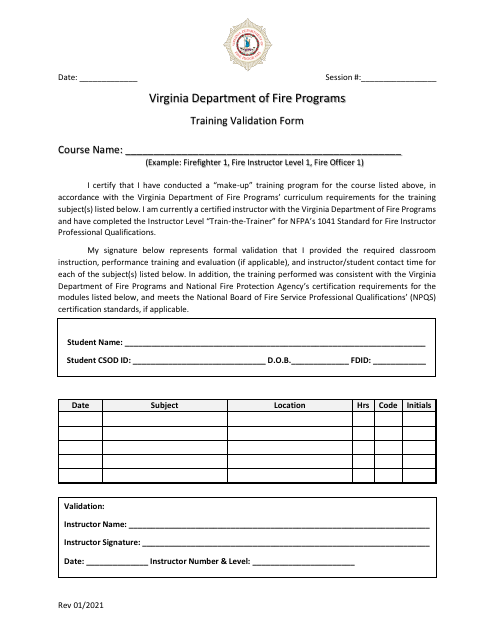

This form is used for requesting course materials in Virginia. It can be used by students or teachers to obtain the necessary resources for their courses.

This form is used for requesting training or reporting course completion in the state of Virginia.

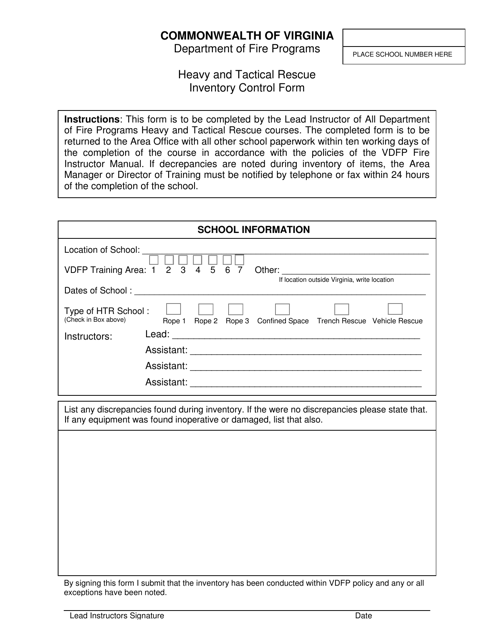

This Form is used for controlling the inventory of heavy and tactical rescue equipment in Virginia. It helps to track and manage the availability of specialized equipment used in rescue operations.

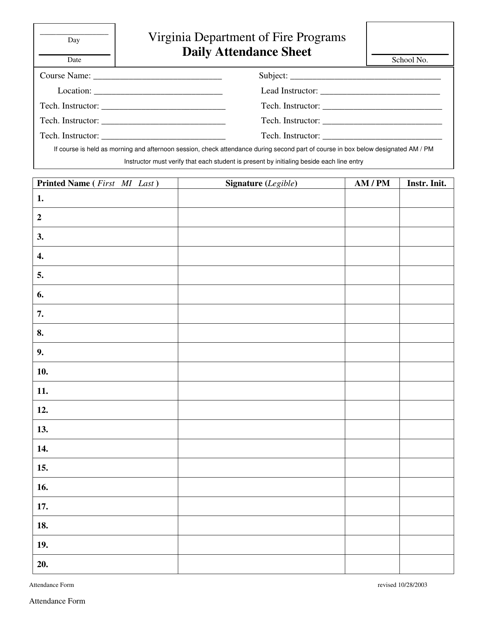

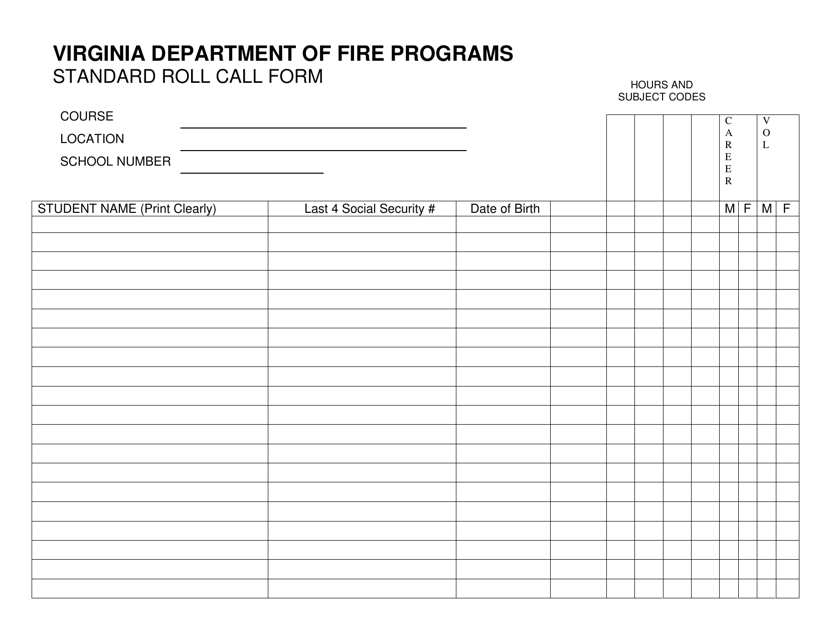

This type of document is used for keeping track of daily attendance in Virginia.

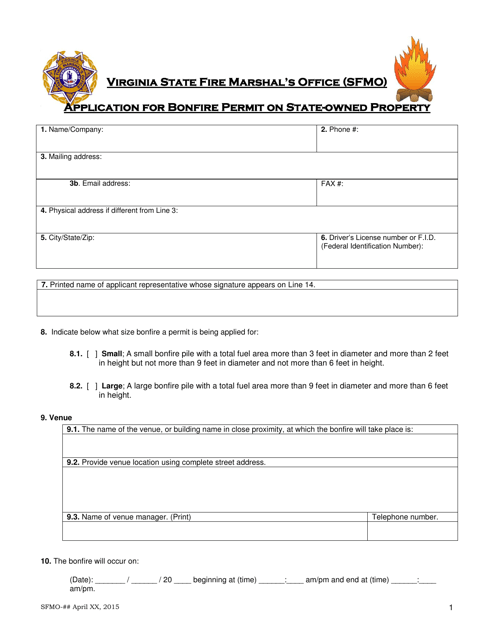

This document is an application for obtaining a bonfire permit on state-owned property in Virginia. It is used to request permission for hosting a bonfire event and ensure compliance with regulations.

This form is used for recording attendance and taking roll call in Virginia classrooms or meetings.

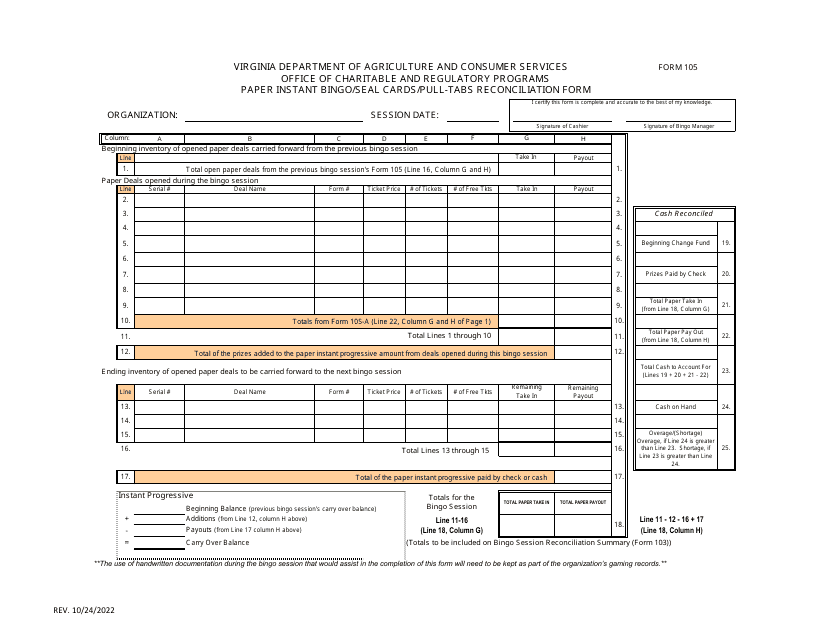

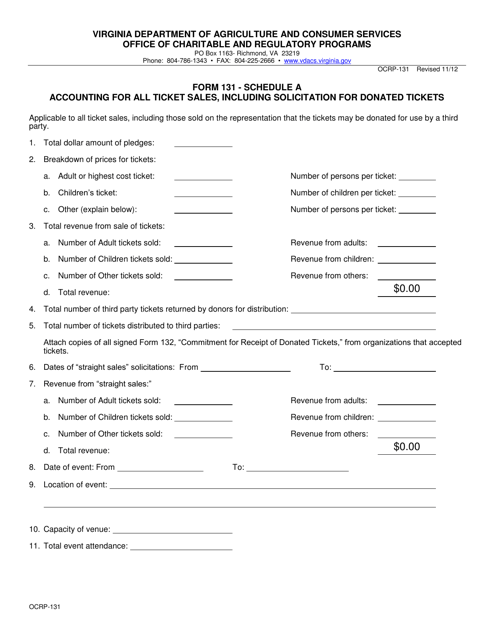

This form is used for accounting for all ticket sales, including solicitation for donated tickets in Virginia.

This form is used for submitting paper W-2 and 1099 forms to the state of Virginia. It is called the VA-W Withholding Transmittal form.