Fill and Sign Virginia Legal Forms

Documents:

4626

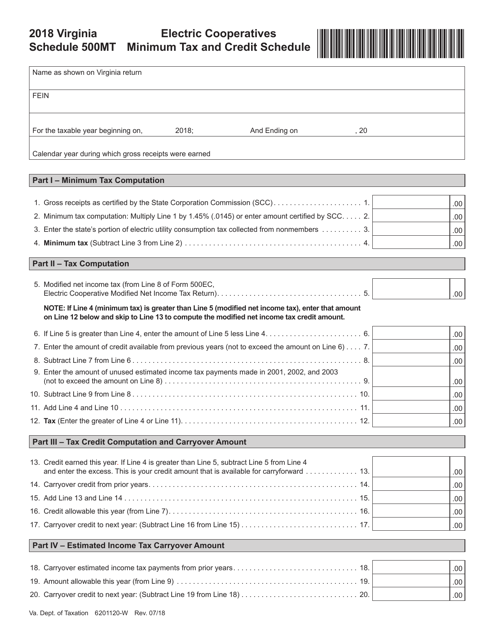

Form 6201120-W Schedule 500MT Electric Cooperatives Minimum Tax and Credit Schedule - Virginia, 2018

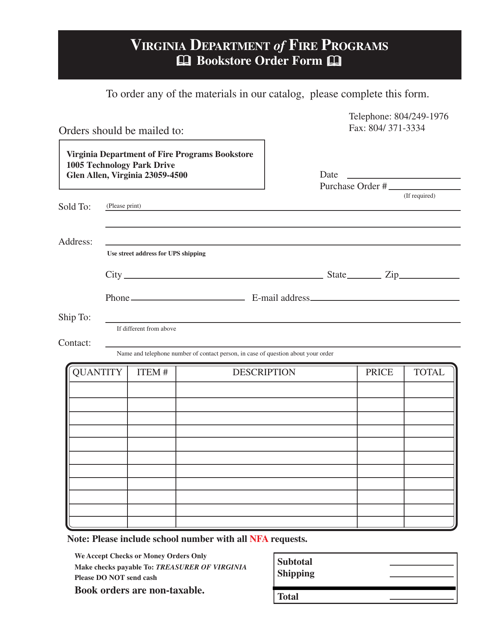

This Form is used for placing an order at a bookstore in Virginia.

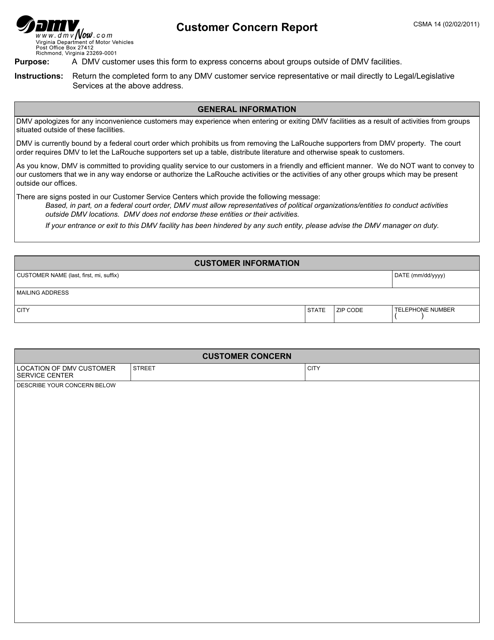

This Form is used for customers in Virginia to report their concerns or complaints to the relevant authorities.

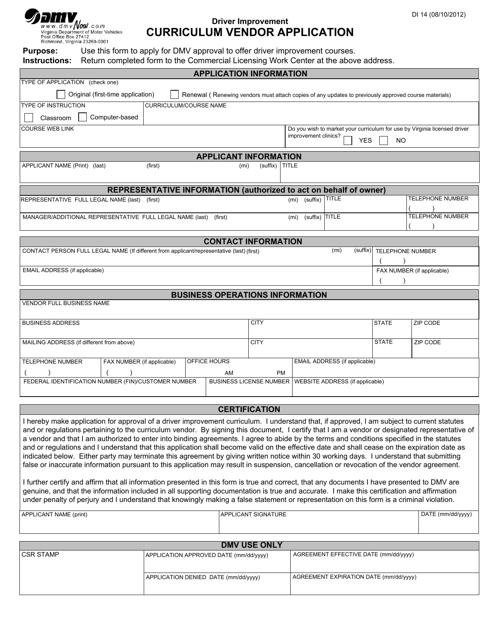

This Form is used for applying as a curriculum vendor in Virginia.

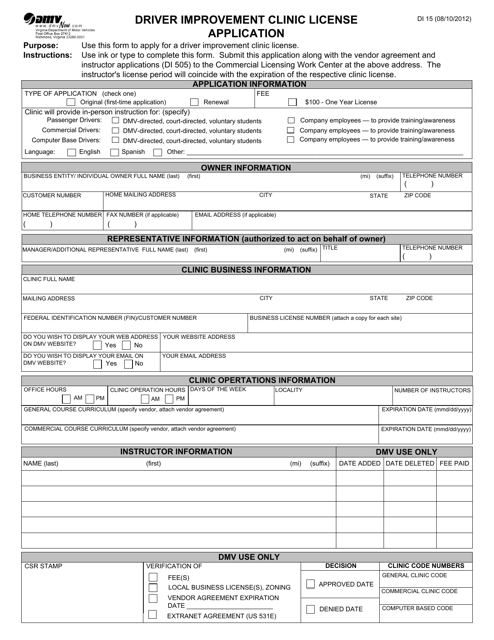

This form is used for applying for a driver improvement clinic license in Virginia. It is necessary for individuals or organizations seeking to operate a driver improvement clinic in the state.

This form is used for providing detailed information about a class 5 vehicle in the state of Virginia.

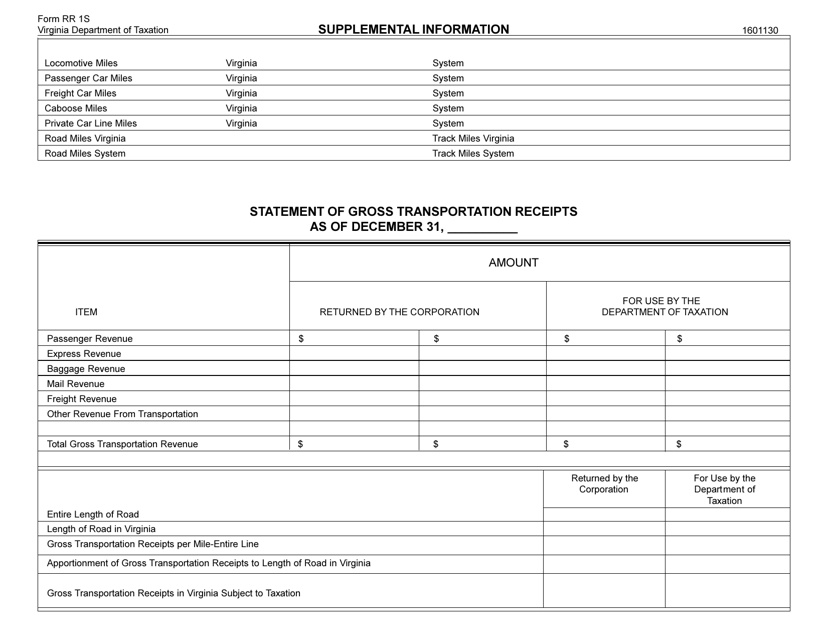

This Form RR1S Supplemental Information is used to provide additional information specifically for the state of Virginia.

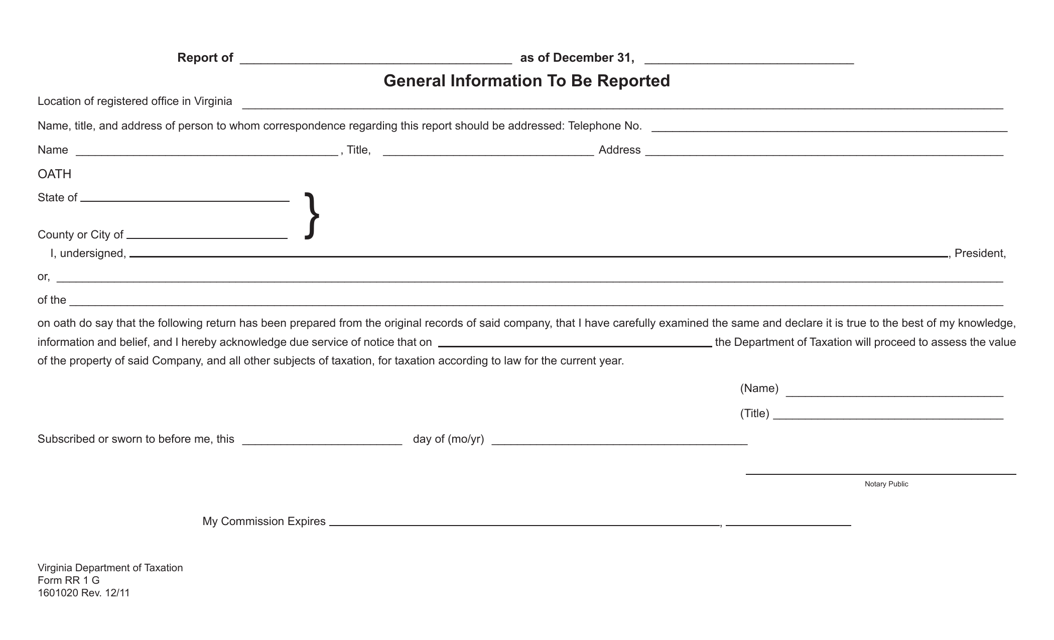

This form is used for taking an oath in the state of Virginia. It is known as the RR1 G Oath Page.

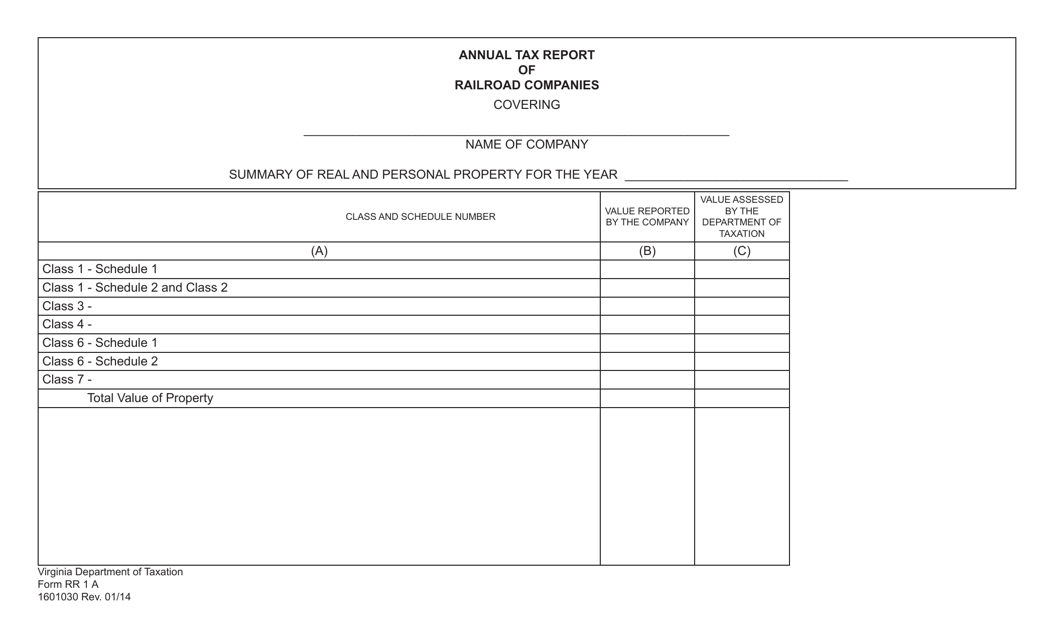

This form is used for railroad companies in Virginia to report a summary of their real and personal property for the annual tax report.

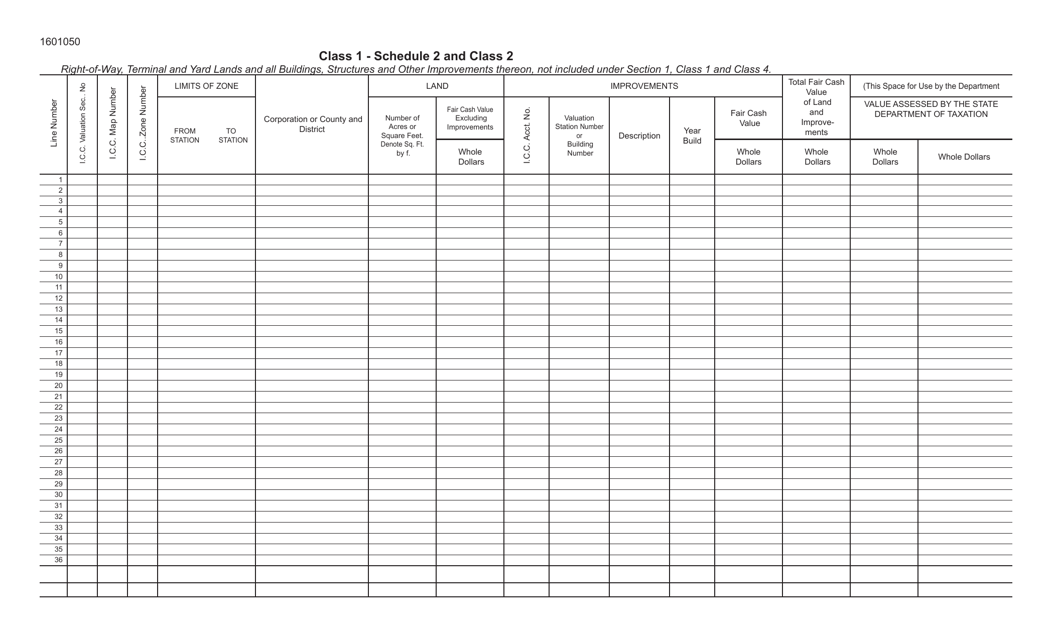

This Form is used for reporting Schedule 2 Class 1 - Class 2 improvements not included under schedule 1, class 1, and class 4 in Virginia.

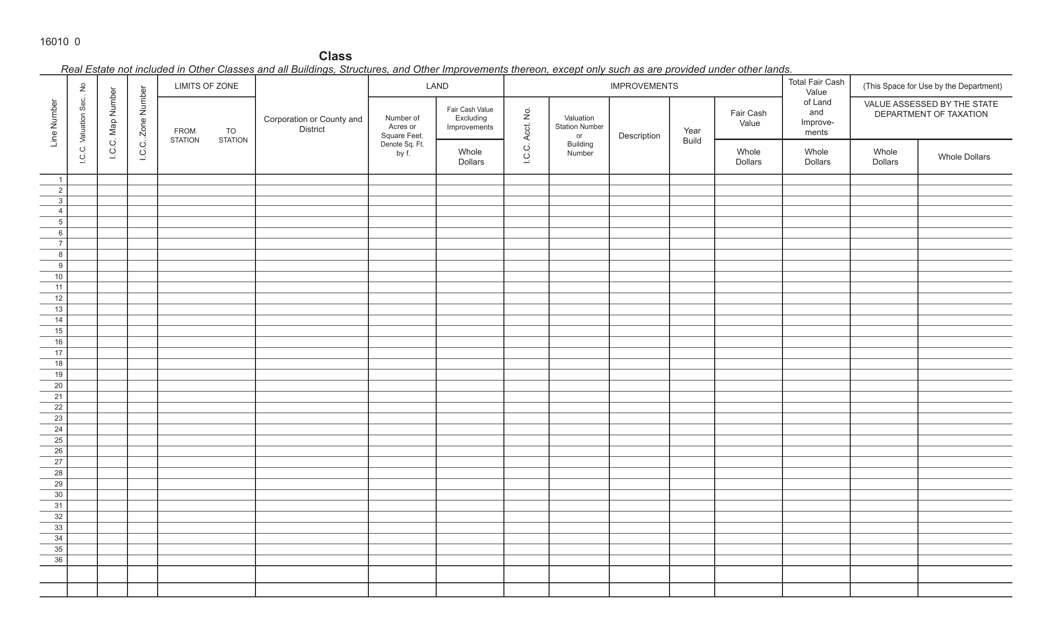

This form is used for reporting real estate properties that do not fall under other classes, as well as all buildings and related structures in Virginia.

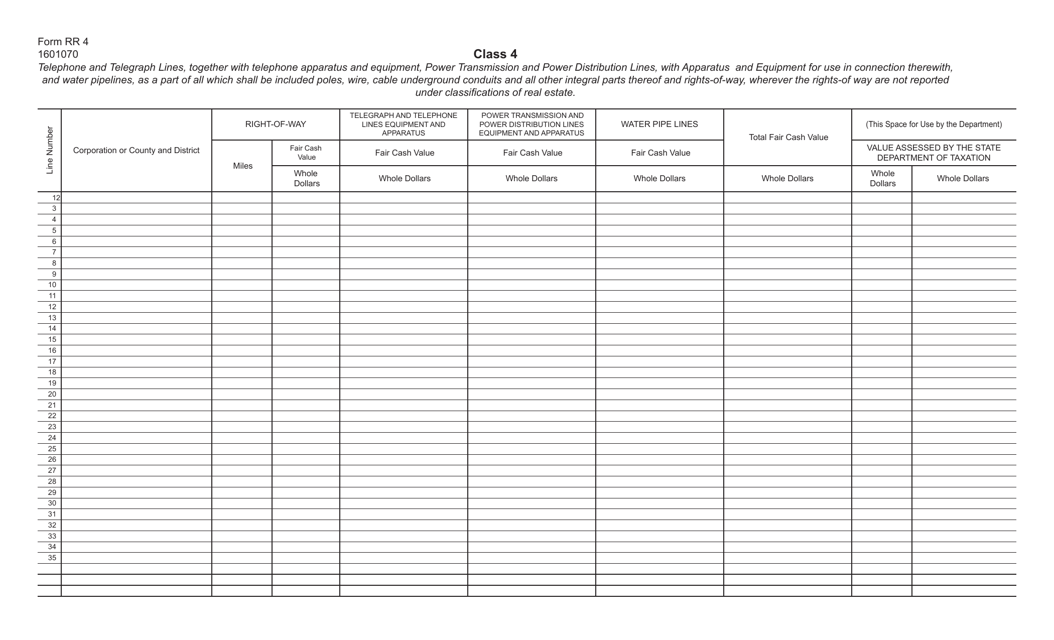

This form is used for reporting telephone and telegraph lines in Virginia that are not classified as real estate.

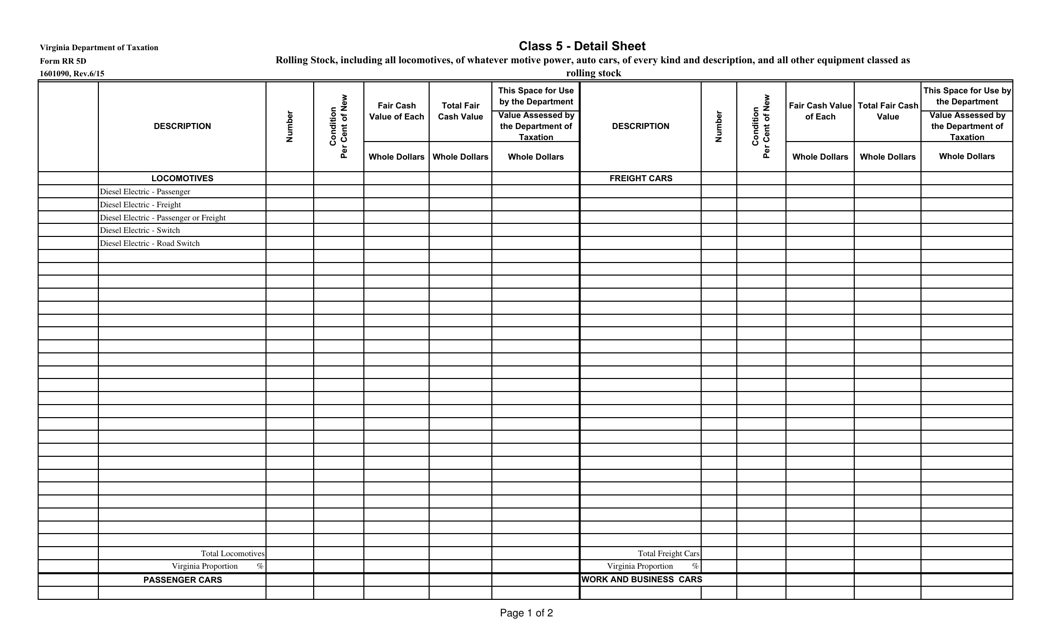

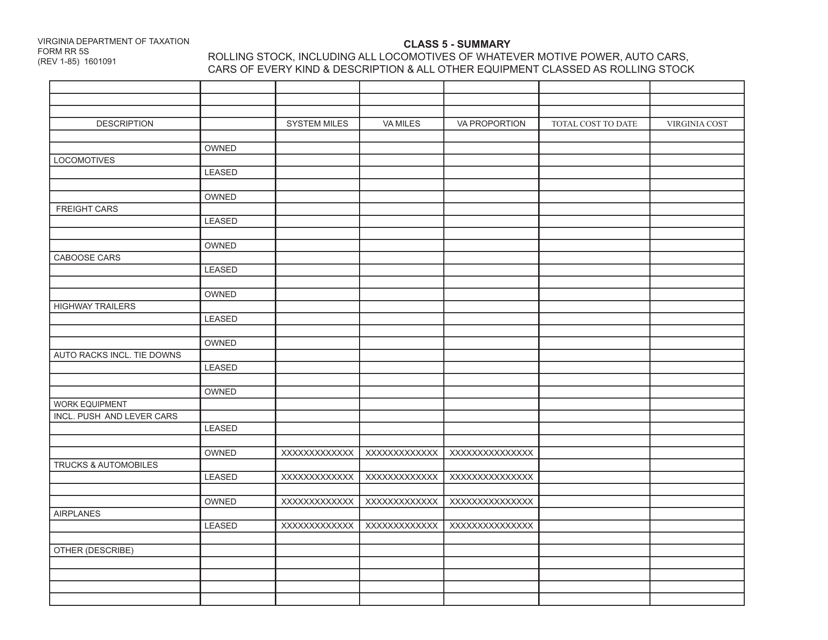

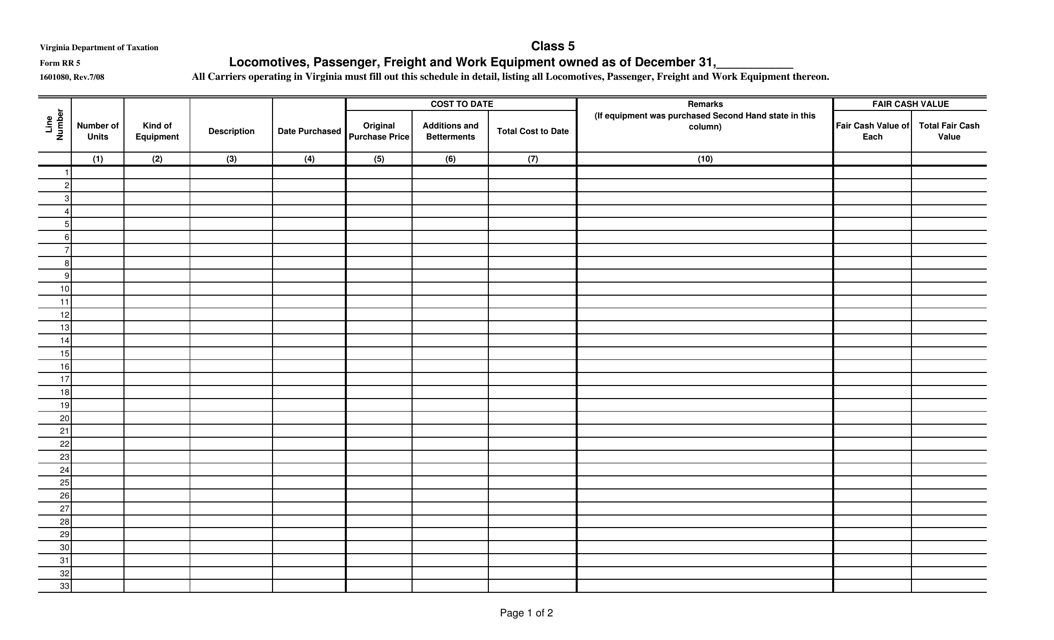

This form is used for reporting locomotives, passenger, freight, and work equipment owned by individuals or companies in Virginia as of December 31st.

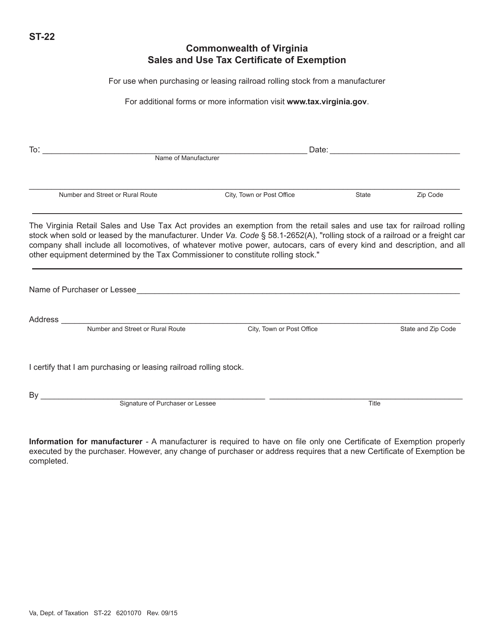

This form is used for claiming an exemption from sales tax for railroad rolling stock in the state of Virginia.

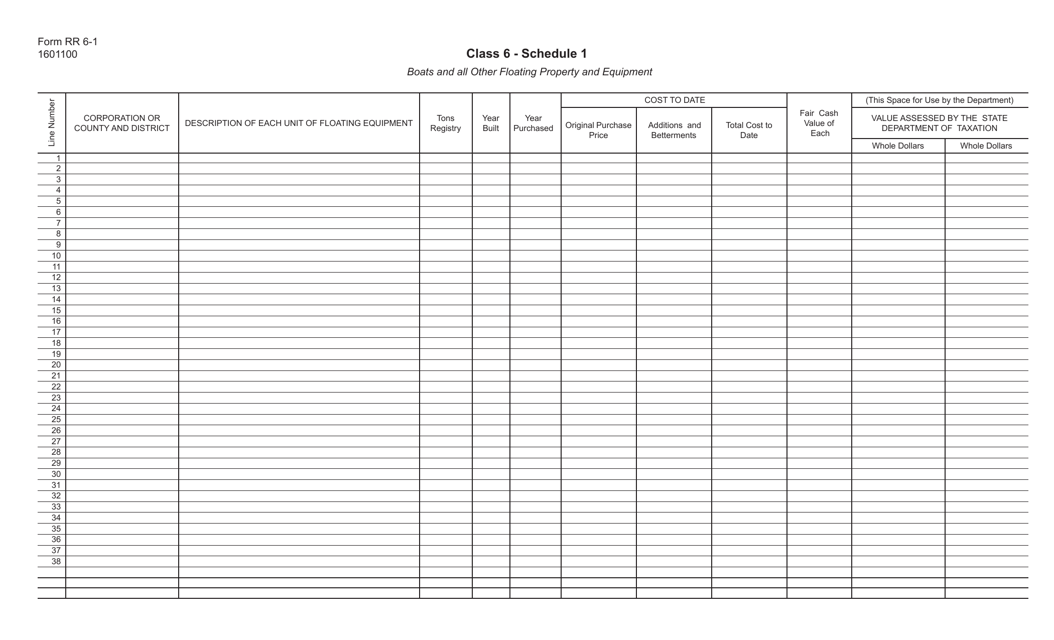

This form is used for reporting boats and all other floating property and equipment in the state of Virginia.

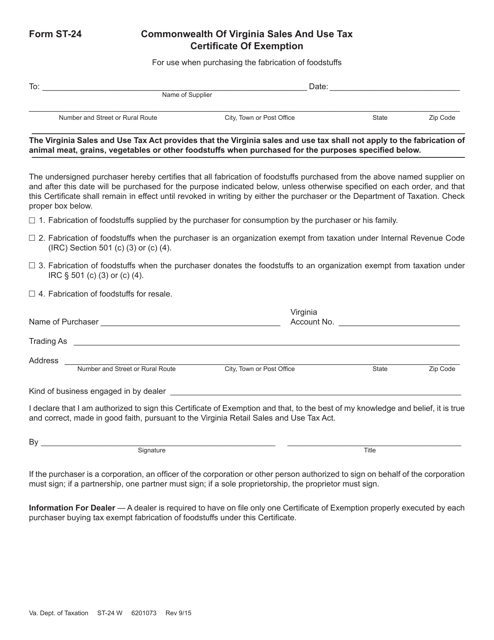

This form is used for requesting an exemption certificate for foodstuffs fabrication in Virginia.

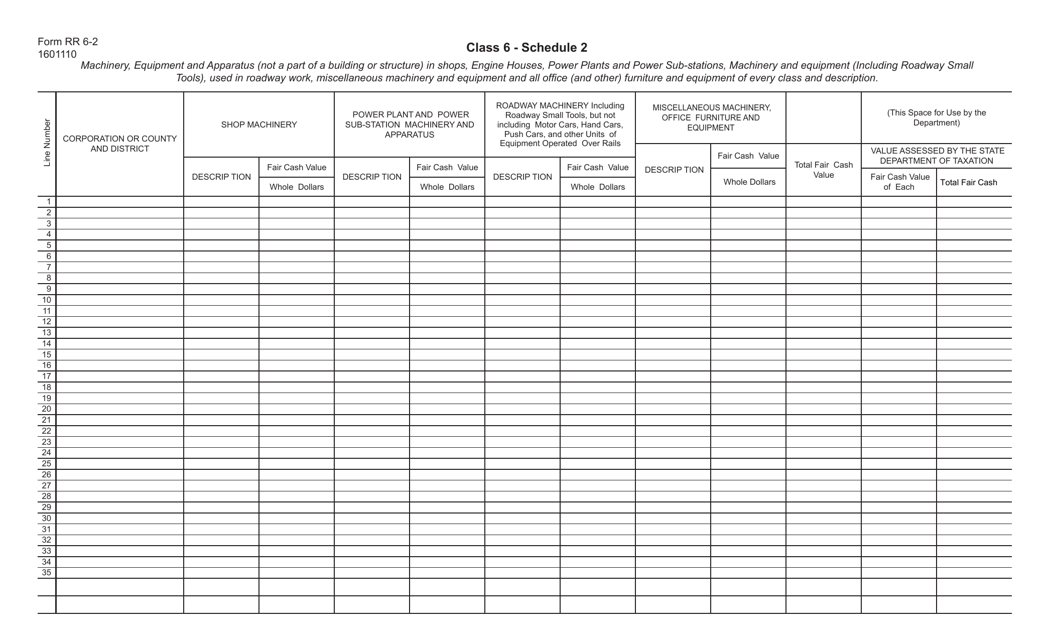

This Form is used for reporting and categorizing machinery, equipment, and apparatus in the state of Virginia under Class 6 for taxation purposes.

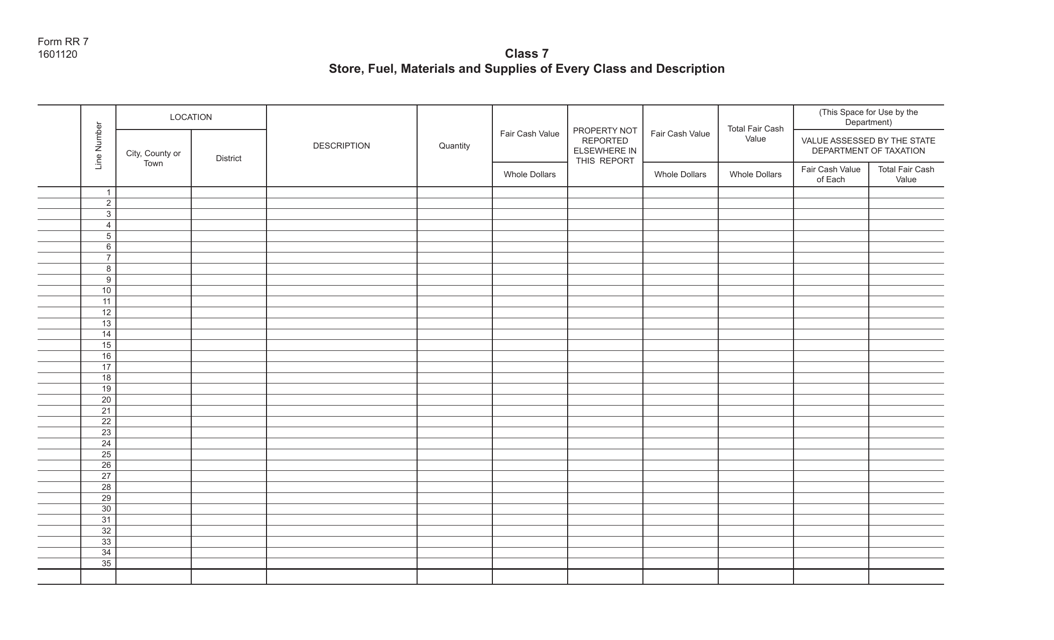

This Form is used for reporting store, fuel, materials, and supplies of every class and description for Class 7 in Virginia.

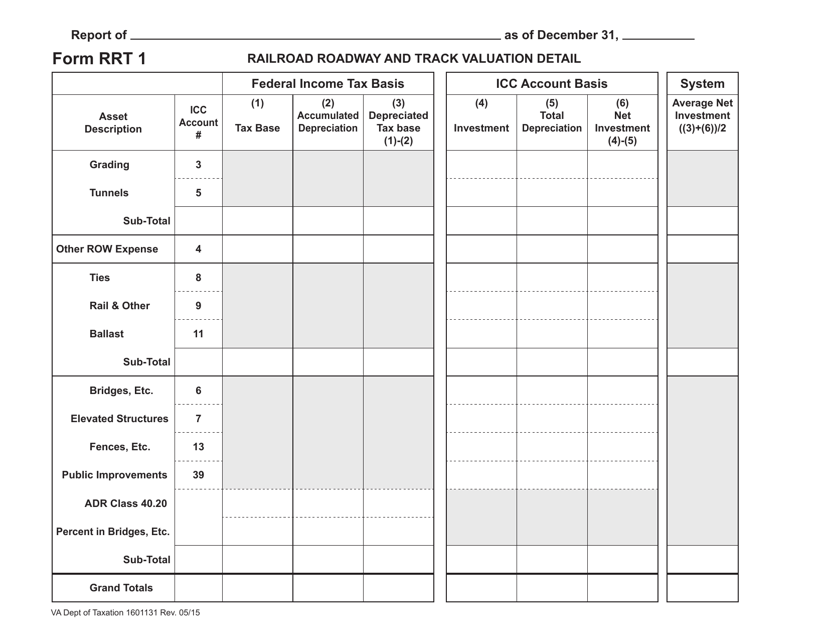

This form is used for providing detailed information on the valuation of railroad roadway and track in Virginia.

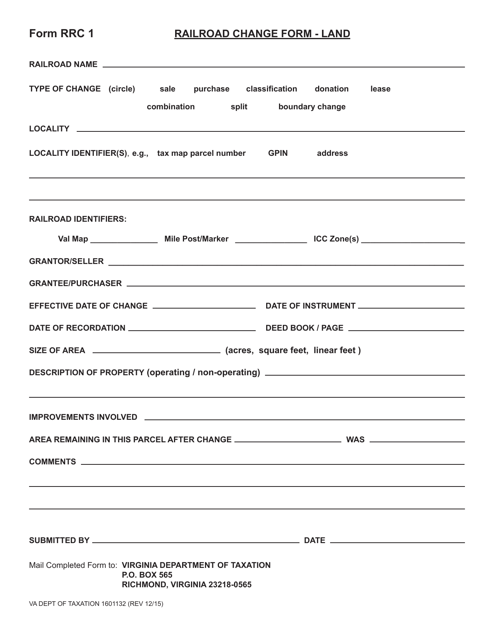

This form is used for making changes to railroad land in Virginia.

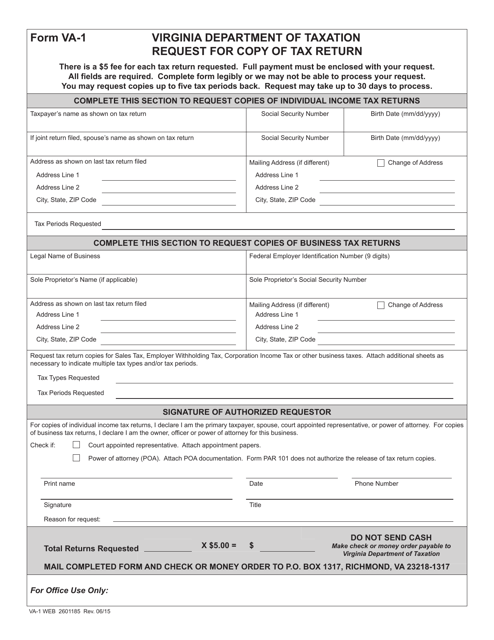

This form is used for requesting a copy of a tax return filed in Virginia. It is necessary if you need to obtain a copy of your previously filed tax return for various reasons.

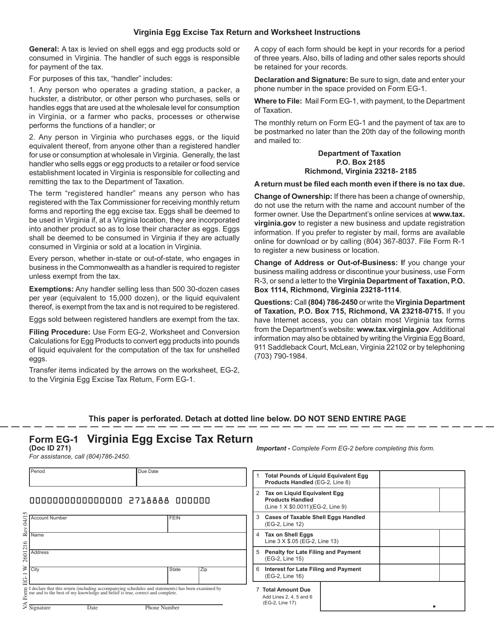

This Form is used for filing the Virginia Egg Excise Tax Return in Virginia. It is the official document to report and pay the state excise tax on eggs sold or used in Virginia.

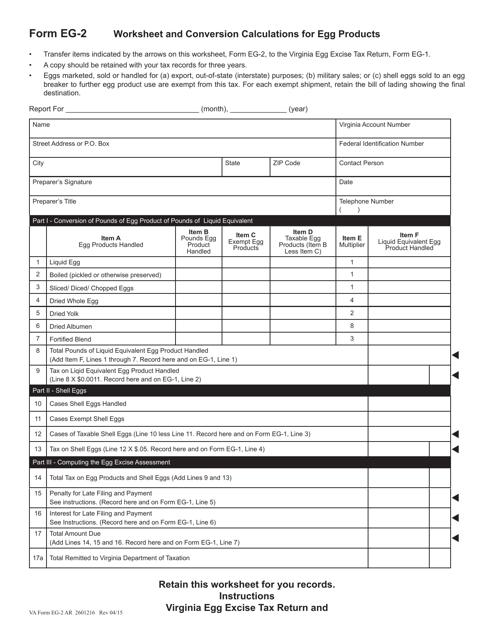

This type of document is a worksheet and conversion calculations for egg products in Virginia. It helps in determining the quantity and measurement conversions for various egg products.

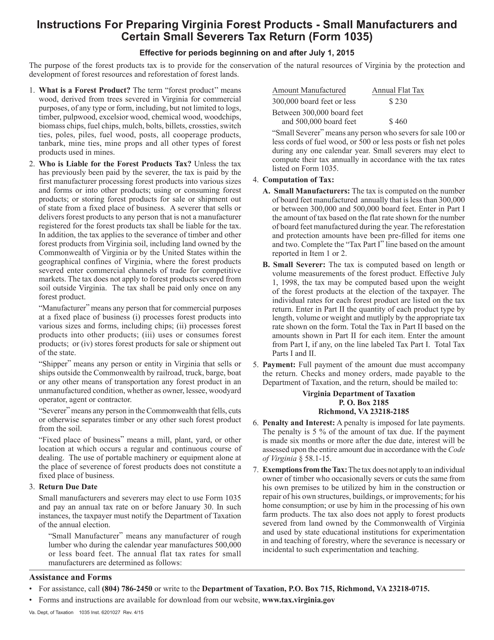

This Form is used for small manufacturers in Virginia to file their forest product tax return. It provides instructions on how to accurately report and pay taxes on forest products.

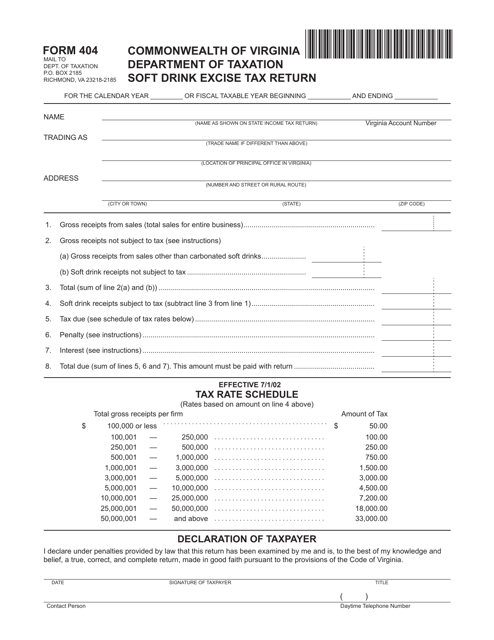

This form is used for reporting and paying the excise tax on soft drinks in the state of Virginia. It is necessary for businesses that manufacture or sell soft drinks to comply with the tax regulations.

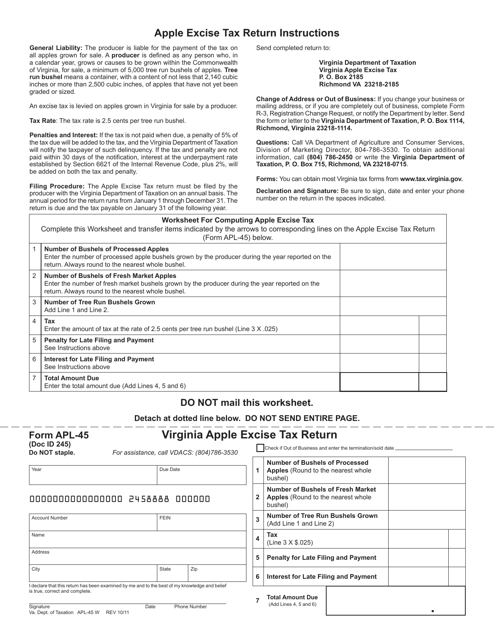

This document is for filing the Virginia Apple Excise Tax Return in the state of Virginia.

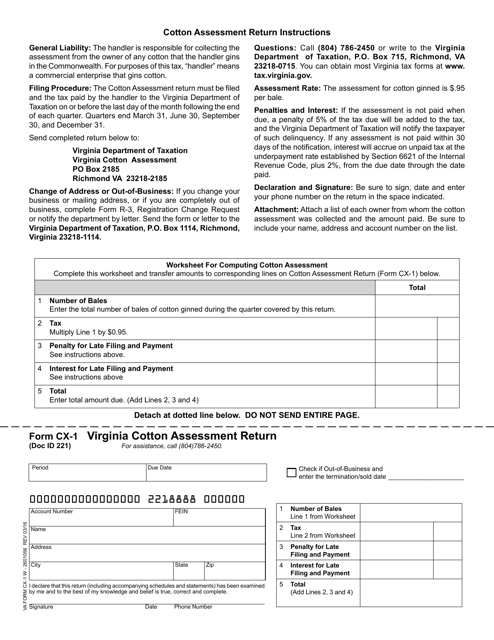

This form is used for reporting cotton assessments in Virginia.

This document is used for the annual tax reporting of gas companies in Virginia. It provides relevant information on the title page.

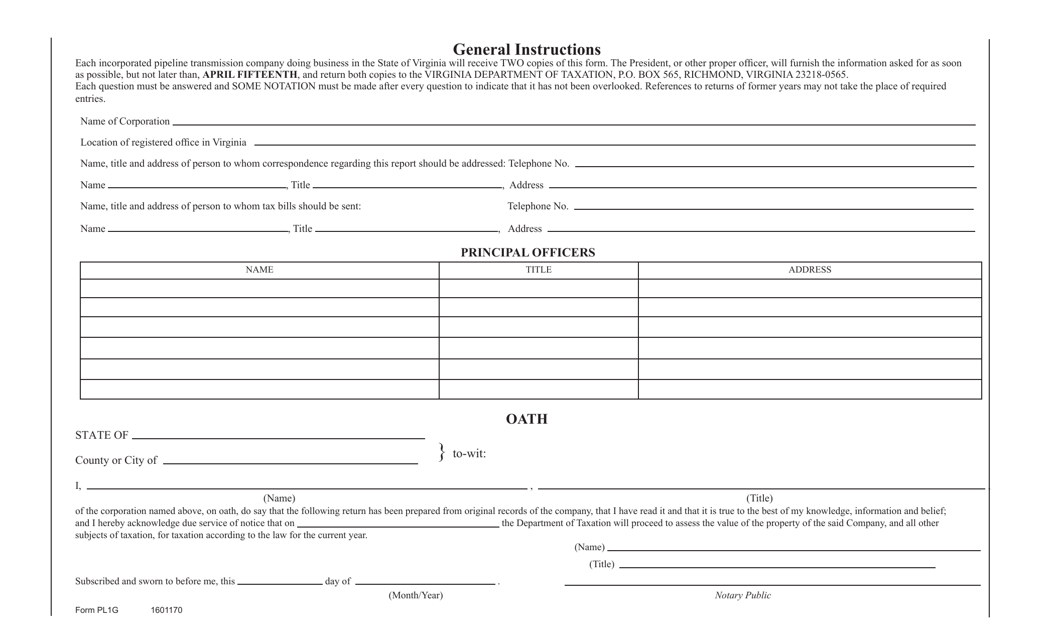

This document provides general instructions and an oath page for Form PL1G in the state of Virginia. It is used for completing the form and swearing under oath.

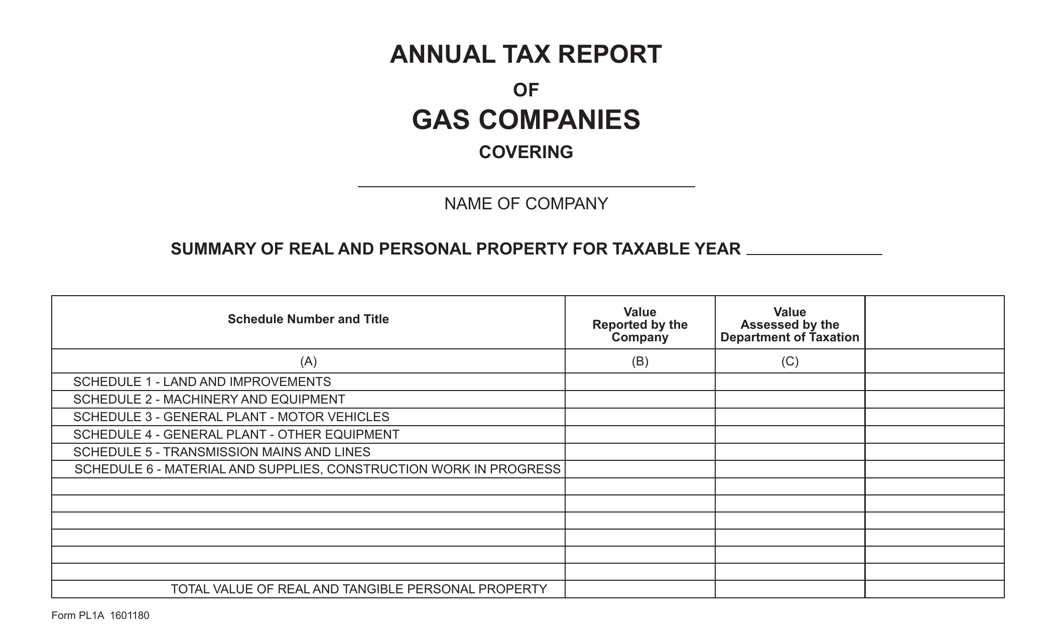

This Form is used for gas companies in Virginia to report their annual tax information. It is necessary for gas companies to submit this report to comply with tax regulations in Virginia.