Fill and Sign Arizona Legal Forms

Documents:

5891

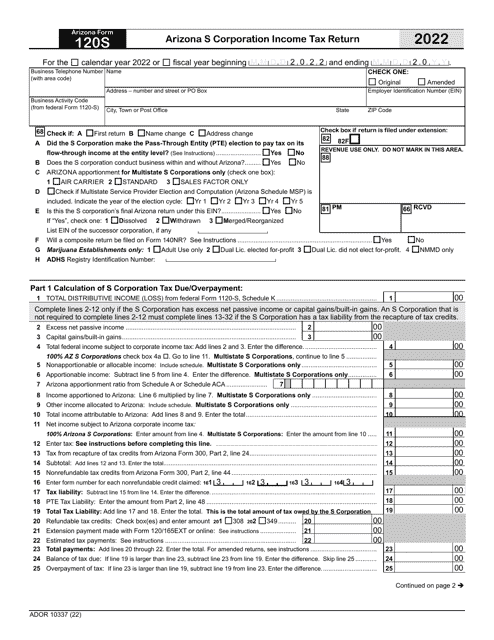

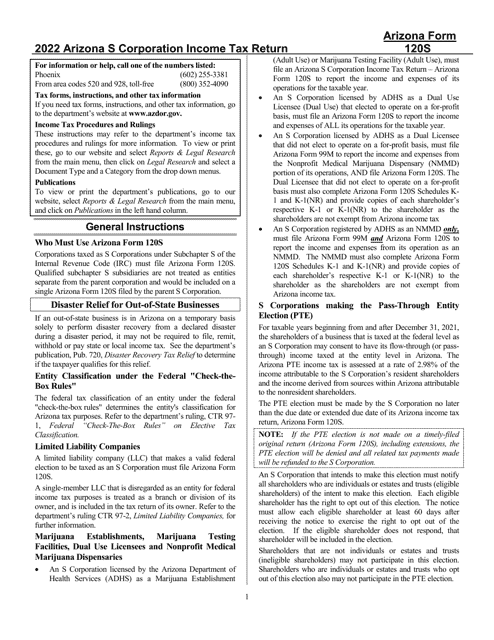

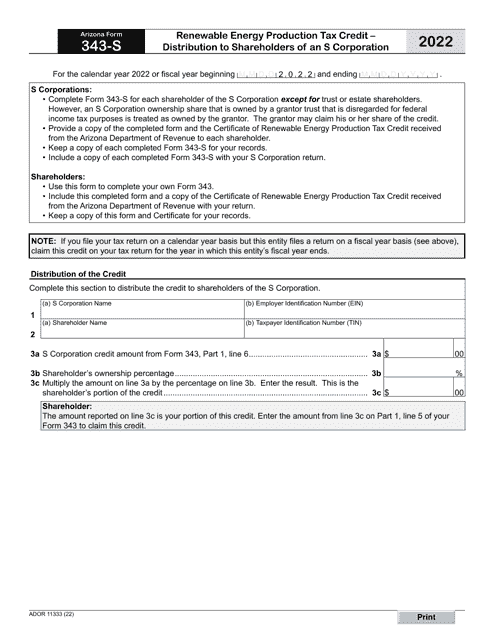

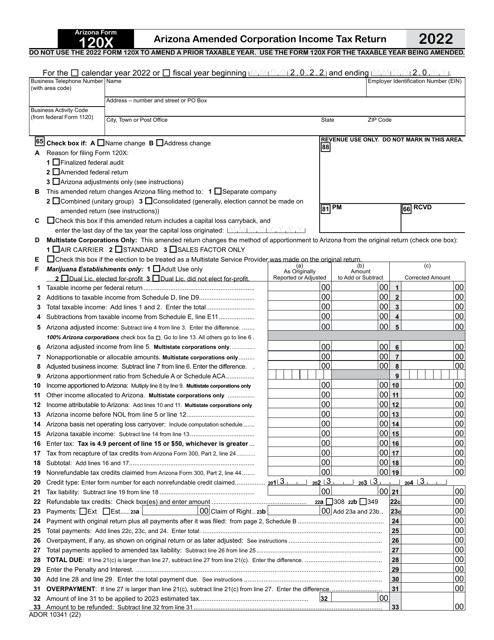

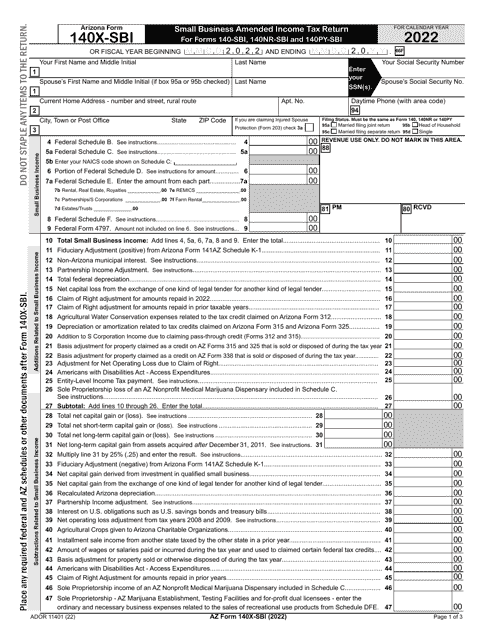

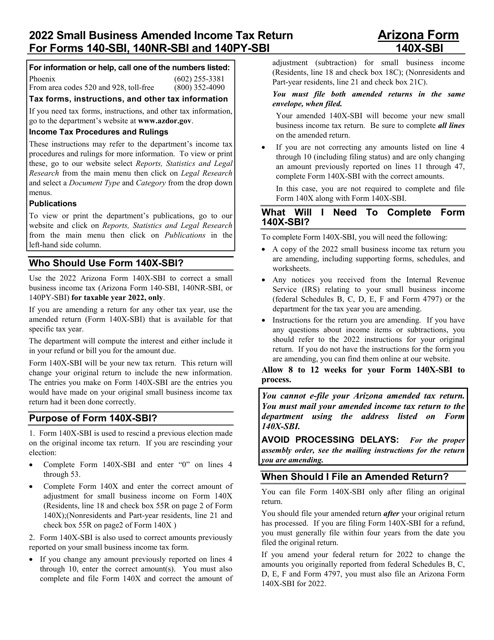

This form is used for filing Arizona S Corporation Income Tax Return. It is specific to the state of Arizona and is for reporting income tax information for S corporations.

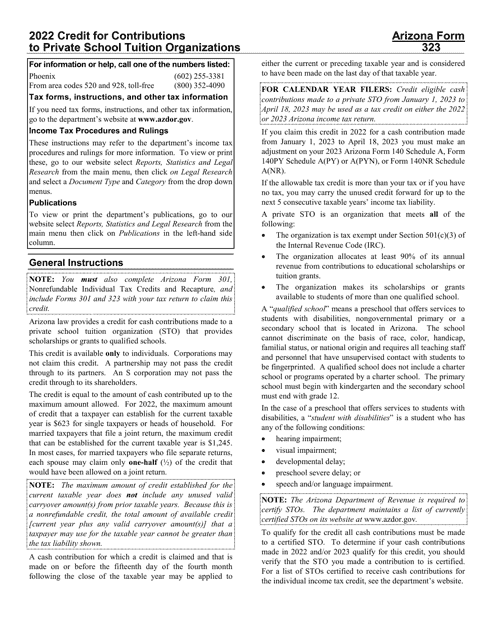

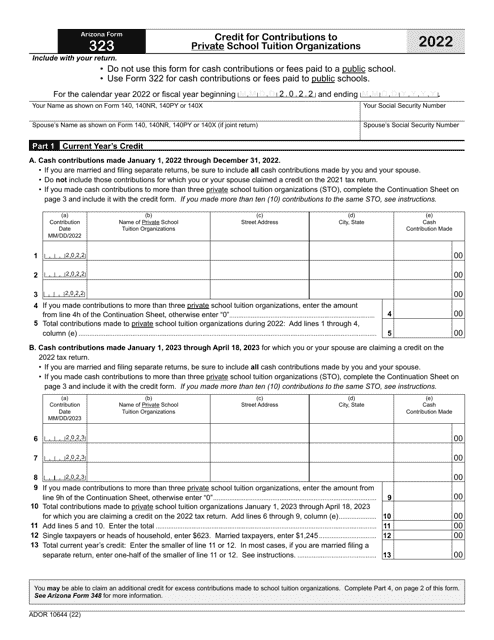

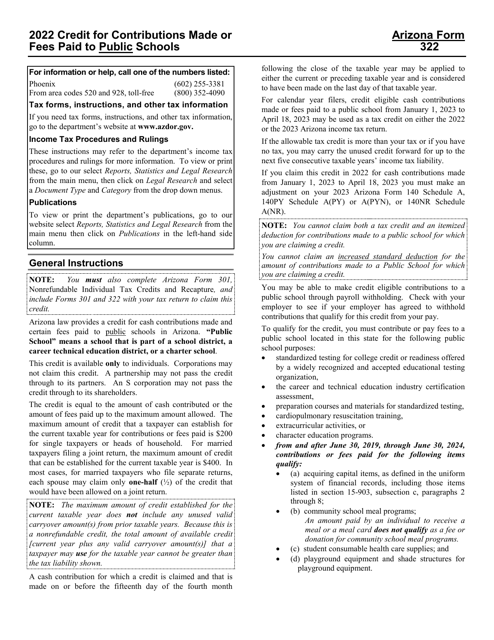

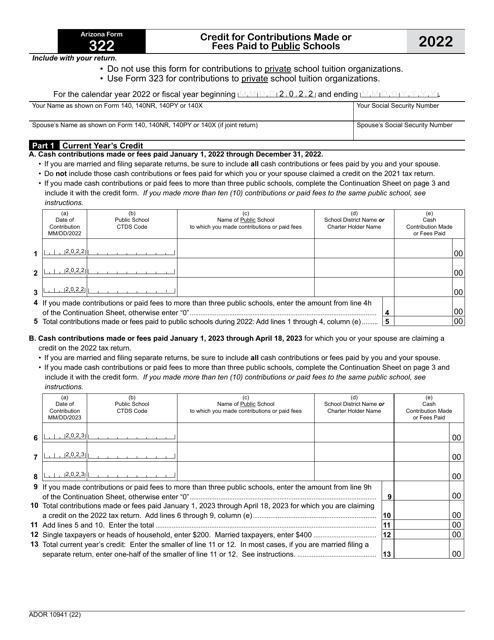

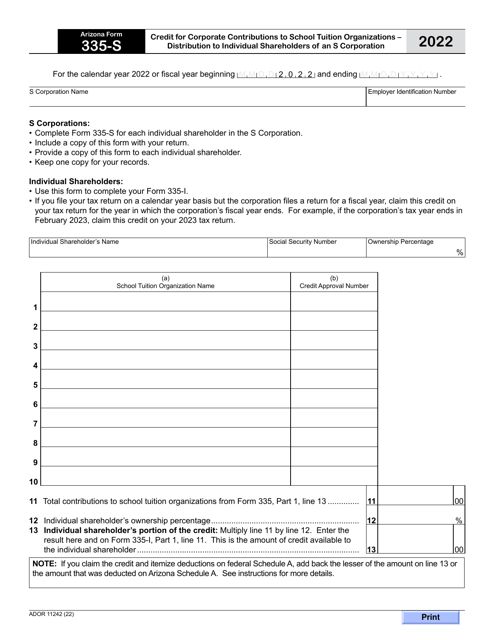

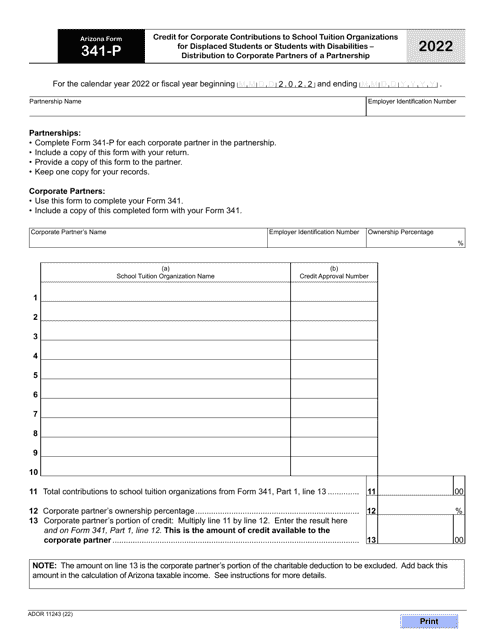

This form is used for claiming a credit for contributions made to private school tuition organizations in the state of Arizona.

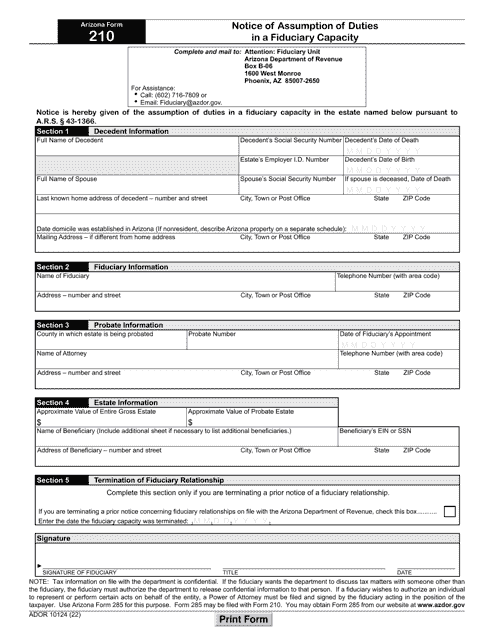

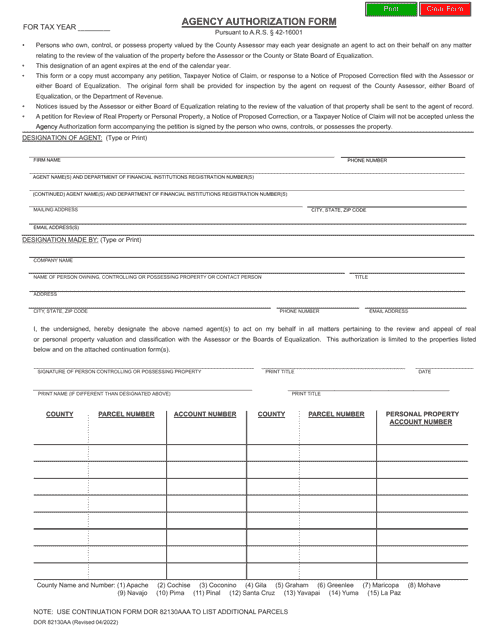

This Form is used for authorizing an agency in Arizona to act on behalf of an individual or organization.

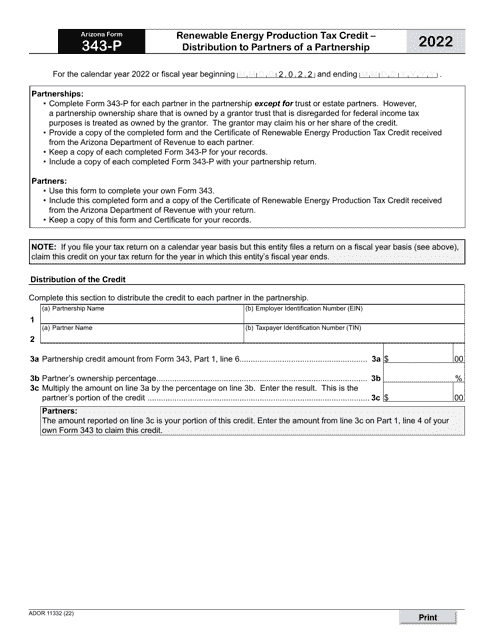

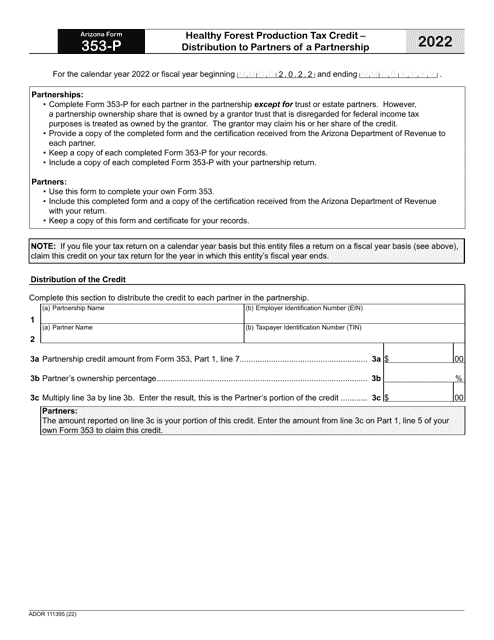

This Form is used for claiming the Healthy Forest Production Tax Credit in Arizona and distributing it to partners of a partnership.

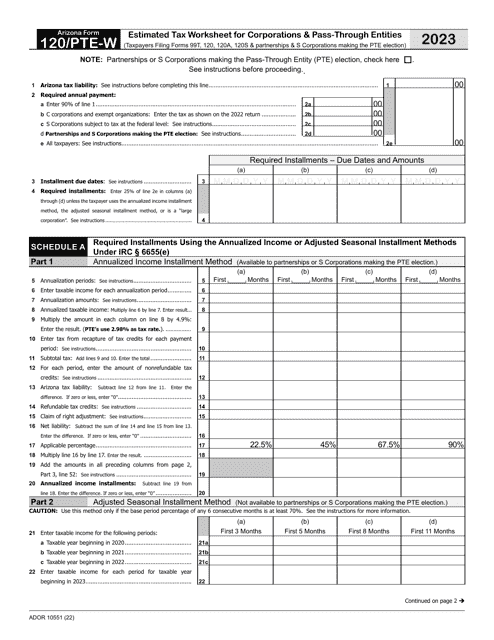

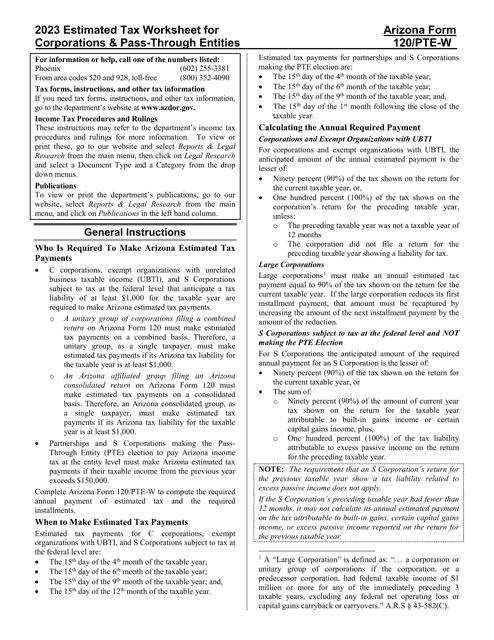

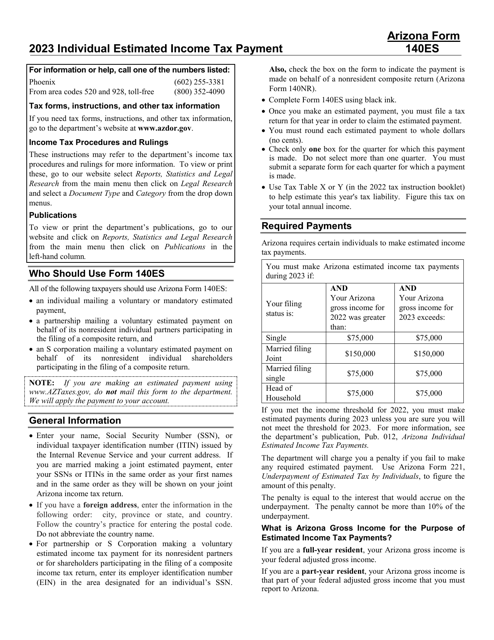

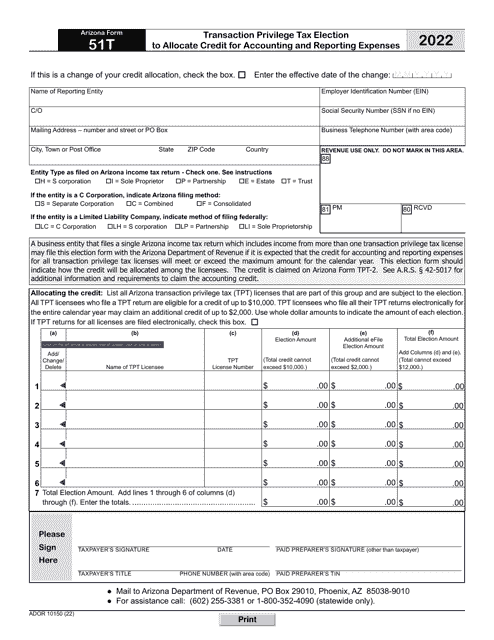

This form is used for estimating taxes for corporations and pass-through entities in Arizona. It helps calculate the amount of taxes that need to be paid.

This Form is used for calculating estimated tax for corporations and pass-through entities in Arizona. It provides instructions on how to fill out Arizona Form 120/PTE-W (ADOR10551).

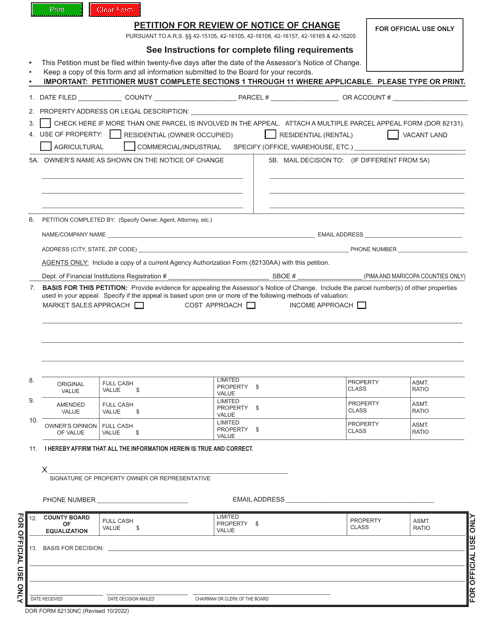

This form is used for filing a petition to review a notice of change in the state of Arizona. It allows individuals to request a formal review of any changes made by the Arizona Department of Revenue.

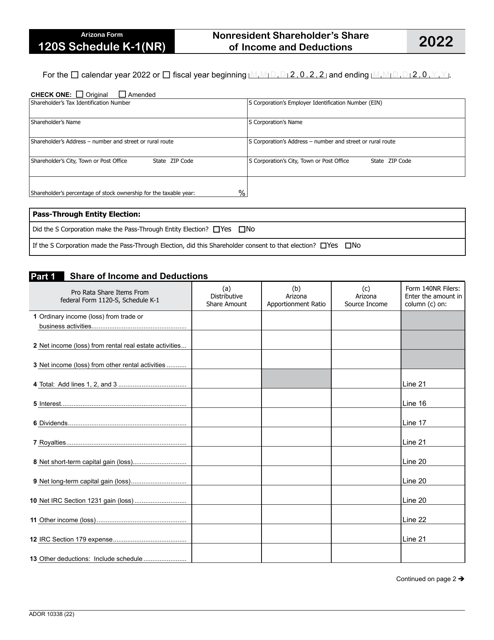

This Form is used for reporting the nonresident shareholder's share of income and deductions in Arizona.

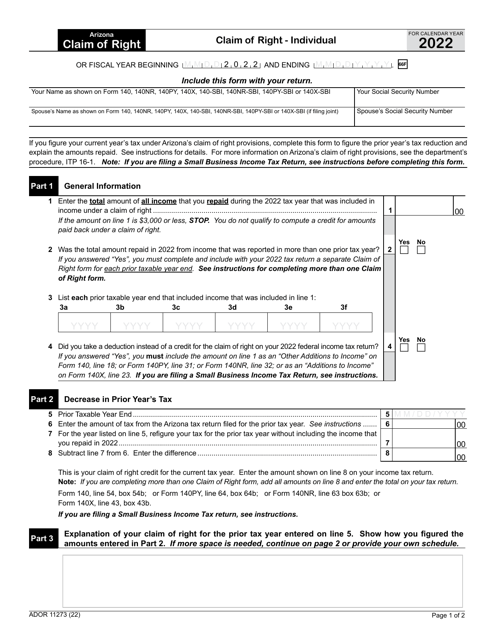

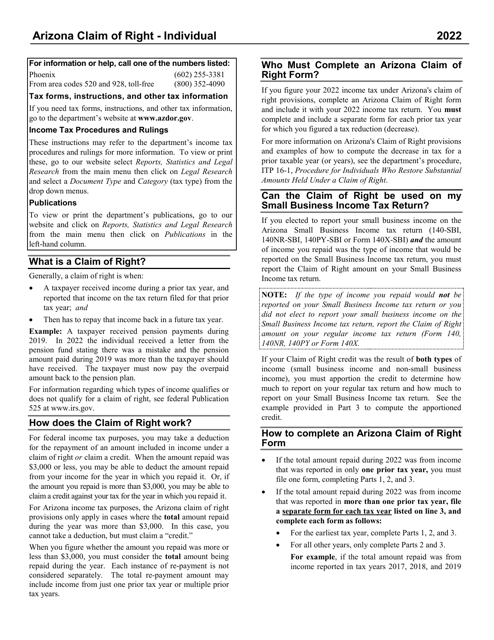

This Form is used for filing a Claim of Right by an individual in Arizona. The claim asserts the individual's right to keep income that would otherwise be subject to tax.

This Form is used for claiming the right to property, income, or other assets in Arizona as an individual. It is known as the Arizona Claim of Right form.