Fill and Sign Arizona Legal Forms

Documents:

5891

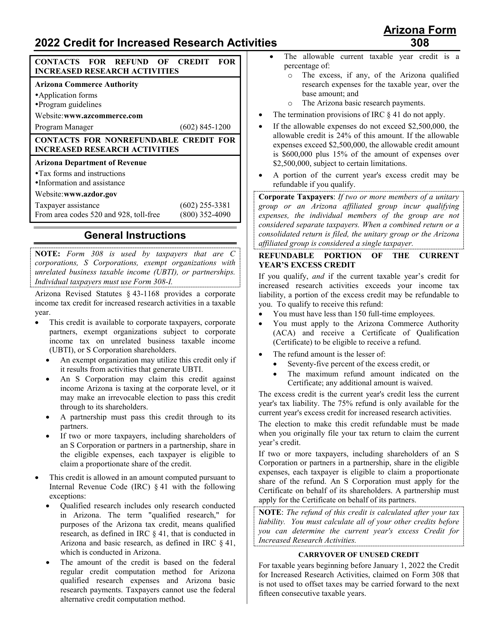

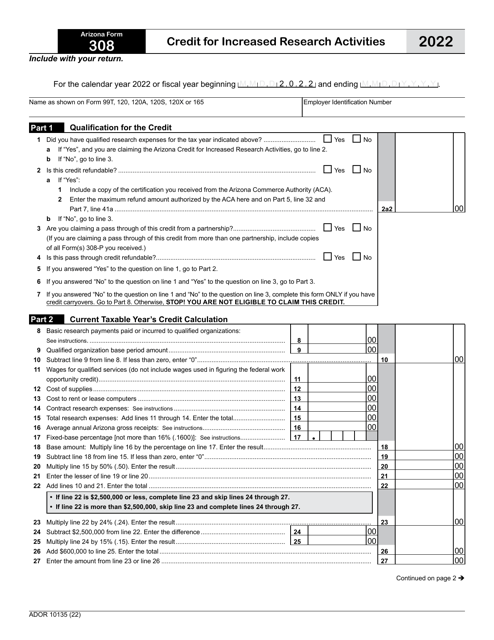

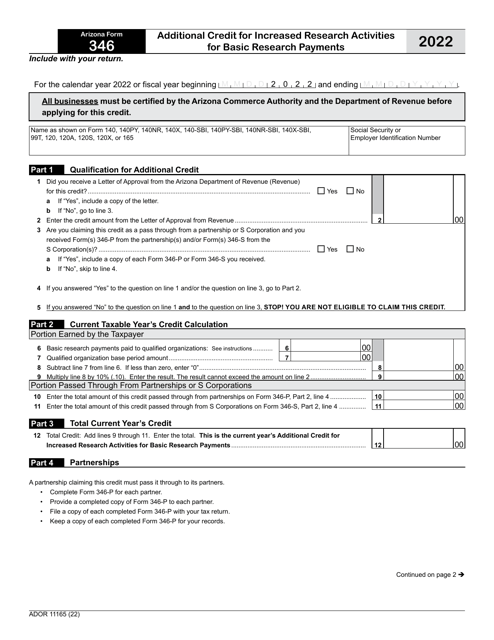

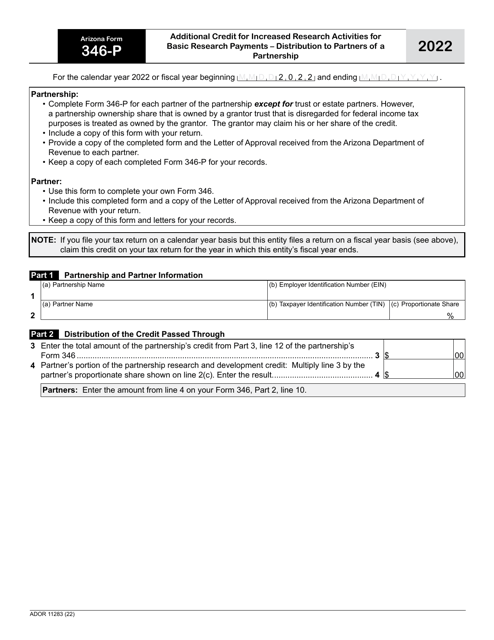

This Form is used for claiming the Credit for Increased Research Activities in the state of Arizona.

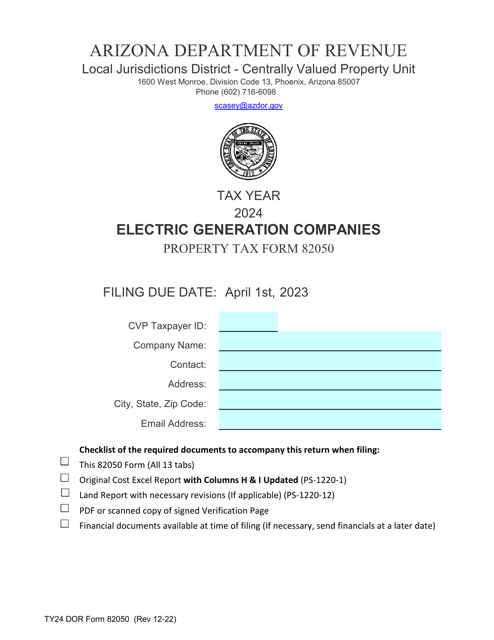

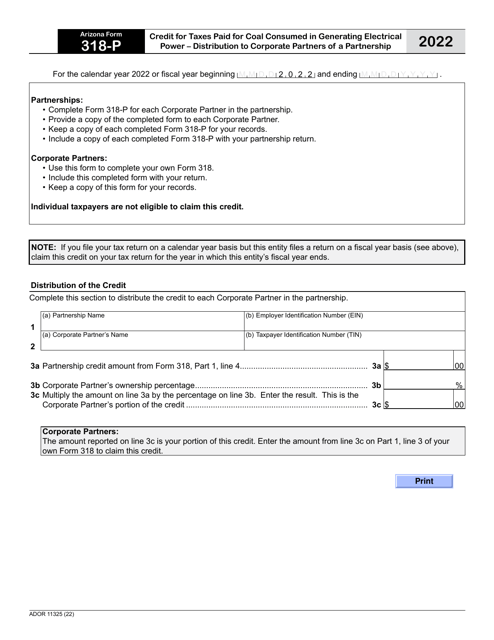

This Form is used for reporting property taxes for electric generation companies in Arizona.

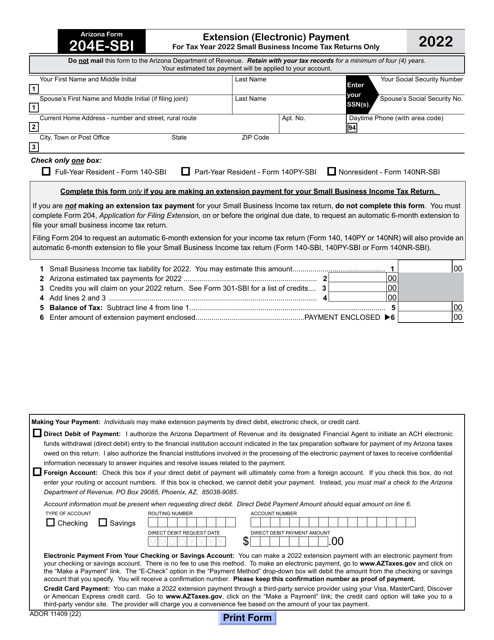

This Form is used for making an extension payment for small business income tax returns in Arizona.

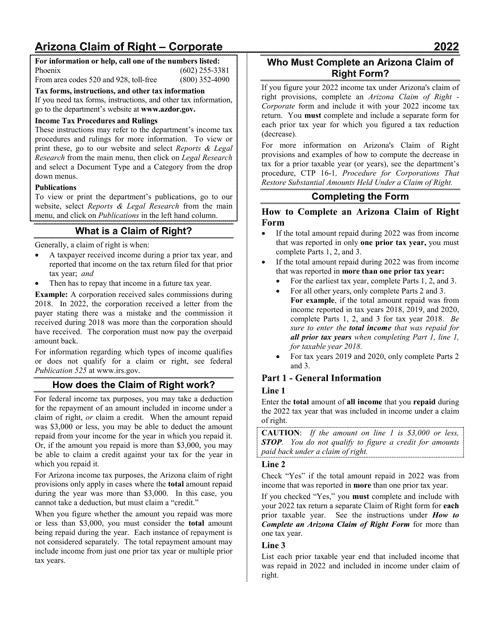

This Form is used for claiming the restoration of a substantial amount held under the claim of right - for corporate entities in Arizona.

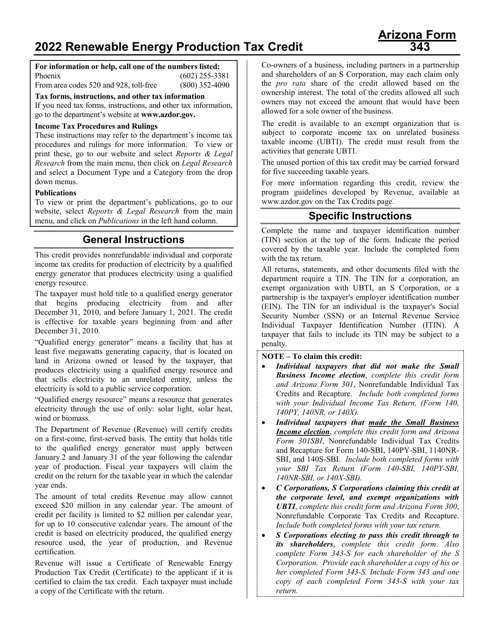

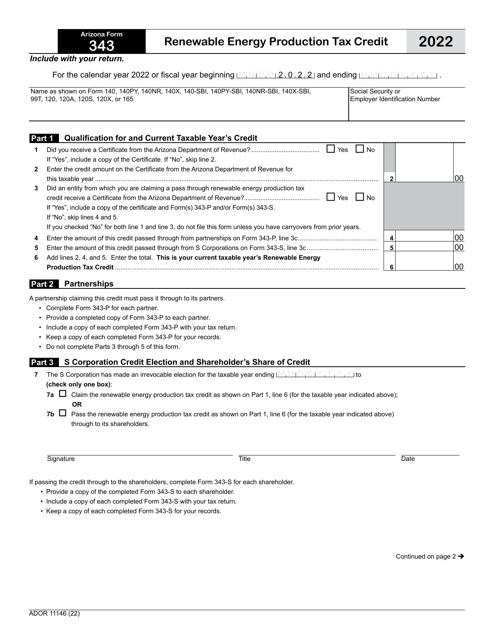

This document is used to provide instructions for completing Arizona Form 343, which is used to claim the Arizona Renewable Energy Production Tax Credit. You can find detailed guidance on how to fill out the form correctly and submit it to the Arizona Department of Revenue.

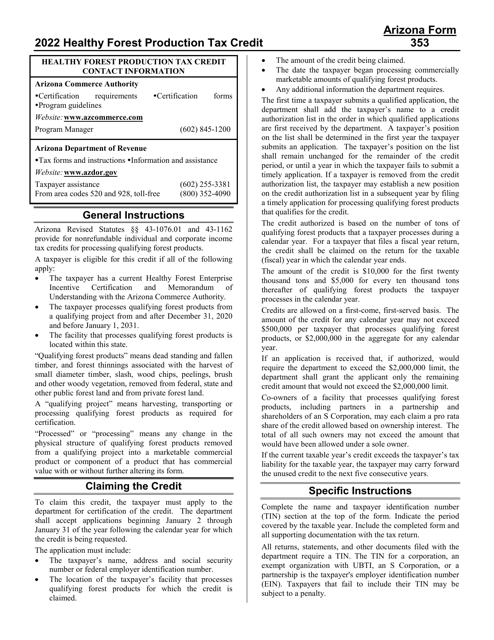

This document provides instructions on how to fill out Arizona Form 353, ADOR11394. This form is used for claiming the Healthy Forest Production Tax Credit in Arizona.

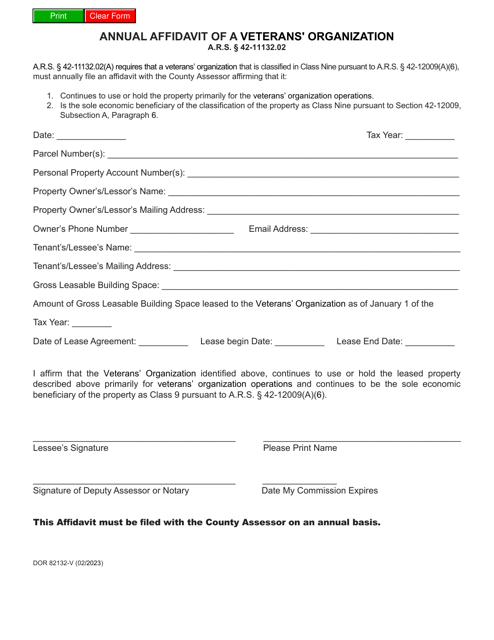

This form is used for veterans' organizations in Arizona to submit an annual affidavit.

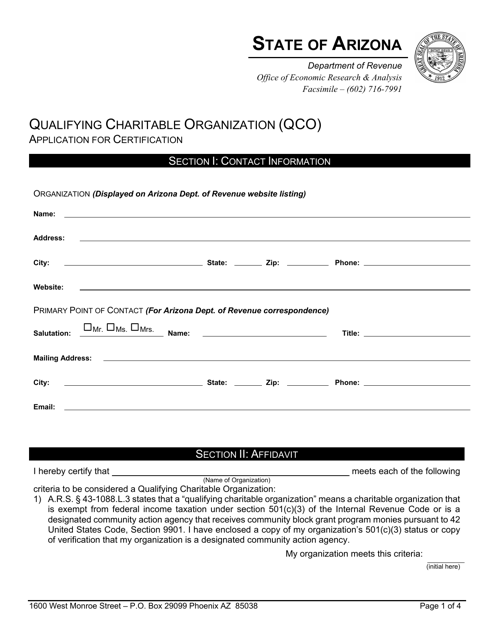

This Form is used for applying for certification as a Qualifying Charitable Organization in Arizona.

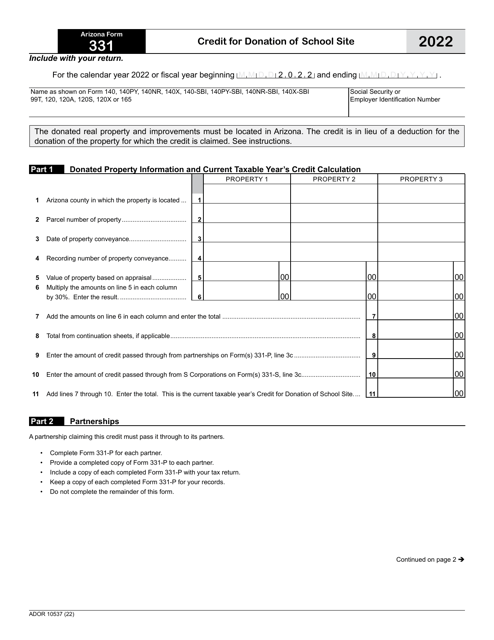

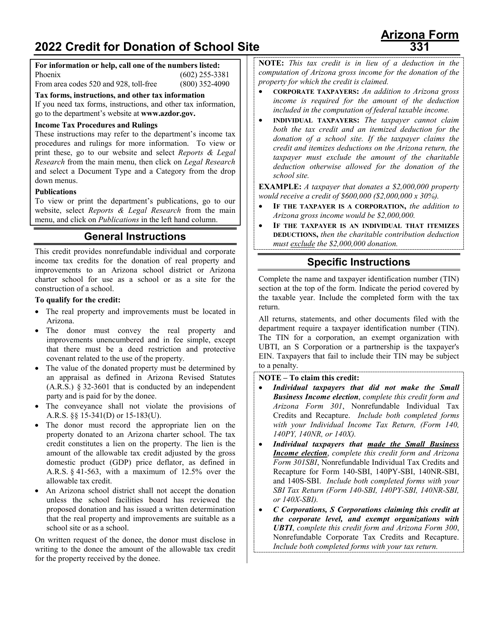

This Form is used for claiming a tax credit for donating a school site in Arizona. It provides instructions on how to fill out Form 331 - ADOR10537.

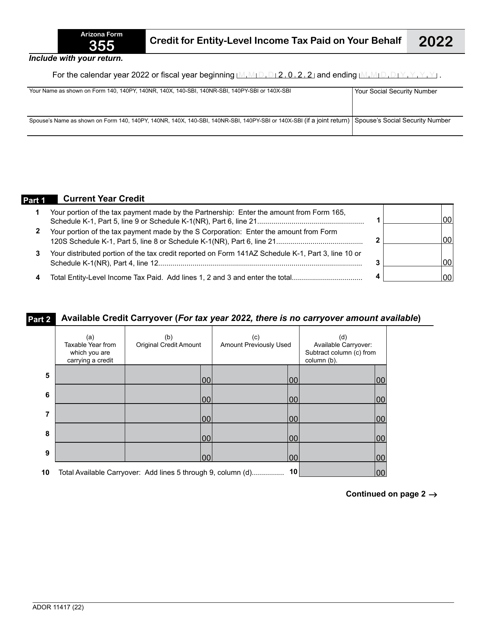

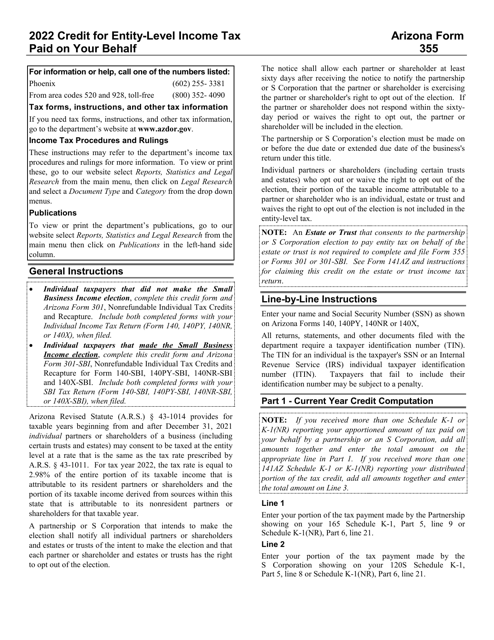

This Form is used for claiming a credit for entity-level income tax paid on your behalf in Arizona.

This Form is used for claiming the credit for entity-level income tax paid on your behalf in the state of Arizona. Follow the instructions provided to correctly complete and submit Form 355 to the Arizona Department of Revenue (ADOR).

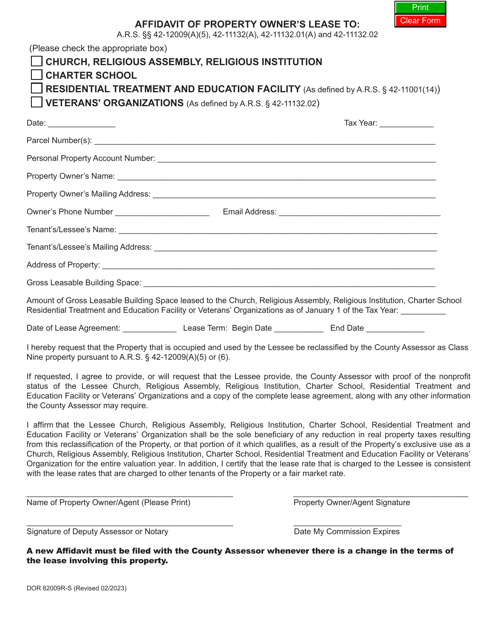

This form is used for property owners in Arizona to provide an affidavit for their lease agreement.