California Tax Forms and Templates

Documents:

248

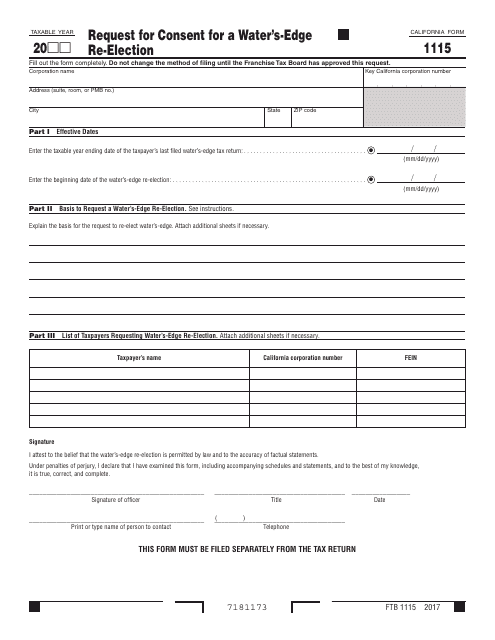

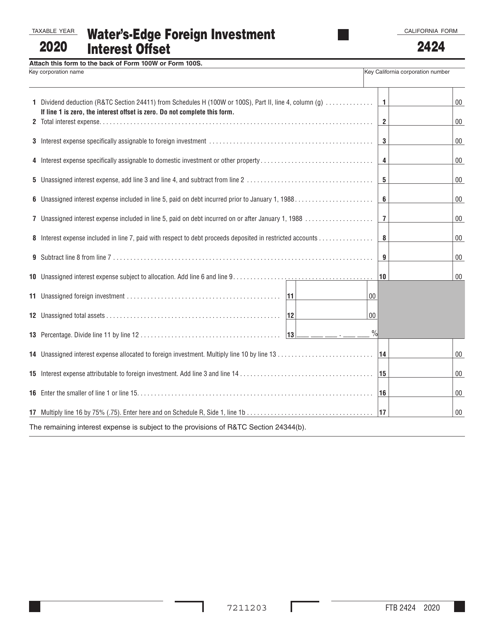

This form is used for requesting consent to re-elect California's water's-edge election method.

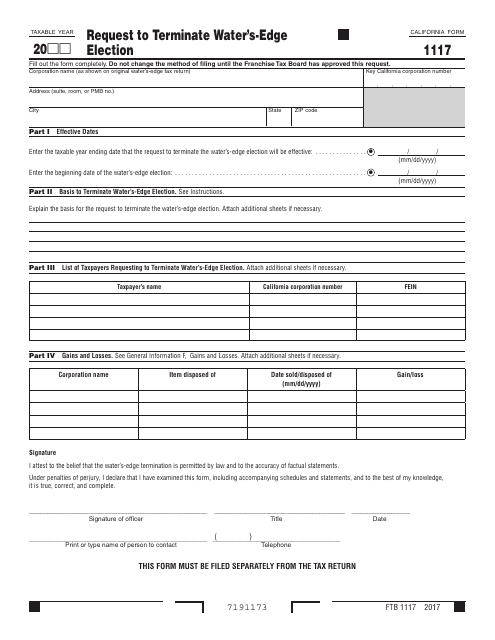

This form is used for requesting to terminate the Water's-Edge Election in California.

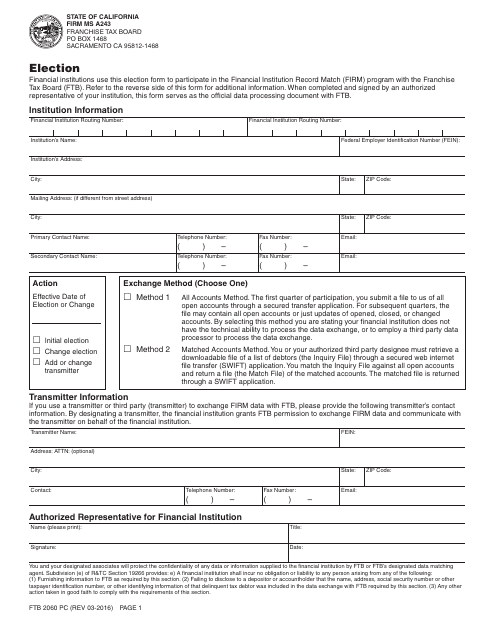

This Form is used for financial institutions in California to elect firm record match with the Franchise Tax Board.

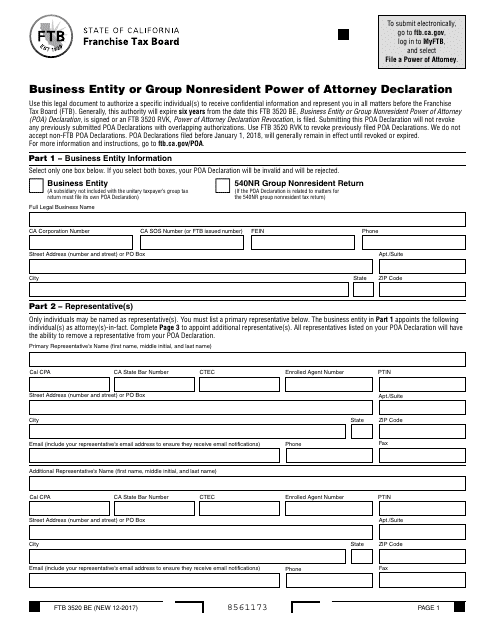

This Form is used for declaring a power of attorney for nonresident business entities or groups in California.

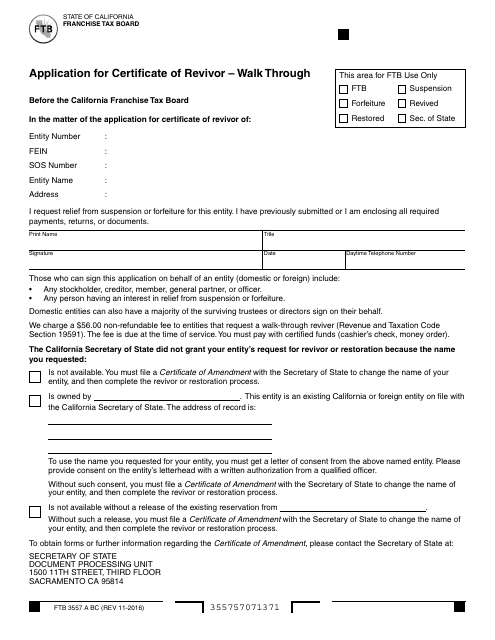

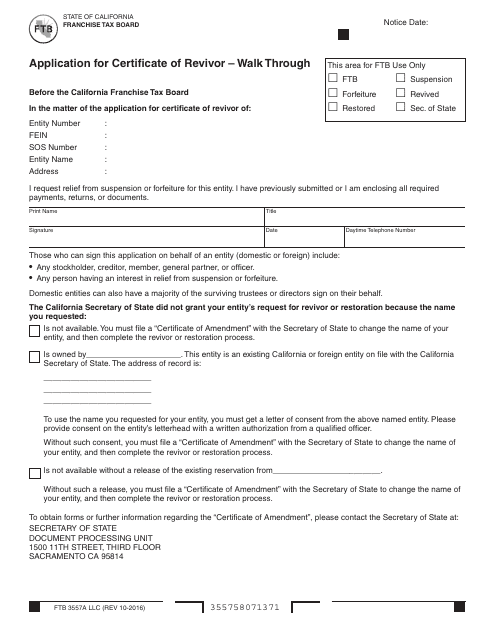

This Form is used for applying for a Certificate of Revivor in California. It is a step-by-step walkthrough guide for completing the application process.

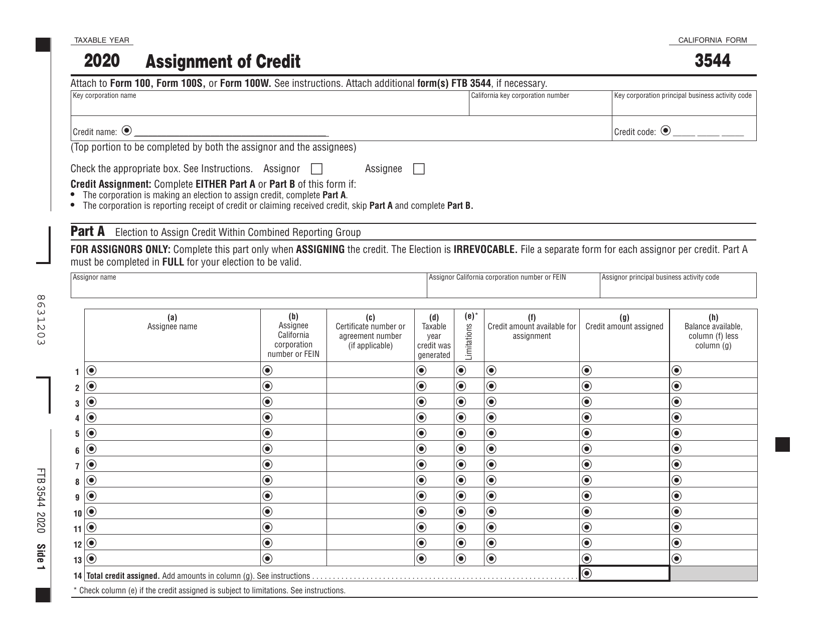

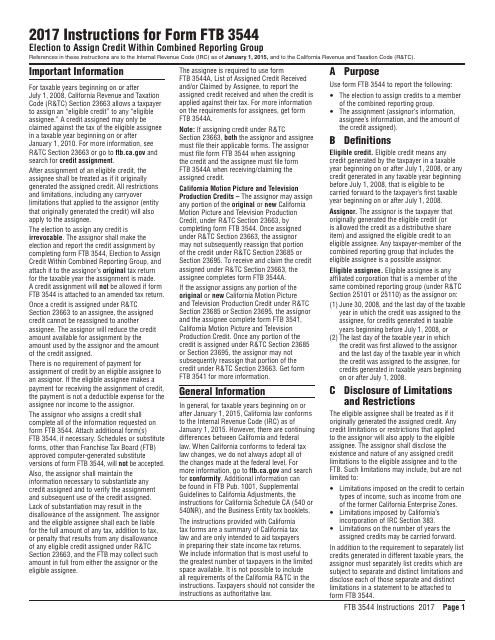

This Form is used for making an election to assign credit within a combined reporting group in California. The form provides instructions on how to complete the election process.

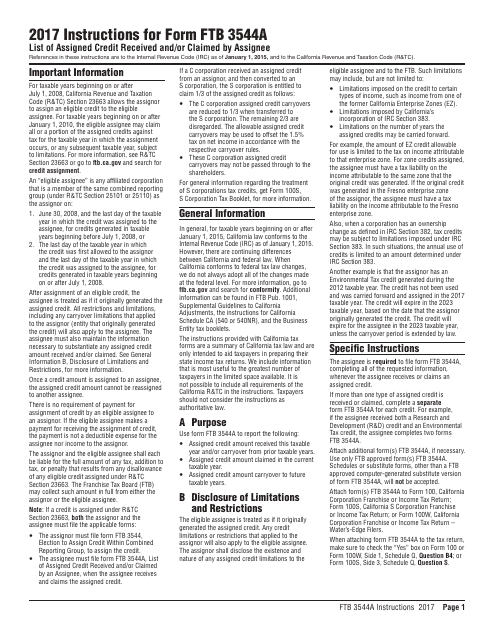

This Form is used for listing the assigned credits received and/or claimed by an assignee in California. It provides instructions on how to properly fill out the form to report the assigned credits.

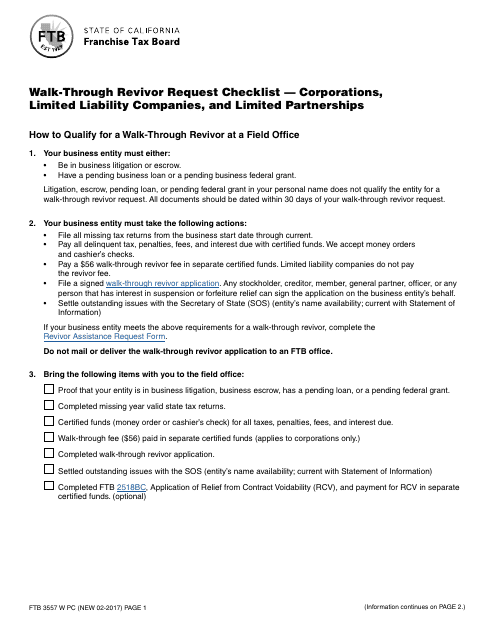

This form is used for the Revivor Request Checklist for Corporations, Limited Liability Companies, and Limited Partnerships in California.

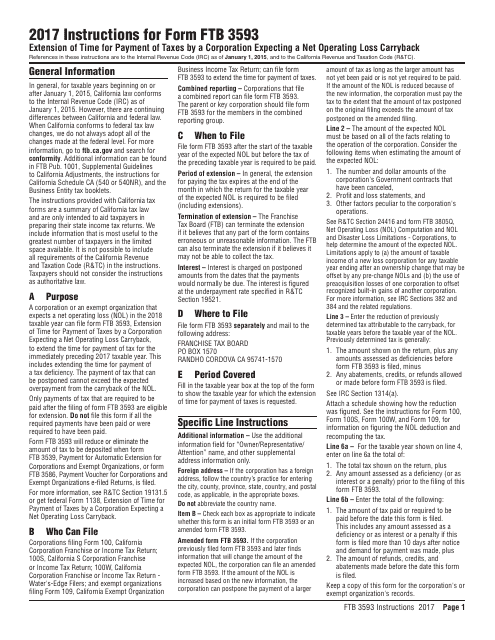

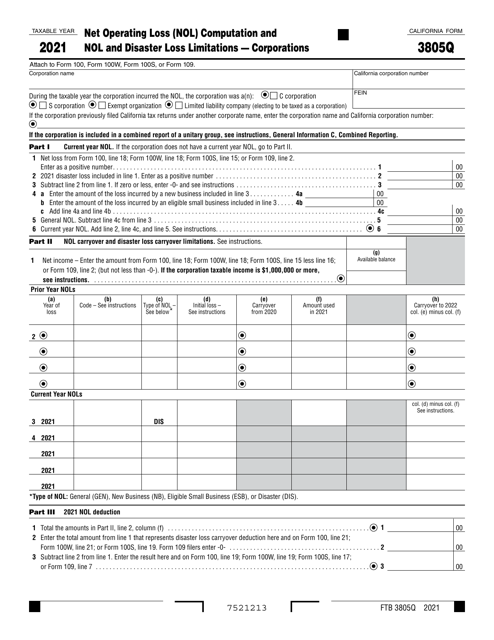

This Form is used for requesting an extension of time to pay taxes by a corporation in California that expects a net operating loss carryback. It provides instructions on how to properly complete the form and submit it to the relevant tax authorities.

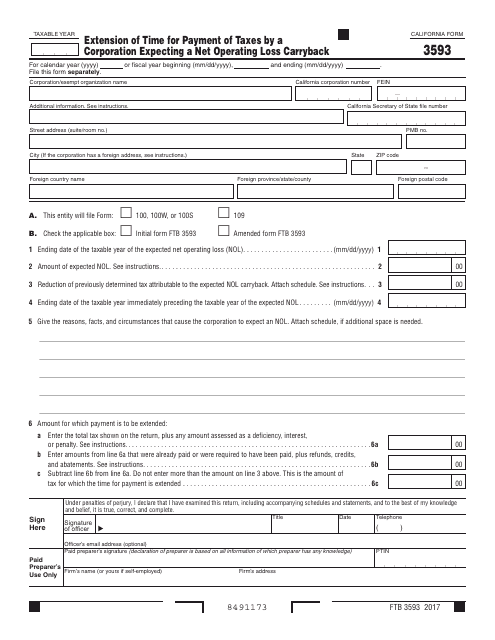

This form is used for corporations in California that are expecting a net operating loss carryback and need an extension of time to pay their taxes.

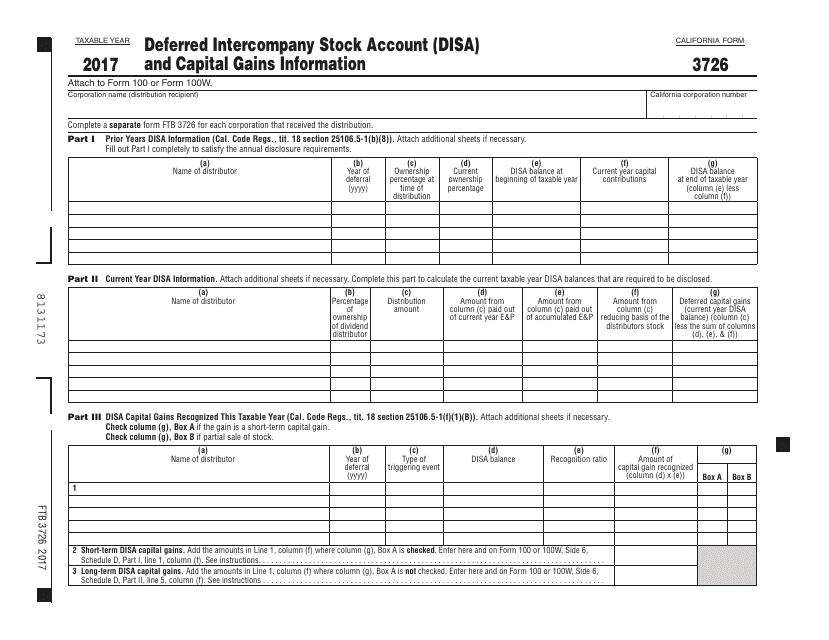

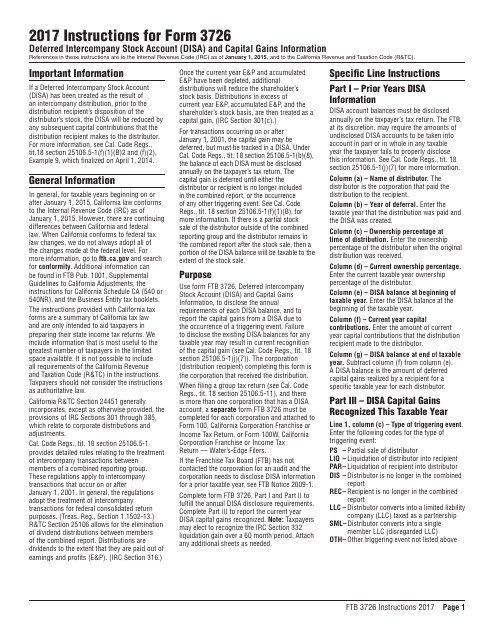

This form is used for reporting deferred intercompany stock account and capital gains information in California.

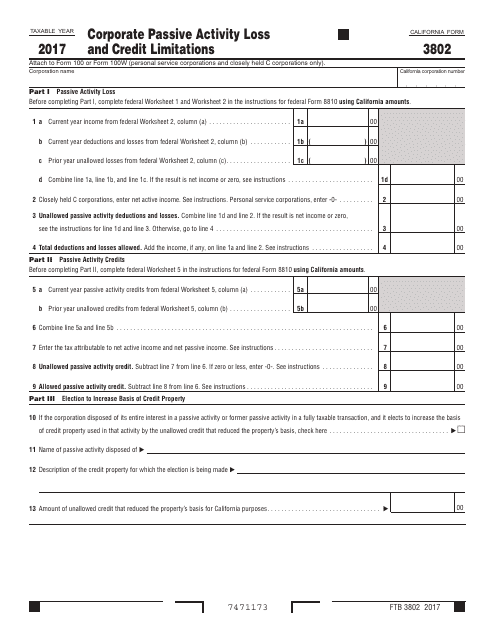

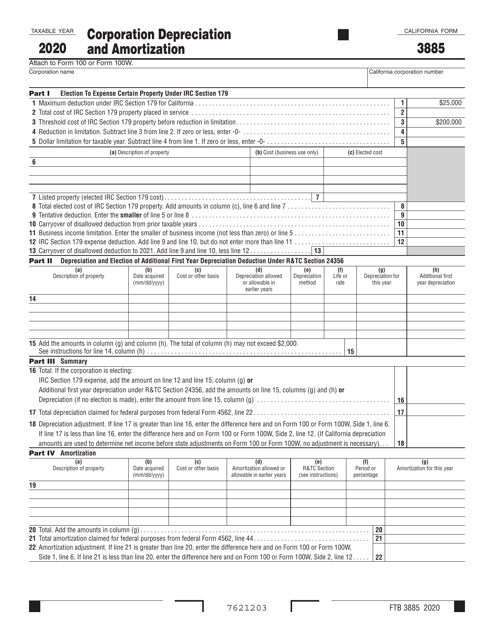

This form is used for reporting passive activity losses and credit limitations for corporations in California.

This Form is used for reporting deferred intercompany stock account (DISA) and capital gains information in California.

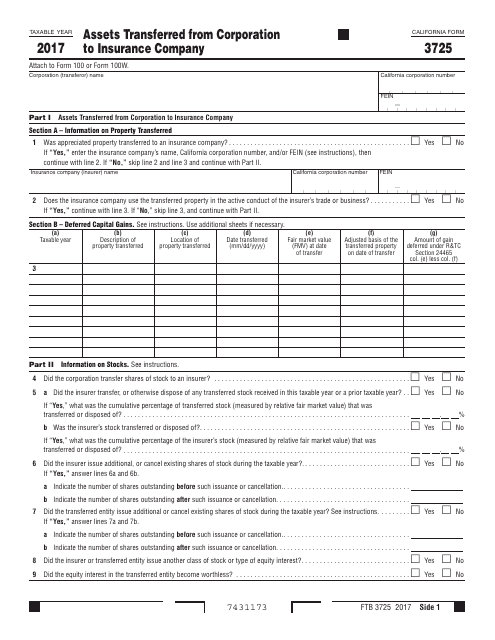

This Form is used for reporting assets transferred from a corporation to an insurance company in the state of California.

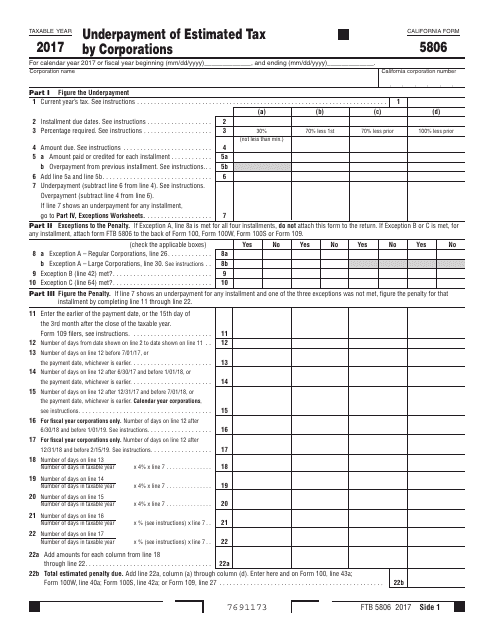

This document is for California corporations who need to report any underpayment of estimated tax. It is used to calculate and pay any penalties or interest owed for not paying enough estimated tax throughout the year.

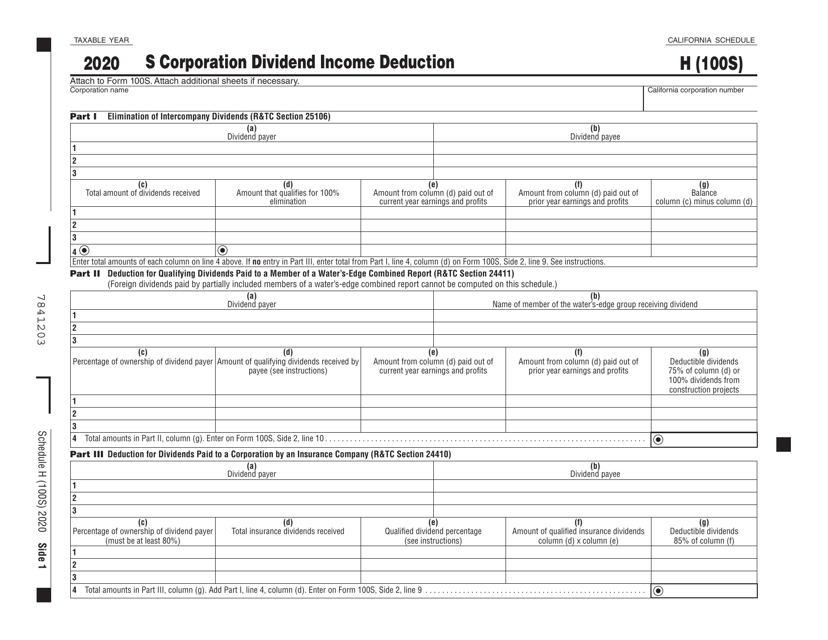

This Form is used for claiming the dividend income deduction in California when filing Form 100. It provides instructions on how to properly report and calculate the deduction.

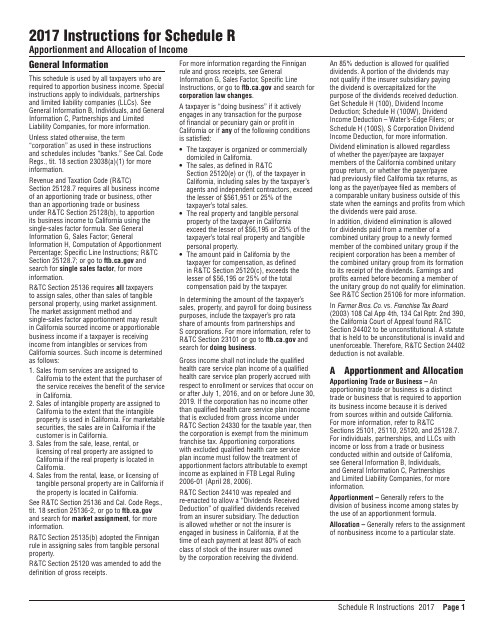

This document is used for instructions on how to complete Form R for apportionment and allocation of income in California.

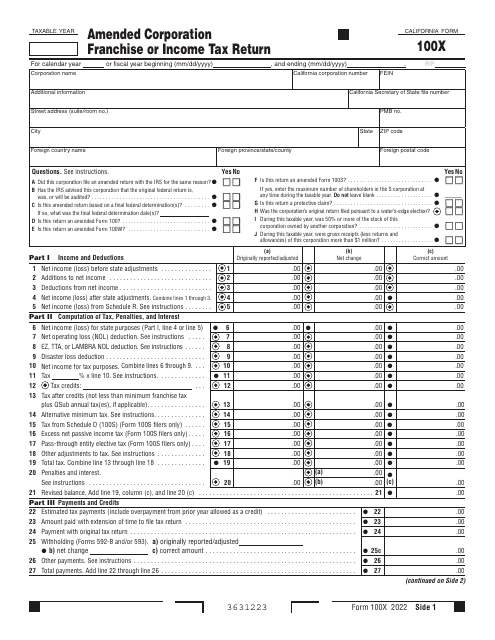

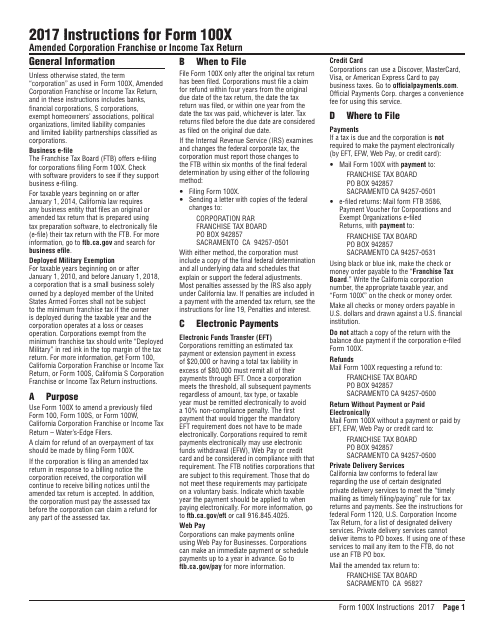

This Form is used for filing an amended corporation franchise or income tax return in California. It provides instructions on how to correct errors or update information on a previously filed return.

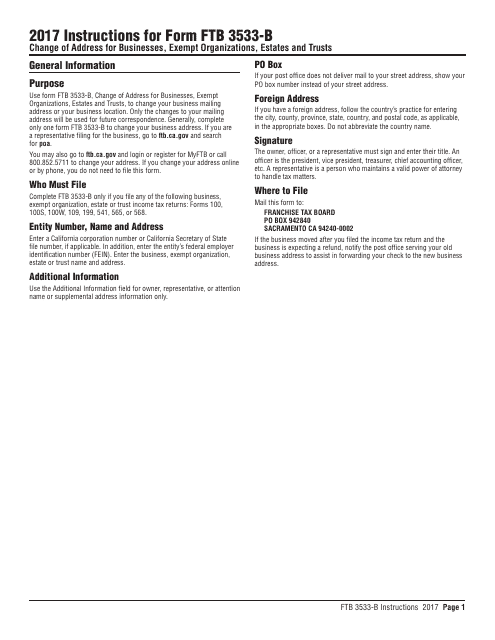

This Form is used for businesses, exempt organizations, estates, and trusts in California to notify the Franchise Tax Board of a change of address. It provides instructions on how to properly complete and submit the form. This document helps ensure that the organization's address is updated and communication can be done effectively with the Franchise Tax Board.

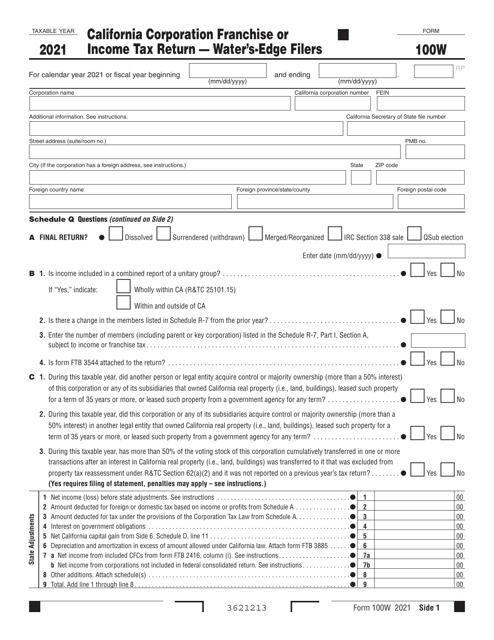

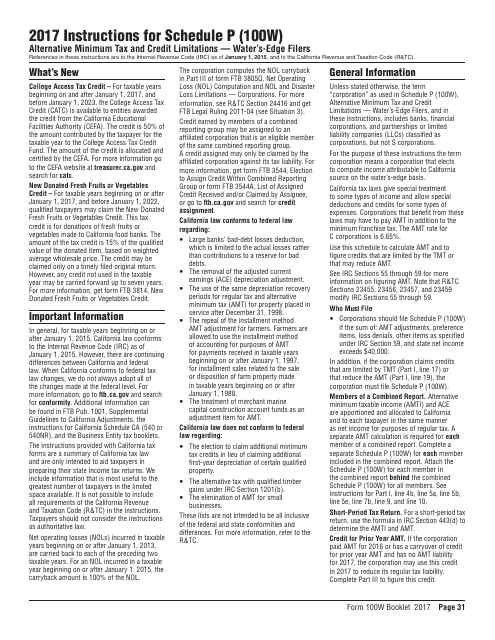

This document is used to provide instructions for filling out Schedule P of Form 100W for California water's-edge filers. It includes information on alternative minimum tax and credit limitations.

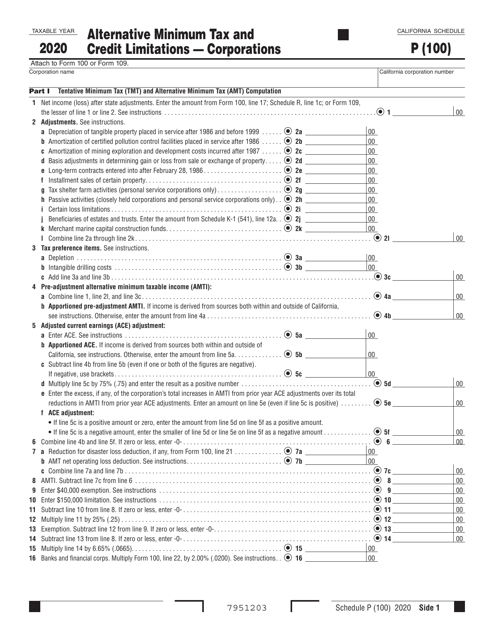

Form 100 Schedule P Alternative Minimum Tax and Credit Limitations - Corporations - California, 2020

This Form is used for applying for a Certificate of Revivor for an LLC in California. It provides a step-by-step guide for the application process.

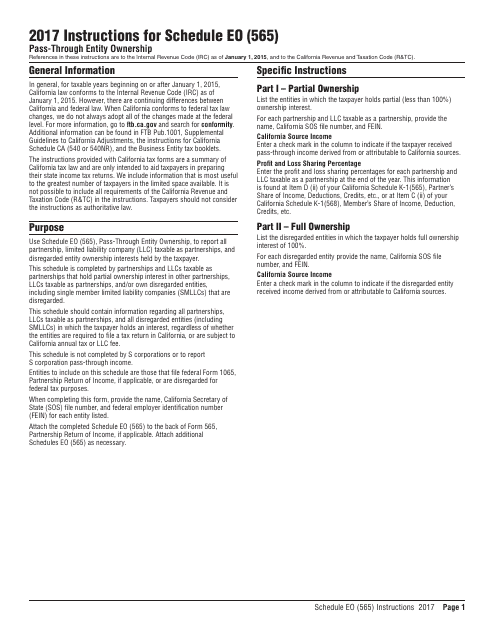

This Form is used for reporting pass-through entity ownership in California. It provides instructions for completing Schedule EO of Form 568.

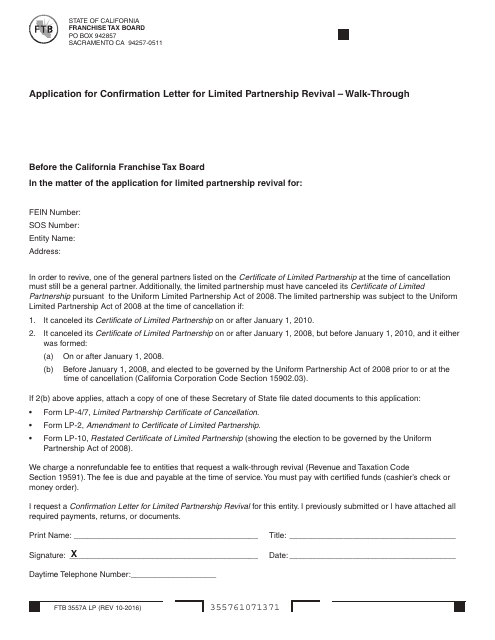

This form is used to request a confirmation letter for reviving a limited partnership in California.

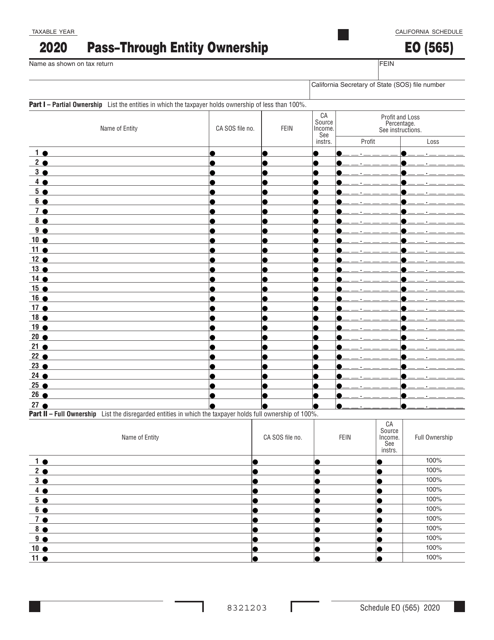

This Form is used for reporting ownership information of pass-through entities in California.

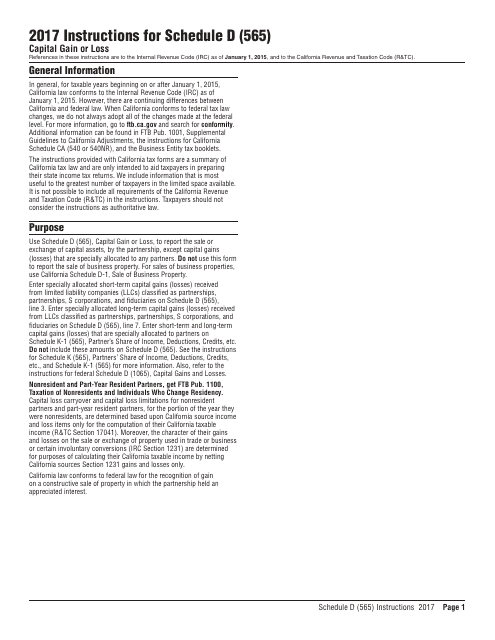

This Form is used for reporting capital gains or losses specifically for California state tax purposes. It is an important document for individuals, partnerships, or limited liability companies (LLCs) that have generated capital gains or losses in California.

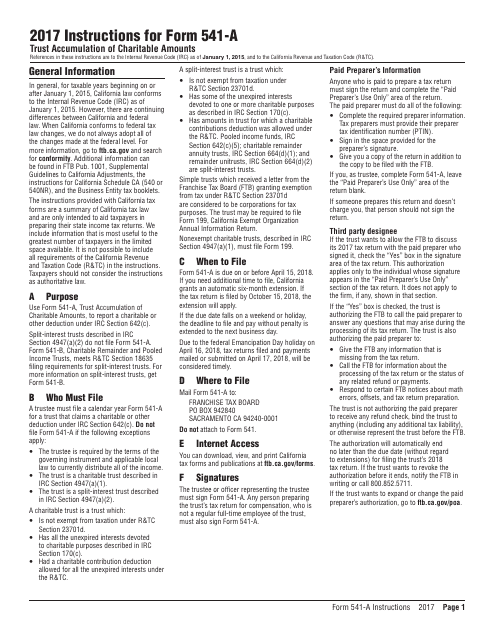

This document is used for providing instructions on completing Form 541-A Trust Accumulation of Charitable Amounts in the state of California. It is a guide for individuals or organizations who need to report and accumulate charitable amounts within a trust.

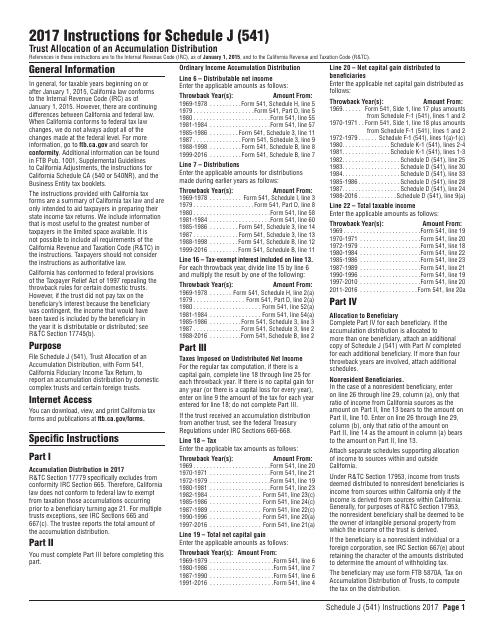

This Form is used for allocating accumulation distributions in trust for California residents.

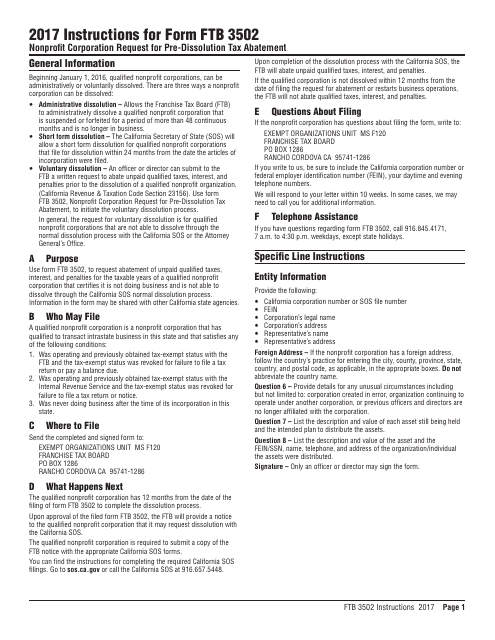

This Form is used for requesting pre-dissolution tax abatement if you are a nonprofit corporation in California. It provides instructions on how to fill out and submit Form FTB3502.

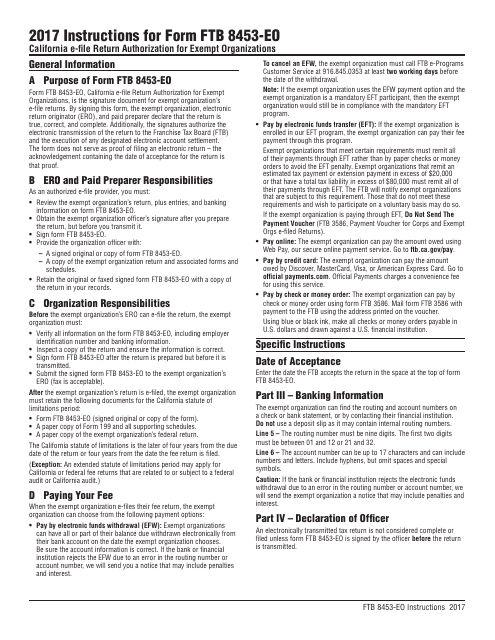

This document is used for authorized exempt organizations in California to electronically file their tax returns.

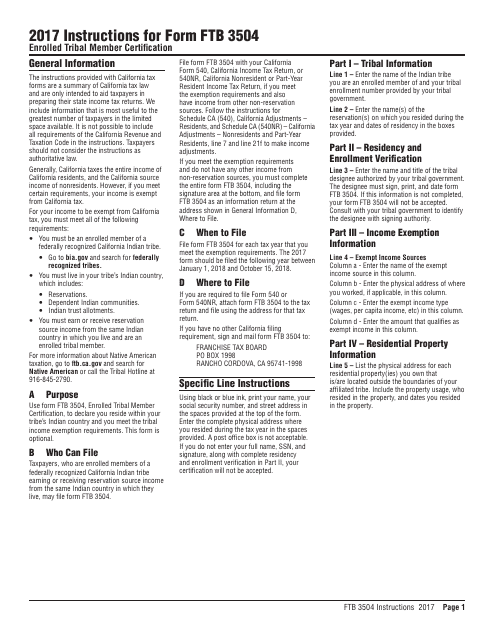

This form is used for enrolled tribal members in California to certify their status. It provides instructions on how to fill out and submit Form FTB3504.