California Tax Forms and Templates

Documents:

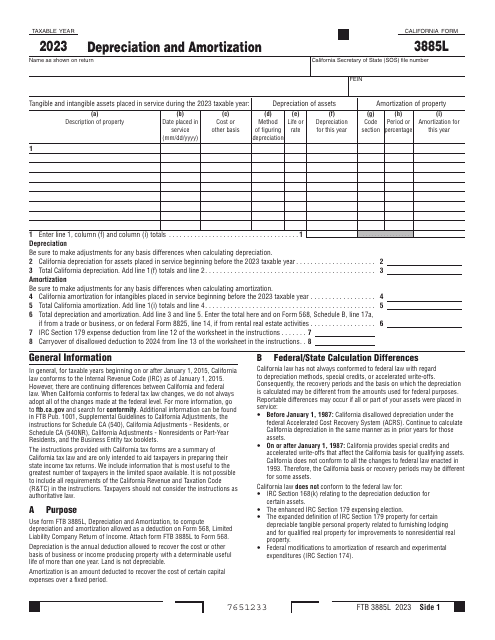

248

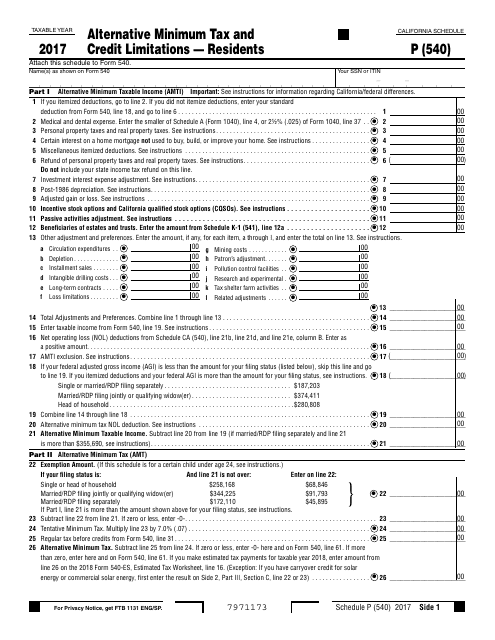

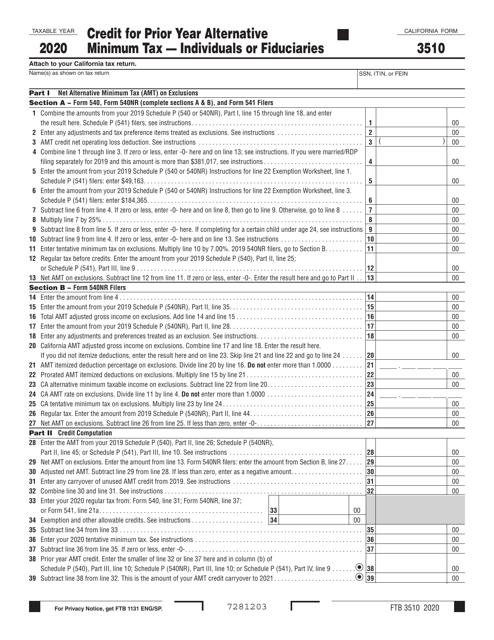

This form is used for calculating the alternative minimum tax and credit limitations for residents of California on their Form 540 tax return.

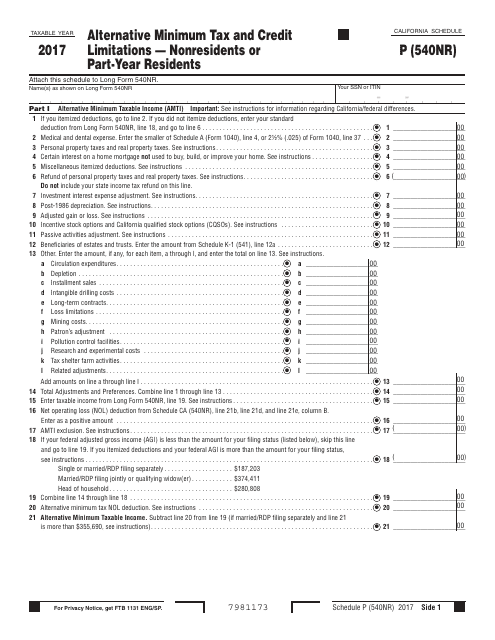

This Form is used for calculating the alternative minimum tax and credit limitations for nonresidents or part-year residents in California. It helps determine the amount of tax owed based on specific criteria and ensures that taxpayers are not subject to excessive tax burdens.

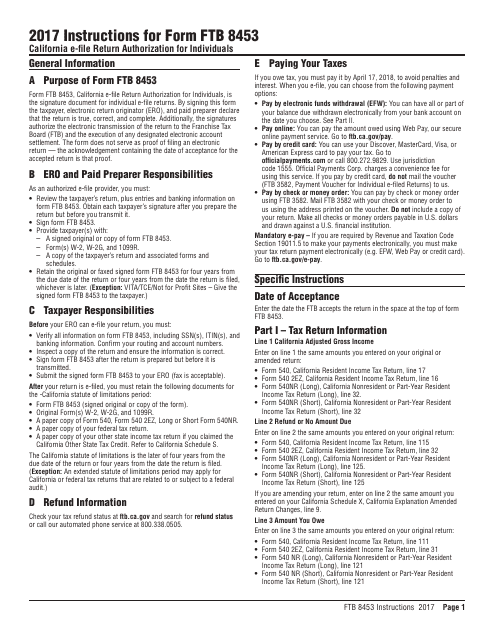

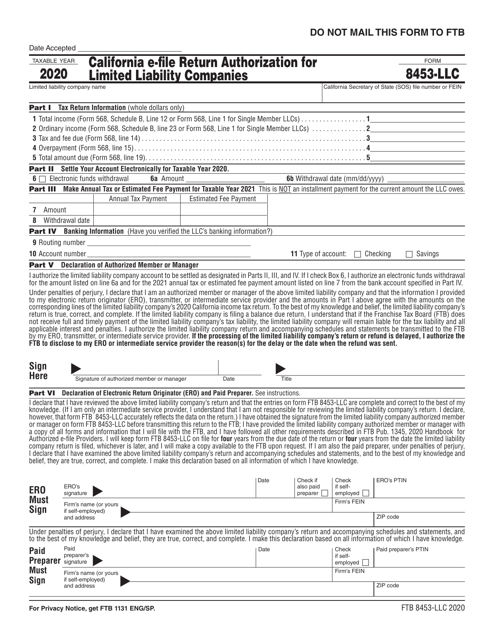

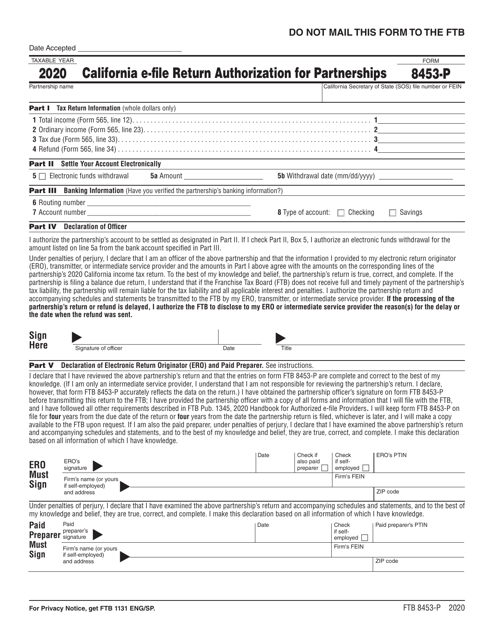

This document is for individuals who want to electronically file their tax returns in California. The form, FTB8453, is used to authorize the electronic filing of the return. It provides instructions on how to complete and submit the form.

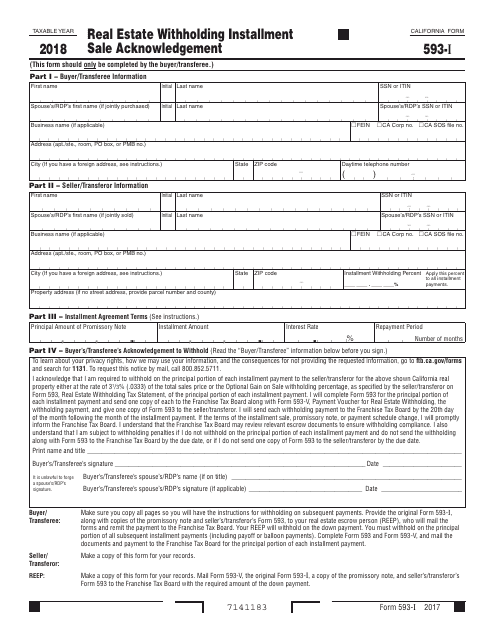

This form is used in California for acknowledging the installment sale of real estate properties and withholding taxes.

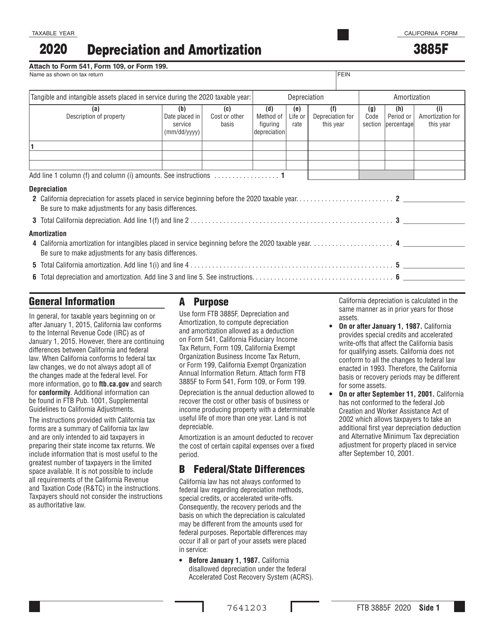

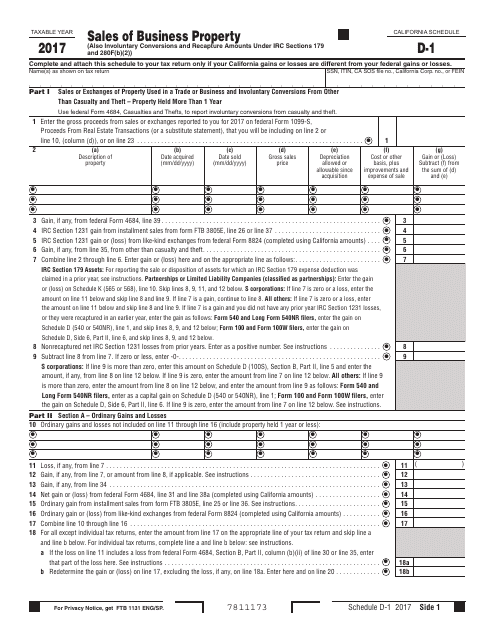

This form is used for reporting sales of business property in California on Form 540 Schedule D-1.

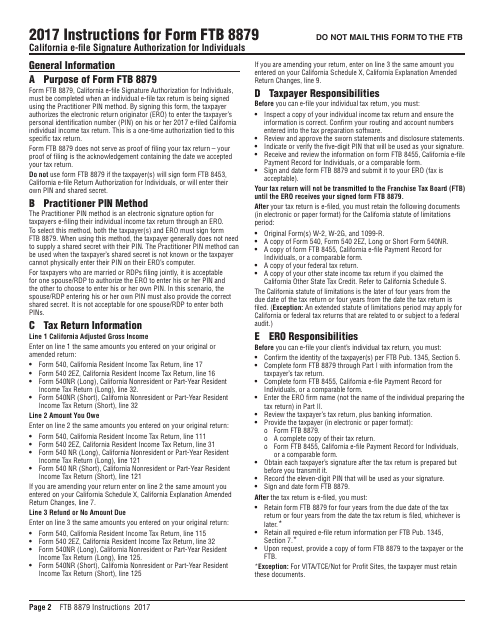

This document is used for authorizing electronic filing of tax returns for individuals in California. It provides instructions on how to complete Form FTB8879 for electronic signature authorization.

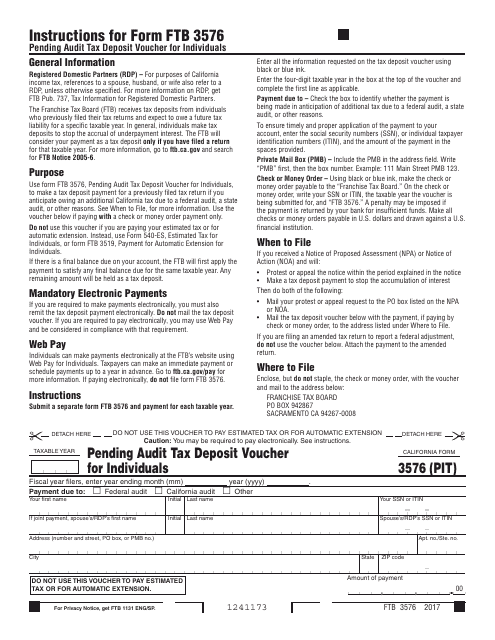

This form is used for making tax deposits for individuals who are under pending audit in the state of California. It serves as a voucher for the tax payment.

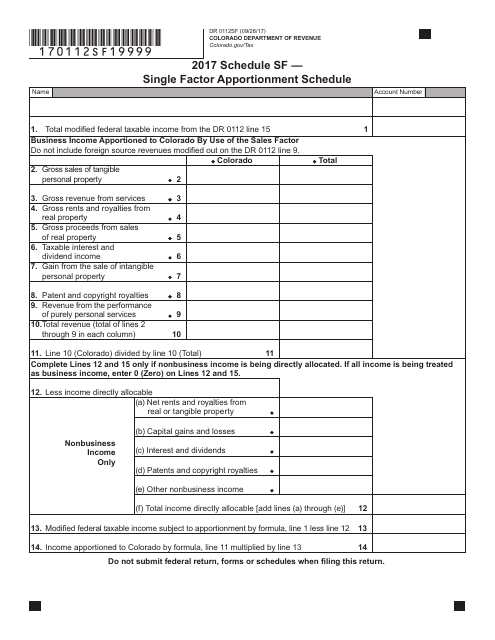

This form is used by taxpayers in Colorado to calculate their single factor apportionment schedule for tax purposes.

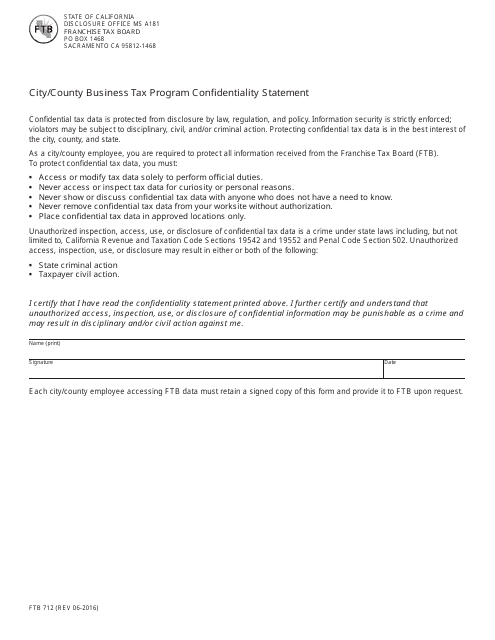

This form is used for the City/County Business Tax Program in California and contains a confidentiality statement.

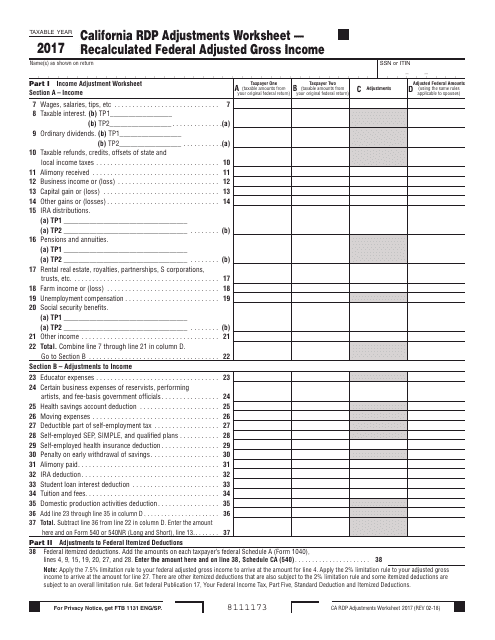

California Rdp Adjustments Worksheet " Recalculated Federal Adjusted Gross Income - California, 2017

This document is used for calculating the recalculated Federal Adjusted Gross Income for California state taxes.

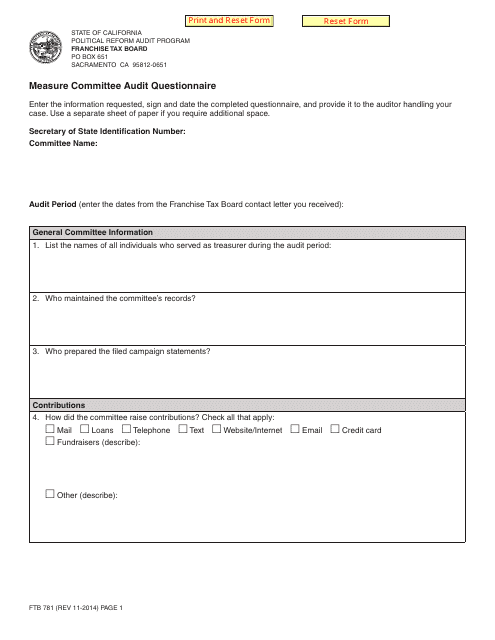

This document is a form used for conducting an audit questionnaire by the Measure Committee in California.

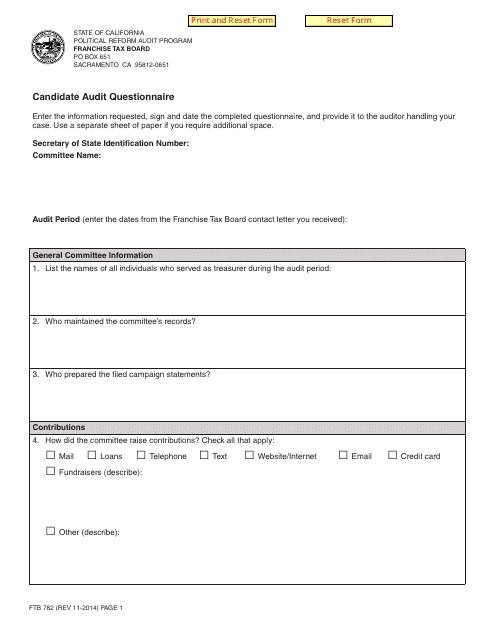

This form is used for conducting audits on candidates in the state of California.

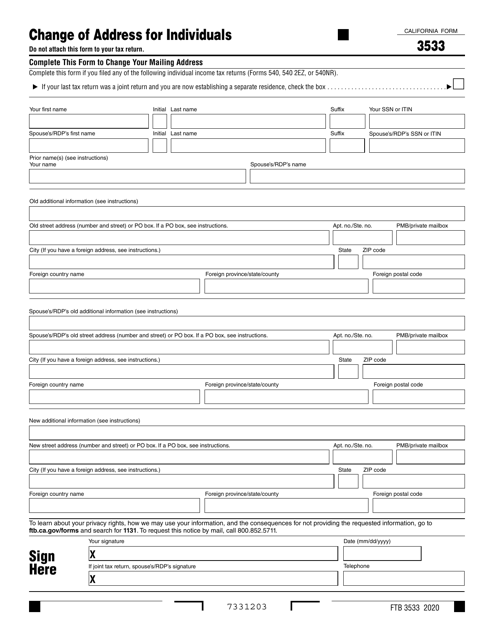

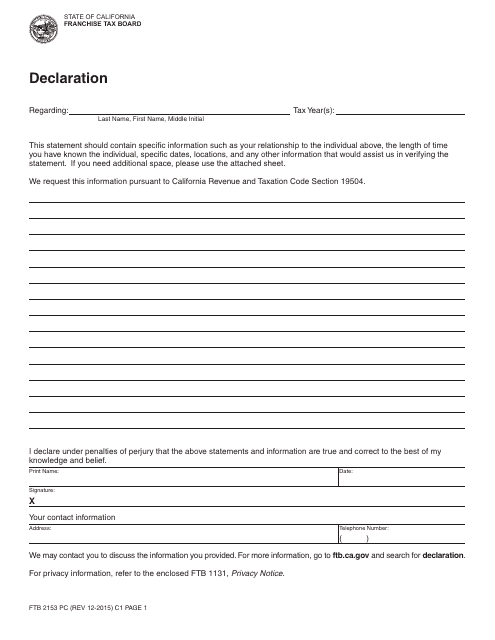

This form is used for filing a declaration of payment and/or communication of your personal income tax with the California Franchise Tax Board.

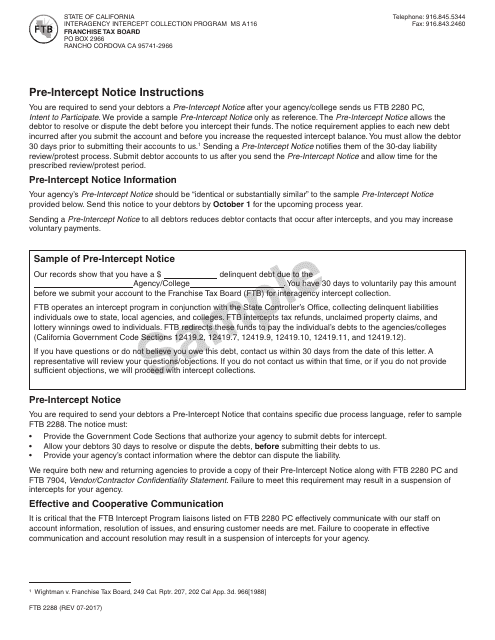

This document is a sample Pre-intercept Notice form used in California by the Franchise Tax Board (FTB). It notifies individuals of potential intercepted funds for unpaid debts.

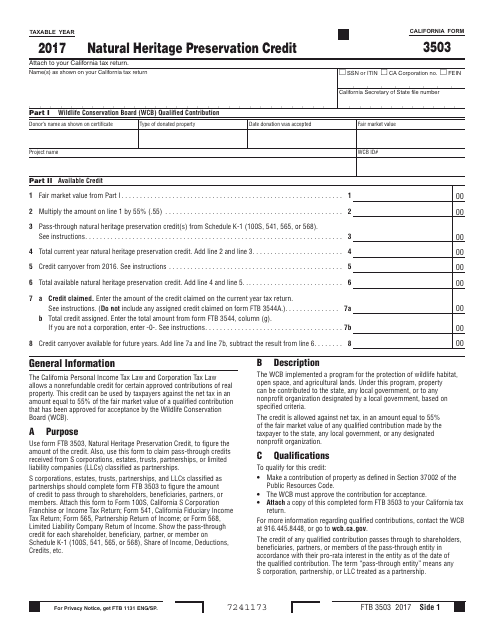

This form is used for claiming the Natural Heritage Preservation Credit in California. It allows individuals or businesses to receive a tax credit for contributing to the preservation of natural heritage sites in the state.

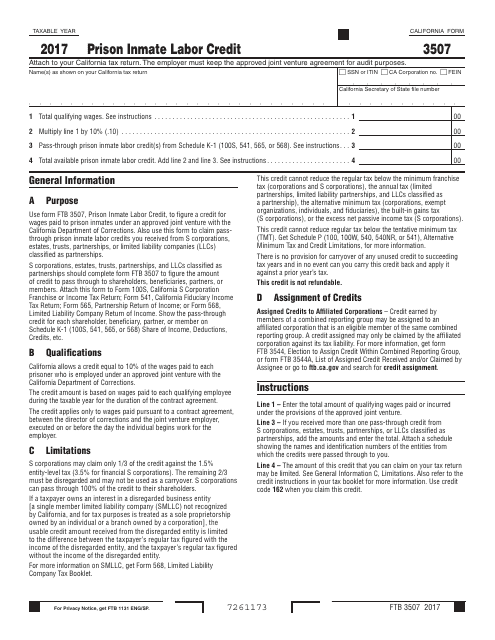

This form is used for claiming the Prison Inmate Labor Credit in California.

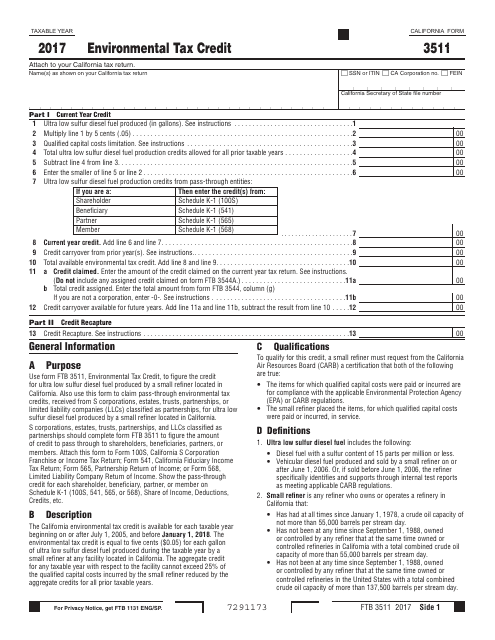

This Form is used for claiming the Environmental Tax Credit in the state of California.

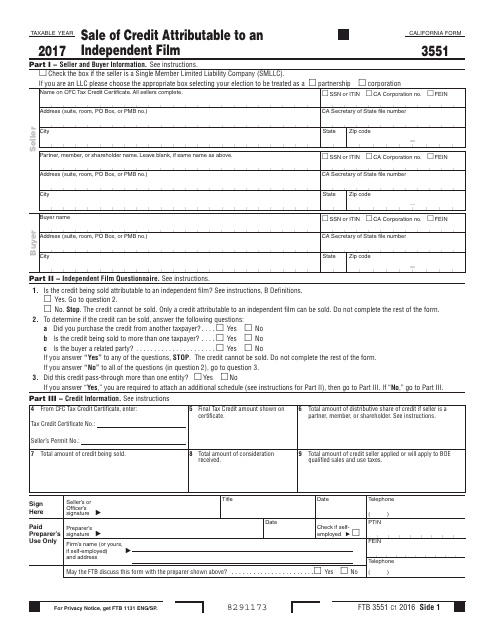

This form is used for reporting the sale of credits related to an independent film in California.

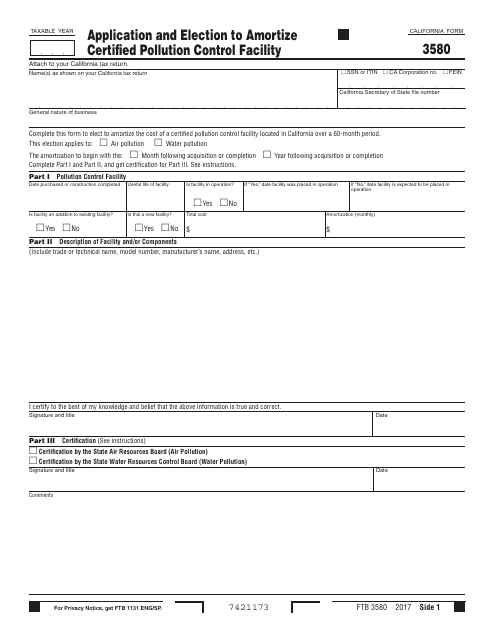

This form is used for applying and electing to amortize a certified pollution control facility in the state of California.

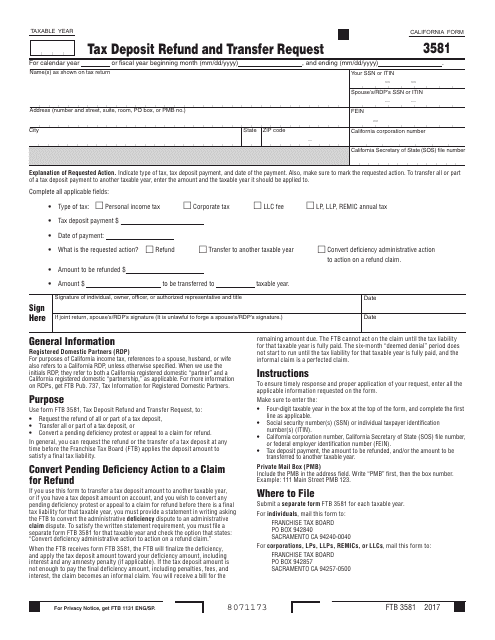

This Form is used for requesting a refund or transferring tax deposits in the state of California.