California Tax Forms and Templates

California Tax Forms are used by individuals and businesses in the state of California to report income, calculate and pay taxes owed to the California Franchise Tax Board (FTB). These forms help taxpayers fulfill their tax obligations, claim deductions and credits, report income from various sources, and determine the amount of taxes owed or refunded. California Tax Forms cover a range of tax-related activities, including filing income tax returns, reporting withholding taxes, making estimated tax payments, claiming tax credits, and requesting extensions.

Documents:

248

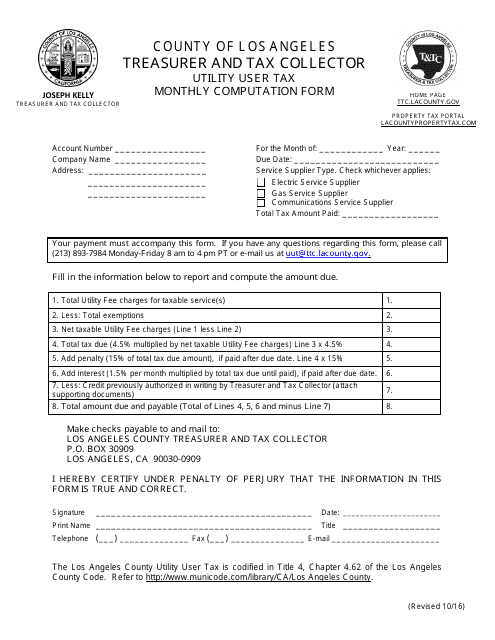

This document is used for calculating the monthly utility user tax in Los Angeles County, California. It is necessary for individuals and businesses to pay this tax based on their utility usage.

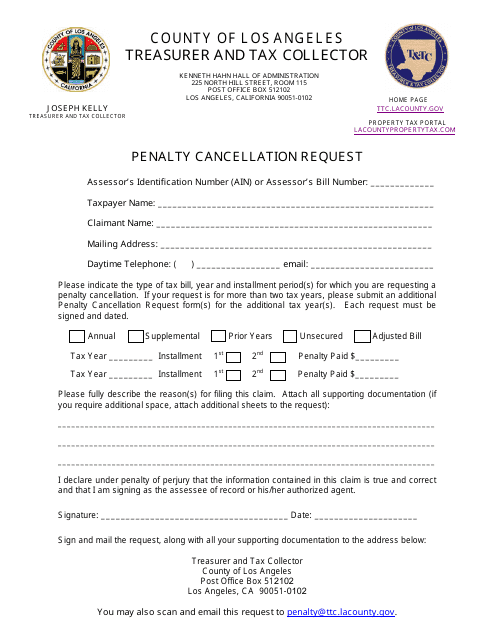

This type of document is used for requesting the cancellation of penalties in Los Angeles County, California.

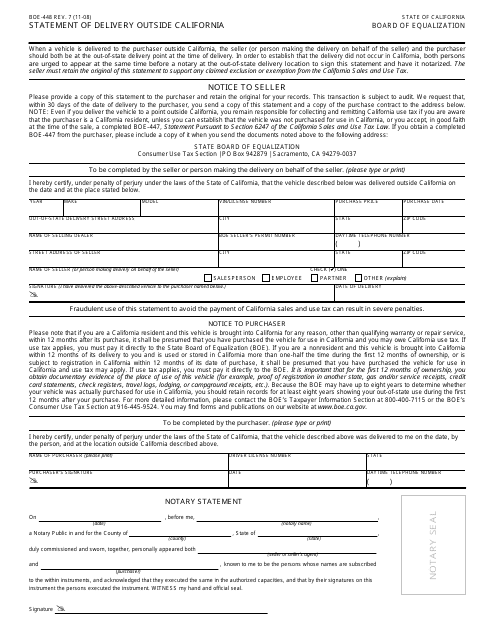

This form is used for reporting deliveries made outside of California for businesses based in California.

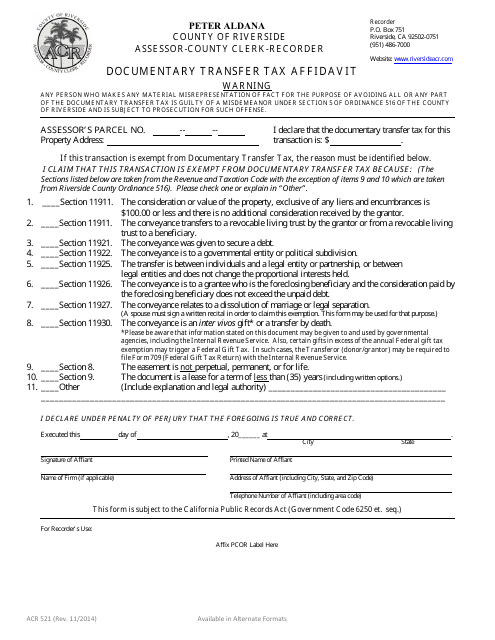

This Form is used for filing a Documentary Transfer Tax Affidavit in Riverside County, California. It is required when transferring real property and helps the county assess the appropriate transfer tax.

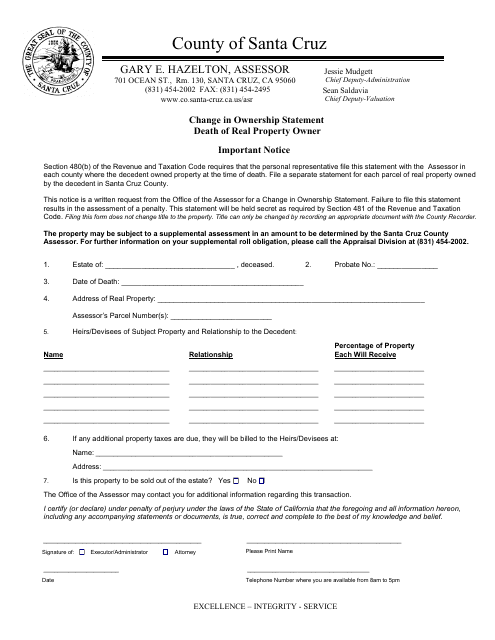

This document is used for notifying the county of Santa Cruz, California about a change in ownership of a real property due to the death of the owner.

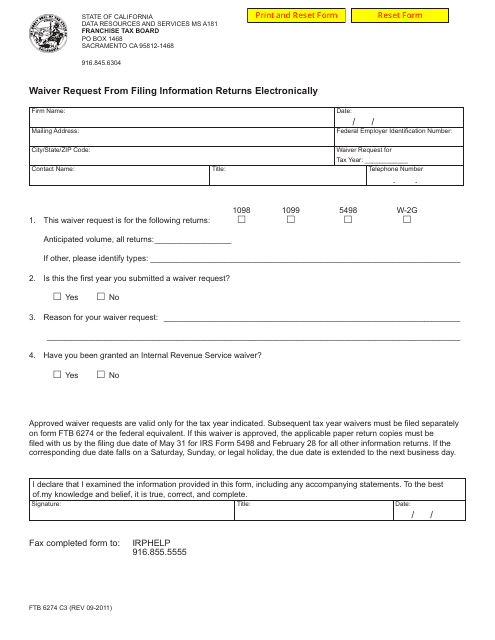

This form is used for requesting a waiver from filing information returns electronically in California.

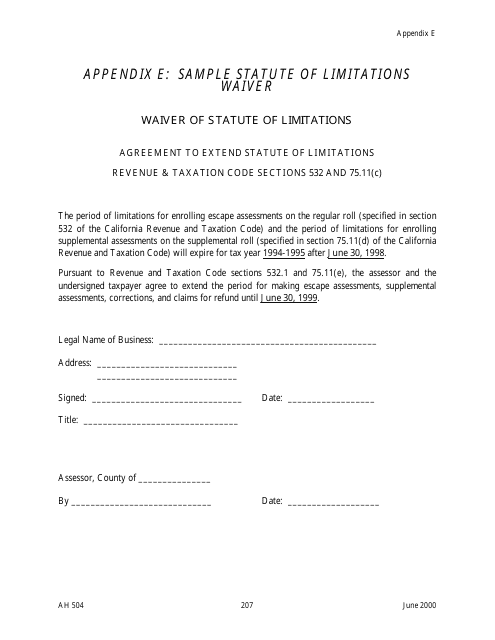

This document is a sample statute of limitations waiver form for use in California. It is used to waive the time limit within which a legal claim or lawsuit can be brought.

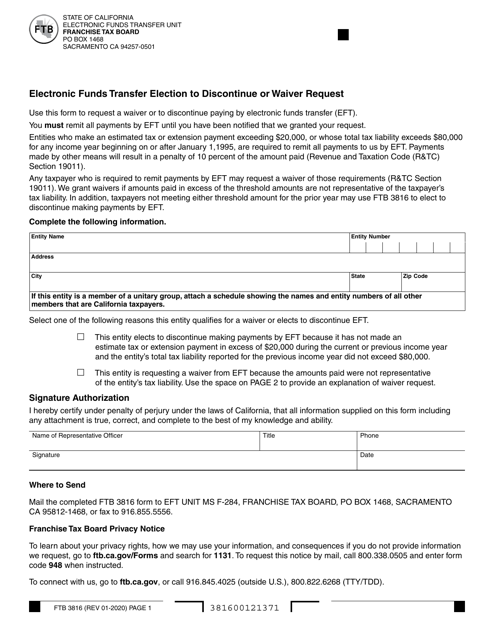

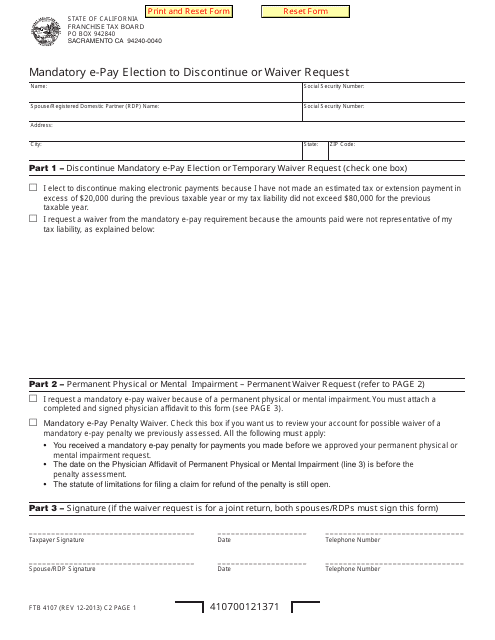

This form is used for making a mandatory electronic payment election and requesting to discontinue or waive the requirement in California.

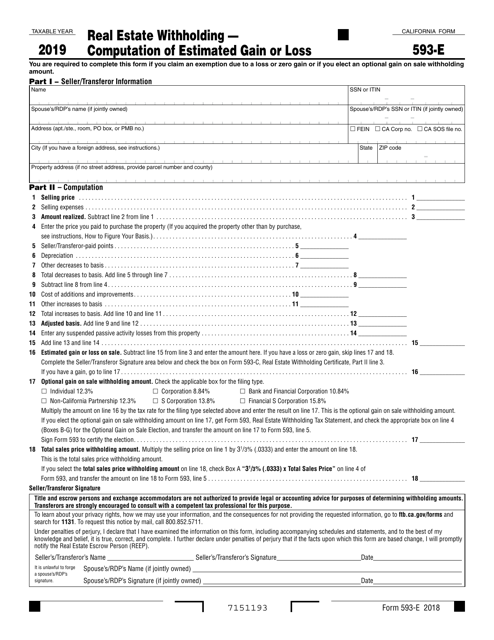

This is a California tax form required for all real estate sales or transfers for which you, the seller/ transferor, are claiming an exemption due to a loss or zero gain or if you elect an optional gain on sale withholding amount.

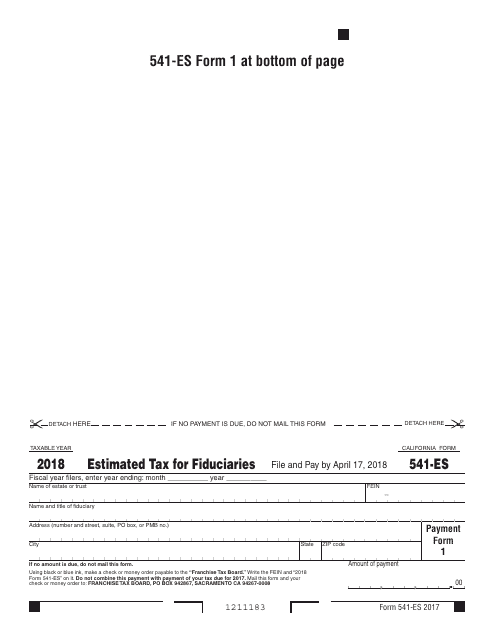

This form is used for fiduciaries in California to estimate and pay their taxes.

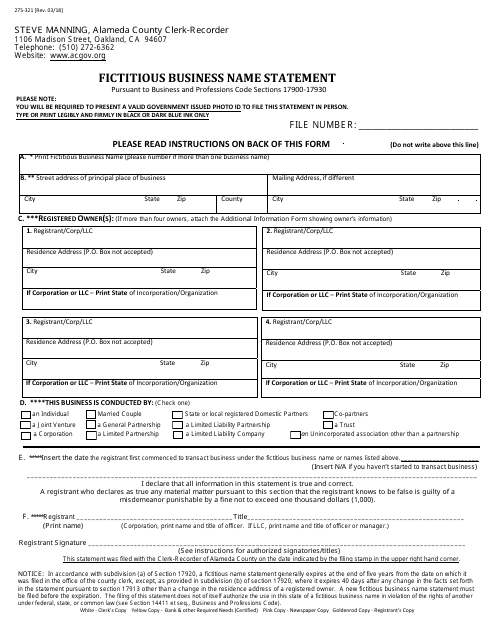

This Form is used for filing a Fictitious Business Name Statement in Alameda County, California.

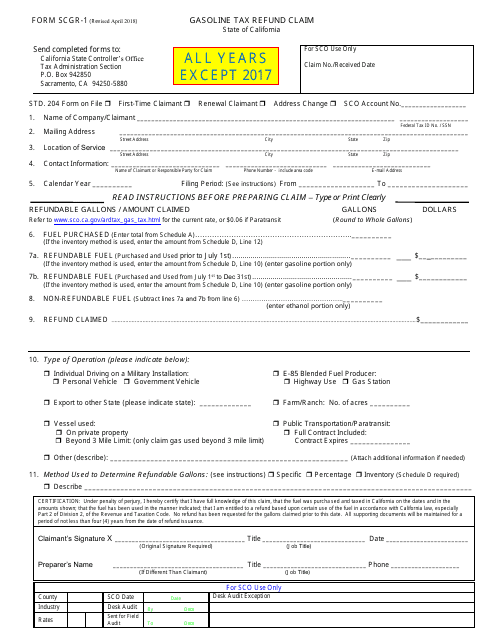

This Form is used for claiming a refund of gasoline tax in California.

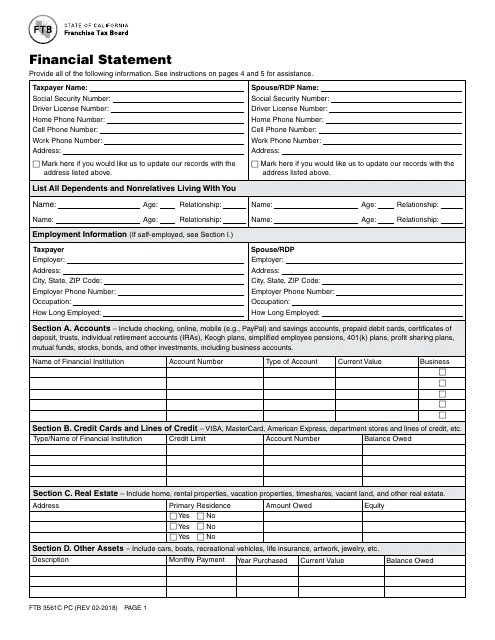

This form is used for filing a financial statement in California.

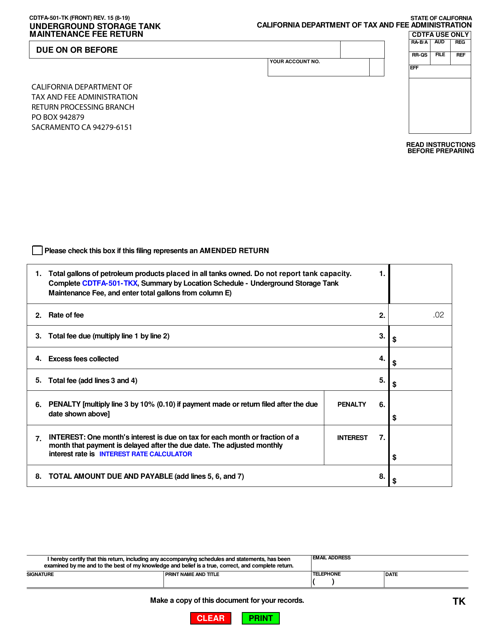

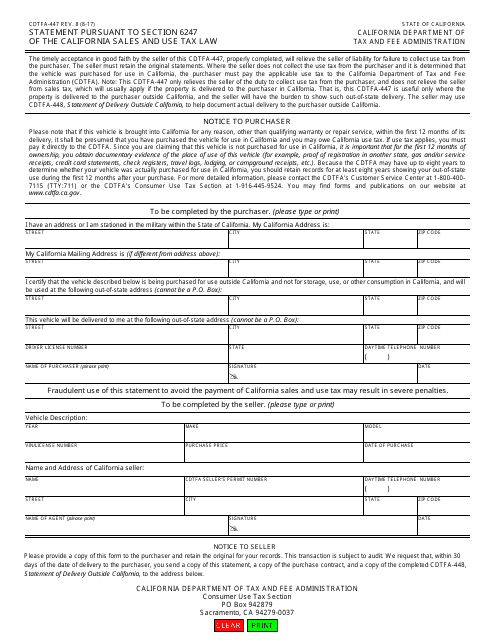

This Form is used for submitting a statement required by Section 6247 of the California Sales and Use Tax Law. It pertains to the calculation and reporting of sales and use taxes in the state of California.

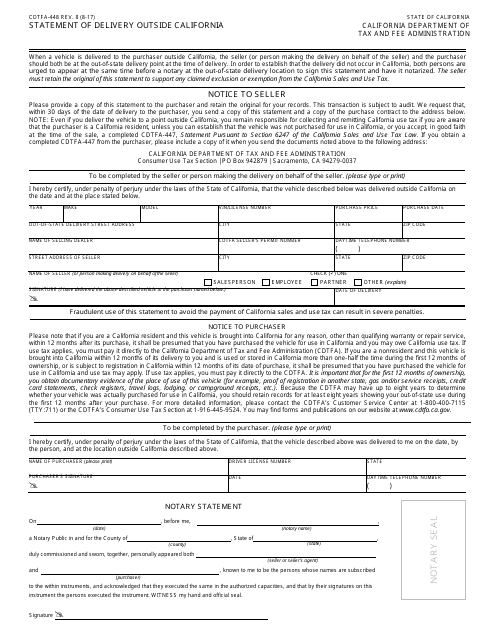

This Form is used for reporting deliveries that occur outside of California by California businesses.

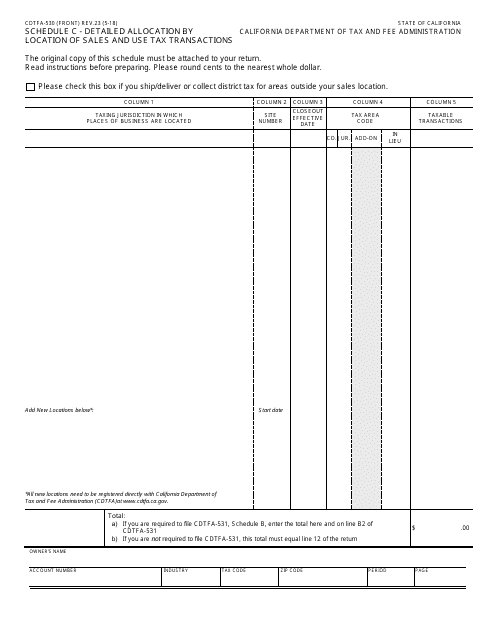

This form is used for providing a detailed allocation of sales and use tax transactions by location in the state of California.

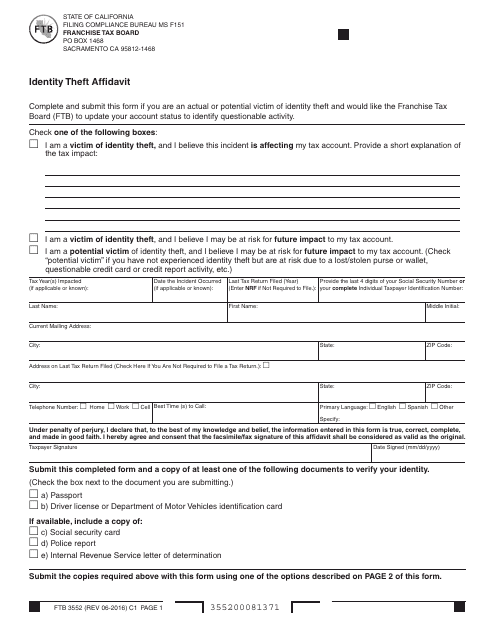

This form is used for reporting incidents of identity theft in the state of California. It is used to provide information and support in resolving any issues related to identity theft.

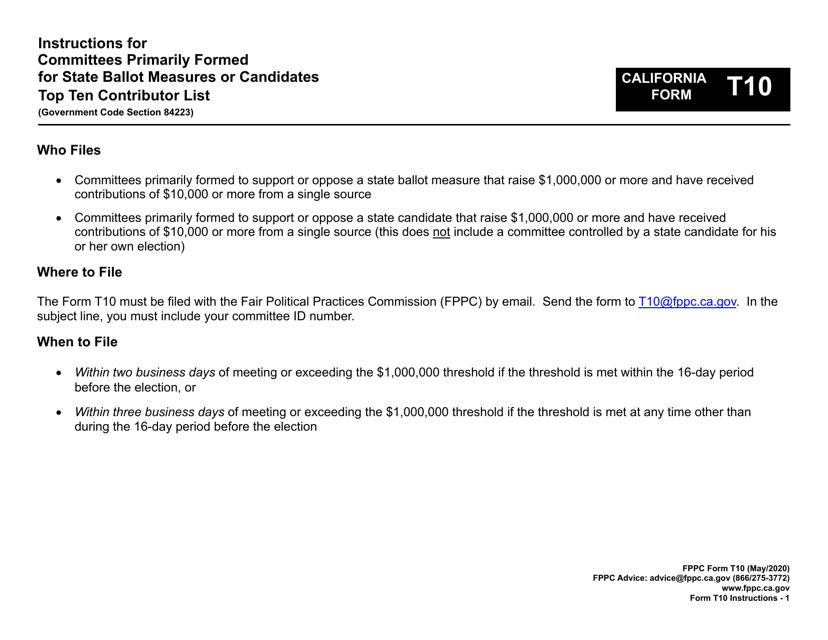

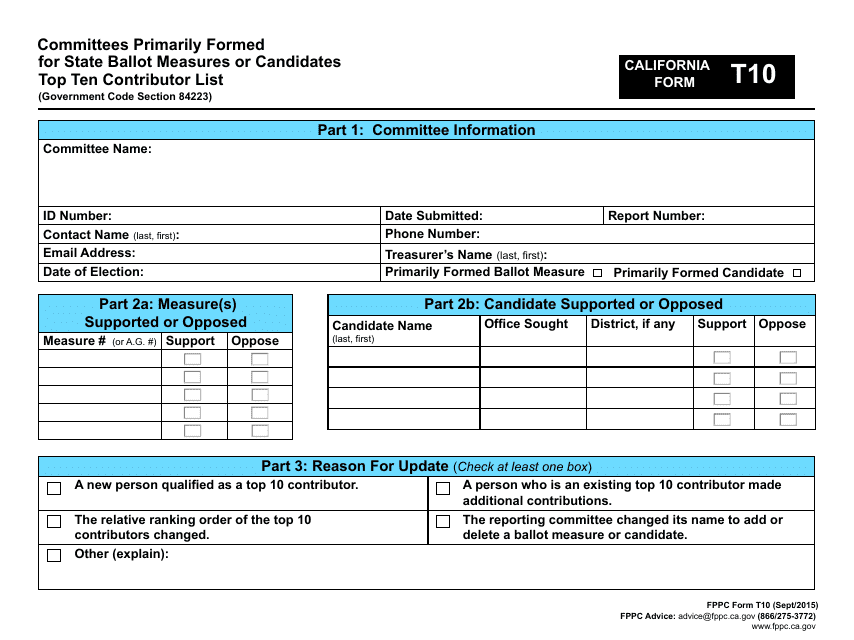

This document is used for disclosing the top ten contributors to committees primarily formed for state ballot measures or candidates in California. It provides transparency in campaign financing.

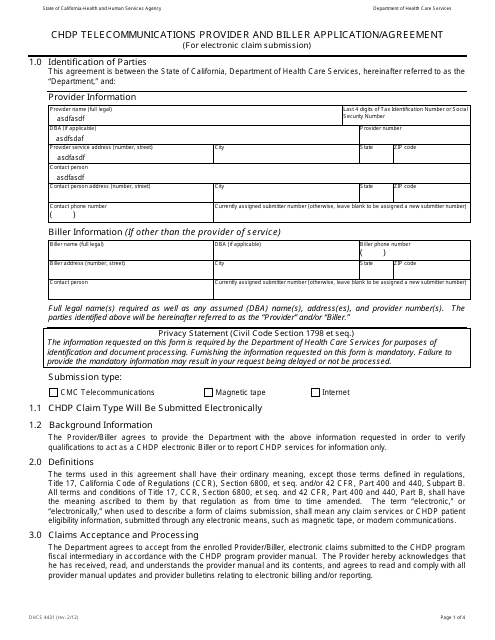

This form is used for Chdp Telecommunications Provider and Biller Application/Agreement in California.

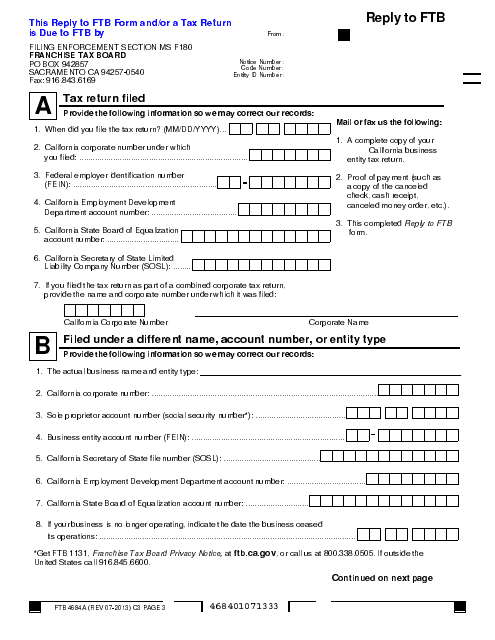

This Form is used for submitting a demand to file a tax return in California.

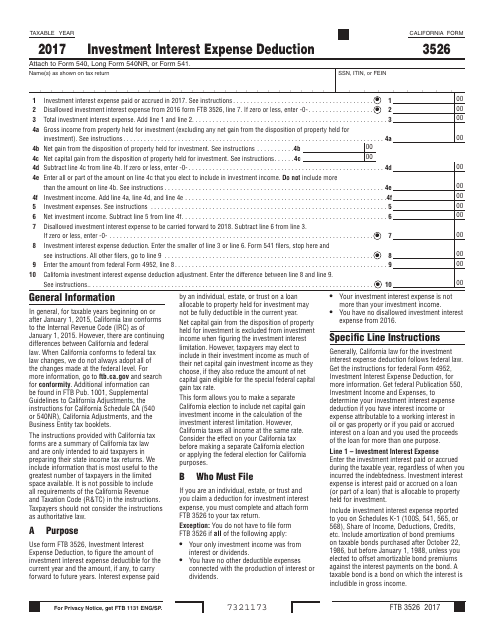

This form is used for claiming the investment interest expense deduction in the state of California. It allows taxpayers to deduct the interest expense paid on their investment loans.

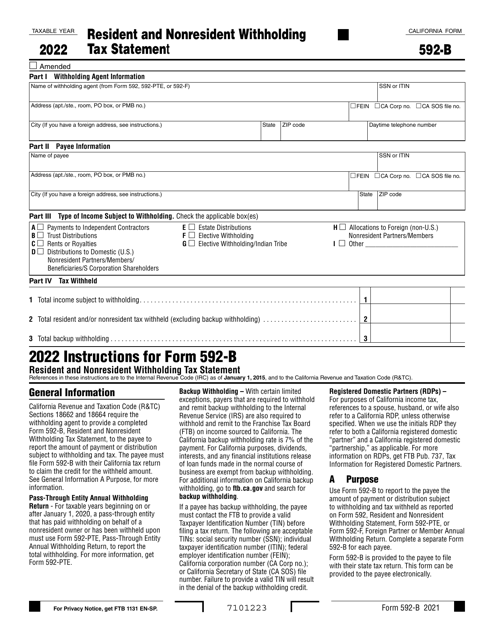

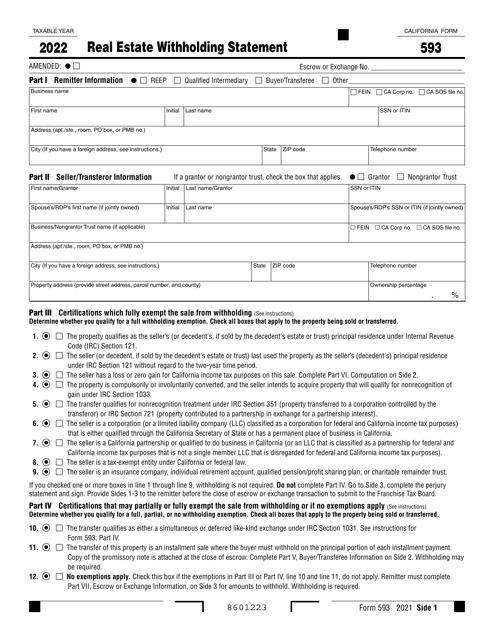

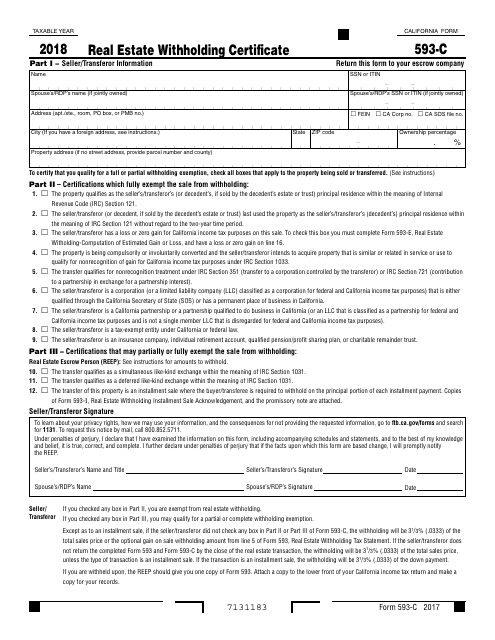

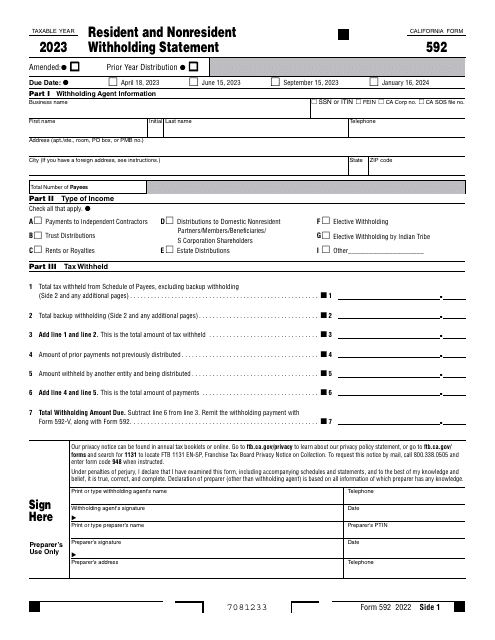

This Form is used for reporting and withholding taxes on real estate transactions in California.

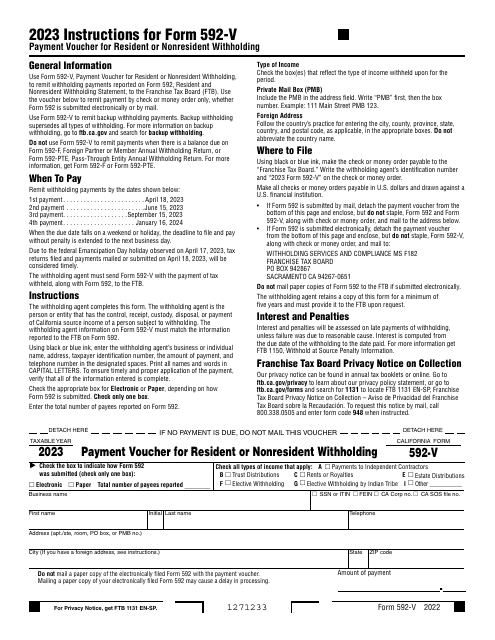

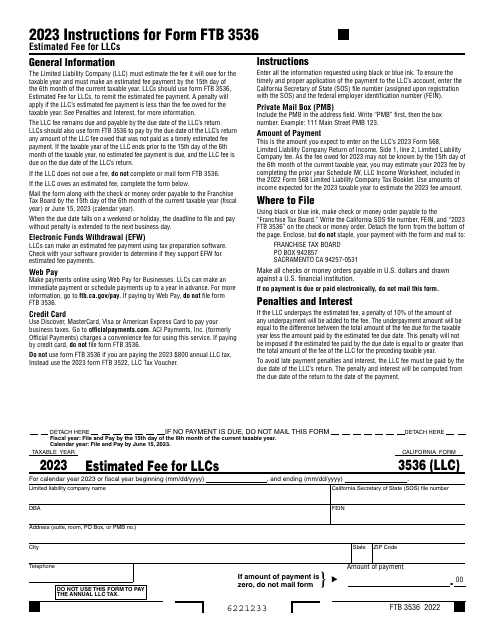

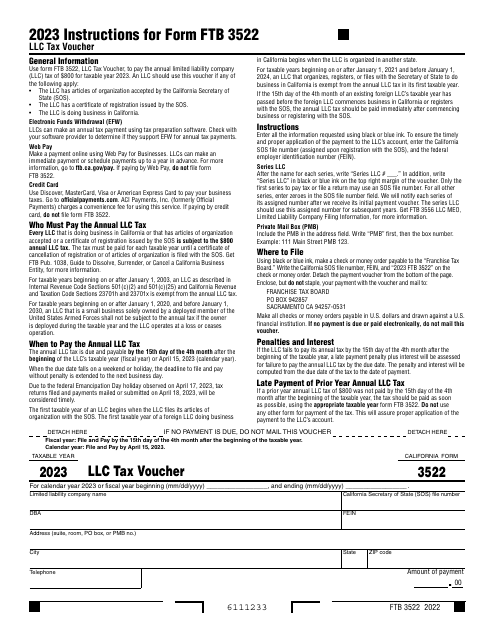

This is a legal document every California-based limited liability company (LLC) needs to submit to pay the annual LLC tax of $800. This form is a tax voucher - it details payment information you need to provide with your check or money order.

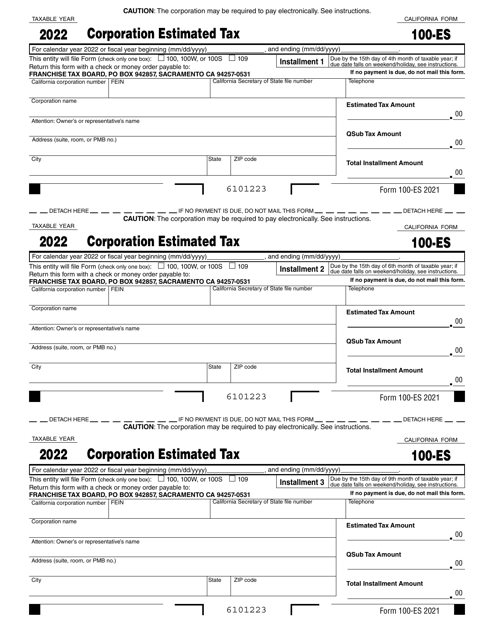

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

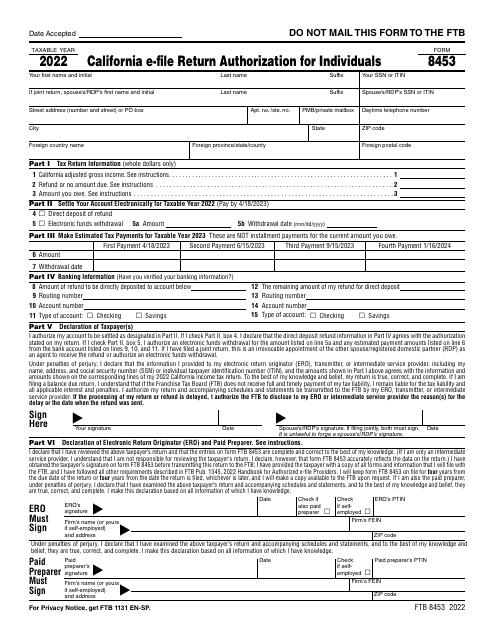

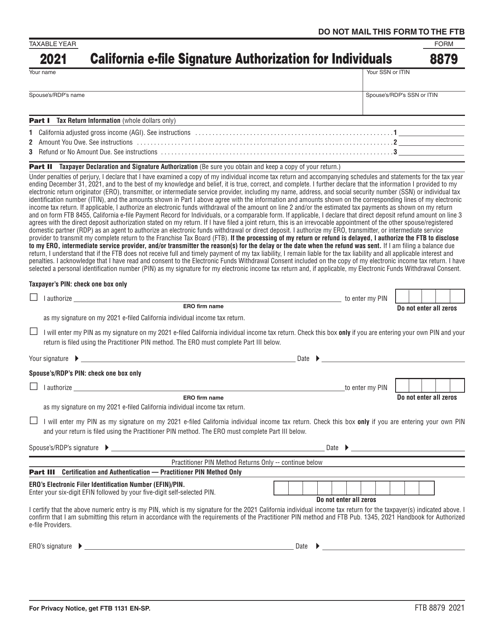

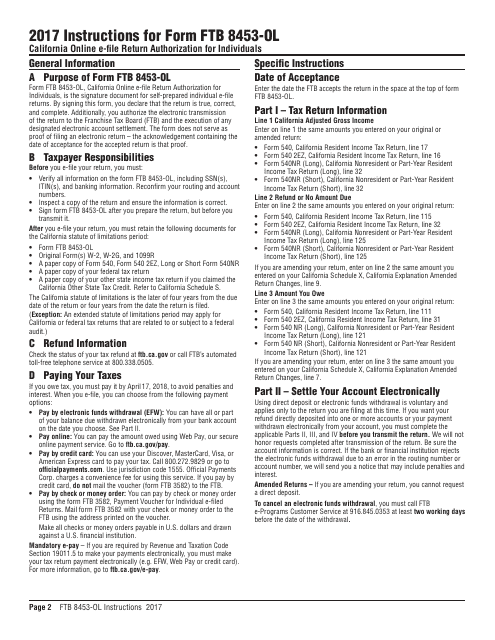

This Form is used for authorizing the electronic filing of individual tax returns in California.

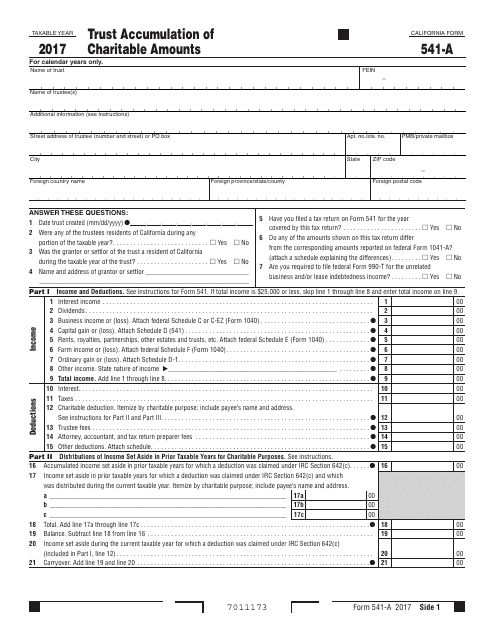

This Form is used for reporting the accumulation of charitable amounts in a trust in the state of California.