Fill and Sign Utah Legal Forms

Documents:

2266

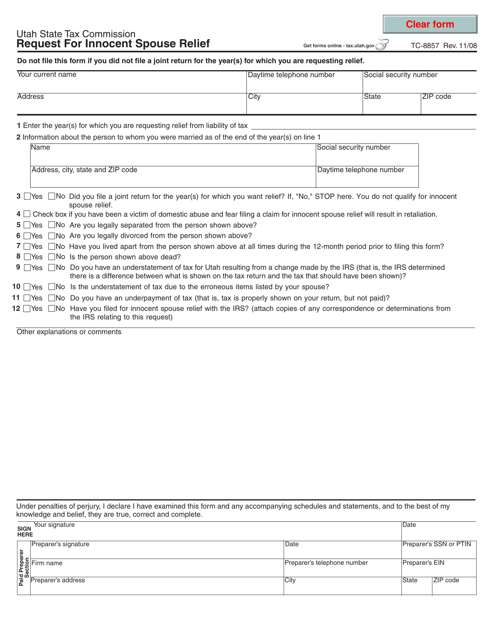

This form is used for requesting innocent spouse relief in the state of Utah. Innocent spouse relief is a provision that allows individuals to avoid being held responsible for taxes owed by their spouse or former spouse. Fill out this form to apply for relief from joint tax liability.

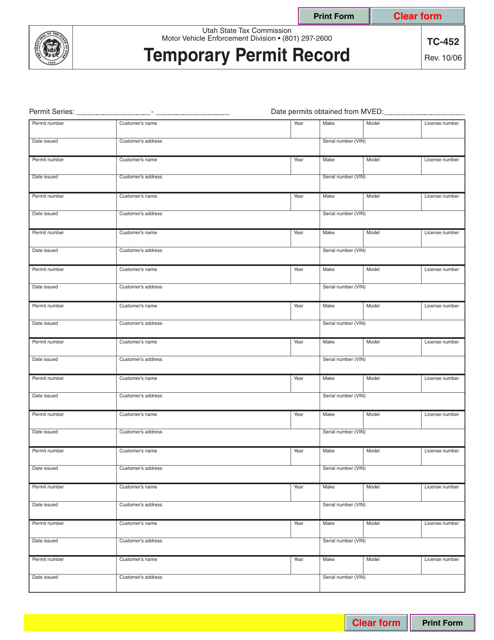

This form is used for recording temporary permits in the state of Utah.

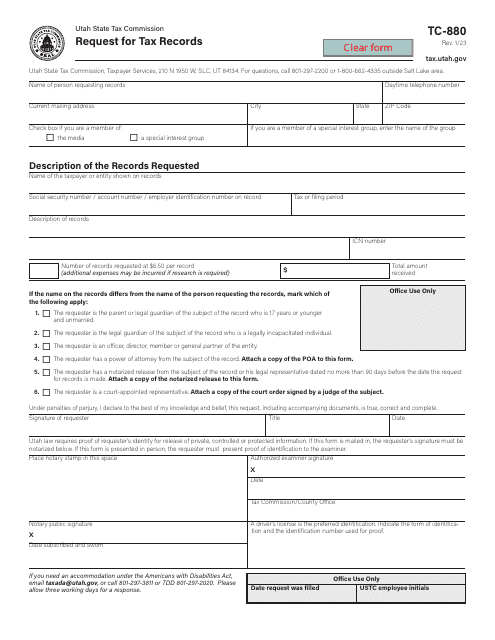

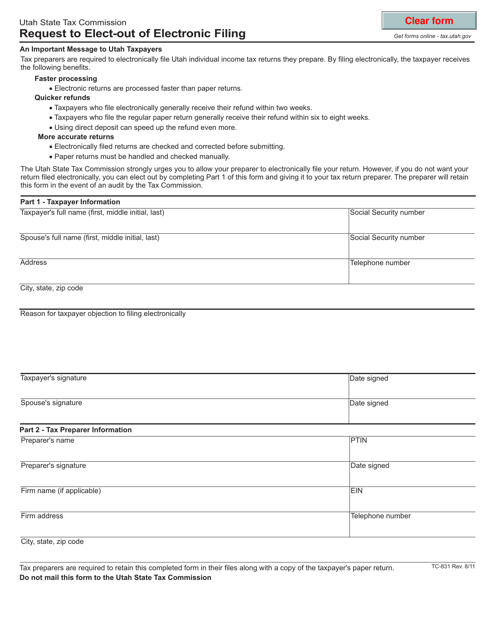

This form is used for requesting to opt out of electronic filing in the state of Utah.

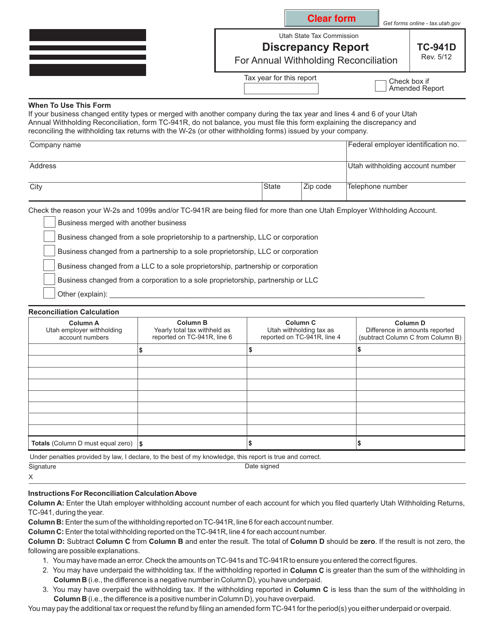

This form is used for reporting discrepancies in annual withholding reconciliation in the state of Utah.

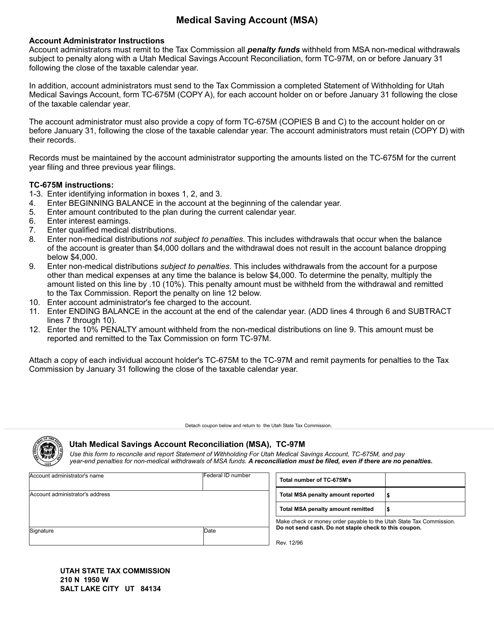

This form is used for reconciling Utah Medical Savings Account (MSA) transactions in the state of Utah.

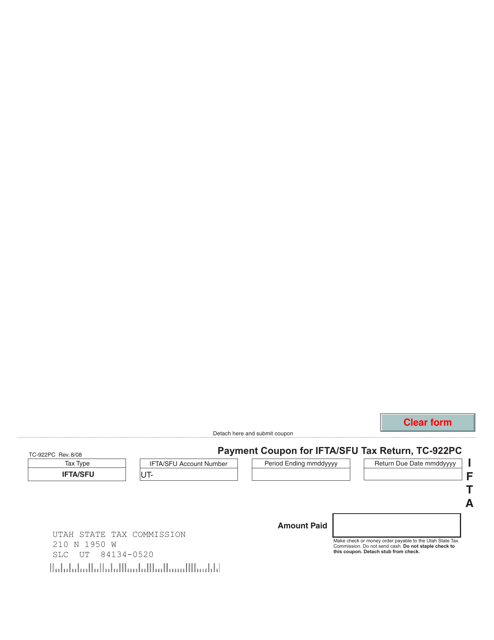

This form is used for submitting payment for IFTA/SFU tax return in Utah.

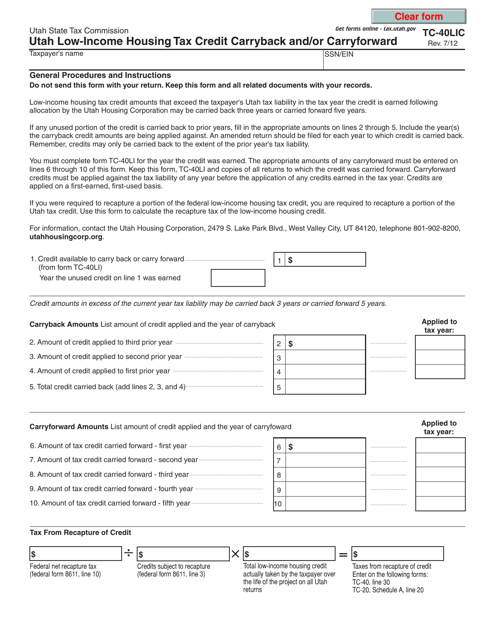

This form is used for reporting low-income housing tax credit carryback and/or carryforward in the state of Utah.

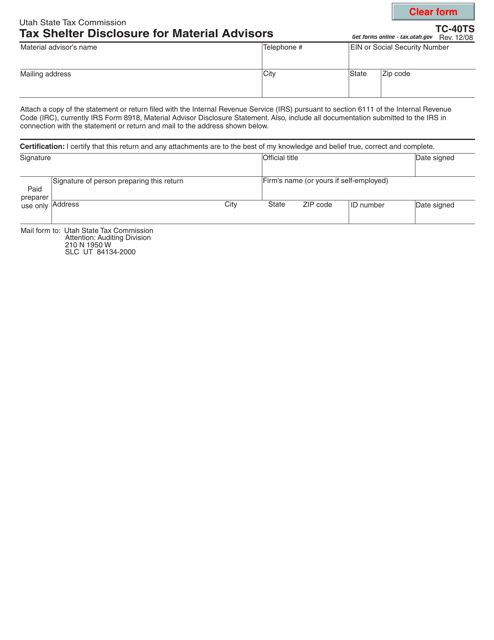

This form is used for disclosing tax shelters to material advisors in Utah.

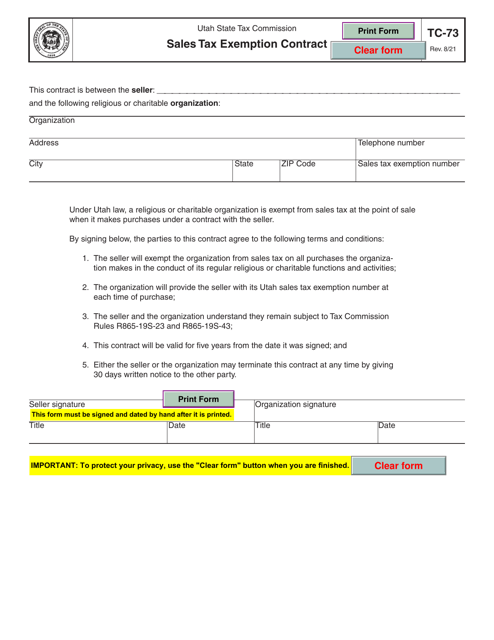

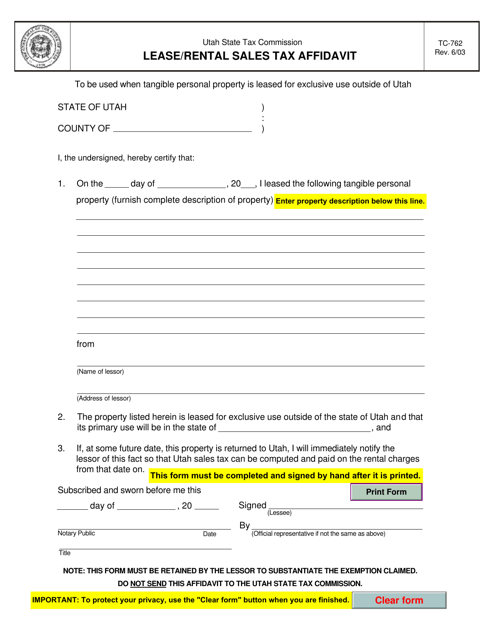

This form is used for reporting and paying sales tax on lease or rental transactions in the state of Utah.

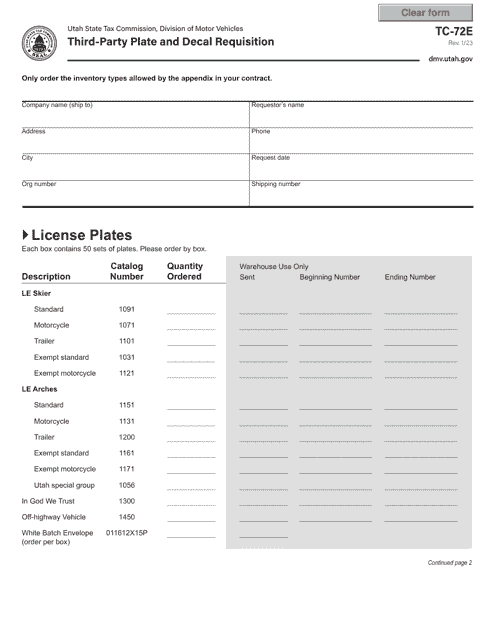

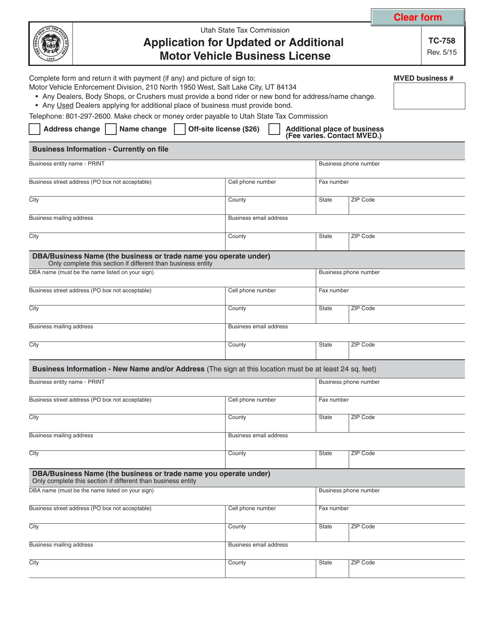

This form is used for applying for an updated or additional motor vehicle business license in Utah.

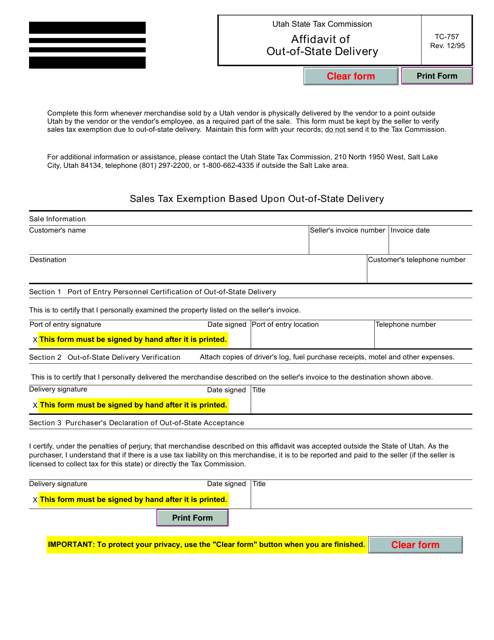

This form is used for declaring that a vehicle was delivered out of state and to request exemption from Utah registration requirements.

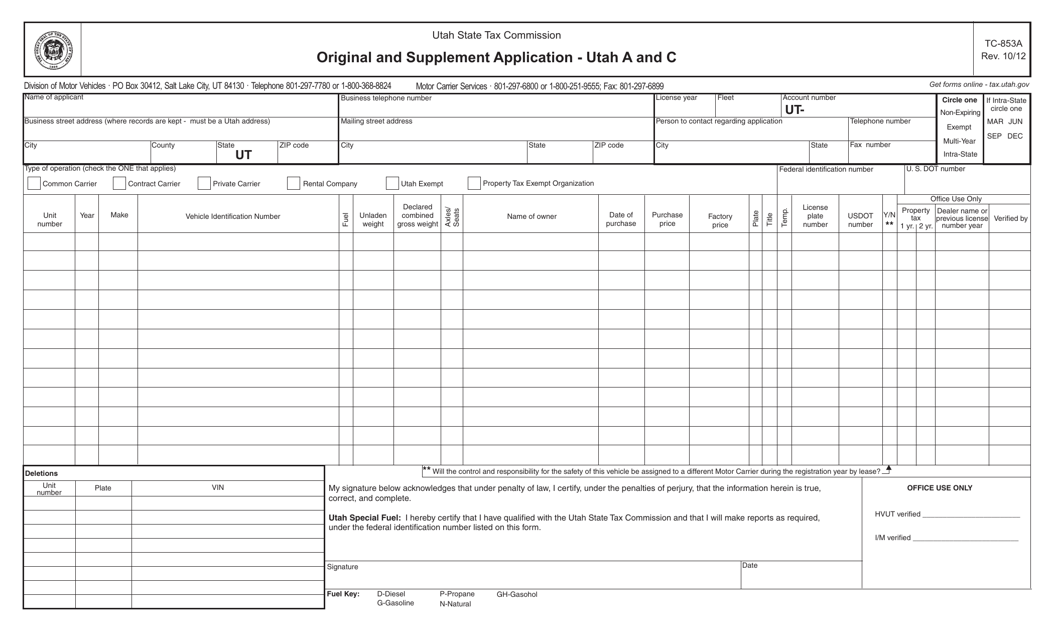

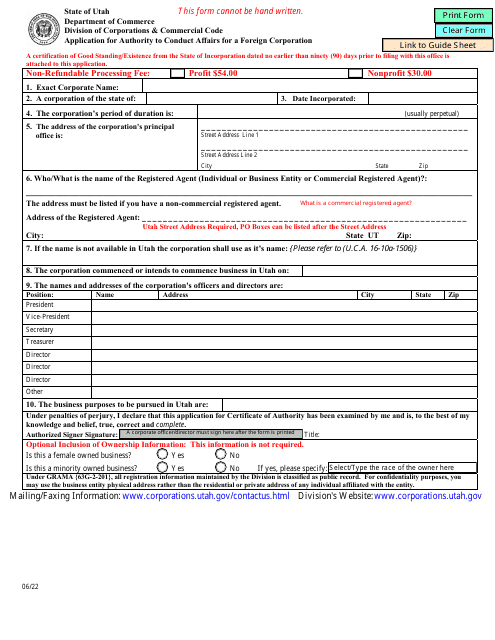

This Form is used for the original and supplemental application for Utah a and C in Utah.

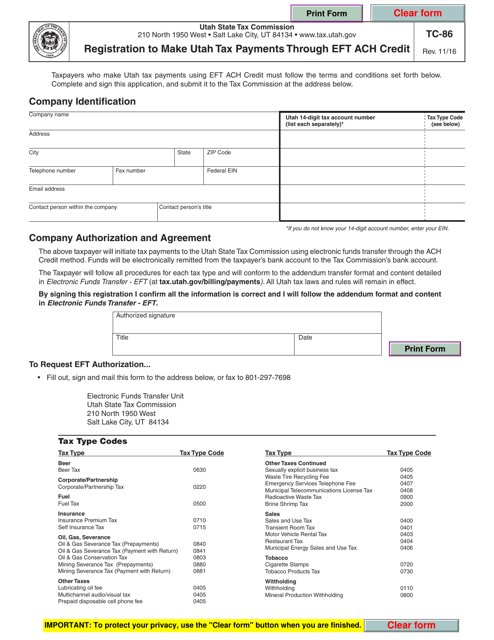

This form is used for registering to make tax payments in Utah through Electronic Funds Transfer (EFT) Automated Clearing House (ACH) Credit.

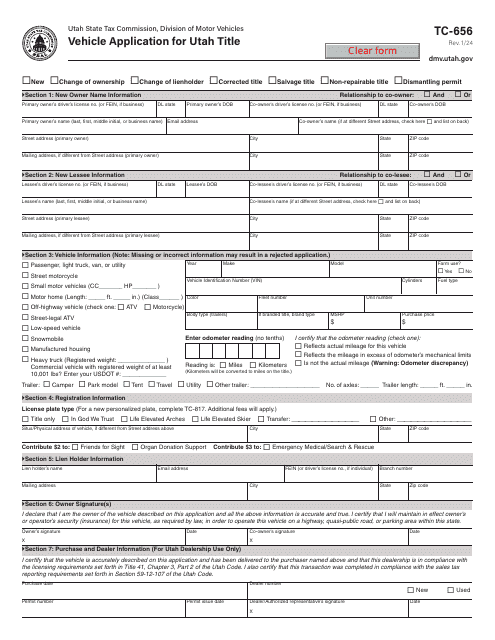

Utah vehicle owners may use this form to apply for a title, change information on an existing title, or request a permit to dismantle a vehicle.

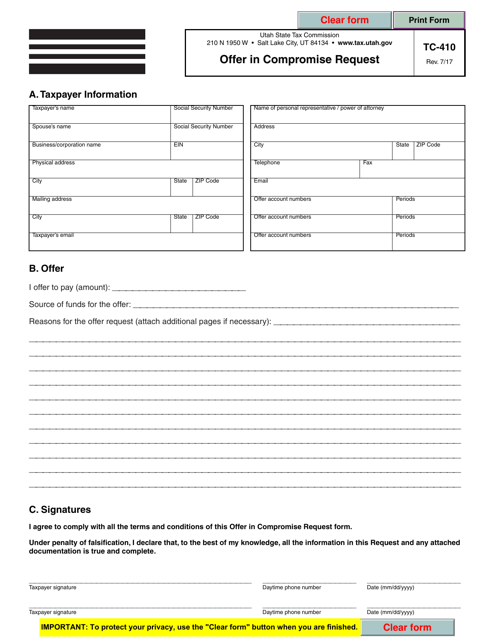

This form is used for requesting an offer in compromise with the state of Utah. It allows individuals or businesses who have outstanding tax liabilities to propose a smaller payment to settle their debts.

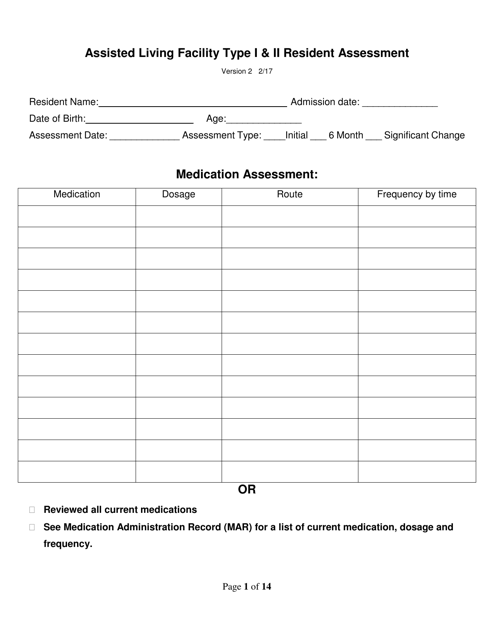

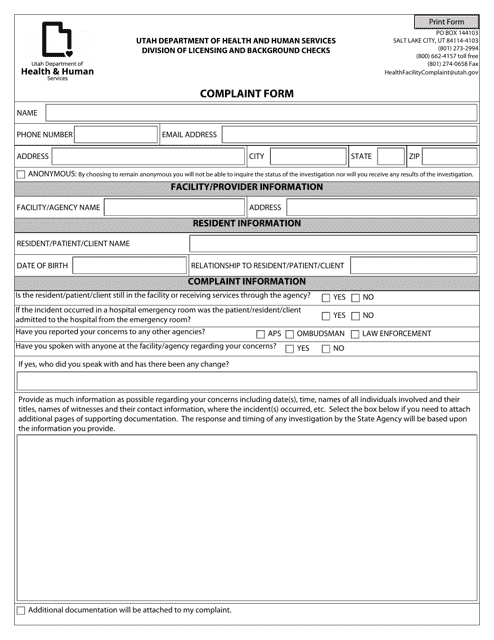

This document is used for assessing the residents in Type I & II Assisted Living Facilities in Utah. It helps determine the care and assistance needed for each resident.

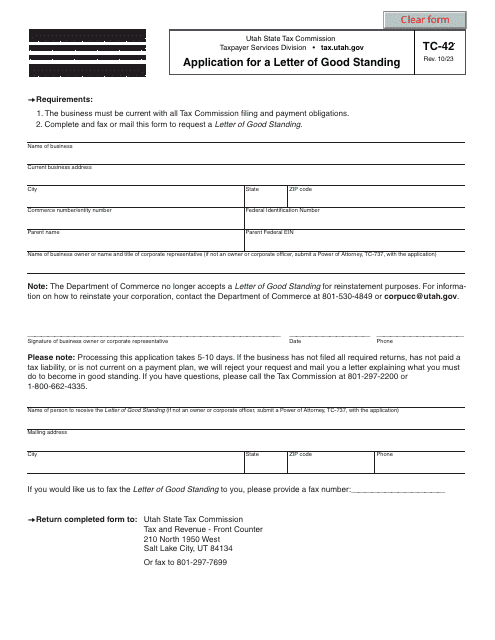

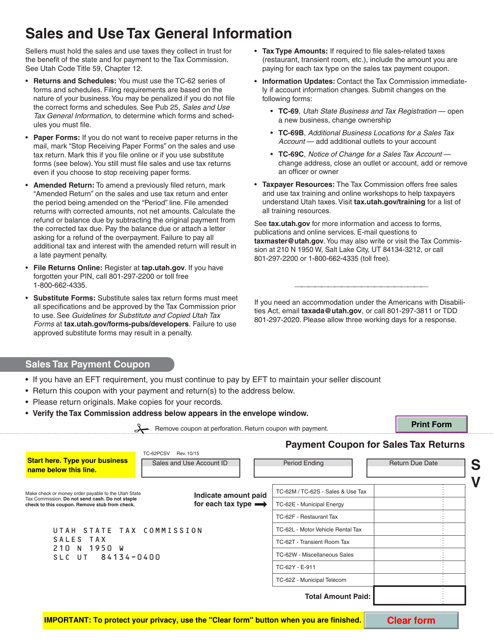

This Form is used for submitting sales tax payments in the state of Utah.

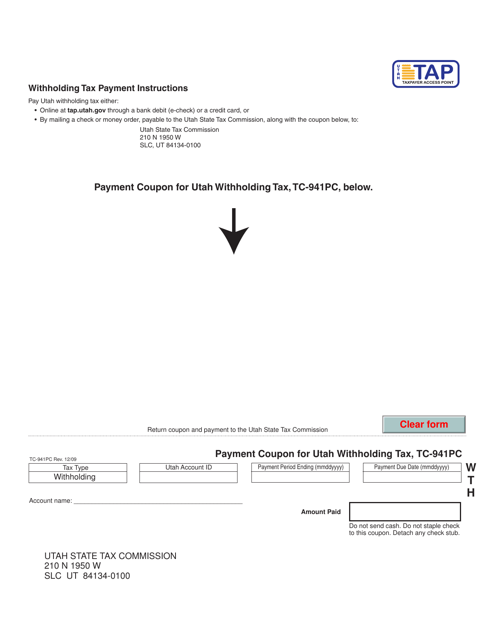

This form is used for making payment for Utah withholding tax in Utah.

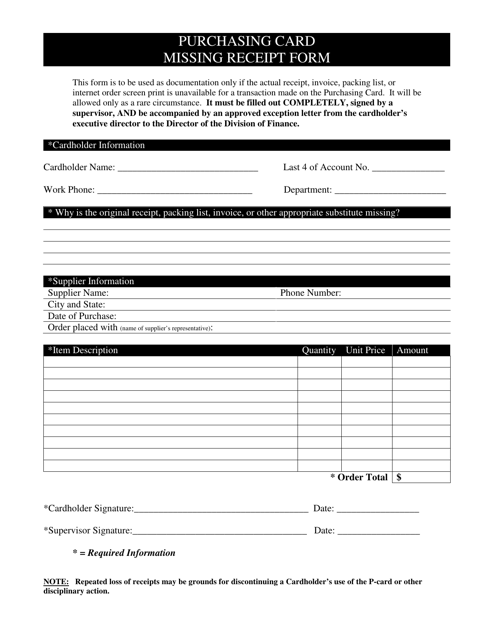

This form is used when a receipt is missing for a purchase made with a purchasing card in the state of Utah. It helps to track and document the purchase, ensuring accountability and compliance.

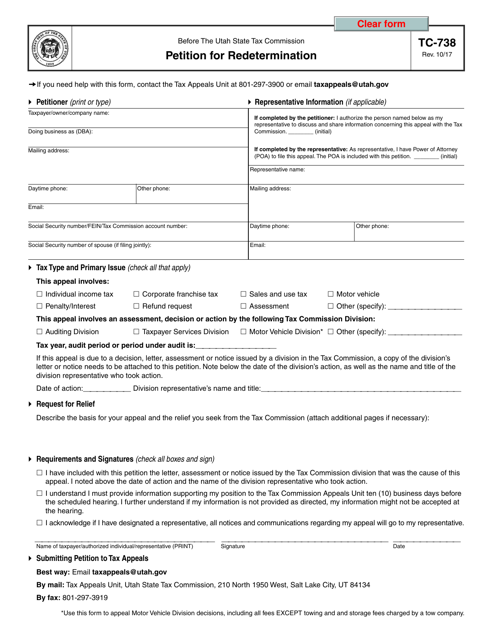

This form is used to file a petition for redetermination in the state of Utah. It allows taxpayers to contest a decision made by the Utah State Tax Commission regarding taxes owed.

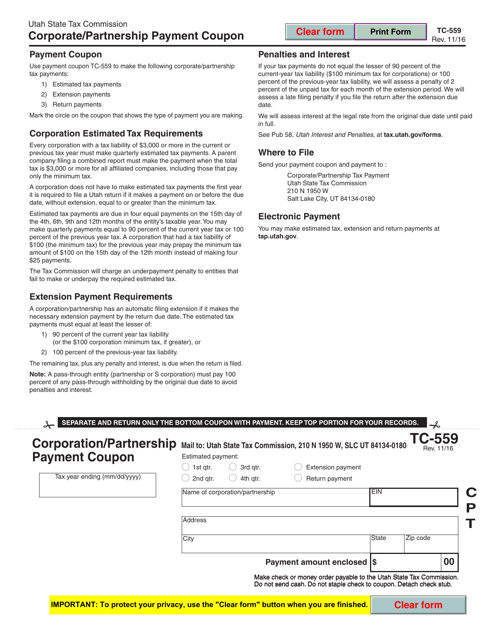

This Form is used for making payments for corporations and partnerships in Utah. It serves as a payment coupon to ensure that the payment is properly applied.

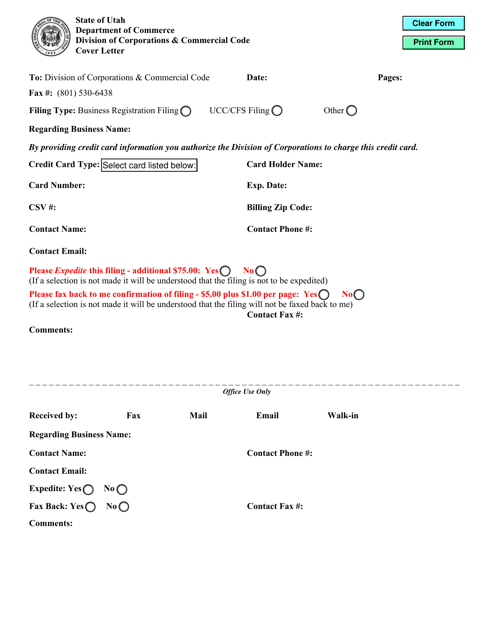

This document is a cover letter template used for job applications in the state of Utah. It follows a standardized format and includes the necessary information to showcase your skills and qualifications to potential employers.

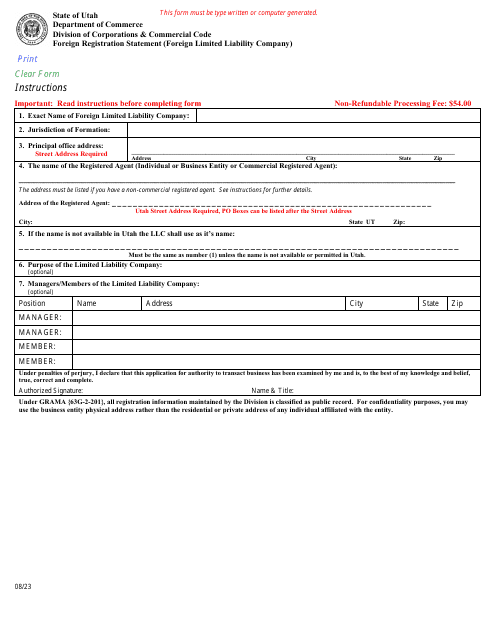

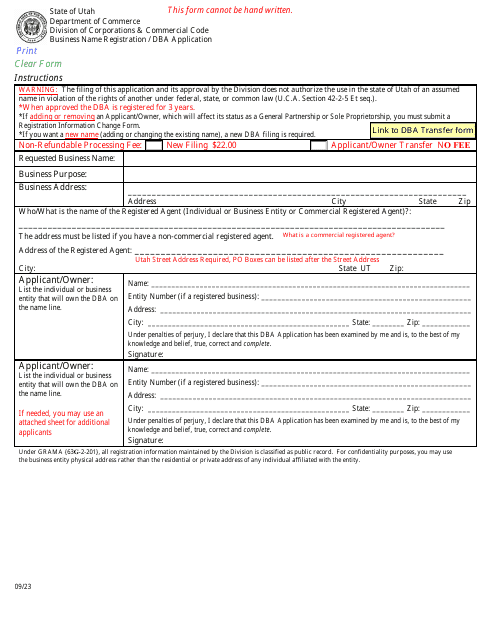

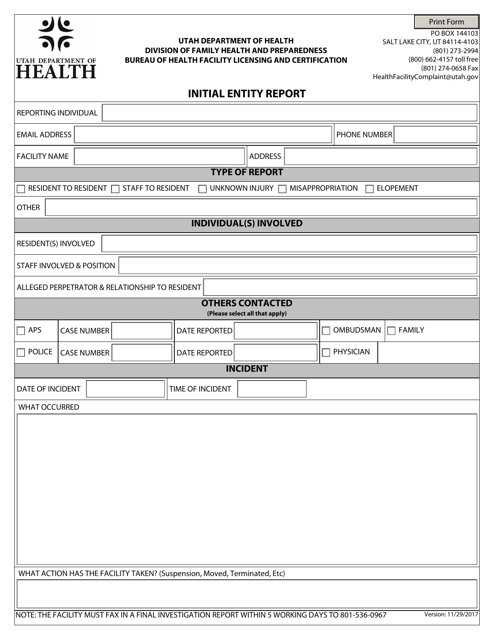

This document is used for filing an initial entity report in the state of Utah. It is a required form for new businesses or entities to provide basic information about their structure and ownership.

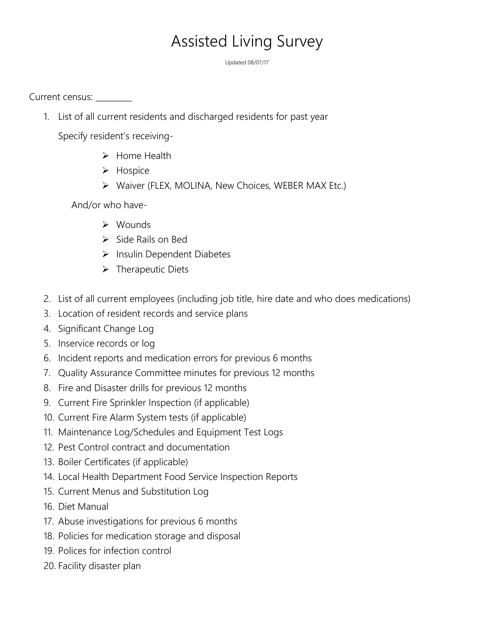

This document is a survey specific to assisted living facilities in Utah. It is used to gather feedback and information about the quality of care and services provided in these facilities.

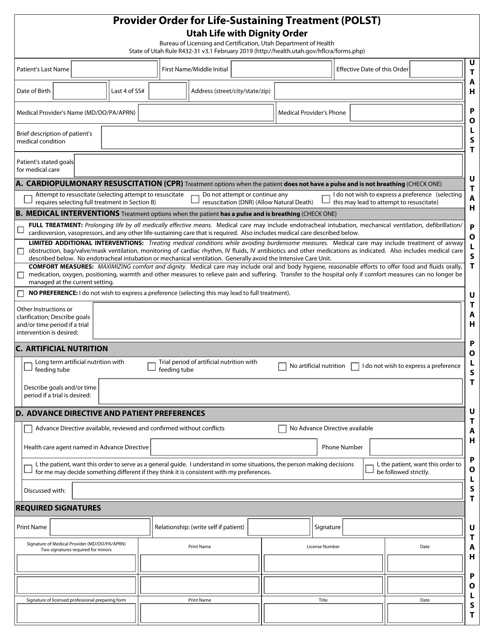

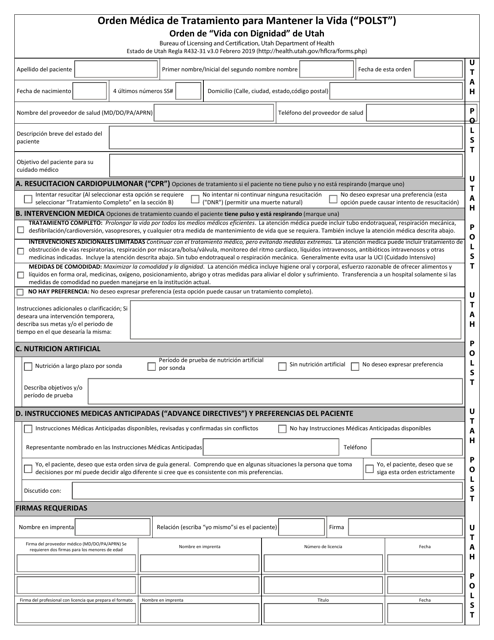

This document is used to make decisions about life-sustaining treatment in Utah. It is a directive that ensures individuals receive the desired medical care and maintain their dignity in critical situations.