Fill and Sign Utah Legal Forms

Documents:

2266

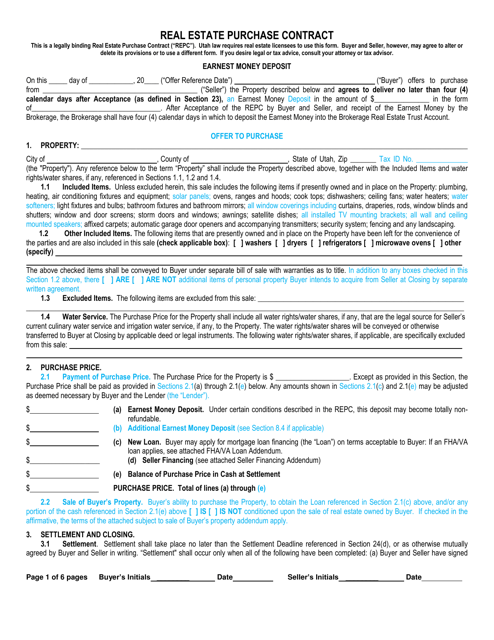

This document is used for a real estate transaction in the state of Utah. It outlines the terms and conditions of the purchase agreement.

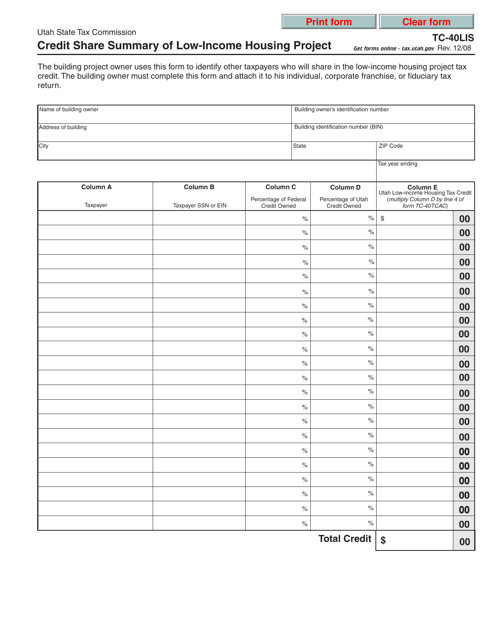

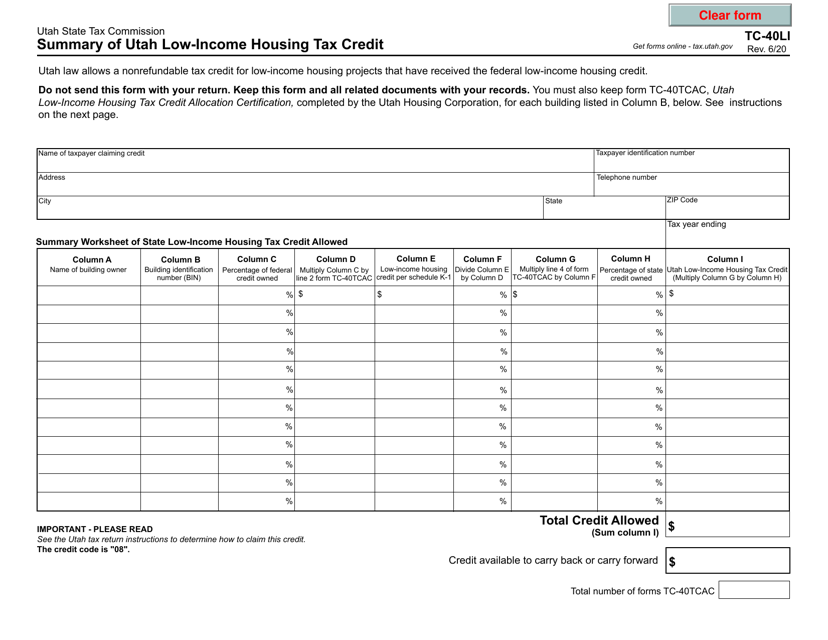

This form is used for summarizing the low-income housing project credits that are being shared in Utah. It helps provide a report on the credits received for affordable housing projects.

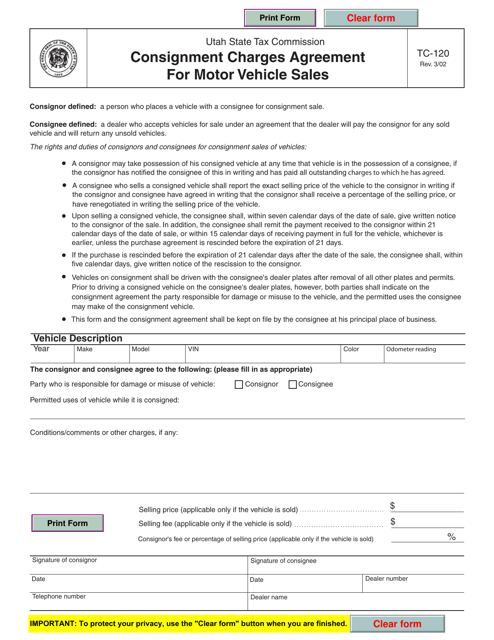

This form is used for consignment charges agreement for motor vehicle sales in Utah.

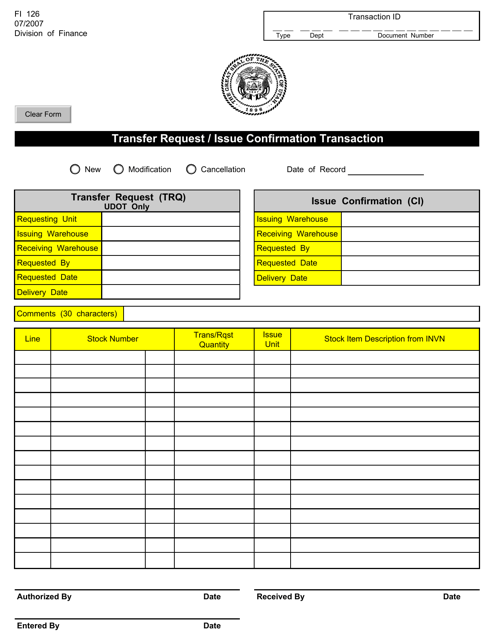

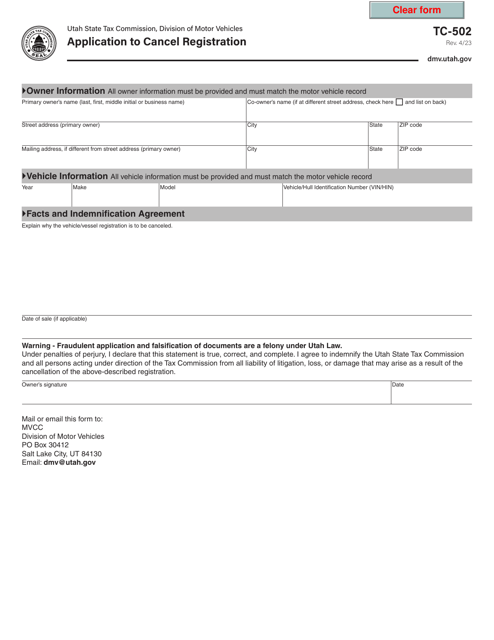

This form is used for requesting a transfer or issuing confirmation transactions in the state of Utah.

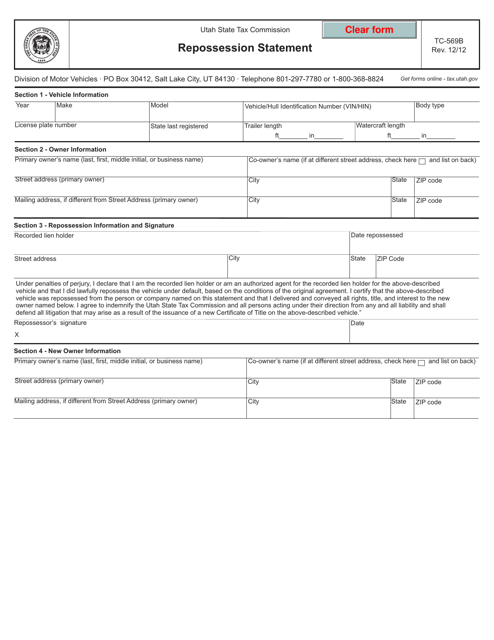

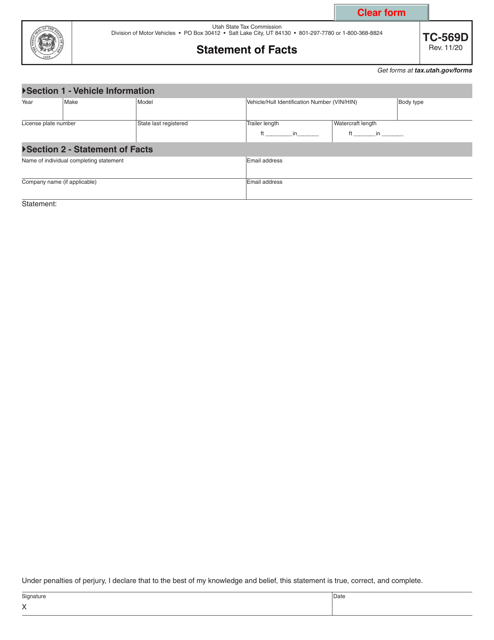

This form is used for reporting the details of a vehicle repossession in the state of Utah. It is required by the Utah State Tax Commission for tax purposes.

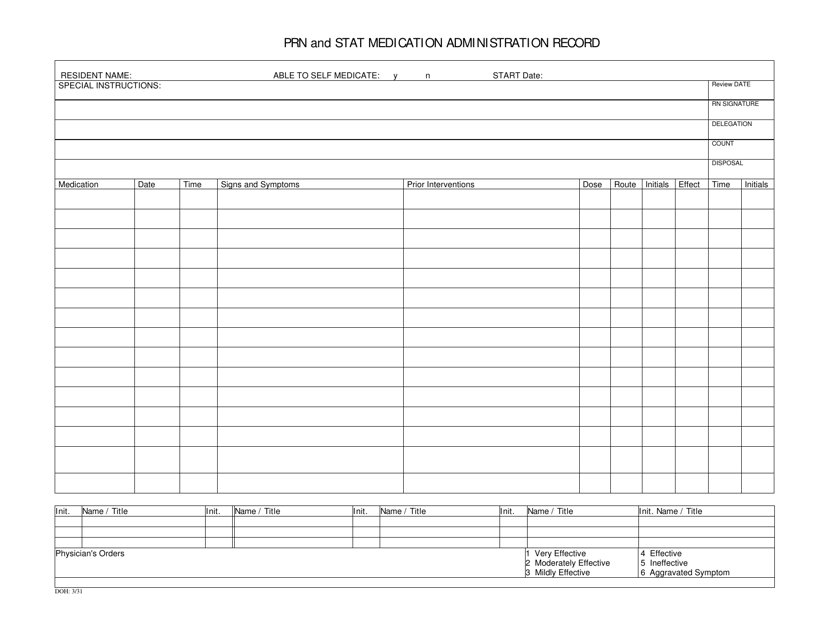

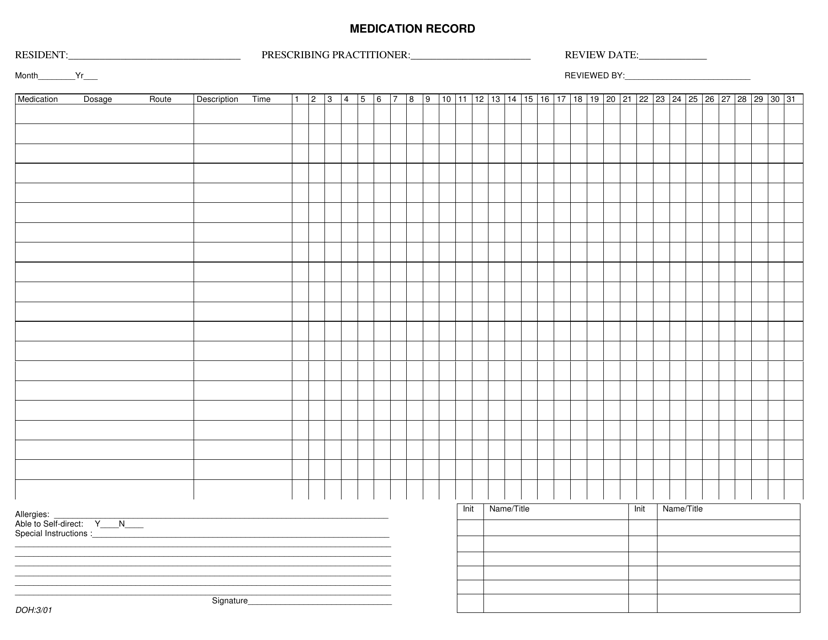

This document is used for recording and tracking the administration of medications in the state of Utah.

This document provides instructions for filing Articles of Incorporation (Profit) in the state of Utah to legally establish a for-profit corporation.

This document provides instructions on how to apply for state trademark or service mark registration in the state of Utah.

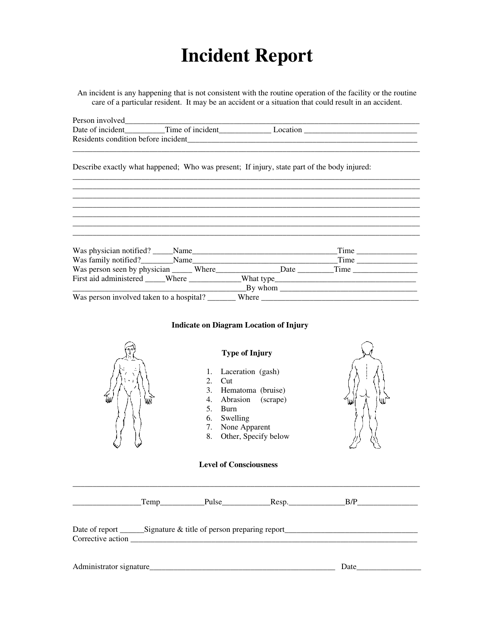

This document is used for reporting incidents that occur in the state of Utah. It helps to document and provide details about the event, such as the date, time, location, and description of what happened.

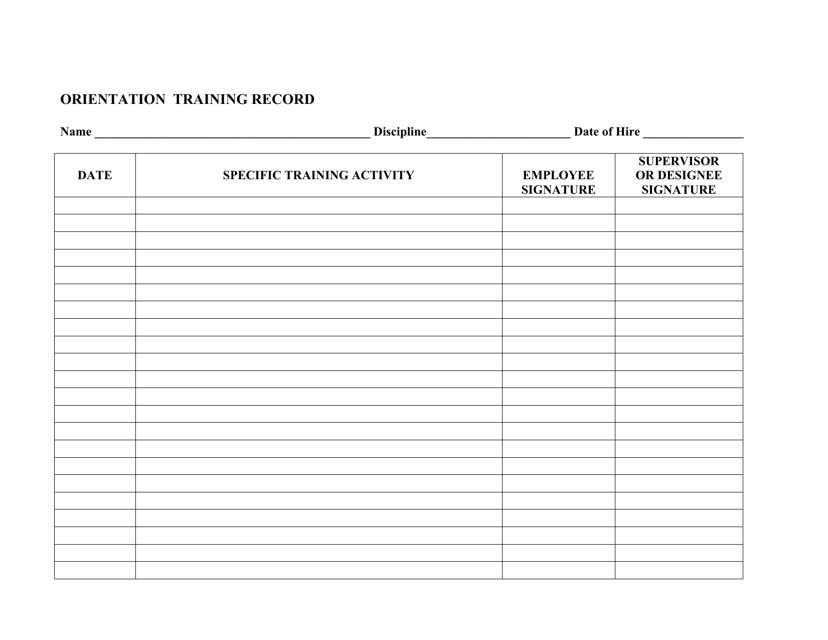

This form is used to record and document the orientation training of employees in Utah.

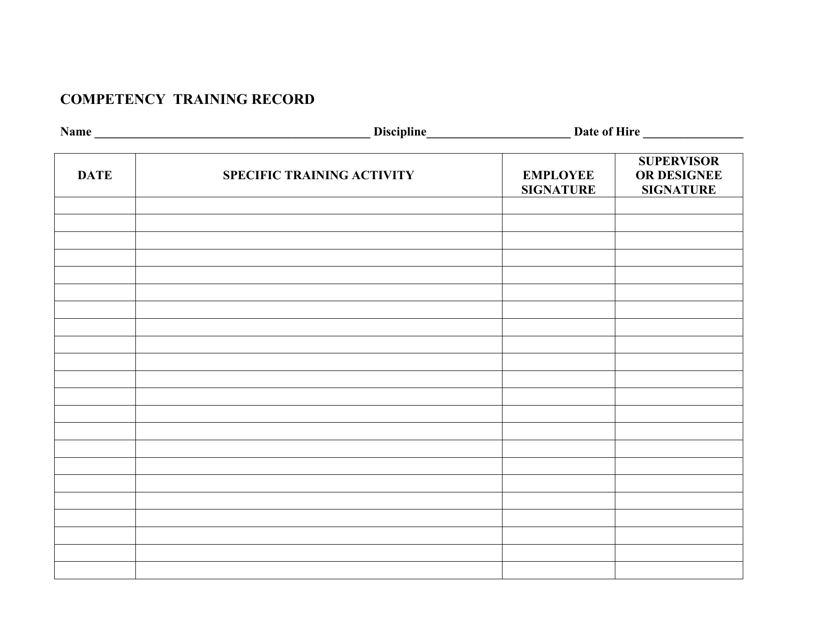

This form is used for keeping track of an individual's competency training in the state of Utah. It allows employers and employees to document completed training courses and certifications.

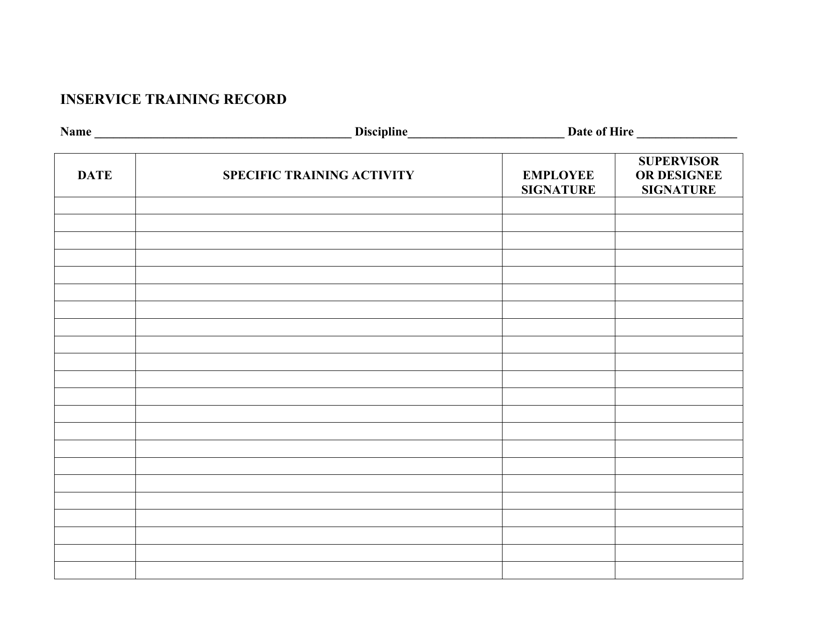

This document records the inservice training of employees in Utah. It tracks the training sessions attended and the skills acquired by the employees.

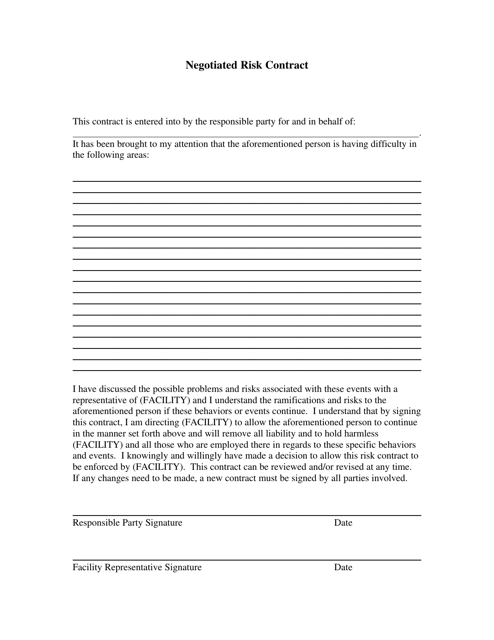

This document is used for a negotiated risk contract in the state of Utah. It outlines the terms and conditions of a contract that involves assuming some level of risk and liability.

This form is used for keeping a record of medications taken in the state of Utah. It helps individuals track their medication history and provides valuable information to healthcare providers.

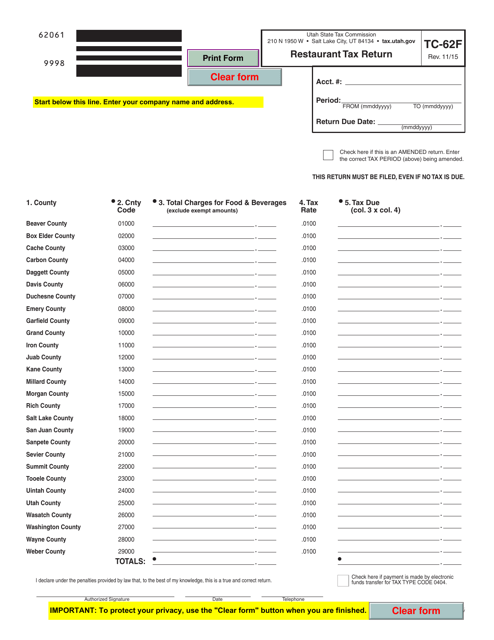

This Form is used for reporting and paying taxes on restaurant sales in the state of Utah.

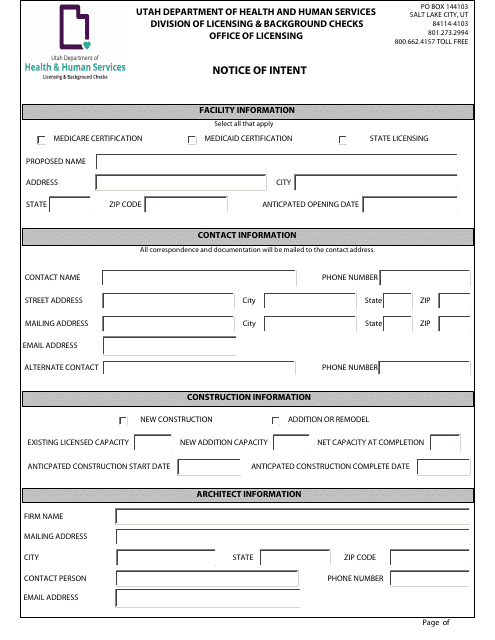

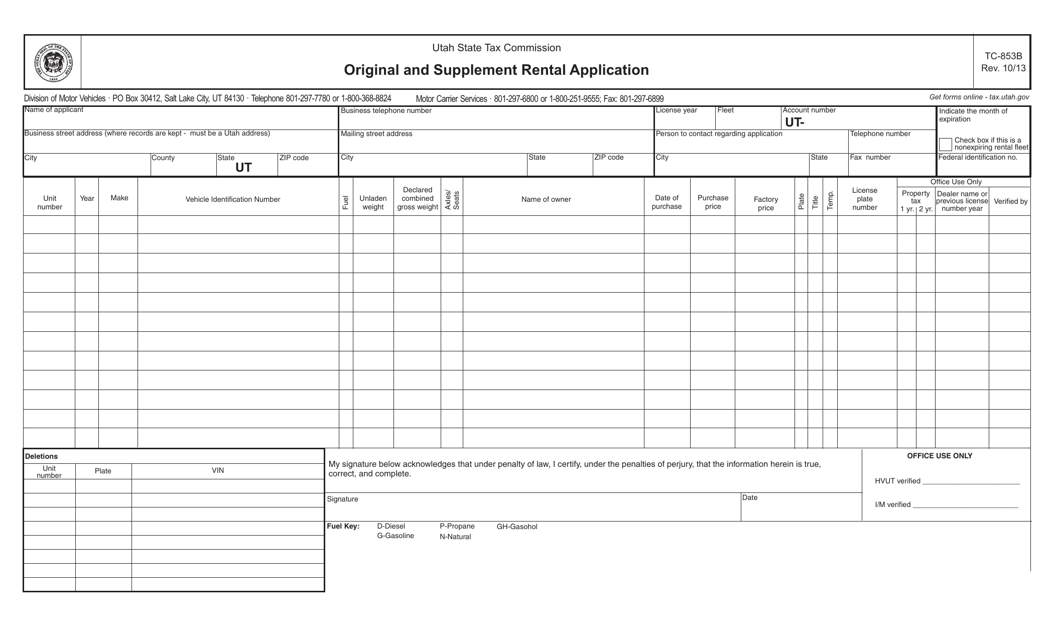

This form is used for submitting a rental application in the state of Utah.

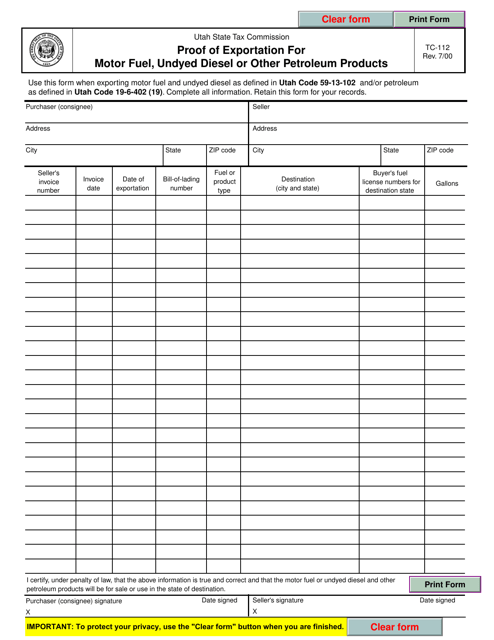

This form is used for providing proof of exportation for motor fuel, undyed diesel, or other petroleum products in the state of Utah. It is required to demonstrate that these products have been exported out of the state.

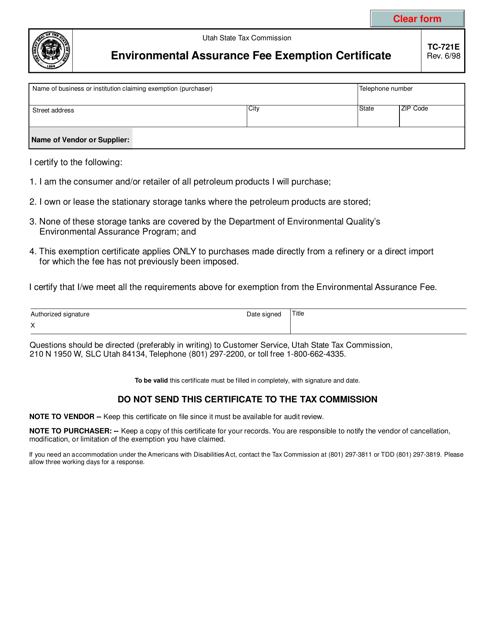

This form is used for applying for an exemption from the Environmental Assurance Fee in Utah.

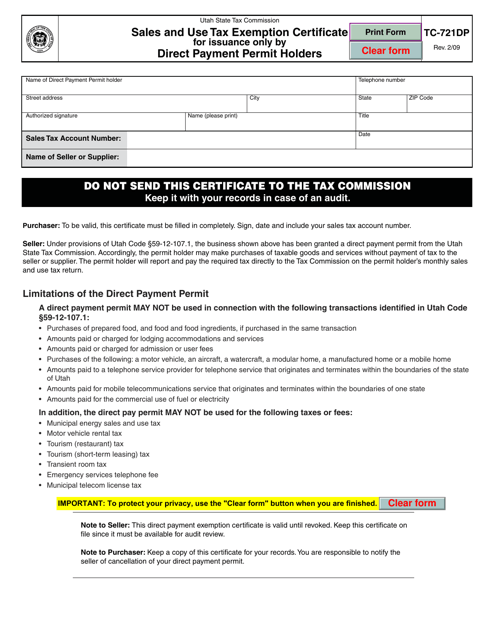

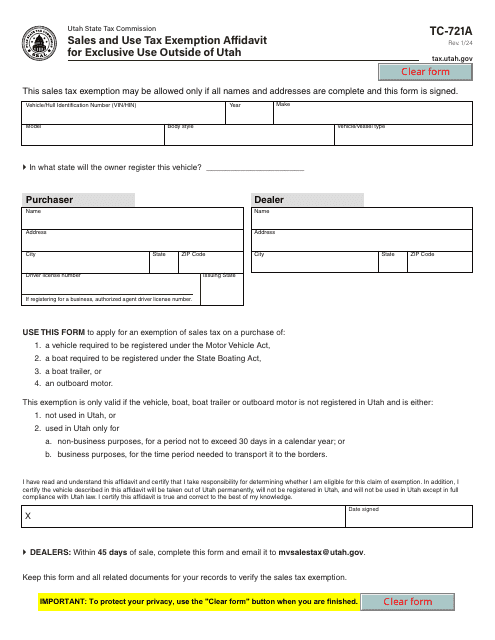

This document is a Sales and Use Tax Exemption Certificate specifically for Direct Payment Permit holders in the state of Utah. It allows these permit holders to claim exemption from paying sales and use taxes for certain transactions.

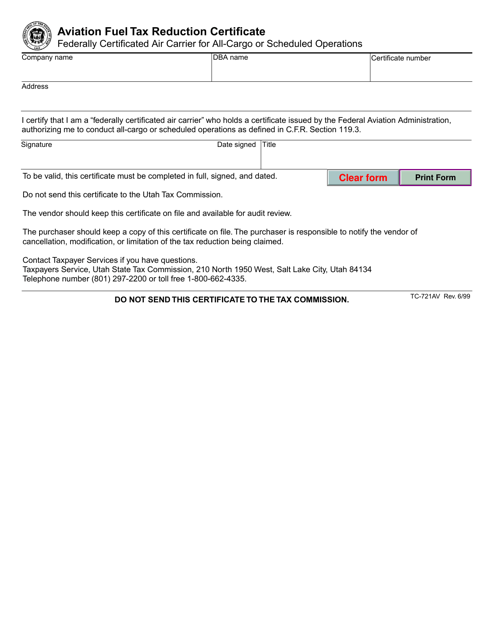

This form is used for applying for an aviation fuel tax reduction certificate in the state of Utah. It is specifically designed for individuals or businesses involved in the aviation industry who qualify for a tax reduction on aviation fuel.

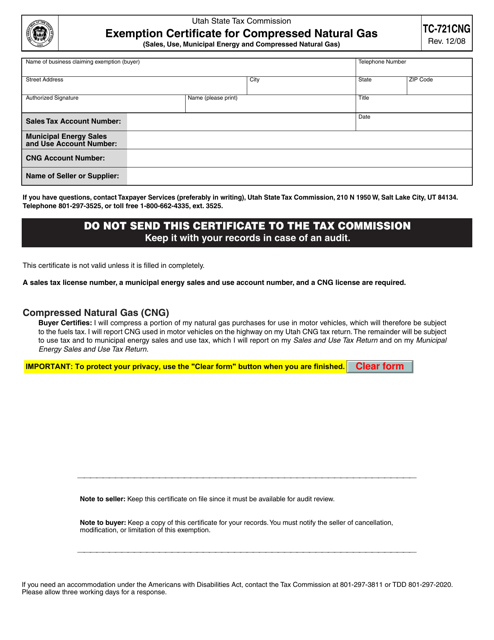

This form is used for obtaining an exemption certificate for using compressed natural gas in Utah.

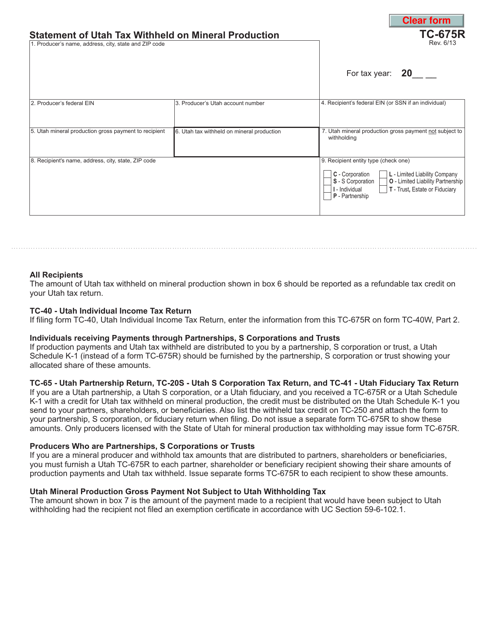

This form is used for reporting the amount of Utah tax withheld on mineral production in Utah. It is necessary for taxpayers involved in mineral production to accurately report and submit this form to the appropriate tax authorities.

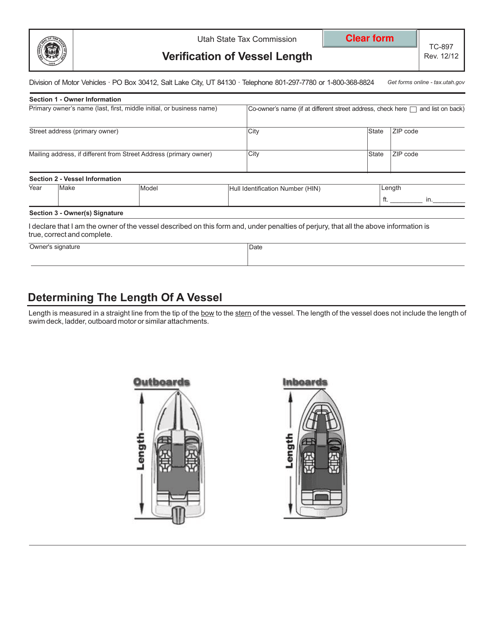

This form is used for verification of the length of a vessel in the state of Utah.

This form is used for requesting an exemption from the withholding tax on mineral production in the state of Utah.

This form is used for requesting a special truck equipment exemption for half registration fees in the state of Utah.