Texas Tax Forms and Templates

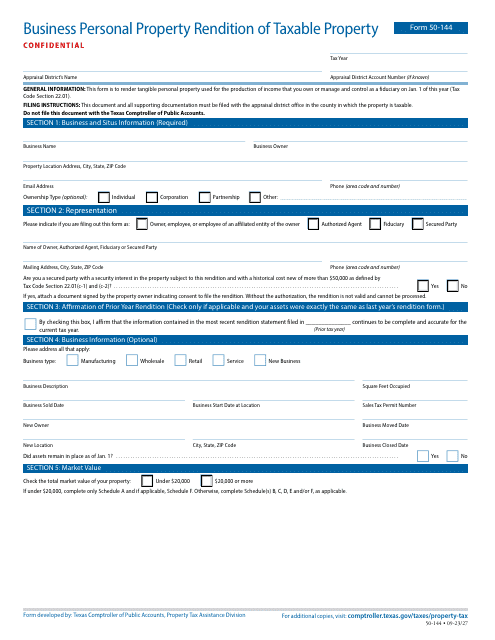

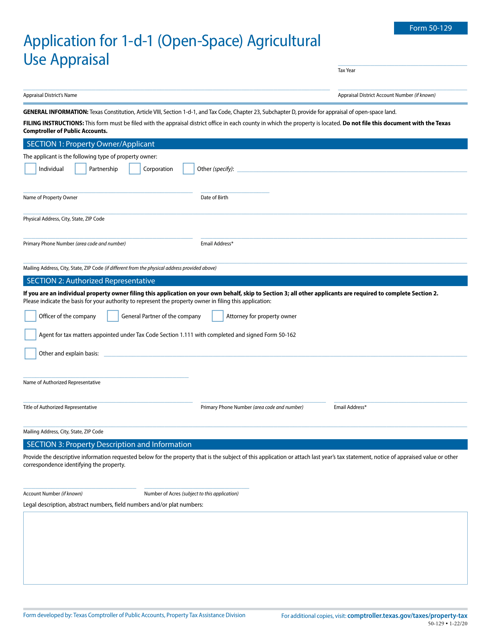

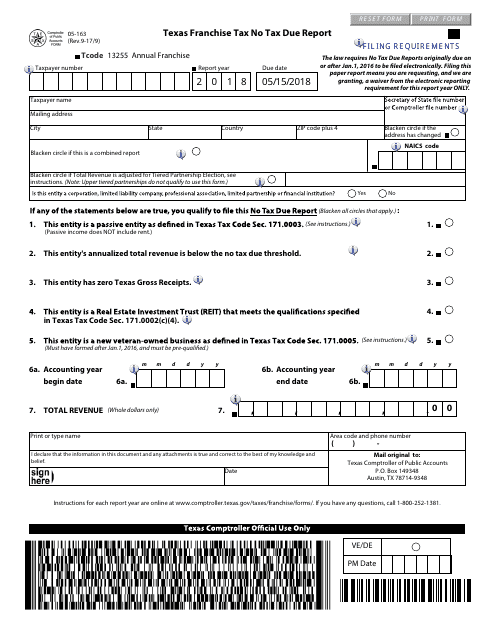

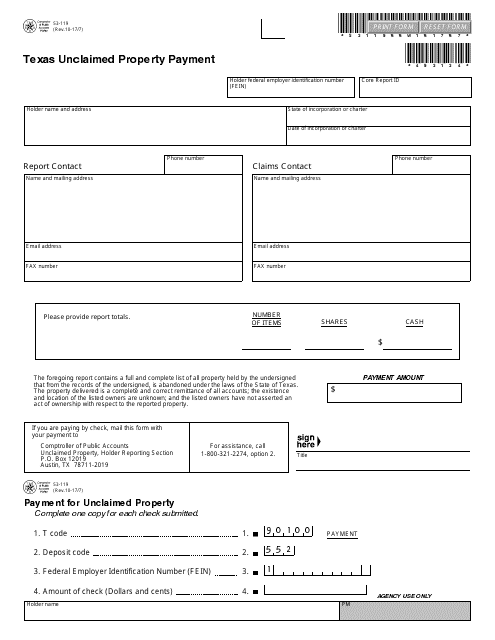

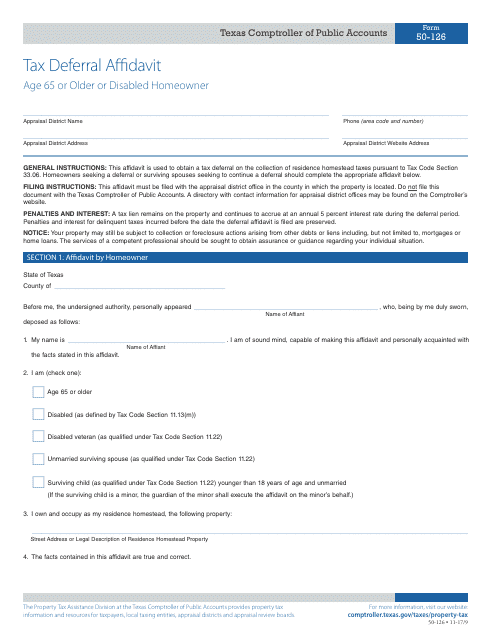

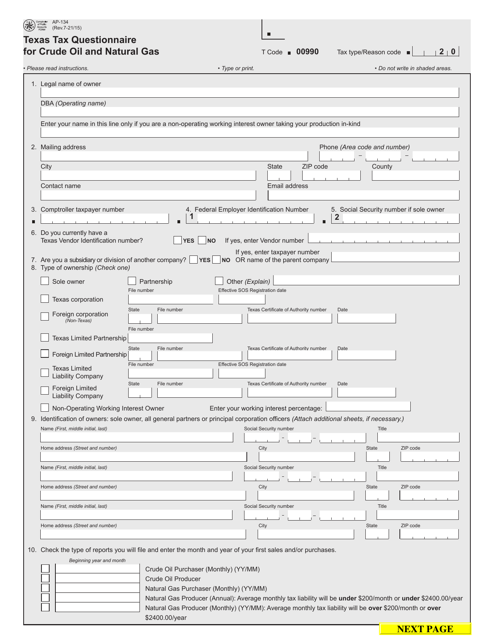

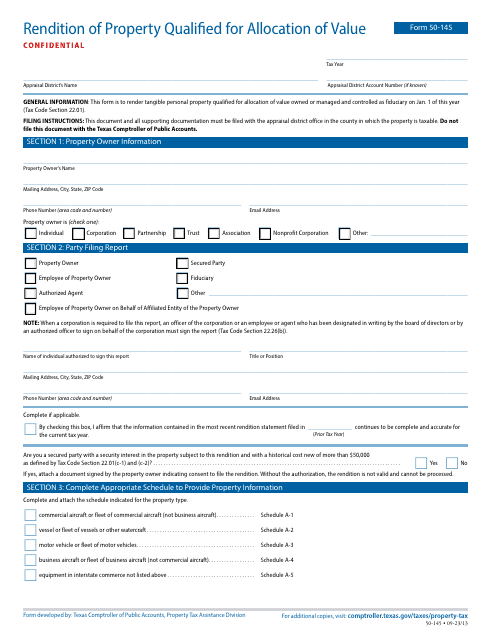

Texas Tax Forms are official documents that individuals and businesses in the state of Texas use to report and pay their taxes. These forms cover various types of taxes, including sales tax, property tax, franchise tax, and income tax, among others. They provide a standardized way for taxpayers to calculate and report their tax obligations to the Texas Comptroller of Public Accounts. Each form is specific to a particular tax type and provides instructions and fields to enter the required information.

Documents:

279

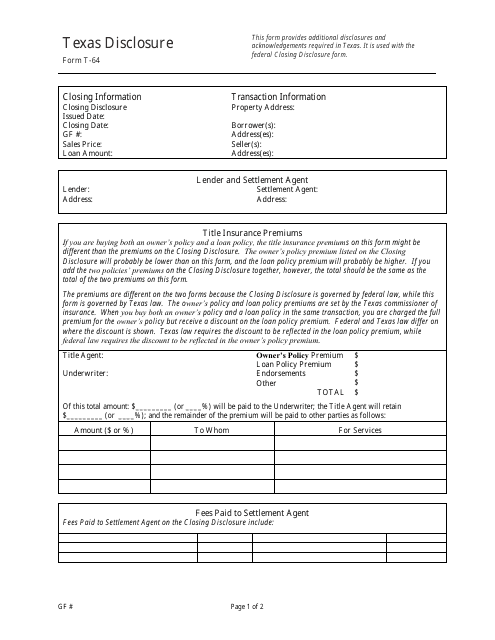

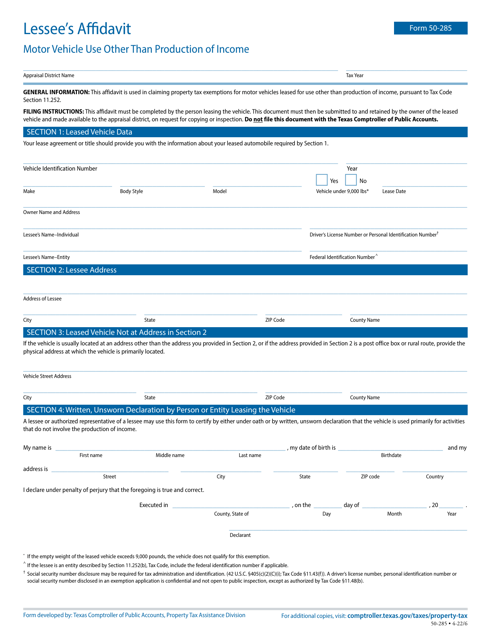

This form is used for disclosing certain information related to a vehicle transaction in the state of Texas. It provides details about the vehicle's history and any known issues or damages.

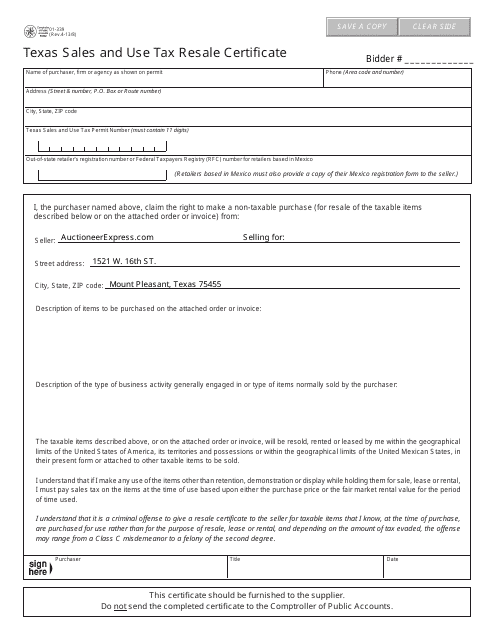

This is a legal form presented by a purchaser to a seller from whom the purchaser buys the goods with the purpose of resale in the state of Texas.

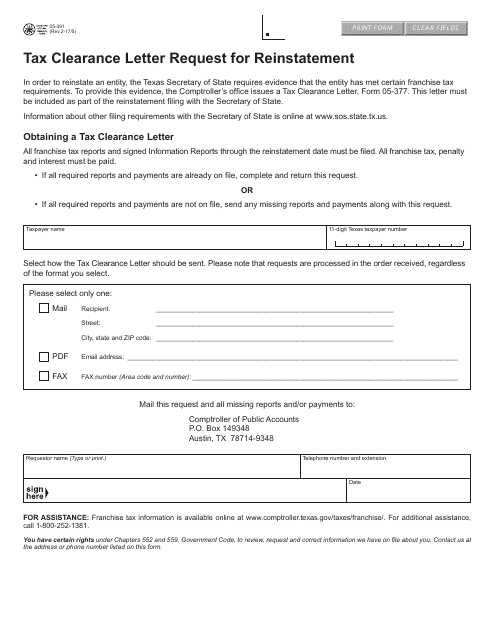

This form is used for requesting a tax clearance letter for reinstatement in the state of Texas.

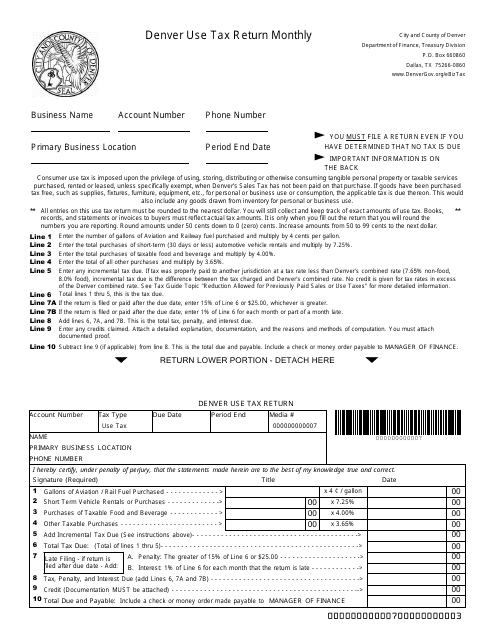

This Form is used for reporting and paying monthly use tax to the City and County of Denver, Texas.

This Form is used for submitting quarterly occupational privilege tax return to the City and County of Denver, Texas.

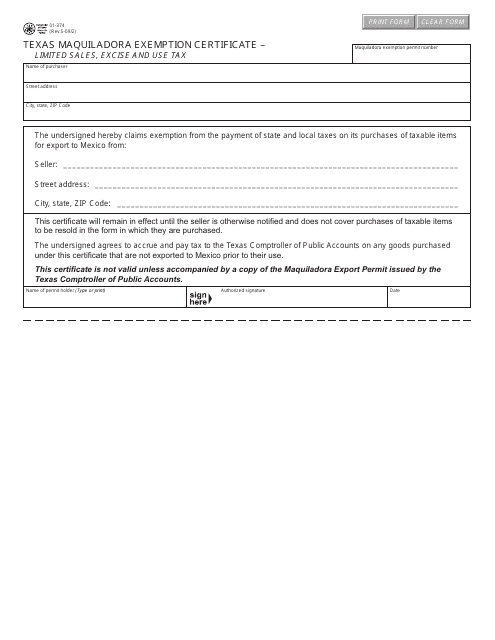

This form is used for businesses operating in Texas to claim exemption from certain taxes for goods produced in a maquiladora (manufacturing facility) in Mexico.

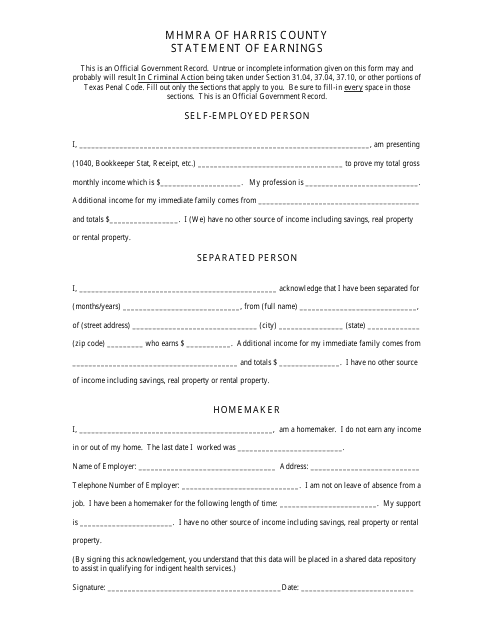

This form is used in Texas to provide a statement of earnings. It is used to report and document an individual's income and earnings.

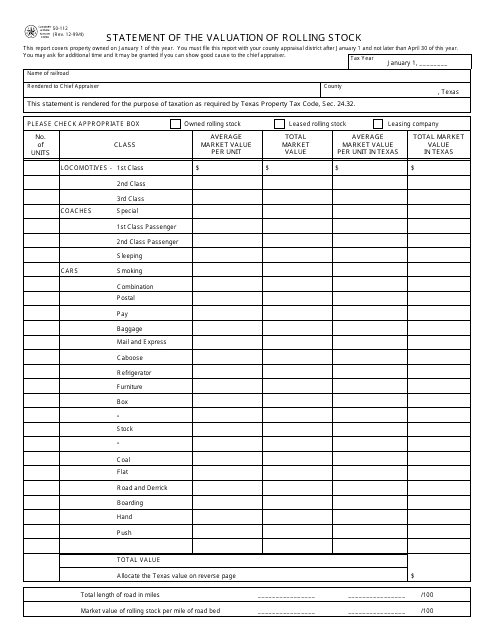

This form is used for reporting the valuation of rolling stock, such as locomotives and freight cars, in the state of Texas.

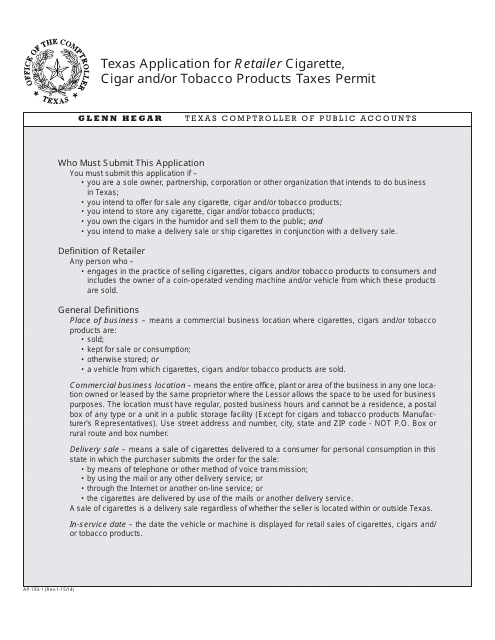

This Form is used for applying for a permit to sell cigarettes, cigars, and/or tobacco products in the state of Texas.

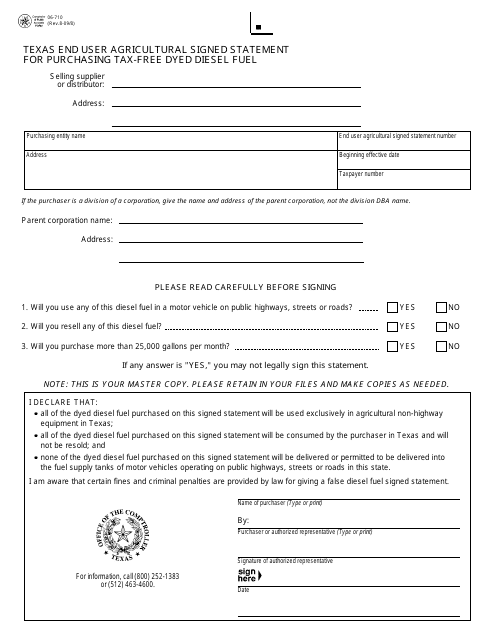

This form is used for Texas residents who are purchasing tax-free dyed diesel fuel for agricultural purposes. The form must be signed by the end user as a statement of eligibility.

This is a legal document completed by a taxable entity that does not owe any taxes to the State of Texas for the report year. This form was released by the Texas Comptroller of Public Accounts.

This form is used for making a payment related to unclaimed property in the state of Texas. It helps individuals or businesses to submit payments for abandoned or unclaimed property to the Texas Comptroller's office.

This form is used for requesting a tax deferral for homeowners in Texas who are 65 years or older or who have a disability.

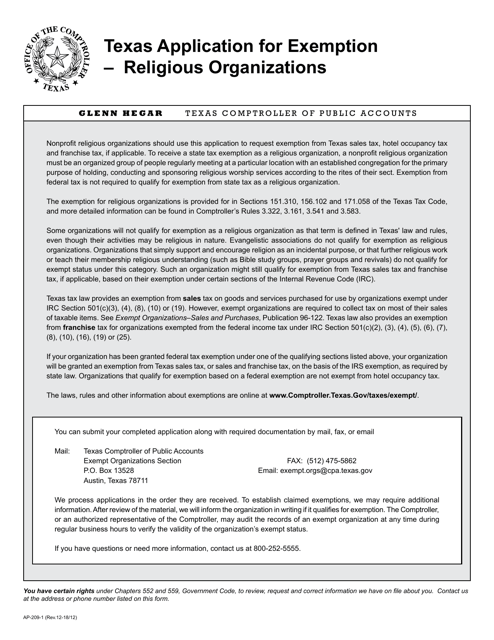

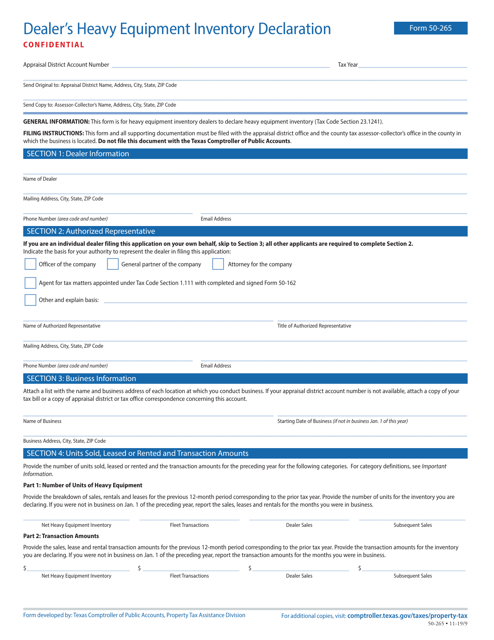

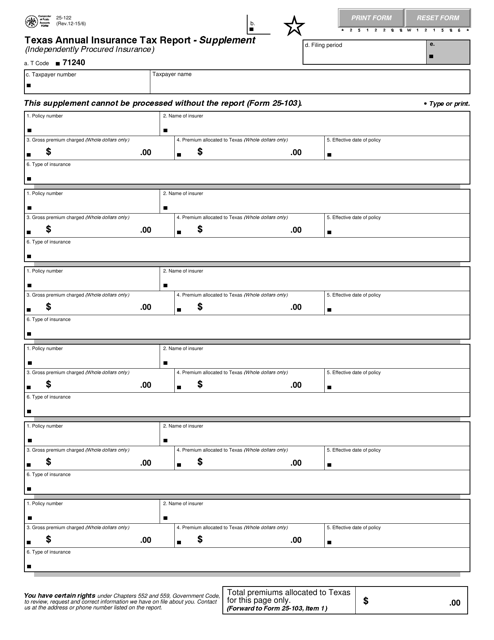

This form is used for organizations primarily engaged in performing charitable functions and for corporations that hold title to property for such organizations in Texas. It is an application form for these types of organizations to apply for certain exemptions and benefits.

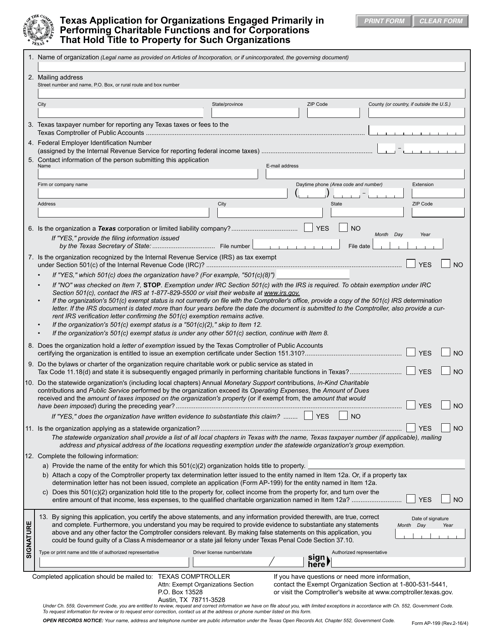

This document is used for filing the annual insurance tax report in the state of Texas. It serves as a supplement to the main tax report form.

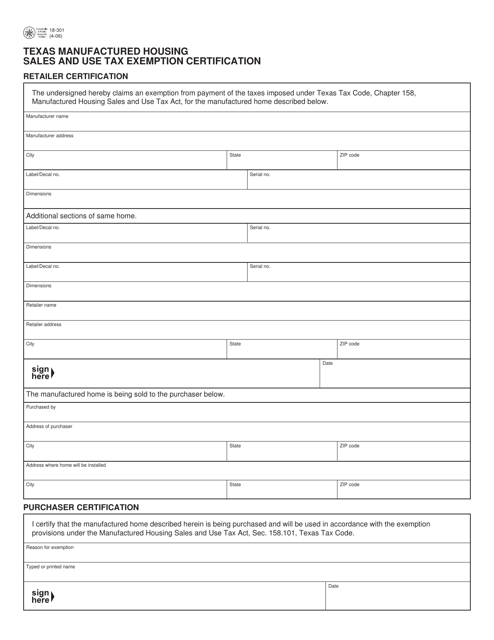

This form is used for obtaining a sales and use tax exemption for the purchase of manufactured housing in the state of Texas.

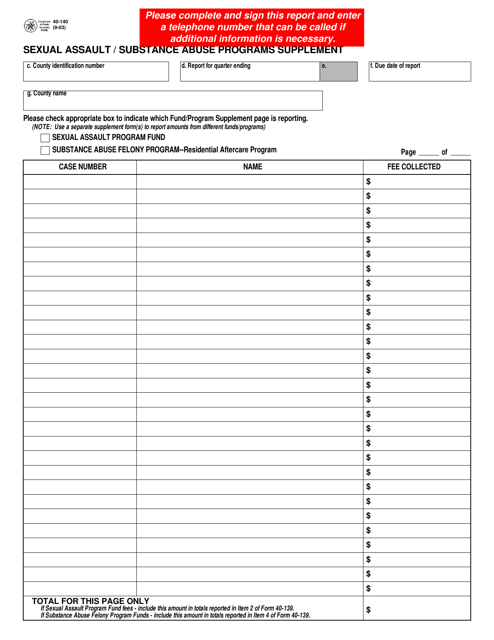

This form is used for reporting sexual assault and substance abuse programs in Texas.

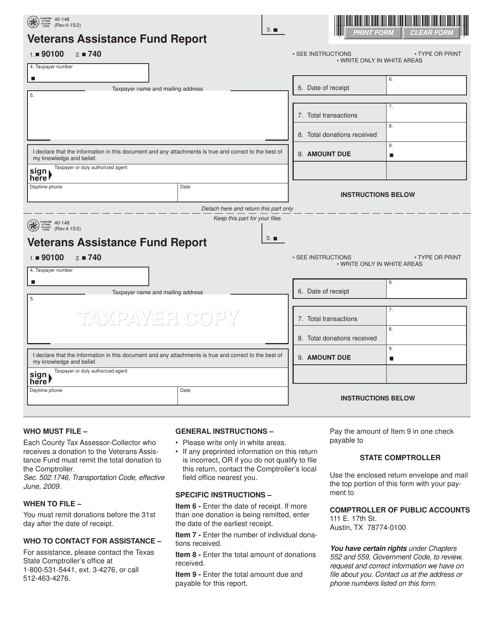

This form is used for reporting funds received and distributed by the Veterans Assistance Fund in Texas.

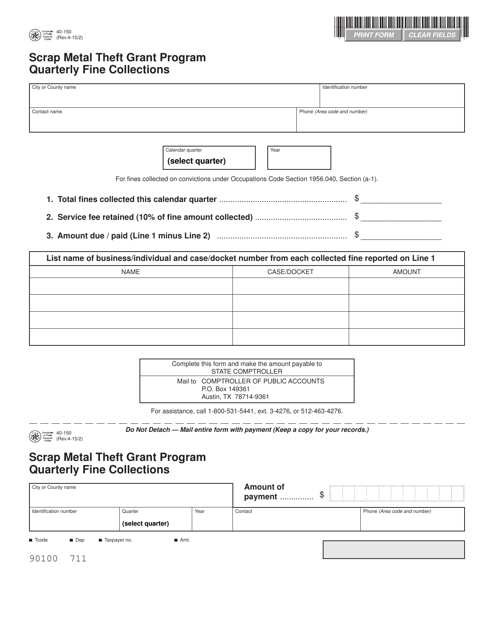

This document is for reporting fine collections under the Scrap Metal Theft Grant Program in Texas on a quarterly basis.

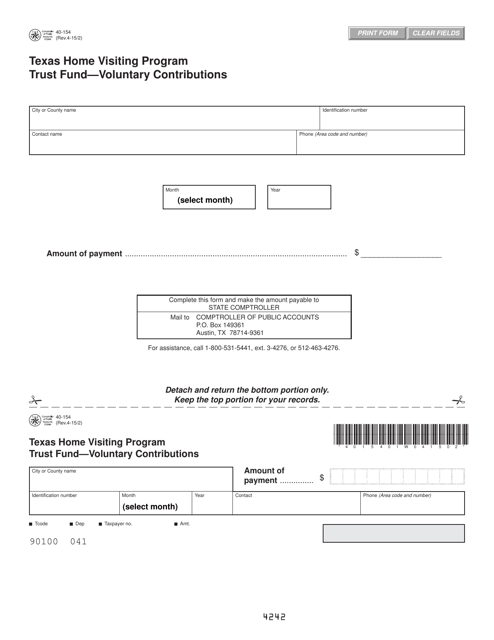

This form is used for making voluntary contributions to the Texas Home Visiting Program Trust Fund in Texas.

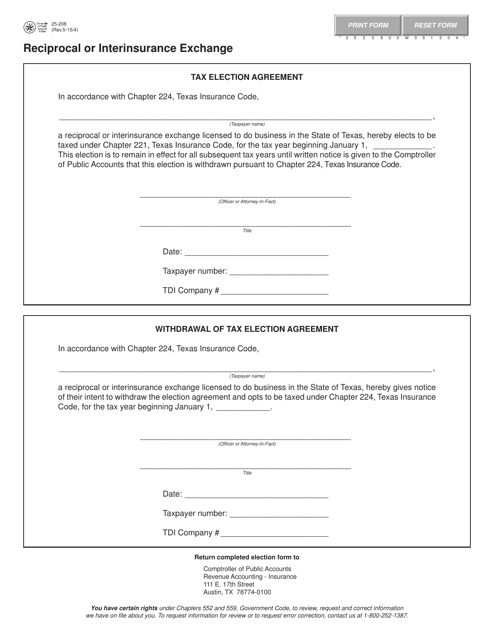

This form is used for reciprocal or interinsurance exchanges in the state of Texas.

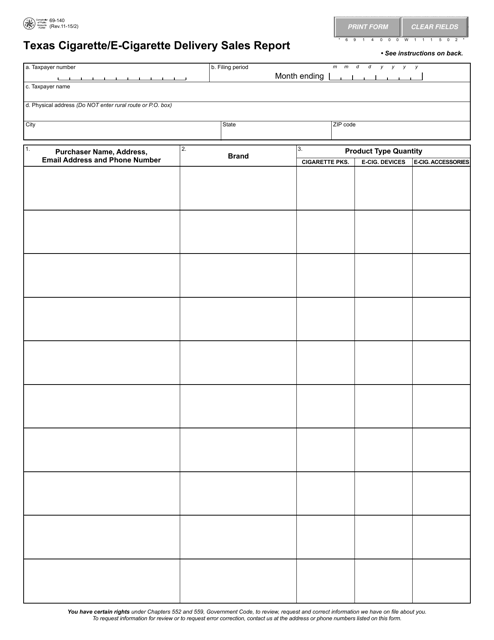

This form is used for reporting sales of cigarettes and e-cigarettes made through delivery in the state of Texas.

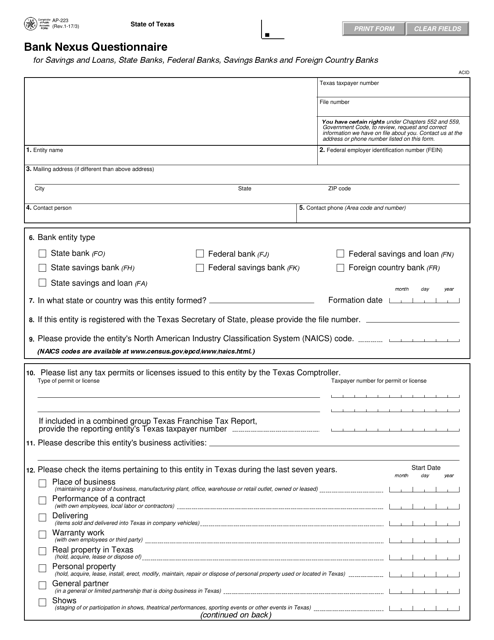

This Form is used for submitting a Bank Nexus Questionnaire in Texas.

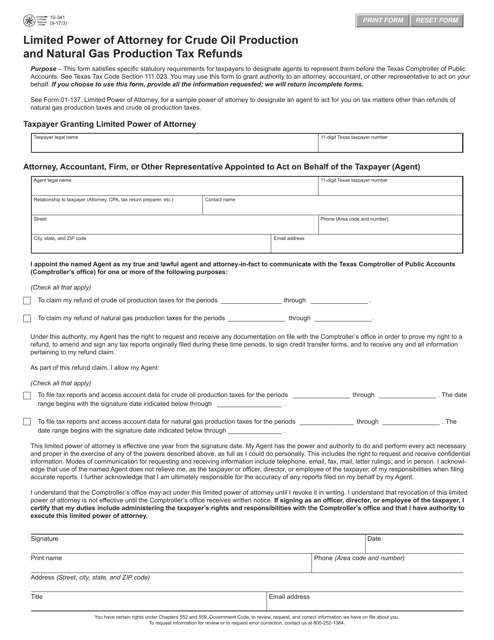

This form is used for granting limited power of attorney to handle crude oil and natural gas production tax refunds in Texas.

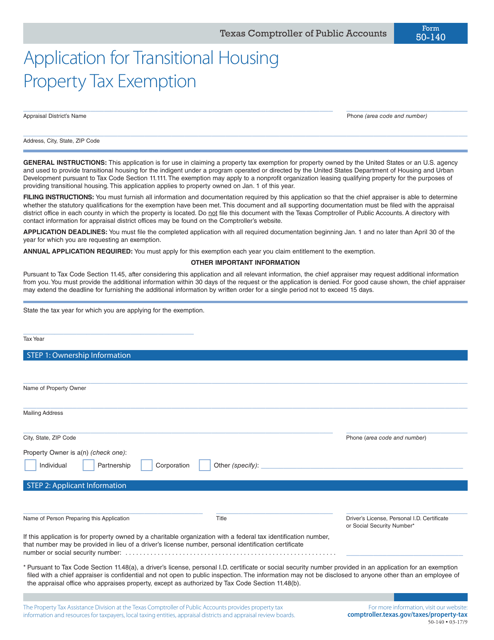

This Form is used for applying for the Transitional Housing Property Tax Exemption in Texas.

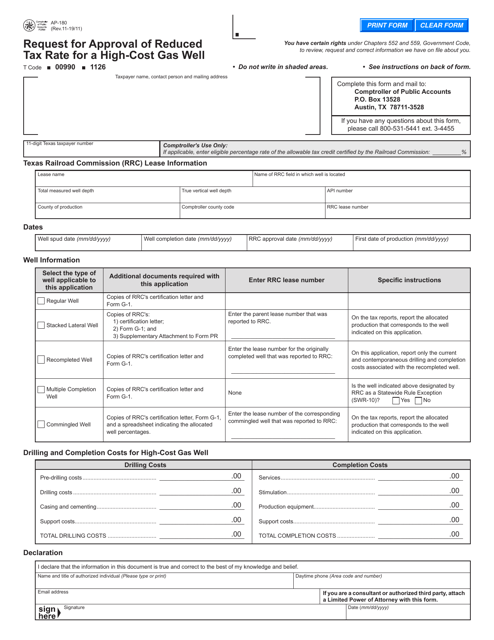

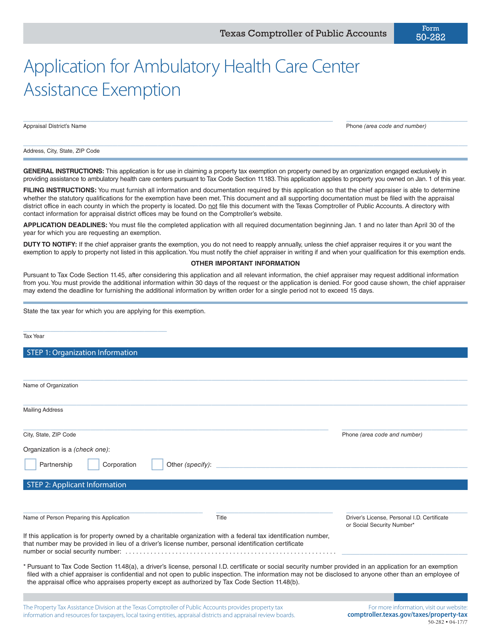

This form is used for applying for an exemption from ambulatory health care center assistance in Texas.

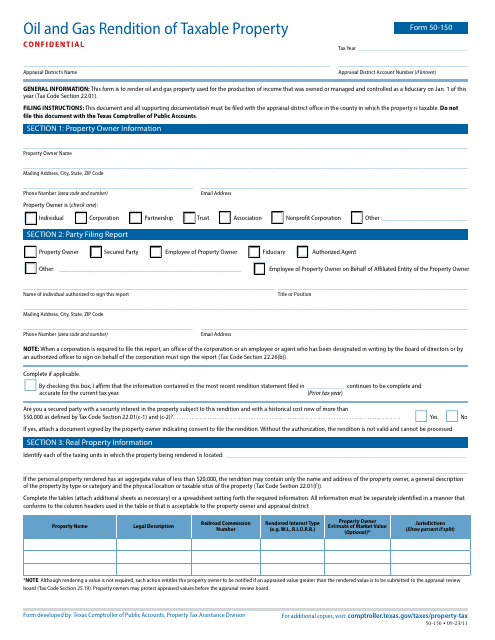

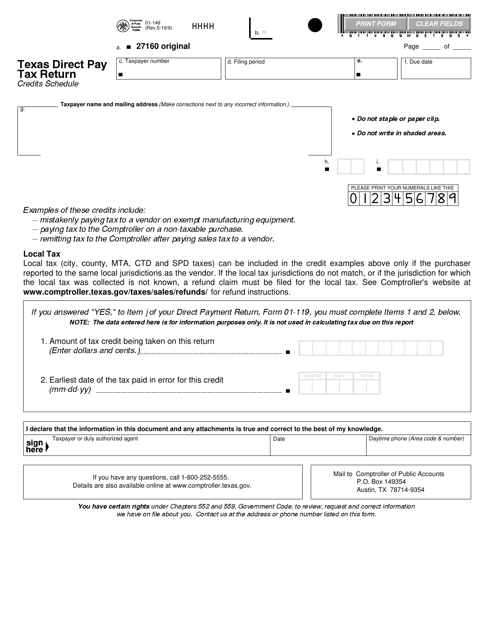

This form is used for reporting and claiming tax credits on the Texas Direct Pay Tax Return.

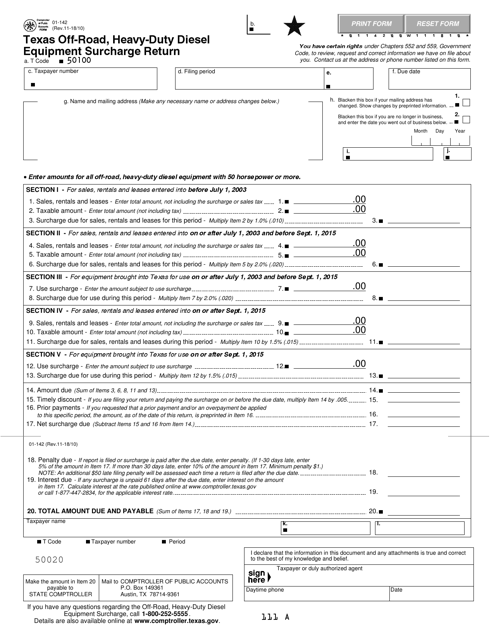

This form is used for reporting and paying the Texas Off-Road Heavy-Duty Diesel Equipment Surcharge. Individuals and businesses that operate off-road heavy-duty diesel equipment in Texas are required to submit this form and make the necessary surcharge payments. This document helps the state of Texas manage and collect surcharges for heavy-duty diesel equipment.