Texas Tax Forms and Templates

Documents:

279

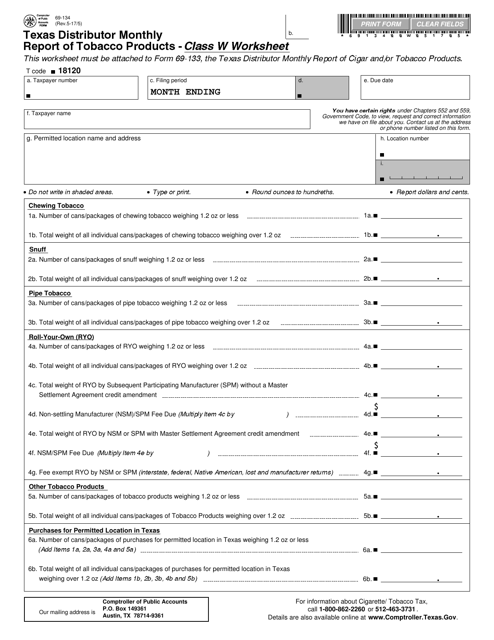

This form is used for Texas distributors to report their monthly sales of tobacco products. It is specifically for Class W products.

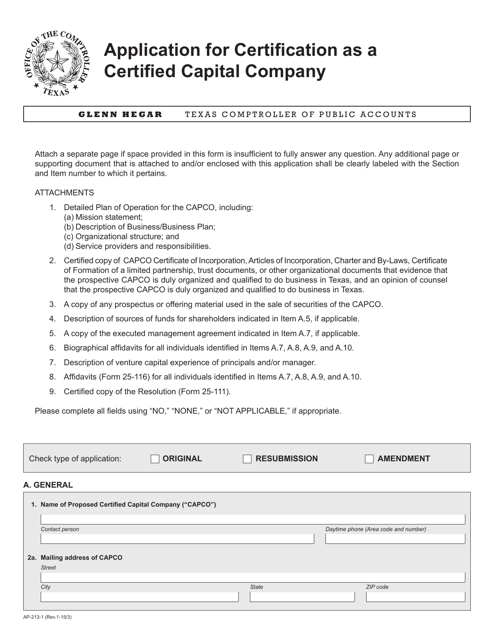

This Form is used for applying for certification as a Certified Capital Company in the state of Texas.

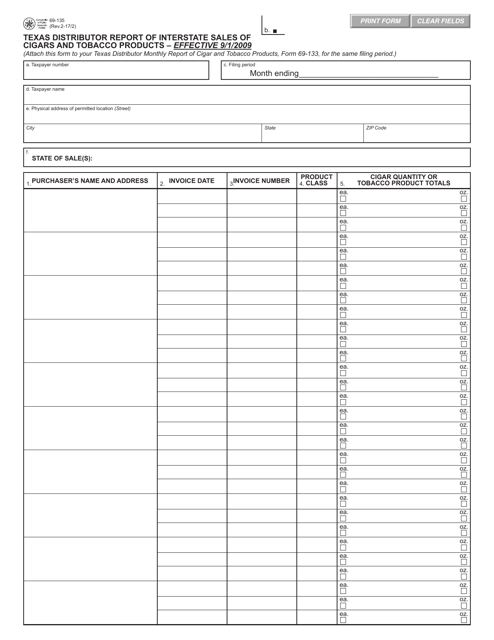

This form is used for reporting interstate sales of cigars and tobacco products in Texas.

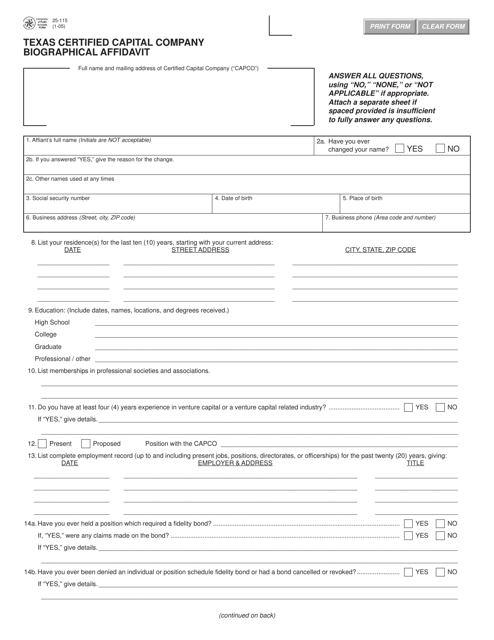

This form is used for submitting biographical information for certification as a capital company in Texas.

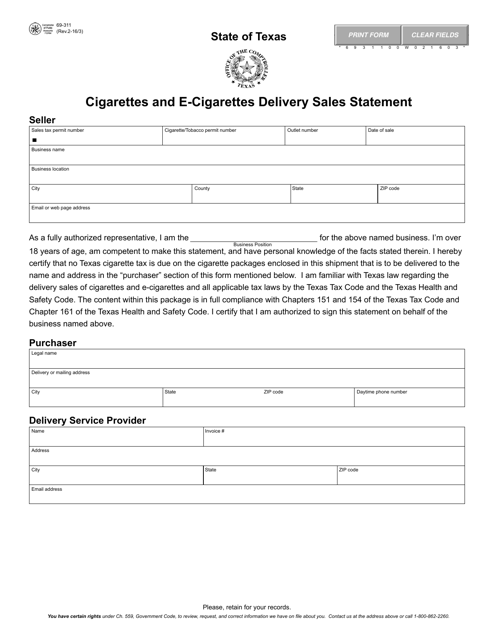

This document is used for reporting cigarette and e-cigarette delivery sales in Texas. It ensures compliance with state regulations for selling these products.

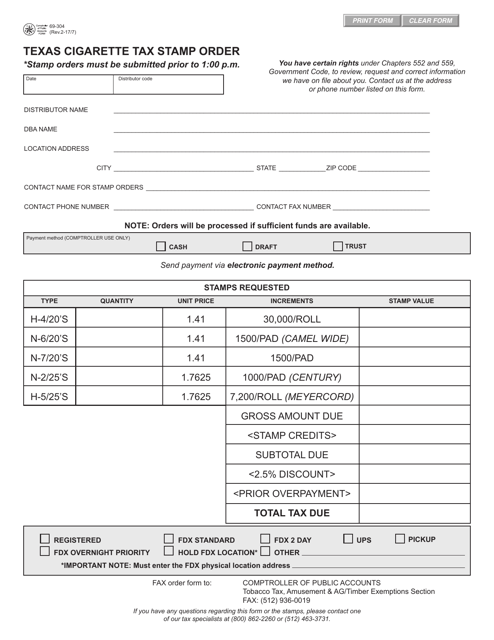

This form is used for ordering Texas cigarette tax stamps. The stamps are required for retailers to affix to each pack of cigarettes sold in Texas. This helps enforce the collection of cigarette taxes and ensures compliance with state regulations.

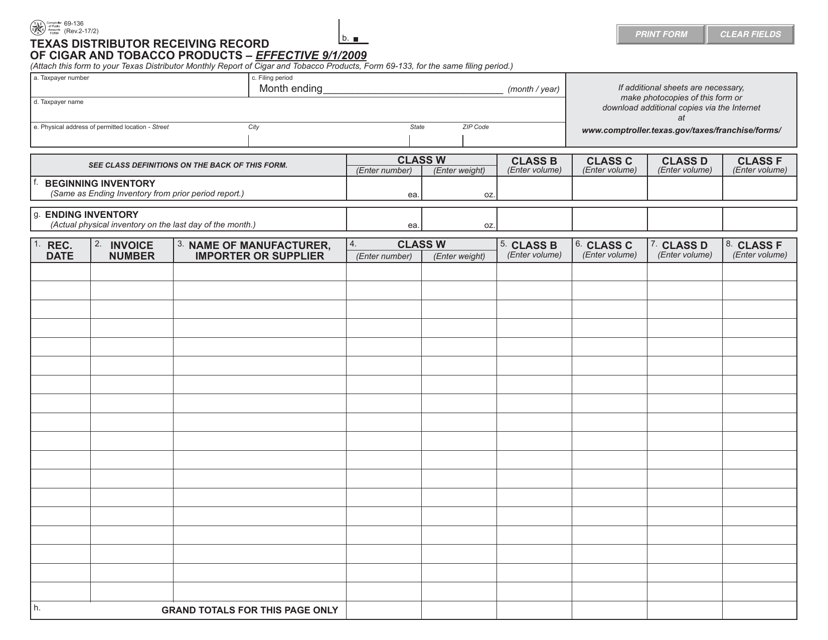

This document is used for recording the receipt of cigar and tobacco products by distributors in Texas.

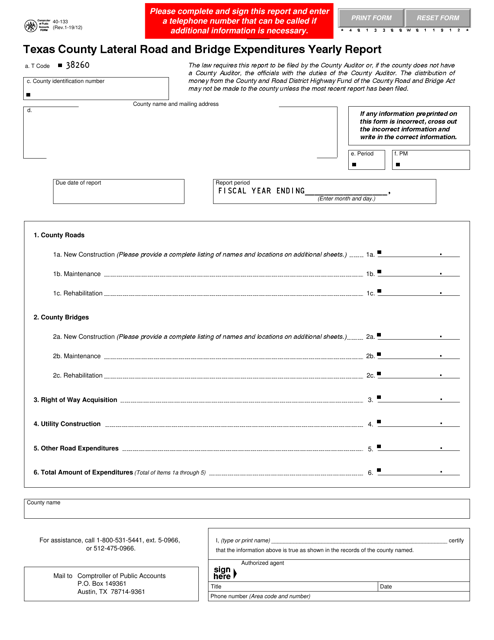

This document is a form used in Texas for reporting yearly expenditures for county lateral road and bridge projects.

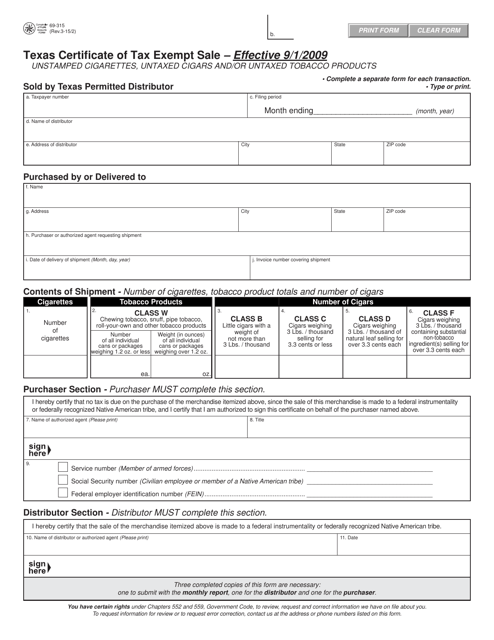

This form is used for reporting and certifying tax exempt sales in the state of Texas. It is necessary for businesses and organizations that are exempt from paying sales tax to provide this form to the seller during a qualifying transaction.

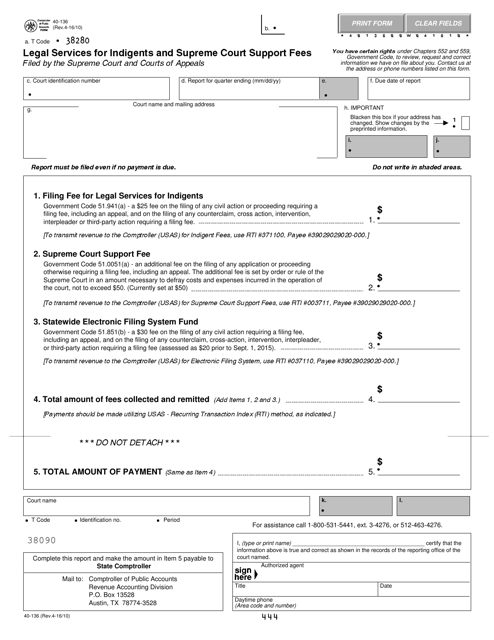

This form is used for applying for legal services for indigents and seeking support fees from the Supreme Court in Texas.

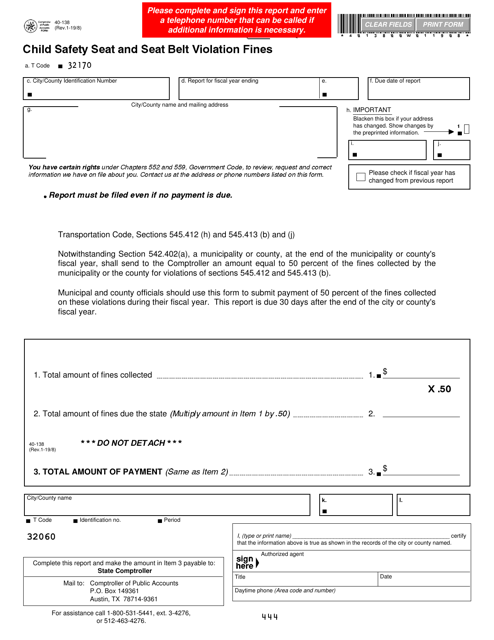

This Form is used for reporting child safety seat and seat belt violation fines in Texas.

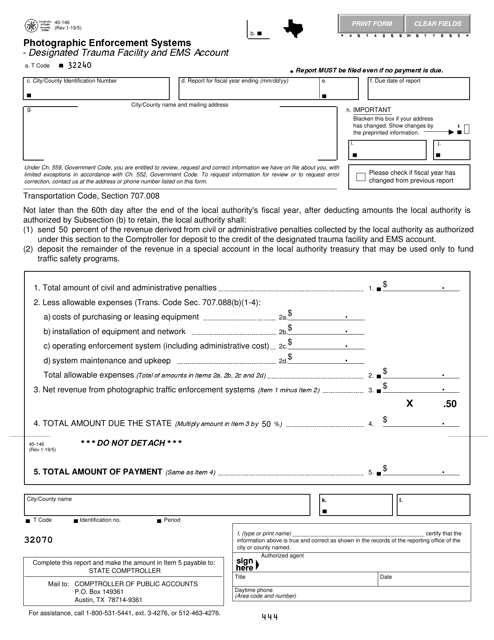

This Form is used for applying to become a designated trauma facility and EMS account holder in Texas if you have a photographic enforcement system.

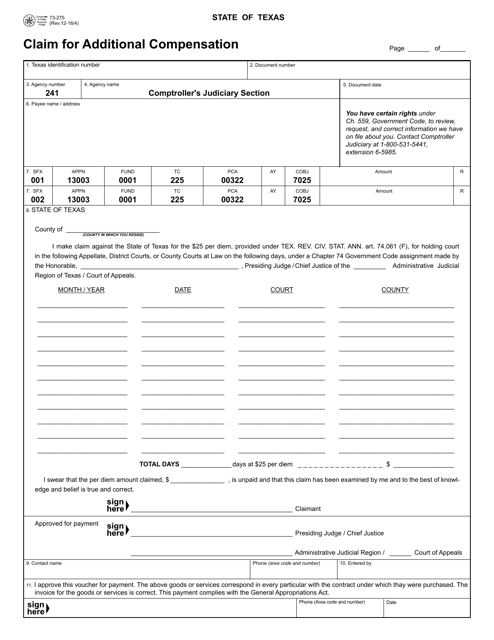

This Form is used for filing a claim for additional compensation in the state of Texas.

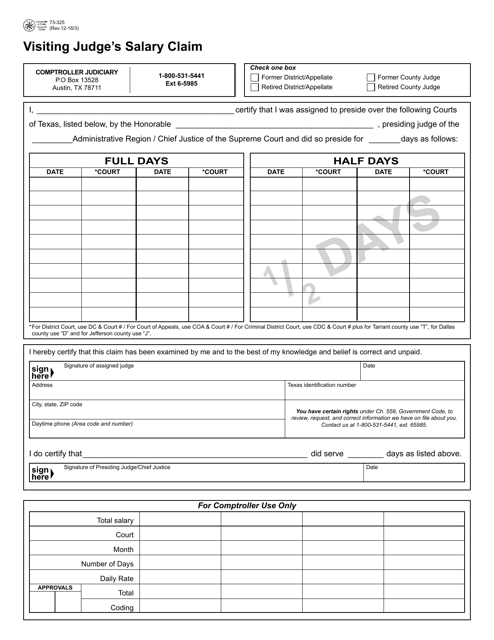

This form is used for visiting judges in Texas to claim their salary.

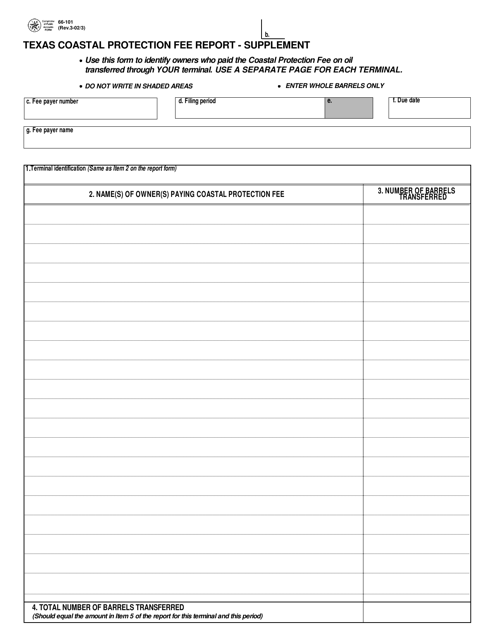

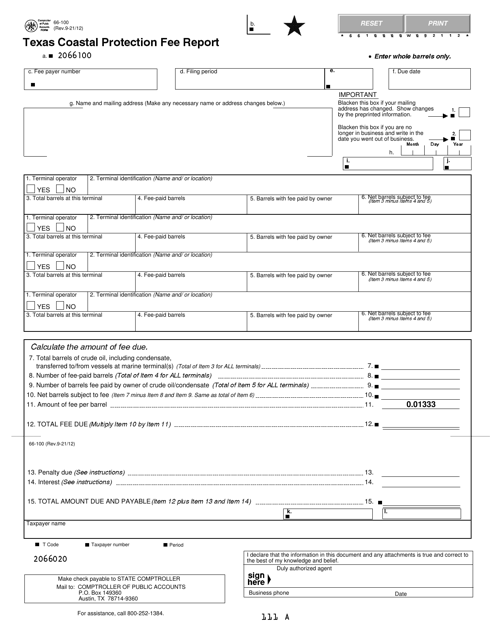

This document is a supplementary report for the Texas Coastal Protection Fee. It is used to provide additional information related to the fee.

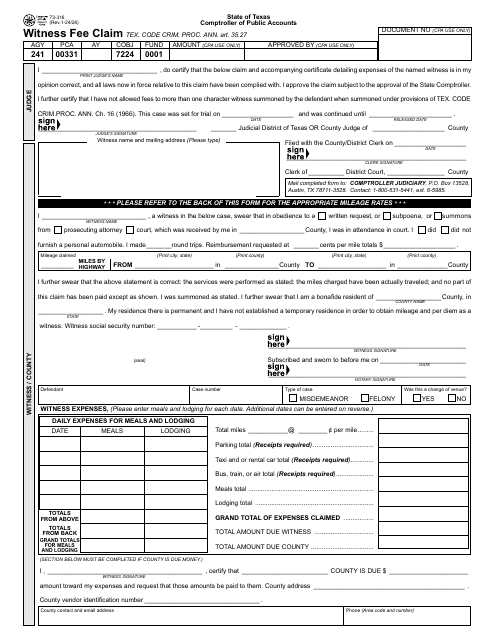

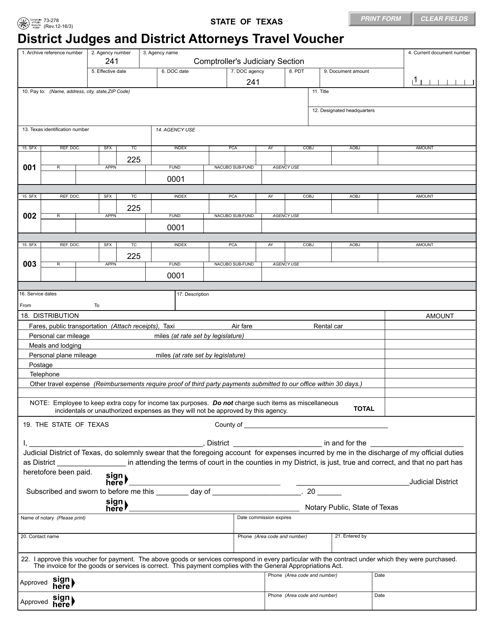

This form is used for District Judges and District Attorneys in Texas to submit travel expenses for reimbursement.

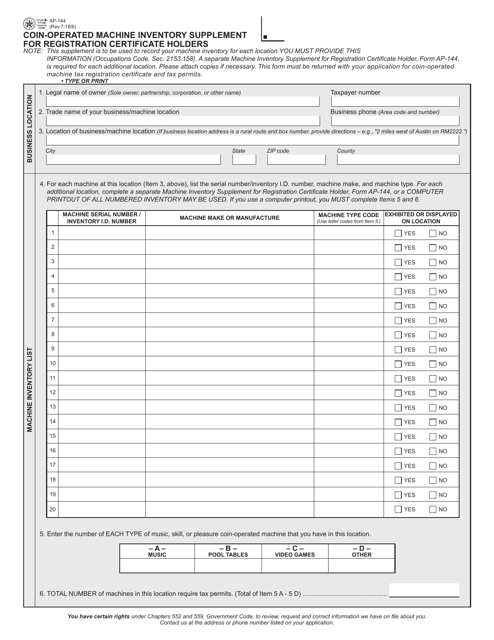

This form is used for Texas registration certificate holders to provide a supplement for their coin-operated machine inventory.

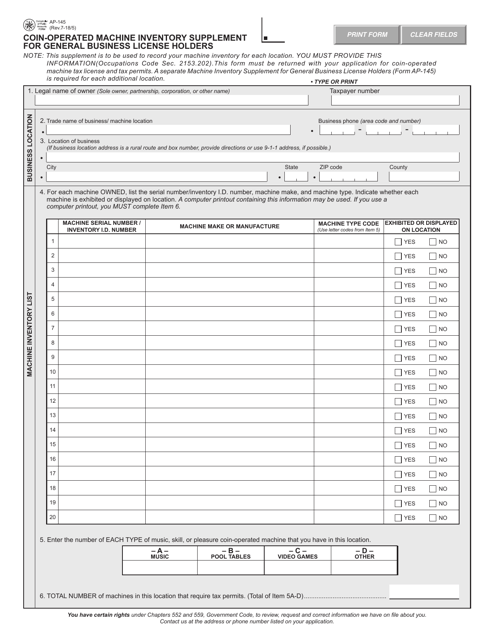

This form is used for general business license holders in Texas to supplement their inventory of coin-operated machines. It helps businesses maintain accurate records of their machines for licensing purposes.

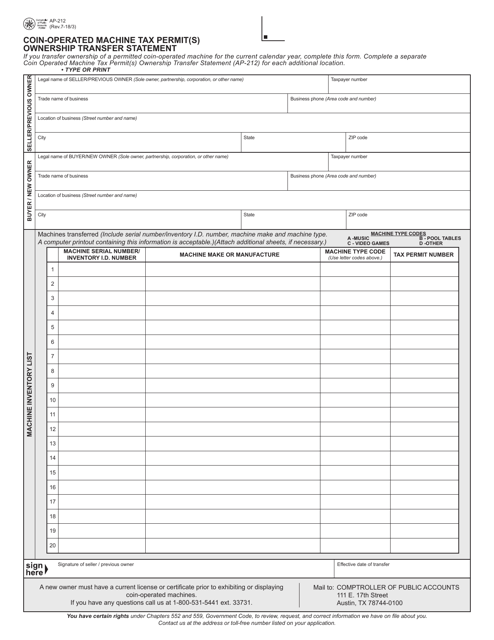

This document is used for transferring ownership of a coin-operated machine tax permit(s) in Texas.

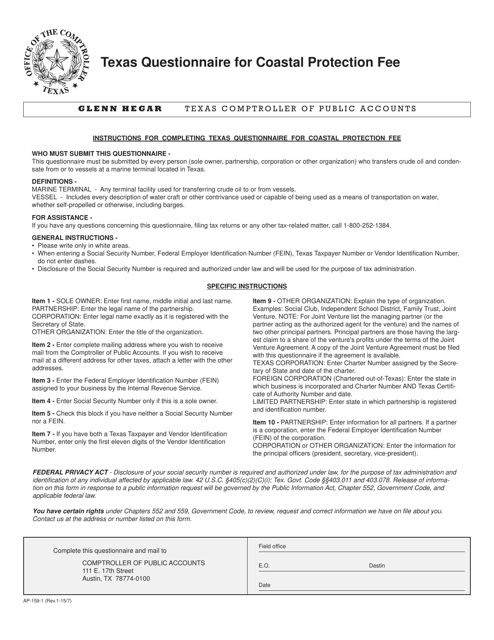

This Form is used for the Texas Questionnaire for Coastal Protection Fee in the state of Texas. It helps in determining the amount of fee payable for coastal protection.

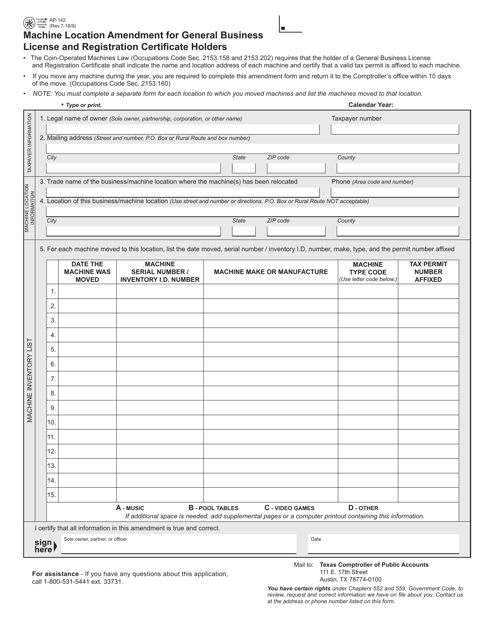

This form is used for general business license and registration certificate holders in Texas to amend the machine location.

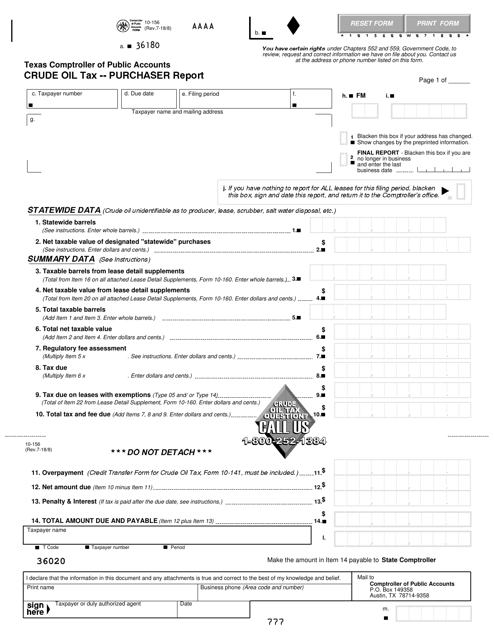

This form is used for reporting crude oil taxes in Texas for purchasers.

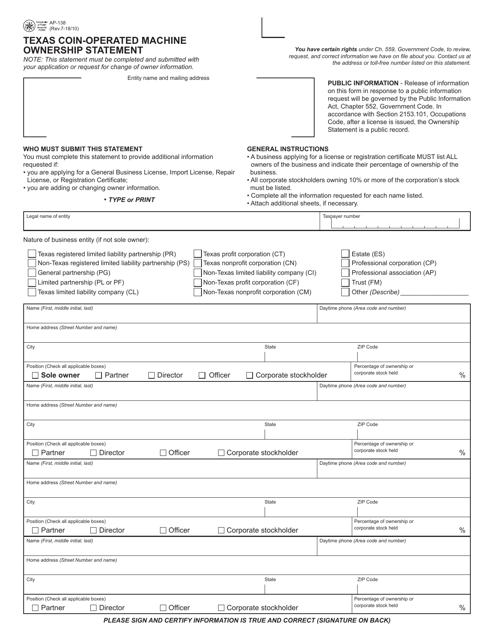

This document is used for filing a statement of ownership for coin-operated machines in Texas.

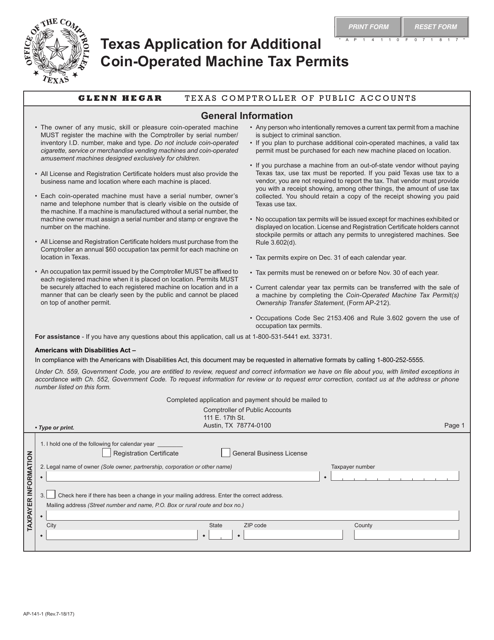

This form is used for applying for additional coin-operated machine tax permits in the state of Texas.

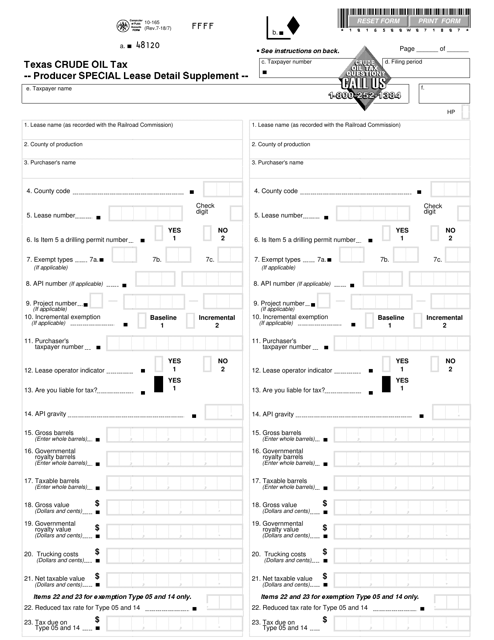

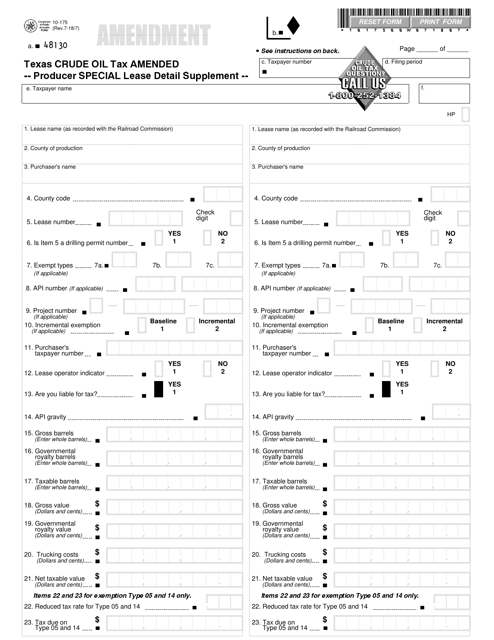

This Form is used for providing additional details about special lease agreements and taxes related to crude oil production in Texas.

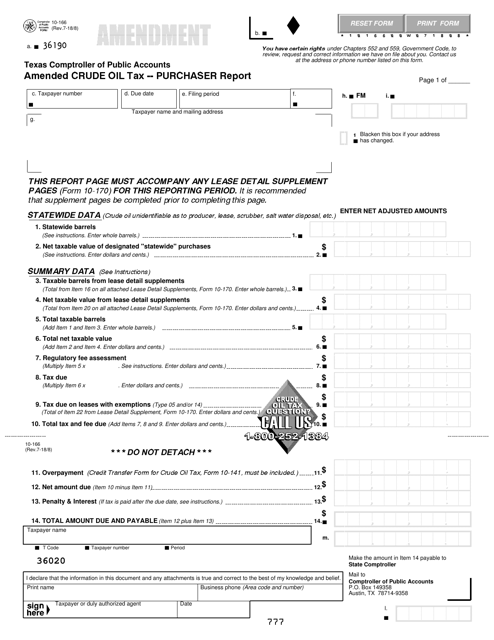

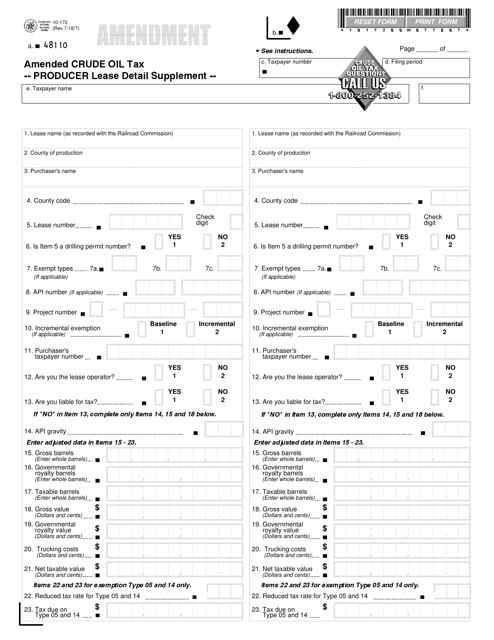

This form is used for reporting amended crude oil tax purchases in Texas.

This Form is used for providing additional information regarding special lease details for amending Texas crude oil tax for producers.

This form is used for providing additional details about the producer lease related to crude oil tax in Texas.

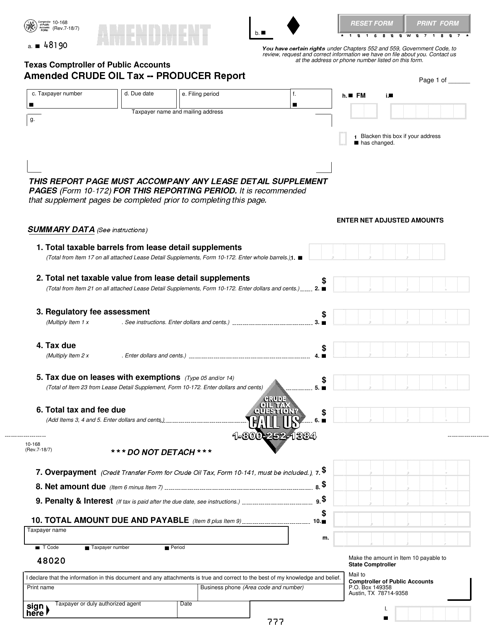

This type of document is used by crude oil producers in Texas to report amended tax information for crude oil production.

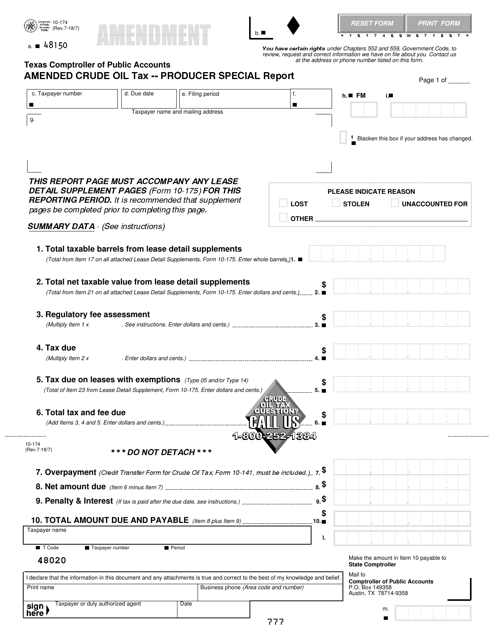

This Form is used for reporting amendments to the Crude Oil Tax Producer Special Report in Texas.