Ohio Tax Forms and Templates

Documents:

265

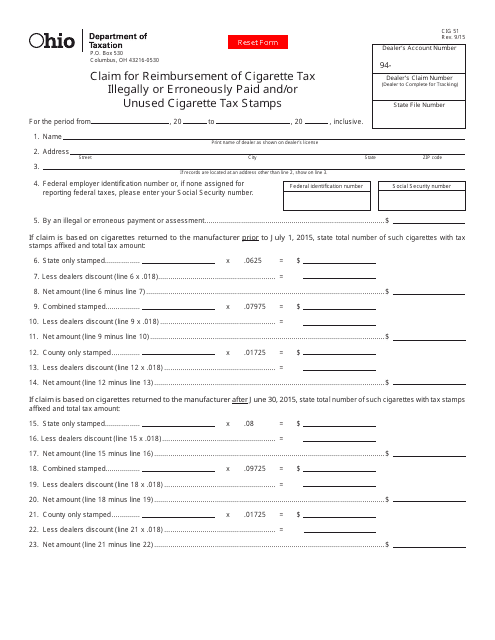

This Form is used for claiming reimbursement of cigarette tax illegally or erroneously paid and/or unused cigarette tax stamps in the state of Ohio.

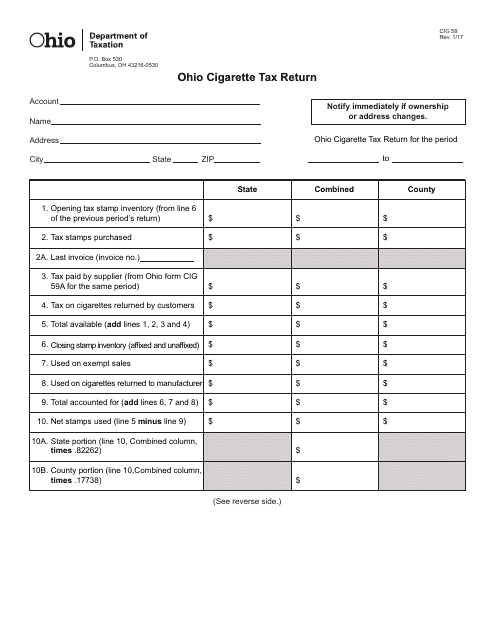

This Form is used for reporting and paying cigarette tax in the state of Ohio.

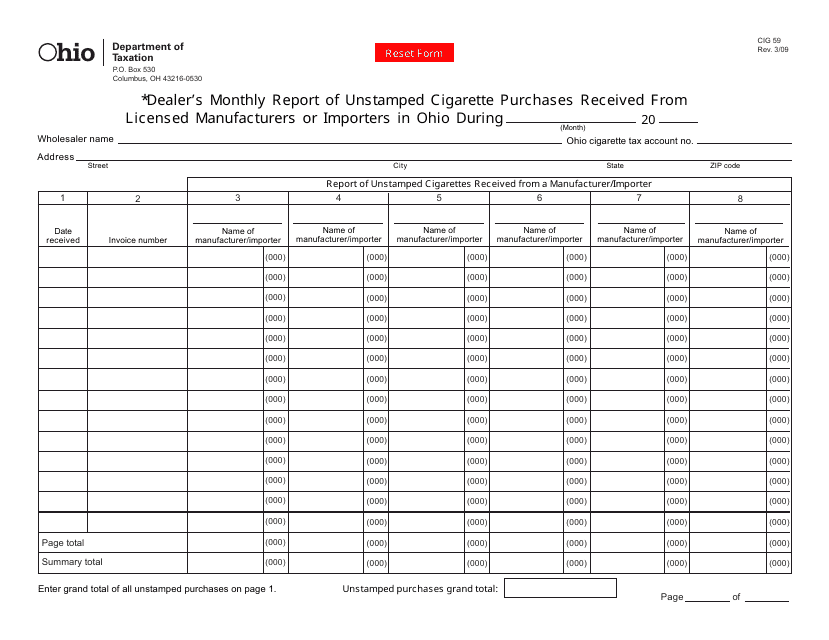

This form is used for dealers in Ohio to report the monthly quantity of unstamped cigarettes they have received.

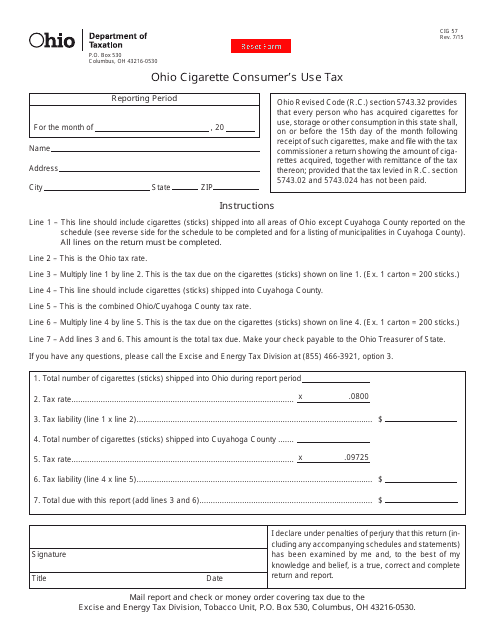

This Form is used for reporting and paying the Ohio Cigarette Consumer's Use Tax for consumers who have purchased cigarettes from out-of-state retailers.

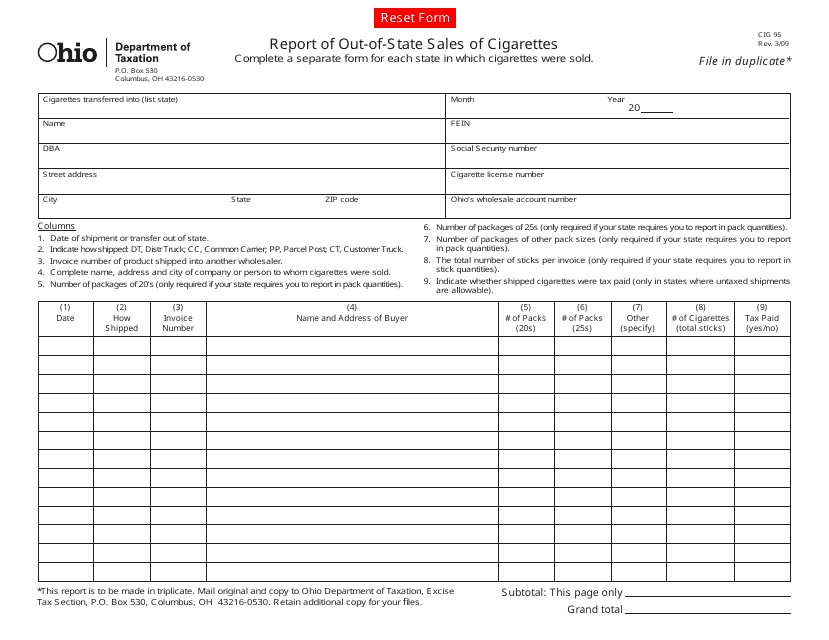

This form is used for reporting out-of-state sales of cigarettes in Ohio.

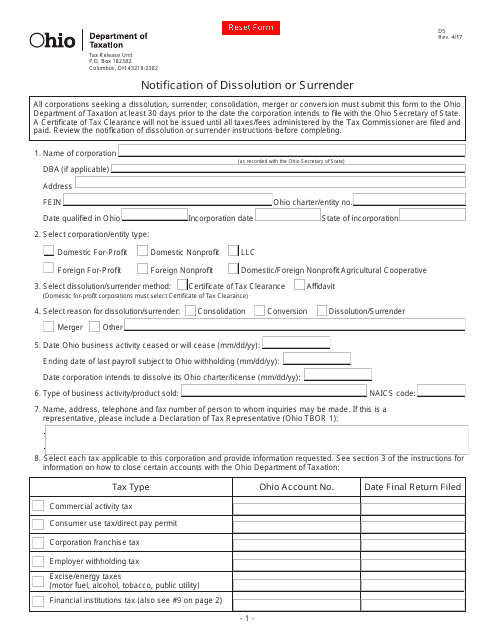

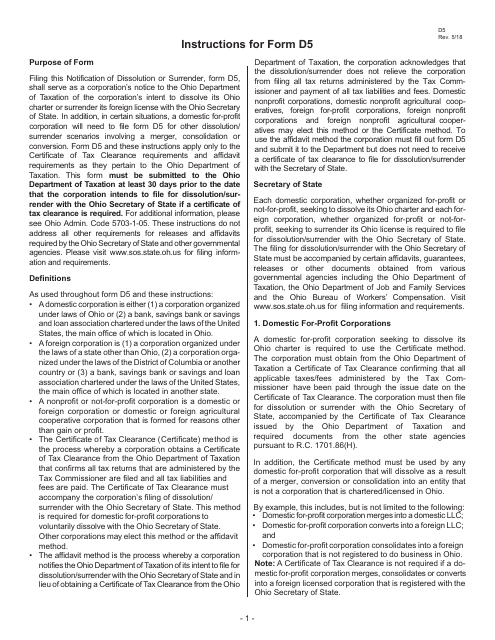

This form is used for notifying the state of Ohio about the dissolution or surrender of a business entity.

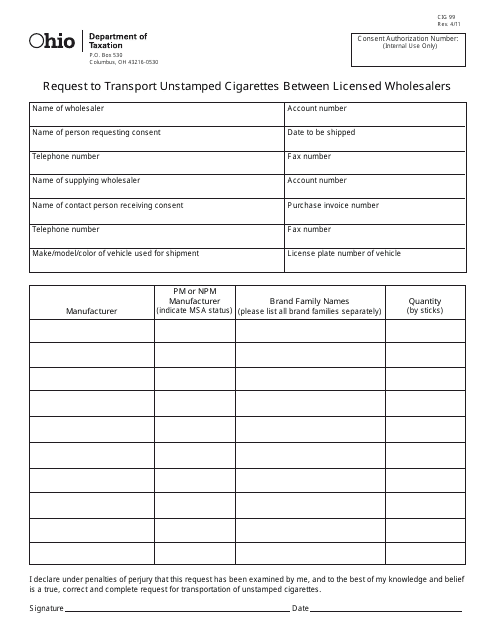

This form is used for requesting permission to transport unstamped cigarettes between licensed wholesalers in the state of Ohio.

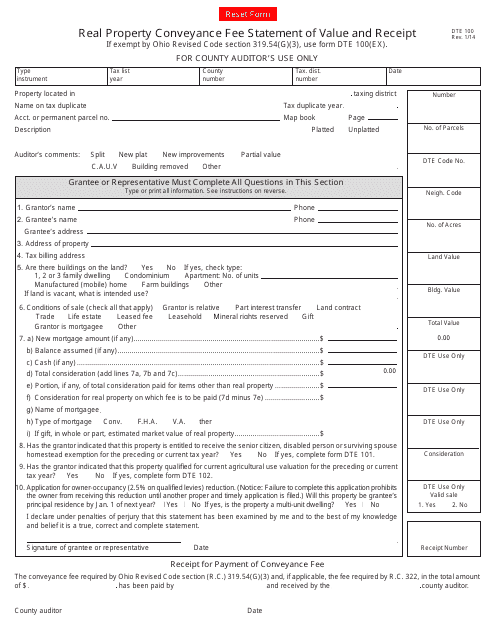

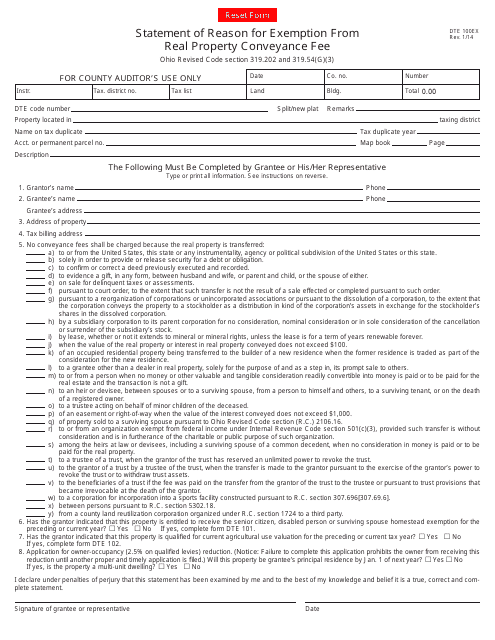

This form is used for reporting the value and receipt of real property conveyance fees in Ohio.

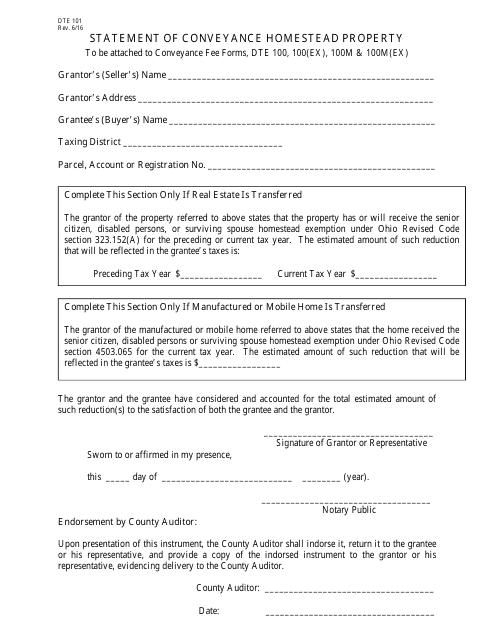

This form is used for submitting a statement of conveyance for homestead property in Ohio.

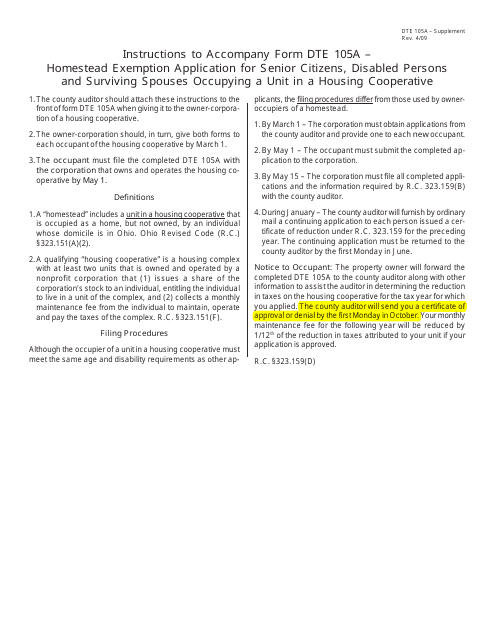

This form is used for applying for the Homestead Exemption in Ohio for senior citizens, disabled persons, and surviving spouses who live in a housing cooperative. It provides instructions on how to complete the application.

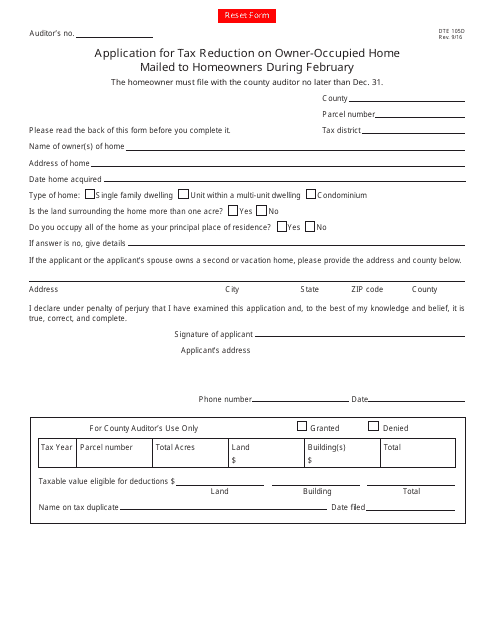

This form is used for applying for a tax reduction on owner-occupied homes in Ohio. It is mailed to homeowners during February.

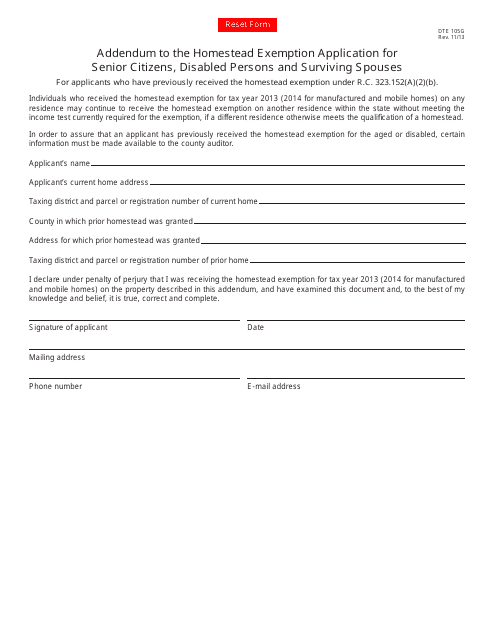

This form is used as an addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses in Ohio. It provides additional information and updates to the original application.

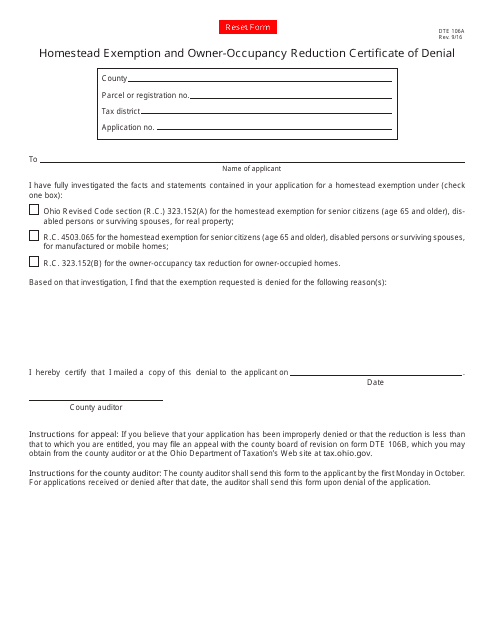

This Form is used for applying for the Homestead Exemption and Owner-Occupancy Reduction Certificate of Denial in Ohio.

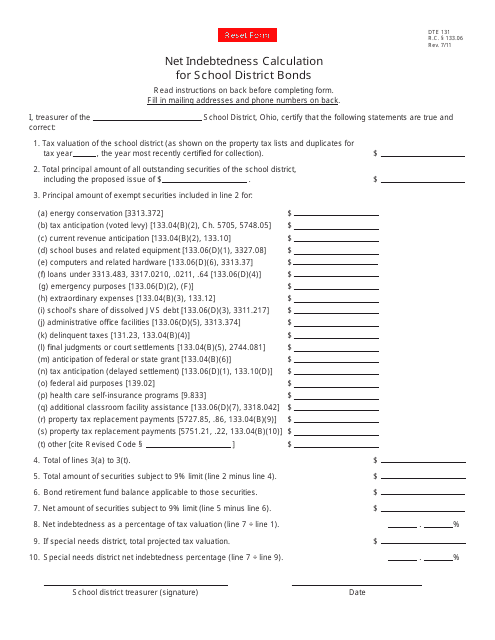

This form is used for calculating the net indebtedness of school district bonds in Ohio.

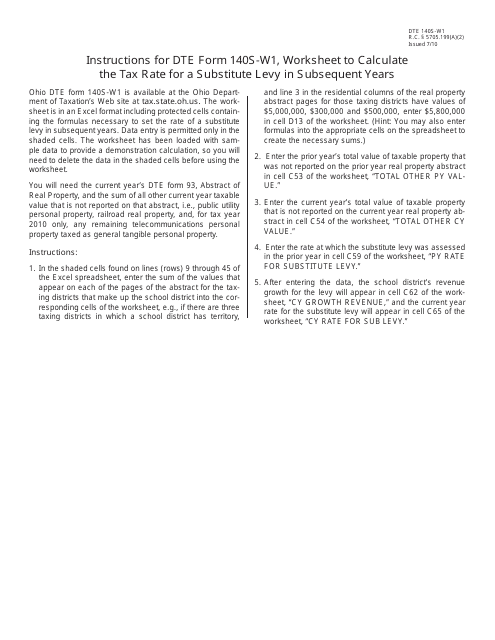

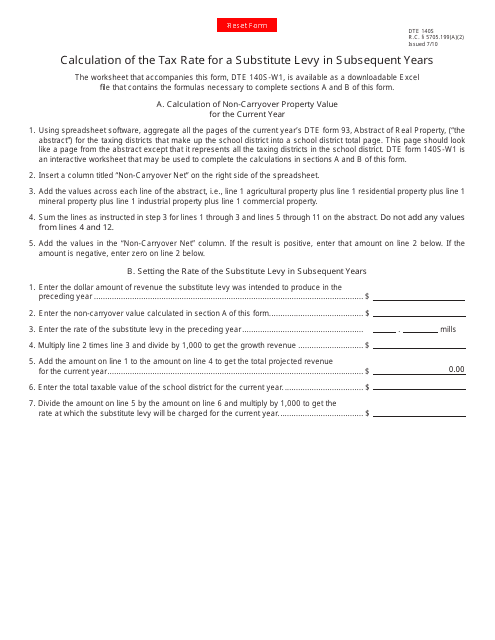

This document provides instructions on how to use Form DTE140S-W1 to calculate the tax rate for a substitute levy in subsequent years in Ohio.

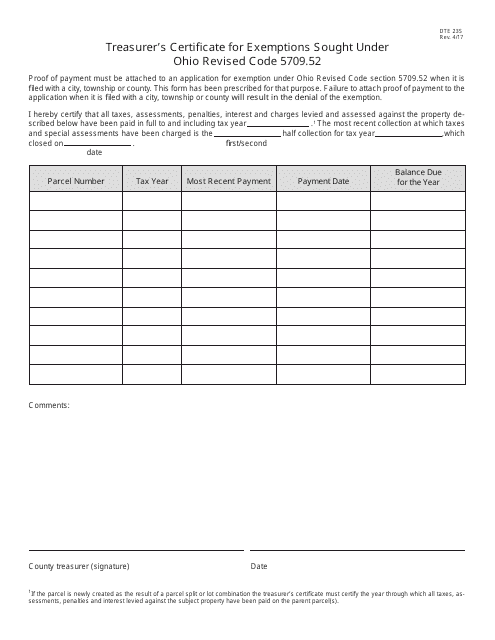

This form is used for requesting exemptions under Ohio Revised Code 5709.52 for treasurer certificate purposes in Ohio.

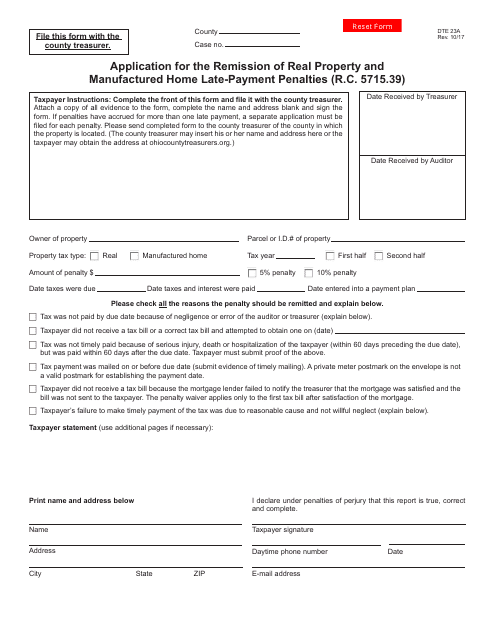

This form is used for applying for the remission of late-payment penalties for real property and manufactured homes in Ohio.

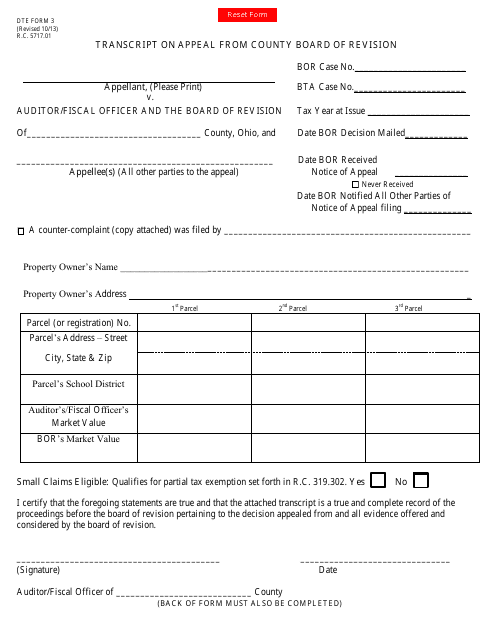

This form is used for filing a transcript of appeal from the County Board of Revision in Ohio.

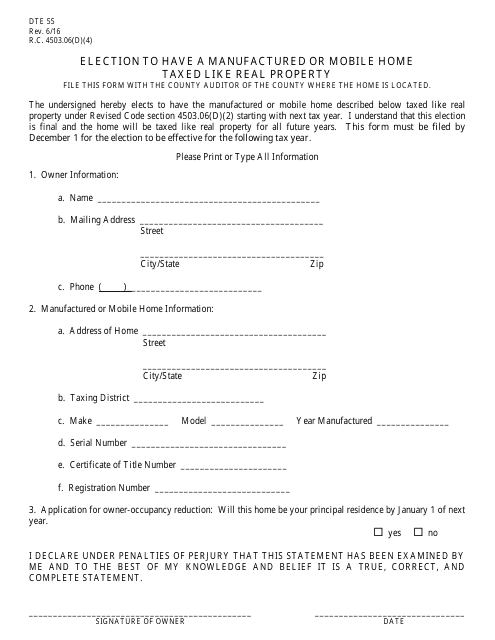

This form is used for electing to have a manufactured or mobile home taxed like real property in the state of Ohio.

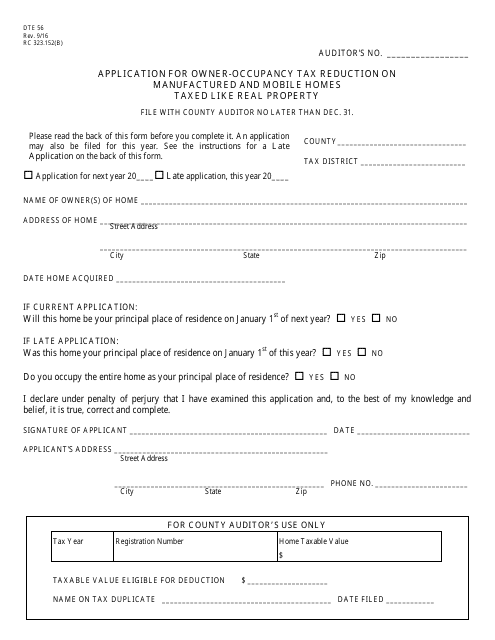

This form is used for applying for an owner-occupancy tax reduction on manufactured and mobile homes taxed like real property in the state of Ohio.

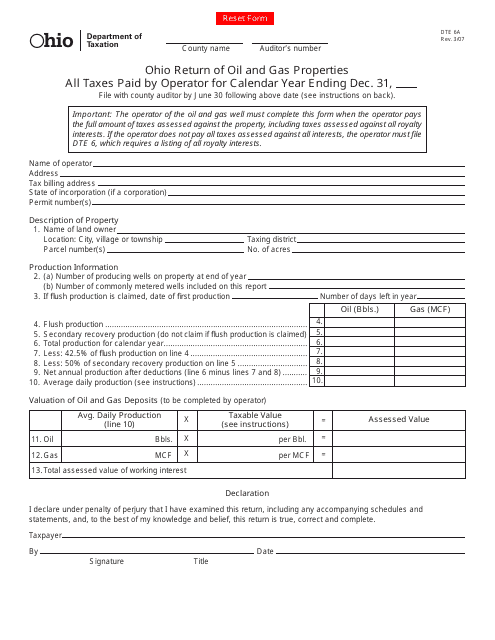

This form is used for reporting and calculating taxes paid by operators of oil and gas properties in Ohio.

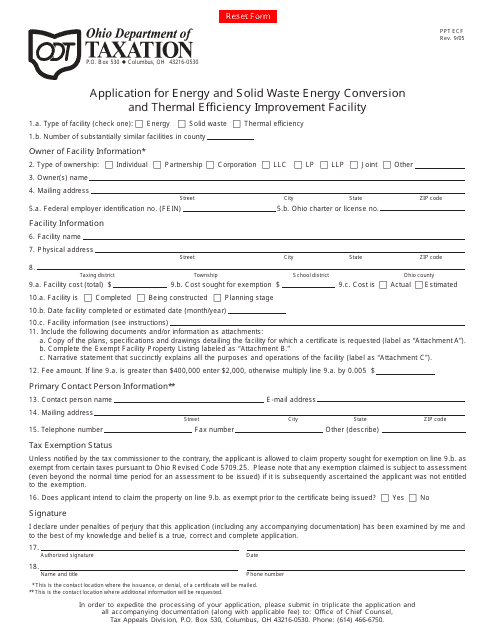

This form is used for applying for the Energy and Solid Waste Energy Conversion and Thermal Efficiency Improvement Facility in Ohio. It allows individuals or organizations to apply for funding to develop projects that promote energy conversion and improve thermal efficiency in the state.

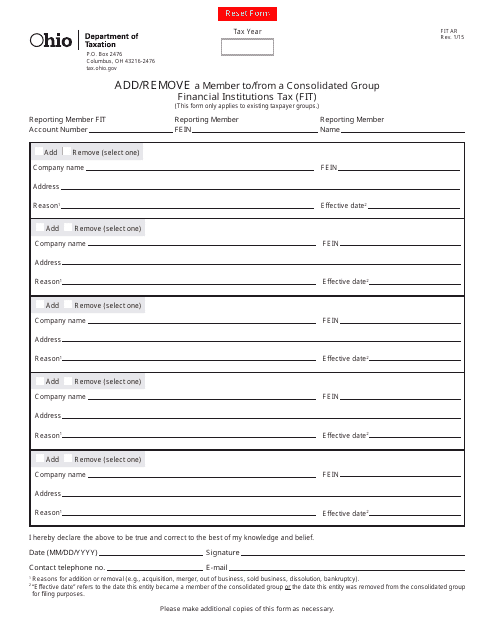

Form FIT AR Add/Remove a Member to/From a Consolidated Group Financial Institutions Tax (Fit) - Ohio

This form is used for adding or removing a member to or from a consolidated group for Financial Institutions Tax (FIT) in Ohio.

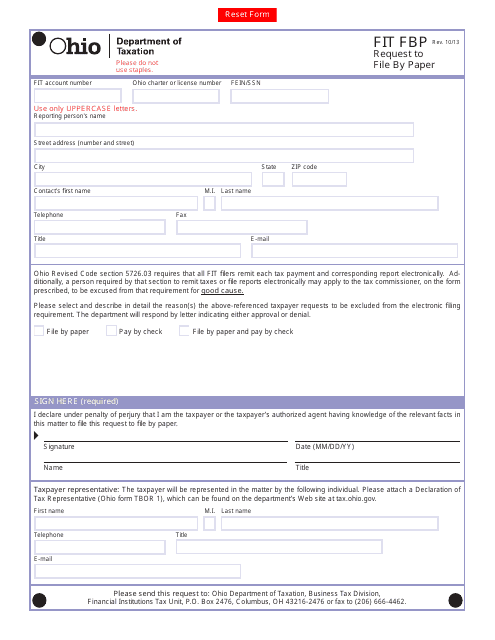

This form is used for submitting a request to file your Federal Income Tax return by paper in the state of Ohio.

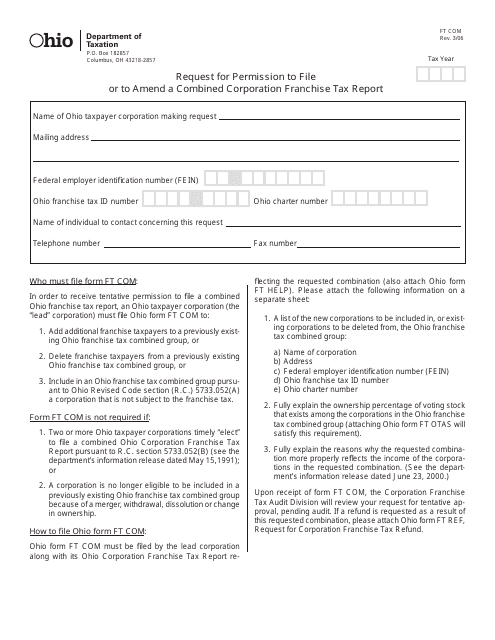

This form is used for requesting permission to file or amend a combined corporation franchise tax report in Ohio.

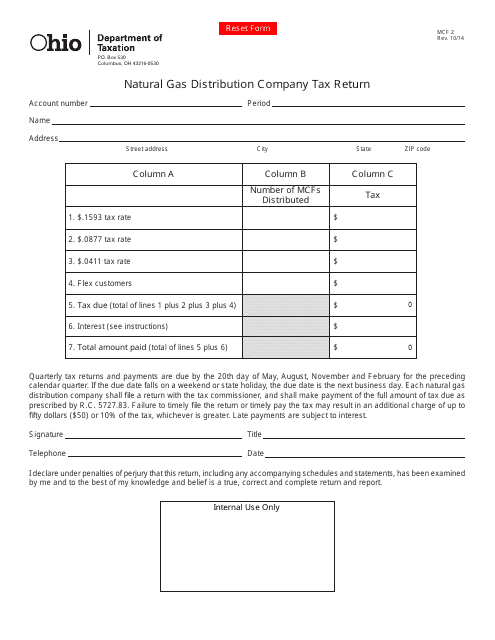

This form is used for filing the Natural Gas Distribution Company Tax Return in the state of Ohio. It is specifically designed for businesses involved in the distribution of natural gas.

This form is used for exporters in Oklahoma to file a monthly report on their export activities.

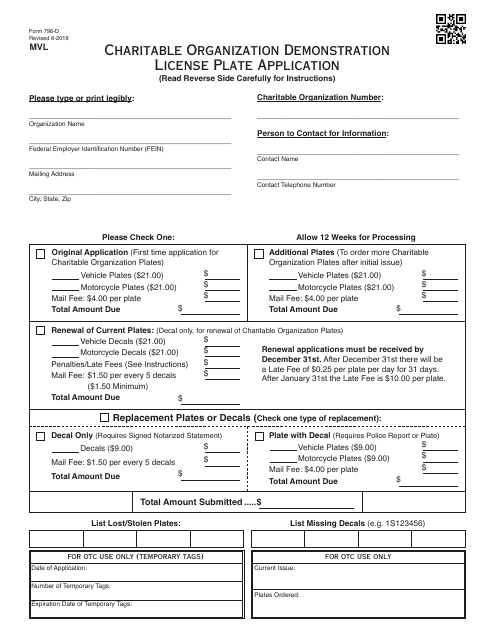

This Form is used for applying for a Charitable Organization Demonstration License Plate in Oklahoma.

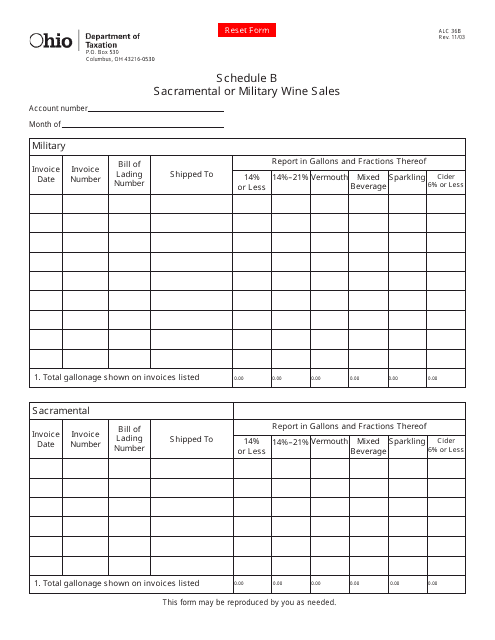

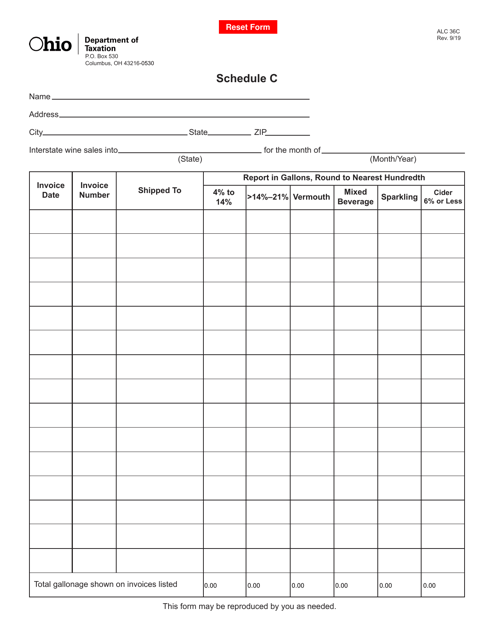

This form is used for sacramental or military wine sales in Ohio.

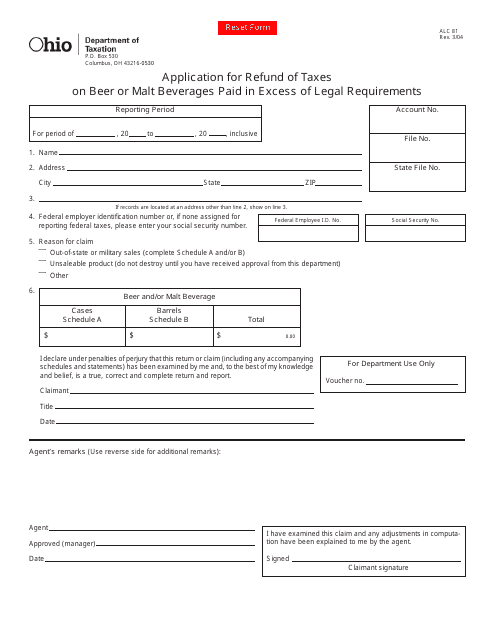

This form is used for applying for a refund of taxes paid on beer or malt beverages that exceed the legal requirements in Ohio.

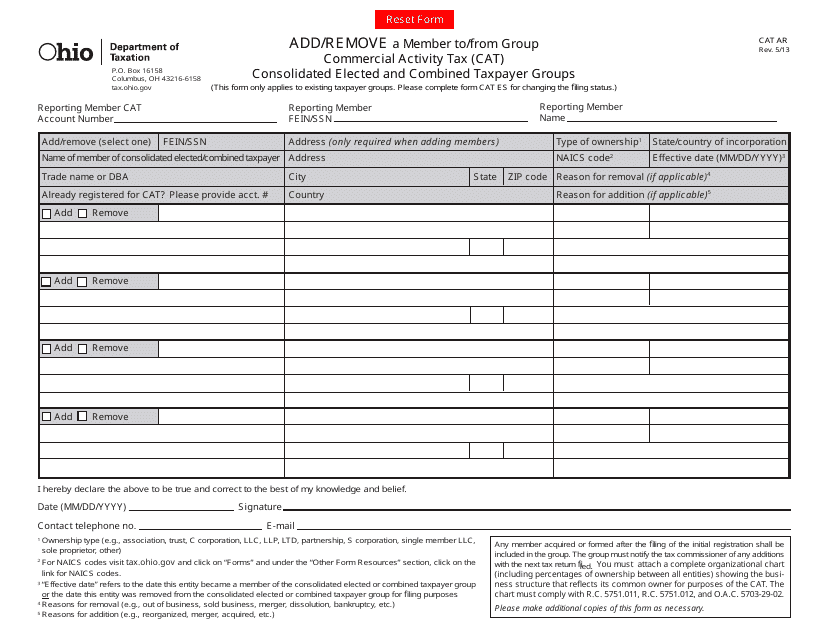

This Form is used for adding or removing a member to/from a Group Commercial Activity Tax (CAT) Consolidated Elected and Combined Taxpayer Groups in Ohio.

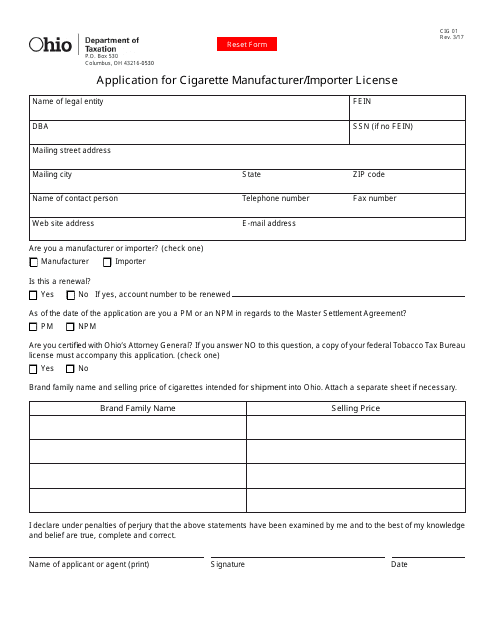

This form is used for applying for a license to manufacture or import cigarettes in the state of Ohio.

This Form is used for applying for a wholesale cigarette dealer's license in the state of Ohio. It is necessary for anyone who wishes to engage in the wholesale sale of cigarettes in the state.

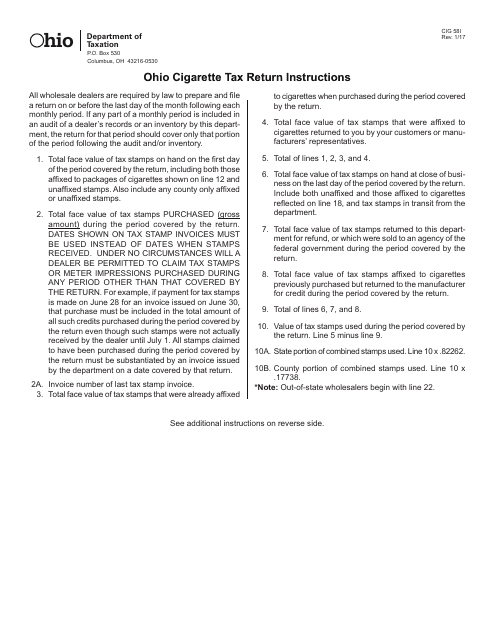

This Form is used for reporting and paying cigarette taxes in the state of Ohio. It provides instructions on how to fill out and submit the CIG58 Ohio Cigarette Tax Return.

This form is used for notifying the state of Ohio about the dissolution or surrender of a business entity. It provides instructions on how to properly fill out the form and submit it to the appropriate authorities.

This Form is used to provide a statement of reason for exemption from the real property conveyance fee in Ohio.

This form is used for calculating the tax rate for a substitute levy in subsequent years in the state of Ohio.