Ohio Tax Forms and Templates

Documents:

265

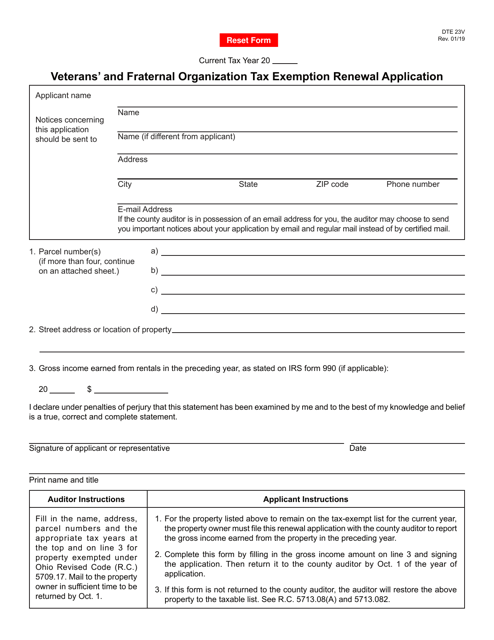

This form is used for veterans' and fraternal organizations in Ohio to renew their tax exemption status.

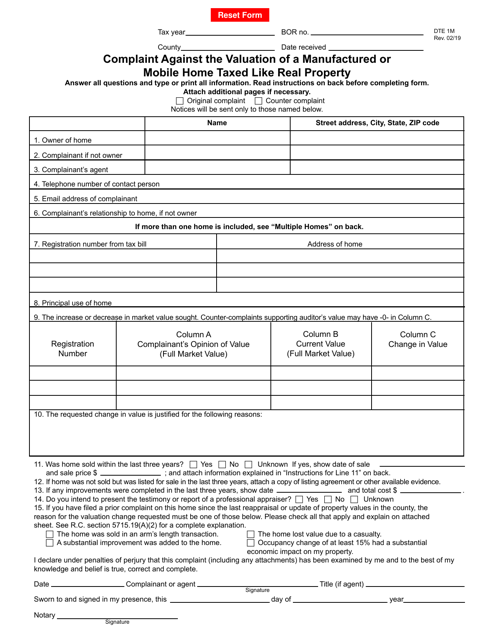

This form is used for filing a complaint against the valuation of a manufactured or mobile home that is taxed like real property in the state of Ohio.

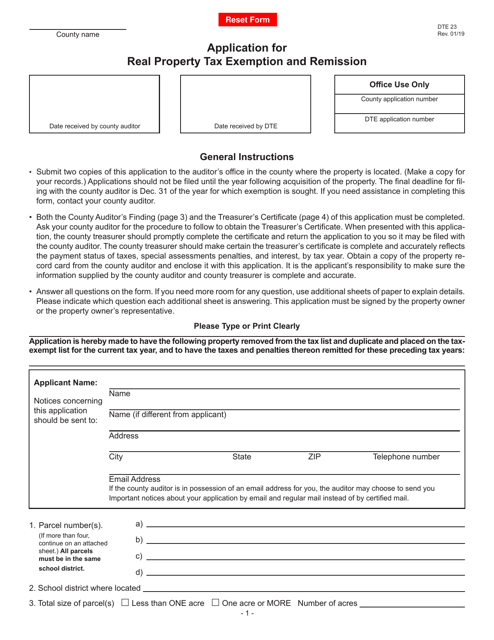

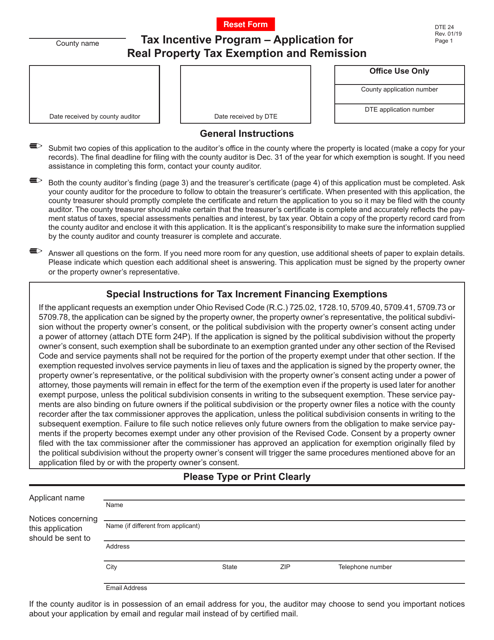

This form is used for applying for a tax incentive program called the Real Property Tax Exemption and Remission in Ohio. It allows property owners to request exemption or remission of their real property taxes.

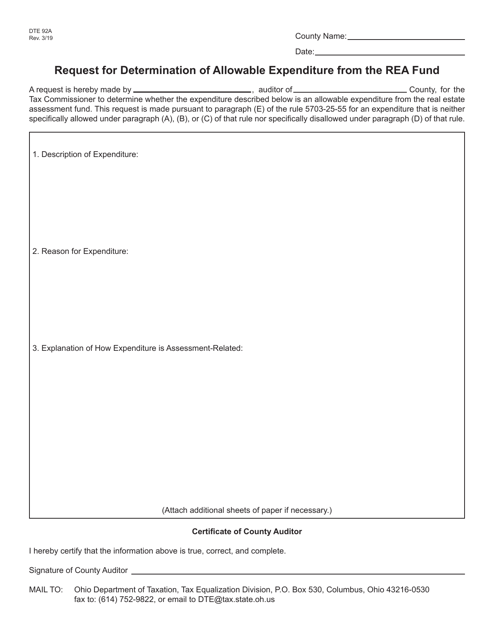

This Form is used for requesting a determination of allowable expenditure from the Real Estate Assessment Fund (REA Fund) in Ohio.

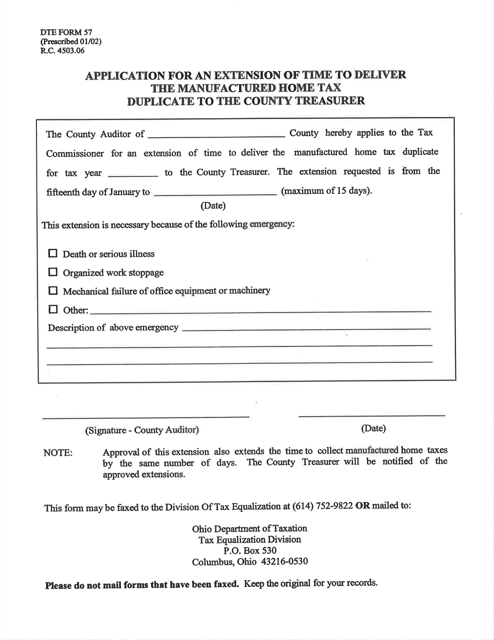

This form is used for applying for an extension of time to deliver the manufactured home tax duplicate to the county treasurer in Ohio.

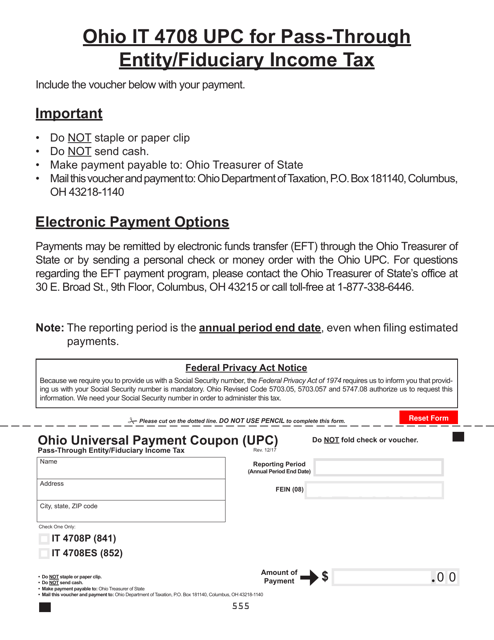

This form is used for paying pass-through entity/fiduciary income tax in Ohio.

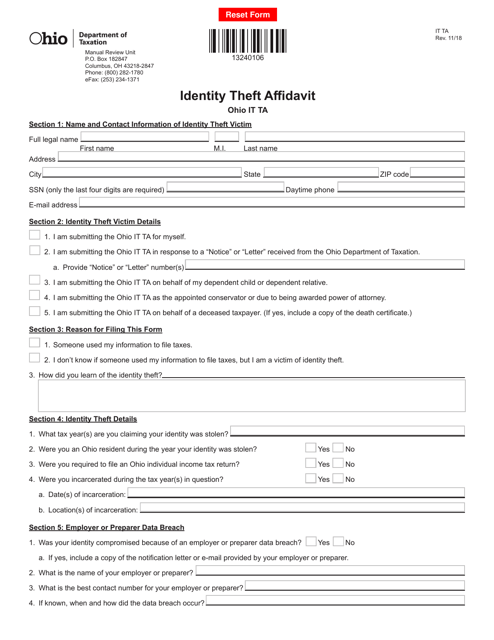

This form is used for reporting identity theft in the state of Ohio. It is used to provide information about the identity theft incident and to request assistance in resolving any related issues.

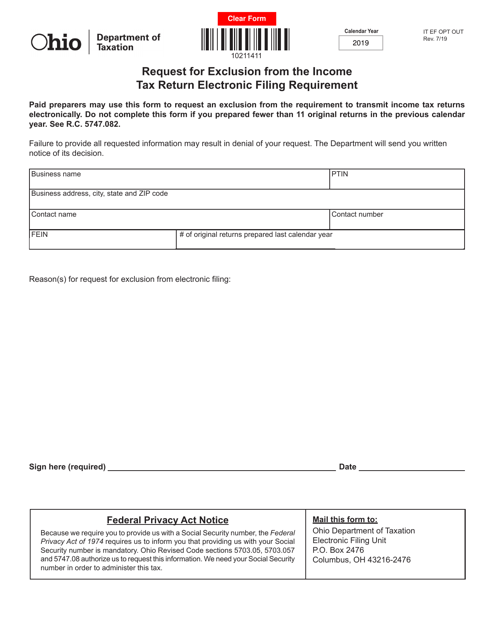

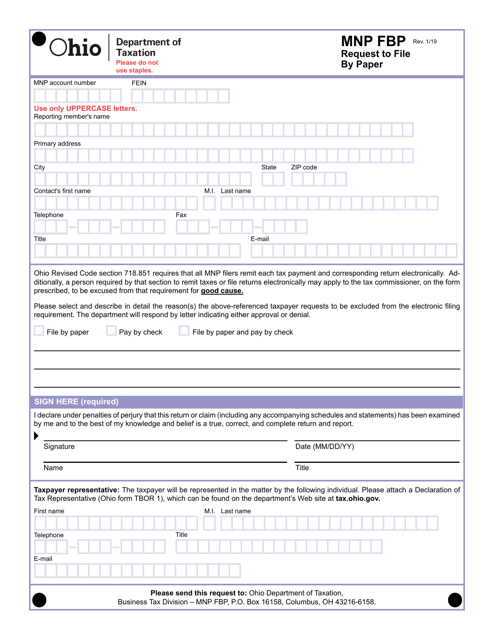

This Form is used for filing a request to transfer your mobile phone number to a new service provider using the paper method in the state of Ohio.

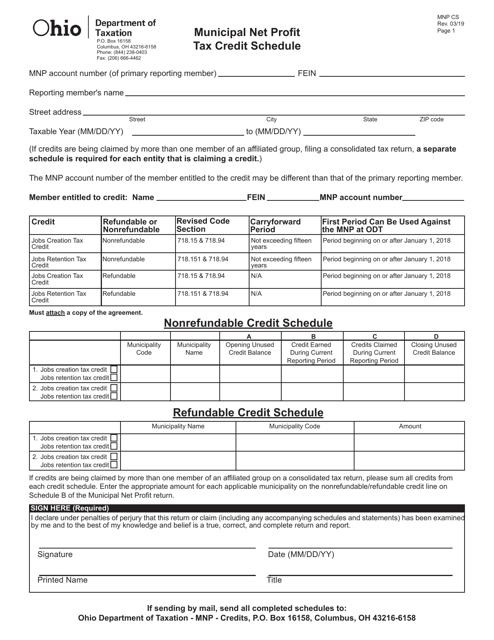

This form is used for claiming the Municipal Net Profit Tax Credit in Ohio for those who have incurred municipal net profit tax in another city or state. The credit is applicable to individuals, estates, and trusts.

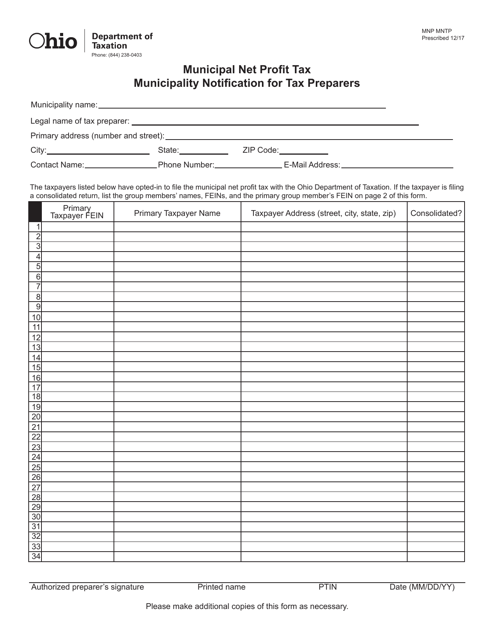

This form is used for tax preparers in Ohio to notify municipalities about the Municipal Net Profit Tax (MNPT) owed by their clients.

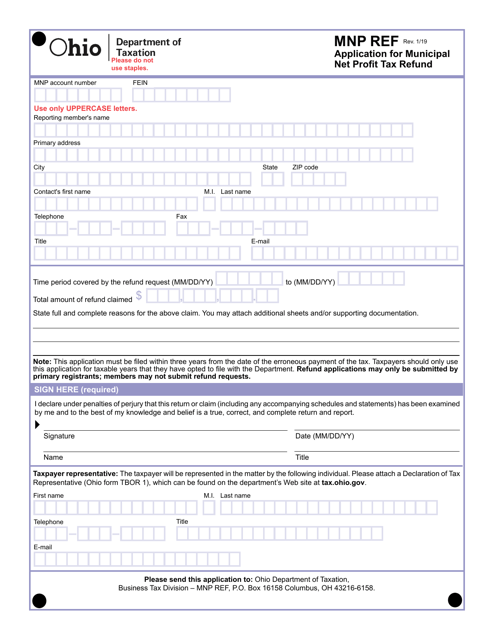

This form is used for applying for a refund of Municipal Net Profit Tax in Ohio.

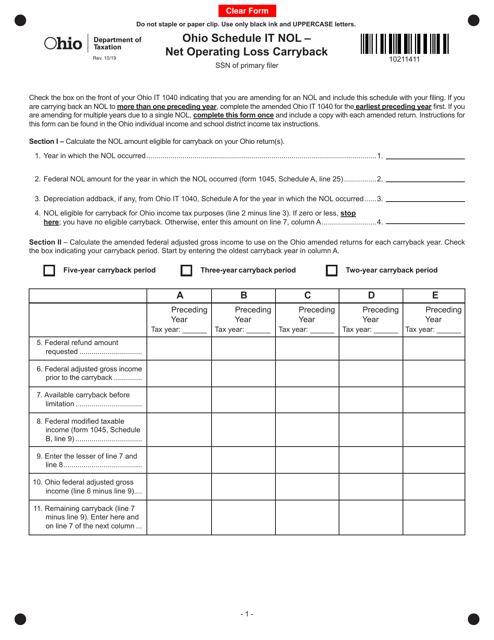

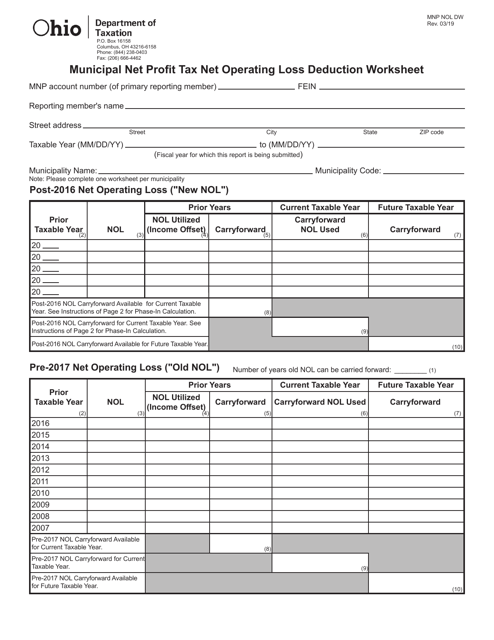

This form is used for calculating the Net Operating Loss (NOL) deduction for the Municipal Net Profit Tax in Ohio. It is specifically designed for businesses and helps determine the allowable deduction for any net operating losses incurred during the tax year.

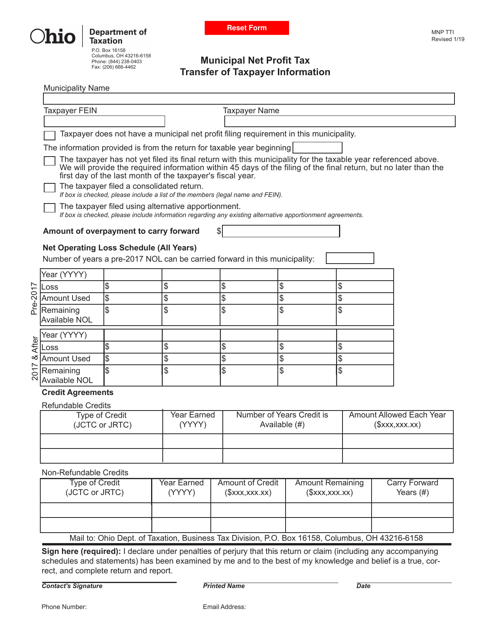

This form is used for transferring taxpayer information related to the Municipal Net Profit Tax in Ohio.

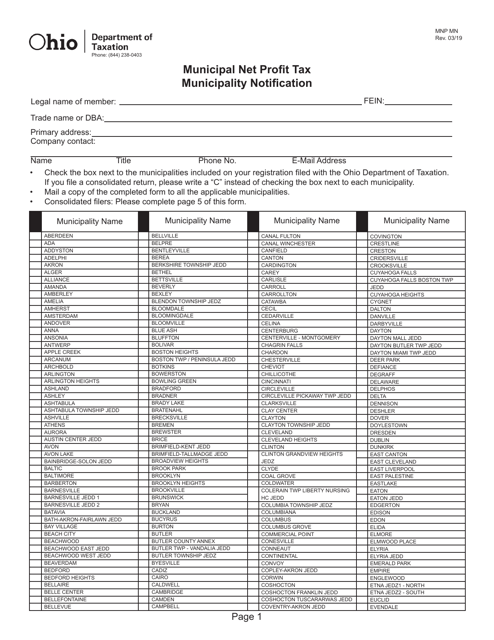

This form is used for notifying the municipality in Ohio about the municipal net profit tax for businesses.

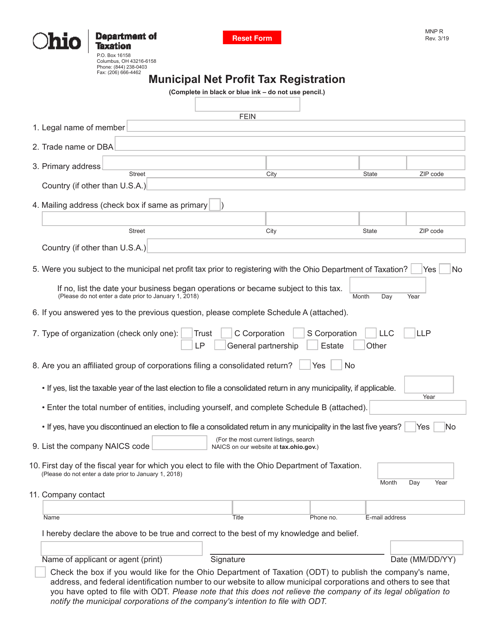

This form is used for businesses in Ohio to register for the Municipal Net Profit Tax. It is required for businesses operating within certain municipalities in the state.

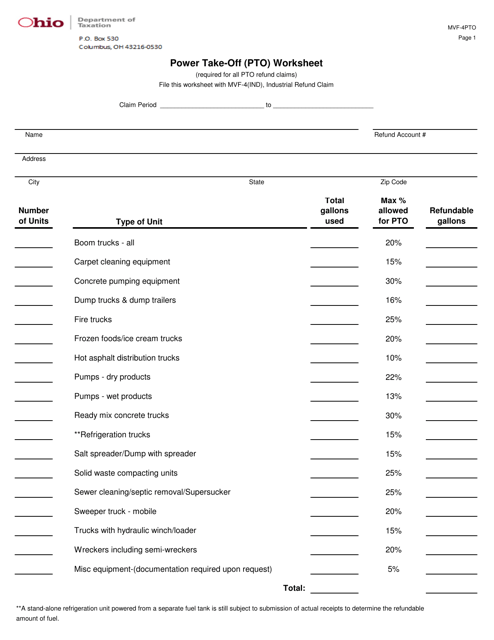

This form is used for completing a power take-off (PTO) worksheet in the state of Ohio. It is used to record information related to PTO equipment and vehicles.

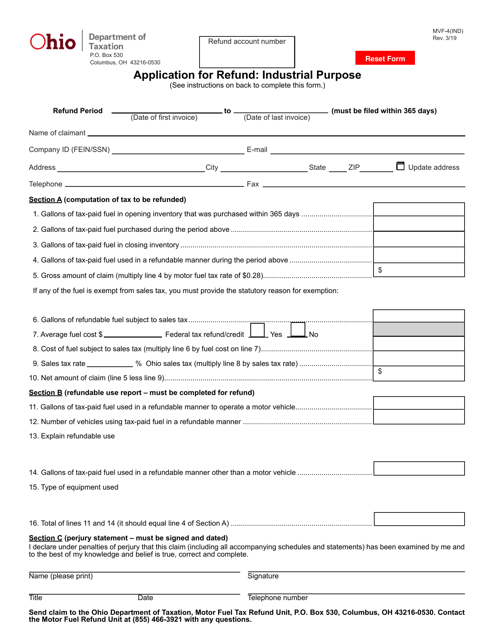

This form is used for applying for a refund for industrial purposes in the state of Ohio.

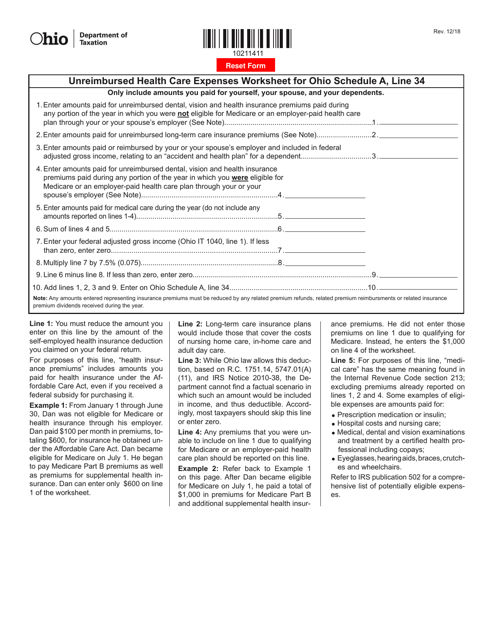

This Form is used for calculating unreimbursed health care expenses in Ohio for Schedule A. It is used to determine the amount that can be deducted on Line 34 of the Ohio state tax return.