Kentucky Tax Forms and Templates

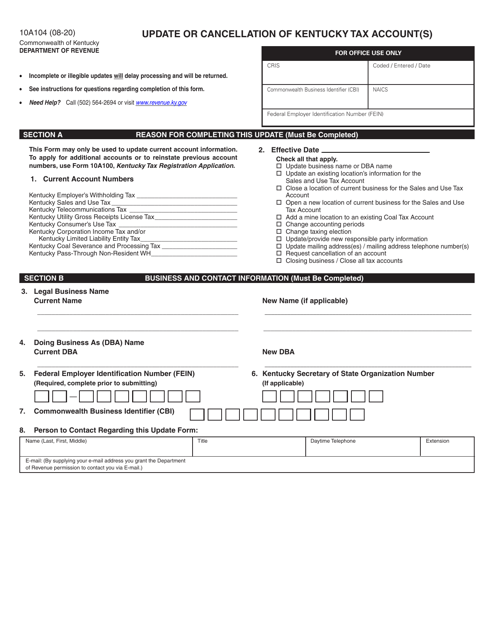

Kentucky Tax Forms are used to report and pay taxes to the state of Kentucky. These forms are used by individuals, businesses, and organizations to file their state income tax, sales tax, use tax, and other types of taxes. The forms help taxpayers accurately report their income, deductions, credits, and other relevant information to ensure compliance with Kentucky tax laws.

Documents:

54

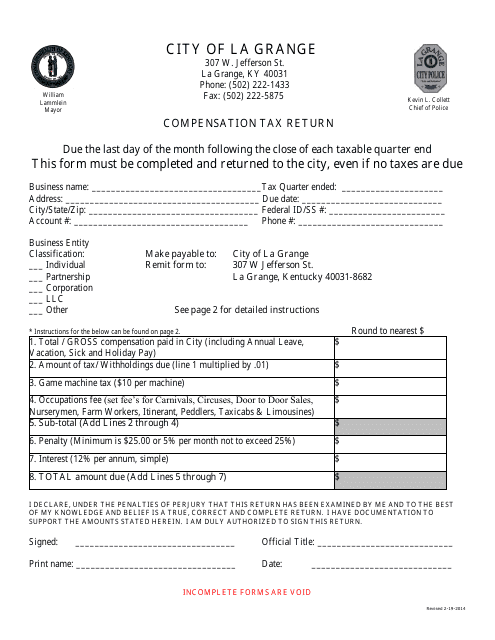

This document is used for reporting compensation tax returns to the City of La Grange, Kentucky.

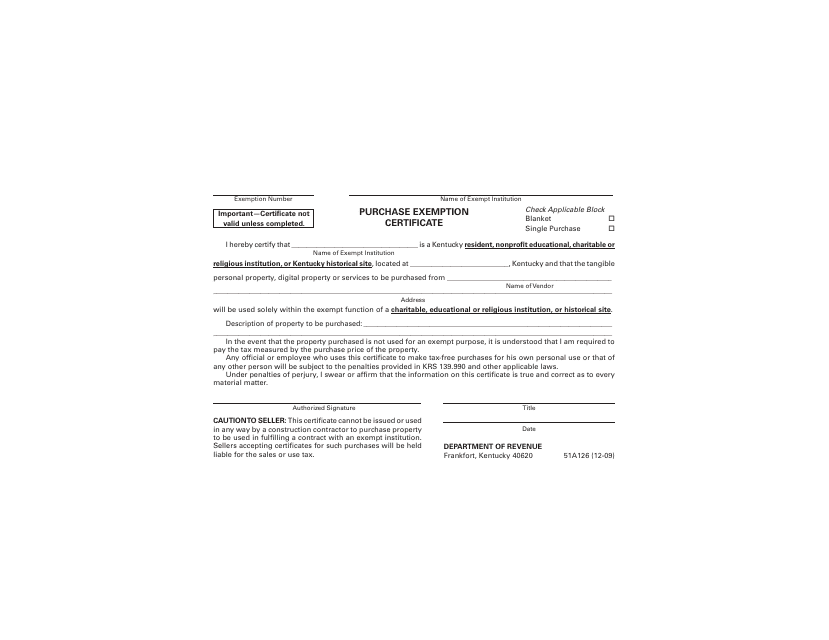

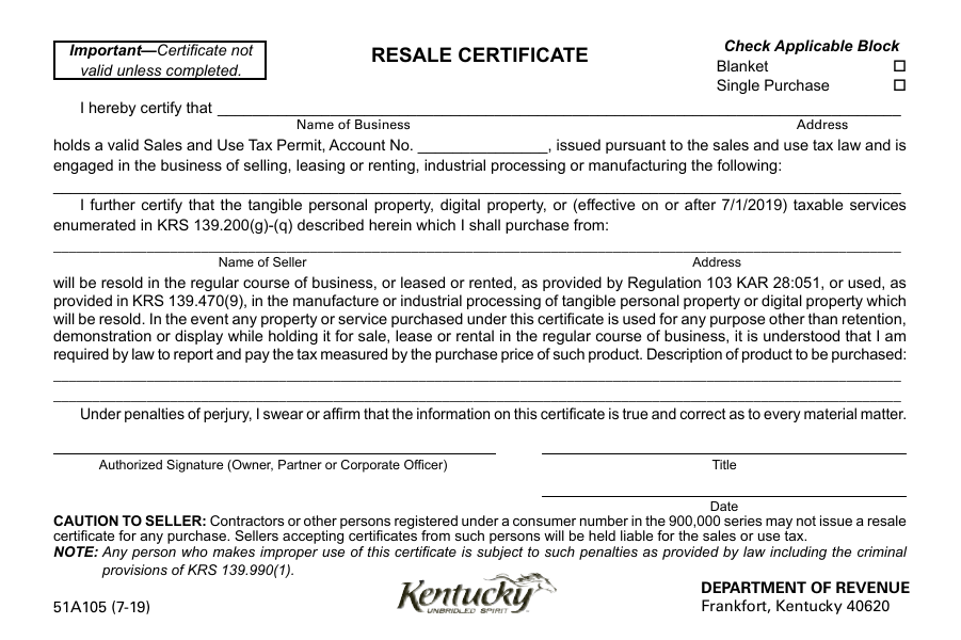

This form is used for requesting a purchase exemption certificate in the state of Kentucky. It allows individuals or businesses to claim an exemption from paying sales tax on specified purchases.

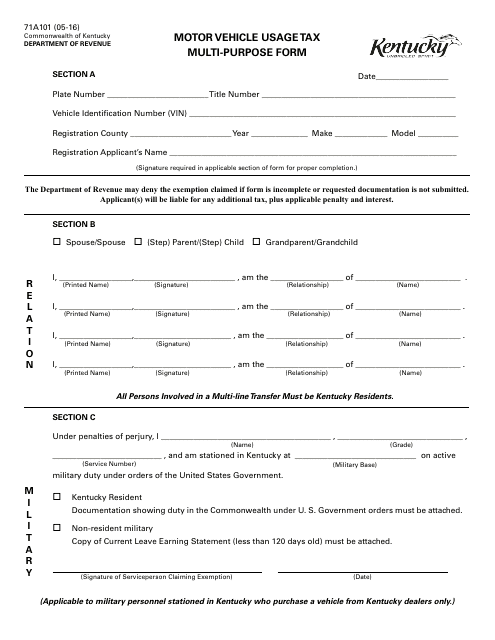

This form is used for reporting and paying motor vehicle usage tax in Kentucky. It is a multipurpose form that can be used for various purposes related to motor vehicle taxation.

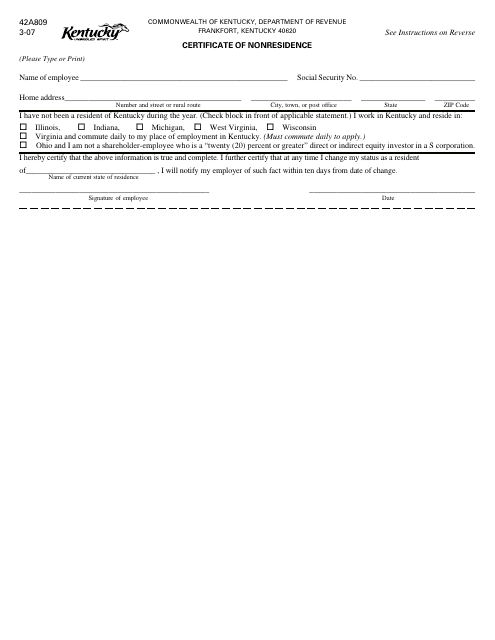

This document is used for obtaining a Certificate of Nonresidence in the state of Kentucky. It is typically required for individuals who are claiming nonresident status for tax or other purposes.

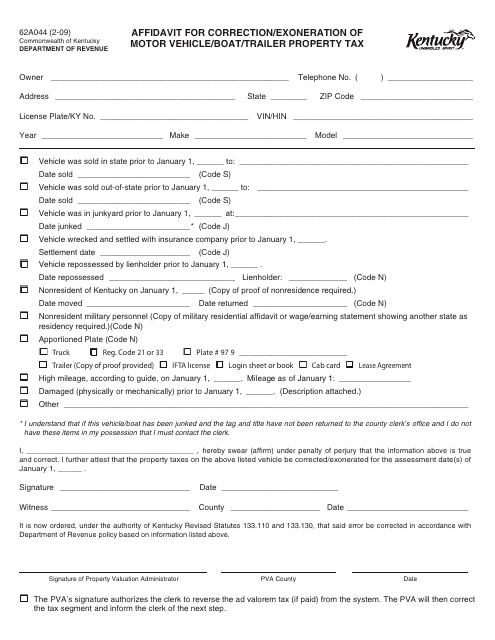

This form is used for correcting or requesting exemption from property tax for motor vehicles, boats, or trailers in Kentucky.

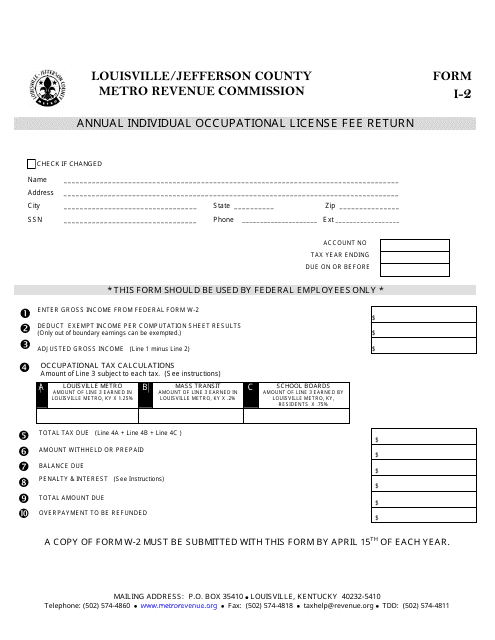

This form is used for reporting and paying the annual individual occupational license fee in Louisville/Jefferson County, Kentucky.

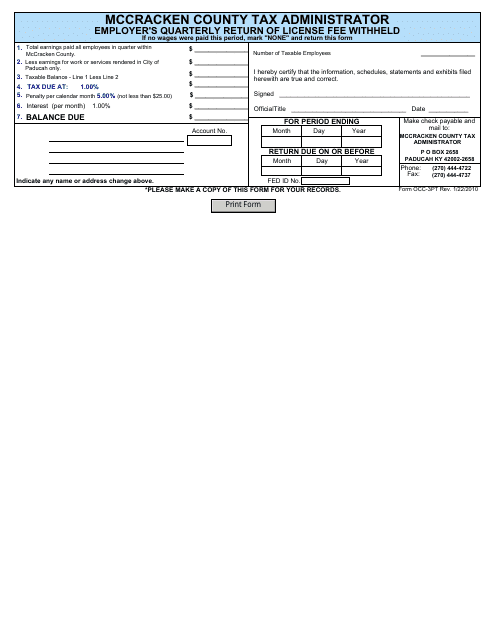

This form is used for employers in McCracken County, Kentucky to report and remit license fee withheld on a quarterly basis.

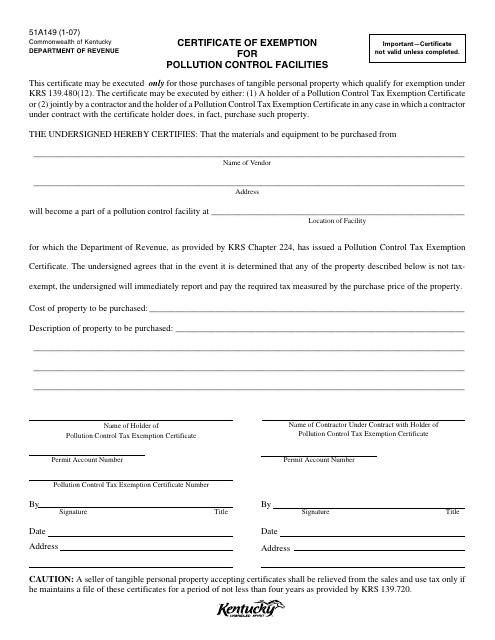

This document is a form used in Kentucky to apply for a certificate of exemption for pollution control facilities. It allows for an exemption from property tax for facilities that are used for pollution control purposes.

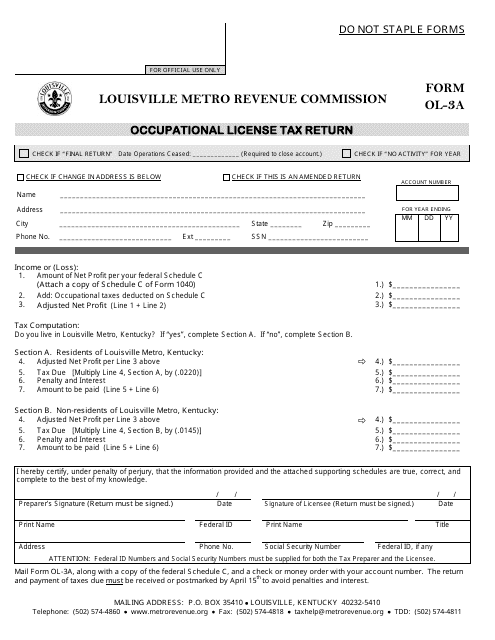

This form is used for filing the Occupational License Tax Return in Louisville, Kentucky.

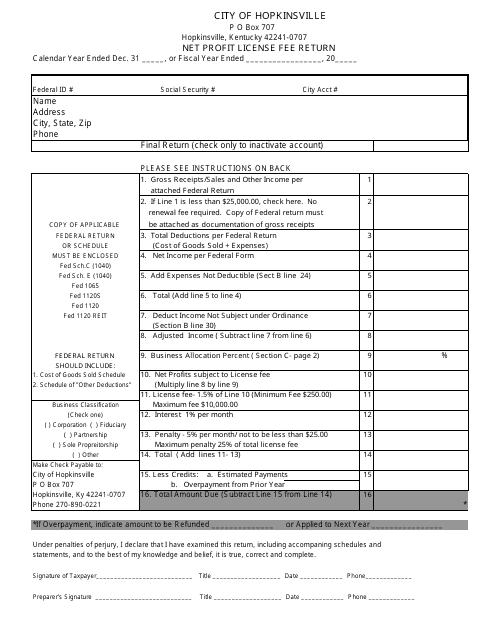

This Form is used for reporting and paying the net profit license fee in the City of Hopkinsville, Kentucky.

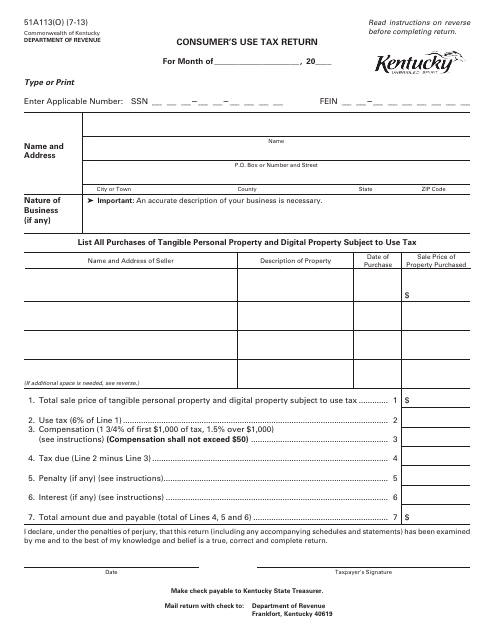

This Form is used for reporting and paying consumer's use tax in the state of Kentucky.

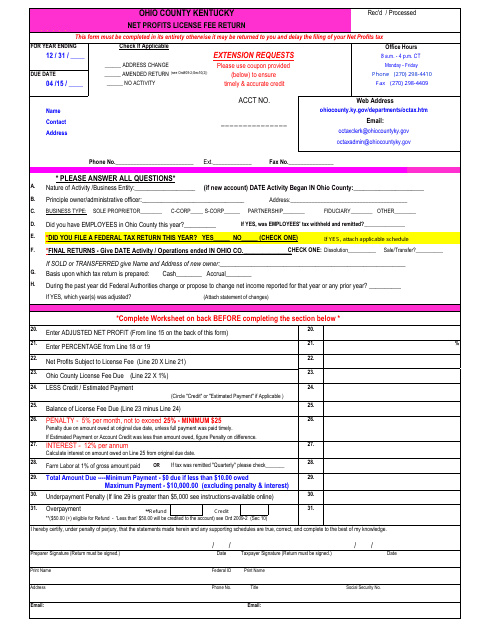

This Form is used for reporting and returning the license fee on net profits in Ohio County, Kentucky.

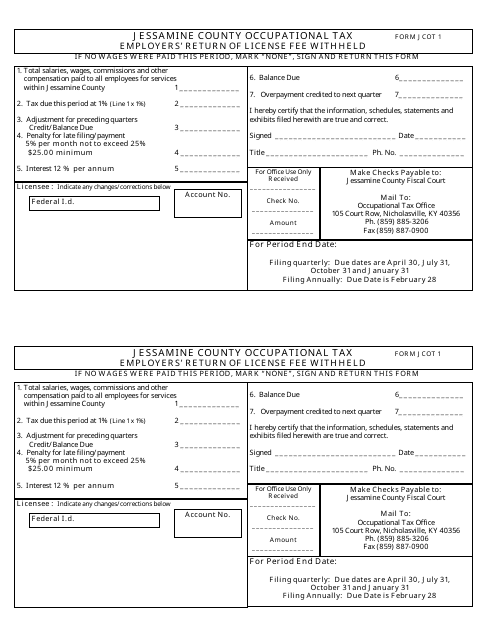

This form is used for employers in Jessamine County, Kentucky to report and remit the occupational tax withheld from their employees' license fees.

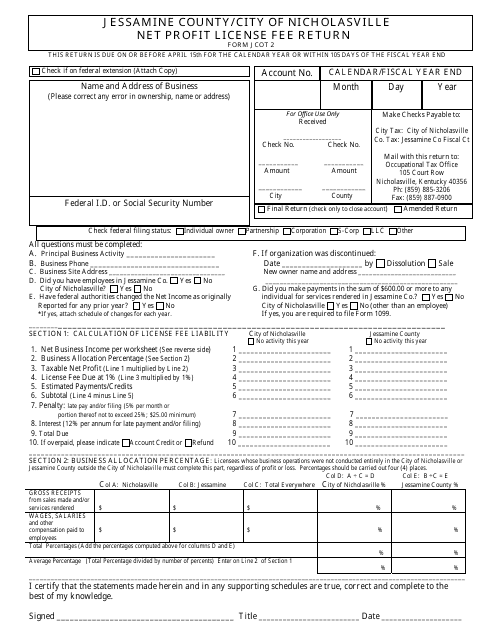

This form is used for filing the Net Profit License Fee Return in the City of Nicholasville, Kentucky.

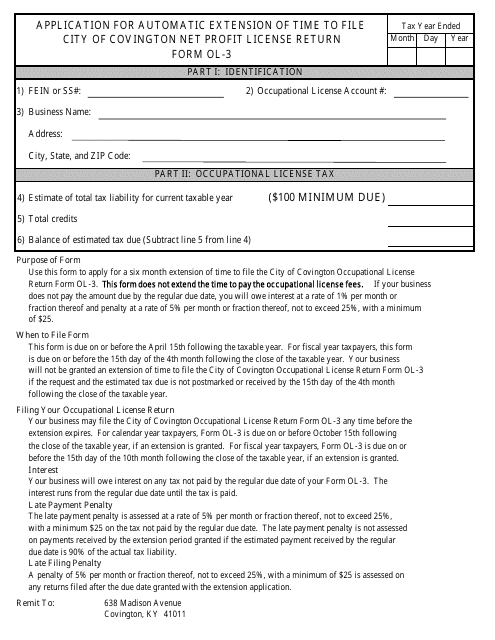

This form is used for requesting an automatic extension of time to file the Net Profit License Return form in the City of Covington, Kentucky.

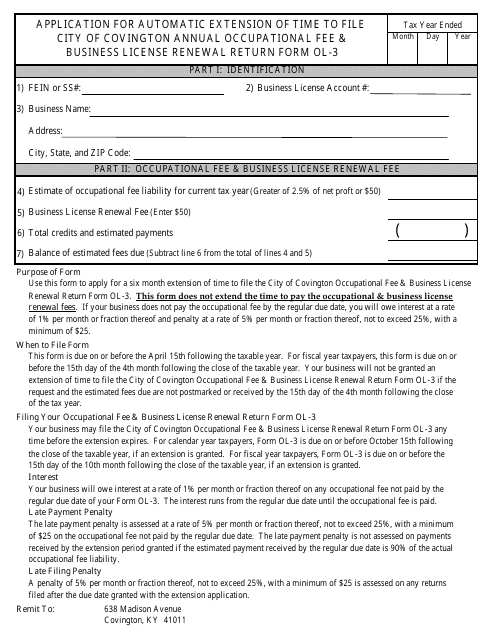

This form is used for requesting an automatic extension of time to file the City of Covington Annual Occupational Fee & Business License Renewal Return (Form Ol-3) in Covington, Kentucky.

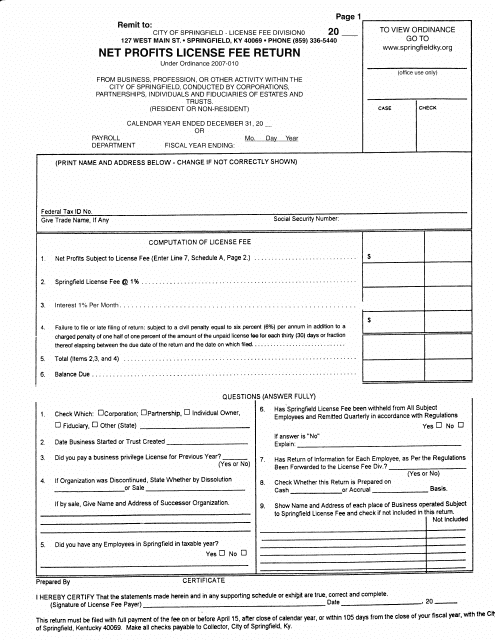

This form is used for reporting and paying the license fee on net profits in the City of Springfield, Kentucky.

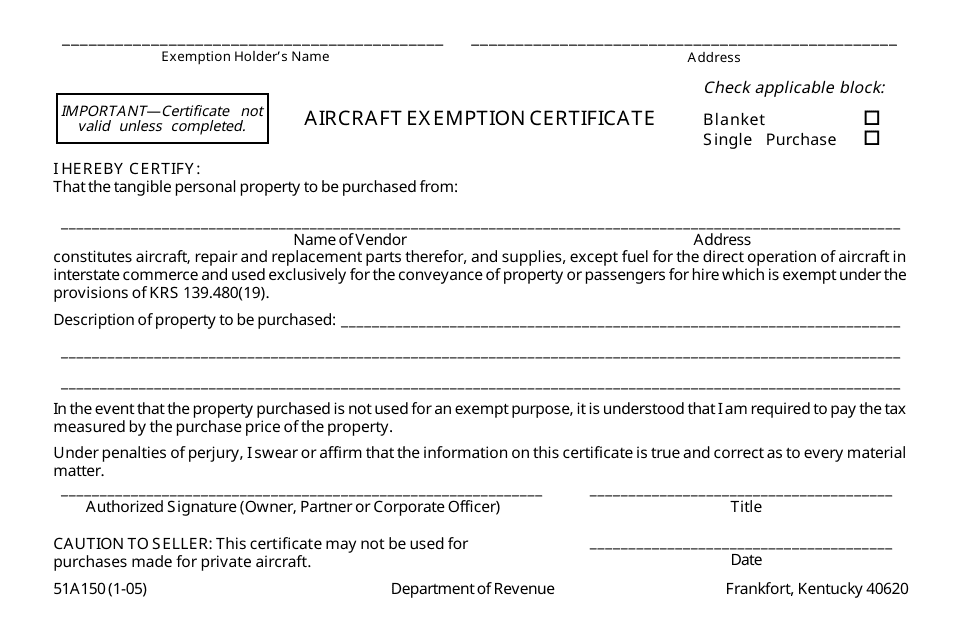

This document is used to apply for an exemption certificate for aircraft in the state of Kentucky.

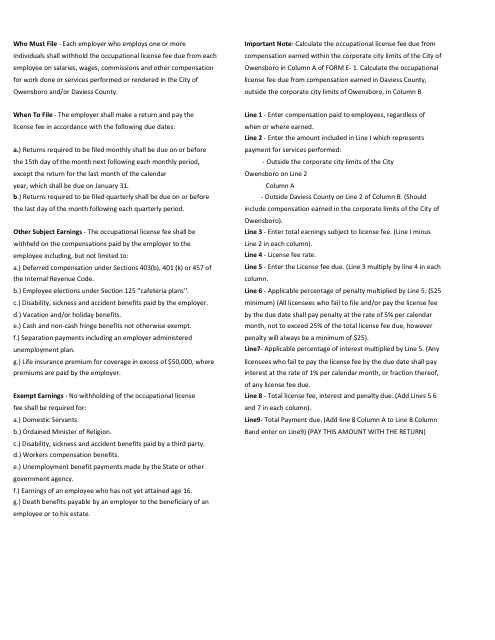

This Form is used for employers to report and remit the license fee withheld from employees in the City of Owensboro, Kentucky. It provides instructions for completing the return and ensuring compliance with local tax regulations.

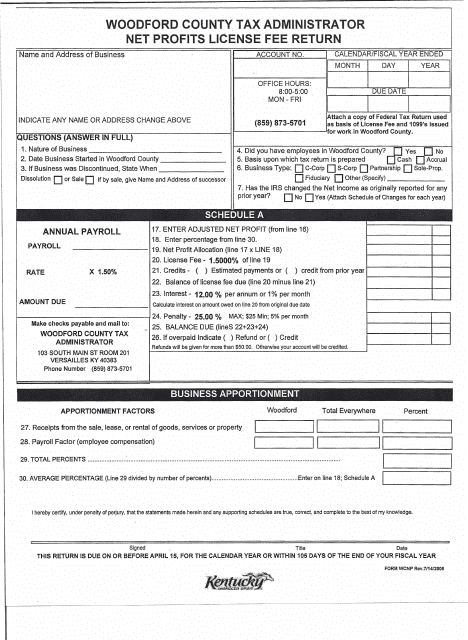

This form is used for reporting and paying the net profits license fee in Woodford County, Kentucky.

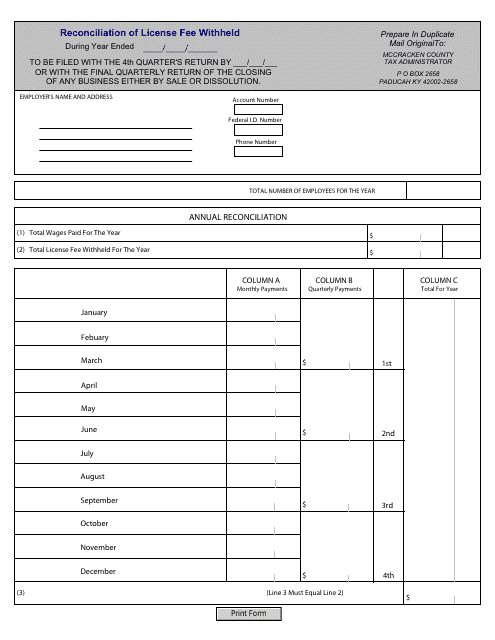

This type of document is used for reconciling license fees withheld in McCracken County, Kentucky.

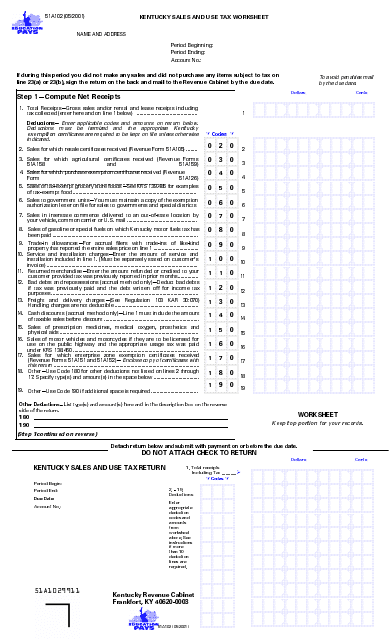

This Form is used for calculating sales and use tax in the state of Kentucky. It helps individuals and businesses determine the amount of tax owed based on their sales and use of taxable items.

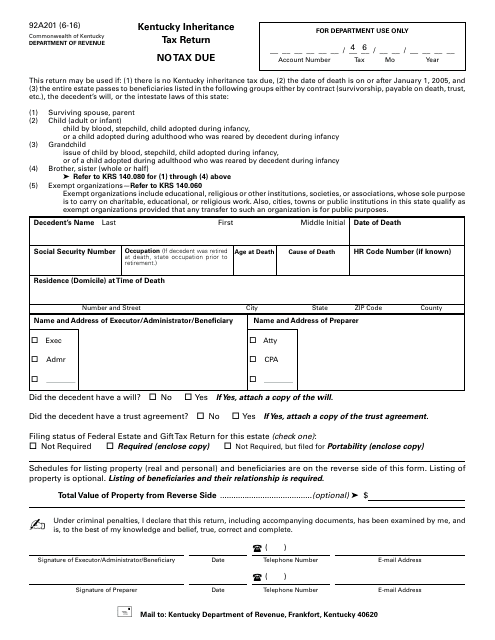

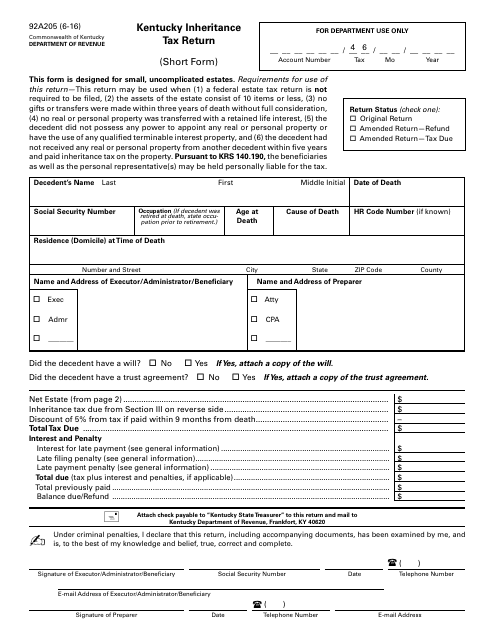

This form is used for filing the Kentucky Inheritance Tax Return when there is no tax due.

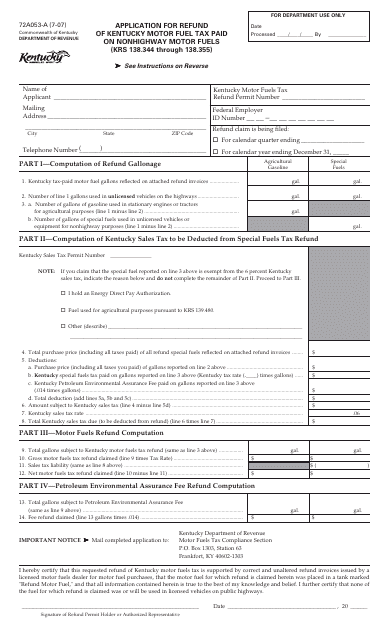

This Form is used for applying for a refund of Kentucky motor fuel tax paid on nonhighway motor fuels in the state of Kentucky.

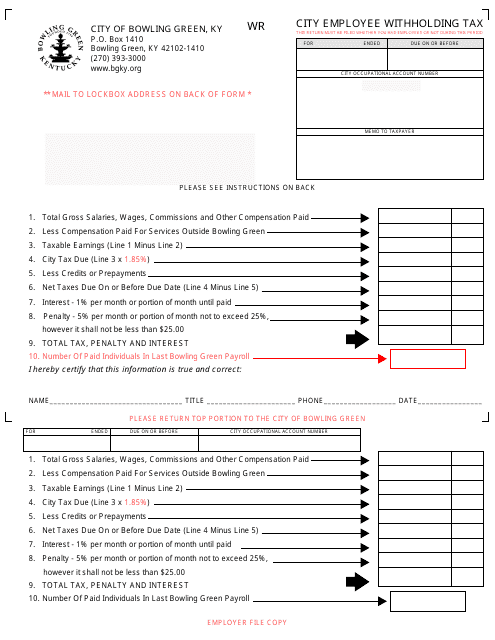

This form is used for the City of Bowling Green, Kentucky employees to report and withhold their city income taxes.

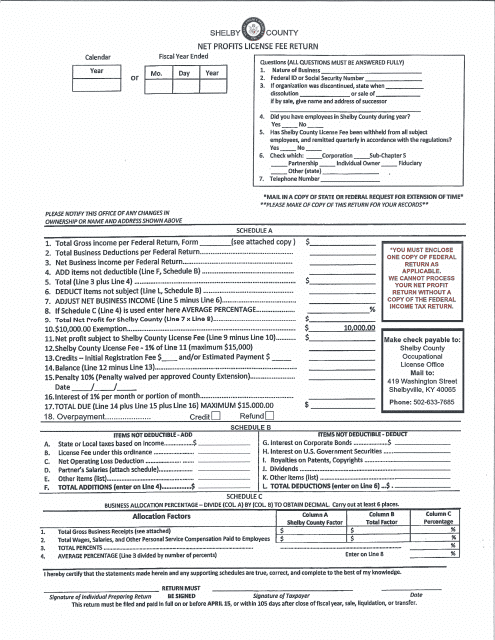

This document is a form used for filing a return for the Net Profit License Fee in Shelby County, Kentucky.

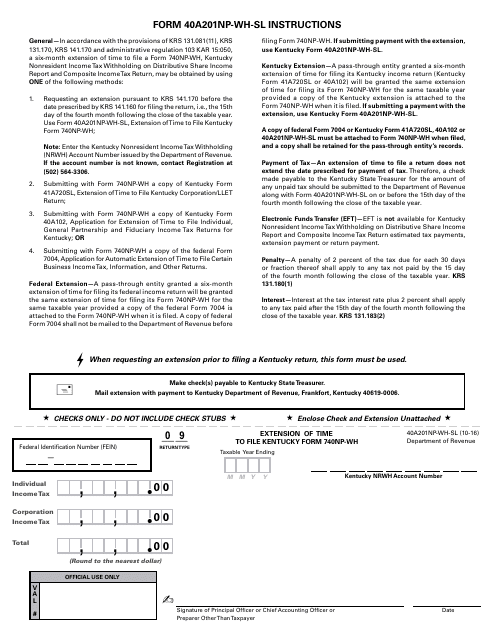

This form is used for requesting an extension of time to file the Kentucky Form 740np-Wh, which is a tax return form specific to Kentucky residents.

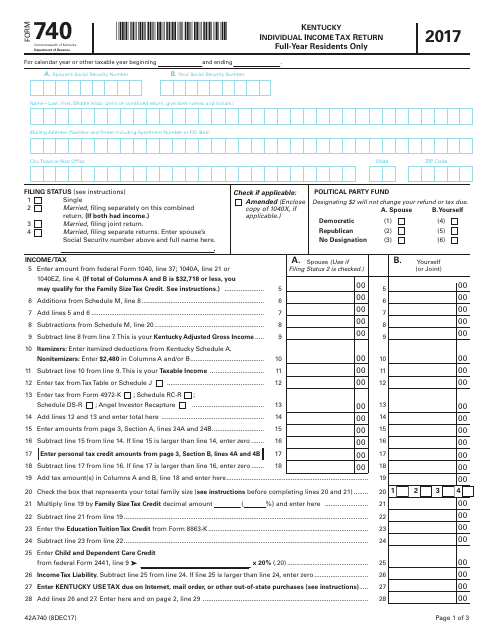

This form is used for filing individual income tax returns for full-year residents of Kentucky.

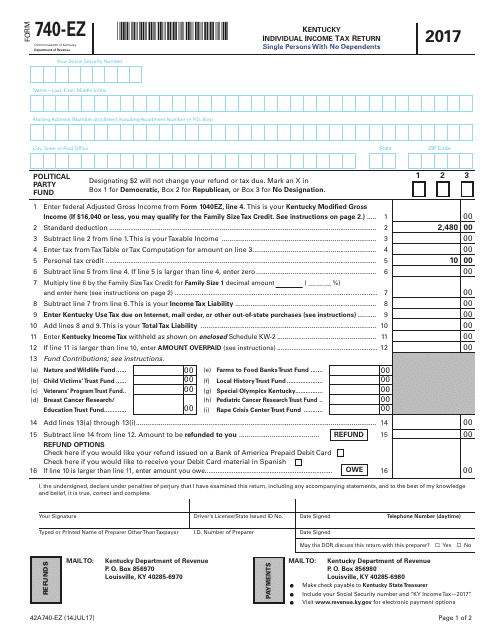

This Form is used for filing individual income tax return in the state of Kentucky.

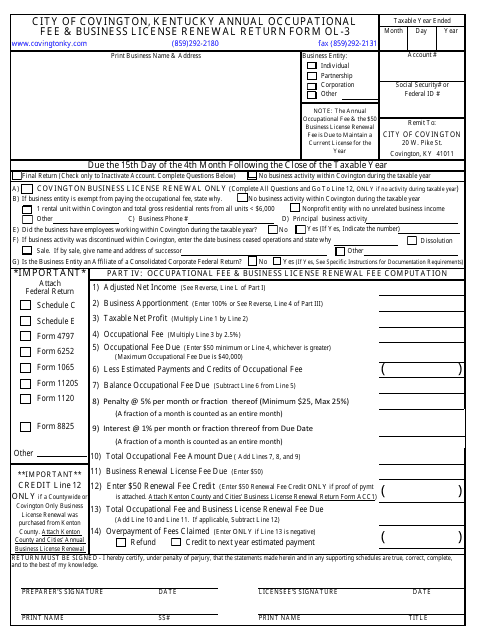

This form is used for renewing the annual occupational fee and business license in the City of Covington, Kentucky.

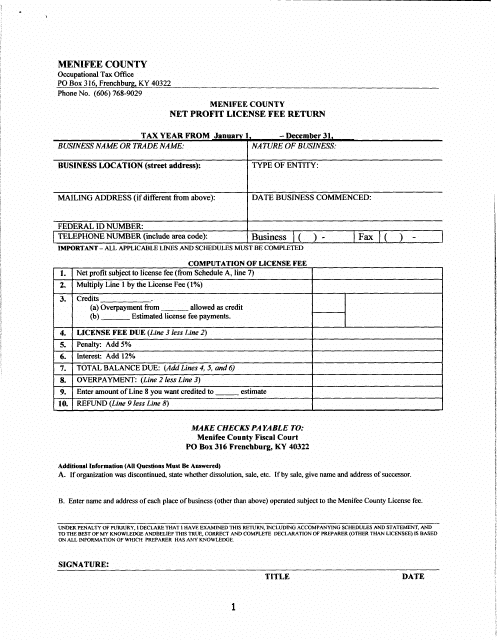

This Form is used for reporting and returning the net profit license fee in Menifee County, Kentucky.

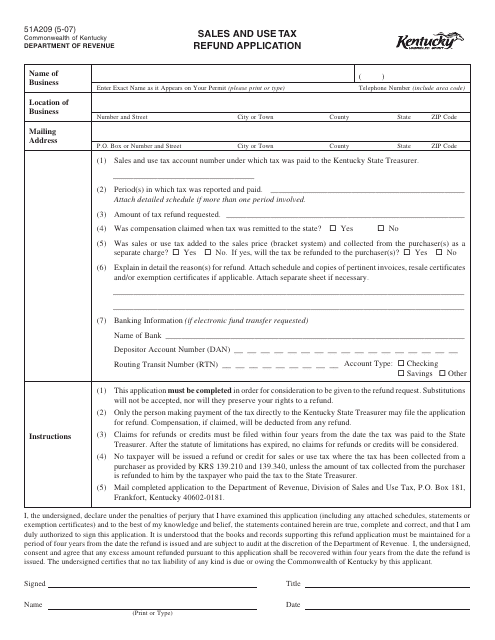

This document is used for applying for a sales and use tax refund in the state of Kentucky.

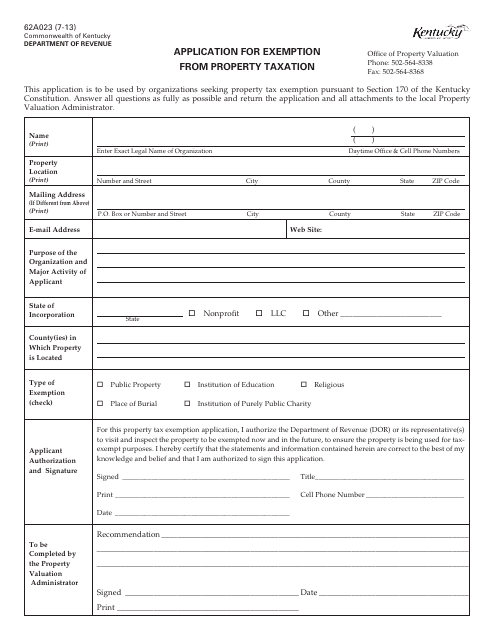

This Form is used for applying for exemption from property taxation in Kentucky. It is required to seek exemption from paying property tax on certain types of properties in the state.

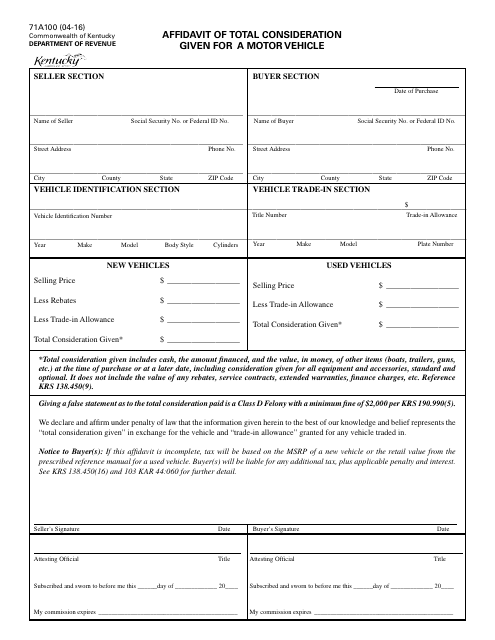

This form is used for declaring the total amount paid for a motor vehicle in the state of Kentucky.

This Form is used for filing the Kentucky Inheritance Tax Return - Short Form in the state of Kentucky

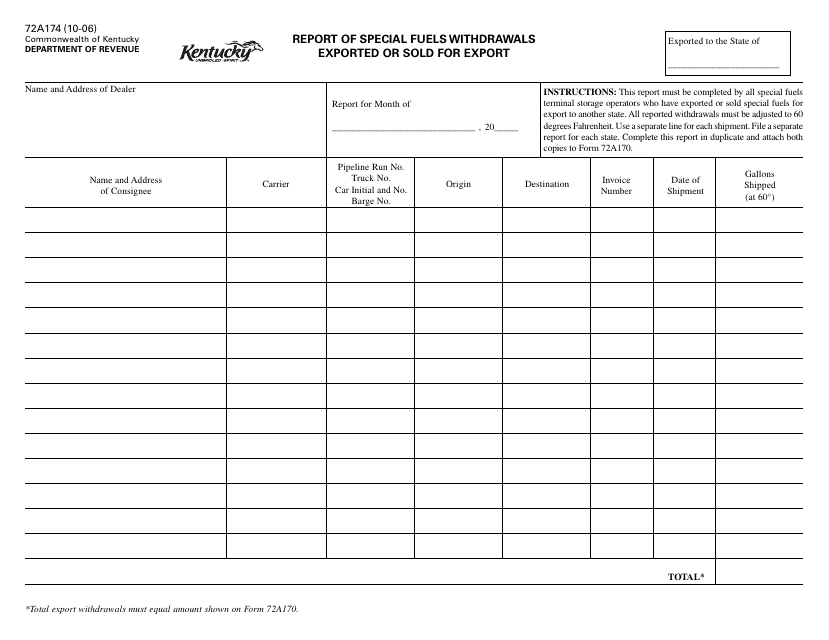

This Form is used for reporting special fuels withdrawals that are exported or sold for export in the state of Kentucky.

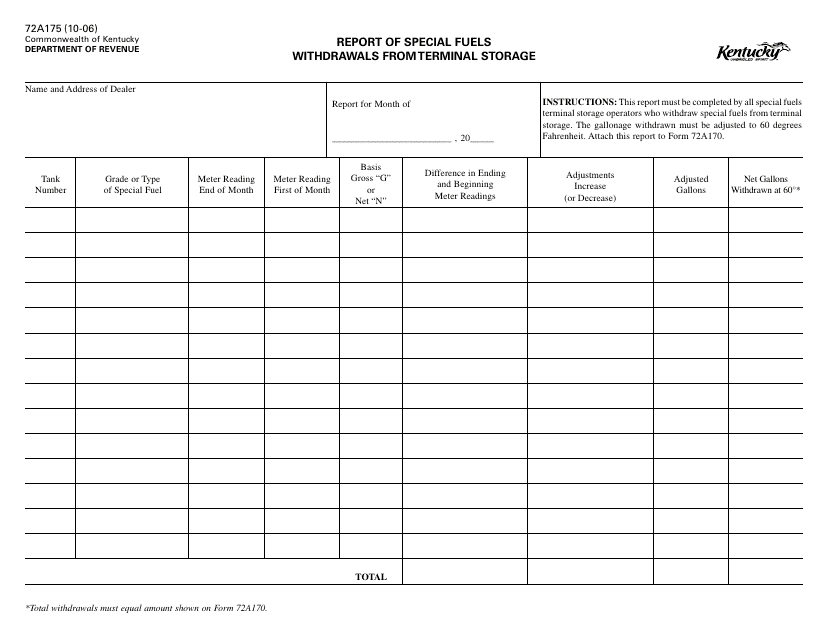

This form is used for reporting the withdrawal of special fuels from terminal storage in Kentucky.

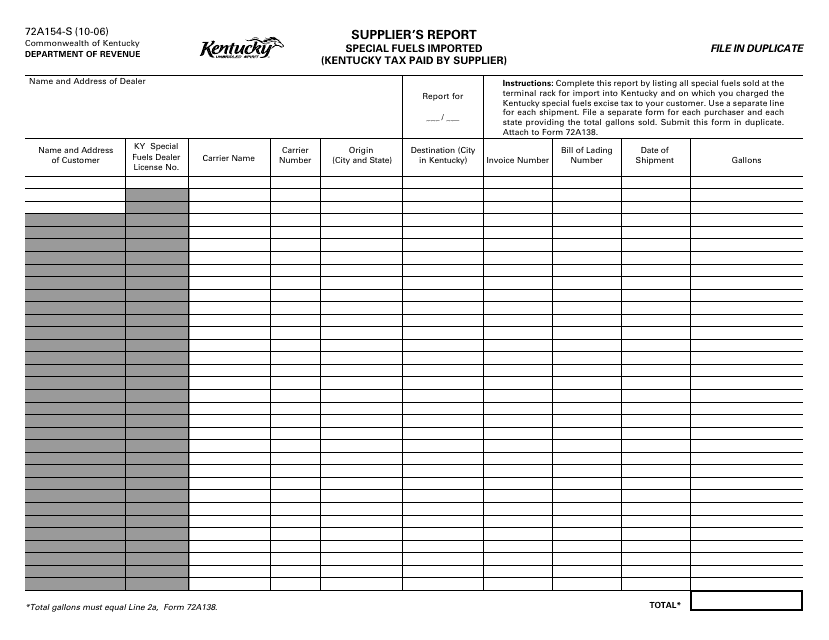

This form is used for suppliers to report the importation of special fuels in Kentucky where the taxes have already been paid by the supplier.