Kentucky Tax Forms and Templates

Documents:

54

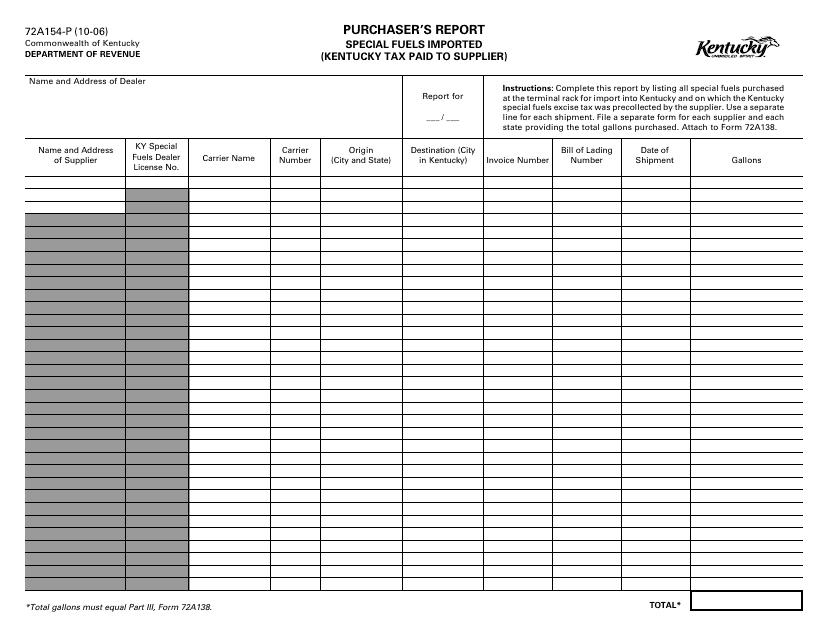

Form 72A154-P Purchaser's Report - Special Fuels Imported (Kentucky Tax Paid to Supplier) - Kentucky

This form is used for reporting the purchase of special fuels that have been imported into Kentucky and where the tax has already been paid to the supplier.

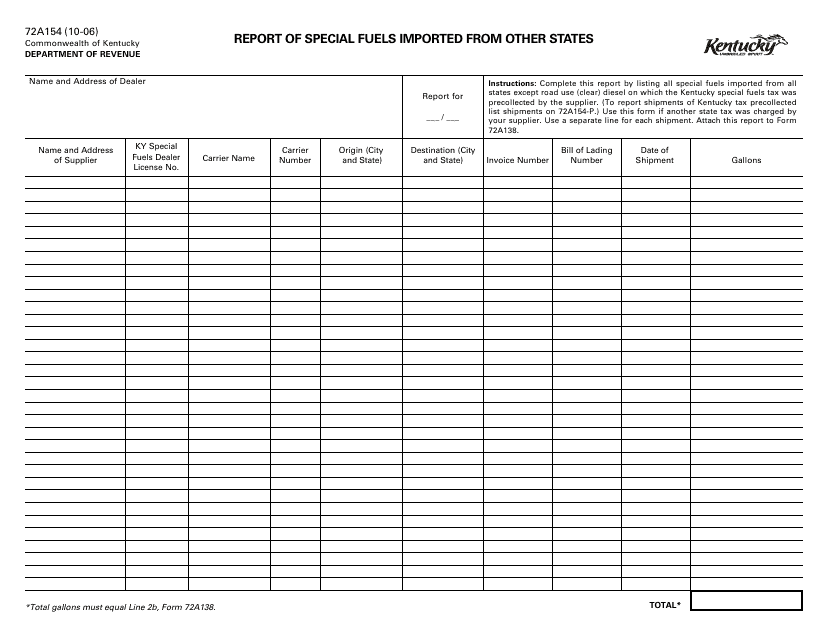

This form is used for reporting special fuels that are imported from other states to Kentucky.

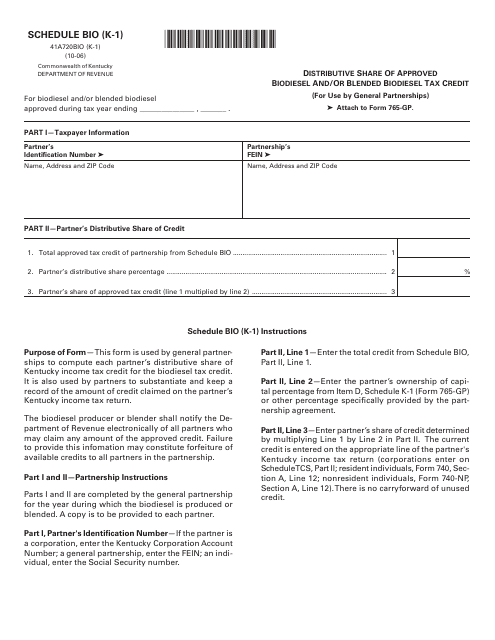

This form is used for reporting the distributive share of approved biodiesel and/or blended biodiesel tax credit in the state of Kentucky.

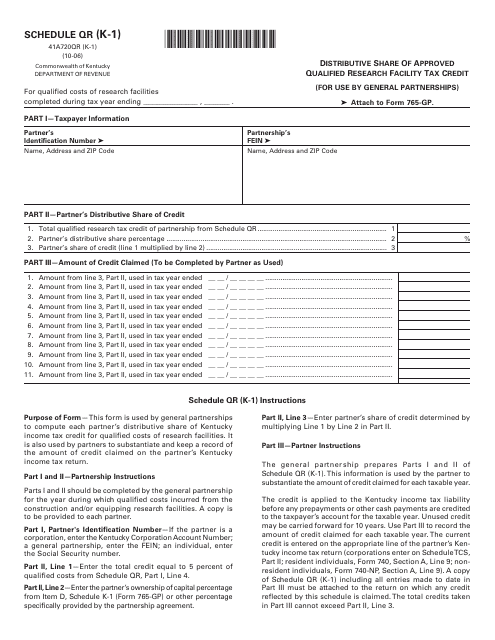

This Form is used for reporting the distributive share of the approved qualified research facility tax credit in Kentucky.

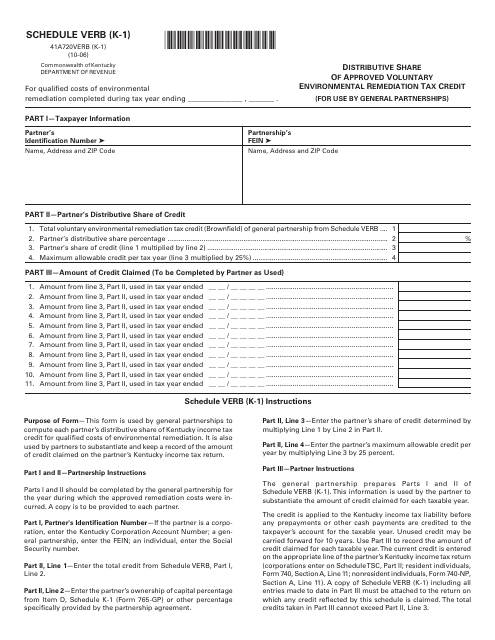

This form is used for reporting the distributive share of the approved voluntary environmental remediation tax credit in Kentucky for partnerships and limited liability companies (LLCs) filing as partnerships.

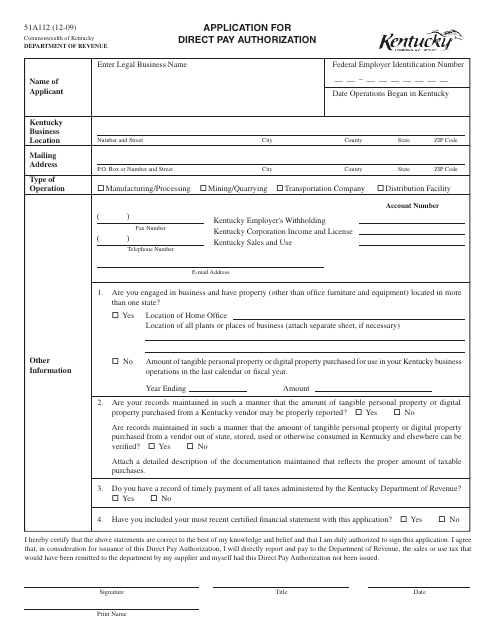

This form is used for applying for Direct Pay Authorization in Kentucky. It enables individuals or businesses to authorize the direct withdrawal of funds from their bank account to pay state taxes.

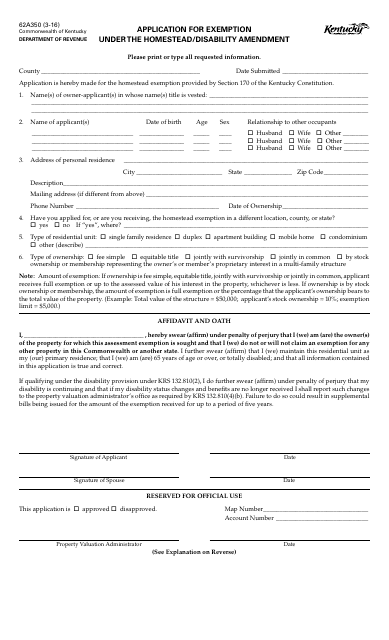

This form is used for applying for an exemption under the Homestead/Disability Amendment in the state of Kentucky.

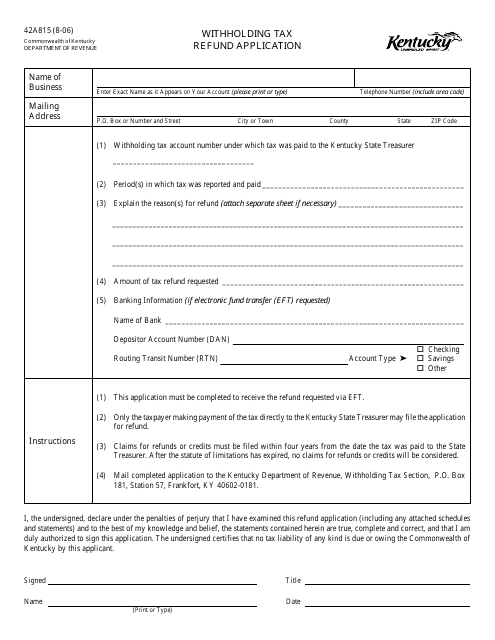

This Form is used for applying for a withholding tax refund in the state of Kentucky.

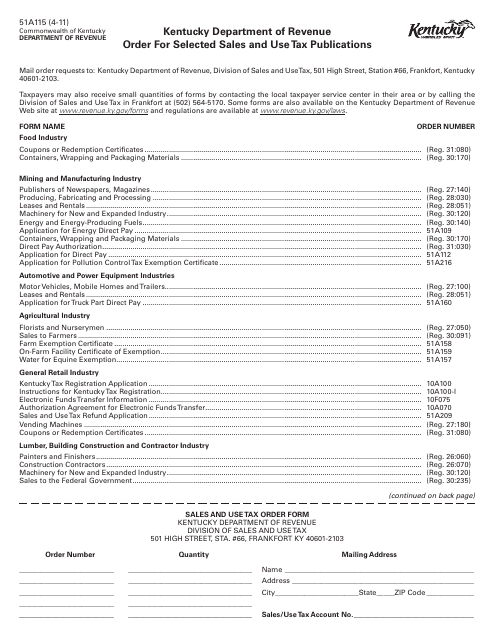

This Form is used for ordering selected sales and use tax publications in the state of Kentucky.

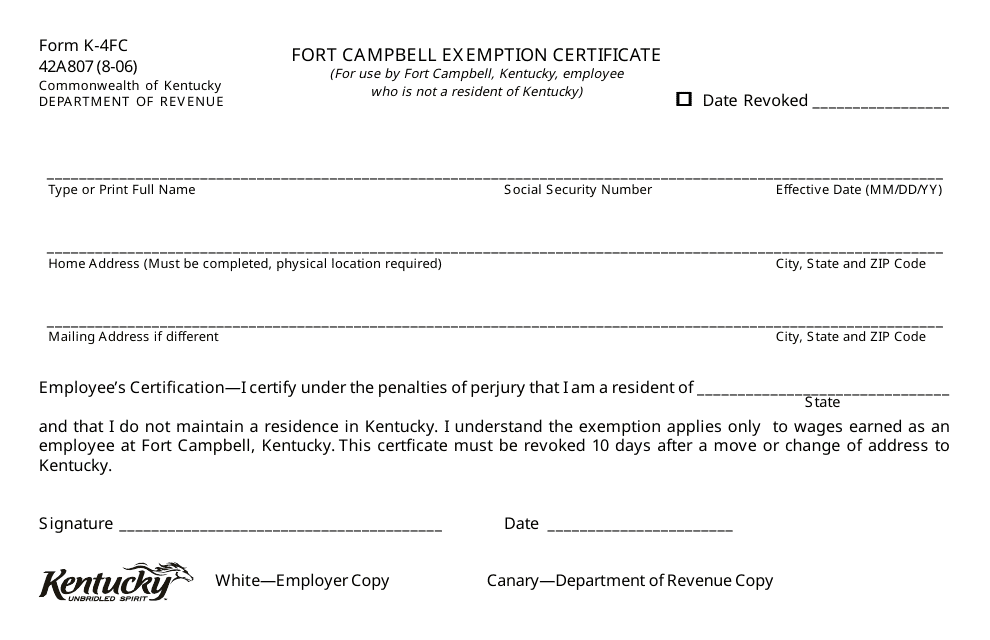

This form is used for applying for a Fort Campbell exemption certificate in Kentucky. It is specifically for those who are eligible for the K-4FC exemption.

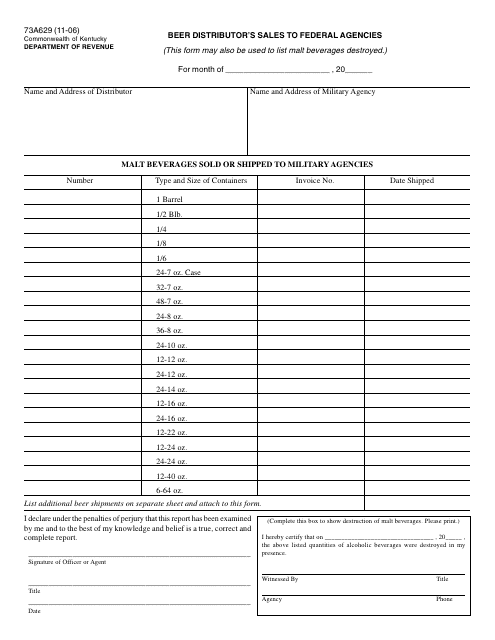

This form is used for beer distributors in Kentucky to report their sales to federal agencies.

This Form is used for creating a performance agreement in the state of Kentucky.

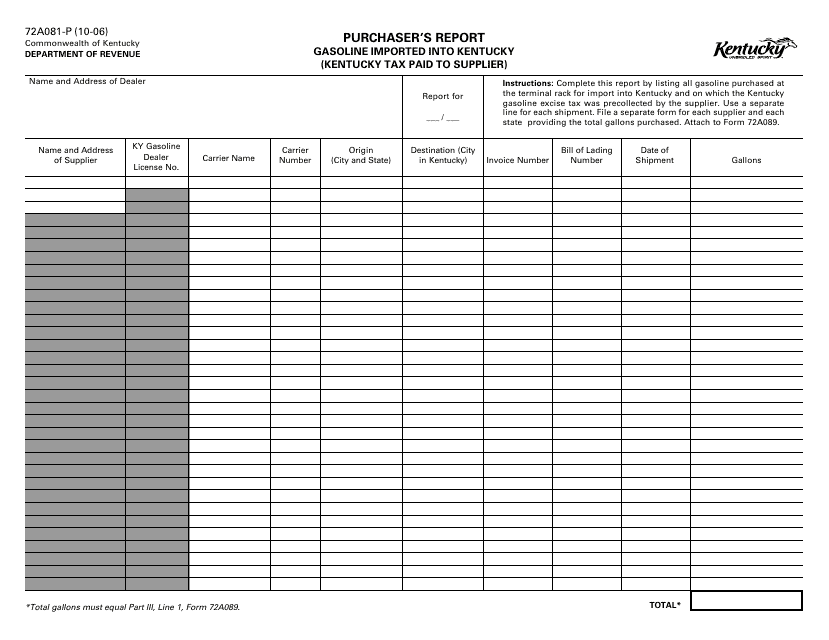

This Form is used for reporting gasoline imported into Kentucky and documenting the payment of Kentucky tax to the supplier.

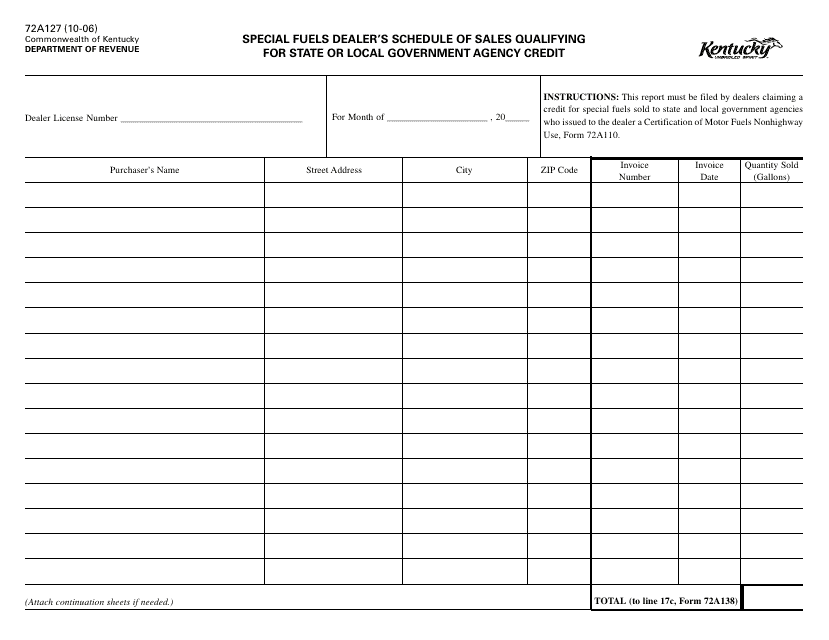

This form is used for reporting sales of special fuels eligible for state or local government agency credits in Kentucky.