Tax Deductions Templates

Documents:

1801

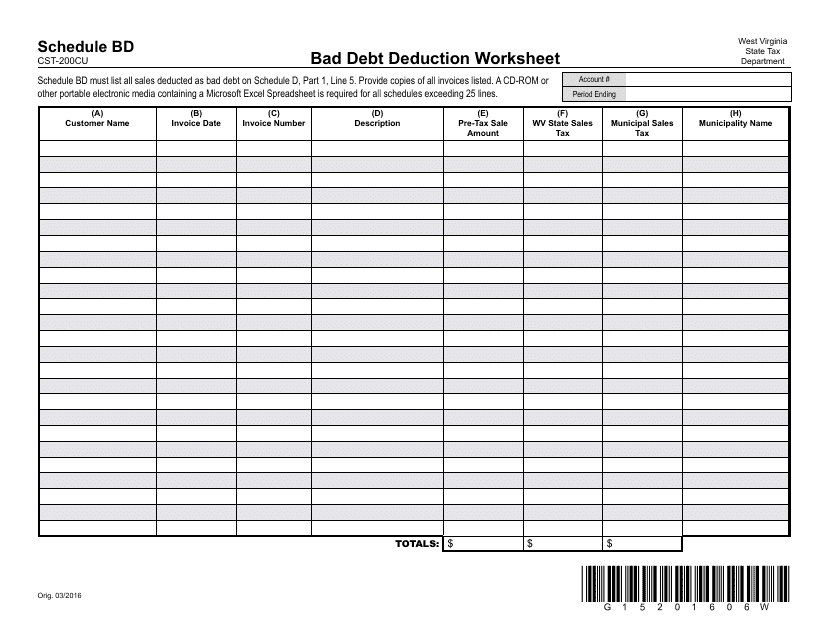

This form is used for calculating the bad debt deduction in the state of West Virginia.

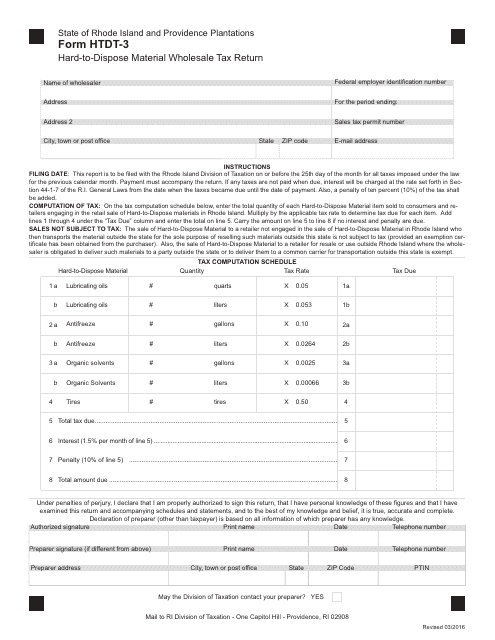

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

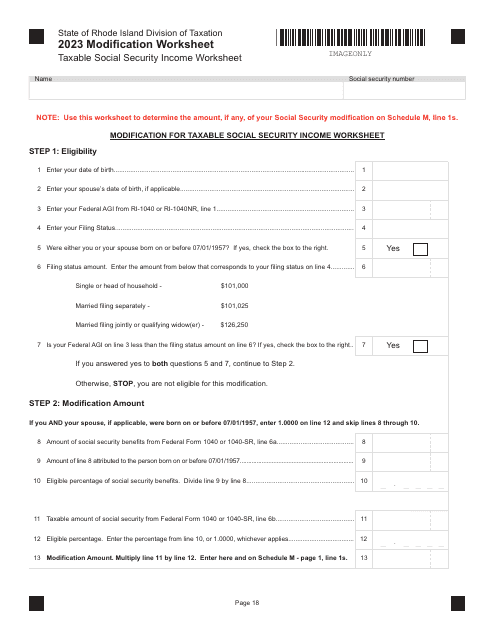

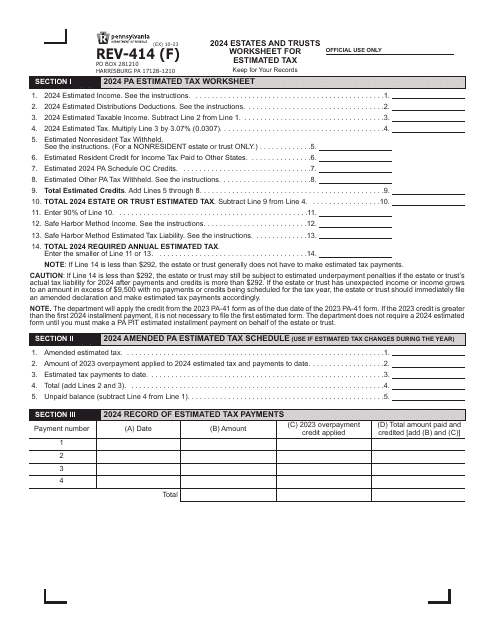

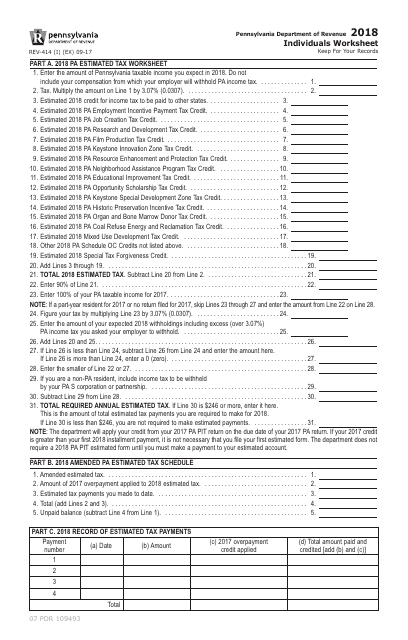

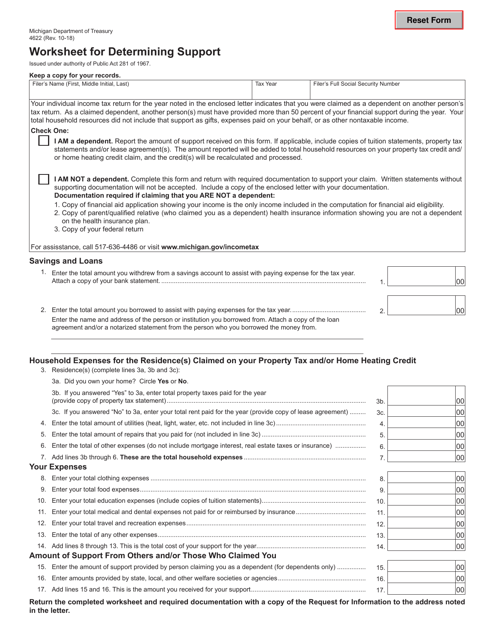

This form is used for individuals in Pennsylvania to complete a worksheet related to their taxes.

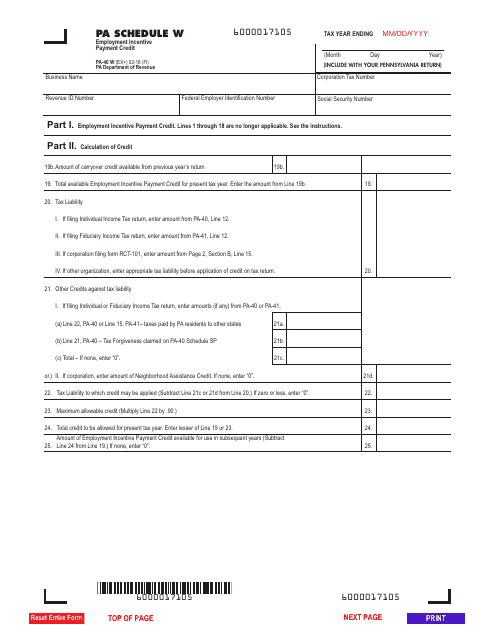

This form is used for reporting the Employment Incentive Payment Credit in Pennsylvania.

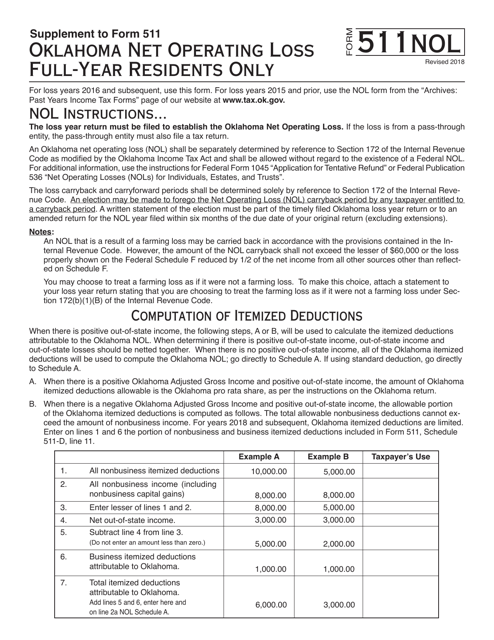

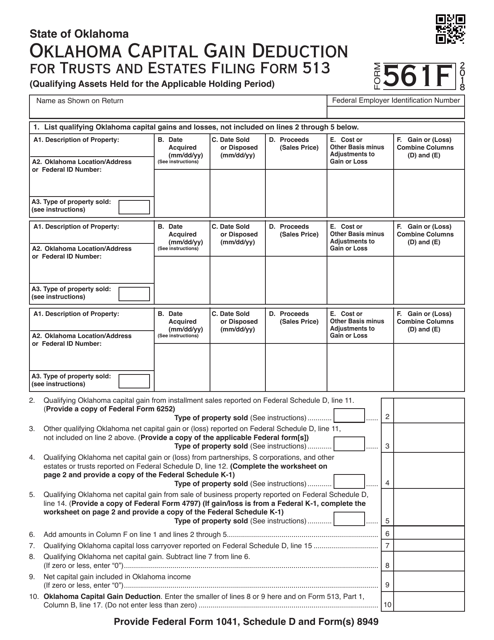

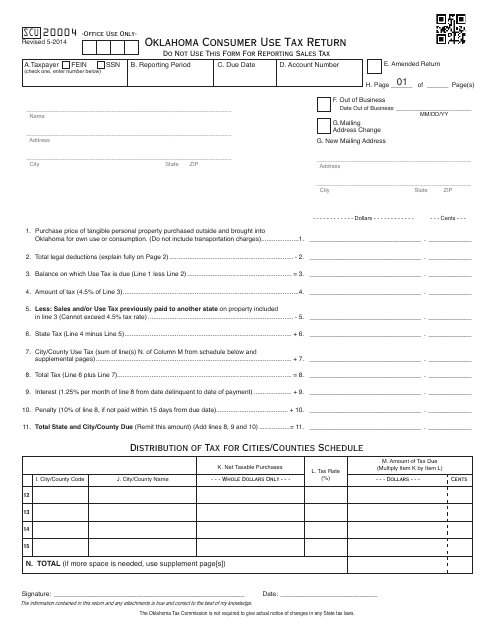

This form is used for reporting and paying consumer use tax in Oklahoma. It is necessary for individuals who have made purchases out-of-state or online and did not pay sales tax at the time of purchase. The form helps ensure that individuals fulfill their tax obligations.

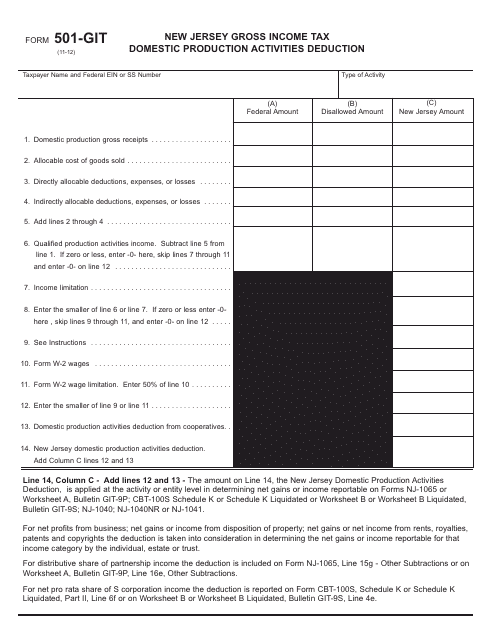

This form is used for claiming the New Jersey Gross Income Tax Domestic Production Activities Deduction in New Jersey. It helps individuals or businesses calculate and report the deduction.

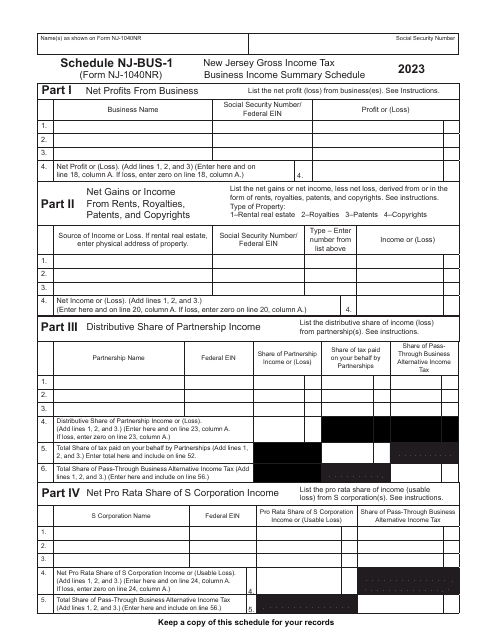

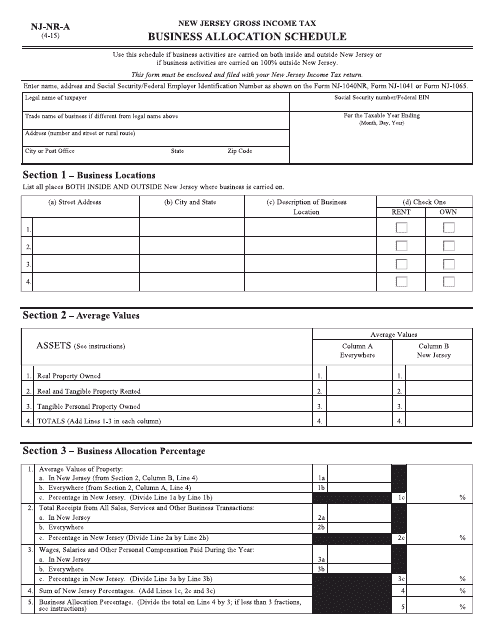

This form is used for business owners to allocate their income and expenses for tax purposes in the state of New Jersey.

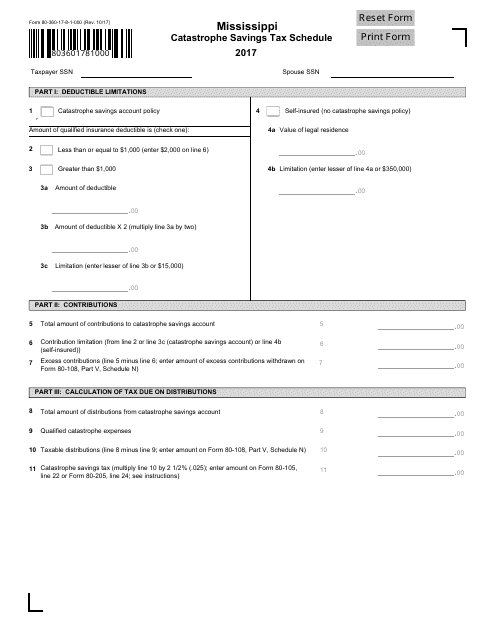

This form is used for reporting and filing taxes related to catastrophe savings in the state of Mississippi.

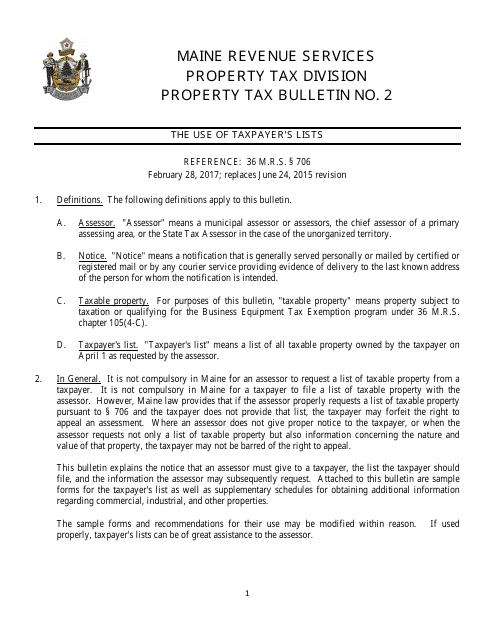

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

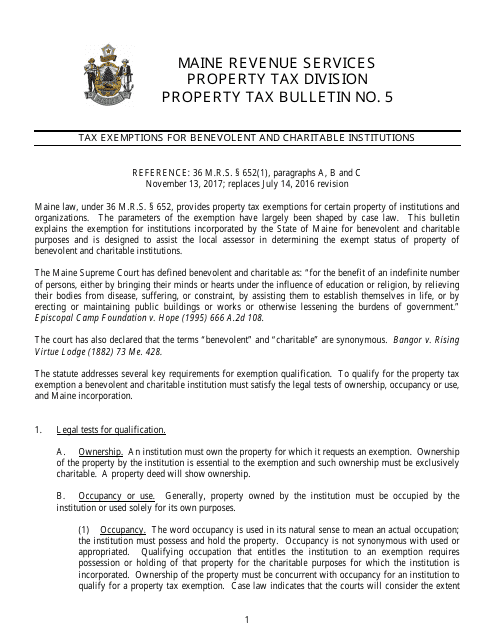

This document provides information about tax exemptions available to benevolent and charitable institutions in the state of Maine. It outlines the eligibility criteria and the process for obtaining these exemptions.

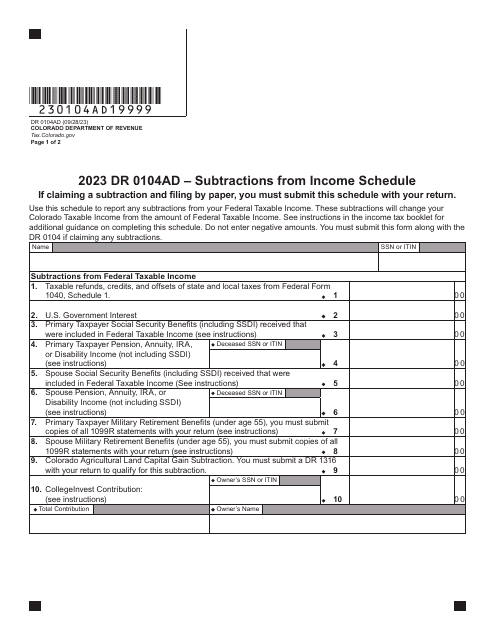

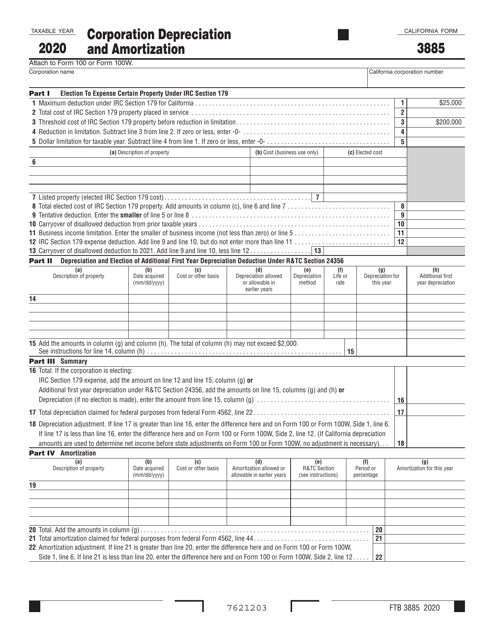

This is an application developed by the Colorado Department of Revenue. The form is used to report subtractions from Federal Taxable Income.

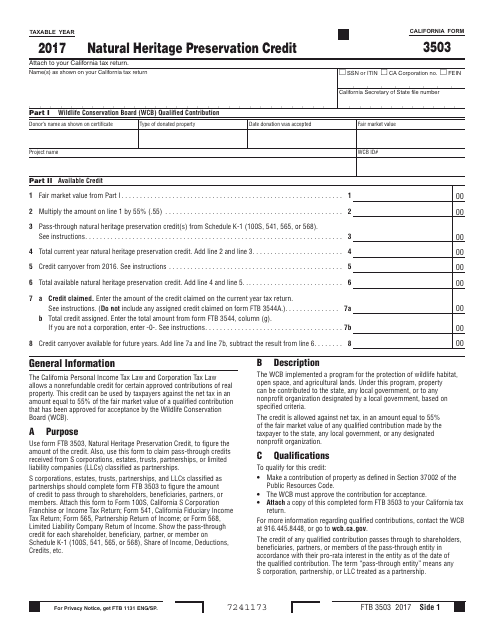

This form is used for claiming the Natural Heritage Preservation Credit in California. It allows individuals or businesses to receive a tax credit for contributing to the preservation of natural heritage sites in the state.

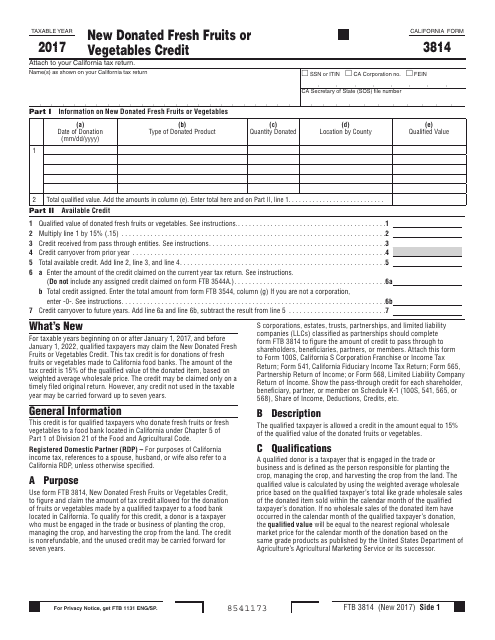

This form is used for claiming the New Donated Fresh Fruits or Vegetables Credit in California. It allows individuals or businesses to receive tax credits for donating fresh fruits or vegetables to California food banks or charitable organizations.

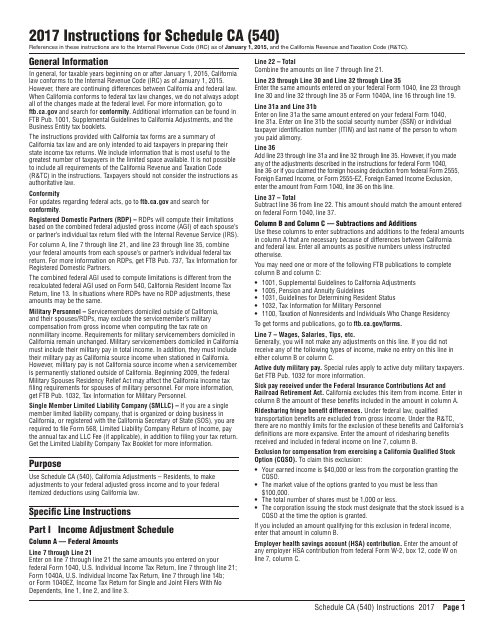

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

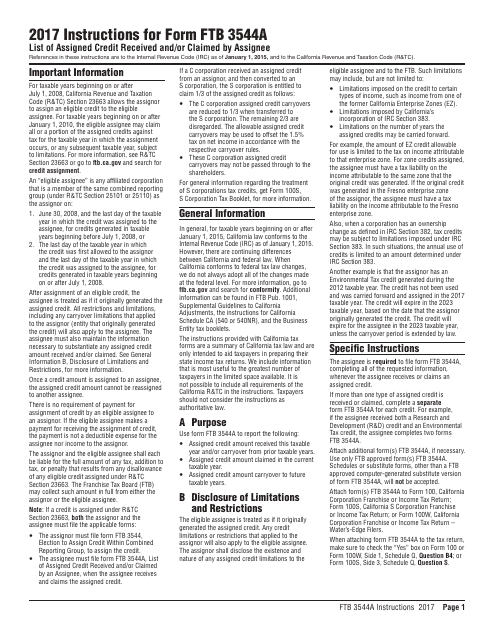

This Form is used for listing the assigned credits received and/or claimed by an assignee in California. It provides instructions on how to properly fill out the form to report the assigned credits.